TIDMPAT

RNS Number : 1403Y

Panthera Resources PLC

29 December 2023

29 December 2023

Panthera Resources PLC

(Panthera or the Company)

Interim Results - Six months ended 30 September 2023

Panthera Resources PLC (AIM: PAT), the gold exploration and

development company with key assets in West Africa and India, is

pleased to announce its unaudited interim results for the half-year

ended 30 September 2023.

Highlights

-- Total loss for the reporting period of US$ 1,010,983 loss or

US$0.01 per share (2022: US$1,477,506 loss or US$0.01 per share)

reflecting our ongoing commitment to our exploration activities

during the period

-- LCM Funding SG Pty Ltd ("LCM Funding" or the "Funder")

successfully completed its due diligence and issued the Funding

Confirmation Notice (the "FCN") for US$13.6 million

-- Moydow completed a 5641 metre reverse circulation (" RC")

drilling campaign at the Cascades Project targeting extensions to

the current resources and several new targets

-- At Kalaka, the Company completed eight reverse circulation

drill holes for 705 metres advance at the K1A Prospect with drill

assay results including 76 metres at 0.53 g/t Au (includes 10

metres at 1.16 g/t Au), 34 metres at 0.50 g/t Au, 85 metres at 0.52

g/t Au (includes 12 metres at 1.62 g/t Au to End of the hole)

-- At Bido, the Company completed IP gradient array (for a total

of 82 km lines) and IP pole-dipole array lines (6.4 km) focusing on

the Kwademen Zone

Mark Bolton, Managing Director of Panthera Resources,

commented:

" The September 2023 decision by the High Court of Rajasthan

("HCR") to dismiss the writ petition adds to the act of

expropriation, and India has again breached its obligations to

provide investment protections to Indo Gold Pty Ltd (" IGPL") and

its investment under the Treaty.

Our focus has now shifted to pursuing a claim against India for

breaches of its obligations under Treaty and we have secured the

US$13.6 million unconditional funding facility from LCM Funding in

support of our claim. The issuance of a Notice of Dispute ("NoD")

will be the first step in this process.

Under the Treaty, compensation for expropriation is required to

be calculated on the basis of the market value of the investment

immediately before the expropriation. The Company believes that the

market value of Bhukia is substantial with the project ranking

among the top undeveloped gold projects in the world. "

Bhukia Project (India)

Arbitration

On 27 September 2023, the Company announced that the HCR had

dismissed Metal Mining India Pvt Ltd's ("MMI") writ petition based

on the recent Mines and Minerals (Development and Regulation)

Amendment Act (2021) ("MMDR2021").

Following the decision by the HCR, the Company's Australian

subsidiary, Indo Gold Pty Ltd ("IGPL") expects to issue a NoD

against India over the latter's breaches of its obligations under

the Treaty.

Following the delivery of the NoD and in the absence of any

meaningful correspondence in relation to this matter from the

Government of India or if no amicable settlement is reached, IGPL

will subsequently deliver a notice of arbitration to the Government

of India. Under the Treaty, an arbitral tribunal is to be

constituted within two months of delivery of the notice of

arbitration.

The Company is aware that on 30 September 2023 the Times of

India reported that, based on information from the Geological

Survey of India and the Additional Chief Secretary of Mines, the

gold deposit at the site could be worth over US$1 billion. This

valuation has not been independently verified by the Company.

Accordingly, while at this stage the Company is not able to make

any comments in relation to the potential quantum of damages that

IGPL will claim from India, the Company will in due course,

announce the actual quantum of damages that IGPL will claim from

India when available. This quantum may differ from that reported by

third parties, including but not limited to, the Times of

India.

Litigation Financing Facility

On 28 February 2023, the Company announced that it had entered

into a conditional agreement with LCM Funding SG Pty Ltd ("LCM

Funding" or the "Funder") to provide a facility to the Company's

subsidiary, IGPL, to support IGPL's claims against India arising

from the Treaty.

On 25 August 2023, the Company announced that LCM Funding had

successfully completed its due diligence and issued the Funding

Confirmation Notice (the "FCN") for US$13.6 million. Following such

issuance, an unconditional funding facility has been made available

to IGPL.

LCM Funding is a subsidiary of Litigation Capital Management

Limited ("LCM"), a firm quoted on the AIM Market of the London

Stock Exchange. LCM is a leading global disputes funder with

significant expertise in international arbitration and cross-border

disputes, including bilateral investment treaty claims over mineral

resource assets.

