TIDMLORD

RNS Number : 6789A

Lords Group Trading PLC

24 January 2024

24 January 2024

Lords Group Trading plc

('Lords', the 'Group' or the 'Company')

FY23 Trading Update

Lords, a leading distributor of building materials in the UK, is

pleased to provide a trading update for the year ended 31 December

2023 ('FY23' or the 'period') ahead of publication of its FY23

Final Results in May 2024.

During the period the Group's trading has again demonstrated

Lords' resilience and capability to deliver its growth strategy

amidst the continuing subdued trading conditions. In the face of

these conditions, Lords has made steady operational progress across

both Merchanting and Plumbing & Heating divisions. Furthermore,

seven additional sites across the UK have been added through

acquisitive and organic growth, generating an expected GBP25

million of annualised revenues at maturity.

As a result, the Group expects to report, subject to audit, FY23

revenue of GBP463 million (FY22: GBP450 million) and FY23 adjusted

EBITDA(2) of approximately GBP26.6 million (FY22: GBP30.0 million),

in line with current market expectations(1) , and adjusted profit

before tax(3) of approximately GBP11.0 million (FY22: GBP17.4

million).

Segmental Trading

The table below shows total revenue growth and like-for-like for

FY23:

Like-for-Like Change in Total

Revenue Growth Revenue

----------------

Unaudited FY23 vs. FY22 FY23 vs. FY22

Division FY23 Revenue

---------------- ----------------

Merchanting GBP215m (6.3)% (2.4)%

--------------- ---------------- ----------------

Plumbing & Heating

("P&H") GBP248m 3.7% 7.8%

--------------- ---------------- ----------------

Group GBP463m (1.2)% 2.8%

--------------- ---------------- ----------------

Overall, the Group has experienced further resilient trading

across the business, despite wider market headwinds, resulting in

total sales growth of 2.8%.

In addition to its organic growth levers, the Group successfully

executes a unique M&A strategy that is focused on creating

market share gains, enhanced profitability and further diversifying

revenue streams. Lords targets specialist, independent businesses

that broaden product range or geographic reach in order to do this.

The Merchanting and P&H markets remain highly fragmented,

offering significant opportunity given Lords' reputation as being

an acquirer of choice in the market.

The Group continues to maintain a prudent and considered

approach to inorganic growth and, whilst a pipeline of acquisition

opportunities remains live, in the current environment the Group is

committed to balance sheet discipline which will remain in

FY24.

Renewables product range extension

Lords has strategically focused on product range extension in

the renewables space in recent years, with strong growth drivers

and market dynamics complementing Lords position in the supply

chain.

In Q4 2023, the Government confirmed that the widely consulted

Clean Heat Market Mechanism ('CHMM') will commence in Q2 2024. The

CHMM will incentivise boiler manufacturers and homeowners to

accelerate the transition towards renewable energy sources across

the UK housing stock, increasing demand for renewable products

including air source heat pumps.

Lords is well placed to benefit from a shift in demand towards

air source heat pumps, enjoying successful and growing trading

relationships with six air source heat pump manufacturers and

achieving 60% revenue growth across its wider renewables range(4)

in FY23.

Balance sheet

As at 31 December 2023, the Group had net debt(5) of GBP28.5

million (30 June 2023: GBP38 million), backed by a freehold

property portfolio with an estimated market value of not less than

GBP15 million . The significant reduction in net debt, ahead of

current market expectations(6) , reflects the Board's focus during

the period to reduce net debt through a number of successful

management controls and initiatives and through the normalisation

of working capital.

P&H working capital fully normalised as at 31 December 2023,

in line with previous guidance at the 2023 interim results,

following the resolution of the industry wide boiler supply issues

in 2022.

Current Trading and Outlook

Throughout FY23 Lords has demonstrated resilient organic growth,

in a sector which has seen a challenging period., The Group

continues to successfully apply a number of steps to manage costs

and reduce debt.

The markets in which we operate in are expected to remain

subdued into FY24 and, whilst there are signs of improvement in

customer demand, these signals remain intermittent and price

deflation persists. This has led the Group to continue to take a

prudent approach to FY24 in order to give the market dynamics

appropriate time to recalibrate as economic volatility reduces.

