Press release Orange: first half 2024 results

Press release

Paris, 24 July 2024

Financial results at 30 June 2024

Lead the Future strategic plan

delivers a strong performance

- Major

achievements on the four strategic pillars midway through Lead

the Future

-

Accelerated EBITDAaL growth in the second quarter

- Strong

cash flow generation in the first half

-

Confirmation of full-year 2024 guidance

|

In millions of euros |

|

2Q 2024 |

change

comparable

basis |

change

historical

basis |

|

6M 2024 |

change

comparable

basis |

change

historical

basis |

|

Revenues |

|

9,989 |

0.9 % |

1.6 % |

|

19,839 |

1.5 % |

2.5 % |

|

EBITDAaL |

|

3,106 |

2.6 % |

3.3 % |

|

5,511 |

2.5 % |

3.7 % |

|

Operating Income |

|

|

|

|

|

2,032 |

8.4 % |

(1.4)% |

|

Consolidated net income |

|

|

|

|

|

1,092 |

|

0.4 % |

|

o/w Consolidated net income of continuing operations |

|

|

|

|

|

884 |

|

(16.3)% |

|

o/w Consolidated net income of discontinued operations (Spain) |

|

|

|

|

|

209 |

|

ns |

|

Net income attributable to owners of the parent

company |

|

|

|

|

|

824 |

|

(6.0)% |

|

eCAPEX (excluding licenses) |

|

1,537 |

2.2 % |

(7.5)% |

|

3,087 |

2.3 % |

(2.1)% |

|

o/w excluding Spain |

|

1,537 |

2.2 % |

3.6 % |

|

2,921 |

2.6 % |

4.0 % |

|

o/w Spain |

|

- |

- |

- |

|

166 |

(2.1)% |

(52.2)% |

|

EBITDAaL - eCAPEX excluding Spain |

|

1,569 |

3.0 % |

3.0 % |

|

2,590 |

2.4 % |

3.4 % |

|

Organic cash flow (telecom activities) |

|

|

|

|

|

1,437 |

|

(2.7)% |

|

o/w excluding Spain |

|

|

|

|

|

1,551 |

|

17.4 % |

|

Free cash flow all-in (telecom activities) |

|

|

|

|

|

1,138 |

|

(1.1)% |

|

o/w excluding Spain |

|

|

|

|

|

1,255 |

|

21.1 % |

|

Earnings per share (EPS) in euro |

|

|

|

|

|

0.28 |

|

(7.1)% |

Commenting on these results, Christel Heydemann,

the Orange group’s Chief Executive Officer, said:

“Orange has had a very good first half with

solid results that allow us to confirm the Group’s guidance. These

results, which notably include a sharp increase in cash flow,

continue to be driven by the remarkable performance of Africa &

Middle East and the solid improvement of EBITDAaL in Europe,

including in France where EBITDAaL stabilized in this first

half.

This once again demonstrates our ability to

execute the Lead the Future strategic plan in a constantly evolving

market.

In France, our position as market leader,

particularly in the high-end segment, and the excellent quality of

our network and service enable us to maintain a disciplined pricing

policy. We continue to launch distinctive and innovative offerings,

such as the new “Orange Cybersecure” B2C cybersecurity solution,

which draws on the recognized expertise of our subsidiary, Orange

Cyberdefense.

In Spain, the MASORANGE teams are fully

operational and are starting to deliver the initial synergies.

Today, MASORANGE announces the signing of a non-binding agreement

with Vodafone Spain to create a FiberCo, which would allow us to

capitalize on our infrastructure.

I would sincerely like to thank all Orange

colleagues for their dedication and performance during this first

half. We will continue to demonstrate our know-how throughout the

coming weeks of the Paris 2024 Olympic and Paralympic Games. Orange

is here to connect athletes, organizers, spectators and viewers

from all around the world.”

Orange group revenues rose 0.9%

compared with the second quarter of 20231

(+85 million euros) thanks to growth in retail services (+2.4%

or +182 million euros) and a smaller decline in wholesale

services (-7.9% or -128 million euros), mainly related to

higher unbundling and civil engineering rates in France in the

first quarter.

- Africa & Middle

East is the main contributor to this growth, with revenues

rising strongly (+10.3% or +177 million euros), driven by a

robust performance in voice as well as double-digit increases in

its four growth engines (+17.9% in mobile data, +19.2% in fixed

broadband, +18.9% for Orange Money and +14.5% in B2B across all

activities).

- Revenues in France

increased +0.3% (+14 million euros) thanks to the growth in

retail services excluding PSTN2 (+2.5%), in line with

the Lead the Future growth target of between 2.0% and

4.0%, and a smaller decline in wholesale (-5.7%).

- Europe declined

(-2.2% or -38 million euros) due to a reduction in low-margin

activities, partially offset by growth of convergent services

(+7.1%).

- The slight decrease in Orange

Business revenues (-1.4% or -27 million euros) was

again due to the decline in Fixed-only revenues (-7.9% or

-65 million euros), partially offset by growth in IT and

Integration services revenues (+4.6% or +43 million euros),

led by Orange Cyberdefense (+10.6%).

- In terms of commercial

performance, the Group maintained its leadership position

in convergence in Europe (including France), with a total of

9.1 million convergent customers (+1.4%), as

well as its commercial momentum in mobile contracts and very

high-speed fixed broadband accesses. Mobile

services had 245.9 million accesses worldwide (+7.3%)

including 91.1 million contracts (+10.9%). Fixed

services had 38.9 million accesses worldwide

(declining -3.3%) of which 13.7 million were very high-speed

broadband accesses, an area that continued to show strong growth

(+14.0%). Fixed narrowband accesses continued their decline

(-12.8%).

The growth in EBITDAaL demonstrates the

Group’s ability to implement its value strategy.

Group EBITDAaL was up 2.6% in the

second quarter. In the first half of 2024, it reached

5,511 million euros (+2.5%), in line with the target of slight

growth in 2024. This growth was driven by the remarkable

performance of Africa & Middle East (+14.7%), by a solid

performance in Europe (+4.0%) and by France (+0.3%). These more

than offset the decline of Orange Business (-11.3%), which recorded

an improvement compared with the first half of 2023 (+5.4 points).

EBITDAaL from telecom activities grew to

5,573 million euros (+2.4%).

Group operating income in the

first half of 2024 was 2,032 million euros, up 8.4% due to the

increase in EBITDAaL.

Consolidated net income in the

first half of 2024 was stable at 1,092 million euros (+4 million

euros on a historical basis). The decrease of -172 million euros in

net income from continuing operations was offset by an increase of

+176 million euros in net income from discontinued operations. The

contribution to net income for the first half 2024 from Spanish

activities was 3 million euros3.

Net income attributable to owners of the

parent company was 824 million euros. Earnings per share,

Group share (EPS) was 0.28 euros, compared with

0.30 euros in the first half of 2023.

In the first half of 2024, eCAPEX

rose +2.6% to 2,921 million euros excluding Spain, in particular to

support growth in Africa & Middle East. eCAPEX for telecom

activities as a percentage of revenues was 14.7%, in line with the

objective of around 15% in 2024. The number of households

connectable to FTTH reached 57.6 million excluding Spain

(+11.6%), and the FTTH customer base was 12.6 million

(+14.8%).

