TIDMRGL

RNS Number : 0719M

Regional REIT Limited

12 September 2023

12 September 2023

Regional REIT Limited

("Regional REIT", the "Group" or the "Company")

2023 Half Year Results

Resilient operational performance in challenging macroeconomic

conditions

Regional REIT (LSE: RGL), t he regional office specialist today

announces its half year results for the six months ended 30 June

2023.

Financial highlights:

-- Total rent collection for the period was 98.8% of rent due,

ahead of the 97.8% of rent collected for the equivalent period in

2022

-- Rent roll broadly unchanged at GBP69.8m (30 June 2022:

GBP72.0m; 31 December 2022: GBP71.8m)

-- Portfolio valuation GBP752.2m (31 December 2022: GBP789.5m).

On a like-for-like basis, portfolio value decreased by 3.8%, after

adjusting for capital expenditure and disposals during the

period.

-- Net initial yield increased to 6.1% (30 June 2022: 5.7%; 31 December 2022: 6.0%)

-- EPRA EPS of 2.5p per share ("pps") for the period (30 June

2022: EPRA EPS: 2.9p); IFRS EPS: (2.4) pps (30 June 2022: IFRS EPS

5.5pps)

-- Operating profit before gains and losses on property assets

and other investments for the period amounted to GBP20.6m (30 June

2022: GBP23.4m)

-- H1 dividend of 2.85pps (30 June 2022: 3.30pps); due to

challenging macroeconomic conditions, and in accordance with the

board's strategy, the dividend continues to be aligned with

earnings going forward

-- EPRA NTA per share 66.9pps (31 December 2022: 73.5pps); IFRS

NAV of 72.5pps (31 December 2022: 78.1pps)

-- Group's cost of debt (incl. hedging) remained low at 3.5% pa

(31 December 2022: 3.5% pa) - 100% fixed, swapped or capped

-- Weighted average debt duration 4.0 years (31 December 2022: 4.5 years)

-- Net LTV 51.9% (31 December 2022: 49.5%). Currently, a

programme of asset management initiatives and disposals are in

train to reduce LTV to the long term target of 40%.

Operational highlights:

-- Good EPC progress continues with the Group weighted average

EPC score improving to C 70 (31 December 2022: C 73)

-- At the period end, 92.0% (31 December 2022: 91.8%) of the

portfolio by valuation was offices, 3.5% retail (31 December 2022:

3.6%), 3.0% industrial (31 December 2022: 3.1%) and 1.5% other (31

December 2022:1.4%)

-- By income, office assets accounted for 91.4% of gross rental

income (30 June 2022: 91.5%; 31 December 2022: 91.5%) and 4.6%

(June 2022: 4.5%, December 2022: 4.5%) was retail. The balance was

made up of industrial, 2.7% (June 2022: 2.6%, December 2022: 2.6%),

and other, 1.4% (June 2022: 1.5%, December 2022: 1.3%)

-- Portfolio remained diversified with 150 properties (31

December 2022: 154), 1,535 units (31 December 2022: 1,552) and

1,038 tenants (31 December 2022: 1,076)

-- The Group made disposals amounting to GBP14.6m (before costs)

during the period, yielding 2.4% (9.4% excluding vacant assets).

The proceeds have since been used in part to reduce borrowing and

fund capital expenditure.

-- At the period end, the portfolio valuation split by region

was as follows: England 78.4% (31 December 2022: 78.3%), Scotland

16.4% (31 December 2022: 16.7%) and the balance of 5.1% (31

December 2022: 5.0%) was in Wales.

-- EPRA Occupancy rate of 82.5% (31 December 2022: 83.4%)

-- During the period, the Company completed 45 new lettings.

When fully occupied, these will provide an additional gross rental

income of c.GBP1.2m per annum ("pa"), 13.5% above December 2022

ERV.

Post-Period end highlights:

-- On 12 September 2023, the Company declared the Q2 2023

dividend of 1.20pps (Q2 2022 dividend: 1.65pps), for the period 1

April 2023 to 30 June 2023, to be paid to shareholders on 19

October 2023.

Stephen Inglis, CEO of London and Scottish Property Investment

Management, the Asset Manager, commented:

"It has been another challenging period for the commercial real

estate sector as rapidly rising interest rates continued to impact

valuations. During the six months to 30 June 2023, the Company's

portfolio valuation declined on a like-for-like basis by 3.8%,

after adjusting for disposals and capital expenditure,

outperforming the MSCI UK regional office benchmark, which saw a

decline of 7.2% over the same period. This has resulted in the

increase of the Company's loan to value to 51.9%. Thanks to the

defensive debt positioning being 100% fixed, swapped or capped, the

weighted average cost of debt remains at 3.5%. The Asset Manager

continues to implement its active asset management strategy,

including a programme of asset sales to reduce net borrowings back

to the Company's long term c.40% target.

"With the challenging economic backdrop our net rental income

has been adversely impacted by higher non-recoverable property

costs and lower income from lease surrender, dilapidations payments

and other income. As such the Board continues to align the dividend

with earnings and has today declared the Q2 2023 dividend of

1.20pps.

"As we look ahead, we remain wholly committed to reducing the

LTV, improving occupancy and the portfolio's weighted average EPC

rating as we actively manage the portfolio. We look forward to

updating shareholders on our progress at the next juncture."

-S -

Enquiries:

Regional REIT Limited

Toscafund Asset Management Tel: +44 (0) 20 7845

6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional

REIT Limited

London & Scottish Property Investment Tel: +44 (0) 141

Management 248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466

5000

Financial PR regional@buchanan.uk.com

Charles Ryland /Henry Wilson / George Beale

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries(1) (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and Toscafund Asset Management LLP, the

Investment Manager.

Regional REIT's commercial property portfolio is comprised

wholly of UK assets, offices located in regional centres outside of

the M25 motorway. The portfolio is geographically diversified, with

150 properties, 1,535 units and 1,038 tenants as at 30 June 2023,

with a valuation of GBP752.2 million.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional Core Property and Core

Plus Property assets. It aims to deliver an attractive total return

to its Shareholders, targeting greater than 10% per annum ("pa"),

with a strong focus on income supported by additional capital

growth prospects.

For more information, please visit the Group's website at

www.regionalreit.com .

KEY FINANCIALS

Period ended 30 June 2023

30 31

June December

2023 2022

Portfolio Valuation GBP752.2m GBP789.5m

IFRS NAV per Share 72.5p 78.1p

EPRA* NTA per Share 66.9p 73.5p

EPRA* earnings per Share 2.5p 2.9p

Dividend per Share 2.85p 3.3p

Net Loan to Value Ratio** 51.9% 49.5%

Weighted Average Cost of Debt** 3.5% 3.5%

Weighted Average Debt Duration** 4.0 yrs 4.5 yrs

The European Public Real Estate Association ("EPRA")*

The EPRA's mission is to promote, develop and represent the

European public real estate sector. As an EPRA member, we fully

support the EPRA Best Practices Recommendations. Specific EPRA

metrics can be found in the Company's financial and operational

highlights, with further disclosures and supporting calculations in

the full Half Year Report.

* The European Public Real Estate Association (EPRA)

** Alternative Performance Measures. Details are provided in the

Glossary of Terms in the full Half-Year Report and the EPRA

Performance Measures below.

CHAIRMAN'S STATEMENT

"99% of tenants having returned to the office and rent

collections remaining strong"

Kevin McGrath

Chairman

Overview

I am pleased to report the Group's results for the six months to

30 June 2023, with 99% of our tenants having returned to the office

and rent collections remaining strong.

The Company has a clear strategy of being the office provider of

choice in the regions outside of London,

offering vibrant places to help tenants thrive at all stages of

their business cycle with tailored offerings to match their

requirements. By utilising the specialised Asset Manager's platform

and with its extensive experience in the regions of the UK, the

Company continues to work hard to deliver a robust income stream

and long-term capital growth, whilst encompassing a sustainable

approach. The portfolio weighted average EPC continued to improve

to C 70 from C 73 as at 31 December 2022.

