Oxurion provides clarification on the agenda of the extraordinary general shareholders' meeting to be held on 24 July 2024

11 Julho 2024 - 1:00PM

UK Regulatory

Oxurion provides clarification on the agenda of the extraordinary

general shareholders' meeting to be held on 24 July 2024

Oxurion provides clarification on the

agenda of the extraordinary general shareholders' meeting to be

held on 24 July 2024

Leuven, BELGIUM – July 11, 2024 – 6:00pm

CET – Oxurion NV (Euronext Brussels: OXUR), an innovative

biopharmaceutical company based in Leuven, announced today it has

provided clarification on the agenda of the extraordinary general

shareholders' meeting to be held on 24 July 2024 (the

EGM) as set out in the convening notice published

on 5 July 2024 in accordance with applicable laws.

The EGM shall deliberate and vote on a potential

share consolidation in respect of all outstanding shares of the

Company by means of a 1-for-10,000 share and resulting

authorization to the board of directors of the Company to further

implement the share consolidation during a three-year period

following the date of the EGM.

The proposed resolution for item 1(c) of the

agenda of the EGM wrongly referred to the fact that proceeds of the

sale of shares not being converted into whole new shares would only

be paid provided that the net proceeds are less than EUR 0.01 per

old share.

It is however only if the net proceeds to be

received by a shareholder for his position with an account holder

are less than EUR 0.01 that the account holder will not be able to

pay any compensation to this shareholder.

By an information note published today on the

website of the Company (www.oxurion.com), the board of directors of

the Company clarified the wording of the proposed resolution for

item 1 (c) of the agenda of the EGM as follows:

"(c) No

fractions of new shares: Within the framework of the Reverse Stock

Split, the existing shares can only be consolidated, in accordance

with the Ratio, into a whole number of new shares. No fractions of

new shares can be issued. Subject to applicable company, financial

and securities law rules, and subject to the provisions of the

foregoing paragraphs, the board of directors shall be authorized to

determine the manner and process to effect the Reverse Stock Split

with respect to holders of existing shares of the Company who at

the time of the Reverse Stock Split do not have a sufficient number

of existing shares in order to receive a whole number of new shares

in accordance with the Ratio. Within this context, the board of

directors shall have the power to determine that (i) the positions

of old shares that cannot be consolidated into a whole number of

new shares in accordance with the Ratio can be aggregated for

consolidation into new shares, (ii) such new shares can be sold or

placed via an exempt private placement or bookbuilding (accelerated

or not) to institutional, qualified or professional investors or

individuals in and outside of Belgium, and (iii) the net proceeds

of such sale or placement, after deduction of relevant transaction

costs and expenses (including commissions, fees and expenses of

agents and advisors) and applicable taxes, all as applicable, can

be distributed on a pro rata basis to the holders of existing

shares that did not have a sufficient number of existing shares to

be converted into whole new shares in accordance with the Ratio,

provided that such proceeds are at least

equivalent to EUR 0.01. If net proceeds are less

or cannot be distributed on a pro rata basis as aforementioned,

these shall accrue to the Company. Subject to applicable provisions

of company, financial and securities law, the board of directors

shall also have the authority to determine that the positions of

existing shares that cannot be consolidated in accordance with the

Ratio into a whole number of new shares can be acquired by the

Company or one of its subsidiaries and that the net proceeds of

such sale will be distributed on a pro rata basis as set forth

above."

This clarification is in the interest of all

shareholders of the Company.

The template proxy and the template voting form

for the EGM available on the website of the Company

(www.oxurion.com) were amended accordingly. Proxies and voting

forms for the EGM received prior to the publication of this press

release will also be corrected.

About Oxurion

Oxurion (Euronext Brussels: OXUR) is engaged in

developing next-generation standard of care ophthalmic therapies

for the treatment of retinal disease. Oxurion is headquartered in

Leuven, Belgium. More information is available at

www.oxurion.com.

Important information about

forward-looking statements

Certain statements in this press release may be

considered “forward-looking”. Such forward-looking statements are

based on current expectations, and, accordingly, entail and are

influenced by various risks and uncertainties. The Company

therefore cannot provide any assurance that such forward-looking

statements will materialize and does not assume any obligation to

update or revise any forward-looking statement, whether as a result

of new information, future events, or any other reason. Additional

information concerning risks and uncertainties affecting the

business and other factors that could cause actual results to

differ materially from any forward-looking statement is contained

in the Company’s Annual Report. This press release does not

constitute an offer or invitation for the sale or purchase of

securities or assets of Oxurion in any jurisdiction. No securities

of Oxurion may be offered or sold within the United States without

registration under the U.S. Securities Act of 1933, as amended, or

in compliance with an exemption therefrom, and in accordance with

any applicable U.S. state securities laws.

For more information, please

contact:

Oxurion NV

Pascal Ghoson, CEO

pascal.ghoson@oxurion.com

Oxurion NV (EU:OXUR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

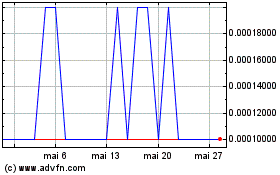

Oxurion NV (EU:OXUR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025