Organic cash flow from telecom

activities excluding Spain reached 1,551 million

euros at 30 June 2024, in line with the target of at least

3.3 billion euros by the end of 2024. The significant

improvement in cash flow generation of 17.4% year on year (+230

million euros) is mainly due to the improvement of the indicator

“EBITDAaL - eCAPEX” (+64 million euros on a historical basis) and

the decrease in income tax expense payments (+134 million

euros).

Free cash flow all-in from telecom

activities excluding Spain was 1,255 million euros, up

more than 21% year on year.

Net debt fell 3,991 million euros

compared with 31 December 2023, mainly due to the 4 461 million

euros of proceeds received as part of the creation of the MASORANGE

joint venture in Spain. The ratio of net financial debt to EBITDAaL

from telecom activities fell to 1.90x at 30 June 2024, still in

line with the target of approximately 2x over the medium term. The

liquidity position of telecom activities of 17,391 million euros is

solid and the average cost of gross debt is 2.96%.

Financial objectives

The Group can therefore confirm its

financial targets for

20244:

- Low single-digit

growth in EBITDAaL

- Discipline on

eCAPEX

- Organic cash flow

from telecom activities of at least 3.3 billion euros

- A ratio of net

debt/EBITDAaL from telecom activities unchanged at about 2x in the

medium term

- On 5 December 2024,

Orange will pay an interim dividend in cash of

0.30 euros per share for 2024. Payment of a dividend of 0.75 euros

per share in respect of the 2024 fiscal year will be proposed to

the Shareholders’ Meeting in 2025.

Orange’s sustainability

commitments

In the first half of 2024, Orange continued to make

progress on its commitments.

The scores currently awarded by ESG rating agencies

are positive: MSCI: A; Sustainalytics: low risk; ISS: Prime B-;

CDP: A-.

The SBTi has validated Orange’s greenhouse gas

emission reduction targets for the medium term (2030) and long term

(2040).

Orange has already exceeded its goal of reducing its scope 1 and 2

CO2 emissions. This year, it launched a program with its

key suppliers with the aim of jointly developing a long-term

pathway toward Net Zero Carbon.

In June, Orange launched cybersecurity solutions in France in the

B2C market.

The number of people who have benefited from free

digital training since 2021 has reached 2.2 million, in line with

the target.

Orange has published its Human Rights Policy, with

commitments to promote digital citizenship, campaign for respecting

privacy and freedom of expression, promote non-discrimination and

equal opportunities, guarantee decent working conditions and do

business with complete confidence, while mitigating the

environmental impacts of its activities.

Changes in the asset portfolio

Launch of MASORANGE in Spain

MASORANGE, the 50:50 joint venture of Orange and

MASMOVIL, was created on 26 March 2024 combining their activities

in Spain. The Group’s Spanish operations are deemed to be

discontinued under IFRS 5 until the closing of the transaction

and are subsequently consolidated using the equity method in the

Group’s accounts. The historical data has been restated.

In the first three months, MASORANGE has delivered

synergies which are expected to reach 100 million euros in 2024,

with an estimated total potential of at least 500 million euros

from the fourth year following the closing of the transaction. In

addition, today MASORANGE and Vodafone Spain announce the signing

of a non-binding agreement to create a shared FTTH network

FiberCo which would cover about 11.5 million premises in

Spain including around 4 million customers.

Transactions between shareholders with no

impact on the nature of the control exercised:

Merger of Orange Romania Communications

into Orange Romania

In December 2023, an agreement was signed with

the Romanian government setting out the key principles of the

merger of Orange Romania Communications (jointly owned by Orange

Romania with a 54% stake and the Romanian government with a 46%

stake) with Orange Romania.

The merger between the two companies, through the

absorption of Orange Romania Communications into Orange Romania,

was completed in early June 2024. On completion of the transaction,

the Romanian government held 20% of Orange Romania. The merger will

enable Orange to implement its convergent operator strategy in

Romania.

Conversion of Nethys’ stake in VOO into

Orange Belgium shares

As part of Orange Belgium’s acquisition of

telecommunication operator VOO in Belgium in June 2023, Nethys had

the option of converting its minority interest in VOO (25% plus one

share) into Orange Belgium shares by June 2025. At the end of 2023,

the Board of Directors of Nethys announced its intention to convert

its stake into Orange Belgium shares.

In May 2024, the Shareholders’ Meeting of Orange

Belgium approved Nethys taking an 11% stake in Orange Belgium. The

capital increase was carried out through the contribution in kind

of all VOO shares held by Nethys. On completion of the transaction,

Orange held 69.6% of the share capital of Orange Belgium. Nethys

has a put option granted by Orange on its stake in Orange Belgium

exercisable until March 2026.

________________________________________________________________________________

The Board of Directors of Orange SA met on

23 July 2024 and reviewed the summary Condensed Consolidated

Financial Statements and management report at 30 June 2024. In

accordance with auditing standards, the Group's statutory auditors

performed a limited review of the interim consolidated financial

statements and verified the information presented in the interim

management report.

More detailed information on the Group’s financial

results and performance indicators is available on the Orange

website

www.orange.com/en/finance/investors/consolidated-results.

Review by operating

segment

France

|

In millions of euros |

|

2Q 2024 |

change

comparable

basis |

change

historical

basis |

|

6M 2024 |

change

comparable

basis |

change

historical

basis |

|

Revenues |

|

4,396 |

0.3 % |

0.3 % |

|

8,736 |

0.6 % |

0.5 % |

|

Retail services (B2C+B2B) |

|

2,824 |

1.3 % |

1.3 % |

|

5,618 |

1.5 % |

1.4 % |

|

Convergence |

|

1,313 |

4.9 % |

4.7 % |

|

2,601 |

4.6 % |

4.3 % |

|

Mobile-only |

|

591 |

(1.6)% |

(1.3)% |

|

1,176 |

(0.7)% |

(0.5)% |

|

Fixed-only |

|

920 |

(1.6)% |

(1.6)% |

|

1,842 |

(1.3)% |

(1.3)% |

|

Wholesale |

|

1,091 |

(5.7)% |

(5.7)% |

|

2,146 |

(4.9)% |

(4.9)% |

|

Equipment sales |

|

296 |

5.5 % |

7.1 % |

|

621 |

4.8 % |

6.3 % |

|

Other revenues |

|

185 |

16.8 % |

14.5 % |

|

351 |

15.9 % |

13.0 % |

|

EBITDAaL |

|

|

|

|

|

2,872 |

0.3 % |

0.5 % |

|

EBITDAaL / Revenues |

|

|

|

|

|

32.9 % |

(0.1 pt) |

(0.0 pt) |

|

Operating Income |

|

|

|

|

|

1,406 |

18.3 % |

18.6 % |

|

eCAPEX |

|

|

|

|

|

1,445 |

1.1 % |

1.1 % |

|

eCAPEX / Revenues |

|

|

|

|

|

16.5 % |

0.1 pt |

0.1 pt |

Growth in retail services and improvement

in EBITDAaL

With quarterly revenues of

4,396 million euros, France recorded growth of 0.3% year on

year (+14 million euros). Growth in retail services (+1.3% or

+37 million euros), equipment sales (+5.5% or +16 million

euros) and other revenues (+16.8% or +27 million euros) offset

the expected decline in wholesale services (-5.7% or

-66 million euros), which was mitigated by the higher

unbundling and civil engineering rates in the first quarter.