The challenging macroeconomic environment continued to affect

all commercial real estate sectors, with a like- for-like decline

in value of 3.8%, after adjusting for capital expenditure,

acquisitions and disposals during the period. However, the

portfolio outperformed versus a decline of 7.2% MSCI UK regional

office values during the period. During the six months to 30 June

2023, disposals of non-core assets amounted to GBP14.1 million (net

of costs) reflecting a net initial yield of 2.4% (9.4% excluding

vacant properties) with no acquisitions in the period. The

programme of disposals reflects our focus upon de-risking the

offering in the short to medium term. The rolling capital

expenditure programme amounted to GBP6.7 million.

Rent collection remained strong throughout the period to 30 June

2023. Currently, rent collection for the period to 30 June 2023

amounted to 98.8% (equivalent period for the six months to 30 June

2022 97.8%), however, operational costs continue to be impacted by

inflationary pressures and resulted in an EPRA diluted earnings of

2.5 pence per share ("pps") (six months to 30 June 2022: 2.9pps).

IFRS diluted earnings per share were (2.4pps) (six months to 30

June 2022: 5.5pps).

Financial Resources

As at 30 June 2023 the EPRA* NTA amounted to GBP344.9 million

(31 December 2022: GBP379.2 million) and a cash balance of GBP41.2

million (31 December 2022: GBP50.1 million), of which GBP26.0

million is unrestricted (31 December 2022: GBP37.8 million).

The defensive debt positioning continues to mitigate rate

volatility. The borrowings are comprised of a 56.4% fixed rate

debt, with the balance being swapped or capped. This proactive and

defensive approach ensured that the weighted average cost of debt

remained 3.5% at 30 June 2023 (31 December 2022: 3.5%), with no

requirement to refinance until August 2024.

The net loan-to-value at 30 June 2023 amounted to 51.9% (31

December 2022: 49.5%). The Asset Manager continues to implement its

active asset management strategy and disposal programme with the

ambition of promptly reducing the net borrowings back to the

Company's long term c.40% target.

* Alternative Performance Measures. Details are provided in the

Glossary of Terms in the full Half Yearly Report and the EPRA

Performance Measures below.

Sustainability

We continue to focus upon sustainability within our business

model with the continued membership of UK Green Building Council,

Better Buildings Partnership, EPRA sustainability benchmarking and

the Global Real Estate Sustainability Benchmark (GRESB). We look

forward to providing a positive update on our GRESB accreditation

in due course.

Market Environment

The UK regions outside of London attracted GBP3.0 billion in Q2

2023, 2.3% above the previous quarter, but 31.6% lower than the

five-year quarterly average. Investment in Q2 brought the H1 2023

total to GBP6.0 billion, 28.0% above the level recorded during the

first lockdown due to the Covid-19 pandemic. Research by Lambert

Smith Hampton ("LSH") highlights the importance of the regional

markets, with the regions outperforming when compared with London.

At GBP3.0 billion, investment in single assets across the UK

regional markets in Q2 2023 was 26.3% higher than the level of

investment in Greater London - well above the five-year quarterly

average margin of 0.6%. Two regions that experienced robust levels

of investment in Q2 2023 were the West Midlands and the South East.

Total investment in the West Midlands reached GBP0.6 billion, 10.8%

above the five-year quarterly average - the strongest regional

performance relative to trend. Data from LSH shows that GBP0.5

billion was invested in the South East. Other regional markets that

performed well relative to trend include Scotland and the North

West of England.

The most recent data from LSH shows that investment in UK

commercial property totalled GBP15.7 billion in the first half of

2023. Although Q2 2023 volumes were 10.6% below Q1 figures, the

number of deals increased by approximately 9.0% over the same

period. The most recent Office of National Statistics figures show

that UK inflation dropped to 6.8% in the year to July, from 7.9% in

June. As a result, LSH predict that there will be a considerable

rise in investment volumes, if not in the final quarter of 2023,

then at the beginning of 2024.

Investment volumes in the UK regional office market reached

GBP0.8 billion in Q2 2023, 27.8% higher than the previous quarter.

Overall, investment in regional offices reached GBP1.4 billion in

H1 2023. Although investment in regional offices in the first half

of 2023 was 43.4% below trend, optimism in the regional markets

continues to be supported by strong employment growth and a fall in

the number of employees exclusively working from home. The most

recent data from the ONS shows that the UK employment rate rose to

76.0% in the three months to May 2023, up 0.1% for the same period

in 2022. Additionally, data from the ONS shows that despite the

rise in hybrid working as a result of Covid-19, the vast majority

of people do not work from home, with 56.0% of employees reporting

that they exclusively travel to the office and only 16.0% of

workers reporting that they worked exclusively from home - down

from 26% in mid-January 20222.

Dividends

For the period under review, the Company declared total

dividends of 2.85pps (six months to June 2022: 3.30pps), comprising

one quarterly dividends of 1.65pps and one quarterly dividend of

1.20pps.

Given the challenging economic backdrop, inflationary pressures

continue to impact the net rental income and the cost base. As such

the Board continues to align the dividend with earnings, with the

priority remaining to offer an attractive dividend to

shareholders.

Asset Manager Update

As announced on the 13 April 2023, ARA Asset Management Ltd.

acquired a majority shareholding

stake in the Asset Manager, London & Scottish Property

Investment Management, with Stephen Inglis retaining a significant

minority interest. The day-to-day asset management team remains

unchanged and are now supported by the resources of a large global

real estate platform, therefore shareholders can be reassured that

the Asset Manager capabilities have been strengthened.

Subsequent Events

On 11 September 2023, the Board of Directors approved a dividend

of 1.20 pence per Share in respect of the period 1 April 2023 to 30

June 2023 for announcement on 12 September 2023. The dividend will

be paid on 19 October 2023 to Shareholders on the register as at 22

September 2023. These condensed consolidated financial statements

do not reflect this dividend.

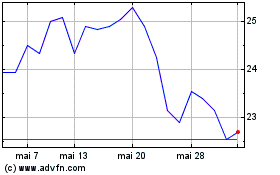

Performance

For the period under review, the Company's Total Shareholder

Return was -18.5%, versus the return of

-10.3% for the FTSE EPRA NAREIT UK Total Return Index over the

same period.

Since listing on 6 November 2015, the Company's EPRA Total

Return was 20.8% and the annualised EPRA Total Return was 2.5%.

Total Shareholder Return was -14.8%, compared with the FTSE EPRA

NAREIT UK Total Return Index, which has generated a return of

-23.7% over the same period.

Since listing on 6 November 2015, the Company's EPRA Total

Return was 20.8% and the annualised EPRA Total Return was 2.5%.

Total Shareholder Return was -14.8%, compared with the FTSE EPRA

NAREIT UK Total Return Index, which has generated a return of

-23.7% over the same period.

Board And Governance

William Eason, Senior Independent Non-Executive Director and Tim

Bee, Non-Executive Director stepped

down from the Board at the 2023 AGM. The Board thanks both Mr

Eason and Mr Bee for their invaluable input and commitment to the

Company over their tenures and wishes them well in their future

endeavours.

Daniel Taylor was appointed as Senior Non-Executive Director and

Massy Larizadeh was appointed Chairman of the Management Engagement

and Remuneration Committee and the Nomination Committee with effect

from 25 May 2023.

Outlook

Although the recent outlook for the UK economy has improved, the

Board remains vigilant to the continued macroeconomic uncertainty

over the short term. The Company has continued to perform well

operationally and has delivered against the controllable factors.

We continue to see significant opportunities for value creation

over the long-term.

Kevin McGrath

Chairman

11 September 2023

ASSET AND INVESTMENT MANAGERS' REPORT

"It has been another challenging period for the commercial real

estate sector as rapidly rising interest rates continued to impact

valuations. During the six months to 30 June 2023, the Company's

portfolio valuation declined on a like-for-like basis by 3.8%,

after adjusting for capital expenditure and disposals, albeit

significantly outperforming the MSCI UK regional office benchmark,

which saw a decline of 7.2% over the same period. This in turn

increased the Company's Loan to Value ("LTV") to 51.9%, whilst the

weighted average cost of debt remained at 3.5% thanks to the

defensive positioning and high rate of fixed, swapped or capped

debt. The Asset Manager continues to implement its active asset

management strategy, including a programme of asset sales to reduce

net borrowings back to the Company's long term c.40% target.

