TIDMKAT

RNS Number : 2620N

Katoro Gold PLC

22 September 2023

Katoro Gold plc (Incorporated in England and Wales)

(Registration Number: 9306219)

Share code on AIM: KAT

ISIN: GB00BSNBL022

('Katoro' or 'the Company')

Dated: 22 September 2023

Katoro Gold plc ( ' Katoro ' or the ' Company ' )

Unaudited Interim Results for the six months ended 30 June

2023

Katoro Gold plc (AIM: KAT), the strategic and precious minerals

exploration and development company, announces its unaudited

interim financial results for the six-month period ending 30 June

2023.

Overview of key highlights during the interim period to

date:

-- On 15 March 2023 the Company sub-divided the existing

Ordinary shares of GBP0.01 into one Deferred Share of GBP0.009 each

and one Ordinary Share of GBP0.001 each. Shareholders retained the

same number of shares, it was simply the par value that

changed.

-- The successful conclusion of a fundraise, of which a gross

amount of GBP150,000 (GBP140,900 net of fees) was raised at 0.1

pence per share. Funding has been utilised for ongoing working

capital and to conclude a project assessment process (RNS dated 3

April 2023).

-- On 14 June 2023 two Directors of the Company retired to

pursue other interests going forward. The Company thanks both

gentlemen for their dedicated support and contribution to the

Company during their tenure.

-- The appointment of Beaumont Cornish Limited as the Company's

new Nominated Advisor ('NOMAD'). This appointment was made in

accordance with Rule 1 of the AIM Rules for Companies (RNS dated 10

January 2023).

The full unaudited interim financial results for the six-month

period ending 30 June 2023 can be viewed below and at www.

katorogold.com .

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014.

**S**

For further information please visit www.katorogold.com or

contact:

Louis Coetzee info@kibo.energy Kibo Energy plc Chief Executive

Officer

James Biddle +44 207 628 3396 Beaumont Cornish Nominated Adviser

Roland Cornish Limited

------------------------------ -------------------- ------------------

Nick Emmerson +44 148 341 3500 SI Capital Ltd Broker

Sam Lomanto

------------------------------ -------------------- ------------------

Zainab Slemang zainab@lifacommunications.com Lifa Communications Investor and

van Rijmenant Media Relations

Consultant

------------------------------ -------------------- ------------------

Chairman's Statement

I am pleased to present Katoro Gold's Interim Financial

Statements for the six months ending 30 June 2023.

The first half of this year continued to be dedicated to the

pursuit of a new suitable project acquisition(s) and the

development of projects and opportunities in the strategic and

precious minerals' exploration sector. Where appropriate and

prudent, development work on current projects continued despite

significant challenges, most notably, severe funding

constraints.

Exploration and Development

During the 2022 financial year, the Company successfully

completed the Haneti Project's diamond drill programme, refined the

geological modelling to focus efforts on high-potential areas, and

thereby improving strategic alignment for upcoming endeavours

currently under consideration. A comprehensive desktop analysis of

historical exploration data, incorporating insights from the 2022

Haneti diamond drilling campaign was also conducted. The analysis

assisted in selective target identification for future project

exploration efforts and also informs ongoing dialogue with

potential project partners. Exploration expenditure during 2023 was

significantly lower than 2022, given funding constraints as well as

the focus on reviewing all available exploration data and results

to determine the most appropriate next steps towards advancing

exploration work on the Henati project.

The Imweru Gold Project still resides with the Lake Victoria

Gold ('LVG') joint venture, with LVG holding an 80% interest in the

JV as announced on 7 March 2022. Lake Victoria Gold is also

developing the adjacent Imwelo Gold Project, with a view on

maximising the full potential of the two projects by consolidating

them..

In line with our aim to diversify the Katoro Gold exploration

portfolio, we continue to investigate and evaluate opportunities,

aligned with the Company's strategy, with specific focus on the

identification of opportunities/projects that demonstrates a clear

path to production and with significant shareholder value

potential.

Corporate

During the first half of 2023, Katoro successfully secured

funding to further the Company's strategic objectives and fulfil

its general working capital requirements. On 3 April 2023, the

Company announced the successful conclusion of a fundraise through

which an amount of GBP150,000 (gross) was raised at 0.1 pence per

share, through a placing by SI Capital. The placing comprised of

GBP130,000 raised by SI Capital with directors subscribing for a

further GBP20,000. Proceeds from said placing were utilised for

ongoing working capital and to progress the continued assessment

and consolidation of the Company's asset portfolio.

The Company also issued a total of 59 085 100 new Ordinary

Shares at 0.1p, to the value of GBP59 085, to Directors to settle

accrued Directors' fees. (Refer to the RNS' dated 3 and 11 April

2023 for further information).

