TIDMMSYS

RNS Number : 8234Z

Microsaic Systems plc

16 January 2024

16 January 2024

Microsaic Systems plc

("Microsaic", "Microsaic Systems" or the "Company")

Interim Results for the six months ended 30 June 2023

Microsaic Systems plc (AIM: MSYS), the developer of

micro-electronic instruments and analytical solutions, is pleased

to announce its unaudited interim results for the six months ended

30 June 2023. The extensive research and development work behind

our novel ProteinID, PFAS (forever chemicals) and acrylamide

detection technologies has concluded with working test units

following the period end. Building on our transition from unit

(4500 MiD(R)) product mass spectrometer sales only to

customer-centric service solutions in science and engineering

services, the Company is now focusing on commercial testing, sales

and servicing of these exciting new technologies.

A copy of these interim results is being made available on the

Company's website at https://www.microsaic.com/investors/, and hard

copies will be sent to shareholders who have requested

communications in that format.

Highlights

-- Unaudited revenues of GBP139k: a decrease of 81% on H1 2022 (GBP735k)

-- EBITDA adjusted loss of GBP1,023k which is 55% higher than H1 2022 (GBP661k)

-- Total comprehensive loss of GBP1,079k an increase of 53% compared to H1 2022 (GBP705k)

-- Cash at 30 June 2023 was GBP587k (H1 2022: GBP2.56m)

-- An agreement was signed with a new global technology

distributor Avantor (via VWR International Ltd)

-- Orders for 8 Units received for manufacture in H2 2023

Post Period Events

-- Technical issues with the testing of key components from

suppliers holding up the manufacturing process are being resolved

with up to 10 units now in final test or being manufactured in H2

2023

-- Unit orders shipped in H2 (including one demonstration unit)

increased to 6 with sales revenue invoiced at GBP262k by year

end

-- July 2023: The DeepVerge plc announcement on 26 June 2023

about its dire financial position resulted in the outstanding debt

of circa GBP1.3m to the Company not being settled. As a result, the

Company's annual audited accounts could not be finalised and

trading on AIM was then temporarily suspended on 3 July pending

publication of the Company's annual audited accounts

-- September 2023: Gerry Brandon resigned as Executive Chairman

on 25 September and was replaced by Bob Moore who was previously a

non-executive director of the Company

-- October 2023: notice of redundancy was issued to all staff

and notice given to close the Woking premises before year end

-- December 2023: After private financing initiatives failed to

complete and after considering delisting from AIM and putting the

Company into administration the Board engaged Turner Pope

Investments to raise sufficient capital with the objective of

restoration of its shares to trading on AIM and make an asset

acquisition. A targeted acquisition saw the Company enter into an

Exclusivity Agreement with DeepVerge plc to acquire certain assets

of its Modern Water business. This is part of the Company's growth

strategy to offer a wider range of technologies and a more

comprehensive service by enhancing our equipment manufacturing and

supply capabilities.

-- January 2024: The Company announced it has executed an

Acquisition Agreement with DeepVerge plc and its subsidiary,

Innovenn UK Limited, to acquire certain assets comprising the

Modern Water business for a total consideration of GBP100,000

payable at completion. The Company also announced that Turner Pope

Investments has successfully secured conditional funding

commitments to raise gross proceeds of circa GBP2.1 million through

a placing of 169,000,000 New Ordinary Shares. Net proceeds of the

Placing (being GBP1.8 million) are to be deployed to satisfy the

acquisition and support the capital needs of the Company as

enlarged by the acquired Modern Water business which will be

restarted under Microsaic's ownership .

Outlook

-- The Board looks forward to the conclusion of commercial

testing of our novel ProteinID and PFAS detection technologies

during 2024 and increased production of our core 4500 MiD(R) units.

Assuming the refinancing of the Company and acquisition of Modern

Water technology and assets is completed, the Company intends to

deploy these acquired technologies together with our existing and

newly developed products in a growing worldwide market.

Bob Moore, Acting Executive Chairman of Microsaic Systems plc,

commented:

"2023 has been a very difficult year for the Company and a total

reset of the business has been required as a result. Nevertheless,

the research and development work by our talented technical team

and substantial investment over many years has resulted in novel

detection technologies that are now ready for commercial testing

and deployment into the market. We look forward to collaborating

with large original equipment manufacturers (OEMs) to realise the

potential of our products through their extensive sales and

marketing channels."