The US$13.6 million non-recourse litigation financing facility

from LCM Funding is to be used in pursuing its Treaty claims

against India. If no award and/or recovery are achieved, then LCM

Funding is not entitled to any repayment of the Facility.

In the event that there is an award and/or recovery, LCM Funding

shall be entitled, in the first instance, to the amounts it has

deployed from the Facility, as well as the greater of:

a) approximately US$1.36 million being 10% of the Funding Limit

(which is the amount of the Facility);

b) a Funder's commission (the "Commission") of between 5% and

15% of the damages recovered, based upon the number of years that

have passed from the date of the Funding Confirmation Notice;

or

c) a multiple (the "Multiple") of between 2 and 4.25 times the

total of the Facility, based upon the number of years that have

passed from the date of the Funding Confirmation Notice.

In the event that the settlement or award includes the value or

benefit of any property other than cash, pursuant to the terms of

the AFA, IGPL is required to realise and convert a portion of its

interest in the property, or secure external finance, to secure

sufficient cash and then apply it in accordance with the above.

West Africa Activities

Cascades (Burkina Faso)

The Cascades Project, formerly named Labola, is owned and

managed by Moydow Holdings Ltd (Moydow). Following a restructuring

completed and announced on 30 June 2022, Panthera currently holds

an equity interest of 20% in Moydow with DFR agreeing to spend up

to US$18 million (Earn-In) on Cascades in order to maintain its

ownership interest of up to 80%.

The Cascades gold exploration project is in the Banfora

greenstone belt of the West African Birimian Supergroup in

southwest Burkina Faso. Cascades is approximately 450km

west-southwest of the capital, Ouagadougou, and 100km northeast of

the Wahgnion gold mine, operated by Endeavour Mining.

More than 65,500m of historical drilling (541 holes) has been

completed across multiple drilling campaigns by previous owners

with Moydow exploring the area since August 2020. Following a 2021

drilling program by Moydow, a maiden Mineral Resource Estimate

(MRE) was published in October 2021 as stated in Table 1:

Table 1 Maiden Mineral Resource Estimate, October 2021

Indicated Mineral Resource: 5.41Mt @ 1.52g/t Au (264,000oz)

Inferred Mineral Resource: 6.93Mt @ 1.67g/t Au (371,000oz)

--------------------------------

In May 2023, the Company completed a 5641 metre (RC) in 57 drill

holes targeting five areas. The drilling programme was the first

phase of a planned two-phase 10,000m programme and targeted both

extensions to the current resources and several new areas (Figure

1):

-- two newly defined targets immediately north and southwest of

the Daramandougou resource pit shell western Zone extension, and

Dara North respectively;

-- step-out drilling on the TT13 target, a significant new gold zone identified in 2022; and

-- first-pass drilling on three other newly delineated targets

in the Wuo Land 2 licence area at Far East, Sina Yar and

TT13-West.

Sina Yar

Ten drill holes were drilled for an aggregate of 903 metres.

Significant mineralisation was intersected in each hole drilled. In

particular, three consecutive holes testing 250m metres of strike

length of the main north-south trending structure in metasediments

intersected significant widths of mineralisation as follows:

- CS23-RC077 50-84 metres, 34 metres @ 1.83g/t

- CS23-RC077 23-29 metres 6 metres @ 1.14

- CS23-RC078 53-71 metres, 18 metres @ 1.13g/t

- CS23-RC078 74-78 metres, 4 metres @ 1.25g/t and

- CS23-RC078 88-96 metres, 8 metres @ 1.64g/t and

- CS23-RC078 103-113 metres, 10 metres @ 1.02g/t

The mineralisation is hosted by quartz veins within a

north-south trending mineralised envelope hosted by banded

greywacke and sandstone metasedimentary sequence. Sina Yar is

currently the target of significant artisanal mining activity over

a kilometre-long strike length exploiting a north-south zone from

what appears to be a near-vertical mineralised envelope. The zone

is open to the north and possibly to the south.

Mineralisation appears open to the north of the drill-tested

area. In the more southerly holes, mineralisation was weaker and

patchier although artisanal activity remains intense. A highly

altered felsitic intrusion has been mapped towards the southern end

of the Sina Yar workings, similar to the intrusions mapped at both

the Daramandougou and Wuo Ne mineral resource areas. Follow-up

drilling is planned at Sina Yar, starting with stepping out to the

north of CS23-RC077.

The three northernmost holes at the Far East target appear to

have found a significant zone of mineralisation albeit low grade.

Significant intersections included hole CS23-RC066 32-60 metres, 28

metres @ 0.56g/t.