On 14 June 2023 two Directors of the Company retired to pursue

other interests. The remaining non-executive directors have been

appointed to the risk-, audit- and remuneration committees to

ensure compliance with corporate governance framework.

On 10 January 2023, the Company announced the appointment of

Beaumont Cornish Limited as its new NOMAD, the appointment of which

was made in accordance with Rule 1 of the AIM Rules for

Companies.

Conclusion

I remain confident in the Company's ongoing efforts to

consolidate and advance the Katoro portfolio towards the creation

and unlocking of shareholder value. We are optimistic about the

various initiatives currently underway and look forward to what

these may deliver during the second half of 2023. I also want to

use this opportunity to thank the directors, shareholders and staff

for their continued support and commitment.

Louis Coetzee

Executive Chairman

Unaudited interim results for the six months ended 30 June

2023

Unaudited condensed consolidated interim Statement of

Comprehensive Income

For the six months ended 30 June 2023

6 months to 6 months to 12 months to

Note 30 June 30 June 31 December

2023 2022 2022

(Unaudited) (Unaudited and Restated) (Audited)

GBP GBP GBP

------------ ------------------------- -------------

Revenue - - -

Cost of sales - - -

------------ ------------------------- -------------

Gross Profit - - -

------------ ------------------------- -------------

Administrative expenses (261,265) (479,491) (664,682)

Foreign exchanges (loss) / gain (240) 60,714 (407)

Reversal of impairment / (impairment) 15 1,067 - (224,966)

Share of loss in associate 15 (1,067) - (4,408)

Loss on disposal of subsidiary - - (75,922)

Share-based payment transactions 6 (22,796) - -

Exploration expenditure (26,800) (278,645) (285,374)

Operating profit/loss (311,101) (697,422) (1,255,759)

------------ ------------------------- -------------

Other Income - 142,045 -

Finance Income 7 15,152 5,260

------------ ------------------------- -------------

Profit / (loss) before tax (311,094) (540,225) (1,250,499)

------------ ------------------------- -------------

Tax - - (61)

------------ ------------------------- -------------

Profit/(loss) for the period (311,094) (540,225) (1,250,560)

------------ ------------------------- -------------

Other comprehensive income

Exchange differences on translating of foreign

operations 6,841 105,383 97,226

------------ ------------------------- -------------

Total comprehensive loss (304,253) (434,842) (1,153,334)

------------ ------------------------- -------------

Loss for the period (311,094) (540,225) (1,250,560)

------------ ------------------------- -------------

Attributable to owners of the parent (293,559) (431,128) (1,054,079)

Attributable to non-controlling interest (17,535) (109,097) (196,481)

------------ ------------------------- -------------

Total comprehensive loss (304,253) (434,842) (1,153,334)

------------ ------------------------- -------------

Attributable to owners of the parent (329,812) (325,745) (994,101)

Attributable to non-controlling interest 25,559 (109,097) (159,233)

------------ ------------------------- -------------

Earnings / (loss) per share

Basic and diluted earnings / (loss) per share (pence) 4 (0.05) (0.09) (0.23)

Unaudited condensed consolidated interim Statement of Financial

Position

As at 30 June 2023

6 months to 6 months to 12 months to

30 June 30 June 31 December

Note 2023 2022 2022

(Unaudited) (Unaudited & Restated) (Audited)

GBP GBP GBP

------------ ----------------------- -------------

Assets

Non-current assets

Intangible assets 7 - 209,500 -

Investments in associates 15 - 182,301 -

------------ ----------------------- -------------

- 391,801 -

------------ ----------------------- -------------

Current assets

Other receivables 7,743 21,002 16,340

Cash and cash equivalents 25,443 342,481 49,596

Total current assets 33,186 363,483 65,936

------------ ----------------------- -------------

Total Assets 33,186 755,284 65,936

------------ ----------------------- -------------

Equity

Called-up share capital 5 669,497 4,604,125 4,604,125

Share premium 2,962,582 2,962,582 2,962,582

Deferred share capital 5 4,143,713 - -

Capital contribution reserve 10,528 10,528 10,528

Translation reserve (333,190) (251,532) (296,937)

Merger reserve 1,271,715 1,271,715 1,271,715

Warrant and share-based payment reserve 6 474,352 946,153 828,223

Retained deficit (9,235,396) (8,813,483) (9,318,504)

------------ ----------------------- -------------

Reserves attributable to owners (36,199) 730,088 61,732

Minority interest (267,081) (242,504) (292,640)

------------ ----------------------- -------------

Total Equity (303,280) 487,584 (230,908)

