TIDMNSCI

RNS Number : 3073V

NetScientific PLC

01 December 2023

For release on RNS: 07.00, 1 December 2023

NetScientific plc

("NetScientific" or the "Company")

Plastic recycling technology company DeepTech Recycling secures

GBP1 million investment

NetScientific Plc (AIM: NSCI), the deep tech and life sciences

VC investment group, announces that its portfolio company DeepTech

Recycling Limited ("Deeptech Recycling") has successfully closed a

GBP1 million fundraising ("Fundraising").

DeepTech Recycling is a UK deep tech company born out of a

global environmental crisis caused by insufficient and

unsustainable management of plastic waste. Its mission is to make

plastic sustainable and support the critical global drive towards a

circular economy for plastics through chemical recycling of plastic

waste. DeepTech Recycling has a unique, patented and proven

technology platform, which was developed over more than 10 years of

structured and accelerated development and commercialisation, and

offers unique and innovative solutions to the environmental

challenges of plastic pollution.

The Fundraising, carried out via an advance subscription

agreement, constitutes the first closing of a target investment

programme of c.GBP3 million, with further investment anticipated

within the next six months. The Fundraising was led and syndicated

by EMV Capital, the Company's wholly owned venture capital and

corporate finance firm.

In December 2022, DeepTech Recycling, in which the NetScientific

group holds a 30 per cent. stake, acquired the majority of assets

of Recycling Technologies Limited out of administration. Since the

acquisition, the value creation team of EMV Capital has worked

closely with DeepTech Recycling to consolidate assets and IP,

embark on further research and development programmes, and start on

the commercial roadmap of the business.

The proceeds of the Fundraising will, inter alia, support

DeepTech Recycling in the completion of a development phase for its

pilot plant, development and adaption of its targeted technology

and licensing strategy, as well as the set-up of its operating base

and development of its core team.

The advance subscription funds will only be applied for shares

in the capital of Deeptech Recycling upon, inter alia, Deeptech

Recycling raising at least GBP1.5 million (or such lower amount as

may be agreed between the parties) within six months of the first

closing of the Fundraising. Such subscription shares are

anticipated to be priced at a 20 per cent. discount to the issue

price of such GBP1.5 million fundraising, with an agreed valuation

cap of GBP6 million. Given the subscription price is not yet known,

and no new shares in DeepTech Recycling have yet been issued,

following completion of the first closing of the Fundraising, the

total equity holding of NetScientific in DeepTech Recycling remains

at 30 per cent. The capital under advisory of EMV Capital in

respect of investors introduced by it to DeepTech Recycling has

increased by GBP1 million.

Related Party Transaction

EMV Capital has agreed with DeepTech Recycling terms of

engagement for advising on the Fundraising and the continued

investment programme, including the provision of value creation

services over up to a three year term ("Engagement Terms").

Pursuant to the Engagement Terms, EMV Capital will charge customary

fees to DeepTech Recycling, including a commission of 6 per cent.

of investment monies introduced by EMV Capital to DeepTech

Recycling, and annual fees for value creation and management

support services anticipated to be c.GBP100,000 for an initial 12

month period. Such fees may, at the election of EMV Capital, be

converted into shares in the capital of DeepTech Recycling at a 25

per cent. discount to the prevailing issue price of such

shares.

DeepTech Recycling is currently owned as to 70 per cent. of its

shares by AB Group Limited, a company owned by Melvin Lawson who is

a substantial shareholder of NetScientific. As such the Engagement

Terms constitute a related party transaction under Rule 13 of the

AIM Rules for Companies. The Directors, excluding Dr Ilian Iliev by

reason of his concert party relationship with Melvin Lawson,

consider, having consulted with the Company's nominated adviser,

Panmure Gordon (UK) Limited, that the Engagement Terms are fair and

reasonable in so far as shareholders of NetScientific are

concerned.

