TIDMAAZ

RNS Number : 6109Z

Anglo Asian Mining PLC

15 January 2024

15 January 2024

Anglo Asian Mining plc

Q4 and FY 2023 Production and Operations Review

FY 2023 production of 31,821 gold equivalent ounces at mid-range

of guidance

Anglo Asian Mining plc ("Anglo Asian" or the "Company"), the

AIM-listed gold, copper and silver producer primarily operating in

Azerbaijan, is pleased to provide an operational and production

review for the fourth quarter ("Q4 2023") and twelve months to 31

December 2023 ("FY 2023" or the "Period").

Production during the Period was significantly reduced due to

operations being partially suspended as the Company and third-party

contractors finalised the results of an environmental audit at its

operations. An action plan was agreed with the Government of

Azerbaijan on 7 November 2023, and the Company was pleased to

restart mining at Gedabek in December 2023.

Production update

-- Total FY 2023 production of 31,821 gold equivalent ounces

("GEOs"), in the mid-range of the revised guidance of 30,000 to

34,000 GEOs (FY 2022: 57,618 GEOs)

-- Q4 2023 production of 3,080 GEOs (Q4 2022: 14,532 GEOs)

Operational update

-- Protocol agreed with the Government of Azerbaijan to restart operations following the partial environmental shut-down in Q3 2023

o Mining from the Gedabek open pit restarted in December

2023

o Operations now being ramped up with flotation production

restarting in Q2 2024

-- Production of gold doré and copper concentrate continued

throughout Q4 2023 from heap leaching and SART processing

-- Caterpillar underground mining fleet for the new Gilar mine

delivered to Gedabek in early December 2023

-- Gilar maiden JORC mineral resource confirmed meaningful quantities of copper and gold

o In-situ mineral resource of 54,000 tonnes of copper, 255,000

ounces of gold and 46,000 tonnes of zinc

-- Gilar development continues with production planned to commence during Q3 2024

Cash and inventory update

-- Net debt of $10.3 million at 31 December 2023 (30 September

2023: net cash of $1.6 million) with the following payment made in

Q4 2023

o $4.7 million to Caterpillar for the underground mining fleet

and associated equipment

-- Negotiations ongoing to refinance $3.7 million of the mining

fleet purchase price with vendor financing

-- Gross cash of $10.3 million at 31 December 2023

o $15.0 million drawn down from International Bank of Azerbaijan

under its revolving credit facility and loan agreements

o $5.6 million loan drawn down from Access Bank in August

2023

-- The Company had inventory at market value of $7.1 million at

31 December 2023 (gold and silver bullion of $6.9 million and

copper concentrate of $0.2 million)

-- 1,000 ounces of gold bullion sold in Q4 2023 at an average

price of $2,001 per ounce under the gold hedging programme,

generating additional sales revenue of $44,000

o Total gold bullion sales in Q4 2023 of 2,416 ounces at an

average of $2,004 per ounce

o 1,500 ounces of gold bullion was sold for $2,061.5 per ounce

on 3 January 2024 yielding proceeds of $3.1 million

Anglo Asian CEO Reza Vaziri commented:

"Despite a number of challenges faced during the Period, we are

pleased to announce production within our previously revised

guidance range.

"In November, we were pleased to agree a protocol with the

Government of Azerbaijan to restart our operations, and mining at

our flagship Gedabek mine recommenced in December. We continue to

make meaningful progress in restarting flotation production, which

is on-track to begin from Q2 2024.

"The completion of a maiden JORC mineral resource for Gilar

marked a milestone for the Company, confirming our internal

estimates regarding the asset's potential and its ability to

meaningfully contribute to our production portfolio in the years

ahead. We were also pleased to announce the delivery of a new

state-of-the-art underground mining fleet for Gilar from

Caterpillar, the first deployment of this type of equipment in

Azerbaijan.

"Looking ahead to 2024, we will continue to prioritise the

development of our exciting asset portfolio in line with our growth

strategy, while driving production from our existing mines. I look

forward to updating the market on our progress in the coming

months."

Note that all references to "$" are to United States dollars and

"CAN$" are to Canadian dollars.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, which was incorporated into UK law by

the European Union (Withdrawal) Act 2018, until the release of this

announcement.

For further information please contact:

Anglo Asian Mining plc

Tel: +994 12 596

Reza Vaziri, Chief Executive Officer 3350

Tel: +994 502 910

Bill Morgan, Chief Financial Officer 400

Tel: +994 502 916

Stephen Westhead, Vice President 894

SP Angel Corporate Finance LLP (Nominated Tel: +44 (0) 20

Adviser and Broker) 3470 0470

Ewan Leggat

Adam Cowl

Hudson Sandler (Financial PR) Tel: +44 0) 20 7796

Charlie Jack 4133

Harry Griffiths

Notes to Editors:

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer with a high-quality portfolio of production and

exploration assets in Azerbaijan. The Company produced 57,618 gold

equivalent ounces ("GEOs") for the year ended 31 December 2022.