------------ ----------------------- -------------

Liabilities

Current liabilities

Trade and other payables 3 144,216 82,921 106,615

Other financial liabilities 192,250 184,779 190,229

------------ ----------------------- -------------

Total current liabilities 336,466 267,700 296,844

------------ ----------------------- -------------

Total Equity and Liabilities 33,186 755,284 65,936

------------ ----------------------- -------------

Unaudited condensed consolidated Statement of Changes in

Equity

Share Share Deferred Warrant Merger Capital Foreign Retained Non-controlling Total

Capital Premium Share reserve Reserve Contribution currency deficit interest

Capital and share Reserve translation

based reserve

payment

reserve

============ =========== =========== ========== =========== ============= ============ ============= ================ ============

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

------------ ----------- ----------- ---------- ----------- ------------- ------------ ------------- ---------------- ------------

Balance at 31 December

2022 (audited) 4,604,125 2,962,582 - 828,223 1,271,715 10,528 (296,937) (9,318,504) (292,640) (230,908)

------------ ----------- ----------- ---------- ----------- ------------- ------------ ------------- ---------------- ------------

Loss for the period - - - - - - (293,559) (17,535) (311,094)

Other comprehensive loss

- exchange differences - - - - - - (36,253) - 43,094 6,841

Capital reorganisation (4,143,713) - 4,143,713 - - - - - - -

Warrants issued - - - 22,796 - - - - - 22,796

Warrants expired - - - (376,667) - - - 376,667 - -

Proceeds of share issue

of share capital 209,085 - - - - - - - - 209,085

------------ ----------- ----------- ---------- ----------- ------------- ------------ ------------- ---------------- ------------

Balance at 30 June 2023

(unaudited) 669,497 2,962,582 4,143,713 474,352 1,271,715 10,528 (333,190) (9,235,396) (267,081) (303,280)

------------ ----------- ----------- ---------- ----------- ------------- ------------ ------------- ---------------- ------------

Balance at 31 December

2021 (audited) 4,604,125 2,962,582 - 946,153 1,271,715 10,528 (356,915) (8,382,355) (133,407) 922,426

------------ ----------- ----------- ---------- ----------- ------------- ------------ ------------- ---------------- ------------

Loss for the period - - - - - - - (431,128) (109,097) (540,225)

============ =========== =========== ========== =========== ============= ============ ============= ================ ============

Other comprehensive loss

- exchange differences - - - - - - 105,383 - - 105,383

Balance at 30 June 2022

(unaudited) - Restated 4,604,125 2,962,582 - 946,153 1,271,715 10,528 (251,532) (8,813,483) (242,504) 487,584

------------ ----------- ----------- ---------- ----------- ------------- ------------ ------------- ---------------- ------------

Balance at 1 January 2022

(audited) 4,604,125 2,962,582 - 946,153 1,271,715 10,528 (356,915) (8,382,355) (133,407) 922,426

------------ ----------- ----------- ---------- ----------- ------------- ------------ ------------- ---------------- ------------

Loss for the period - - - - - - - (1,054,079) (196,481) (1,250,560)

Other comprehensive

income - exchange

differences - - - - - - 59,978 - 37,248 97,226

Expiry of share warrants

and options - - - (117,930) - - - 117,930 - -

Balance at 31 December

2022 (audited) 4,604,125 2,962,582 - 828,223 1,271,715 10,528 (296,937) (9,318,504) (292,640) (230,908)

------------ ----------- ----------- ---------- ----------- ------------- ------------ ------------- ---------------- ------------

Notes 5 5 6

Unaudited condensed consolidated interim Statement of Cash

Flow

For the six months ended 30 June 2023

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

------------ ------------ ------------

Loss for the period before

taxation (311,094) (540,225) (1,250,499)

Adjusted for:

Foreign exchange loss / (gain) 240 (5,875) 407

Share-based payment transactions 22,796 - -

Share in loss in associate - - 4,408

(Profit) / loss on disposal

of subsidiaries - (142,045) 75,922

Impairments of associates - - 15,466

Impairments of intangible assets - - 209,500

Impairments of other financial

assets - 71,002 -

Share issue costs not settled

in cash 9,100 - -

Other non-cash items 8,622 - 961

Non-trade expenses not settled

in cash 59,085 - -

------------ ------------ ------------

Operating loss before working

capital changes (211,251) (617,143) (943,835)

Decrease in trade and other

receivables 8,597 27,700 32,362

Increase / (Decrease) in trade

and other payables 37,601 (5,531) 18,163

------------ ------------ ------------

Net cash outflows from operating

activities (165,053) (594,974) (893,310)