The growth in retail services excluding fixed-only

narrowband services (PSTN) of 2.5% (+66 million euros) is

fully in line with the Lead the Future growth target of

between 2% and 4%. It reflects the successful execution of France’s

volume and value strategy, as illustrated by the improvement in

commercial performance this quarter and the strong year-on-year

growth in convergent ARPO, which reached 76.5 euros.

As French market leader, the Group’s pricing

strategy is disciplined and based on a volume/value balance that is

supported by a wide range of segmented offers conducive to

cross-selling, the solidity of its NPS and customer base, the

quality of the network and the significant potential for migration

to 5G and Fiber. New targeted offers have been launched (including

Smart TV, Orange Cybersecure…).

Mobile net additions for the second quarter were

+104,0005, benefiting in particular from the good

momentum of the Sosh brand. The churn rate remained moderate at

11.4%. Fixed broadband net additions in the second quarter

stabilized at -4,000, with Fiber retaining its excellent momentum

(+261,000). At 30 June 2024, 38.9 million households were

connectable to Orange Fiber.

With slight growth of 0.3% in the first half,

France confirms its target for stable EBITDAaL in

2024.

The disciplined investment policy translated to an

eCapex to EBITDAaL ratio of 16.5% in the first

half.

Europe

|

In millions of euros |

|

2Q 2024 |

change

comparable

basis |

change

historical

basis |

|

6M 2024 |

change

comparable

basis |

change

historical

basis |

|

Revenues |

|

1,741 |

(2.2)% |

5.3 % |

|

3,468 |

(2.1)% |

7.4 % |

|

Retail services (B2C+B2B) |

|

1,271 |

(0.0)% |

12.7 % |

|

2,503 |

0.0 % |

13.7 % |

|

Convergence |

|

353 |

7.1 % |

33.1 % |

|

699 |

7.0 % |

34.5 % |

|

Mobile-only |

|

546 |

(0.2)% |

1.8 % |

|

1,082 |

(0.3)% |

2.1 % |

|

Fixed-only |

|

248 |

(4.1)% |

28.1 % |

|

496 |

(4.1)% |

29.2 % |

|

IT & Integration services |

|

124 |

(8.9)% |

(6.5)% |

|

226 |

(8.7)% |

(5.2)% |

|

Wholesale |

|

210 |

(10.8)% |

(7.0)% |

|

408 |

(10.1)% |

(6.0)% |

|

Equipment sales |

|

224 |

(4.6)% |

(1.0)% |

|

482 |

(3.1)% |

1.3 % |

|

Other revenues |

|

36 |

(5.2)% |

(50.7)% |

|

75 |

(13.8)% |

(36.6)% |

|

EBITDAaL |

|

|

|

|

|

956 |

4.0 % |

12.7 % |

|

EBITDAaL / Revenues |

|

|

|

|

|

27.6 % |

1.6 pt |

1.3 pt |

|

Operating Income |

|

|

|

|

|

107 |

14.7 % |

(63.0)% |

|

eCAPEX |

|

|

|

|

|

672 |

4.5 % |

(10.8)% |

|

o/w excluding Spain |

|

|

|

|

|

506 |

6.8 % |

24.4 % |

|

eCAPEX / Revenues excluding Spain |

|

|

|

|

|

14.6 % |

1.2 pt |

2.0 pt |

|

o/w Spain |

|

|

|

|

|

166 |

(2.1)% |

(52.2)% |

Solid growth in EBITDAaL

Revenues for Europe decreased

-2.2% (-38 million euros) in the second quarter due to a

reduction in low-margin activities, partially offset by growth in

convergent services (+7.1% or +23 million euros). Low-margin

activities declined: these included wholesale services (-10.8% or

-25 million euros) due to the regulatory decrease in call

termination rates, which had no effect on EBITDAaL, the resale of

energy in Poland (due to lower prices compared with 2023), revenues

from IT & Integration services (-8.9% or -12 million

euros) and equipment sales (-4.6% or -11 million euros).

The good performance of Convergence benefited from

price increases and growth in the Fixed broadband customer base,

with nearly 3.6 million FTTH and cable customers, up +10.5%

year on year. Declines of 0.6 points in Mobile churn and 2.4 points

in Fixed broadband churn, as well as net additions of +117,000 in

Mobile, +72,000 in Fiber and +21,000 in Convergence, reflect good

commercial momentum.

EBITDAaL grew 4.0% (+37 million

euros) due to operational efficiency and the initial effects of the

consolidation in Belgium, which delivered 13.9% growth in EBITDAaL

as a result of synergies and price increases. EBITDAaL rose 3.8% in

Poland and decreased slightly in central Europe (-2.5%).

With an upwardly revised target for 2024, the Group

is confident about Europe’s ability to achieve low to moderate

growth in EBITDAaL in 2024.

eCAPEX (excluding Spain) increased

6.8% in the first half (+32 million euros) in line with the

investment plan.

Africa & Middle East

|

In millions of euros |

|

2Q 2024 |

change

comparable

basis |

change

historical

basis |

|

6M 2024 |

change

comparable

basis |

change

historical

basis |

|

Revenues |

|

1,893 |

10.3 % |

6.8 % |

|

3,742 |

10.7 % |

7.8 % |

|

Retail services (B2C+B2B) |

|

1,710 |

11.3 % |

8.6 % |

|

3,373 |

11.7 % |

9.4 % |

|

Mobile-only |

|

1,458 |

10.3 % |

7.6 % |

|

2,872 |

10.7 % |

8.3 % |

|

Fixed-only |

|

232 |

13.9 % |

11.6 % |

|

464 |

15.1 % |

13.0 % |

|

IT & Integration services |

|

20 |

77.3 % |

76.9 % |

|

37 |

78.9 % |

77.9 % |

|

Wholesale |

|

150 |

(0.2)% |

(9.8)% |

|

302 |

0.5 % |

(6.7)% |

|

Equipment sales |

|

23 |

18.0 % |

11.5 % |

|

46 |

11.8 % |

7.1 % |

|

Other revenues |

|

11 |

(2.0)% |

(13.6)% |

|

20 |

3.3 % |

(6.7)% |

|

EBITDAaL |

|

|

|

|

|

1,425 |

14.7 % |

13.1 % |

|

EBITDAaL / Revenues |

|

|

|

|

|

38.1 % |

1.3 pt |

1.8 pt |

|

Operating Income |

|

|

|

|

|

943 |

27.9 % |

27.2 % |

|

eCAPEX |

|

|

|

|

|

692 |

11.1 % |

6.8 % |

|

eCAPEX / Revenues |

|

|

|

|

|

18.5 % |

0.1 pt |

(0.2 pt) |

Outstanding growth in EBITDAaL

Africa & Middle East recorded strong growth in

revenues in the second quarter (+177 million

euros), with double-digit growth (+10.3%) for the fifth consecutive

quarter and +6.8% on a historical basis.