Enquiries:

Microsaic Systems plc +44 (0) 20 3657 0050

Bob Moore, Acting Executive Chairman via TPI

Singer Capital Markets

(Nominated Adviser & Joint Broker)

Aubrey Powell / Angus Campbell / Oliver

Platts +44 (0)20 7496 3000

Turner Pope Investments (TPI) Limited

(Joint Broker)

Andy Thacker / James Pope +44 (0) 20 3657 0050

About Microsaic Systems

Microsaic has over 20 years' experience in microelectronics and

development of instrumentation. The Co mpany has an extensive and

innovative patent portfolio in industry-leading technology designed

and developed for "Industry 4.0" application serving markets in

diversified Industries, Human and Environmental Health. Microsaic's

very energy efficient micro system solutions have enabled

analytical detection and characterisation at the point-of-need,

whether within a mobile testing capability, conventional laboratory

setting, or within a bioprocessing facility for continuous

detection of data at multiple steps in the process workflow.

Microsaic's products and solutions are commercially available

through global markets via a network of regional and local

partners, targeting its core laboratory, manufacturing and

point-of-need applications.

Chairman's Statement

We would like to thank our existing shareholders and new

investors for the support they have shown for the refinancing of

the Company and its growth plans which include the acquisition of

the Modern Water business, both in early 2024.

We are delighted that the Company has been able to remain

solvent after a total reset and by retaining our admission to

trading on AIM the Company now has the necessary financing to

complete the acquisition and provide capital to invest in and

develop the enlarged business. The assets acquired are

complementary to the existing Microsaic business model. Using the

acquired assets we intend to restart the manufacture of the

MicroTox(R) bio-reagents for water testing in the near term. Post

acquisition we will seek positive cash generation from these new

activities and look to benefit from growth opportunities and

potential synergies over the longer term.

Microsaic's cost base has been dramatically reduced and we will

now operate a much leaner, more efficient outsourced manufacturing

and servicing model for our existing and acquired testing machine

technologies. 2024 will prove to be a busy year. The objective is

to reset and redesign the Company around a new and much more

efficient cost model based on the integration of the enlarged

business to optimise growth of sales, solutions and services income

to be generated by the combined entities.

STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

FOR THE SIX MONTHSED 30 JUNE 2023

6 months 6 months Year to 31

to 30 June to 30 June December

2023 2022 2022

Notes Unaudited Unaudited Audited

GBP GBP GBP

Revenue 4 139,404 734,914 1,567,697

Cost of sales 5 (145,494) (301,538) (618,330)

Gross profit (6,090) 433,376 949,367

Other operating income - - -

Research and development expenses (312,637) (219,491) (404,043)

Impairment of related party debt - - (1,130,169)

Other operating expenses (852,726) (914,819) (1,731,749)

Total operating expenses (1,165,363) (1,134,310) (3,265,961)

Loss from operations before share-based

payments (1,171,453) (700,394) (2,316,594)

Share-based payments 11 - (126,002) (234,749)

Loss from operations after share-based

payments (1,171,453) (826,936) (2,551,343)

Financial cost (873) (4,104) (7,013)

Finance income 12,592 7,083 23,423

Loss before tax (1,159,734) (823,957) (2,534,933)

Tax on loss on ordinary activities 81,207 119,246 246,224

Total comprehensive loss for the period (1,078,527) (704,711) (2,288,709)

Loss per share attributable to the equity

holders of

the Company

Basic and diluted loss per ordinary shares 6 (0.017)p (0.011)p (0.036)p

Note that the above revenues in the 6 months to 20 June 2023

include GBP65,826 to DeepVerge plc subsidiaries (1H 2022:

GBP546,718, FY22 GBP1,248,828). Although DeepVerge made payments to

cover the revenues in the period, on 26 June 2023, DeepVerge

announced that it would no longer be able to support its

subsidiaries and was anticipating a sale or liquidation of these

assets. The results above, subsequent performance in 2023 and

expectations or forecasts for 2024 and beyond therefore need to be

considered on the basis that no further payments and no further

revenues are expected to be received from DeepVerge.