On 30 March 2023, the Company published its strategic plan for

growth which shows a clearly defined path for the Company to

transition to a multi-asset, mid-tier copper and gold producer by

2028, by which time copper will be the principal product of the

Company, with forecast production of around 36,000 copper

equivalent tonnes. It plans to achieve this growth by bringing into

production four new mines during the period 2024 to 2028 at Zafar,

Gilar, Xarxar and Garadag.

The Company owns approximately 13.1 per cent. of Libero Copper

& Gold Corporation ("Libero"). Libero is listed on the TSX

Venture Exchange in Canada and owns Mocoa in Colombia, one of the

world's largest undeveloped copper-molybdenum resources.

https://www.angloasianmining.com/

Production and sales overview

Q4 2023 production

-- Total production of 3,080 GEOs (Q4 2022: 14,531 GEOs), comprising of:

o 2,979 ounces of gold (Q4 2022: 11,121 ounces):

-- 2,975 ounces contained within gold doré

-- 4 ounces from sulfidisation, acidification, recycling and

thickening ("SART") processing

o 18 tonnes of copper (Q4 2022: 624 tonnes):

-- 18 tonnes from SART processing

o 2,874 ounces of silver (Q4 2022: 37,378 ounces):

-- 1,610 ounces contained within gold doré

-- 1,264 ounces from SART processing

FY 2023 production

-- Total production of 31,821 GEOs (FY 2022: 57,618 GEOs), including:

o 21,758 ounces of gold (FY 2022: 43,114 ounces)

o 2,138 tonnes of copper (FY 2022: 2,516 tonnes)

o 53,226 ounces of silver (FY 2022: 182,046 ounces)

Q4 2023 Sales

-- Q4 2023 gold bullion sales of 2,416 ounces at an average of

$2,004 per ounce (Q4 2022: 13,645 ounces sold at an average of

$1,727 per ounce)

-- Q4 2023 copper concentrate shipments totalled 2,186 dry

metric tonnes ("dmt") with a sales value of $2.3 million (excluding

Government of Azerbaijan profit share) (Q4 2022: 4,606 dmt with a

sales value of $7.5 million)

Gedabek - mining, detailed production and sales

The Company mined the following amounts and grades of ore in the

12 months to 31 December 2023:

9 months to 3 months to 12 months to

30 September 2023 31 December 2023 31 December 2023

Average Average Average

gold gold gold

Mine Ore mined grade Ore mined grade Ore mined grade

(tonnes) (g/t) (tonnes) (g/t) (tonnes) (g/t)

----------- -------- ---------- -------- ---------- --------

Open pit 1,079,302 0.35 101,393 0.69 1,180,695 0.38

Gadir - u/g 93,625 1.65 15,695 1.58 109,320 1.64

Gedabek - - - - - - -

u/g

----------- -------- ---------- -------- ---------- --------

Total 1,172,927 0.67 117,088 0.81 1,290,015 0.49

------------- ----------- -------- ---------- -------- ---------- --------

The Company processed the following amounts and grades of ore by

leaching for FY 2022 and FY 2023:

Quarter ended Ore processed Gold grade of ore processed

------------------------------------- ------------------------------------

Heap Heap Heap Heap

leach leach Agitation leach leach Agitation

pad crushed pad ROM leaching pad crushed pad ROM leaching

ore ore plant* ore ore plant*

(tonnes) (tonnes) (tonnes) (g/t) (g/t) (g/t)

------------- ------------- --------- ----------

31 March 2022 115,173 273,577 144,275 0.75 0.48 1.63

30 June 2022 82,814 299,762 162,239 0.78 0.53 1.40

30 September

2022 92,398 302,714 162,669 0.81 0.57 1.42

31 December 2022 24,606 213,120 156,285 0.72 0.56 1.42

------------- ---------- ---------- ------------- --------- ----------

FY 2022 314,991 1,089,173 625,468 0.77 0.56 1.43

------------------ ------------- ---------- ---------- ------------- --------- ----------

31 March 2023 94,518 196,595 62,006 0.74 0.49 1.3

30 June 2023 56,522 202,788 105,213 0.75 0.46 1.4

------------- ---------- ---------- ------------- --------- ----------

H1 2023 151,040 399,383 167,219 0.75 0.49 1.4

------------- ---------- ---------- ------------- --------- ----------

30 September

2023 25,690 34,621 - 0.83 0.45 -

31 December 2023 - - - - - -

------------- ---------- ---------- ------------- --------- ----------

H2 2023 25,690 34,621 - 0.83 0.45 -

------------- ---------- ---------- ------------- --------- ----------

FY 2023 176,730 434,004 167,219 0.76 0.48 1.4

------------------ ------------- ---------- ---------- ------------- --------- ----------