This performance was underpinned by a solid

performance in voice, with positive volume and value effects, and

the continued rapid growth of retail services (+11.3%) thanks to

double-digit increases in the four growth engines, namely Mobile

data (+17.9%), Fixed broadband (+19.2%), Orange Money (+18.9%) and

B2B across all activities (+14.5%). Orange Money recorded revenue

growth of more than 20% in nine countries.

The mobile customer base reached

156.0 million, a year-on-year increase of 6.8%, with

accelerated growth in the 4G customer base (+25.1%) and a 4.4%

increase in average Mobile ARPO in the first half. The fixed

broadband customer base was 3.6 million customers, up 16.3%.

Lastly, Orange Money had 35.6 million active customers, up 14.0%.

The “Max it” app has 10.5 million active users.

EBITDAaL increased 14.7% (+183

million euros) in the first half of the year. The EBITDAaL growth

rate thus increased for the third consecutive half and the EBITDAaL

margin rose 1.3 points, largely owing to the digitalization of

distribution.

eCAPEX rose 11.1% in the first

half, supporting the strong growth.

Despite the devaluation of the Egyptian pound,

Africa & Middle East posted solid first-half growth on a

historical basis of +7.8% in revenues, +13.1% in EBITDAaL and

+19.8% in “EBITDAaL – eCAPEX” cash flow.

With an upwardly revised target for 2024, the Group

is confident that the segment can achieve continuous double-digit

growth in EBITDAaL.

Orange Business

|

In millions of euros |

|

2Q 2024 |

change

comparable

basis |

change

historical

basis |

|

6M 2024 |

change

comparable

basis |

change

historical

basis |

|

Revenues |

|

1,980 |

(1.4)% |

(0.7)% |

|

3,919 |

(0.9)% |

(0.6)% |

|

Fixed-only |

|

751 |

(7.9)% |

(7.7)% |

|

1,502 |

(8.3)% |

(8.4)% |

|

Voice |

|

196 |

(15.1)% |

(15.0)% |

|

396 |

(14.5)% |

(14.6)% |

|

Data |

|

555 |

(5.1)% |

(4.8)% |

|

1,107 |

(5.9)% |

(6.0)% |

|

IT & Integration services |

|

977 |

4.6 % |

5.9 % |

|

1,914 |

6.0 % |

6.7 % |

|

Mobile |

|

252 |

(2.4)% |

(2.4)% |

|

503 |

(1.2)% |

(1.2)% |

|

Mobile-only |

|

176 |

(2.4)% |

(2.4)% |

|

352 |

1.0 % |

1.0 % |

|

Wholesale |

|

10 |

(2.0)% |

(2.0)% |

|

20 |

(2.0)% |

(2.0)% |

|

Equipment sales |

|

66 |

(2.3)% |

(2.3)% |

|

131 |

(6.8)% |

(6.8)% |

|

EBITDAaL |

|

|

|

|

|

277 |

(11.3)% |

(10.9)% |

|

EBITDAaL / Revenues |

|

|

|

|

|

7.1 % |

(0.8 pt) |

(0.8 pt) |

|

Operating Income |

|

|

|

|

|

105 |

(9.9)% |

(11.0)% |

|

eCAPEX |

|

|

|

|

|

138 |

(2.6)% |

(1.6)% |

|

eCAPEX / Revenues |

|

|

|

|

|

3.5 % |

(0.1 pt) |

(0.0 pt) |

Continuous improvement in line with the

recovery plan

Revenues for the Orange Business

segment were 1,980 million euros in the second quarter of

2024, down slightly (-1.4% or -27 million euros).

Growth in IT & Integration services (+4.6% or

+43 million euros) was driven by double-digit growth at Orange

Cyberdefense (+10.6%) and the performance of Digital services

(+7.2%). It did not fully offset the structural decline in legacy

fixed voice and data activities (-7.9% or -65 million

euros).

The Orange Business transformation

plan is continuing to deliver results: the first

departures under the voluntary departure plan have begun and the

plan to transition employees from legacy activities to IT

activities is continuing at pace. The number of certifications

reached 14,154, compared with the target of 20,000 in 2025.

The commercial success of the cybersecurity

offering launched in France on the B2C market demonstrates the

ability to leverage the expertise of Orange Cyberdefense. This

offering will also be rolled out in other European countries.

The deterioration in EBITDAaL in

the first half (-11.3%, compared with -16.7% in the first half of

2023) is in line with the ambition to slow the decline in 2024

relative to 2023. EBITDAaL for the first half, in line with the

expected trajectory, confirms the ambition of Orange Business to

halve the decline in 2024 compared with 2023, before returning to

growth in 2025 as a result of the plan launched last year.

TOTEM

|

In millions of euros |

|

2Q 2024 |

change

comparable

basis |

change

historical

basis |

|

6M 2024 |

change

comparable

basis |

change

historical

basis |

|

Revenues |

|

175 |

3.8 % |

3.8 % |

|

349 |

1.9 % |

1.9 % |

|

Wholesale |

|

175 |

3.8 % |

3.8 % |

|

349 |

1.9 % |

1.9 % |

|

Other revenues |

|

- |

- |

- |

|

- |

- |

- |

|

EBITDAaL |

|

|

|

|

|

185 |

2.0 % |

1.2 % |

|

EBITDAaL / Revenues |

|

|

|

|

|

53.0 % |

0.0 pt |

(0.4 pt) |

|

Operating Income |

|

|

|

|

|

129 |

2.5 % |

1.3 % |

|

eCAPEX |

|

|

|

|

|

64 |

(0.0)% |

(1.9)% |

|

eCAPEX / Revenues |

|

|

|

|

|

18.3 % |

(0.4 pt) |

(0.7 pt) |

The revenues of the TowerCo TOTEM grew 1.9% in the

first half due to the increase in tower location planning and

construction work in France (mainly on behalf of new occupants) and

hosting (+1.3%), partially offset by the decrease in revenues from

energy reselling (largely due to the fall in average prices).

Hosting revenues were 289 million euros in the first half and the

contributory share grew 1.8% (+8.2% excluding MASORANGE). There

were 27,169 sites at the end of June 2024, with a tenancy ratio of

1.41 co-tenants per site, an increase in line with the target to

reach 1.5 co-tenants per site in 2026.

EBITDAaL continued its steady growth of +2.0%

(+4.4% for hosting activities) in the first half, while eCAPEX

remained stable.