STATEMENT OF FINANCIAL POSITION (UNAUDITED)

AS AT 30 JUNE 2023

30 June 30 June 31 December

2023 2022 2022

Notes Unaudited Unaudited Audited

GBP GBP GBP

ASSETS

Non-current assets

Intangible assets 60,546 66,637 69,160

Property, plant and equipment 286,609 296,342 380,272

Right of use assets 38,018 90,554 54,005

Total non-current assets 385,173 453,533 503,437

------------------------------- ------ ------------- ------------- -------------

Current assets

Inventories 283,771 255,346 274,045

Trade and other receivables 448,392 1,112,605 594,364

Corporation tax receivable 342,519 387,032 514,009

Cash and cash equivalents 587,024 2,562,741 1,241,480

Total current assets 1,661,706 4,317,724 2,623,898

TOTAL ASSETS 2,046,879 4,771,257 3,127,335

------------------------------- ------ ------------- ------------- -------------

EQUITY AND LIABILITIES

Equity

Share capital 1,731,413 1,731,413 1,731,413

Share premium 28,262,518 28,262,518 28,262,518

Share-based payment reserve 2,316,048 2,817,181 2,400,796

Retained losses (30,669,247) (28,616,601) (29,675,468)

Total Equity 1,640,732 4,194,511 2,719,259

------------------------------- ------ ------------- ------------- -------------

Current liabilities

Trade and other payables 218,984 379,382 236,445

Lease liability 17,929 73,699 52,918

Total current liabilities 236,913 453,081 289,363

------------------------------- ------ ------------- ------------- -------------

Non-current liabilities

Provision 9 148,649 105,045 115,385

Lease liability 20,584 18,620 3,328

Total non-current liabilities 169,233 123,665 118,713

------------------------------- ------ ------------- ------------- -------------

Total liabilities 406,146 576,746 408,076

------------------------------- ------ ------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 2,046,879 4,771,257 3,127,335

------------------------------- ------ ------------- ------------- -------------

STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

AS AT 30 JUNE 2023

Share

based

Share Share payment Retained Total

capital premium reserve Losses equity

GBP GBP GBP GBP GBP

At 1 January

2022 1,702,913 28,006,018 2,888,707 (28,024,418) 4,573,220

Total

comprehensive

loss for the

period - - - (704,711) (704,711)

Transactions

with owners

Shares issued 28,500 256,500 - - 285,000

Transfer in

respect of

lapsed share

options - - (112,528) 112,528 -

Share based

payments share

options - - 41,002 - 41,002

At 30 June 2022 1,731,413 28,262,518 2,817,181 (28,616,601) 4,194,511

----------------- ----------------- ------------------- ----------------------- ------------------------ ---------------------

At 1 July 2022 1,731,413 28,262,518 2,817,181 (28,616,601) 4,194,511

Total

comprehensive

loss for the

period - - - (1,583,998) (1,583,998)

Transactions

with owners

Transfer in

respect of

directors

warrants

exercised - - (300,075) 300,075 -

Transfer in

respect of

lapsed share

options - - (225,056) 225,056 -

Share based

payments-share

options - - 108,746 - 108,746

At 31 December

2022 1,731,413 28,262,518 2,400,796 (29,675,468) 2,719,259

----------------- ----------------- ------------------- ----------------------- ------------------------ ---------------------

At 1 January

2023 1,731,413 28,262,518 2,400,796 (29,675,468) 2,719,259

Total

comprehensive

loss for the

period - - - (1,078,527) (1,078,527)

Transactions

with owners

Transfer in

respect of

lapsed share

options - - (84,748) 84,748 -

Share based

payments share

options - - - - -

At 30 June 2023 1,731,413 28,262,518 2,316,048 (30,669,247) 1,640,732

----------------- ----------------- ------------------- ----------------------- ------------------------ ---------------------

STATEMENT OF CASH FLOWS (UNAUDITED)

FOR THE SIX MONTHSED 30 JUNE 2023

6 months 6 months Year to 31

to 30 June to 30 June December

2023 2022 2022

Notes Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating

activities

Cash absorbed by operations 12 (870,893) (997,506) (2,133,332)

Corporation tax received 252,697 - -

Net cash used in operating

activities (618,196) (997,506) (2,133,332)

--------------------------------- ------ ------------------------ --------------------- -------------------------

