Half-year report

FORESIGHT ENTERPRISE VCT PLC

LEI: 213800MWJNR3WZZ3ZP42

UNAUDITED HALF-YEARLY FINANCIAL REPORT

FOR THE PERIOD ENDED 30 JUNE 2024

Financial Highlights

- Total net assets £171.1 million

- A special dividend of 5.0p per share was paid

on 19 January 2024, returning £13.2 million to

Shareholders

- Post period end, an interim dividend of 3.3p

per share was paid on 12 July 2024, returning £8.7

million to Shareholders

- The value of the investment portfolio has increased by

£8.7 million in the last six months

- Net Asset Value per share decreased by 1.7% in the period from

65.6p at 31 December 2023 to

64.5p at 30 June 2024

- Including the payment of a 5.0p dividend on 19 January 2024,

NAV Total Return per share at 30 June 2024 was

69.5p (being NAV at the end of the period plus

dividends paid in the period), representing a positive NAV Total

Return of 5.9% in the period

Chair’s Statement

I am pleased to present the unaudited Half-Yearly Financial

Report for Foresight Enterprise VCT plc for the period ended

30 June 2024 and to report a Net Asset Value Total Return

of 5.9% for the period, including a dividend yield of

8.6%.

The business environment is slowly improving with interest rates

looking like they have peaked and inflationary pressures more

stable, as are energy costs. All of these factors are key to a more

stable business environment which is a prerequisite to building

business confidence and, from this, hopefully growth. However, the

spectre of a worsening geopolitical landscape continues to cause

concern for citizens and investors alike. The threat of recession

is receding, but markets remain uncertain with forthcoming US

elections and a new UK Government and what that might mean for us

all. The continuing issues in Ukraine and the Middle East only

goes to add to the uncertainty and these matters influence the

Manager’s investment thinking too. Against that backdrop, I am

delighted to say our portfolio is performing well with some good

exits and a positive pipeline of new investment opportunities being

considered. The Board is soon to embark upon our annual strategy

review with the Manager. I believe the strong and growing team of

investment professionals serves us well. The Manager’s regional

presence across core commercial centres in the UK further adds to

the diversity of opportunities they can review and invest in. We

will continue to have great focus to ensure the Company and sector

selections are considered, well researched and suggest

good value prior to investment.

In the six months ended 30 June 2024, 22 companies in the

portfolio recorded a combined increase in valuation of

£13.7 million, offset by 19 companies recording an aggregate

fall in valuation of £5.0 million.

Strategy

The Board believes that it is in the best interests of Shareholders

to continue to pursue a strategy of:

- Growth in Net Asset Value Total Return above a 5% annual target

while continuing to grow the Company’s assets

- Payment of annual dividends of at least 5% of the NAV

per share based on the opening NAV per share of that financial

year

- Implementation of a number of new and follow-on qualifying

investments every year, exceeding deployment requirements to

maintain VCT status

- Maintaining a programme of regular share buybacks at a discount

of 5%, subject to market conditions

Central to the Company being able to achieve these objectives is

the ability of the Manager to source and complete attractive new

qualifying investment opportunities.

Whilst this task has not been made easier by the changes to VCT

legislation since 2015, which (amongst other requirements) place

greater emphasis on growth or development capital investment into

younger companies, the Company is fortunate in that it has pursued

a policy of seeking growth capital investments for several years

prior to the rule changes and the Manager has an established track

record in this area.

Performance and portfolio activity

During the period Net Asset Value per share decreased by 1.7% from

65.6p as at 31 December 2023 to 64.5p as at 30 June 2024.

After adding back the payment of a 5.0p dividend paid on 19 January

2024, NAV Total Return per share at 30 June 2024 was

69.5p, representing a positive NAV Total Return of 5.9% in the

period. This positive movement is a result of the strategy and

business changes throughout the portfolio alluded to above.

On 13 October 2023, the Company launched an offer for

subscription to raise up to £20 million, with an over‑allotment

facility to raise up to a further £10 million, through the issue of

new shares. The offer was closed on 15 April 2024 having raised

gross proceeds of £30.0 million, £28.8 million after expenses. We

would like to thank those existing Shareholders who have supported

the offer and welcome all new Shareholders to the Company.