Although the intersections are low grade, historical drilling by

High River Gold intersected several high-grade intercepts nearby

and grab samples by DFR in 2022 returned grades up to 9.3g/t in

quartz veins being exploited by artisanal miners. The

mineralisation appears to be open north of CS23-RC066 and the

current artisanal workings appear to extend between 250 metres to

450 metres further north of CS23-RC066.

TT13 Target

The TT-13 target was tested by DFR with a first-pass drilling

programme of 9 holes in July 2022. A 1,800 metre strike length of

intermittent mineralisation has been delineated from field mapping

and drone surveys. The zone is characterised by almost continuous

artisanal workings at the surface. The 2022 drilling here

delineated a 300-metre strike length with significant

mineralisation in three holes for example CS22-RC029 27-36m, 9

metres @ 1.0g/t plus 56-66m, 10 metres @ 1.81g/t. The current

campaign targeted the northerly and southerly extensions of the

zone. Mineralisation is sporadic but several holes intersected

significant mineralisation which extends the zone. For example,

hole CS23-RC098, collared 370 metres north of CS22-RC029, returned

8 metres @ 1.21g/t (30-38 metres) plus 4 metres @ 1.81g/t (63-67

metres).

TT-13 West target

In the first pass drilling at the newly delineated TT-13 West

target five easterly inclined holes targeted a vertical shear zone

in a new orpaillage area 800 metres west of the TT13 target. The

artisans are targeting an array of thin, reportedly high-grade,

quartz veins in metasediment but the mineralisation intersected has

been sporadic. The highest grade intersected in the drilling was

CS23-RC086, 61-62 metres downhole, 1 metre @11.6g/t gold. The

broadest intercept was in CS23-RC088 63-78 metres, 15 metres @

0.88g/t.

Western Zone SW-Extension and Dara North targets

Drilling at the Dara North and the Southwestern Extension of the

Western Zone was targeted primarily at combined

resistivity/chargeability geophysics anomalies and at each target

significant mineralisation was only intersected over sub-mineable

widths. At Dara North, a pervasive linear zone of artisanal mining

confirms the northerly extension of Western Zone mineralisation

from the main Daramandougou artisanal area. However, the

mineralised zone appears to be thin and sporadic within the 750

metres of strike length tested.

Bassala Project (Mali)

The Bassala project is located within the highly gold-endowed

Birimian volcano-sedimentary belt in southwestern Mali,

approximately 200km south of the capital city Bamako.

The belt hosts the Kalana (Endeavour Mining, 4Moz) and Kodieran

(Wassoul'or, 2Moz) gold mines, both within a few kilometres of the

Bassala project. The adjacent belt to the west is also well endowed

with gold and hosts the Siguiri (AngloGold Ashanti ("AngloGold"),

17Moz), Tri-K (Avocet Mining, 3Moz), Kobada (African Gold Group,

3Moz), and Yanfolila (Hummingbird Resources, 2Moz) gold mines.

In June 2022 and July 2022, the Company completed a 5931 metre

drilling programme to follow up results of earlier drilling across

the Bassala North, Bassala Central and Bassala South Sectors, with

five significant prospects defined from initial and follow-up

geochemical drilling campaigns. The most significant prospect is

the Tabakorole Prospect which has a 2km strike length within which

drilling has identified wide zones of mineralisation. Drill assay

results (based on 5m composite sampling) from the 2022 campaigns

include:

- 5 metres at 5.60 g/t Au from 40m

- 5 metres at 4.68 g/t Au from 10m

- 5 metres at 3.73 g/t Au from 35m.

Recent field work at Bassala in 2023 has identified the location

of new artisanal gold diggings that highlight several zones of

potential mineralisation that had not previously been drill tested

by the Company. The Company intends to complete geological mapping

and sampling of these new zones ahead of planning for further

drilling.

Bido (Burkina Faso)

The Bido permit in Burkina Faso is located on the Koudougou

quadrangle some 125km WSW of the capital Ouagadougou. The tenement

lies within the Boromo greenstone belt which also hosts the Poura

gold deposit (1 to 2 Moz), situated about 50 km to the SSW of the

area, as well as numerous gold occurrences.

In 2022, the Company completed an IP geophysical survey and

expanded its geological mapping and outcrop rock sampling, with 28

strong IP anomalies identified. Rock sample results identified

several outcropping mineralised vein systems coincident with the

strong IP anomalies, best results from grab sampling being:

- 42.2g/t Au

- 20.0g/t Au

- 13.6g/t Au

- 13.4g/t Au

- 10.9g/t Au

In 2023, the Company completed a geophysical programme of IP

gradient array (for a total of 82 km lines ) and IP pole-dipole

array lines (6.4 km). The work is focusing on three prospects

(Figure 2) on the Kwademen Zone (Kwademen, Kwademen-East and

Kwademen-South).