International Carriers & Shared

Services

|

In millions of euros |

|

2Q 2024 |

change

comparable

basis |

change

historical

basis |

|

6M 2024 |

change

comparable

basis |

change

historical

basis |

|

Revenues |

|

327 |

(15.9)% |

(20.1)% |

|

662 |

(9.2)% |

(13.3)% |

|

Wholesale |

|

224 |

(22.7)% |

(22.7)% |

|

428 |

(17.2)% |

(17.2)% |

|

Other revenues |

|

104 |

4.0 % |

(13.7)% |

|

234 |

10.5 % |

(5.2)% |

|

EBITDAaL |

|

|

|

|

|

(142) |

(90.0)% |

(65.7)% |

|

EBITDAaL / Revenues |

|

|

|

|

|

(21.5)% |

(11.2 pt) |

(10.2 pt) |

|

Operating Income |

|

|

|

|

|

(519) |

(65.9)% |

(57.6)% |

|

eCAPEX |

|

|

|

|

|

75 |

(21.8)% |

(23.0)% |

|

eCAPEX / Revenues |

|

|

|

|

|

11.3 % |

(1.8 pt) |

(1.4 pt) |

Revenues from wholesale services were down 22.7%

(-66 million euros) in the second quarter, partly due to the impact

of the sale of rights of use for a submarine cable in the first

half of 2023. The decline in voice revenues (in volume and price)

was partially offset by the increase in services related to the

management of data and roaming activities.

The increase in other revenues in the second

quarter of 4.0% (+4 million euros) reflects the good

performance of Orange Marine’s submarine cable laying and

maintenance activities, Sofrecom’s services and the increase in

patent and intellectual property revenues for the Group’s

innovation division.

EBITDAaL deteriorated by 67 million euros in the

first half, due to the impact of the sale of rights of use for a

submarine cable in the first half of 2023, phasing effects and

one-off expenses.

Mobile Financial Services

|

In millions of euros |

|

|

|

|

|

6M 2024 |

change

comparable

basis |

change

historical

basis |

|

Net Banking Income (NBI) |

|

|

|

|

|

34 |

(19.1)% |

(54.9)% |

|

Cost of bank credit risk |

|

|

|

|

|

(9) |

(31.2)% |

(73.1)% |

|

Operating Income |

|

|

|

|

|

(140) |

(85.6)% |

(92.2)% |

|

eCAPEX |

|

|

|

|

|

0 |

(99.4)% |

(99.4)% |

The plan to discontinue Orange Bank’s activities in

Europe is ongoing:

- in France, Orange Bank completed the

referral of customer accounts to Hello Bank! and BNP Paribas;

- in Spain, Orange Bank finalized in May

the sale of its loan portfolio to Banco Cetelem.

At the end of June, Orange signed an exclusive

partnership with BNP Paribas Personal Finance France to strengthen

its mobile handset financing offer. Under its Cetelem brand, BNP

Paribas Personal Finance will offer Orange customers in France a

payment installment plan to make online and in-store purchases of

mobile handsets more affordable.

Calendar of upcoming events

24 October 2024 - Publication of

Third-Quarter 2024 Financial Results

Contacts

press:

Frédéric Texier

fred.texier@orange.com

Tom Wright

tom.wright@orange.com

Caroline Cellier

caroline.cellier@orange.com |

financial communication:

(analysts and investors)

Constance Gest

constance.gest@orange.com

Louise Racine

louise.racine@orange.com

Hong Hai Vuong

honghai.vuong@orange.com

Louis Celier

louis.celier@orange.com |

Disclaimer

This press release contains forward-looking

statements about Orange’s financial situation, results of

operations and strategy. Although we believe these statements are

based on reasonable assumptions, they are subject to numerous risks

and uncertainties, including matters not yet known to us or not

currently considered material by us, and there can be no assurance

that anticipated events will occur or that the objectives set out

will actually be achieved. More detailed information on the

potential risks that could affect our financial results is included

in the Universal Registration Document filed on 28 March 2024

with the French Financial Markets Authority (AMF) and in the annual

report (Form 20-F) filed on 29 March 2024 with the U.S. Securities

and Exchange Commission. Forward-looking statements speak only as

of the date they are made. Other than as required by law, Orange

does not undertake any obligation to update them in light of new

information or future developments.