Shanker Patel, Chief Executive Officer of Lords, commented:

"Like many of our peers it has been a challenging year but the

fundamentals of our business have underpinned a resilient

performance that I'm incredibly proud of.

"Our scale and profitability in both Merchanting and Plumbing

& Heating have benefitted from our organic growth levers as we

build our geographic footprint, extend our product range and build

our digital sales expertise. We maintain an ongoing ability to

execute earnings enhancing M&A, but balance sheet discipline

remains a core consideration. In that regard it is pleasing to

report net debt reduction ahead of market expectations. As market

conditions improve we are confident that we are exceptionally well

positioned for growth."

(1) Current consensus analyst forecasts are for FY23 revenues of

between GBP445 million and GBP450 million, FY23 Adjusted EBITDA of

between GBP26.2 million and GBP27.0 million, and Adjusted Profit

Before Tax of between GBP12.1 million and GBP13.2 million.

(2) Adjusted EBITDA is EBITDA (defined as earnings before

interest, tax, depreciation and amortisation and, in accordance

with IFRS) but also excluding exceptional items, the impact of an

in period change to the Group's stock provisioning policy and

share-based payments.

(3) Adjusted profit before tax is profit before tax before

exceptional items, share based payments and amortisation of

intangible assets.

(4) Air Source Heat Pumps, Controls, Under Floor Heating, Air

Con, Electric Boilers

(5) Net debt is defined as borrowings less cash and cash

equivalents.

(6) Current consensus analyst forecasts are for FY23 year-end

net debt of between GBP30.0 million and GBP32.6 million

- Ends -

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended. Upon

the publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

FOR FURTHER ENQUIRIES:

Lords Group Trading plc Via Buchanan

Shanker Patel, Chief Executive Officer Tel: +44 (0) 20 7466

5000

Chris Day, Chief Financial Officer and

Chief Operating Officer

Cavendish Capital Markets Limited (Nominated Tel: +44 (0)20 7220

Adviser and Joint Broker) 0500

Ben Jeynes / Dan Hodkinson (Corporate

Finance)

Julian Morse / Henry Nicol (Sales)

Berenberg (Joint Broker) Tel: +44 (0)20 3207

Matthew Armitt / Richard Bootle / Detlir 7800

Elezi

Buchanan Communications Tel: +44 (0) 20 7466

5000

Henry Harrison-Topham / Steph Whitmore / LGT@buchanan.uk.com

Abby Gilchrist

Notes to editors:

Lords is a specialist distributor of building, plumbing, heating

and DIY goods. The Group principally sells to local tradesmen,

small to medium sized plumbing and heating merchants, construction

companies and retails directly to the general public.

The Group operates through the following two divisions:

-- Merchanting: supplies building materials and DIY goods

through its network of merchant businesses and online platform

capabilities. It operates both in the 'light side' (building

materials and timber) and 'heavy side' (civils and landscaping),

through 31 locations in the UK.

-- Plumbing and Heating: a specialist distributor in the UK of

plumbing and heating products to a UK network of independent

merchants, installers and the general public. The division offers

its customers an attractive proposition through a multi-channel

offering. The division operates over 17 locations enabling

nationwide next day delivery service.

Lords was established over 35 years ago as a family business

with its first retail unit in Gerrards Cross, Buckinghamshire.

Since then, the Group has grown to a business operating from 48

sites. Lords aims to become a GBP500 million turnover building

materials distributor group by 2024 as it grows its national

presence.

Lords was admitted to trading on AIM in July 2021 with the

ticker LORD.L. For additional information please visit

www.lordsgrouptradingplc.co.uk .

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAPFDAAKLEFA

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

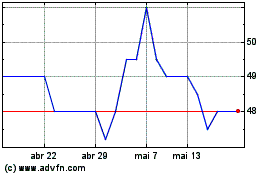

Lords Group Trading (LSE:LORD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Lords Group Trading (LSE:LORD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024