The Company has also acquired analog historical data from the

archives of the library of the Ministry of Mines in Ouagadougou and

has commenced converting the database to a digital format to

intergrate with the Company's data. The historical works performed

on the Kwademen area included mapping, trenching, soil sampling,

drilling, and geophysics (EM). The results of these programs have

highlighted the presence of gold and base metals occurrences.

Kalaka Project (Mali)

The Kalaka Project is located in southeast Mali, between Morila

and Syama gold mines and is approximately 260 km southeast of

Bamako. It lies approximately 80 km south of the Morila gold mine

(8m oz) and 85 km northwest of Resolute's Syama gold mine (6m oz)

and is situated adjacent and to the east of the regional Banifin

Shear Zone.

Panthera and DFR Gold Inc (DFR) each have 40% interest in Kalaka

held through their interest in Maniger Ltd. The remaining 20%

interest is owned by a local partner, Golden Spear Mali SARL.

Panthera is the operator of the project.

During the September 2023 period the Company completed eight

reverse circulation drill holes for 705 metres advance at the K1A

Prospect at the Kalaka Project in Mali with drill assay results

(based on 2m sampling intervals) including:

- 76 metres at 0.53 g/t Au (includes 10 metres at 1.16 g/t Au) in hole KRC_23_005

- 34 metres at 0.50 g/t Au in hole KRC_23_006

- 85 metres at 0.52 g/t Au in hole KRC_23_007 (includes 12

metres at 1.62 g/t Au to End of the hole)

The programme was interrupted due to heavy rain and accordingly,

the proposed northern exploration holes were untested.

Events Post Balance Date

In December 2023, the Company completed an equity capital

raising of GBP935,000.

Based on current expenditure levels, it is anticipated that all

funds will be used within the next 6 months. The Group's ability to

continue as a going concern is dependent upon raising additional

capital.

Panthera Resources PLC

Unaudited Interim Financial Information for the period ended

30 September 2023

Set out below are the unaudited result of the group for the six

months to 30 September 2023.

Group Statement of Comprehensive Income

For the six months ended 30 September

2023

Six months Six months

to 30 September to 30 September

2023 2022

Notes Unaudited $USD Unaudited $USD

------------------------------------------- ------ ----------------- -----------------

Continuing operations

Revenue - -

------------------------------------------- ------ ----------------- -----------------

Gross profit - -

Other Income 2 411,274 13

Exploration costs expensed (167,368) (842,611)

Administrative expenses (441,737) (427,279)

Share of losses in Investment

in Associate 3 (335,798) (167,066)

Arbitration related expense 4 (482,968) -

------------------------------------------- ------ ----------------- -----------------

Loss from operations (1,016,597) (1,436,943)

Investment revenues 22 7

------------------------------------------- ------ ----------------- -----------------

Loss before taxation (1,016,575) (1,436,936)

Taxation - -

Other comprehensive income

Items that may be reclassified

to profit or loss:

Exchange differences 5,592 (40,570)

-----------------

Loss and total comprehensive

income for the period (1,010,983) (1,477,506)

------------------------------------------- ------ ----------------- -----------------

Total loss for the period

attributable to:

- Owners of the Parent Company (1,012,665) (1,432,158)

- Non-controlling interest (3,910) (4,778)

(1,016,575) (1,436,936)

------------------------------------------- ------ ----------------- -----------------

Total comprehensive income

for the period attributable

to:

- Owners of the Parent Company (1,007,073) (1,472,728)

- Non controlling interest (3,910) (4,778)

(1,010,983) (1,477,506)

------------------------------------------- ------ ----------------- -----------------

Earnings per share attributable

to the owners of the parent

Continuing operations (undiluted/diluted) 5 (0.01) (0.01)

------------------------------------------- ------ ----------------- -----------------

