Capgemini H1 2024 results

Media relations:

Victoire Grux

Tel.: +33 6 04 52 16 55

victoire.grux@capgemini.com

Investor relations:

Vincent Biraud

Tel.: +33 1 47 54 50 87

vincent.biraud@capgemini.com

Capgemini H1 2024 results

-

H1 2024 revenues of €11,138 million, -2.5% year-on-year on

a reported basis

-

Growth at constant exchange

rates*

of -2.6% in H1 and -1.9% in

Q2

-

Resilient Operating

margin* at 12.4%,

stable year-on-year

-

Organic free cash

flow* of €163 million,

up €216 million year-on-year

-

2024 constant currency revenue growth target adjusted to

-0.5% to -1.5% (was 0% to 3%)

-

2024 operating margin and organic free cash flow targets

confirmed

Paris, July 26, 2024 –

The Board of Directors of Capgemini SE, chaired by Paul Hermelin,

convened yesterday in Paris to review and adopt the

accounts1 of Capgemini Group for the first half of

2024.

Aiman Ezzat, Chief Executive Officer of the

Capgemini Group, said: “As expected, our growth trajectory

started to improve in Q2 and is trending in the right direction in

almost all businesses, sectors and regions. The recovery is

particularly visible in North America. However, the slope of

recovery in the second half will be affected by the recent

deterioration of the outlook in the automotive and aerospace

sectors and the slower recovery in financial services. In this

context, we now expect a low single-digit constant currency exit

rate, and target a constant currency growth rate of -0.5% to -1.5%

for the full year. Despite this, we confirm our operating margin

and free cash flow targets for the full year, demonstrating the

resilience of the Group.

Our leadership in AI services is clearly

recognized by industry analysts. Generative AI is still driving

many client discussions and we are engaging in larger programs to

deploy uses cases at scale. We are currently working on over 350

new projects, and we have over 2,000 deals in the pipeline. We also

scaled our capabilities, having trained more than 120,000 employees

on generative AI tools and continue to invest in tools, assets and

platforms.

Client demand is primarily focused on

improved efficiency and cost transformation. The traction for our

value-added services in the fields of cloud, data & AI,

sustainability, and intelligent industry remains strong.

In an environment that remains soft in the

short term, all our resources are mobilized around growth. As

demonstrated by the performance of our Strategy &

Transformation business, we are well positioned to capture the

market upturn.”

1ST

HALF KEY FIGURES

|

(in millions of euros) |

H1

2023 |

H1

2024 |

Change |

|

Revenues |

11,426 |

11,138 |

-2.5% |

|

Operating margin* |

1,413 |

1,384 |

-2% |

|

as a % of revenues |

12.4% |

12.4% |

+0 bp |

|

Operating profit |

1,151 |

1,147 |

-0% |

|

as a % of revenues |

10.1% |

10.3% |

+20 bp |

|

Net profit (Group share) |

809 |

835 |

+3% |

|

Basic earnings per share (€) |

4.70 |

4.88 |

+4% |

|

Normalized earnings per share (€)* |

5.80 |

5.88 |

+1% |

|

Organic free cash

flow* |

-53 |

163 |

+216 |

|

Net cash / (Net debt)* |

(3,244) |

(2,775) |

|

|

|

Capgemini generated revenues of

€11,138 million in H1 2024, down -2.5% year-on-year on a reported

basis and -2.6% at constant exchange rates*. On an

organic basis (i.e., restated for changes in Group scope and

exchange rates), revenues contracted by -3.0%.

As anticipated, the demand environment is

starting slowly to improve. Having passed the trough in Q1, revenue

growth rates improved in Q2 as expected, in all businesses and

almost all regions and sectors. Q2 Group revenues thus contracted

by -1.9% at constant exchange rates and -2.3% on an organic

basis.

In the first half of the year, clients remained

focused on driving efficiency through cost transformation programs.