During the period the Manager completed three new investments

and three follow-on investments costing £6.5 million and

£2.5 million respectively. The Manager successfully disposed

of Callen-Lenz Associates Limited and Specac International Limited,

generating proceeds of £34.3 million, with a further £3.6

million of deferred consideration included within debtors at

the period end. Adding in the £1.5 million of cash returned in the

investment period, this represents a combined return multiple of

6.4 times the original investment. The Manager also disposed

of two challenged businesses, Crosstown Dough Limited and So-Sure

Limited, during the period. Further details of these investments

and realisations can be found in the Manager’s Review.

The Board and the Manager are confident that a number of new and

follow-on investments can be achieved this year, particularly with

the increased investment activity noted above. Details of each of

these new, existing and former portfolio companies can be found in

the Manager’s Review.

The Manager continues to see a strong pipeline of potential

investments sourced through its regional networks and

well-developed relationships with advisers and the SME community;

however, it is also focused on supporting the existing portfolio

through the current economic climate.

Responsible investing

The analysis of environmental, social and governance (“ESG”) issues

is embedded in the Manager’s investment process and, whilst the

Company has no specific objective to invest in companies which have

an ESG focus, these factors are more generally considered key in

determining the quality of a business and its long-term success.

Central to the Manager’s responsible investment approach are five

ESG principles that are applied to evaluate investee companies,

acquired since May 2018, throughout the lifecycle of their

investment, from their initial review and acquisition to their

final sale. Every year, the portfolio companies are assessed and

progress measured against these principles. More detailed

information about the process can be found on pages 24 and 25 in

the Unaudited Half-Yearly Financial Report.

Dividends

A special interim dividend of 5.0p per share was declared on 14

December 2023 based on an ex-dividend date of 4 January 2024

and a record date of 5 January 2024. The dividend was paid on

19 January 2024, returning £13.2 million to Shareholders.

Additionally, an interim dividend of 3.3p per share was declared on

11 June 2024 based on an ex-dividend date of 27 June 2024 and a

record date of 28 June 2024. The dividend was paid on

12 July 2024, returning £8.7 million to Shareholders.

The Board and the Manager continue to hope that additional

“special” dividends can be paid as and when particularly successful

portfolio exits are made.

Buybacks

The Board is pleased to have achieved an average discount across

all buybacks of 5.0% to the Net Asset Value per share in the period

and continues to have an objective of maintaining buybacks at a

discount of 5%, subject to market conditions.

Shareholder communication

We were delighted to hold the AGM on 11 June 2024. We hope many of

you will be available to attend our next in‑person investor forum

event which will be announced in due course. These events have

proven very popular with our Shareholders in the past and provide

the opportunity to learn first-hand about some of our investee

companies from their founders and management.

Board composition

The Board continues to review its own performance and undertakes

succession planning to maintain an appropriate level of

independence, experience, diversity and skills in order to be in a

position to discharge all its responsibilities.

VCT Sunset clause

I am pleased to report that the European Commission has decided not

to raise objections in respect of the prolongation of the UK’s VCT

scheme by ten years to April 2035. This now removes any recent

uncertainty and will help support further investment by the VCT

sector in early stage companies.

Outlook

As I mentioned in my introduction, the business environment is

improving with interest rates and inflationary pressures beginning

to ease. However, the geopolitical landscape of the world is as

hostile and uncertain as I have seen it. We are therefore

carefully considering how all of these factors, in an ever-changing

world, challenge the investment thesis.

We do, however, have the benefit of these developing companies

in which we invest, on the whole being able to more swiftly adapt

to the fast-moving environment in which we operate with the

benefit of our Manager and a strong funding base.

We have a diverse portfolio of investments and we are confident

that our continued focus on the wider business landscape, alongside

the Manager’s deep understanding of the individual investee

companies in which we invest, will protect us from the most

extreme market conditions.

We have a strong balance sheet with a diversified portfolio that

we believe will provide sustainable long-term value for

Shareholders.

Michael Gray

Chair

26 September 2024

Manager’s Review

The Board has appointed Foresight Group LLP (the “Manager”) to

provide investment management and administration services.