Group Statement of Financial Position

As at 30 September 2023

30 September 31 March 2023

2023

Notes Unaudited $USD Unaudited $USD

-------------------------------- ------ --------------- ---------------

Non-current assets

Intangible Assets 1,251,457 1,251,457

Property, plant and equipment 2,232 2,288

Investments 457,201 654,357

-------------------------------- ------ --------------- ---------------

1,710,890 1,908,102

Current assets

Trade and other receivables 6 468,732 65,826

Cash and cash equivalents 217,486 126,275

-------------------------------- ------ --------------- ---------------

686,218 192,101

-------------------------------- ------ --------------- ---------------

Total assets 2,397,108 2,100,203

Non-current liabilities

Provisions 41,998 42,508

41,998 42,508

Current liabilities

Provisions 33,930 27,160

Trade and other payables 7 841,748 799,293

Total liabilities 917,676 868,961

-------------------------------- ------ --------------- ---------------

Net assets 1,479,432 1,231,242

-------------------------------- ------ --------------- ---------------

Equity

Share capital 2,019,222 1,721,441

Share premium 23,099,794 22,125,397

Capital reorganisation reserve 537,757 537,757

Other reserves 967,598 980,604

Retained earnings (24,762,937) (23,755,864)

-------------------------------- ------ --------------- ---------------

Total equity attributable

to owners of the parent 1,861,434 1,609,334

Non-controlling interest (382,002) (378,092)

Total equity 1,479,432 1,231,242

-------------------------------- ------ --------------- ---------------

Group Statement of changes of equity

For the six months ended 30 September 2023

Share Share Capital Other Retained Total Non-controlling Total

Capital premium re-organisation reserves earnings equity interest

account reserve

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

$USD $USD $USD $USD $USD $USD $USD $USD

--------------- ------------------- ------------- ---------------- ------------------- ------------------ ---------------------- ------------------------ --------------------

Balance at

1 April 2022 1,408,715 20,510,881 537,757 980,604 (20,791,956) 2,782,536 (361,740) 2,420,796

Loss for the

period - - - - (1,432,158) (1,432,158) (4,778) (1,436,936)

Foreign

exchange

differences

realised

during

the period - - - - (40,570) (40,570) - (40,570)

Total

comprehensive

income for

the period - - - - (1,472,728) (1,472,728) (4,778) (1,477,506)

--------------- ------------------- ------------- ---------------- ------------------- ------------------ ---------------------- ------------------------ --------------------

Issue of

shares

during the

period 193,958 1,239,021 - - - 1,432,979 - 1,432,979

Loss on

remeasurement

of financial

assets at

FVOCI - - - 295 - 295 - 295

Foreign

exchange

differences

on

translation

of currency - - - 177,642 - 177,642 - 177,642

Total

transactions

in the year

recognised

directly in

equity 193,958 1,239,021 - 177,937 - 1,610,916 - 1,610,916

--------------- ------------------- ------------- ---------------- ------------------- ------------------ ---------------------- ------------------------ --------------------

Balance at

30 September

2022 1,602,673 21,749,902 537,757 1,295,076 (22,264,684) 2,920,724 (366,518) 2,554,206

--------------- ------------------- ------------- ---------------- ------------------- ------------------ ---------------------- ------------------------ --------------------

Balance at

1 April 2023 1,721,441 22,125,937 537,757 980,604 (23,755,864) 1,609,334 (378,092) 1,231,242

Loss for the

period - - - - (1,012,665) (1,012,665) (3,910) (1,016,575)

Foreign

exchange

differences

realised

during

the period - - - - 5,592 5,592 - 5,592

Total

comprehensive

income for

the period - - - - (1,007,073) (1,007,073) (3,910) (1,010,983)

--------------- ------------------- ------------- ---------------- ------------------- ------------------ ---------------------- ------------------------ --------------------

Issue of

shares

during the

period 297,781 974,397 - - - 1,272,178 - 1,272,178

Share options

issued - - - 1,848 - 1,848 - 1,848

Foreign

exchange

differences

on

translation

of currency - - - (14,855) - (14,855) - (14,855)

Total

transactions

in the period

recognised

diectly in

equity 297,781 974,397 - (13,007) - 1,259,171 - 1,259,171

--------------- ------------------- ------------- ---------------- ------------------- ------------------ ---------------------- ------------------------ --------------------

Balance at

30 September

2023 2,019,222 23,099,794 537,757 967,597 (24,762,937) 1,861,432 (382,002) 1,479,430

--------------- ------------------- ------------- ---------------- ------------------- ------------------ ---------------------- ------------------------ --------------------

Group Statement of cash flows

For the period ended 30 September 2023

Six months Six months

to 30 September to 30 September

2023 2022

Unaudited Unaudited

$USD $USD

---------------------------------------------- ----------------- -----------------

Cash flows from operating activities

Cash used in operations (737,942) (1,472,597)

Income taxes paid - -

---------------------------------------------- ----------------- -----------------

Net cash outflow from operating activities

8 (737,942) (1,472,597)