The Company's operational performance during the period remained

robust, thanks to our high-quality blue- chip tenant base, which is

diversified by both sector and geography, leading to rent

collection of 98.8% and rental income totalling GBP69.8m.

As we look ahead to the remainder of 2023, we remain wholly

committed to reducing the LTV, and improving the portfolio's

weighted average EPC rating as we actively manage the portfolio. We

look forward to updating Shareholders on our progress at the next

juncture."

Stephen Inglis

CEO of London & Scottish Property Investment Management,

Asset Manager

Investment Activity in the UK Commercial Property Market

Investment in the UK commercial property market totalled GBP54.1

billion in 2022, according to research from LSH. However, due to

the impact of further interest rate hikes as a result of continuing

inflation, investment was more subdued in the first two quarters of

2023 due to more prolonged uncertainty. The most recent data from

LSH shows that investment in UK commercial property reached GBP15.7

billion in the first half of 2023. Although Q2 2023 volumes were

10.6% below Q1 figures, the number of deals increased by

approximately 9.0% over the same period. That said, financial

markets have begun to settle following news that inflation slowed

substantially to its lowest annual rate since March 2022. The most

recent ONS figures show that UK inflation dropped to 6.8% in the

year to July, from 7.9% in June, ahead of forecasts which predicted

a fall to 8.2%. As a result, LSH predict that there will be a

considerable rise in investment volumes, if not in the final

quarter of 2023, then at the beginning of 2024.

The UK regions outside of London attracted GBP3.0 billion in Q2

2023, 2.3% above the previous quarter, but 31.6% lower than the

five-year quarterly average. Investment in Q2 brought the H1 2023

total to GBP6.0 billion, 28.0% above the level recorded during the

first lockdown due to the Covid-19 pandemic. Research by LSH

highlights the importance of the regional markets, with the regions

outperforming when compared with London. At GBP3.0 billion,

investment in single assets across the UK regional markets in Q2

2023 was 26.3% higher than the level of investment in Greater

London - well above the five-year quarterly average margin of 0.6%.

Two regions that experienced robust levels of investment in Q2 2023

were the West Midlands and the South East. Total investment in the

West Midlands reached GBP0.6 billion, 10.8% above the five-year

quarterly average - the strongest regional performance relative to

trend. Data from LSH shows that GBP0.5 billion was invested in the

South East. Other regional markets that performed well relative to

trend include Scotland and the North West of England.

Investment volumes in the UK regional office market reached

GBP0.8 billion in Q2 2023, 27.8% higher than the previous quarter.

Overall, investment in regional offices reached GBP1.4 billion in

H1 2023. Although investment in regional offices in the first half

of 2023 was 43.4% below trend, optimism in the regional markets

continues to be supported by strong employment growth and a fall in

the number of employees exclusively working from home. The most

recent data from the ONS shows that the UK employment rate rose to

76.0% in the three months to May 2023, up 0.1% for the same period

in 2022(1) . Additionally, data from the ONS shows that despite the

rise in hybrid working as a result of Covid-19, the vast majority

of people do not work from home, with 56.0% of employees reporting

that they exclusively travel to the office and only 16.0% of

workers reporting that they worked exclusively from home - down

from 26% in mid- January 2022(2) .

1 ONS, Labour Market Overview, UK, July 2023

2 ONS, Opinions and Lifestyle Survey, February 2023

Overseas investment in the UK commercial property market

accounted for 54.5% of total investment in Q2 2023 and drove

overall investment at the larger end of the market, accounting for

78.6% of the GBP100m plus deals in Q2 2023. Figures indicate that

overseas investment reached GBP4.0 billion in Q2 2023, despite

being 3.6% higher than the previous quarter, overseas investment

was 35.8% below the five-year quarterly average. International

investment in the second quarter of the year brought the H1 2023

total to GBP7.9 billion. However, overseas investment was largely

supported by the North American buyers - the only net buyer of UK

commercial property in Q2 2023, which accounted for approximately

62.0% of all overseas investment. LSH research suggests that North

American investors were the most acquisitive net buyers at GBP2.5

billion. Conversely, inflows from Far East and European investors

stood at only one third of the quarterly average.

Occupational Demand in the UK Regional Office Market

Avison Young estimate that take-up of office space across the

nine regional markets (3) reached 1.6 million sq. ft. in Q2 2023,

bringing the half year total to 3.3 million sq. ft., 3.6% below the

five year average take-up for the first six months of the year.

City centre activity accounted for the largest proportion of

take-up (58.5%) in H1 2023 at 1.9 million sq. ft. However, when

comparing this to previous years, city centre take-up as a

proportion of total take-up has steadily declined from a high of

63.8% in 2019. In the first half of 2023 approximately 1.4 million

sq. ft. was transacted in the out of town market, 3.0% above the

five year average, and accounting for 41.5% of total H1 2023

take-up - the highest proportion recorded over the last decade (4)

. The Asset Manager believes that there is scope for take-up to

increase throughout the remainder of 2023 as there continues to be

a drive among employers to get more workers back into the office in

order to increase productivity. Additionally, many of the large

tech companies like Google, Amazon, Zoom and Lyft have moved away

from fully remote working, with some mandating at least three days

in the office. Meanwhile, JP Morgan and Goldman Sachs have

curtailed remote working. Furthermore, encouraging research from

the Centre for Cities (5) think tank suggests that in the next two

years, working five days a week from the office will become the

norm again.

Occupational demand in the regional office markets continued to

be driven by the professional services sector, which accounted for

the highest proportion of take-up at 16.9% in the first six months

of 2023. Moreover, public services, education & health, and

technology, media & telecoms sectors accounted for the second

and third largest proportion of take-up in the regional cities,

accounting for 18.4% and 14.7%, respectively (6) . Savills research

indicates that although office market sentiment is going through a

period of change, the same key sectors continue to drive demand for

UK office stock as the three most active sectors prior to the

Covid-19 pandemic remain in the top three in the first half of

2023.

According to Savills, there was a rise in availability for

regional office stock across ten regional UK markets (7) , with

total availability in H1 2023 to 15.3 million sq. ft. Despite the

uptick in availability in the first half of 2023 supply across the

ten regional markets remains 1.2% below the long-term average.

In terms of speculative development, it is estimated that

approximately 3.7 million sq. ft. of office space is currently

under construction in the Big Nine regional markets, down from 4.7

million sq. ft. for the same period last year, with Manchester,

Bristol, and Glasgow accounting for 25.3%, 18.4% and 17.2%,

respectively. Approximately 30.7% of office buildings currently

under construction are already pre-let.

3 Nine regional office markets mentioned by Avison Young

include: Birmingham, Bristol, Cardiff, Edinburgh, Glasgow, Leeds,

Liverpool, Manchester, Newcastle

4 Avison Young, The Big Nine, Q2 2023

5 Centre for Cities, Office Politics, May 2023

6 Savills, The Regional Office Market Review, Q2 2023

7 Ten regional office markets mentioned by Savills includes:

Aberdeen, Birmingham, Bristol, Cambridge, Cardiff, Edinburgh,

Glasgow, Leeds, Manchester, and Oxford

Rental Growth in the UK Regional Office Market

According to monthly data from MSCI, rental value growth held up

well for the rest of UK office markets in the 12 months ended June

2023 with growth of 2.7%. Conversely, central London offices

experienced modest growth of 1.3% over the same period. The most

recent figures from MSCI shows that there is evidence of sustained

rental growth in the majority of the regional office markets. By

region, the strongest regional rental growth in June (year-on-year

comparison) was recorded in the South West of England at 3.3% (8) .

Avison Young expects rental growth to continue across most markets

for the remainder of 2023 and into 2024. Demand for quality office

space has put an upward pressure on rents, with growth of 4.3%

recorded across the Big Nine regional markets in the first half of

2023, with average headline rents now sitting at GBP35.39 per sq.

ft., according to research from Avison Young.

