Kistos Holdings PLC Redemption of Kistos NL2 bonds (2568W)

11 Dezembro 2023 - 4:00AM

UK Regulatory

TIDMKIST

RNS Number : 2568W

Kistos Holdings PLC

11 December 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS

(SI 2019/310) (UK MAR). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

11(th) December 2023

Kistos Holdings plc

("Kistos" or "the Company")

Redemption of Kistos NL2 bonds

Kistos announces that on Friday 8(th) December 2023 its Dutch

subsidiary, Kistos NL2 B.V., notified Nordic Trustee AS of the

exercise of its Call Option and redemption of all its outstanding

bonds. Of the original EUR150,000,000 of bonds issued by Kistos

NL2, EUR73,168,000 has already been repurchased by the Company.

The Company will redeem the outstanding EUR76,832,000 (plus

accrued and unpaid interest) under both of its Bond Issues at a

redemption price equal to 102.5% of the nominal amount for each

redeemed bond. The redemption date will be 22 December 2023 and the

record date will be 20 December 2023.

Andrew Austin, Executive Chairman of Kistos, said:

"The redemption of the Kistos NL2 B.V. bonds from our cash

resources will boost Kistos' profitability by reducing our net

interest costs. By removing certain covenants contained in the Bond

Terms, it will also enhance our financial flexibility."

For the purposes of UK MAR, the person responsible for arranging

the release of this announcement on behalf of Kistos is Andrew

Austin, Executive Chairman.

Enquiries

Kistos Holdings plc via Hawthorn Advisors

Andrew Austin, Executive Chairman

Panmure Gordon (NOMAD, Joint Broker) Tel: 0207 886 2500

John Prior / James Sinclair-Ford

Berenberg (Joint Broker) Tel: 0203 207 7800

Matthew Armitt / Ciaran Walsh

Hawthorn Advisors (Public Relations Tel: 0203 745 4960

Advisor)

Henry Lerwill / Simon Woods

Camarco (Public Relations Advisor) Tel: 0203 757 4983

Billy Clegg

Notes to editors

Kistos plc was established to acquire and manage companies in

the energy sector engaging in the energy transition trend. The

Company has undertaken a series of transactions including the

acquisition of a portfolio of highly cash generative natural gas

production assets in the Netherlands from Tulip Oil Netherlands

B.V. in 2021. This was followed in July 2022, with the acquisition

of a 20% interest in the Greater Laggan Area (GLA) from

TotalEnergies, which includes four producing gas fields and a

development project. In May 2023, Kistos completed its third

acquisition, acquiring the total share capital of Mime Petroleum

and its Norwegian Continental Shelf Assets. These comprise a 10%

stake in the Balder joint venture spanning Balder and Ringhorne oil

fields.

Kistos is a low carbon intensity gas producer with Estimated

Scope 1 CO emissions from its operated activities offshore of less

than 0.01 kg/boe in 2022 (excluding necessary flaring during

drilling campaigns).

https://www.kistosplc.com

- ENDS -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAFAEFEADFAA

(END) Dow Jones Newswires

December 11, 2023 02:00 ET (07:00 GMT)

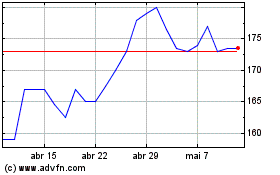

Kistos (LSE:KIST)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

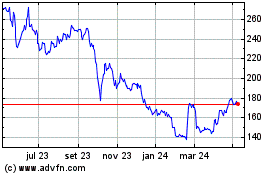

Kistos (LSE:KIST)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025