------------ ------------ ------------

Cash flows from financing

activities

Issue of shares (net of share

issue costs) 140,900 - -

Proceeds from other financial

liabilities - 109,499 114,950

------------ ------------ ------------

Net cash proceeds from financing

activities 140,900 109,499 114,950

------------ ------------ ------------

Net decrease in cash and cash

equivalents (24,153) (485,475) (778,360)

Cash and cash equivalents at

beginning of period 49,596 827,956 827,956

------------ ------------ ------------

Cash and cash equivalents

at end of period 25,443 342,481 49,596

------------ ------------ ------------

Notes to the unaudited condensed consolidated interim financial

statements

For the six months ended 30 June 2023

Note 1 General information

Katoro Gold plc ('Katoro' or the 'Company') is incorporated in

England and Wales as a public limited company ('plc'). The

Company's registered office is located at 60 Gracechurch Street,

London EC3V OHR.

The principal activity of Katoro, through its subsidiaries

(together the 'Group'), is to carry out evaluation and exploration

studies within a licenced portfolio area with a view to generating

commercially viable Mineral Resources, namely gold and nickel

mines. In Haneti, the Group has one nickel mining project, which

has mineral exploration licences currently held by Eagle

Exploration Ltd.

The condensed interim consolidated financial statements do not

represent statutory accounts within the meaning of section 435 of

the Companies Act 2016.

The condensed consolidated financial statements of the Company

have been prepared in accordance with the Accounting Standard IAS

34, 'Interim Financial Reporting', as adopted by the UK.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

period ended 31 December 2022, which has been prepared in

accordance with UK-adopted IFRSs, and any public announcements made

by Katoro Gold plc during the interim reporting period.

The condensed consolidated financial statements of the Group are

presented in Pounds Sterling, which is the functional and

presentation currency for the Group and its related

subsidiaries.

The condensed consolidated financial statements do not represent

statutory accounts within the meaning of section 435 of the

Companies Act 2016.

Accounting policies applied are consistent with those of the

previous financial period and annual report unless where new

standards became effective during the period and a newly adopted

accounting policy for Investments in equity instruments -

Associates.

The seasonality or cyclicality of operations does not impact on

the interim financial statements.

Investments in associates

Associates are all entities over which the group has significant

influence but not control, generally accompanying a shareholding

between 20% and 50% of the voting rights. Investments in associates

are accounted for using the equity method of accounting.

Use of estimates and judgements

The preparation of these consolidated statements in conformity

with UK adopted International Accounting Standards require

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets, liabilities, income, and expenses.

The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

In particular, there are significant areas of estimation,

uncertainty and critical judgements in applying accounting policies

that have the most significant effect on the amounts recognised in

the financial statements in the following areas:

-- Exploration and evaluation expenditure;

-- Impairment assessment of non-financial assets;

Exploration and evaluation expenditure - significant judgement

concerning the choice of accounting policy

In line with the Group's accounting policy, all the exploration

and evaluation expenditure has been charged to profit or loss, as

in the judgement of the Directors the commercial viability of the

mineral deposits had not been established. Moreover, until such

time that commercial viability of the Blyvoor Joint Venture is

reached, and the recoverability of the other financial asset

receivable, as disclosed below, is more certain all amounts

contributed to the joint operation will be expensed to exploration

and evaluation expenditure.

Impairment assessment of non-financial assets

In applying IAS 36, impairment assessments are performed

whenever events or changes in circumstances indicate that the

carrying amount of an asset or CGU may not be recoverable.

Estimates are made in determining the recoverable amount of assets

which includes the estimation of cash flows and discount rates used

as well as determination of the fair value in an open market

transaction, where available. In estimating the cash flows,

management bases cash flow projections on reasonable and

supportable assumptions that represent management's best estimate

of the range of economic conditions that will exist over the

remaining useful life of the assets. The discount rates used

reflect the current market assessment of the time value of money

and the risks specific to the assets for which the future cash flow

estimates have not been adjusted. Where market values are available

for similar assets in a similar condition, managements assess the

reasonability of these valuations in order to utilise these

valuations as a comparable open market value to determine whether

an indication of impairment exists.

Joint arrangements - Blyvoor Joint Venture

Arrangements under which Katoro has contractually agreed to

share control with another party or parties are joint ventures

where the parties have rights to the net assets of the arrangement,

or joint operations where the parties have rights to the assets and

obligations for the liabilities relating to the arrangement.

Exploration & Evaluation Assets

Exploration and evaluation activity involves the search for

mineral resources, the determination of technical feasibility and

the assessment of commercial viability of an identified

resource.

Exploration and evaluation activity includes:

-- researching and analysing historical exploration data.

-- gathering exploration data through topographical, geochemical, and geophysical studies.