Appendix 1: financial key

indicators

Quarterly data

|

In millions of euros |

|

2Q 2024 |

2Q 2023

comparable

basis |

2Q 2023

historical

basis |

variation

comparable

basis |

change

historical

basis |

|

Revenues |

|

9,989 |

9,903 |

9,835 |

0.9 % |

1.6 % |

|

France |

|

4,396 |

4,383 |

4,384 |

0.3 % |

0.3 % |

|

Europe |

|

1,741 |

1,779 |

1,653 |

(2.2)% |

5.3 % |

|

Africa & Middle-East |

|

1,893 |

1,716 |

1,773 |

10.3 % |

6.8 % |

|

Orange Business |

|

1,980 |

2,007 |

1,994 |

(1.4)% |

(0.7)% |

|

Totem |

|

175 |

168 |

168 |

3.8 % |

3.8 % |

|

International Carriers & Shared Services |

|

327 |

389 |

410 |

(15.9)% |

(20.1)% |

|

Intra-Group eliminations |

|

(524) |

(540) |

(546) |

|

|

|

EBITDAaL (1) |

|

3,106 |

3,027 |

3,007 |

2.6 % |

3.3 % |

|

o/w Telecom activities |

|

3,133 |

3,058 |

3,034 |

2.5 % |

3.3 % |

|

As % of revenues |

|

31.4 % |

30.9 % |

30.8 % |

0.5 pt |

0.5 pt |

|

o/w Mobile Financial Services |

|

(28) |

(31) |

(27) |

10.2 % |

(4.8)% |

|

eCAPEX |

|

1,537 |

1,504 |

1,661 |

2.2 % |

(7.5)% |

|

o/w excluding Spain |

|

1,537 |

1,504 |

1,484 |

2.2 % |

3.6 % |

|

o/w Telecom activities |

|

1,537 |

1,492 |

1,472 |

3.0 % |

4.4 % |

|

As % of revenues |

|

15.4 % |

15.1 % |

15.0 % |

0.3 pt |

0.4 pt |

|

o/w Mobile Financial Services |

|

(1) |

12 |

12 |

- |

- |

|

o/w Spain |

|

- |

- |

177 |

- |

- |

|

EBITDAaL - eCAPEX excluding Spain |

|

1,569 |

1,523 |

1,524 |

3.0 % |

3.0 % |

|

(1) EBITDAaL presentation adjustments are described in Appendix

2. |

|

|

|

|

|

|

30 June data

|

In millions of euros |

|

6M 2024 |

6M 2023

comparable

basis |

6M 2023

historical

basis |

variation

comparable

basis |

change

historical

basis |

|

Revenues |

|

19,839 |

19,552 |

19,352 |

1.5 % |

2.5 % |

|

France |

|

8,736 |

8,687 |

8,691 |

0.6 % |

0.5 % |

|

Europe |

|

3,468 |

3,541 |

3,230 |

(2.1)% |

7.4 % |

|

Africa & Middle-East |

|

3,742 |

3,380 |

3,472 |

10.7 % |

7.8 % |

|

Orange Business |

|

3,919 |

3,953 |

3,944 |

(0.9)% |

(0.6)% |

|

Totem |

|

349 |

342 |

342 |

1.9 % |

1.9 % |

|

International Carriers & Shared Services |

|

662 |

728 |

763 |

(9.2)% |

(13.3)% |

|

Intra-Group eliminations |

|

(1,036) |

(1,079) |

(1,090) |

|

|

|

EBITDAaL (1) |

|

5,511 |

5,378 |

5,313 |

2.5 % |

3.7 % |

|

o/w Telecom activities |

|

5,573 |

5,443 |

5,375 |

2.4 % |

3.7 % |

|

As % of revenues |

|

28.1 % |

27.8 % |

27.8 % |

0.3 pt |

0.3 pt |

|

France |

|

2,872 |

2,862 |

2,859 |

0.3 % |

0.5 % |

|

Europe |

|

956 |

919 |

848 |

4.0 % |

12.7 % |

|

Africa & Middle-East |

|

1,425 |

1,243 |

1,260 |

14.7 % |

13.1 % |

|

Orange Business |

|

277 |

312 |

311 |

(11.3)% |

(10.9)% |

|

Totem |

|

185 |

181 |

183 |

2.0 % |

1.2 % |

|

International Carriers & Shared Services |

|

(142) |

(75) |

(86) |

(90.0)% |

(65.7)% |

|

o/w Mobile Financial Services |

|

(62) |

(65) |

(62) |

4.7 % |

(0.6)% |

|

Operating Income |

|

2,032 |

1,874 |

2,061 |

8.4 % |

(1.4)% |

|

o/w Telecom activities |

|

2,172 |

1,949 |

2,133 |

11.4 % |

1.8 % |

|

o/w Mobile Financial Services |

|

(140) |

(75) |

(73) |

(85.6)% |

(92.2)% |

|

Consolidated net income |

|

1,092 |

|

1,088 |

|

0.4 % |

|

Consolidated net income of continuing operations |

|

884 |

|

1,055 |

|

(16.3)% |

|

Net income attributable to owners of the parent company |

|

824 |

|

877 |

|

(6.0)% |

|

eCAPEX |

|

3,087 |

3,016 |

3,154 |

2.3 % |

(2.1)% |

|

o/w excluding Spain |

|

2,921 |

2,847 |

2,807 |

2.6 % |

4.0 % |

|

o/w Telecom activities |

|

2,921 |

2,828 |

2,787 |

3.3 % |

4.8 % |

|

As % of revenues |

|

14.7 % |

14.5 % |

14.4 % |

0.3 pt |

0.3 pt |

|

o/w Mobile Financial Services |

|

0 |

19 |

20 |

(99.4)% |

(99.4)% |

|

o/w Spain |

|

166 |

169 |

347 |

(2.1)% |

(52.2)% |

|

EBITDAaL - eCAPEX excluding Spain |

|

2,590 |

2,531 |

2,506 |

2.4 % |

3.4 % |

|

(1) EBITDAaL presentation adjustments are described in Appendix

2. |

|

|

|

|

|

|

|

In millions of euros |

|

June 30

2024 |

December 31

2023 |

|

Organic cash-flow from telecom activities (excluding

Spain) |

|

1,551 |

1,320 |

|

Free cash flow all-in from telecom activities (excluding

Spain) |

|

1,255 |

1,036 |

|

Net financial debt (1) (3) |

|

23,011 |

27,002 |

|

Ratio of net financial debt / EBITDAaL from telecom

activities (2) (3) |

|

1.90 |

2.05 |

|

(1) Net financial debt as defined and used by Orange does not

include Mobile Financial Services activities, for which this

concept is not relevant. |

|

(2) The ratio of net financial debt to EBITDAaL from telecom

activities is calculated based on the ratio of the Group’s net

financial debt to EBITDAaL from telecom activities over the

previous 12 months. |

|

(3) At December 31, 2023, net financial debt and ratio of net

financial debt to EBITDAaL from telecom activities including

Spain. |

Appendix 2: adjusted data to

income statement items

Quarterly data

|

|

|

2Q 2024 |

|

2Q 2023

historical basis |

|

In millions of euros |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Revenues |

|

9,989 |

- |

9,989 |

|

9,835 |

- |

9,835 |

|

External purchases |

|

(4,054) |

(2) |

(4,056) |

|

(4,050) |

(13) |

(4,063) |

|

Other operating income |

|

211 |

26 |

237 |

|

196 |

- |

196 |

|

Other operating expense |

|

(130) |

(4) |

(133) |

|

(91) |

(50) |

(141) |

|

Labor expenses |

|

(2,162) |

(0) |

(2,162) |

|

(2,162) |

(238) |

(2,399) |

|

Operating taxes and levies |

|

(289) |

(1) |

(290) |

|

(294) |

(1) |

(295) |

|

Gains (losses) on disposal of fixed assets, investments and

activities |

|

na |

12 |

12 |

|

na |

14 |

14 |

|

Restructuring costs |

|

na |

(64) |

(64) |

|

na |

(25) |

(25) |

|

Depreciation and amortization of financed assets |

|

(40) |

- |

(40) |

|

(31) |

- |

(31) |

|

Depreciation and amortization of right-of-use assets |

|

(352) |

2 |

(350) |

|

(330) |

(3) |

(333) |

|

Impairment of right-of-use assets |

|

(0) |

(34) |

(34) |

|

0 |

(28) |

(28) |

|

Interests expenses on liabilities related to financed assets |

|

(4) |

4 |

na |

|

(4) |

4 |

na |

|

Interests expenses on lease liabilities |

|

(64) |

64 |

na |

|

(61) |

61 |

na |

|

EBITDAaL |

|

3,106 |

3 |

na |

|

3,007 |

(279) |

na |

|

Significant litigation |

|

24 |

(24) |

na |

|

(39) |

39 |

na |

|

Specific labour expenses |

|

0 |

(0) |

na |

|

(238) |

238 |

na |

|

Fixed assets, investments and business portfolio review |

|

12 |

(12) |

na |

|

14 |

(14) |

na |

|

Restructuring program costs |

|

(95) |

95 |

na |

|

(60) |

60 |

na |

|

Acquisition and integration costs |

|

(6) |

6 |

na |

|

(22) |

22 |

na |

|

Interests expenses on liabilities related to financed assets |

|

na |

(4) |

(4) |

|

na |

(4) |

(4) |

|

Interests expenses on lease liabilities |

|

na |

(64) |

(64) |

|

na |

(61) |

(61) |

30 June data

|

|

|

6M 2024 |

|

6M 2023

historical basis |

|

In millions of euros |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Revenues |