Demand for non-strategic discretionary deals remains soft. In that

context, Capgemini’s most innovative services in Cloud, Data &

AI and Intelligent Industry continued to enjoy solid traction.

Bookings totaled €11,793

million in the first half of 2024, down -1.7% at constant exchange

rates, leading to a book-to-bill ratio of 1.06 for the period.

Booking trends also improved in Q2: at €6,138 million, Q2 bookings

were stable year-on-year at constant currency and the book-to-bill

ratio reached 1.09, which is above historical average and reflects

ongoing robust commercial momentum.

The operating

margin* amounts to €1,384

million or 12.4% of revenues, a stable % year-on-year. The

continued shift in Capgemini’s mix of offerings towards more

innovative and value-added services more than compensated for the

inflation impact, illustrating the resilience of the Group’s

operating model. The investment in selling efforts to fuel future

growth was offset by the improvement in gross margin, to 26.7%.

Other operating income and

expenses represent a net expense of €237 million, down by

€25 million year-on-year.

Consequently, the operating

profit amounts to €1,147 million, almost flat year-on-year

in value and up +20 basis points in % of Group revenues, to

10.3%.

Net financial result is an

income of €20 million compared with a €22 million expense in H1

2023, reflecting mainly higher interest income.

The income tax expense is €326

million, up by €13 million. The effective tax rate is 28.0% in H1

2024, compared with 27.8% for the same period last year.

Taking into account the share of profits of

associates and non-controlling interests, the Group share

in net profit for H1 2024 is up +3%

year-on-year at €835 million. Basic earnings per

share increased by +4% year-on-year to €4.88.

Normalized earnings per

share* stands at €5.88,

compared with €5.80 in H1 2023.

Finally, organic free cash

flow* generation amounted to

€163 million in H1 2024, compared with -€53 million for the

same period last year. Capgemini announced or closed four

acquisitions since the beginning of the year. Total cash outflow

for acquisitions amounted to €30 million in H1. The Group also paid

dividends of €580 million (€3.40 per share) and allocated €325

million (net) to share buybacks.

OPERATIONS BY REGION

At constant exchange rates, revenues in the

North America region (28% of Group revenues in H1

2024) decreased by -5.4% year-on-year. The Financial Services, TMT

(Telecoms, Media and Technology) and Consumer Goods & Retail

sectors contributed the most to this decline, partly offset by

growth in the Manufacturing sector. Operating margin increased to

15.5%, compared with 15.2% in H1 last year.

Revenues in the United Kingdom and

Ireland region (12% of Group revenues) declined by -2.8%,

mostly driven by the Financial Services and Consumer Goods &

Retail sectors. Conversely, the Energy & Utilities and Services

sectors enjoyed a solid growth. Operating margin rose from 18.4% to

20.5%.

Activity in France (20% of

Group revenues) was down -2.7%. Solid momentum in the Public Sector

was more than offset by visible softness in the TMT, Manufacturing

and Financial Services sectors. Operating margin decreased from

11.1% in H1 last year to 9.1%.

Revenues in the Rest of Europe

region (31% of Group revenues) were virtually stable at -0.1%. The

underlying sector performance proved quite contrasted, with a

strong momentum in the Energy & Utilities and Public sectors

offset by a visible contraction of the TMT sector. Operating margin

increased to 11.1%, compared with 10.5% in H1 2023.

Finally, revenues in the Asia-Pacific

and Latin America region (9% of Group revenues) were down

-1.6%. This contraction was mainly driven by the decline of the

Financial Services sector, partly offset by the Consumer Goods

& Retail and Public sectors which proved quite dynamic over the

period. The region reported an operating margin of 10.5%, up from

10.2% in H1 last year.

OPERATIONS BY

BUSINESS

At constant exchange rates, total

revenues* of Strategy &

Transformation services (9% of the Group’s total revenues

in H1 2024) increased by +2.7% year-on-year at constant exchange

rates. Client demand for strategic consulting on their transition

towards a more digital and sustainable model is supplemented by

their growing interest in exploring the broad GenAI

opportunity.