-- exploratory drilling, trenching and sampling.

-- determining and examining the volume and grade of the resource.

-- surveying transportation and infrastructure requirements; and

-- conducting market and finance studies.

Exploration and evaluation expenditure is charged to the income

statement as incurred except in the following circumstances, in

which case the expenditure may be capitalised:

In respect of minerals activities:

-- the exploration and evaluation activity are within an area of

interest which was previously acquired as an asset acquisition or

in a business combination and measured at fair value on

acquisition; or

-- the existence of a commercially viable mineral deposit has been established.

At each reporting period end the capitalisation criteria had not

been met due to the existence of a commercially viable mineral

deposit not being established and therefore no exploration and

evaluation assets have been recognised.

Capitalised exploration and evaluation expenditure considered to

be tangible is recorded as a component of property, plant and

equipment at cost less impairment charges. Otherwise, it is

recorded as an intangible.

Intangible assets all relate to exploration and evaluation

expenditure which are carried at cost with an indefinite useful

life and therefore are reviewed for impairment when there are

indicators of impairment. Where a potential impairment is

indicated, assessment is performed for each area of interest in

conjunction with the group of operating assets (representing a cash

generating unit) to which the exploration is attributed.

Exploration areas at which reserves have been discovered but

require major capital expenditure before production can begin, are

continually evaluated to ensure that commercial quantities of

reserves exist or to ensure that additional exploration work is

under way or planned.

Note 2 Going concern

The Company currently generates no revenue and had a net

liability position of GBP303,280 and available cash reserves of

GBP25,443 as at 30 June 2023 (30 June 2022: net asset position of

GBP487,584 and cash reserves of GBP342,481 and 31 December 2022:

net liability position of GBP230, 908 and cash reserves of

GBP49,596). The Company's existing cash resources are expected to

run out by approximately the end of September 2023 and therefore

the Company is reliant on completing a fundraise by that date to

fund its ongoing working capital.

The Directors regularly review cash flow requirements to ensure

the Group can meet financial obligations as and when they fall due.

The Directors have evaluated the Group's liquidity risk and

liquidity requirements to confirm whether the Group has adequate

cash resources and working capital to continue as a going concern

for the foreseeable future. The Directors assessed available

information about the future, possible outcomes of planned events

and the responses to such events and conditions that would be

available to the Board.

In the past the Group has raised funds via equity contributions

from new and existing shareholders, enabling the Group to remain a

going concern until such time that revenues are earned through the

sale or development and mining of a mineral deposit. There can be

no assurance that such funds will continue to be available on

reasonable terms, or at all in future.

There is a material uncertainty related to the events or

conditions described above that may cast significant doubt on the

entity's ability to continue as a going concern, and, therefore,

that it may be unable to realise its assets and discharge its

liabilities in the normal course of business.

In response to the above the Directors continue to review the

Group's options to secure additional funding for its general

working capital requirements, alongside its ongoing review of

potential acquisition targets and corporate development needs. A

deferral of Directors' salaries has been agreed upon in the short

term.

The evaluation of the going concern considers that Katoro has a

strong proven track record of being able to source funding on an

ongoing basis, even in difficult market conditions, and it expects

to be able to continue doing so.

Various other sources of funding are being considered, most

notably:

-- Capital placing

-- Credit loan notes

-- Exercise of outstanding warrants

-- A letter of support can be obtained from Kibo Energy Plc, a

shareholder

Katoro also enjoys strong support, with specific reference to

funding, from its corporate broker, SI Capital Ltd, which also has

a proven track record of being able to facilitate ongoing

funding.

The Group and Company will require additional finance to

progress work on its current assets and bring them to commercial

development and cash generation. As a result, the Directors

continue to monitor and manage the Company's cash and overheads

carefully in the best interests of its shareholders.

Whilst the Directors continue to consider it appropriate to

prepare the financial statements on a going concern basis the above

constitutes a material uncertainty that shareholders should be

aware of.

Note 3 Trade and other payables

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

-------- -------- ------------

Trade payables 92,667 82,921 8,989

Accruals 51,549 - 97,626

-------- -------- ------------

144,216 82,921 106,615

-------- -------- ------------

Note 4 Earnings per share

The calculation of loss per share is based on the following loss

and number of shares:

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

------------ ------------ ------------

Loss for the period

from continuing operations

attributable to equity

holders of parent (293,559) (431,128) (1,054,079)

------------ ------------ ------------

Weighted average basic

and diluted number of

shares 615,980,994 460,412,590 460,412,593

------------ ------------ ------------

Basic and diluted earnings/(loss)

per share (pence) (0.05) (0.09) (0.23)

The Group presents basic and diluted EPS data on the basis that

the current structure has always been in place. Therefore, the

number of Katoro shares in issue as at the period end has been used

in the calculation. Basic earnings/Loss per share is calculated by

dividing the profit/loss for the period from continuing operations

of the Group by the weighted average number of shares in issue

during the period.