Portfolio summary

As at 30 June 2024, the Company’s portfolio comprised

45 investments with a total cost of £71.4 million and a

valuation of £102.7 million. The portfolio is diversified by

sector, transaction type and maturity profile. Details of the ten

largest investments by valuation, including an update on their

performance, are provided on pages 17 to 20 in the Unaudited

Half-Yearly Financial Report.

During the six months to 30 June 2024, the value of the

investment portfolio decreased by £16.9 million as a result of

successful realisations of several investments generating

£34.5 million. This was partially offset by an increase of

£8.7 million in the valuation of the remaining investments,

plus £9.0 million of new and follow‑on investments.

Overall, the portfolio has performed well despite uncertainty in

the market with ongoing conflicts in Ukraine and Gaza, numerous

elections taking place worldwide, fears of a potential recession in

the US and continued domestic price inflation, coupled with high

interest rates.

In line with the Board’s strategic objectives, we remain focused

on growing the Company through further development of Net Asset

Value Total Return. For the six months to 30 June 2024, Net Asset

Value Total Return was 5.9% and net assets increased by 1.5% to

£171.1 million following the payment of a 5.0p per share dividend

costing the Company £13.2 million, meaning that the Company has

successfully met this objective in the period under review.

New investments

Three new investments were completed in the six months to 30 June

2024, totalling £6.5 million. New investments were across

children’s play centres, engineering solutions and cybersecurity.

Follow-on investments totalling £2.5 million were also made in

three existing investee companies. There is a strong

pipeline of opportunities that we expect to convert during the

second half of 2024.

Family Adventures Group Limited

In January 2024, the Company invested £2.5 million of growth

capital into Family Adventures Group, a provider of daycare

nurseries and children’s leisure sites that combines soft play

areas with theatrical role play facilities. All inspected sites

have been rated “Good” by Ofsted and have an average score of

9.9/10 on daynurseries.co.uk; whilst the leisure sites have

market-leading Net Promoter Scores and high repeat visits.

The investment will be used to aid the business with a

continued rollout of nursery and leisure sites across the South

West and the Midlands.

Evolve Dynamics Limited

In March 2024, the Company completed a £2.0 million investment into

Evolve Dynamics. Founded in 2016, the company designs and

manufactures smaller Unmanned Aerial Systems (“UAS”) with

capabilities for intelligence, surveillance and reconnaissance. The

company’s UAS products are also widely deployed within UK and

international police forces, fire services, energy inspection and

search & rescue organisations. The investment will help scale

the business and aid in new product launches.

Lepide Group Holding Company

Limited

In March 2024, the Company invested £2.0 million into Lepide, a

cyber security software solution that helps organisations to

protect their unstructured data. Lepide actively monitors event

logs within Windows Active Directory in order to detect suspicious

activity and help organisations to manage over‑exposure of data.

The investment will help scale the business and accelerate growth

initiatives.

Follow-on investments

The Company made follow-on investments in three companies during

the six months to 30 June 2024, totalling £2.5 million. Further

details of each of these are provided below.

The additional equity injections in the period were used to

support further growth plans, such as launching new products, and

expansion of commercial capabilities. We continue to

successfully navigate the volatility that has been felt across the

markets over the course of the year and remain vigilant about the

health of the portfolio and the need for follow-on funding during

the second half of 2024. Given the size of the portfolio, further

opportunities to deploy capital into growing existing investments

are expected.

HomeLink Healthcare Limited

In March 2024, the Company completed a £1.0 million follow‑on

investment into HomeLink Healthcare. The Company first invested

into HomeLink in March 2022. Contracting with the NHS, the business

provides patients with wound care, physiotherapy and intravenous

therapies in their own home. HomeLink is also a leader in remote

patient monitoring practices, offers a virtual ward solution and

has now saved the NHS over 150,000 hospital bed days. The

investment will support the organic expansion of the company.