8 Colliers International, Property Snapshot, June 2023

Regional REIT's Office Assets

EPRA occupancy of the Group's regional offices as at 30 June

2023 was 81.6% (30 June 2022: 83.3%). A like-for- like comparison

of the Group's regional offices EPRA occupancy, 30 June 2023 versus

30 June 2022, shows occupancy of 81.6% (30 June 2022: 84.7%).

WAULT to first break was 2.8 years (30 June 2022: 2.6 years);

like-for-like WAULT to first break was 2.8 years (30 June 2022: 2.6

years).

Property Portfolio

As at 30 June 2023, the Group's property portfolio was valued at

GBP752.2 million (30 June 2022: GBP918.2 million; 31 December 2022:

GBP789.5 million), with rent roll of GBP69.8 million (30 June 2022:

GBP72.0 million; 31 December 2022: GBP71.8 million), and an EPRA

occupancy rate of 82.5% (30 June 2022: 83.8%; 31 December 2022:

83.4%). On a like-for-like basis, 30 June 2023 versus 30 June 2022

EPRA occupancy was 82.5% (30 June 2022: 85.2%).

There were 150 properties (30 June 2022: 159; 31 December 2022:

154), in the portfolio, with 1,535 units (30 June 2022: 1,517; 31

December 2022: 1,552) and 1,038 tenants (30 June 2022: 1,086; 31

December 2022: 1,076). If the portfolio was fully occupied at

Colliers view of market rents, the rental income would be GBP88.9

million per annum (30 June 2022: GBP94.1 million; 31 December 2022:

GBP92.0

million).

As at 30 June 2023, the net initial yield on the portfolio was

6.1% (30 June 2022: 5.7%; 31 December 2022: 6.0%), the equivalent

yield was 9.5% (30 June 2022: 8.6%; 31 December 2022: 9.0%) and the

reversionary yield was 10.4% (30 June 2022: 9.2%; 31 December 2022:

10.2%).

Property Portfolio by Sector as at 30 June 2023

Sector WAULT

to Gross

Sq. Occupancy first rental Average Capital

Valuation ft. (EPRA) break income rent ERV rate Yield

EPRA

Net

% by initial Equivalent Reversionary

Properties (GBPm) valuation (m) (%) (yrs) (GBPm) (GBPpsf) (GBPm) (GBPpsf) (%) (%) (%)

Office 125 692.3 92.0 5.6 81.6 2.8 63.7 14.60 83.0 123.92 6.0 9.6 10.5

Retail 18 26.4 3.5 0.3 93.1 3.8 3.2 11.16 2.9 79.69 9.3 9.5 9.6

Industrial 4 22.3 3.0 0.4 97.0 5.5 1.9 5.27 2.1 53.17 6.5 7.6 8.0

Other 3 11.2 1.5 0.1 100.0 9.8 1.0 15.57 0.9 116.20 7.3 8.7 7.1

------------- ------------ ---------- ----------- ----- ---------- ------- -------- ---------- -------- ---------- -------- ------------ --------------

Total 150 752.2 100.0 6.4 82.5 3.0 69.8 13.76 88.9 116.91 6.1 9.5 10.4

------------- ------------ ---------- ----------- ----- ---------- ------- -------- ---------- -------- ---------- -------- ------------ --------------

Property

Portfolio

by Region

as at 30

June 2023

WAULT

to Gross

Sq. Occupancy first rental Average Capital

Valuation ft. (EPRA) break income rent ERV rate Yield

EPRA

Net

% by initial Equivalent Reversionary

Region Properties (GBPm) valuation (m) (%) (yrs) (GBPm) (GBPpsf) (GBPm) (GBPpsf) (%) (%) (%)

Scotland 36 123.7 16.4 1.2 76.9 4.8 11.5 13.66 17.5 101.93 5.6 10.0 11.4

South East 26 138.9 18.5 0.9 82.9 2.4 12.4 16.24 15.6 147.98 5.8 9.1 9.9

North East 23 122.1 16.2 1.0 80.3 3.2 10.5 12.75 13.7 117.52 5.8 9.5 10.4

Midlands 26 151.4 20.1 1.4 86.5 2.9 15.0 13.05 17.9 107.76 6.2 9.4 10.3

North West 19 103.0 13.7 0.9 75.7 2.2 9.4 13.55 12.3 110.99 5.8 9.7 10.6

South West 14 74.6 9.9 0.5 91.9 2.1 7.1 16.83 7.9 157.48 7.8 9.3 9.7

Wales 6 38.5 5.1 0.4 97.0 3.8 3.8 10.23 4.0 88.34 7.6 8.8 9.0

------------- ------------ ---------- ----------- ----- ---------- ------- -------- ---------- -------- ---------- -------- ------------ --------------

Total 150 752.2 100.0 6.4 82.5 3.0 69.8 13.76 88.9 116.91 6.1 9.5 10.4

------------- ------------ ---------- ----------- ----- ---------- ------- -------- ---------- -------- ---------- -------- ------------ --------------

Tables may not sum due to rounding.

Top 15 Investments (market value) as at 30 June 2023

Annualised % of WAULT

Market EPRA gross gross to

value % of Lettable Occupancy rent rental first

(GBPm) portfolio area (%) (GBPm) income break

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

University

of Glasgow,

Glasgow

Tay House

Centre

Ltd, Fairhurst

Group LLP,

London

& Scottish

300 Bath Property

Street, Investment

Glasgow Office Management 21.4 2.8% 156,853 87.6% 1.2 1.8% 2.4

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Eagle

Court, Virgin

Coventry Media Ltd,

Road, Rexel UK

Birmingham Office Ltd 20.2 2.7% 132,979 67.6% 1.6 2.3% 0.6

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Aviva Central

Services

UK

Ltd, Lloyd's

Register

EMEA,

Complete

Fertility

Ltd,

Hampshire National

Corporate Westminster

Park, Bank

Eastleigh Office Plc 19.8 2.6% 84,043 100.0% 1.7 2.4% 3.5

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Metropolitan

Housing

Trust

Ltd, SMS

Electronics

Ltd,

Heart Internet

Beeston Ltd, SMS

Business Product

Park, Office/ Services

Nottingham Industrial Ltd 17.2 2.3% 215,330 100.0% 1.4 2.0% 5.1

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

NNB Generation

Company

800 Aztec (HPC) Ltd,

West, Edvance

Bristol Office SAS 16.5 2.2% 73,292 100.0% 1.5 2.2% 0.9

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Chiesi

Ltd, Ingredion

UK

Ltd, Assetz

SME Capital

Ltd,

Contemporary

Manchester Travel

Green, Solutions

Manchester Office Ltd 16.5 2.2% 107,760 79.1% 1.4 2.0% 3.1

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

First Source

Solutions

UK

Ltd, DHU

Orbis Health

1, 2 & Care C.I.C.,

3, Pride Tentamus

Park, Pharma

Derby Office (UK) Ltd 16.2 2.1% 121,883 100.0% 1.8 2.6% 3.9

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Global

Norfolk Banking

House, School

Smallbrook Ltd,

Queensway, Accenture

Birmingham Office (UK) Ltd 15.3 2.0% 115,780 97.7% 1.4 1.9% 6.8

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

IMServ

Europe

Ltd, Market

Linford Force

Wood Information

Business (Europe)

Park, Ltd, Aztech

Milton IT Solutions

Keynes Office Ltd 15.2 2.0% 107,352 91.1% 1.5 2.1% 2.1

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Hermes

Parcelnet

Capitol Ltd, BDW

Park, Trading

Leeds Office Ltd 13.4 1.8% 98,340 45.9% 0.7 1.0% 4.6

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Evolution

Money Group

Ltd,

Mott MacDonald

Ltd, NCG

Portland (Manchester)

Street, Ltd, Simard

Manchester Office Ltd 12.9 1.7% 55,787 95.9% 1.1 1.5% 2.4

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Please

Hold (UK)

Ltd,

A.M.London

Fashion

Ltd,

CVS

(Commercial

Valuers

Oakland &

House, Surveyors)