The Company had in issue warrants and options at 30 June 2023.

The inclusion of such warrants and options in the weighted average

number of shares in issue would be anti-dilutive, and therefore,

they have not been included for the purpose of calculating the loss

per share.

Note 5 Share Capital

The called-up and fully paid share capital of the Company is as

follows:

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

-------- ---------- ------------

Allotted, called-up

and fully paid: 669,497 4,604,125 4,604,125

-------- ---------- ------------

A reconciliation of share capital is set out below:

Number of Allotted, Deferred

shares called-up share capital

and fully

paid

GBP GBP

------------ ------------ ---------------

At 1 January 2022 460,412,593 4,604,125 -

At 1 July 2022 460,412,593 4,604,125 -

At 1 January 2023 460,412,593 4,604,125 -

------------ ------------ ---------------

Capital reorganisation - (4,143,713) 4,143,713

Shares issued 209,085,100 209,085 -

At 30 June 2023 669,497,693 669,497 4,143,713

------------ ------------ ---------------

The following share transactions took place during the period 1

January 2023 to 30 June 2023:

-- On 16 March 2023 Katoro underwent a capital reorganisation

whereby all ordinary shares in issue as at the date of subdivision

was subdivided into an Ordinary Share of GBP0.001 and a Deferred

Share of GBP0.009.

-- On 3 April 2023 130,000,000 shares in Katoro was issued at

par value of GBP0.001 as part of a cash placement.

-- On 3 April 2023 20,000,000 shares in Katoro was issued at par

value of GBP0.001 as part of directors subscriptions'.

-- On 3 April 2023 48,000,000 shares in Katoro was issued at par

value of GBP0.001 in lieu of payment for Director's fees due.

-- On 11 April 2023 11,085,100 shares in Katoro was issued at

par value of GBP0.001 in lieu of payment for Director's fees

due.

Note 6 Warrant and Share-based payment reserve

Warrants

The following reconciliation serves to summarise the composition

of the warrant reserve as at period end:

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

---------- -------- ------------

Opening balance of warrant

reserve 376,667 494,597 494,597

Issue of warrants 22,796 - -

Expiry of warrants (376,667) - (117,930)

474,352 494,597 376,667

---------- -------- ------------

Reconciliation of the quantity of warrants in issue:

30 June 30 June 31 December

2023 2022 2022

------------- ------------ -------------

Opening balance 166,166,666 194,574,999 194,574,999

Warrants exercised - - -

Warrants issued 209,085,100 - -

Warrants expired (36,666,666) - (28,408,333)

------------- ------------ -------------

338,585,100 194,574,999 166,166,666

------------- ------------ -------------

No warrants have been exercised in the six-month period ended 30

June 2022.

The following warrant transactions took place during the period

1 January 2023 to 30 June 2023:

-- On 3 April 2023 130,000,000 warrants were issued pursuant a

share issue. The warrants have an exercise price of GBP0.002 each

and expire 36 months after the issue thereof.

-- On 3 April 2023 20,000,000 warrants were issued pursuant a

share issue. The warrants have an exercise price of GBP0.002 each

and expire 36 months after the issue thereof.

-- On 3 April 2023 48,000,000 warrants were issued to directors

pursuant a share issue. The warrants have an exercise price of

GBP0.002 each and expire 36 months after the issue thereof.

-- On 3 April 2023 11,085,100 warrants were issued to directors

pursuant a share issue. The warrants have an exercise price of

GBP0.002 each and expire 36 months after the issue thereof.

-- On 25 June 2023 36,666,666 warrants previously in issue expired.

All warrants have been valued on the Black-Scholes model based

on a risk free rate of 3.41% and volatility of 117%.

Share Options

The following reconciliation serves to summarise the composition

of the share-based payment reserve as at period end:

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

-------- -------- ------------

Opening balance of share-based

payment reserve 451,556 451,556 451,556

Vesting of share options - - -

-------- -------- ------------

451,556 451,556 451,556

-------- -------- ------------

Reconciliation of the quantity of Share Options in issue:

30 June 30 June 31 December

2023 2022 2022

----------- ----------- ------------

Opening balance 32,244,781 32,244,781 32,244,781

Closing balance 32,244,781 32,244,781 32,244,781

----------- ----------- ------------

During the period no new share options were vested and no share

options expired.