Total revenues of Applications &

Technology services (62% of the Group’s total revenues and

Capgemini’s core business) declined by -3.4%.

Lastly, Operations &

Engineering (29% of the Group’s total revenues) total

revenues decreased by -1.8%.

OPERATIONS IN Q2 2024

Revenue growth rates started to improve in Q2 in

all businesses and almost all regions and sectors. Group revenues

totaled €5,611 million, -1.9% year-on-year at constant

exchange rates and -2.3% on an organic basis.

As expected, North America is the region which

improved the most in Q2 with a revenue contraction limited to -3.7%

at constant exchange rates compared with -7.1% posted in Q1, mainly

driven by an improvement in the TMT sector - although still

contracting in Q2. The Rest of Europe region posted slight growth

of +0.4%, with continued momentum in the Energy & Utilities

sector, while the Financial Services and Services sectors returned

to growth. Revenues in the United Kingdom and Ireland decreased by

-2.5%, with softness in the Financial Services and Consumer Goods

& Retail sectors partly offset by a dynamic Energy &

Utilities sector. Activity decreased by -2.7% in France despite a

solid momentum in the Public Sector. Finally, revenues in the

Asia-Pacific and Latin America region declined moderately at

-1.6%.

HEADCOUNT

The Group’s total headcount stands at 336,900 as

at June 30, 2024, down -4% year-on-year and virtually stable since

the end of March. The offshore workforce stands at 192,500

employees or 57% of the total headcount.

BALANCE SHEET

Capgemini’s balance sheet structure was

relatively unchanged in H1 2024.

Cash and cash equivalents and cash management

assets represent €2.9 billion as at June 30, 2024. Taking into

account total borrowings of €5.7 billion, Capgemini’s net

debt* stands at €2.8 billion as at June 30, 2024,

compared with €3.2 billion as at June 30, 2023 and €2.0 billion as

at December 31, 2023.

SUSTAINABILITY

In terms of environmental sustainability,

Capgemini has been accelerating its internal sustainability

upskilling program through its own Sustainability Campus. In June,

the Group made the Sustainability awareness module mandatory to all

employees, starting in August 2024. Capgemini was recognized again

by an Ecovadis Platinum rating in recognition of its sustainability

achievement, with an overall score of 87 points out of 100, up 7

points from last year, and remained part of the CDP (Carbon

Disclosure Project) A-List. The Group also extended the scope of

its Energy Command Center (ECC) in India in partnership with

Schneider Electric, from 8 campuses (operated since 2022) to 23

campuses and more than 70 buildings. In addition, the ECC is now

offered as a service, leveraging Capgemini’s and Schneider

Electric’s joint expertise in energy optimization to help

organizations accelerate their transition towards smarter and more

sustainable energy management.

In terms of diversity and inclusion, Capgemini

is continuing to shape inclusive futures for all. The Group

recently launched the 2nd cohort of EmpowHer, its

sponsorship program to bring women to executive leadership

positions. In February, Capgemini published its D&I policy,

illustrating its focus and commitments. In May, the Group launched

its fourth global employee network group, CulturALL, which

celebrates the rich heritage, unique customs, and traditions that

each employee brings to the table, with 160 nationalities across

over 50 countries represented within the Group. In addition,

Capgemini has been recognized as one of the "Best Places to Work

for People with Disabilities" this year.

OUTLOOK

The Group’s financial targets for 2024 are

updated as follows:

- Revenue growth of -0.5% to -1.5% at

constant currency (was 0% to 3%);

- Operating margin of 13.3% to 13.6%

(unchanged);

- Organic free cash flow of around

€1.9 billion (unchanged).

The inorganic contribution to growth should be

around half a point (was ranging from a marginal impact up to

1 point).