Cash flows from investing

activities

Purchases of intangible

assets (5,307) (6,331) (26,880)

Purchases of property,

plant and equipment (23,397) (65,019) (208,495)

Interest received 12,592 5,850 23,423

Net cash used in investing

activities (16,112) (65,500) (211,952)

--------------------------------- ------ ------------------------ --------------------- -------------------------

Cash flows from financing

activities

Proceeds from share issues - 200,000 200,000

Share issue costs - - -

Repayment of lease liabilities (20,148) (39,130) (78,112)

Net cash from/(used in)

financing activities (20,148) 160,870 121,888

--------------------------------- ------ ------------------------ --------------------- -------------------------

Net increase/(decrease)

in cash and cash equivalents (654,456) (902,136) (2,223,396)

Cash and cash equivalents

at beginning of the year 1,241,480 3,464,876 3,464,876

Cash and cash equivalents

at the end of the period 587,024 2,562,741 1,241,480

--------------------------------- ------ ------------------------ --------------------- -------------------------

NOTES TO THE INTERIM FINANCIAL INFORMATION (UNAUDITED)

1. Nature of Operations

Microsaic Systems plc (the "Company") is registered in England

and Wales. The Company's registered office is 1-7 Park Road,

Caterham, Surrey CR3 5TB, with effect from 11 January 2024. The

Company has no subsidiaries, so the financial information relates

to the Company only. Microsaic is a high technology company

developing compact, chip-based mass spectrometers that are designed

to improve the efficiency of pharmaceutical R&D.

2. Basis of preparation

The interim financial statements of the Company for the six

months ended 30 June 2023, which are unaudited, have been prepared

in accordance with the accounting policies set out in the annual

report and accounts for the year ended 31 December 2022, which were

prepared under International Financial Reporting Standards

("IFRS").

This report does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006 and has not been audited. The

financial information for the full preceding year is based on the

statutory accounts for the year ended 31 December 2022. Those

statutory accounts have been published and will shortly be filed

with the Registrar of Companies. The auditor's report on those

statutory accounts was unqualified.

As permitted, this interim report has been prepared in

accordance with the AIM Rules for Companies and not in accordance

with IAS 34 "Interim Financial Reporting" and therefore it is not

fully compliant with IFRS.

The interim financial statements are presented in pounds

sterling.

3. Critical accounting estimates and judgements

Accounting estimates and judgements are continually evaluated

and are based on past experience and other factors, including

expectations of future events that are believed to be reasonable

under the circumstances.

The Company makes estimates and assumptions concerning the

future. The resulting accounting estimates could, by definition,

differ from the actual outcome.

Estimates and adjustments that have a risk of causing a material

adjustment to the carrying amounts of assets and liabilities are

set out in the annual report and accounts for the year ended 31

December 2022, and no additional items have been identified.

4. Revenues

IFRS 15 provides a single, principles based, five-step model to

be applied to all contracts with customers. The five-step framework

includes:

Identify the contract(s) with a customer;

Identify the performance obligations in the contract; Determine

the transaction price;

Allocate the transaction price to the performance obligations in

the contract; and Recognise revenue when the entity satisfies a

performance obligation.

The Company recognises revenue from the following four

sources:

Sale of products;

Sale of consumables and spare parts; Product service and product

support; and Consultancy services.

All revenues and trade receivables arise from contracts with

customers. Revenue is measured based on the consideration which the

Company expects to be entitled in a contract with a customer and

excludes amounts collected on behalf of third parties. The sale of

products, consumables and spare

parts is recognised when the sole performance obligation is met

which is usually on delivery to the customer. For product service,

product support and consultancy services revenue, the performance

obligation is satisfied over the duration of the service period and

revenue is recognised in line with the satisfaction of the

performance obligation.

Sale of products

The Company sells compact mass spectrometers (Microsaic 4500

MiD(R)) mainly through OEMs and Distributors. A small proportion of

its sales are direct to the customer. Discounts are offered and

agreed as part of the contractual terms. Terms are generally Ex

Works so control passes when the customer collects the goods.

Payment terms are generally 30 days from the date of invoice.

Sales of consumables and spare parts

The Company sells consumables and spare parts mainly through

OEMs and Distributors. Terms are generally Ex Works so control

passes when the customer collects the goods. Discounts are offered

and agreed as part of the contractual terms. Payment terms are

generally 30 days from the date of invoice.