Manchester Office Ltd 12.9 1.7% 161,502 78.5% 1.0 1.5% 2.1

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

The Scottish

Ministers,

The

Scottish

Sports

Council,

Templeton Noah

On The Beers Ltd,

Green, The Wise

Glasgow Office Group 12.0 1.6% 142,520 92.7% 1.3 1.9% 3.9

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Knights

Professional

Services

Ltd, DMH

Stallard

LLP,

Spirent

Communications

Plc,

Origin Travelopia

1 & 2, Holdings

Crawley Office Ltd 11.7 1.6% 45,855 100.0% 1.1 1.6% 1.5

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Utmost

Life and

Pensions

Ltd,

Buildings Musarubra

2, Bear UK Subsidiary

Brook 3

Office Ltd, Agria

Park, Pet Insurance

Aylesbury Office Ltd 11.3 1.5% 61,642 94.5% 1.0 1.5% 4.0

------------ ------------ ---------------- ------- ---------- ---------- ---------- ----------- ------- ------

Total 232.4 30.9% 1,680,918 87.4% 19.8 28.4% 3.1

-------------------------------------------- ------- ---------- ---------- ---------- ----------- ------- ------

Tables may not sum due to rounding

Top 15 Tenants (share of rental income) as at 30 June 2023

%

of

WAULT Annualised gross

to first Lettable gross rental

break area rent income

--------

Tenant Property Sector (years) (Sq. (GBPm)

Ft)

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Eagle Court, Birmingham

Virgin Media Southgate Park, Information

Ltd Peterborough and communication 0.7 107,830 1.8 2.5%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Electricity,

gas, steam

Shell Energy Columbus House, and air conditioning

Retail Ltd Coventry supply 0.5 53,253 1.4 2.0%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

1 Burgage Square,

Merchant Square,

Wakefield

Albert Edward House,

Preston

Bennett House,

Secretary of Stoke-On-Trent

State for Oakland House,

Communities & Manchester

Local Waterside Business

Government Ltd Park, Swansea Public sector 4.1 108,915 1.1 1.5%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Electricity,

gas, steam

Endeavour House, and air conditioning

EDF Energy Ltd Sunderland supply 7.2 77,565 1.0 1.5%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Administrative

First Source and

Solutions Orbis 1, 2 & 3, support service

UK Ltd Pride Park, Derby activities 3.8 62,433 1.0 1.4%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Electricity,

gas, steam

Two Newstead Court, and air conditioning

E.ON UK Plc Nottingham supply 1.8 99,142 0.9 1.4%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Professional,

scientific

John Menzies 2 Lochside Avenue, and technical

Plc Edinburgh activities 0.1 43,780 0.9 1.3%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Electricity,

NNB Generation gas, steam

Company (HPC) 800 Aztec West, and air conditioning

Ltd Bristol supply 0.7 41,743 0.9 1.2%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Global Banking

School

Ltd Norfolk House, Birmingham Education 9.4 44,245 0.8 1.2%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Professional,

SPD Development scientific

Co Clearblue Innovation and technical

Ltd Centre, Bedford activities 2.3 58,167 0.8 1.2%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Aviva Central

Services Hampshire Corporate Other service

UK Ltd Park, Eastleigh activities 1.4 42,612 0.8 1.1%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Information

Odeon Cinemas Kingscourt Leisure and

Ltd Complex, Dundee communication 12.3 41,542 0.8 1.1%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

1175 Century Way,

Thorpe Park, Leeds

Albert Edward House,

Preston

Fairfax House,

Wolverhampton

lll Acre, Princeton

Drive, Stockton

On Tees

Southgate Park, Human health

Peterborough and

The Foundation Chester social work

SpaMedica Ltd Business Park, Chester activities 2.9 50,656 0.7 1.0%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Electricity,

gas, steam

800 Aztec West, and air conditioning

Edvance SAS Bristol supply 1.1 31,549 0.7 1.0%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Compass House, Dundee

Quadrant House,

Care Inspectorate Dundee Public sector 4.8 51,852 0.7 1.0%

------------------- -------------------------- ----------------------- ---------- --------- ----------- --------

Total 3.3 915,284 14.2 20.3%

------------------------------------------------------------------------ ---------- --------- ----------- --------

Table may not sum due to rounding

PROPERTY PORTFOLIO SECTOR AND REGION SPLITS BY VALUATION AND

INCOME AS AT 30 JUNE 2023

By Valuation

As at 30 June 2023, 92.0% (June 2022: 92.0%, December 2022:

91.8%) of the portfolio by market value was offices and 3.5% (June

2022: 3.5%, December 2022: 3.6%) was retail. The balance was made

up of industrial, 3.0% (June 2022: 3.1%, December 2022: 3.1%) and

other, 1.5% (June 2022: 1.4%, December 2022: 1.4%). By UK region,

as at 30 June 2023, Scotland represented 16.4% (June 2022: 16.9%,

December 2022: 16.7%) of the portfolio and England 78.4% (June

2022: 78.3%, December 2022: 78.3%) the balance of 5.1% (June 2022:

4.8%, December 2022: 5.0%) was in Wales. In England, the largest

regions were the Midlands, South East and the North East.

By Income

As at 30 June 2023, 91.4% (June 2022: 91.5%, December 2022:

91.5%) of the portfolio by income was offices and 4.6% (June 2022:

4.5%, December 2022: 4.5%) was retail. The balance was made up of

industrial, 2.7% (June 2022: 2.6%, December 2022: 2.6%), and other,

1.4% (June 2022: 1.5%, December 2022: 1.3%). By UK region, as at 30

June 2023, Scotland represented 16.5% (June 2022: 17.6%, December

2022: 16.5%) of the portfolio and England 78.0% (June 2022: 77.1%,

December 2022: 78.2%); the balance of 5.5% was in Wales (June 2022:

5.3%, December 2022: 5.3%). In England, the largest regions were

the Midlands, the South East and the North East.

LEASE EXPIRY PROFILE

The WAULT on the portfolio is 4.8 years (30 June 2022: 4.7; 31

December 2022: 4.7); WAULT to first break is 3.0 years (30 June

2022: 2.9; 31 December 2022: 3.0). As at 30 June 2023, 14.0% (30

June 2022: 11.9%; 31 December 2022: 14.5%) of income was from

leases, which will expire within one year, 12.6% (30 June 2022:

14.8%; 31 December 2022: 14.0%) between one and two years, 30.9%

(30 June 2022: 31.4%; 31 December 2022: 29.5%) between two and five

years and 42.5% (30 June 2022: 41.8%; 31 December 2022: 42.0%)

after five years.

Lease Expiry Income Profile

0-1 year 14.0%

1-2 years 12.6%

2-5 years 30.9%

5+ years 42.5%

Tenants by Standard Industrial Classification ("SIC") as at 30

June 2023

SIC Code % of Headline

Rent

Information and communication 12.9%

Professional, scientific and technical

activities 12.5%

Administrative and support services

activities 10.9%

Financial and insurance activities 8.3%

Wholesale and retail trade 7.8%

Electricity, gas, steam and air

conditioning supply 7.2%

Human health and social work activities 5.2%

Public Sector 5.0%

Manufacturing 4.8%

Education 4.6%

Construction 4.1%

Not Specified 3.3%

Other* 13.3%

----------------------------------------- --------------

Total 100.0%

* Other - Accommodation and food service activities, activities

of extraterritorial organisations and bodies, activities of

households as employers; undifferentiated goods, arts,

entertainment and recreation, charity, mining and quarrying, other

service activities, overseas company, public administration and

defence; compulsory social security. real estate activities,

registered society, transportation and storage, water supply,

sewerage, waste management and remediation activities.

FINANCIAL REVIEW

Net Asset Value

Between 1 January 2023 and 30 June 2023, the EPRA NTA* of the

Group decreased to GBP344.9 million (IFRS NAV: GBP373.8 million)

from GBP379.2 million (IFRS NAV: GBP402.9 million) as at 31

December 2022, equating to a decrease in the diluted EPRA NTA of

6.6pps to 66.9pps (IFRS: 72.5pps). This is after the dividends

declared in the period amounting to 3.3pps.

In the six months to 30 June 2023, the investment property

revaluation decrease amounted to GBP29.5 million, for the

properties held as at 30 June 2023.

