TIDMWATR

RNS Number : 6417V

Water Intelligence PLC

05 December 2023

Water Intelligence plc

Trading Update: On-Track During the First Ten Months

Water Intelligence plc (AIM: WATR.L) (the "Group" or "Water

Intelligence"), a leading multinational provider of precision,

minimally-invasive leak detection and remediation solutions for

both potable and non-potable water is pleased to provide its

Trading update for the ten month period ended 31 October 2023.

Update on Growth Strategy

-- Market demand for precision water and wastewater

infrastructure solutions continues to grow globally. During Q3, the

Group renewed multi-year municipal contracts in Australia and

executed new municipal contracts in the EU to grow the Group's

presence internationally

-- In terms of execution, the Group will be completing in the

US, during Q1 2024, its implementation of Salesforce and related

applications for its scheduling, delivery and payments system to

achieve operating scaleability and efficiencies across corporate

and franchise locations. Such enhanced execution functionalities

are expected to lead to gaining additional national insurance

contracts during Q4 for execution during 2024

-- Both EBITDA and PBT margins have improved despite higher inflation and higher interest rates

-- In terms of investments to support growth, in October the

Group launched a new training, product assembly and R&D

facility in Connecticut to supply more trained technicians and

specialized equipment to meet market demand for solutions; the

facility will also be a showcase to support the sale of new

American Leak Detection franchises for which there is current

demand.

Financial Highlights for the ten month period ended 31 October

2023

-- Revenue increased by 6% to $64.4 million (2022: $60.9 million)

o Franchise royalty flat $5.8 million (2022: $5.8 million)

o Franchise-related activities (franchise sales, equipment

sales, business-to-business channels) increased by 9% to $9.7

million (2022: $8.9 million)

-- Insurance business-to-business channel grew by 9% to $9.1

million (2022: $8.4 million)

o US Corporate sales increased by 5% to $42.6 million (2022:

$40.4 million)

o International Corporate sales rose by 10% to $6.4 million

(2022: $5.8 million)

-- Statutory PBT grew by 11% to $6.8 million (2022: $6.1 million)

-- Adjusted PBT (before non-cash expenses of amortization and

share-based payments; and non-core costs) increased by 14% to $8.7

million (2022: $7.7 million)

-- Statutory EBITDA rose by 6% to $11.3 million (2022: $10.7 million)

-- Adjusted EBITDA (before non-cash share-based payments; and

non-core costs) rose by 9% to $12.6 million (2022: $11.6

million)

-- Adjusted PBT and Adjusted EBITDA Margins improve

o Adjusted PBT margins improve to 14% (2022: 13%)

o Adjusted EBITDA margins improve to 20% (2022: 19%)

-- Balance sheet strong at 31 October 2023

o Cash and equivalents at $17.2 million

o Bank Debt of $15.3 million and Deferred Acquisition Payments

of $8.6 million (combined $23.9 million) with payments spread

through 2027 at a fixed interest rate of approximately 5%

o Net Debt (including bank debt and deferred consideration) to

Statutory EBITDA TTM ratio: 0.58 (low degree of leverage affording

significant financial capacity for acquisitions)

Commenting on the Group's performance, Executive Chairman, Dr.

Patrick DeSouza remarked:

" From an operational perspective, the Group has adjusted well

during 2023 to inflationary and higher interest rate headwinds. We

are achieving profit growth and increasing margins, as well as

making investments for accelerating sales growth in 2024 and

beyond. Moreover, we will be completing our Salesforce

implementation during Q1 2024 which will enable us to accelerate

the growth of our national sales channels. To meet increased market

demand, we are launching an advanced training centre in

Connecticut. Importantly, we have maintained a strong balance sheet

and have additional financial capacity to invest in organic growth

and to execute accretive acquisitions to fuel added revenue and

profits.

We remain confident in our long-term growth prospects and our

ability to continue delivering value for both our franchise and

corporate stakeholders. In delivering on our growth plan, we

appreciate the on-going support of our shareholders."

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Enquiries:

Water Intelligence

plc

Patrick DeSouza, Executive Tel: +1 203 654 5426

Chairman

RBC Capital Markets - Joint Tel: +44 (0)20 7653 4000

Broker

Rupert Walford

Elizabeth Evans

Daniel Saveski

WH Ireland Limited - NOMAD Tel: +44 (0)20 7220 1666

& Joint Broker

Hugh Morgan

James Bavister

Tel: +44 (0)20 3903

Dowgate Capital Ltd - Joint 7715

Broker

Stephen Norcross

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKQBKBBDBQBK

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

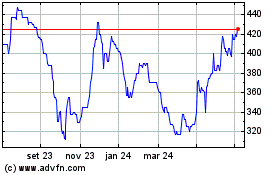

Water Intelligence (LSE:WATR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

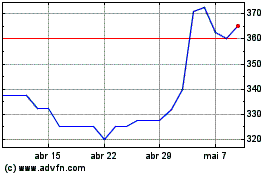

Water Intelligence (LSE:WATR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024