CONFERENCE CALL

Aiman Ezzat, Chief Executive Officer,

accompanied by Nive Bhagat, Chief Financial Officer, and Olivier

Sevillia, Chief Operating Officer, will present this press release

during a conference call in English to be held today at

8.00 a.m. Paris time (CET). You can follow this conference

call live via webcast at the following link. A replay will also be

available for a period of one year.

All documents relating to this publication will

be posted on the Capgemini investor website at

https://investors.capgemini.com/en/.

PROVISIONAL CALENDAR

October 30,

2024 Q3 2024

revenues

February 18, 2025 FY

2024 results

April 29, 2025 Q1

2025 revenues

May 7,

2025 Shareholders’

Meeting

DISCLAIMER

This press release may contain forward-looking

statements. Such statements may include projections, estimates,

assumptions, statements regarding plans, objectives, intentions

and/or expectations with respect to future financial results,

events, operations and services and product development, as well as

statements, regarding future performance or events. Forward-looking

statements are generally identified by the words “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “plans”,

“projects”, “may”, “would”, “should” or the negatives of these

terms and similar expressions. Although Capgemini’s management

currently believes that the expectations reflected in such

forward-looking statements are reasonable, investors are cautioned

that forward-looking statements are subject to various risks and

uncertainties (including, without limitation, risks identified in

Capgemini’s Universal Registration Document available on

Capgemini’s website), because they relate to future events and

depend on future circumstances that may or may not occur and may be

different from those anticipated, many of which are difficult to

predict and generally beyond the control of Capgemini. Actual

results and developments may differ materially from those expressed

in, implied by or projected by forward-looking statements.

Forward-looking statements are not intended to and do not give any

assurances or comfort as to future events or results. Other than as

required by applicable law, Capgemini does not undertake any

obligation to update or revise any forward-looking statement.

This press release does not contain or

constitute an offer of securities for sale or an invitation or

inducement to invest in securities in France, the United States or

any other jurisdiction.

ABOUT CAPGEMINI

Capgemini is a global business and technology

transformation partner, helping organizations to accelerate their

dual transition to a digital and sustainable world, while creating

tangible impact for enterprises and society. It is a responsible

and diverse group of 340,000 team members in more than 50

countries. With its strong over 55-year heritage, Capgemini is

trusted by its clients to unlock the value of technology to address

the entire breadth of their business needs. It delivers end-to-end

services and solutions leveraging strengths from strategy and

design to engineering, all fueled by its market leading

capabilities in AI, cloud and data, combined with its deep industry

expertise and partner ecosystem. The Group reported 2023 global

revenues of €22.5 billion.

Get the Future You Want |

www.capgemini.com

* *

*

APPENDIX3F2

BUSINESS CLASSIFICATION

- Strategy &

Transformation includes all strategy, innovation and

transformation consulting services.

- Applications &

Technology brings together “Application Services” and

related activities and notably local technology services.

- Operations &

Engineering encompasses all other Group businesses. These

comprise Business Services (including Business Process Outsourcing

and transaction services), all Infrastructure and Cloud services,

and R&D and Engineering services.

DEFINITIONS

Organic growth or like-for-like

growth in revenues is the growth rate calculated at

constant Group scope and exchange rates. The Group scope

and exchange rates used are those for the reported period. Exchange

rates for the reported period are also used to calculate

growth at constant exchange rates.

|

Reconciliation of growth rates |

Q1 2024 |

Q2 2024 |

H1 2024 |

|

Organic growth |

-3.6% |

-2.3% |

-3.0% |

|

Changes in Group scope |

+0.3 pts |

+0.4 pts |

+0.4 pts |

|

Growth at constant exchange rates |

-3.3% |

-1.9% |

-2.6% |

|

Exchange rate fluctuations |

-0.2 pts |

+0.4 pts |

+0.1 pts |

|

Reported growth |

-3.5% |

-1.5% |

-2.5% |

When determining activity trends by business and

in accordance with internal operating performance measures, growth

at constant exchange rates is calculated based on total

revenues, i.e., before elimination of inter-business

billing. The Group considers this to be more representative of

activity levels by business. As its businesses change, an

increasing number of contracts require a range of business

expertise for delivery, leading to a rise in inter-business

flows.

