TIDMSPO

RNS Number : 9365L

Sportech PLC

11 September 2023

11 September 2023

Sportech PLC

("Sportech" or the "Company")

Proposed cancellation of admission of Ordinary Shares to trading

on AIM

Sportech (AIM:SPO) announces the proposed cancellation of

admission of its ordinary shares of 10p each ("Ordinary Shares") to

trading on AIM ("Cancellation"), re-registration as a private

limited company ("Re-registration") and adoption of new articles of

association ("New Articles").

The Board has undertaken a review to evaluate the benefits and

drawbacks to the Company and its shareholders of its admission to

trading on AIM. This review has acknowledged the significant

burdens (financial and non-financial) associated with its status as

a publicly traded company, particularly given the scale of the

Sportech group's business. For this reason, the Board has concluded

that Cancellation and Re-registration are in the best interests of

the Company and its shareholders as a whole. A detailed explanation

of these reasons is set out in the Appendix to this

announcement.

A circular will be sent to shareholders setting out the

background to and reasons for the proposed Cancellation,

Re-registration and associated adoption of the New Articles

("Circular"). The Circular will also contain a notice convening a

general meeting ("General Meeting") at which shareholders will be

invited to consider and, if thought fit, approve the proposed

Cancellation, Re-registration and associated adoption of the New

Articles. The Circular is expected to be posted to shareholders in

the second half of September.

To be passed, the resolution approving the Cancellation

requires, pursuant to Rule 41 of the AIM Rules, the approval of not

less than 75 per cent. of the votes cast by shareholders at the

General Meeting. The resolution to approve the Re-registration and

the associated adoption of New Articles also requires the approval

of not less than 75 per cent. of the votes cast by shareholders at

the General Meeting.

Should the Cancellation be approved by shareholders at the

General Meeting, the Company intends to implement a matched bargain

facility with a third party matched bargain facility provider. This

will facilitate shareholders buying and selling Ordinary Shares on

a matched bargain basis following the Cancellation.

Further details of the proposed Cancellation, Re-registration

and associated adoption of New Articles will be set out in the

Circular which, as noted above, is expected to be posted to

shareholders in the second half of September.

For further information, please contact:

Sportech PLC enquiries@sportechplc.com

Richard McGuire, Executive Chairman

Clive Whiley, Senior Independent

Director

Peel Hunt (Nominated Adviser Tel: +44 (0) 20 7418 8900

& Broker)

George Sellar

Andrew Clark

Lalit Bose

Notes to Editors:

About Sportech

Sportech operates in the gaming market and has two main

businesses. Firstly, it runs Sports Bars and other betting venues

in Connecticut, USA, where it has an exclusive license to offer

pari-mutuel wagering, it also has a distribution agreement with the

Connecticut Lottery Corporation to provide retail sports betting.

Secondly, Sportech provides online gaming through two separate

lines of business. Mywinners.com operates under an exclusive

license to offer pari-mutuel betting online in Connecticut, while

123bet.com offers pari-mutuel betting online across the wider

USA.

Important notices:

Peel Hunt LLP ("Peel Hunt"), which is authorised and regulated

in the United Kingdom by the FCA, is acting as Corporate Broker to

Sportech and no one else in connection with the matters described

in this Announcement and will not be responsible to anyone other

than Sportech for providing the protections afforded to clients of

Peel Hunt, or for providing advice in connection with the matters

referred to herein. Neither Peel Hunt nor any of its group

undertakings or affiliates owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Peel Hunt in connection with this Announcement or

any matter referred to herein.

APPENDIX

Background to and reasons for the Cancellation and Re-registration

As shareholders will be aware, the Company undertook a share consolidation

and subdivision and capital distribution in July 2023 (the "Share Capital

Reorganisation"). Following the Share Capital Reorganisation becoming effective,

the Board undertook a thorough review of the corporate costs being borne

by the Company as a result of its status as a publicly traded company.

Following that review, the Board has concluded that the Company's continued

status as a publicly traded company is not appropriate given the scale of

its business and, accordingly, the Cancellation and Re-registration are

in the best interests of the Company and its shareholders as a whole for

reasons including those set out below.

* Costs and regulatory burden : The considerable cost

and management time and the legal and regulatory

burden associated with maintaining the Company's

admission to trading on AIM is, in the Board's

opinion, disproportionate to the benefits of the

Company's continued admission to trading on AIM.

These costs: (a) amounted to approximately GBP450,000

in the year ended 31 December 2022; (b) contributed

to the Sportech group's pre-tax loss of GBP934,000 in

that period to a material extent; and (c) represented

approximately 28 per cent. of the Sportech group's

adjusted EBITDA of GBP1.6 million in that period.

Given the lower costs associated with private limited

company status, it is estimated that the Cancellation

and Re-registration will materially reduce the

Company's recurring administrative and adviser costs

by approximately GBP450,000 per annum, which the

Board believes can be better spent supporting and

investing in the Sportech group's business.

* Lack of liquidity : Notwithstanding the Share Capital

Reorganisation, there continues to be limited

liquidity in the Ordinary Shares. As a result, the

Board believes that shareholders are not provided

with the opportunities to trade in meaningful volumes

or with frequency in an active market in Ordinary

Shares.

* Market volatility : As a result of the limited

liquidity in Ordinary Shares described above, small

trades in Ordinary Shares can have a significant

impact on price and therefore market valuation, which,

the Board believes, in turn has a materially adverse

impact on: (a) the Company's status within its

industry; (b) the perception of the Company amongst

its customers, suppliers and other partners; (c)

staff morale; and (d) the Company's ability to seek

appropriate financing or realise an appropriate value

for any material future disposal(s).

* Challenges related to the Company's position as a

micro-cap stock : Growing the Company, a UK micro-cap

stock, comes with a range of challenges, which, in

the Board's view, stem from the Company's small

market valuation, limited resources, and the dynamic

nature of the market. These challenges include, but

are not limited to: (a) access to capital; (b) a lack

of visibility among analysts, media and potential

investors; (c) increased volatility in Company

valuation unrelated to company performance leading to

higher risk perception; and (d) an aversion from

potential investors, seeking stability and a

valuation that aligns with Company performance.

* Strategic flexibility : The Board believes that a

private limited company can take and implement

strategic decisions more quickly than a company which

is publicly traded as a result of the more flexible

regulatory regime that is applicable to a private

company.

Therefore, following careful consideration, the Board believes that it is

in the best interests of the Company and shareholders to seek the proposed

Cancellation, Re-registration and associated adoption of New Articles.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKKBPFBKDPCD

(END) Dow Jones Newswires

September 11, 2023 02:01 ET (06:01 GMT)

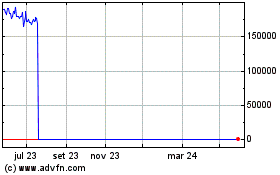

Sportech (LSE:SPO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Sportech (LSE:SPO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024