The investment property portfolio was valued at GBP752.2 million

(30 June 2022: GBP918.2 million; 31 December 2022: GBP789.5

million). The decrease of GBP37.3 million since the December 2022

year-end is a reflection of revaluation movement loss of GBP29.5

million, GBP14.1 million of net property disposals and GBP0.4

million loss on the disposal of investment properties, offset by

subsequent expenditure of GBP6.8 million. Overall, on a

like-for-like basis, the portfolio value decreased by 3.8%, after

adjusting for capital expenditure, acquisitions and disposals

during the period.

The table below sets out the acquisitions, disposals and capital

expenditure for the respective periods:

Six months Six months Year ended

to 30 June to June 31 December

2023 2022 2022

(GBPmillion) (GBPmillion) (GBPmillion)

------------------------------ ------------- ------------- -------------

Acquisitions

Net (after costs) 0.1 78.9 79.3

Gross (before costs) 0.0 74.7 74.7

------------------------------ ------------- ------------- -------------

Disposals

Net (after costs) 14.1 71.4 84.1

Gross (before costs) 14.6 75.5 90.0

------------------------------ ------------- ------------- -------------

Capital Expenditure

Net (after dilapidations) 6.7 3.1 10.0

Gross (before dilapidations) 6.8 3.3 10.9

------------------------------ ------------- ------------- -------------

The diluted EPRA NTA per share decreased to 66.9pps (31 December

2022: 73.5pps). The EPRA NTA is reconciled in the table below:

Six months to 30 June

2023

Pence per

GBPm Share

---------- ------------

Opening EPRA NTA (31 December

2022) 379.2 73.5

---------------------------------------- ---------- ------------

Net rental and property income 26.0 5.0

Administration and other expenses (5.3) (1.0)

Loss on the disposal of investment

properties (0.4) (0.1)

Change in the fair value of investment

properties (29.5) (5.7)

Change in value of right of use (0.1) (0.0)

---------------------------------------- ---------- ------------

EPRA NTA after operating profit 369.9 71.7

---------------------------------------- ---------- ------------

Net finance expense (7.9) (1.5)

Taxation 0.0 0.0

---------------------------------------- ---------- ------------

EPRA NTA before dividends paid 361.9 70.2

---------------------------------------- ---------- ------------

Dividends paid** (17.0) (3.3)

---------------------------------------- ---------- ------------

Closing EPRA NTA (30 June 2023) 344.9 66.9

---------------------------------------- ---------- ------------

Tables may not sum due to rounding

* The Group has determined that EPRA net tangible assets (NTA)

is the most relevant measure. Further detail on the new EPRA

performance measures can be found in the full Annual Report.

**As at 30 June 2022, there were 515,736,583 Shares in

issue.

Income Statement

Operating profit before gains and losses on property assets and

other investments for the six months ended 30 June 2023 amounted to

GBP20.6 million (six months to 30 June 2022: GBP23.4 million). Loss

after finance and before taxation of GBP12.1 million (six months to

30 June 2022: gain GBP28.3 million). The six months to 30 June 2023

included the partial rent roll for properties disposed of during

the period. The decrease also includes the loss in the fair value

of investment properties in the six months to June 2023 of

GBP29.5m, the loss on the disposal of investment properties of

GBP0.4m, and the change in the value of right of use asset of

GBP0.1million.

Rental and property income amounted to GBP34.3 million,

excluding recoverable service charge income and other similar items

(six months to 30 June 2022 GBP37.1m million). The decrease was

primarily the result of the decrease in the rent roll being held

over the six months to 30 June 2023.

Currently more than 80% of the rental income is collected within

30 days of the due date and the bad debts provision in the period

amounted to only GBP0.4 million (release in the six months to 30

June 2022: GBP0.2 million).

Non-recoverable property costs, excluding recoverable service

charge income and other similar costs, amounted to GBP8.3 million

(six months to 30 June 2022: GBP8.1 million), and the rent roll

decreased to GBP69.8 million (six months to 30 June 2022: GBP72.0

million).

Realised loss on the disposal of investment properties amounted

to GBP0.4 million (six months to 30 June 2022: loss GBP3.3

million). The disposal losses were from the aggregate disposal of

four properties in the period, on which individual asset management

plans had been completed. The change in the fair value of

investment properties amounted to a loss of GBP29.5 million (six

months to 30 June 2022: gain of GBP4.8 million). Net capital

expenditure amounted to GBP6.7 million (six months to 30 June 2022:

GBP3.1 million). The gain on the disposal of the right of use asset

amounted to GBPnil (six months to 30 June 2022: GBPnil). The change

in value of right of use asset amounted to a charge of GBP0.1

million (six months to 30 June 2022: charge GBP0.1 million).

Finance expenses amount to GBP8.0 million (six months to 30 June

2022: GBP8.4 million).

The EPRA cost ratio, including direct vacancy costs, was 39.9%

(30 June 2022: 36.9%). The EPRA cost ratio, excluding direct

vacancy costs was 17.3% (30 June 2022: 16.5%). The ongoing charges

for the six months ending 30 June 2023 were 7.0% (30 June 2022:

5.4%).

The EPRA Total Return from Listing to 30 June 2023 was 20.8% (30

June 2022: 44.4%), with an annualised rate of 2.5% pa (30 June

2022: 5.7% pa).

Dividend

During the period from 1 January 2023 to 30 June 2023, the

Company declared dividends totalling 3.30pps (six months to 30 June

2022: 3.35pps). A schedule of dividends can be found on the Company

website.

Debt Financing and Gearing

Borrowings comprise third-party bank debt and the retail

eligible bond. The bank debt is secured over properties owned by

the Group and repayable over the next three to six years. The

weighted average maturity of the bank debt and retail eligible bond

is 4.0 years (30 June 2022: 5.0 years; 31 December 2022: 4.5

years).

The Group's borrowing facilities are with the Royal Bank of

Scotland, Bank of Scotland & Barclays, Scottish Widows Limited

& Aviva Investors Real Estate Finance, Scottish Widows Limited

and Santander UK. The total bank borrowing facilities at 30 June

2023 amounted to GBP381.7 million (30 June 2022: GBP392.9million;

31 December 2022: GBP390.8 million) (before unamortised debt

issuance costs), with GBP5.7 million available to be drawn. In

addition to the bank borrowings, the Group has a GBP50 million 4.5%

retail eligible bond, which is due for repayment in August 2024. In

aggregate, the total debt available at 30 June 2023 amounted to

GBP437.4 million (30 June 2022: GBP444.9 million; 31 December 2022:

GBP444.9 million).

At 30 June 2023, the Group's cash and cash equivalent balances

amounted to GBP41.2 million (30 June 2022: GBP46.2 million; 31

December 2022: GBP50.1 million), of which GBP26.0 million (30 June

2022: GBP43.2 million; 31 December 2022: GBP37.8 million) was

unrestricted cash.

The Group's net loan to value ("LTV") ratio stands at 51.9% (30

June 2022: 43.2%; 31 December 2022: 49.5%) before unamortised

costs. A programme of asset management initiatives and disposals

continues to be diligently executed to ensure the net borrowing

reverts to our long- term target of c.40%.

Debt Profile and LTV Ratios as at 30 June 2023

Gross

Original Outstanding loan to Annual interest

facility debt* Maturity value** rate

Lender GBP'000 GBP'000 date % %

----------------- ---------- ------------ --------- --------- ----------------

Royal Bank of

Scotland, Bank 2.40 over 3

of Scotland months

& Barclays 128,000 125,677 Aug-26 52.7 GBP SONIA

----------------- ---------- ------------ --------- --------- ----------------

Scottish Widows

Ltd. and Aviva

Investors Real

Estate Finance 157,500 157,500 Dec-27 51.4 3.28 Fixed

----------------- ---------- ------------ --------- --------- ----------------

Scottish Widows

Ltd. 36,000 36,000 Dec-28 43.8 3.37 Fixed

----------------- ---------- ------------ --------- --------- ----------------

2.20% over 3

months

Santander UK 65,870 62,516 Jun-29 47.2 GBP SONIA

----------------- ---------- ------------ --------- --------- ----------------

387,370 381,693

----------------- ---------- ------------ --------- --------- ----------------

Retail Eligible

Bond 50,000 50,000 Aug-24 N/A 4.50% Fixed

----------------- ---------- ------------ --------- --------- ----------------

437,370 431,693

----------------- ---------- ------------ --------- --------- ----------------

Table may not sum due to rounding.

