Kistos Holdings PLC Shetland Gas Plant update (4045W)

12 Dezembro 2023 - 4:00AM

UK Regulatory

TIDMKIST

RNS Number : 4045W

Kistos Holdings PLC

12 December 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS

(SI 2019/310) (UK MAR). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

12(th) December 2023

Kistos Holdings plc

("Kistos" or "the Company")

Shetland Gas Plant update

Further to its announcement of 6(th) December 2023, Kistos (LSE:

KIST), a joint venture partner in the Greater Laggan Area and

co-owner of the Shetland Gas Plant, today provides an update on the

recent shutdown of the plant.

TotalEnergies, the operator of the plant, continues to

investigate the cause of the heating medium system failure at SGP,

and in parallel has started work to replace the failed section.

Both workstreams need to be completed to ensure the safe restart of

the facility, which Kistos expects to occur in the next two

weeks.

Kistos remains in regular contact with the operator and will

provide further updates as appropriate. In the meantime, the

Company confirms that its average production in 2023 is still

expected to be within the previously guided range of 8,500 - 10,500

boe/d.

For the purposes of UK MAR, the person responsible for arranging

the release of this announcement on behalf of Kistos is Andrew

Austin, Executive Chairman.

Notes to editors

Kistos plc was established to acquire and manage companies in

the energy sector engaging in the energy transition trend. The

Company has undertaken a series of transactions including the

acquisition of a portfolio of highly cash generative natural gas

production assets in the Netherlands from Tulip Oil Netherlands

B.V. in 2021. This was followed in July 2022, with the acquisition

of a 20% interest in the Greater Laggan Area (GLA) from

TotalEnergies, which includes four producing gas fields and a

development project. In May 2023, Kistos completed its third

acquisition, acquiring the total share capital of Mime Petroleum

and its Norwegian Continental Shelf Assets. These comprise a 10%

stake in the Balder joint venture spanning Balder and Ringhorne oil

fields.

Kistos is a low carbon intensity gas producer with Estimated

Scope 1 CO emissions from its operated activities offshore of less

than 0.01 kg/boe in 2022 (excluding necessary flaring during

drilling campaigns).

https://www.kistosplc.com

- ENDS -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLVFLFFXLLEFBZ

(END) Dow Jones Newswires

December 12, 2023 02:00 ET (07:00 GMT)

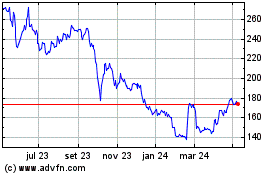

Kistos (LSE:KIST)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

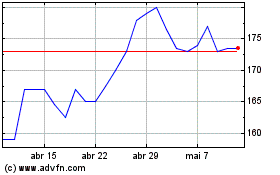

Kistos (LSE:KIST)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025