Investing activities

Payments for arbitration related expenses (304,330) -

Additional investment in joint venture (138,694) -

Net cash generated/(used) in investing

activities (443,024) -

Financing activities

Proceeds from issue of shares 1,412,979 -

Effect of exchange rate movement on cash - (1)

Net cash generaged from financing activities 1,272,178 1,412,978

Net increase in cash and cash equivalents (91,211) (59,619)

Cash and cash equivalents at beginning

of the period 126,275 175,925

Cash and cash equivalents at end of the

period 217,486 116,306

---------------------------------------------- ----------------- -----------------

NOTES TO THE FINANCIAL STATEMENTS

Basis of preparation

1

The interim consolidated financial statements have been prepared

in accordance with UK adopted International Financial Reporting

Standards (IFRS) and IFRS Interpretations Committee (IFRS IC)

interpretations as adopted by the European Union applicable to

companies under IFRS . The interim financial information relating

to the six-month periods to 30 September 2023 and 30 September

2022 are unaudited.

The interim financial statements have been prepared on the historical

cost basis, except for the valuation of investments at fair value

through profit or loss. The interim financial statements have

been prepared under the same accounting policies as the year

end financial statements to 31 March 2023 as approved on 29 September

2023. The principal accounting policies adopted are set out in

the Annual Report 31 March 2023.

The interim financial statements have been prepared on a going

concern basis. The group incurred a net loss of $1,010,983 and

incurred operating cash outflows of $737,942 and is not expected

to generate any revenue or positive outflows from operations

in the 12 months from the date at which these interim financial

statements were signed. Management indicates that on current

expenditure levels, all current cash held will be used prior

to the 12 months subsequent of the signing of these interim financial

statements.

While the Directors are confident that they will be able to secure

the necessary funding, the current conditions do indicate the

existence of a material uncertainty that may cast significant

doubt regarding the applicability of the going concern assumption.

The Directors have, in the light of all the above circumstances,

a reasonable expectation that the group has adequate resources

to continue in operational existence for the foreseeable future.

Thus, they continue to adopt the going concern basis of accounting

preparing the group interim financial statements.

The functional currency of the Company is British Pounds (GBP).

This is due to the Company being registered in the U.K and being

listed on AIM, a London based market. Additionally, a large proportion

of its administrative and operative costs are denominated in

GBP.

The interim financial statements are prepared in United States

Dollars ($), which is the reporting currency of the Group. Monetary

amounts in these interim financial statements are rounded to

the nearest whole dollar. This has been selected to align the

Group with accounting policies of other major gold-producing

Companies, the majority of whom report in $.

As permitted by section 408 of the Companies Act 2006, the Company

has not presented its own statement of comprehensive income and

related notes. The Company's total comprehensive loss for the

period was $868,044 (2022: $1, 480,858).

At the date of authorisation of these interim financial statements,

there are no new, but not yet effective, standards, amendments

to existing standards, or interpretations that have been published

by the IASB that will have a material impact on these financial

statements.

Other Income

2

Group

------------------------------

Six months Six months

to to

30 September 30 September

2023 2022

$ USD $ USD

------------------------------------- -------------- --------------

Arbitration Finance Facility Income 411,274 -

Sundry income - 13

------------------------------------- -------------- --------------

Other Income 411,274 13

------------------------------------- -------------- --------------

On 24 August 2023, the Company announced that LCM had issued

a Funding Confirmation Notice making available a US$13.6 million

unconditional arbitration finance facility for IGPL to support

its claims against India over the latter's breaches of its obligations

under the Treaty. Funding will be made available to cover arbitration

related expenses.

Share of losses in Investment in Associate and Joint Venture

3 Group

------------------------------

Six months Six months

to to

30 September 30 September

2023 2022

$ USD $ USD

---------------------------------------------- -------------- --------------

Moydow investment share of loss attributable

to Group at 45.8% ownership - 167,066

Moydow investment share of loss attributable 169,704 -

to Group at 20% ownership

Maniger joint venture share of loss 166,094 -

attributable to Group at 50% ownership

---------------------------------------------- -------------- --------------

Share of losses in Investment and

Joint Venture 335,798 167,066

---------------------------------------------- -------------- --------------

The Company's 45.8% investment in Moydow was diluted on 1 July

2022 to 20% following the completion of the farm in agreement with

diamond Field Resources ("DFR") whereby DFR acquired all the shares

and options in Moydow not held by the Group. As part of the

agreement, the Kalaka and Nigerian projects were transferred into a

new company called Maniger. As a result, the Company's investment

interest in Moydow and the Cascade project has reduced to 20% and

the Group now has a 50% joint venture interest in Maniger. The

Directors have assessed the Company has significant influence over

Moydow due its 20% holding and over Maniger due its 50%

holding.