Marvine Besong, Managing Director and CTO of DeepTech Recycling,

said:

"This investment represents a significant vote of confidence in

our mission to transform non-recyclable plastic waste into high

value oil products, a process that is a key lever in achieving

substantial reductions in plastic waste disposal and greenhouse gas

emissions. The oil products generated can be used by the

petrochemical industry as the feedstock for producing

virgin-quality plastics , further re-enforcing our passionate

support for the drive towards a circular economy.

" As the business continues to make strong progress, we will

leverage this new capital injection to scale up our operations and

accelerate the realisation of our robust pipeline of opportunities.

EMV Capital has played a key role in facilitating our fundraising

initiatives, as well as the relaunch of the business. We are

grateful for the insightful contributions of their value creation

team."

Dr Ilian Iliev, CEO of NetScientific, and Chair and Investment

Director of DeepTech Recycling added:

"We are pleased with the outcome of this pivotal fundraising for

DeepTech Recycling. The company's innovative chemical recycling

platform can be integrated and scaled into the existing waste

management value chain internationally. It is a balanced approach,

addressing the global plastic waste crisis, while recognising the

importance of plastic in the modern economy. We look forward to

continuing to work with DeepTech Recycling as it actively

contributes to a cleaner, more sustainable future.

"This transaction is a further example of our capital efficient

investment model, where the NetScientific group was able to secure

a 30 per cent. stake for nominal value. In turn our subsidiary EMV

Capital was able to secure investor support for the company's

growth strategy. We look forward to reporting on the company's

fundraising programme, and the impact on the net asset value and

fair value of our shareholding, upon the company issuing new shares

in due course."

The person responsible for arranging the release of this

announcement on behalf of the Company is Edward Hooper, General

Counsel and Executive Director of the Company.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF REGULATION (EU) NO 596/2014 WHICH

IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018, AS AMENDED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

-Ends-

NetScientific

NetScientific

Ilian Iliev, CEO Via Belvedere Communications

Panmure Gordon (UK) Limited (NOMAD and

Broker)

Emma Earl / Freddy Crossley / Will Goode

/ Mark Rogers (Corporate Finance)

Rupert Dearden (Corporate Broking) +44 (0)20 7886 2500

Belvedere Communications

John West / Llew Angus / Lily Pearce +44 (0)20 7653 8702

About NetScientific

NetScientific plc (AIM: NSCI) is a deep tech and life sciences

VC investment group with an international portfolio of innovative

companies.

NetScientific identifies, invests in, and builds high growth

companies in the UK and internationally. The company adds value

through the proactive management of its portfolio, progressing to

key value inflection points, and delivering investment returns

through partial or full liquidity events.

NetScientific differentiates itself by employing a

capital-efficient investment approach, making judicial use of its

balance sheet and syndicating investments through its wholly owned

VC subsidiary, EMV Capital. The group secures a mixture of direct

equity stakes and carried interest stakes in its portfolio of

companies, creating a lean structure that can support a large

portfolio.

NetScientific is headquartered in London, United Kingdom, and is

admitted to trading on AIM, a market operated by the London Stock

Exchange.

www.netscientific.net

About DeepTech Recycling Limited

DeepTech Recycling is a UK-based technology company born out of

a global environmental crisis caused by insufficient and

unsustainable management of plastic waste. The company's mission is

to make plastic sustainable and support the critical global drive

towards a circular economy for plastics.

DeepTech Recycling has a unique, patented and demonstrated

technology platform, which was developed over more than 10 years of

structured and accelerated development and commercialisation, and

offers a unique innovative solution to the environmental challenges

of plastic pollution.

The technology converts currently unrecyclable plastic waste,

that would normally be landfilled or incinerated, into oil that can

be used by the petrochemical industry as the feedstock for

producing virgin quality plastic.

https://www.deeptech-recycling.co.uk/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FURFBLLXXFLEFBB

(END) Dow Jones Newswires

December 01, 2023 02:00 ET (07:00 GMT)

Netscientific (LSE:NSCI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

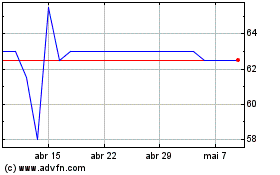

Netscientific (LSE:NSCI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024