|

19,839 |

- |

19,839 |

|

19,352 |

- |

19,352 |

|

External purchases |

|

(8,110) |

(2) |

(8,112) |

|

(8,049) |

(13) |

(8,062) |

|

Other operating income |

|

440 |

26 |

466 |

|

381 |

- |

381 |

|

Other operating expense |

|

(247) |

(8) |

(255) |

|

(164) |

41 |

(123) |

|

Labor expenses |

|

(4,346) |

(8) |

(4,354) |

|

(4,224) |

(265) |

(4,489) |

|

Operating taxes and levies |

|

(1,164) |

(2) |

(1,166) |

|

(1,157) |

(2) |

(1,159) |

|

Gains (losses) on disposal of fixed assets, investments and

activities |

|

na |

(140) |

(140) |

|

na |

50 |

50 |

|

Restructuring costs |

|

na |

(108) |

(108) |

|

na |

(35) |

(35) |

|

Depreciation and amortization of financed assets |

|

(77) |

- |

(77) |

|

(59) |

- |

(59) |

|

Depreciation and amortization of right-of-use assets |

|

(690) |

0 |

(689) |

|

(660) |

(3) |

(663) |

|

Impairment of right-of-use assets |

|

(1) |

(34) |

(34) |

|

0 |

(28) |

(28) |

|

Interests expenses on liabilities related to financed assets |

|

(8) |

8 |

na |

|

(6) |

6 |

na |

|

Interests expenses on lease liabilities |

|

(125) |

125 |

na |

|

(101) |

101 |

na |

|

EBITDAaL |

|

5,511 |

(143) |

na |

|

5,313 |

(149) |

na |

|

Significant litigation |

|

23 |

(23) |

na |

|

57 |

(57) |

na |

|

Specific labour expenses |

|

(7) |

7 |

na |

|

(265) |

265 |

na |

|

Fixed assets, investments and business portfolio review |

|

(140) |

140 |

na |

|

50 |

(50) |

na |

|

Restructuring program costs |

|

(143) |

143 |

na |

|

(70) |

70 |

na |

|

Acquisition and integration costs |

|

(10) |

10 |

na |

|

(28) |

28 |

na |

|

Interests expenses on liabilities related to financed assets |

|

na |

(8) |

(8) |

|

na |

(6) |

(6) |

|

Interests expenses on lease liabilities |

|

na |

(125) |

(125) |

|

na |

(101) |

(101) |

Appendix 3: economic CAPEX to

investments in property, plant and intangible

investment

Quarterly data

|

|

|

2Q 2024 |

|

2Q 2023

historical

basis |

|

In millions of euros |

|

Excluding Spain |

Spain |

Group total |

|

Excluding Spain |

Spain |

Group total |

|

Investments in property, plant and equipment and intangible

assets |

|

1,626 |

- |

1,626 |

|

1,668 |

197 |

1,865 |

|

Financed assets |

|

(35) |

- |

(35) |

|

(74) |

- |

(74) |

|

Proceeds from sales of property, plant and equipment and intangible

assets |

|

(54) |

- |

(54) |

|

(62) |

- |

(62) |

|

Telecommunication licenses |

|

0 |

- |

0 |

|

(48) |

(20) |

(68) |

|

eCAPEX |

|

1,537 |

- |

1,537 |

|

1,484 |

177 |

1,661 |

30 June data

|

|

|

6M 2024 |

|

6M 2023

historical

basis |

|

In millions of euros |

|

Excluding Spain |

Spain |

Group total |

|

Excluding Spain |

Spain |

Group total |

|

Investments in property, plant and equipment and intangible

assets |

|

3,099 |

168 |

3,267 |

|

3,457 |

378 |

3,834 |

|

Financed assets |

|

(56) |

- |

(56) |

|

(145) |

- |

(145) |

|

Proceeds from sales of property, plant and equipment and intangible

assets |

|

(121) |

- |

(121) |

|

(153) |

- |

(153) |

|

Telecommunication licenses |

|

(2) |

(2) |

(4) |

|

(352) |

(31) |

(383) |

|

eCAPEX |

|

2,921 |

166 |

3,087 |

|

2,807 |

347 |

3,154 |

Appendix 4: key performance

indicators

|

In thousand, at the end of the period |

|

June 30

2024 |

|

June 30

2023 |

|

Number of convergent customers |

|

9,077 |

|

8,949 |

|

Number of mobile accesses (excluding MVNOs)

(1) |

|

245,899 |

|

229,246 |

|

o/w |

Convergent customers mobile accesses |

|

15,602 |

|

15,317 |

|

|

Mobile only accesses |

|

230,297 |

|

213,929 |

|

o/w |

Contract customers mobile accesses |

|

91,065 |

|

82,099 |

|

|

Prepaid customers mobile accesses |

|

154,834 |

|

147,147 |

|

Number of fixed accesses (2) |

|

38,864 |

|

40,178 |

|

|

Fixed Retail accesses |

|

26,700 |

|

27,063 |

|

|

|

Fixed Broadband accesses |

|

21,426 |

|

21,012 |

|

|

|

o/w |

Very high‑speed broadband fixed accesses |

|

13,669 |

|

11,995 |

|

|

|

|

Convergent customers fixed accesses |

|

9,077 |

|

8,949 |

|

|

|

|

Fixed accesses only |

|

12,349 |

|

12,063 |

|

|

|

Fixed Narrowband accesses |

|

5,274 |

|

6,051 |

|

|

Fixed Wholesale accesses |

|

12,164 |

|

13,114 |

|

Group total accesses (1+2) |

|

284,763 |

|

269,424 |

|

Data excluding Spain. 2023 data is on a comparable basis and

includes access to the telecom operator VOO acquired in June 2023

by Orange Belgium. |

Key performance indicators (KPI) by country are

presented in the "Orange investors data book Q2 2024" available on

www.orange.com, under Finance/Results:

www.orange.com/en/latest-consolidated-results

Appendix 5:

glossary

Key figures

Data on a comparable basis: data based on

comparable accounting principles, scope of consolidation and

exchange rates are presented for previous periods. The transition

from data on an historical basis to data on a comparable basis

consists of keeping the results for the period ended and then

restating the results for the corresponding period of the preceding

year for the purpose of presenting, over comparable periods,

financial data with comparable accounting principles, scope of

consolidation and exchange rate. The method used is to apply to the

data of the corresponding period of the preceding year, the

accounting principles and scope of consolidation for the period

just ended as well as the average exchange rate used for the income

statement for the period ended. Changes in data on a comparable

basis reflect organic business changes. Data on a comparable basis

is not a financial aggregate as defined by IFRS and may not be

comparable to similarly-named indicators used by other

companies.

Retail services (B2C + B2B): aggregation of

revenues from (i) Convergent services, (ii) Mobile-only services,

(iii) Fixed-only services and (iv) IT & integration services

(see definitions). Retail Services (B2C+B2B) revenues include all

revenues of a given scope excluding revenues from wholesale

services, equipment sales and other revenues (see definitions).

EBITDAaL or “EBITDA after Leases”: operating

income (i) before depreciation and amortization of fixed assets,

effects resulting from business combinations, impairment of

goodwill and fixed assets, share of profits (losses) of associates

and joint ventures, (ii) after interest on debts related to

financed assets and on lease liabilities, and (iii) adjusted for

significant litigation, specific labor expenses, fixed assets,

investments and businesses portfolio review, restructuring programs

costs, acquisition and integration costs and, where appropriate,

other specific elements. EBITDAaL is not a financial aggregate as

defined by IFRS standards and may not be directly comparable to

similarly-named indicators in other companies.

eCAPEX or “economic CAPEX”: (i) acquisitions of

property, plant and equipment and intangible assets, excluding

telecommunications licenses and financed assets, (ii) less the

price of disposal of property, plant and equipment and intangible

assets. eCAPEX is not a financial performance indicator as defined

by IFRS standards and may not be directly comparable to indicators

referenced by similarly-named indicators in other companies.