* Before unamortised debt issue costs

** Based on valuation undertaken by Colliers at 30/6/23

The Managers continue to monitor the borrowing requirements of

the Group.

The net gearing ratio (net debt to Ordinary Shareholders' equity

(diluted) of the Group was 104.5% as at 30 June 2023 (30 June 2022:

77.3%; 31 December 2022: 96.9%).

Interest cover, excluding amortised costs, stands at 2.8 times

(30 June 2022: 3.2 times; 31 December 2022: 3.4 times) and

including amortised costs, stands at 2.6 times (30 June 2022: 2.8

times; 31 December 2022: 3.0 times).

Hedging

The Group applies an interest rate hedging strategy that is

aligned to the property management strategy and aims to mitigate

interest rate volatility on at least 90% of the debt exposure.

Six months Six months

ended ended Year ended

30 June

2023 30 June 2022 31 December 2022

% % %

Borrowings interest rate hedged

Thereof : 101.6 100.5 100.9

Fixed 56.4 56.7 56.9

Swap 28.4 27.6 27.8

Cap 16.6 16.1 16.2

Weighted Average Cost of

Debt ("WACD")(10) 3.5 3.5 3.5

Table may not sum due to rounding

The over-hedged position has arisen due to the entire Royal Bank

of Scotland, Bank of Scotland & Barclays and Santander UK

facilities, including any undrawn balances, being hedged by

interest rate cap derivatives which have no ongoing cost to the

Group.

(10) WACD - Group borrowings interest and net derivative costs

per annum at the period end, divided by total Group debt in issue

at the period end.

Tax

The Group entered the UK REIT regime on 7 November 2015 and all

of the Group's UK property rental operations became exempt from UK

corporation tax from that date. The exemption remains subject to

the Group's continuing compliance with the UK REIT rules.

On 9 January 2018, the Company registered for VAT purposes in

England.

At 30 June 2023, the Group recognised a tax charge of GBPnil (30

June 2022: GBPnil tax charge).

PRINCIPAL RISKS AND UNCERTAINTIES

For Regional REIT, effective risk management is a cornerstone of

delivering our strategy and integral to the achievement of our

objective of delivering long term value through active asset

management across the portfolio. The principal and emerging risks

and uncertainties the Group faces are summarised below and

described in detail on pages 49 to 59 of the 2022 Annual Report,

which is available on the Group's website: www.regionalreit.com -

Annual Report 2022.

The Audit Committee, which assists the Board with its

responsibilities for managing risk, regularly reviews the risk

appetite of the Company. Taking into consideration the latest

information available, the Company is able to assess and respond

quickly to new and emerging risks.

Though the principal risks and uncertainties remain

substantially unchanged since the Annual Report and Accounts for

the year ended 31 December 2022, the risks remain heightened in

light of concerns around rising inflation, higher interest rates

and the unsettled geopolitical backdrop, all of which may impact

valuations and the wider UK economy.

A summary of the Group's principal risks is provided here.

Strategic risk

Investment decisions could result in lower dividend income and

capital returns to our Shareholders.

Valuation risk

The valuation of the Group's portfolio, undertaken by the

external valuer, Colliers International Property Consultants Ltd ,

could impact the Group's profitability and net assets.

Covid risk

The economic disruption after-effects resulting from Covid-19,

coupled with possible new strains and other infectious diseases,

could further impact rental incomes, the Group's property portfolio

valuations, the ability to access funding at competitive rates,

maintain a progressive dividend policy and adhere to the HMRC

REIT

regime requirements.

Economic and Political risk

The macro-health of the UK economy could impact on borrowing and

hedging costs, demand by tenants for

suitable properties and the quality of the tenants.

Funding risk

The Group may not be able to secure further debt on acceptable

terms, which could impinge upon investment opportunities and the

ability to grow the Group. Bank reference rates maybe set to

continue to become more volatile, accompanying volatile inflation.

Breach of covenants within the Group's funding structure could lead

to a cancellation of debt funding if the Company is unable to

service the debt.

Tenant risk

Type and concentration of tenants could result in a lower rental

income. A higher concentration of lease term maturity and/or break

options, could result in a more volatile rental income.

Financial and Tax Change risk

Changes to UK financial legislation and the tax regime could

result in lower rental income.

Operational risk

Business disruption could result in lower rental income.

Accounting, Legal and Regulatory risk

Changes to accounting, legal and regulatory requirements could

affect current operating processes and the Board's ability to

achieve the investment objectives and provide favourable returns to

our Shareholders.

Environmental and Energy Efficiency Standards

Changes to the environment could impact upon the Group's cost

base, operations and legal requirements which need to be adhered

too. All of these risks could impinge upon the profitability of the

Group.

INTERIM MANAGEMENT REPORT AND DIRECTORS' RESPONSIBILITY

STATEMENT

Interim Management Report

The important events that have occurred during the period under

review, the principal risks and uncertainties and the key factors

influencing the financial statements for the remaining six months

of the year are set out in the Chairman's Statement and the Asset

and Investment Managers' Report.

The principal risks and uncertainties faced by the Group are

substantially unchanged since the date of the Annual Report and

Accounts for the year ended 31 December 2022 and are summarised

above.

The condensed consolidated financial statements for the period

from 1 January 2023 to 30 June 2023 have not been audited or

reviewed by auditors pursuant to the Financial Reporting Council

guidance on Review of Interim Financial Information and do not

constitute annual statutory accounts for the purposes of the

Law.

Going Concern

The financial statements continue to be prepared on a going

concern basis. The Directors have reviewed areas of potential

financial risk and cash flow forecasts. No material uncertainties

have been detected which would influence the Group's ability to

continue as a going concern for a period of not less than 12

months. Accordingly, the Board of Directors continue to adopt the

going concern basis in preparing the condensed consolidated

financial statements.

Further detail on the assessment of going concern can be found

in note 2.3 below.

Responsibility Statement of the Directors in respect of the

Half-Yearly Report

In accordance with Disclosure Guidance and Transparency Rule

4.2.10R we, the Directors of the Company (whose names are listed in

full at the end of this report), confirm that to the best of their

knowledge:

-- the condensed set of consolidated financial statements has been prepared in accordance with International Accounting Standard (IAS) 34, "Interim Financial Reporting", as contained in UK-adopted International Accounting Standards, as required by Disclosure Guidance and Transparency Rule DTR 4.2.4R, and gives a true and fair view of the assets, liabilities, financial position and profit of the Group;

-- this Half-Yearly Report includes a fair review, required

under DTR 4.2.7R, of the important events that have occurred during

the first six months of the financial year, their impact on the

condensed set of consolidated financial statements and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

-- this Half-Yearly Report includes a fair review, required

under DTR 4.2.8R, of related party transactions that have taken

place in the first six months of the current financial year and

that have materially affected the financial position and or

performance of the Group during that period; and any changes in the

related party transaction described in the last Annual Report that

could do so.

