TIDMECO

RNS Number : 1964V

Eco (Atlantic) Oil and Gas Ltd.

30 November 2023

30 November 2023

ECO (ATLANTIC) OIL & GAS LTD.

("Eco," "Eco Atlantic," "Company," or together with its

subsidiaries, the "Group")

Unaudited Results for the three and six month periods ended 30

September 2023

Eco (Atlantic) Oil & Gas Ltd. (AIM: ECO, TSX -- V: EOG) ,

the oil and gas exploration company focused on the offshore

Atlantic Margins, is pleased to announce its results for the three

and six month periods ended 30 September 2023.

Highlights:

Financials (as at 30 September 2023)

-- The Company had cash and cash equivalents of US$3.85 million and no debt.

-- The Company had total assets of US$51.0 million, total

liabilities of US$1.71 million and total equity of US$49.30

million.

Operations:

Guyana

-- On 10 August 2023, the Company signed a Sale Purchase

Agreement for its wholly owned subsidiary, Eco Guyana Oil and Gas

(Barbados) Limited to acquire a 60% Operated Interest in Orinduik

Block, offshore Guyana, through the acquisition of Tullow Guyana

B.V. , a wholly owned subsidiary of Tullow Oil Plc. in exchange for

a combination of upfront cash and contingent consideration (the

"Transaction") .

Post-period end:

-- On 15 November 2023, Eco announced that the Company had

received Government approval for the transfer of 60% Working

Interest and Operatorship in the offshore Orinduik Block in Guyana

from the Minister of Natural Resources, Cooperative Republic of

Guyana.

-- On 21 November 2023, the Company announced completion of the

Transaction, upon which Eco became the designated Operator of the

Orinduik Block and increase its aggregate Participating Interest to

75%, held via Eco Orinduik B.V. (60%) and Eco (Atlantic) Guyana Inc

(15%). TOQAP Guyana B.V continues to hold a Participating Interest

of 25%.

-- A formal farm-out process for the Orinduik Block has

commenced and the Company expects to provide further updates in due

course.

South Africa

Block 3B/4B

-- O n 17 July 2023, the Company issued 1,200,000 shares to the

Lunn Family Trust in place of the US$500,000 cash consideration due

in respect of the acquisition of the 6.25% interest in Block3B/4B

from the Lunn Family Trust as previously announced on 27 June

2022.

-- On 11 July 2023, the Company signed a legally binding Letter

of Intent with Africa Oil to farm out a 6.25% Participating

Interest in Block 3B/4B, offshore South Africa for up to US$10.5

million in cash. On 14 August 2023, the parties signed the final

Assignment and Transfer agreement. Additional US$2.5m cash

consideration is expected to be received upon Government of SA

approval of the transfer, with the initial consideration of US$2.5m

already having been received.

-- Government of SA approval and therefore the $2.5m cash

payment from Africa Oil are expected to be received by year end

2023.

-- The JV partners continue to progress a farm-out, in

conjunction with preparations for a two well drilling campaign on

the Block. Further updates will be made as appropriate.

Block 2B

-- Eco has applied for a Production Right Application to the

Petroleum Agency of South Africa, for Block 2B, and continues to

assess opportunities available to deliver value from this licence

for the benefit of stakeholders.

Namibia

-- Following media reports that significant multi-well drilling

campaigns are about to be undertaken offshore Namibia, Eco

continues to receive third party interest in its strategic acreage

position offshore Namibia.

-- The Company continues to assess farm out opportunities with

its four licences in the region as it considers options for

progressing exploration and commercial activity on its acreage.

Board Changes:

-- Post period end, on October 9, 2023, the Company announced

the appointment of Miss Alice Carroll and Miss Selma Usiku as

executive and non-executive directors respectively of the Company

with immediate effect, with Helmut Angula retiring from the

Board.

Gil Holzman, President and Chief Executive Officer of Eco

Atlantic, commented:

"We have made progress on all fronts across our exploration

portfolio in 2023. The most notable development was the acquisition

of a 60% Working Interest in the Orinduik Block, offshore Guyana,

from a subsidiary of Tullow Oil Plc. This transaction made Eco the

Operator of the licence and brings our total stake in the Block to

75%. We have already commenced with a farm-out process and opened a

data room, receiving early interest from a number of multi-national

oil and gas companies.

"Also, offshore South Africa, we continue to progress plans for

a two-well campaign on Block 3B/4B in parallel to continuing

farm-out discussions with various large industry partners. In

Namibia, we continue to receive incoming interest with regard to

our highly strategic acreage position, which has increased

following recent media reports of multi-well drilling campaigns

being lined up.

"In closing, the last two quarters of 2023 have been a highly

active period for us, and we look forward to sharing further

updates on the ongoing farm out workstreams and drilling plans with

our stakeholders as and when we are in a position to do so."

The Company's unaudited financial results and Management's

Discussion and Analysis for the three and six months ended 30

September 2023 are available for download on the Company's website

at www.ecooilandgas.com and on Sedar at www.sedar.com .