Note 7 Exploration and evaluation assets

Exploration and evaluation assets consist solely of separately

identifiable prospecting assets held by Kibo Nickel and its

subsidiaries.

The following reconciliation serves to summarise the composition

of intangible prospecting assets as at period end:

Reconciliation of exploration and evaluation

assets

GBP

----------

Carrying value at 1 January 2022 209,500

----------

Carrying value at 30 June 2022 209,500

Impairment (209,500)

----------

Carrying value at 31 December 2022 -

----------

Carrying value at 30 June 2023 -

----------

Haneti comprises tenements (prospecting licences, offers and

applications) prospective for nickel, platinum-group-elements and

gold. It covers an area of approximately 5,000 sq. km in central

Tanzania and forms a near contiguous project block. The project

area straddles the Dodoma, Kondoa and Manyoni districts all within

the Dodoma (Administrative) Region. The main prospective belt of

rocks within the project, the Haneti-Itiso Ultramafic Complex

(HIUC), is centred on the small town of Haneti, located 88

kilometres north of Tanzania's capital city Dodoma. The HIUC

sporadically crops out over a strike length of 80 kilometres with

most outcrop exposure occurring 15 kilometres east of Haneti

village where artisanal mining of the semi-precious mineral

chrysoprase (nickel-stained chalcedonic quartz) is being carried

out at a few localities.

As at 31 December 2022, the Company had successfully completed

the diamond drilling programme. The results were analysed and will

allow for a refined approach during the next phase of the project,

with a focus on specified areas. This plan has not yet been

developed in sufficient detail and accordingly further funding has

not yet been obtained. Due to this uncertainty, management has

applied a provision for impairment against the carrying value of

the intangible asset to the value of GBP209,500, during the

December 2022 financial year. The status remained the same at the

interim period ended on 30 June 2023.

Note 8 Board of Directors

Non-executive directors Paul Dudley and Myles Campion retired on

14 June 2023 due to other interests they wish to pursue going

forward. The remaining non-executive directors have been appointed

on the risk-, audit- and remuneration committees to ensure

compliance with the corporate governance framework. Additional

directors will be appointed if the need arises.

Note 9 Events after the reporting period

The directors are not aware of any material event that occurred

after the reporting date and up to the date of this report.

Note 10 Unaudited results

These condensed consolidated interim financial results have not

been audited or reviewed by the Group's auditors.

Note 11 Commitments and contingencies

There are no material contingent assets or liabilities as at 30

June 2023.

Note 12 Segment reporting

Segmental disclosure per category

Mining and Corporate Total

exploration

GBP GBP GBP

------------- ---------- ------------

30 June 2023

Administrative costs (108,412) (154,142) (262,554)

Exploration expenditure (26,800) - (26,800)

Other profit or loss

items (51) (21,689) (21,740)

------------- ---------- ------------

Loss before tax (135,263) (175,831) (311,094)

Segmental assets 4,716 28,470 33,186

Segmental liabilities 245,710 90,756 336,466

------------- ---------- ------------

30 June 2022

Administrative costs (143,570) (335,921) (479,491)

Exploration expenditure (278,645) - (278,645)

Other profit or loss

items 70,138 147,773 217,911

------------- ---------- ------------

Loss before tax (352,077) (188,148) (540,225)

Segmental assets 244,817 510,467 755,284

Segmental liabilities 211,907 55,793 267,700

------------- ---------- ------------

31 December 2022

Administrative costs (261,794) (627,854) (889,648)

Exploration expenditure (285,374) - (285,374)

Other profit or loss

items 445 (75,922) (75,477)

------------- ---------- ------------

Loss before tax (546,723) (703,776) (1,250,499)

Segmental assets 6,103 59,833 65,936

Segmental liabilities 219,192 77,652 296,844

------------- ---------- ------------

Segmental disclosure per geographical location

Tanzania Cyprus United South Total

Kingdom Africa

GBP GBP GBP GBP GBP

---------- ---------- ------------ -------- ------------

30 June

2023

(Loss)/profit

before

tax (31,330) (106,311) (175,831) 2,378 (311,094)

Segmental

assets 4,513 - 28,470 203 33,186

30 June

2022

Profit/(loss)

before

tax (282,130) 754,127 (1,009,653) (2,569) (540,225)

Segmental

assets 215,252 806,676 (293,922) 27,278 755,284

31 December

2022

Loss before

tax (300,438) (212,725) (729,695) (7,641) (1,250,499)

Segmental

assets 214,705 996 435,945 1,818 653,464

---------- ---------- ------------ -------- ------------

Note 13 Related parties

Relationships

Name Relationship

Kibo Energy plc Significant shareholder and controlling

parent

Power Metal Resources plc Significant shareholder of a subsidiary

Board of directors

Louis Coetzee Chairman (Executive)