* includes previously heap leached ore

The Company processed the following amounts of ore and contained

metal by flotation for FY 2022 and FY 2023 :

Quarter ended Ore processed Gold content Silver content Copper content

(tonnes) (ounces) (ounces) (tonnes)

-------------- ------------- --------------- ---------------

31 March 2022 104,475 1,921 33,522 577

30 June 2022 114,099 1,293 24,209 745

30 September

2022 143,838 1,314 24,582 724

31 December 2022 119,819 1,389 18,003 670

-------------- ------------- --------------- ---------------

FY 2022 482,231 5,917 100,316 2,716

-------------- ------------- --------------- ---------------

31 March 2023 192,516 1,487 19,787 1,133

30 June 2023 190,593 1,033 10,380 1,191

-------------- ------------- --------------- ---------------

H1 2023 383,109 2,520 30,167 2,324

-------------- ------------- --------------- ---------------

30 September

2023 62,369 478 4,358 363

31 December 2023 - - - -

-------------- ------------- --------------- ---------------

H2 2023 62,369 478 4,358 363

-------------- ------------- --------------- ---------------

FY 2023 445,478 2,998 34,525 2,687

------------------ -------------- ------------- --------------- ---------------

The following table summarises gold doré production and sales at

Gedabek for FY 2022 and FY 2023:

Quarter ended Gold produced* Silver Gold sales** Gold Sales

(ounces) produced* (ounces) price

(ounces) ($/ounce)

31 March 2022 8,963 7,574 7,519 1,904

30 June 2022 10,137 7,620 3,754 1,895

30 September

2022 10,473 6,949 10,000 1,727

31 December

2022 10,437 4,820 13,645 1,727

-------------- ----------- ------------- ----------

FY 2022 40,010 26,963 34,918 1,783

-------------- -------------- ----------- ------------- ----------

31 March 2023 5,965 2,841 5,719 1,895

30 June 2023 7,375 3,593 4,787 1,992

-------------- ----------- ------------- ----------

H1 2023 13,340 6,434 10,506 1,939

-------------- ----------- ------------- ----------

30 September

2023 4,001 1,488 2,900 1,949

31 December

2023 2,975 1,610 2,416 2,004

-------------- ----------- ------------- ----------

H2 2023 6,976 3,098 5,316 1,974

-------------- ----------- ------------- ----------

FY 2023 20,316 9,532 15,822 1,951

-------------- -------------- ----------- ------------- ----------

Note

* including Government of Azerbaijan's share

** excluding Government of Azerbaijan's share

The gold and silver production from agitation and heap leaching

for FY 2022 and FY 2023 is as follows:

Quarter Gold Silver

ended

Agitation Heap Total Agitation Heap Total

leaching leaching leaching leaching

(ounces) (ounces) (ounces) (ounces) (ounces) (ounces)

---------- ---------- ---------- ---------- ---------- ----------

31 March 2022 5,674 3,289 8,963 4,803 2,771 7,574

30 June 2022 6,196 3,941 10,137 4,654 2,966 7,620

30 Sept 2022 5,517 4,956 10,473 3,673 3,276 6,949

31 Dec 2022 5,831 4,606 10,437 2,684 2,136 4,820

---------- ---------- ---------- ---------- ---------- ----------

FY 2022 23,218 16,792 40,010 15,814 11,149 26,963

--------------- ---------- ---------- ---------- ---------- ---------- ----------

31 March 2023 2,105 3,860 5,965 1,077 1,764 2,841

30 June 2023 3,463 3,912 7,375 1,735 1,858 3,593

---------- ---------- ---------- ---------- ---------- ----------

H1 2023 5,568 7,772 13,340 2,812 3,622 6,434

---------- ---------- ---------- ---------- ---------- ----------

30 Sept 2023 - 4,001 4,001 - 1,488 1,488

31 Dec 2023 - 2,975 2,975 - 1,610 1,610

---------- ---------- ---------- ---------- ---------- ----------

H2 2023 - 6,976 6,976 - 3,098 3,098

---------- ---------- ---------- ---------- ---------- ----------

FY 2023 5,568 14,748 20,316 2,812 6,720 9,532

--------------- ---------- ---------- ---------- ---------- ---------- ----------

The following table summarises copper concentrate production

from both the Company's SART and flotation plants at Gedabek for FY

2022 and FY 2023 :