Product service and product support revenue

Service and support to our OEMs and Distributors includes

training their sales and service teams and servicing the products

from time to time. Discounts are offered and agreed as part of the

contractual terms. Terms are Ex Works so control passes when the

customer receives the service. Payment terms are generally 30 days

from the date of invoice.

Usually, there is no obligation on the Company for returns,

refunds or similar arrangements. Also, the Company does not

manufacture specific items to a customer's specification and no

financing component is included in the terms with customers.

The Company provides assurance warranties which are 15 months

from the date of shipment for OEMs and Distributors. These

warranties confirm that the product complies with agreed-upon

specifications. The Company is looking to provide service

warranties in the future to direct customers in Europe, where the

revenue from such warranties will be recognised over the period of

the service agreement.

Consultancy services revenue

Consultancy services comprise science and engineering

consultancy, laboratory services and monitoring services. These

services are delivered over a period of time usually in accordance

with a master services agreement and/or statement of works with an

agreed outcome at the end of the project or project phase.

Consultancy services revenue is recognised by reference to the

stage of completion of the project or project phase at the balance

sheet date as follows:

-- Where there are defined project or project phase milestones,

the revenue is recognised in full on completion of the project or

project phase and on a time basis for the stage of completion where

the project or project phase is not completed at the balance sheet

date. The stage of completion is recognised as the proportion of

time spent on the project or project phase compared with the total

time anticipated to complete the project or project phase;

and/or

-- Where the project is defined with the client in terms of time

spent, the revenue is recognised on the basis of consulting time

spent on the project by the Company at the time-based rates agreed

with the client.

The geographical analysis of revenues (by location of shipment)

was as follows:

6 months 6 months Year to 31

to 30 June to 30 June December

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

UK 11,251 634,200 1,354,872

USA 2,185 50,703 103,752

EU 71,636 29,610 67,646

China 54,332 12,122 30,631

ROW - 8,279 10,796

139,404 734,914 1,567,697

---------------------------- ------------------------ --------------------- --------------------

The product group analysis of revenues was as follows:

6 months 6 months Year to 31

to 30 June to 30 June December

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

---------------------------- ------------------------ --------------------- --------------------

Product/Unit 47,087 165,011 206,915

Consumables and spares 13,596 67,586 137,397

Service and support income 78,721 502,317 1,223,385

139,404 734,914 1,567,697

---------------------------- ------------------------ --------------------- --------------------

Note that the above revenues in the 6 months to 20 June 2023

include GBP65,826 to DeepVerge subsidiaries (1H 2022: GBP546,718,

FY22 GBP1,248,828). However, on 26 June 2023, DeepVerge plc

announced that it would no longer be able to support its

subsidiaries and was anticipating a sale or liquidation of these

assets. The results above, subsequent performance in 2023 and

expectations or forecasts for 2024 and beyond therefore need to be

considered on the basis that no further payments and no further

revenues are expected to be received from DeepVerge.

5. Cost of sales

Cost of sales of products

The cost of sales of mass spectrometers and related equipment is

the bought in purchase cost of the product or the transfer value

from stock value if a unit has been previously written down.

Usually, the sale is made on an Ex-Works basis but if it were not

the cost of delivery to the customer is also included in cost of

sales.

Cost of sales of consumables and spare parts

The cost of sales of consumable and spare parts is the bought in

purchase cost of the consumable or spare part or the transfer value

from stock value if an item has been previously written down.

Usually, the sale is made on an Ex-Works basis but if it were not

the cost of delivery to the customer is also included in cost of

sales.

Cost of sales of product service and product support income

The cost of sales of service and support income is the

time-based apportionment of the employment costs of the relevant

staff spent on the delivery of the service and support income plus

any related costs of fulfilment such as travel expenses and any

externally incurred direct costs. For the purposes of cost of

sales, the employment costs are considered to be salaries, pensions

and employers national insurance but does not include share-based

payments nor any apportionment of training or overheads.

Cost of sales of consultancy services revenue

The cost of sales of consultancy services (comprising science

and engineering consultancy, laboratory services and monitoring

services) is the time-based apportionment of the employment costs

of the relevant staff spent on the delivery of this revenue plus

any related costs of fulfilment such as travel expenses and any

externally-incurred direct costs. For the purposes of cost of

sales, the employment costs are considered to be salaries, pensions

and employers national insurance but does not include share-based

payments nor any apportionment of training or overheads.