Lukas Maree Non-executive director

Louis Scheepers Non-executive director

Myles Campion Non-executive director

Paul Dudley Non-executive director

Related party balances 30 June 30 June 31 December

included in: 2023 2022 2022

GBP GBP GBP

---------- ---------- ------------

Trade Payables

Kibo Energy plc (6,025) (20,247) (16,025)

---------- ---------- ------------

Other financial liabilities

Power Metal Resources

plc (192,250) (184,779) (190,229)

---------- ---------- ------------

Accrued directors'

fees payable

Louis Coetzee (8,878) - (2,939)

Louis Scheepers (8,878) - (2,939)

Myles Campion (7,122) - (2,939)

Paul Dudley (7,246) - (3,436)

Tinus Maree (8,878) - (2,939)

(41,002) - (15,192)

(239,277) (205,026) (221,446)

Related party transactions 30 June 30 June 31 December

included in: 2023 2022 2022

GBP GBP GBP

---------- ---------- ------------

Issue of share in lieu

of payment of accrued

directors fees

Louis Coetzee 12,000 - -

Louis Scheepers 12,000 - -

Myles Campion 12,000 - -

Paul Dudley 11,085 - -

Tinus Maree 12,000 - -

Issue of warrants

Louis Coetzee 1,308 - -

Louis Scheepers 1,308 - -

Myles Campion 1,308 - -

Paul Dudley 1,211 - -

Tinus Maree 1,308 - -

65,528 - -

---------- ---------- ------------

Related parties of the Group comprise subsidiaries, significant

shareholders and the Directors.

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation.

Transactions with related parties are affected on a commercial

basis and related party debts are repayable on a commercial

basis.

The transactions during the period between the Company and its

subsidiaries included the settlement of expenditure to/from

subsidiaries, working capital funding and settlement of the

Company's liabilities through the issue of equity in subsidiaries.

The loans to/from Group companies do not have fixed repayment terms

and are unsecured.

Note 14 Principal risks

The principal risks and uncertainties identified in the last

Annual Report of Katoro Gold plc, issued in May 2023, have not

materially changed/altered in the interim period.

Note 15 Investment in associates

The investment in associates have been valued on the fair value

of the disposal price of the Kibo Gold subgroup to LVG and is

carried at equity accounted value less impairment.

GBP

-----------

Opening balance at 1 January 2022 -

Recognition of associate 182,301

-----------

Proceeds for the disposal of 80% of Kibo

Gold subgroup to LVG 729,203

Fair value of the 100% shareholding of

Kibo Gold subgroup 911,504

Fair value of the 20% interest in Kibo

Gold subgroup retained 182,301

-----------

Closing balance at 30 June 2022 182,301

Additional contributions 19,919

Share in loss of Associate (4,408)

Impairment (197,812)

-----------

Closing balance as at 31 December 2022 -

Share in loss of Associate (1,067)

Reversal of impairment 1,067

-----------

Closing balance at 30 June 2023 -

-----------

Note 16 Financial instruments - Fair value and risk management

The carrying amount of all financial assets and liabilities

approximates the fair value. Directors consider the carrying value

of financial instruments of a short-term nature, i.e. those that

mature in 12 months or less, to approximate the fair value of such

assets or liability classes.

The carrying values of longer-term assets are considered to

approximate their fair value as these instruments bear interest at

interest rates appropriate to the risk profile of the asset or

liability class.

The Group carries no unlisted financial instruments measured in

the statement of financial position at fair value as at 30 June

2023, nor in any of the comparative periods.

Note 17 Comparative figures

Amounts relating to costs allocated to share premium were

reclassified during the period 1 January 2022 to 30 June 2022. This

resulted in no change to the net asset value of the company for the

period ended 30 June 2022. No changes were made to any other period

as this was corrected in the audited statutory accounts for the

year ended 31 December 2022.

Previously Effect Restated

stated of change

----------- ----------- ---------

GBP GBP GBP

----------- ----------- ---------

As at 30 June 2022

Statement of financial

position

Equity 487,584 - 487,584

----------- ----------- ---------

Statement of profit or

loss

Net loss 483,175 57,050 540,225

----------- ----------- ---------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LBMJTMTITBPJ

(END) Dow Jones Newswires

September 22, 2023 02:00 ET (06:00 GMT)

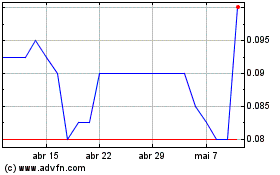

Katoro Gold (LSE:KAT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Katoro Gold (LSE:KAT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025