Concentrate Copper Gold Silver

production* content* content* content*

(dmt) (tonnes) (ounces) (ounces)

------------ --------- --------- ---------

2022

Quarter ended 31 March

SART processing 330 188 12 25,114

Flotation 2,586 380 1,065 17,986

------------ --------- --------- ---------

Total 2,916 568 1,077 43,100

------------ --------- --------- ---------

Quarter ended 30 June

SART processing 316 168 14 25,582

Flotation 3,811 547 715 15,672

------------ --------- --------- ---------

Total 4,127 715 729 41,254

------------ --------- --------- ---------

Quarter ended 30 September

SART processing 367 208 33 24,077

Flotation 2,805 401 581 14,094

------------ --------- --------- ---------

Total 3,172 609 614 38,171

------------ --------- --------- ---------

Quarter ended 31 December

SART processing 438 244 39 20,833

Flotation 2,648 380 645 11,725

------------ --------- --------- ---------

Total 3,086 624 684 32,558

------------ --------- --------- ---------

2023

Quarter ended 31 March

SART processing 364 191 26 8,750

Flotation 4,544 665 762 11,095

------------ --------- --------- ---------

Total 4,908 856 788 19,845

------------ --------- --------- ---------

Quarter ended 30 June

SART processing 272 145 16 10,316

Flotation 5,613 869 479 8,101

------------ --------- --------- ---------

Total 5,885 1,014 495 18,417

------------ --------- --------- ---------

Quarter ended 30 September

SART processing 85 43 4 2,194

Flotation 1,316 207 151 1,974

------------ --------- --------- ---------

Total 1,401 250 155 4,168

------------ --------- --------- ---------

Quarter ended 31 December

SART processing 29 18 4 1,264

Flotation - - - -

------------ --------- --------- ---------

Total 29 18 4 1,264

------------ --------- --------- ---------

Note

* including Government of Azerbaijan's share.

Certain amounts for SART and flotation production may differ to

those previously disclosed due to final reconciliation of

production.

The following table summarises total copper concentrate

production and sales for FY 2022 and FY 2023. Note that sales of

concentrates are initially recorded as provisional amounts until

agreement of final assay.

Concentrate Copper Gold Silver Concentrate Concentrate

production* content* content* content* sales** sales**

(dmt) (tonnes) (ounces) (ounces) (dmt) ($000)

Quarter ended

------------ --------- --------- --------- ------------ --------------

31 March 2022 2,916 568 1,077 43,100 1,477 3,248

30 June 2022 4,127 715 729 41,254 4,642 8,127

30 Sept 2022 3,172 609 614 38,171 1,718 3,378

31 December

2022 3,086 624 684 32,558 4,606 7,487

------------ --------- --------- --------- ------------ --------------

FY 2022 13,301 2,516 3,104 155,083 12,443 22,240

--------------- ------------ --------- --------- --------- ------------ --------------

31 March 2023 4,908 856 788 19,845 1,147 2,743

30 June 2023 5,885 1,014 495 18,417 5,501 7,678

------------ --------- --------- --------- ------------ --------------

H1 2023 10,793 1,870 1,283 38,262 6,648 10,421

------------ --------- --------- --------- ------------ --------------

30 Sept 2023 1,401 250 155 4,168 2,358 3,066

31 December

2023 29 18 4 1,264 2,186 2,306

------------ --------- --------- --------- ------------ --------------

H2 2023 1,430 268 159 5,432 4,544 5,372

------------ --------- --------- --------- ------------ --------------

FY 2023 12,223 2,138 1,442 43,694 11,192 15,793

--------------- ------------ --------- --------- --------- ------------ --------------

Notes

* including Government of Azerbaijan's share

** excludes Government of Azerbaijan's share

Cash and net debt at 31 December 2023

US$m

Cash at bank (available for use) 4.3

Restricted cash (security for

borrowing) 6.0

---------------------------------- -------

Total cash 10.3

---------------------------------- -------

IBA - credit facility: 5.5 %

per annum (5.0)

IBA - revolving credit line:

6.5 % per annum (10.0)

Access bank: 0.5 % per month (5.6)

---------------------------------- -------

Total debt (20.6)

---------------------------------- -------

Net cash / (debt) (10.3)

---------------------------------- -------

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLBDGDBBUBDGSX

(END) Dow Jones Newswires

January 15, 2024 02:00 ET (07:00 GMT)

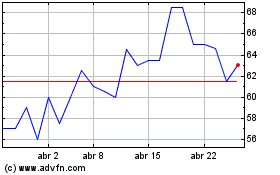

Anglo Asian Mining (LSE:AAZ)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Anglo Asian Mining (LSE:AAZ)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024