6. Loss per share

6 months 6 months Year to 31

to 30 June to 30 June December

2023 2022 2022

Unaudited Unaudited Audited

Comprehensive loss attributable

to equity (1,078,527) (704,711) (2,288,709)

shareholders (GBP)

Weighted average number

of ordinary 0.01p

(2022: 0.01p) shares for

the purpose of basic 6,324,666,516 6,287,359,621 6,324,666,516

and diluted loss per share

Basic and diluted loss

per ordinary share (p) (0.017)p (0.011)p (0.036)p

--------------------------------- -------------- -------------- --------------

The basic loss per share has marginally increased when compared

with H1 2022. This was due to a 56% increase in the comprehensive

loss, arising mainly from the 81% reduction in revenues.

Potential ordinary shares are not treated as dilutive as the

Company is loss making, therefore the weighted average number of

ordinary shares for the purposes of the basic and diluted loss per

share are the same.

7. EBITDA Adjusted Loss

A key indicator of performance for the Company is Adjusted

EBITDA Loss (Loss of earnings before interest, tax, depreciation,

amortisation and other items such as share-based payments and

exceptional one-off expenditure). Detailed below is the Adjusted

EBITDA Loss for the period:

6 months 6 months Year to

to 30 June to 30 June 31-Dec

2023 2022 2022

Unaudited Unaudited Unaudited

GBP GBP GBP

Comprehensive loss for period (1,078,527) (704,711) (2,288,709)

Adjust for:

Tax on loss on ordinary activities (81,207) (119,246) (246,224)

Depreciation of property,

plant and equipment 95,250 74,364 178,102

Depreciation of right of

use assets 37,797 35,980 72,528

Amortisation of Intangibles 13,921 14,099 30,487

Net finance cost/(income) (10,176) (2,979) 16,410

Share-based payments (excluding

fee shares) - 41,002 234,749

EBITDA Adjusted Loss (1,022,942) (661,491) (2,002,657)

------------------------------------ ------------------- ----------- ------------

8. Employees and employment related costs

6 months 6 months Year to 31

to 30 June to 30 June December

2023 2022 2022

Unaudited Unaudited Audited

Staff Numbers

--------------------------------------- ----------- ----------- ----------

Directors 2 3 3

Other staff 21 19 19

--------------------------------------- ----------- ----------- ----------

Average Headcount 23 22 22

--------------------------------------- ----------- ----------- ----------

GBP GBP GBP

--------------------------------------- ----------- ----------- ----------

Employment costs (including Directors)

Wages and salaries 526,258 514,539 985,734

Social security costs 57,000 74,710 133,630

Termination payments 4,854 21,125 21,125

Pension costs 70,954 77,578 144,038

Employment related share-based

payments 21,277 82,943 234,749

--------------------------------------- ----------- ----------- ----------

680,343 770,895 1,519,276

--------------------------------------- ----------- ----------- ----------

9. Provisions

Dilapidations Warranties TOTAL

GBP GBP GBP

----------------------------------- -------------- ----------- --------

Balance at 1 January 2023 91,619 23,766 115,385

Provided for/(reduced) during the

period 25,907 7,357 33,264

Balance at 30 June 2023 117,526 31,123 148,649

----------------------------------- -------------- ----------- --------

The dilapidations provision has been updated for the estimated

impact of inflation.

10. Commitments

As at 30 June 2023, purchase commitments relating to purchase

orders placed on, and related contractual arrangements and

obligations, with our third-party manufacturers amounted to

GBP559,800 (31 December 2022: GBP651,944).

11. Share-based payments

The share-based payments charge comprises 6 months 6 months Year to

to 30 June to 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

Directors' fees settled in shares - 41,941 85,000

Share options granted - 41,002 149,749

Employment related share-based payments - 82,943 234,749

Brokers' fees settled in shares - 43,059 -

- 126,002 234,749

-------------------------------------------------------------------- -------------------- ----------------------

There were no Directors' fees settled in shares in the 6 month

period to 30 June 2023.