Arbitration Related Expenses

4 Group

------------------------------

Six months Six months

to to

30 September 30 September

2023 2022

$ USD $ USD

----------------------------- -------------- --------------

Arbitration related expenses 482,968 -

----------------------------- -------------- --------------

Arbitration related expenses are those incurred in relation to

IGPL's claims against India over the latter's breaches of its

obligations under the Treaty.

Earnings per share

5 Group

------------------------------

Six months Six months

to to

30 September 30 September

2023 2022

Number Number

----------------------------------------- -------------- --------------

Weighted average number of ordinary

shares for basic earnings per share 149,331,074 122,269,464

----------------------------------------- -------------- --------------

Earnings

Continuing operations $ USD $ USD

Loss for the period from continuing

operations (1,016,575) (1,436,936)

Less non-controlling interests (3,910) (4,778)

Earnings for basic and diluted earnings

per share being net loss attributable

to equity shareholders (1,012,665) (1,432,158)

----------------------------------------- -------------- --------------

Basic earnings per share (0.01) (0.01)

----------------------------------------- -------------- --------------

Basic earnings per share has been calculated by dividing the

loss attributable to equity holders of the Company after taxation

by the weighted average number of shares in issue during the

period. There is no difference between the basic and diluted loss

per share on loss making operations.

Trade and other receivables Group

6 ------------------------------

Six months Six months

to to

30 September 30 September

2023 2022

$ USD $ USD

----------------------------------------- -------------- --------------

Current:

Other debtors 44,682 65,290

Arbitration finance facility receivable 404,328 -

Tenement Deposits 529 536

Loans advanced to other companies 19,193 -

----------------------------------------- -------------- --------------

468,732 65,826

----------------------------------------- -------------- --------------

Trade and other receivables are expected to be recovered in less

than 12 months for the Group. Subsequent to year end the Company

has received $404,328 from Arbitration funders.

Trade and other payables Group

7 --------------------------------

Six months Six months

to to

30 September 30 September

2023 2022

$ USD $ USD

------------------------------ ---------------- --------------

Current:

Trade payables 281,929 553,279 553,279

Arbitration related payables 455,524 -

Accruals and other payables 23,280 163,172

Intercompany creditor 81,015 102,843

------------------------------ ---------------- --------------

841,748 799,294

------------------------------ ---------------- --------------

Subsequent to year end the Company has paid $455,524 in

Arbitration related payables.

Cash flows from operating activities Group

8 ------------------------------

Six months Six months

to to

30 September 30 September

2023 2022

$ USD $ USD

-------------------------------------------- -------------- --------------

Loss for the period after

tax (1,010,983) (1,477,506)

Adjustments for:

Depreciation and impairment

of property, plant and equipment 56 (2,208)

Unrealised foreign exchange

gain/(loss) (12,952) 178,154

Share of loss of Investments 335,798 167,066

Payments made in shares in

lieu of cash - 20,000

Arbitration related expenses 304,330 -

Movements in working capital:

(Increase)/decrease in trade

and other receivables (402,906) 176,202

Increase/(decrease) in trade

and other payables 42,455 (527,561)

Increase/(decrease) in provisions 6,260 (6,744)

------------------------------------------- -------------- ----------------

Cash flow s used in operating

activities (737,942) (1,472,597)

------------------------------------------- -------------- ----------------

9 Related party transactions Group

------------------------------

Six months Six months

to to

30 September 30 September

2023 2022

$ USD $ USD

------------------------------------------- -------------- ----------------

Remuneration for qualifying services

- Directors 152,840 149,963

Remuneration disclosed above includes

the following amounts paid to the

highest paid Director 93,180 92,693

------------------------------------------ -------------- --------------

Directors' Fees Share based payments Total

For the For the For the For the For the For the

period period period period period period

ended 30 ended 30 ended 30 ended 30 ended 30 ended 30

Sep 2023 Sep 2022 Sep 2023 Sep 2022 Sep 2023 Sep 2022

-------------------

$ USD $ USD $ USD $ USD $ USD $ USD

------------------- --------- --------- ---------- ---------- --------- ---------

Mike Higgins 11,015 17,583 11,015 3,517 22,030 21,100

Mark Bolton 93,180 92,693 - - 98,180 92,693

David Stein 6,294 10,048 6,294 2,010 12,589 12,057

Tim Hargreaves 6,294 10,048 6,294 2,010 12,589 12,057

Catherine Apthorpe 6,294 10,048 6,294 2,010 12,589 12,057

------------------- --------- --------- ---------- ---------- --------- ---------

Totals 123,010 140,418 29,830 9,545 152,840 149,963

------------------- --------- --------- ---------- ---------- --------- ---------

At 30 September 2023, Directors were owed $94,522 in fees for

services performed during the period. These amounts have been

accrued and will be paid in the next 12 months.