Organic Cash Flow (telecoms activities): for the

perimeter of the telecoms activities, net cash provided by

operating activities, minus (i) lease liabilities repayments and

debts related to financed assets repayments, and (ii) purchases and

sales of property, plant and equipment and intangible assets, net

of the change in the fixed assets payables, (iii) excluding

telecommunication licenses paid and significant litigations paid or

received. Organic Cash Flow (telecoms activities) is not a

financial aggregate defined by IFRS and may not be comparable to

similarly-named indicators used by other companies.

Free cash flow all-in (telecoms activities):

Free cash flow all-in from telecom activities corresponds to net

cash provided by operating activities, minus (i) purchases and

sales of property, plant and equipment and intangible assets, net

of the change in the fixed assets payables, (ii) repayments of

lease liabilities and on debts related to financed assets, and

(iii) payments of coupons on subordinated notes. Free cash flow

all-in from telecom activities is not a financial aggregate defined

by IFRS and may not be comparable to similarly-named indicators

used by other companies.

Earnings per share (EPS) – Group share Net

income – Basic: Basic earnings per share are calculated by dividing

(a) net income for the year attributable to the shareholders of the

Group, after deduction of the remuneration net of the tax to

holders of subordinated notes, by (b) the weighted average number

of ordinary shares outstanding during the period.

Return On Capital Employed (ROCE): ROCE (Return

On Capital Employed) from telecoms activities corresponds to Net

Operating Profit After Tax (NOPAT) for the year ended (N) divided

by Net Operating Assets (NOA) for the previous year (N-1).

Net Operating Profit After Tax (NOPAT) for the

year ended (N) corresponds to operating profit (i) after interest

on lease liabilities and on debts related to financed assets, and

(ii) after income tax adjusted for the tax impact of financial

income excluding interest on lease liabilities and on debts related

to financed assets (tax charge calculated on the basis of the

statutory tax rate applicable in France, the tax jurisdiction of

the parent company Orange SA).

Net Operating Assets (NOA) for the previous year

(N-1) correspond to (i) equity and (ii) financial liabilities and

derivative liabilities (non‑current and current), excluding debts

on financed assets, (iii) less financial assets and derivative

assets (non‑current and current), cash and cash equivalents,

including investments in Mobile Financial Services.

ROCE from telecoms activities is not a financial

aggregate defined by IFRS and may not be comparable to

similarly-named indicators used by other companies.

Performance indicators

Fixed retail accesses: number of fixed broadband

accesses (xDSL (ADSL and VDSL), FTTx, cable, Fixed-4G (fLTE) and

other broadband accesses (satellite, Wimax and others)) and fixed

narrowband accesses (mainly PSTN) and payphones.

Fixed wholesale accesses: number of fixed

broadband and narrowband wholesale accesses operated by Orange.

Convergence

Convergent services: customer base and revenues

from B2C Convergent retail offers, excluding equipment sales (see

definition) defined as an offer combining at least a broadband

access (xDSL, FTTx, cable or Fixed-4G (fLTE) with cell-lock) and a

mobile voice contract (excluding MVNOs).

Convergent ARPO: average quarterly revenues per

convergent offer (ARPO) calculated by dividing revenues from retail

Convergent services offers invoiced to B2C customers generated over

the past three months (excluding IFRS 15 adjustments) by the

weighted average number of retail Convergent offers over the same

period. ARPO is expressed by monthly revenues per convergent

offer.

Mobile-only services

Mobile-only services: revenues from mobile

offers (mainly outgoing calls: voice, SMS and data) invoiced to

retail customers, excluding convergent services and equipment sales

(see definitions). The customer base includes customers with a

contract excluding retail convergence, machine-to-machine contracts

and prepaid cards.

Mobile-only ARPO: average quarterly revenues

from Mobile-only (ARPO) calculated by dividing revenues from

Mobile-only retail services (excluding machine-to-machine and IFRS

15 adjustments) generated over the past three months by the

weighted average of Mobile-only customers (excluding

machine-to-machine) over the same period. The ARPO is expressed as

monthly revenues per Mobile-only customer.

Fixed-only services

Fixed-only services: revenues from fixed retail

offers, excluding B2C convergent offers and equipment sales (see

definitions). It includes (i) fixed narrowband services

(conventional fixed telephony), (ii) fixed broadband services, and

(iii) business solutions and networks (with the exception of

France, for which essential business solutions and networks are

supported by Orange Business segment). For the Orange Business

segment, Fixed-only service revenues include sales of network

equipment related to the operation of voice and data services. The

customer base consists of fixed narrowband and fixed broadband

customers, excluding retail convergence customers.

Fixed-only Broadband ARPO: average quarterly

revenues from Fixed-only Broadband (ARPO) calculated by dividing

the revenue from Fixed-only Broadband retail services (excluding

IFRS 15 adjustments) generated over the past three months by the

weighted average of Fixed-only Broadband customers over the same

period. ARPO is expressed as monthly revenues per Fixed-only

Broadband customer.

IT & integration

services

IT & Integration services: revenues from

unified communication and collaboration services (Local Area

Network and telephony, advising, integration and project

management), hosting and infrastructure services (including Cloud

Computing), applications services (customer relations management

and other applications services), security services, video

conferencing offers, machine-to-machine services (excluded

connectivity) as well as sales of equipment related to the above

products and services.

Wholesale

Wholesale: revenues from other carriers consists

of (i) mobile services to other carriers including incoming

traffic, visitor roaming, network sharing, national roaming and

Mobile Virtual Network Operators (MVNOs), (ii) fixed services to

other carriers including national networking, services to

international carriers, high-speed and very high-speed broadband

access (fibre access, unbundling of telephone lines and xDSL access

sales) and the sale of telephone lines on the wholesale market, and

(iii) equipment sales to other carriers.

Equipment sales

Equipment sales: revenues from all mobile and

fixed equipment sales, excluding (i) equipment sales associated

with the supply of IT & Integration services, (ii) sales of

network equipment related to the operation of voice and data

services in the Orange Business operating segment, (iii) equipment

sales to other carriers, and (iv) equipment sales to dealers and

brokers.

Other revenues

Other revenues: revenues including (i) equipment

sales to brokers and dealers, (ii) portal, (iii) on-line

advertising revenues, (iv) corporate transversal business line

activities, and (v) other miscellaneous revenues.

1 Unless otherwise stated, percentage changes are

on a year-on-year basis, calculated against the second quarter of

2023 on a comparable basis.

2 Public Switched Telephone Network

3 Orange Spain net income in the first quarter of +209 million

euros was offset by the share of net income of MASORANGE in the

second quarter of -206 million euros.

4 These targets are on a comparable basis and do

not take into account mergers and acquisitions not yet finalized.

They exclude Spain.

5 Excluding M2M and prepaid

- PR Orange H1 2024 Results_FINAL_24072024

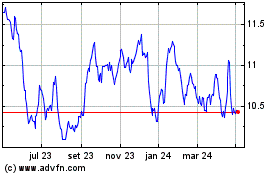

Orange (EU:ORA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

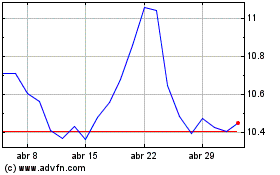

Orange (EU:ORA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024