The following are the Company's Balance Sheet, Income

Statements, Cash Flow Statement and selected notes from the annual

Financial Statements. All amounts are in US Dollars, unless

otherwise stated.

Balance Sheet

September 30, March 31,

------------------------------------------------

2023 2023

------------------------------------------------ ------------------------- ------------------

Assets

Current Assets

Cash and cash equivalents 3,850,448 4,110,734

Short-term investments 13,107 13,107

Government receivable 30,550 22,494

Amounts owing by license partners,

net - 477,578

Accounts receivable and prepaid

expenses 164,142 1,529,451

------------------------------------------------ ------------------------- ------------------

Total Current Assets 4,058,247 6,153,364

------------------------------------------------ ------------------------- ------------------

Non- Current Assets

Investment in associate 8,279,820 8,612,267

Petroleum and natural gas licenses 38,668,895 40,852,020

------------------------------------------------ ------------------------- ------------------

Total Non-Current Assets 46,948,715 49,464,287

------------------------------------------------ ------------------------- ------------------

Total Assets 51,006,962 55,617,651

------------------------------------------------ ------------------------- ------------------

Liabilities

Current Liabilities

Accounts payable and accrued liabilities 1,410,571 4,416,789

Advances from and amounts owing

to license partners, net 298,775 286,553

Warrant liability - 261,720

------------------------------------------------

Total Current Liabilities 1,709,346 4,965,062

Total Liabilities 1,709,346 4,965,062

------------------------------------------------ ------------------------- ------------------

Equity

Share capital 122,088,498 121,570,983

Restricted Share Units reserve 920,653 920,653

Warrants 14,778,272 14,778,272

Stock options 2,900,501 2,804,806

Foreign currency translation reserve (1,744,484) (1,458,709)

Accumulated deficit (89,645,824) (87,963,416)

------------------------------------------------ ------------------------- ------------------

Total Equity 49,297,616 50,652,589

------------------------------------------------ ------------------------- ------------------

Total Liabilities and Equity 51,006,962 55,617,651

------------------------------------------------ ------------------------- ------------------

Income Statement

Three months ended Six months ended

September 30, September 30,

-------------------------------------------------- -------------------------------------------------------

2023 2022 2023 2022

------------------------ ------------------------ --------------------------- --------------------------

Revenue

Interest income 21 36,325 1,686 56,452

------------------------ ------------------------ --------------------------- --------------------------

21 36,325 1,686 56,452

Operating expenses

:

Compensation

costs 236,556 210,605 420,998 479,914

Professional

fees 202,557 240,894 298,560 460,579

Operating

costs,

net 411,201 11,097,960 761,381 13,041,411

General and

administrative

costs 160,569 350,864 273,042 608,154

Share-based

compensation (15,817) 750,667 95,695 1,751,886

Foreign

exchange

loss 139,795 690,794 99,745 975,221

------------------------ ------------------------ --------------------------- --------------------------

Total operating

expenses 1,134,861 13,341,784 1,949,421 17,317,165

------------------------ ------------------------ --------------------------- --------------------------

Operating loss (1,134,840) (13,305,459) (1,947,735) (17,260,713)

Gain on

settlement

of liability (200,640) - (200,640) -

Fair value

change

in warrant

liability - 415,712 261,720 1,846,696

Share of losses

of company

accounted

for at equity (166,223) (92,302) (332,447) (184,605)

------------------------ ------------------------ --------------------------- --------------------------

Net loss for the

period from continuing

operations, before

taxes (1,501,703) (12,982,049) (2,219,102) (15,598,622)

Tax recovery 536,694 - 536,694 -

------------------------ ------------------------ --------------------------- --------------------------

Net loss for the

period from continuing

operations. After

taxes (965,009) (12,982,049) (1,682,408) (15,598,622)

Loss from discontinued

operations, after-tax - (800,210) - (898,323)

Net loss for the

period (965,009) (13,782,259) (1,682,408) (16,496,945)

Foreign

currency

translation

adjustment 9,901 (441,472) (285,775) (553,102)

Comprehensive

loss for the period (955,108) (14,223,731) (1,968,183) (17,050,047)

------------------------ ------------------------ --------------------------- --------------------------

Basic and diluted

net loss per share:

from continuing

operations (0.004) (0.038) (0.006) (0.049)

======================== ======================== =========================== ==========================

from discontinued

operations (0.000) (0.002) (0.000) (0.003)

======================== ======================== =========================== ==========================

Weighted average

number of ordinary

shares used in

computing basic

and diluted net

loss per share 369,421,234 343,966,022 368,390,620 319,575,745

======================== ======================== =========================== ==========================

Cash Flow Statement

Six months ended

September 30,

----------------------------------------------

2023 2022

-------------------- ------------------------

Cash flow from operating

activities - continued operations

Net loss from continuing

operations (1,682,408) (15,598,622)

Items not affecting cash:

Share-based compensation 95,695 1,751,886

Revaluation of warrant liability (261,720) (1,846,696)

Share of losses of companies

accounted for at equity 332,447 184,605

Changes in non--cash working

capital:

Government receivable (8,056) (5,169)

Accounts payable and accrued

liabilities (2,805,578) 1,601,059

Accounts receivable and

prepaid expenses 1,365,309 (948,297)

Reallocation to discontinued

operations cashflows - 419,113

Advance from and amounts

owing to license partners 489,800 1,486,236

------------------------------------ -------------------- ------------------------

Cash flow from operating

activities - continued operations (2,474,511) (12,955,885)

------------------------------------ -------------------- ------------------------

Cash flow from operating

activities - discontinued

operations - (1,069,617)

Cash flow from investing

activities

Proceeds from Block 3B/4B 2,500,000 -

farmout

------------------------------------ -------------------- ------------------------

Cash flow from investing 2,500,000 -

activities - continued operations

------------------------------------ -------------------- ------------------------

Cash flow from financing

activities

Proceeds from private placements,

net - 35,662,446

Exercise of stock options - 67,406

------------------------------------ --------------------

Cash flow from financing

activities - 35,729,852

------------------------------------ -------------------- ------------------------

Increase in cash and cash

equivalents 25,489 21,704,350

Foreign exchange differences (285,775) (553,102)

Cash and cash equivalents,

beginning of period 4,110,734 3,438,834

------------------------------------ -------------------- ------------------------

Cash and cash equivalents,

end of period 3,850,448 24,590,082

------------------------------------ -------------------- ------------------------

Notes to the Financial Statements

Basis of Preparation

The consolidated financial statements of the Company have been

prepared on a historical cost basis with the exception of certain

financial instruments that are measured at fair value. Historical

cost is generally based on the fair value of the consideration

given in exchange for assets.

Summary of Significant Accounting Policies

Critical accounting estimates

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognized

prospectively from the period in which the estimates are revised.

The following are the key estimate and assumption uncertainties

considered by management.

**S**

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0) 20

8434 2754

Gil Holzman, CEO

Colin Kinley, COO

Alice Carroll, Executive Director +44(0)781 729 5070

Strand Hanson Limited (Financial &

Nominated Adviser) +44 (0) 20 7409 3494

James Harris

James Bellman

Berenberg (Broker) +44 (0) 20 3207 7800

M atthew Armitt

Detlir Elezi

Echelon Capital (Financial Adviser

N. America Markets)

Ryan Mooney +1 (403) 606 4852

Simon Akit +1 (416) 8497776

Celicourt (PR) +44 (0) 20 7770 6424

Mark Antelme

Jimmy Lea

Notes to editors:

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM-quoted Atlantic Margin-focused

oil & gas exploration company with offshore license interests

in Guyana, Namibia, and South Africa. Eco aims to deliver material

value for its stakeholders through its role in the energy

transition to explore for low carbon intensity oil and gas in

stable emerging markets close to infrastructure.

Offshore Guyana in the proven Guyana-Suriname Basin, the Company

is Operator and holds a 75% Working Interest in the 1,800 km(2)

Orinduik Block. In Namibia, the Company holds Operatorship and an

85% Working Interest in four offshore Petroleum Licences: PELs: 97,

98, 99, and 100, representing a combined area of 28,593 km2 in the

Walvis Basin.

Offshore South Africa, Eco is Operator and holds a 50% working

interest in Block 2B and a 26.25% Working Interest in Block 3B/4B

operated by Africa Oil Corp., totalling some 20,643km2.

Cautionary Notes:

This news release contains certain "forward-looking statements",

including, without limitation, statements containing the words

"will", "may", "expects", "intends", "anticipates" and other

similar expressions which constitute "forward-looking information"

within the meaning of applicable securities laws. Forward-looking

statements reflect the Company's current expectations, assumptions,

and beliefs, and are subject to a number of risks and uncertainties

that could cause actual results to differ materially from those

anticipated. These forward-looking statements are qualified in

their entirety by the inherent risks and uncertainties surrounding

future expectations.

Important factors that could cause actual results to differ

materially from expectations include, but are not limited to,

general economic and market factors, competition, the effect of the

global pandemic and consequent economic disruption, and the factors

detailed in the Company's ongoing filings with the securities

regulatory authorities, available at www.sedar.com . Although

forward-looking statements contained herein are based on what

management considers to be reasonable assumptions based on

currently available information, there can be no assurance that

actual events, performance or results will be consistent with these

forward-looking statements, and our assumptions may prove to be

incorrect. Readers are cautioned not to place undue reliance on

these forward-looking statements. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements either as a result of new information, future events or

otherwise, except as required by applicable laws.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZMFMVGZGFZG

(END) Dow Jones Newswires

November 30, 2023 02:00 ET (07:00 GMT)

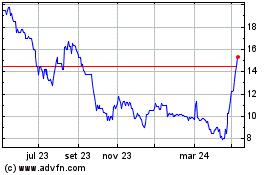

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

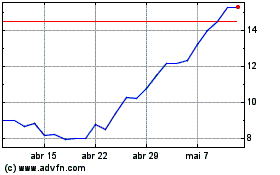

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024