Transactions with related parties

Directors of the Group, or their Director-related entities, hold

positions in other entities that result in them having control

or significant influence over the financial or operating policies

of these entities.

The terms and conditions of the transactions with Directors and

their Director related entities were no more favourable than

those available, or which might reasonably be expected to be

available, on similar transactions to non-Director related entities

on an arm's length basis.

The transactions recognised during the period relating to Directors

and their Director related entities were as follows:

* Indo Gold Pty Ltd (IGPL) owes by way of intercompany

loan to the Company $396,825 at 30 September 2023.

* Panthera Exploration Mali SARL owes by way of

intercompany loan to the Company $61,199 at 30

September 2023.

* Panthera Burkina SARL owes by way of intercompany

loan to the Company $12,135 at 30 September 2023.

* A fee was charged by the Company to IGPL during the

period of $4,056 for management services, company

secretarial, accounting and legal services provided.

* A fee was charged by the Company to Panthera Burkina

SARL during the period of $12,135 for tenement

service expenses.

* A fee was charged by the Company to Panthera

Exploration Mali SARL during the period of $3,961 for

tenement service expenses.

* The Company owes Directors $94,522 at 30 September

2023 for services rendered during the period.

Events Subsequent to Reporting Date

10

Capital Raising

Subsequent to 30 September, the Company has completed an equity

capital raising of GBP935,000 at 5 pence per share ("the Placing)

and issued 18,700,000 shares in December 2023. In addition, pursuant

to the Placing Agreement with Novum Securities Limited ("Novum")

and as a result of certain funds separately introduced by Allenby

Capital Limited ("Allenby") to the Subscription, the Company

has agreed to issue 312,000 options and 360,000 options to Novum

and Allenby Capital respectively, exercisable at a price of 5

pence on or before 14 December 2025 (together the "Option") with

each Option entitling the holder to acquire one new Ordinary

Share upon exercise of the Option.

As at the date of this report, the issued ordinary share capital

of Panthera consists of 173,989,083 ordinary shares.

Contacts

Panthera Resources PLC

Mark Bolton (Managing Director) +61 411 220 942

contact@pantheraresources.com

Allenby Capital Limited (Nominated Adviser & Broker) +44 (0) 20 3328 5656

John Depasquale / Vivek B hardwaj (Corporate Finance)

Kelly Gardiner / Stefano Aquilino (Sales & Corporate

Broking)

Allenby Capital Limited (Nominated Adviser & Joint Broker) +44 (0) 20 3328 5656

John Depasquale / Vivek B hardwaj (Corporate Finance)

Guy McDougall / Kelly Gardiner (Sales & Corporate

Broking)

Novum Securities Limited (Joint Broker) +44 (0) 20 7399 9400

Colin Rowbury

Financial Public Relations

Zak Mir +44 (0) 786 752 7659

Subscribe for Regular Updates

Follow the Company on Twitter at: @PantheraPLC

For more information and to subscribe to updates visit:

pantheraresources.com

Qualified Person

The technical information contained in this disclosure has been

read and approved by Ian S Cooper (BSc, ARSM, FAusIMM, FGS), who is

a qualified geologist and acts as the Qualified Person under the

AIM Rules - Note for Mining and Oil & Gas Companies. Mr Cooper

is a geological consultant to Panthera Resources PLC.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Forward-looking Statements

This news release contains forward-looking statements that are

based on the Company's current expectations and estimates.

Forward-looking statements are frequently characterised by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties, and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes, and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events, or results not to be as

anticipated, estimated, or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events, or results

or otherwise. Forward-looking statements are not guarantees of

future performance and accordingly, undue reliance should not be

put on such statements due to the inherent uncertainty therein.

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFSFFLLAFIV

(END) Dow Jones Newswires

December 29, 2023 02:00 ET (07:00 GMT)

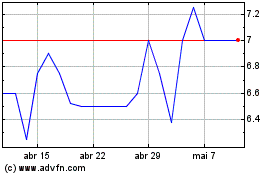

Panthera Resources (LSE:PAT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Panthera Resources (LSE:PAT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024