12. Cash absorbed by operations

Year to

6 months 6 months 31

to 30

June to 30 June December

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

Total comprehensive loss for the

year (1,078,527) (704,711) (2,288,709)

Adjustments for:

Amortisation of intangible

assets 13,921 14,099 30,487

Depreciation of right of use

assets 37,797 35,980 72,528

Depreciation of property, plant

and equipment 95,250 74,364 178,102

Transfer of property, plant and

equipment to

cost of goods - - (44,192)

Profit on disposal of right of

use

assets - - 1,638

Increase/(Decrease) in provision

for dilapidation 25,907 8,199 (415)

Increase/(Decrease) in provision

for warranty 7,357 (3,114) 15,840

Increase/(Decrease) in provision

for expected

credit losses - 4,755 1,127,416

Share-based payments (inclusive

of fees settled in shares) - 126,002 234,749

Increase/(Decrease) in inventory

provision 15,652 (14,033) (28,152)

Tax on loss on ordinary

activities (81,207) (119,246) (246,224)

Interest on lease liability 2,416 4,104 7,013

Interest received (12,592) (5,850) (23,423)

--------------------------------- ----------------------------- --------------------------- -----------------------

Cash absorbed by operations

before

movements in working capital (974,026) (579,451) (963,342)

Movements in working capital:

(Increase)/Decrease in

inventories (25,378) 42,587 38,008

(Increase)/Decrease in trade and

other receivables 145,972 (485,413) (1,089,832)

Increase/(Decrease) in trade and

other payables (17,461) 24,771 (118,166)

Cash absorbed by operations (870,893) (997,506) (2,133,332)

--------------------------------- ----------------------------- --------------------------- -----------------------

13. Related party transactions

During the period, Microsaic and DeepVerge plc ("DeepVerge") had

two directors in common: Gerard Brandon and Nigel Burton. Gerard

Brandon was Executive Chairman of Microsaic and CEO of DeepVerge

until his resignation on 25 September 2023.

In the six months ended 30 June 2023, revenue from DeepVerge

subsidiaries totalled GBP65,826 to (1H 2022: GBP546,718, FY22

GBP1,248,828). However, on 26 June 2023, DeepVerge plc announced

that it would no longer be able to support its subsidiaries and was

anticipating a sale or liquidation of these assets. The results

above, subsequent performance in 2023 and expectations or forecasts

for 2024 and beyond therefore need to be considered on the basis

that no further payments and no further revenues are expected to be

received from DeepVerge.

At 31 December 2022, GBP1,511,198 (2021: GBP247,412) inclusive

of VAT was owed by DeepVerge to Microsaic relating to the supply of

goods and services recognised as revenues for the year ended 31

December 2022. The Company had expected to receive material

payments from DeepVerge beginning in December 2022, but in the

absence of these and given the increasing levels of overdue

payments from DeepVerge, the Company sought to reach a formal

agreement with DeepVerge, as first announced in the RNS dated 18

April 2023. However, given the circumstances of DeepVerge's

financial position, it was not possible to obtain written agreement

although DeepVerge made initial payments in line with the

informally agreed plan - hence the outstanding balance reduced from

GBP1.5m to approximately GBP1.4m gross in early 2023.

On 26 June 2023 DeepVerge issued an RNS casting significant

doubt on its ability to settle this debt. In preparing the accounts

to 31 December 2022, given that it was the opinion of the directors

that the conditions leading to this were in existence at 31

December 2022, a provision for expected credit losses of

GBP1,130,169 (2021: GBP0) was recognised against this debt in the

accounts to 31 December 2022. This represented the amount of

outstanding debt at 26 June 2023, less recoverable VAT. No further

provisions were made in relation to DeepVerge in the six months

ended 30 June 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFFSIMELSESF

(END) Dow Jones Newswires

January 16, 2024 02:00 ET (07:00 GMT)

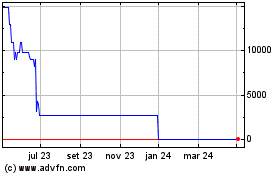

Microsaic Systems (LSE:MSYS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

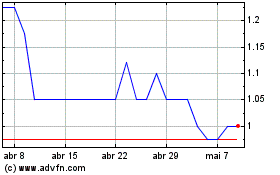

Microsaic Systems (LSE:MSYS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024