Operating margin is one of the

Group’s key performance indicators. It is defined as the difference

between revenues and operating costs. It is calculated before

“Other operating income and expense” which include amortization of

intangible assets recognized in business combinations, expenses

relative to share-based compensation (including social security

contributions and employer contributions) and employee share

ownership plan, and non-recurring revenues and expenses, notably

impairment of goodwill, negative goodwill, capital gains or losses

on disposals of consolidated companies or businesses, restructuring

costs incurred under a detailed formal plan approved by the Group’s

management, the cost of acquiring and integrating companies

acquired by the Group, including earn-outs comprising conditions of

presence, and the effects of curtailments, settlements and

transfers of defined benefit pension plans.

Normalized net profit is equal to profit for the

year (Group share) adjusted for the impact of items recognized in

“Other operating income and expense”, net of tax calculated using

the effective tax rate. Normalized earnings per

share is computed like basic earnings per share, i.e.,

excluding dilution.

Organic free cash flow is equal

to cash flow from operations less acquisitions of property, plant,

equipment and intangible assets (net of disposals) and repayments

of lease liabilities, adjusted for cash out relating to the net

interest cost.

Net debt (or net

cash) comprises (i) cash and cash equivalents, as

presented in the Consolidated Statement of Cash Flows (consisting

of short-term investments and cash at bank) less bank overdrafts,

and also including (ii) cash management assets (assets presented

separately in the Consolidated Statement of Financial Position due

to their characteristics), less (iii) short- and long-term

borrowings. Account is also taken of (iv) the impact of hedging

instruments when these relate to borrowings, intercompany loans,

and own shares.