This Half-Yearly Report was approved and authorised for issue by

the Board of Directors on 11 September2023 and the above

responsibility statement was signed on its behalf by:

Kevin McGrath

Chairman

11 September 2023

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Continuing Operations

Revenue

Rental and property income 5 44,415 45,211 93,318

Property costs 6 (18,438) (16,267) (30,672)

-------------------------------------- ------- --------------- --------------

Net rental and property income 25,977 28,944 62,646

-------------------------------------- ------- -------------- --------------- --------------

Administrative and other expenses 7 (5,341) (5,568) (11,421)

-------------------------------------- ------- --------------- --------------

Operating profit before gains

and losses on property assets

and other investments 20,636 23,376 51,225

-------------------------------------- ------- -------------- --------------- --------------

Loss on disposal of investment

properties 13 (403) (3,281) (8,636)

Change in fair value of investment

properties 13 (29,491) 4,785 (113,233)

Gain on disposal of right

of use assets - 36 76

Change in fair value of right

of use assets (69) (112) (185)

-------------------------------------- ------- --------------- --------------

Operating (loss)/profit (9,327) 24,804 (70,753)

-------------------------------------- ------- -------------- --------------- --------------

Finance income 8 17 34 126

Finance expenses 9 (7,953) (8,437) (17,285)

Net movement in fair value

of derivative financial instruments 16 5,128 11,851 22,743

-------------------------------------- ------- --------------- --------------

(Loss)/profit before tax (12,135) 28,252 (65,169)

-------------------------------------- ------- -------------- --------------- --------------

Taxation 10 - - 6

-------------------------------------- ------- -------------- --------------- --------------

Total comprehensive (loss)/income

for the period (attributable

to owners of the parent Company) (12,135) 28,252 (65,163)

-------------------------------------- ------- -------------- --------------- --------------

(Losses)/earnings per Share

- basic and diluted 11 (2.4)p 5.5p (12.6)p

-------------------------------------- ------- -------------- --------------- --------------

Total comprehensive (loss)/income arises from continuing

operations.

The notes below are an integral part of these condensed

consolidated financial statements.

Condensed Consolidated Statement of Financial Position

As at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Investment properties 13 752,226 918,200 789,480

Right of use assets 11,057 12,402 11,126

Non-current receivables

on tenant loan 452 674 578

Derivative financial instruments 16 29,577 13,557 24,449

---------------------------------- ------- --------------

793,312 944,833 825,633

---------------------------------- ------- -------------- ------------- ------------

Current assets

Trade and other receivables 33,068 32,181 30,274

Cash and cash equivalents 41,231 46,158 50,148

---------------------------------- ------- -------------- ------------- ------------

74,299 78,339 80,422

Total assets 867,611 1,023,172 906,055

---------------------------------- ------- -------------- ------------- ------------

Liabilities

Current liabilities

Trade and other payables (38,230) (47,188) (39,231)

Deferred income (17,244) (12,537) (16,661)

Deferred tax liabilities (699) (705) (699)

---------------------------------- -------

(56,173) (60,430) (56,591)

---------------------------------- ------- -------------- ------------- ------------

Non-current liabilities

Bank and loan borrowings 14 (376,331) (386,932) (385,265)

Retail eligible bonds 15 (49,829) (49,673) (49,752)

Lease liabilities (11,490) (12,762) (11,505)

---------------------------------- -------

(437,650) (449,367) (446,522)

Total liabilities (493,823) (509,797) (503,113)

---------------------------------- ------- -------------- ------------- ------------

Net assets 373,788 513,375 402,942

---------------------------------- ------- -------------- ------------- ------------

Equity

Stated capital 17 513,762 513,762 513,762

Accumulated losses (139,974) (387) (110,820)

---------------------------------- ------- -------------- ------------- ------------

Total equity attributable to owners

of the parent Company 373,788 513,375 402,942

------------------------------------------- -------------- ------------- ------------

Net asset value per Share

- basic and diluted 18 72.5p 99.5p 78.1p

--------------------------- ----- -------- -------- --------

The notes below are an integral part of these condensed

consolidated financial statements.

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Attributable to owners of

the parent company

Stated Accumulated

capital losses Total

Notes GBP'000 GBP'000 GBP'000

-------------------------- -------- --------- ------------ ----------

Balance at 1 January

2023 513,762 (110,820) 402,942

Total comprehensive loss - (12,135) (12,135)

Dividends paid 12 - (17,019) (17,019)

-------------------------- -------- --------- ------------ ----------

Balance at 30 June 2023 513,762 (139,974) 373,788

-------------------------- -------- --------- ------------ ----------

For the six months ended 30 June 2022

Attributable to owners of

the parent company

Stated Accumulated

capital losses Total

Notes GBP'000 GBP'000 GBP'000

---------------------------- -------- --------- ------------ ----------

Balance at 1 January

2022 513,762 (11,361) 502,401

Total comprehensive income - 28,252 28,252

Dividends paid 12 - (17,278) (17,278)

---------------------------- -------- --------- ------------ ----------

Balance at 30 June 2022 513,762 (387) 513,375

---------------------------- -------- --------- ------------ ----------

For the year ended 31 December 2022

Attributable to owners of

the parent company

Stated Accumulated

capital losses Total

Notes GBP'000 GBP'000 GBP'000

-------------------------- -------- --------- ------------ ----------

Balance at 1 January

2022 513,762 (11,361) 502,401

Total comprehensive loss - (65,163) (65,163)

Dividends paid 12 - (34,296) (34,296)

-------------------------- -------- --------- ------------ ----------

Balance at 31 December

2022 513,762 (110,820) 402,942

-------------------------- -------- --------- ------------ ----------

The notes below are an integral part of these condensed

consolidated financial statements.

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------------------- --------------- -------------- -------------

Cash flows from operating activities

(Loss)/profit for the year before taxation (12,135) 28,252 (65,169)

- Change in fair value of investment properties 24,491 (4,785) 113,233

- Change in fair value of financial derivative

instruments (5,128) (11,851) (22,743)

Loss on disposal of investment properties 403 3,281 8,636

- Gain on disposal of right of use assets - (36) (76)

- Change in fair value of right of use

assets 69 112 185

Finance income (17) (34) (126)

Finance expense 7,953 8,437 17,285

(Increase) in trade and other receivables (2,679) (2,631) (619)

(Decrease)/increase in trade and other

payables and deferred income (433) 1,686 (2,150)

-------------------------------------------------- --------------- -------------- -------------

Cash generated from

operations 17,524 22,431 48,456

-------------------------------------------------- --------------- -------------- -------------

Finance costs (7,430) (7,406) (15,198)

Net cash flow generated from operating

activities 10,094 15,025 33,258

-------------------------------------------------- --------------- -------------- -------------

Investing activities

Purchase of investment properties and

subsequent expenditure (6,755) (81,970) (89,287)

Sale of investment properties 14,115 71,423 84,087

Interest received 28 33 116

-------------------------------------------------- --------------- -------------- -------------

Net cash flow from/(used in) operating

activities 7,388 (10,514) (5,084)

-------------------------------------------------- --------------- -------------- -------------

Financing activities

Dividends paid (17,004) (16,956) (33,971)

Bank borrowings advanced 1,944 14,322 14,322

Bank borrowings repaid (11,043) (11,370) (13,467)

Bank borrowing costs

paid (78) (153) (485)

Lease repayments (218) (324) (553)

-------------------------------------------------- --------------- -------------- -------------

Net cash flow (used in)/generated from

financing activities (26,399) (14,481) (34,154)

-------------------------------------------------- --------------- -------------- -------------

Net decrease in cash and cash equivalents

for

the period (8,917) (9,970) (5,980)

Cash and cash equivalents at the start

of the period 50,148 56,128 56,128

-------------------------------------------------- --------------- -------------- -------------

Cash and cash equivalents at the end

of the period 41,231 46,158 50,148

-------------------------------------------------- --------------- -------------- -------------

The notes below are an integral part of these condensed

consolidated financial statements.

Notes to the Condensed Consolidated Financial Statements

For the six months ended 30 June 2023

1. Corporate information

The condensed consolidated financial statements of the Group for

the six months ended 30 June 2023 comprise the results of the

Company and its subsidiaries (together constituting the "Group")

and were approved by the Board and authorised for issue on 11

September 2023.

The Company is a company limited by shares incorporated in

Guernsey under The Companies (Guernsey) Law,

2008, as amended (the "Law"). The Company's Ordinary Shares are

admitted to the Official List of the Financial

Conduct Authority ("FCA") and traded on the London Stock

Exchange ("LSE").

The Company was incorporated on 22 June 2015 and is registered

with the Guernsey Financial Services

Commission as a Registered Closed-Ended Collective Investment

Scheme pursuant to The Protection of

Investors (Bailiwick of Guernsey) Law, 2020, as amended, and the

Registered Collective Investment Scheme Rules & Guidance

2021.

The Company did not begin trading until 6 November 2015 when its

shares were admitted to trading on the LSE.

The nature of the Group's operations and its principal

activities are set out in the Chairman's Statement.

The address of the registered office is: Mont Crevelt House,