RESULTS BY REGION

| |

Revenues |

|

Year-on-year growth |

|

Operating margin rate |

|

|

H1 2024

(in millions of euros) |

|

Reported

|

At constant exchange rates |

|

H1 2023 |

H1 2024 |

|

North America |

3,108 |

|

-5.5% |

-5.4% |

|

15.2% |

15.5% |

|

United Kingdom and Ireland |

1,380 |

|

-0.4% |

-2.8% |

|

18.4% |

20.5% |

|

France |

2,245 |

|

-2.7% |

-2.7% |

|

11.1% |

9.1% |

|

Rest of Europe |

3,470 |

|

-0.1% |

-0.1% |

|

10.5% |

11.1% |

|

Asia-Pacific and Latin America |

935 |

|

-3.7% |

-1.6% |

|

10.2% |

10.5% |

|

TOTAL |

11,138 |

|

-2.5% |

-2.6% |

|

12.4% |

12.4% |

OPERATIONS BY BUSINESS

| |

Total revenues |

|

Year-on-year growth |

|

|

H1 2024

(% of Group revenues) |

|

At constant exchange rates

in Total revenues

of the business |

|

Strategy & Transformation |

9% |

|

+2.7% |

|

Applications & Technology |

62% |

|

-3.4% |

|

Operations & Engineering |

29% |

|

-1.8% |

SUMMARY INCOME STATEMENT AND OPERATING

MARGIN

|

(in millions of euros) |

H1 2023 |

H1 2024 |

Change |

|

Revenues |

11,426 |

11,138 |

-2.5% |

|

Operating expenses |

(10,013) |

(9,754) |

|

|

Operating margin |

1,413 |

1,384 |

-2% |

|

as a % of revenues |

12.4% |

12.4% |

- |

|

Other operating income and expense |

(262) |

(237) |

|

|

Operating profit |

1,151 |

1,147 |

- |

|

as a % of revenues |

10.1% |

10.3% |

+20 bp |

|

Net financial income/(expense) |

(22) |

20 |

|

|

Income tax income/(expense) |

(313) |

(326) |

|

|

Share of associates |

(4) |

(3) |

|

|

(-) Non-controlling interests |

(3) |

(3) |

|

|

Net profit (Group share) |

809 |

835 |

+3% |

NORMALIZED AND DILUTED EARNINGS PER

SHARE

|

(in millions of euros) |

H1 2023 |

H1 2024 |

Change |

|

Average number of shares outstanding |

171,947,414 |

170,981,563 |

|

|

BASIC EARNINGS PER SHARE (in

euros) |

4.70 |

4.88 |

+4% |

|

Diluted average number of shares outstanding |

178,089,362 |

177,293,357 |

|

|

DILUTED EARNINGS PER SHARE (in

euros) |

4.54 |

4.71 |

+4% |

|

|

|

|

|

|

(in millions of euros) |

H1 2023 |

H1 2024 |

Change |

|

Net profit (Group share) |

809 |

835 |

+3% |

|

Effective tax rate, excluding exceptional tax expenses |

27.8% |

28.0% |

|

|

(-) Other operating income and expenses, net of tax |

189 |

171 |

|

|

Normalized profit for the period |

998 |

1,006 |

+1% |

|

Average number of shares outstanding |

171,947,414 |

170,981,563 |

|

|

NORMALIZED EARNINGS PER SHARE (in

euros) |

5.80 |

5.88 |

+1% |

CHANGE IN CASH AND CASH EQUIVALENTS AND

ORGANIC FREE CASH FLOW

|

(in millions of euros) |

H1 2023

|

H1 2024 |

|

Net cash from operating activities |

244 |

456 |

|

Acquisitions of property, plant and equipment and intangible

assets, net of disposals |

(125) |

(135) |

|

Net interest cost |

(24) |

(14) |

|

Repayments of lease liabilities |

(148) |

(144) |

|

ORGANIC FREE CASH FLOW |

(53) |

163 |

|

Other cash flows from (used in) investing and financing

activities |

(481) |

(1,171) |

|

Increase (decrease) in cash and cash

equivalents |

(534) |

(1,008) |

|

Effect of exchange rate fluctuations |

(70) |

60 |

|

Opening cash and cash equivalents, net of bank

overdrafts |

3,795 |

3,517 |

|

Closing cash and cash equivalents, net of bank

overdrafts |

3,191 |

2,569 |

NET DEBT

|

(in millions of euros) |

June 30, 2023 |

December 31, 2023 |

June 30, 2024 |

|

Cash and cash equivalents |

3,195 |

3,536 |

2,572 |

|

Bank overdrafts |

(4) |

(19) |

(3) |

|

Cash and cash equivalents, net of bank

overdrafts |

3,191 |

3,517 |

2,569 |

|

Cash management assets |

575 |

161 |

367 |

|

Long-term borrowings |

(5,663) |

(5,071) |

(4,276) |

|

Short-term borrowings and bank overdrafts |

(1,339) |

(675) |

(1,421) |

|

(-) Bank overdrafts |

4 |

19 |

3 |

|

Borrowings, excluding bank overdrafts |

(6,998) |

(5,727) |

(5,694) |

|

Derivative instruments |

(12) |

2 |

(17) |

|

NET CASH / (NET DEBT) |

(3,244) |

(2,047) |

(2,775) |

1 Limited review procedures on the

interim consolidated financial statements have been completed. The

auditors are in the process of issuing their report.

2 Note that in the appendix, certain totals may not

equal the sum of amounts due to rounding adjustments.

- Capgemini_-_2024-07-26_-_H1_2024_Results

- Capgemini_H1_Q2_2024_infographics_ENG

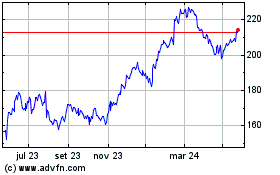

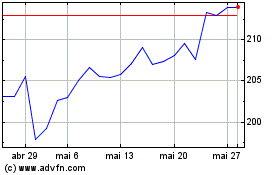

Capgemini (EU:CAP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Capgemini (EU:CAP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024