Hexarad Group Limited

In June 2024, the Company completed a £0.7 million follow‑on

investment into Hexarad Group. The Company initially invested £0.9

million into Hexarad in June 2021, which preceded a

£0.7 million follow-on in August 2022. Hexarad is a

teleradiology company, supporting NHS and private healthcare

providers with access to a diversified pool of radiologists in

order to provide fast, accurate diagnosis and enable more timely

and higher quality patient care. The latest investment forms part

of a larger funding round, including a new third‑party investor, to

support the ongoing development of the technology, as well as the

expansion of the commercial and operational teams.

Sprintroom Limited

In March 2024, the Company completed a £0.8 million follow‑on

investment into Sprintroom, which trades as Sprint Electric.

The business designs and manufactures drives for controlling

electric motors in light and heavy industrial applications, as well

as recovering and reusing otherwise lost energy. The investment

will be used to drive continued revenue growth and develop further

iterations of the new product range.

Post period end activity

After the period end, the Company completed three follow‑on

investments totalling £2.2 million into NorthWest EHealth Limited,

which provides software and services to the clinical trials market;

Strategic Software Applications Ltd, a London-based SaaS technology

provider supporting financial institutions in meeting their

regulatory compliance obligations; and Red Flag Alert Technology

Group Limited, a Manchester-based proprietary SaaS intelligence

platform with modular capabilities spanning compliance,

prospecting, risk management and financial health assessments.

Realisations

The M&A climate has proven more challenging in recent years in

light of macroeconomic conditions, including higher interest rates

and geopolitical uncertainty alluded to above. Despite this, we are

pleased to report the particularly strong realisations of

Callen-Lenz Associates Limited and Specac International Limited, as

well as the disposal of two challenged businesses within the

portfolio: Crosstown Dough Ltd and So-Sure Limited. Two loans

totalling £0.6 million were also fully repaid in the period.

We continue to engage with a range of potential acquirers of

several portfolio companies and to carefully consider

the timing of exit for each. Demand from both private

equity and trade buyers remains for high-quality, high-growth

businesses.

Callen-Lenz Associates Limited

In May 2024, the Company achieved the successful exit of

Callen-Lenz Associates, returning £23.4 million to the Company.

Including a further £2.9 million of earnout recognised at the

period end, the sale implies a 5.4x cash‑on‑cash return on the

total investment made of £4.9 million, equivalent to an IRR of

124%.

Since investment, we have worked with the board to expand both

non-executive and executive leadership, which led to successful

product launches and a significant increase in headcount and

revenue. With the business focus successfully transitioned from

R&D to commercial sales, the exit will facilitate

continued growth.

Crosstown Dough Limited

In June 2024, the Company realised its investment in

Crosstown Dough, a doughnut vendor operating from

31 sites including a mix of bricks and mortar, food trucks and

market stalls. Crosstown’s core products are made at

its central production unit in Battersea. The sale of

Crosstown to Karali Group, a large franchise operator of Burger

King in the UK and US, allowed distributions to be made to

creditors whilst facilitating the continuation of the business. The

business had been impacted by wage and supply chain inflation.

Specac International Limited

In March 2024, the Company announced the sale of Specac

International, a leading manufacturer of high-specification sample

analysis and preparation equipment used in testing and research

laboratories worldwide, primarily supporting infrared spectroscopy.

The transaction generated proceeds of £11.2 million at completion.

When added to £1.5 million of cash returned pre-exit, this implies

a total cash-on-cash return of 10.3x, equivalent to an IRR of 33%,

with a further £704,000 of deferred consideration recognised at the

period end. Since investment, the business has grown to sell

globally through both original equipment manufacturers (“OEMs”) and

distributors. We also engaged with the team to support management

team changes, improvements in governance, headcount and numerous

product launches, as well as a major site move. The exit

will facilitate the continued growth of the business.

So-Sure Limited

In March 2024, the investment in So-Sure was fully written off

as it failed to perform in line with the management plan

proposed at the Manager’s Investment Committee. So-Sure Limited is

a technology company acting as “Managing General Agent” for

insurers. The company’s mission is to offer a more trusted

proposition, greater pricing transparency and improved customer

experience through its customer-centric digital platform.

Realisations in the period ended 30 June

2024

| |

|

|

|

|

|

|

Company |

Detail |

Total invested (£) |

Accounting cost at date of disposal (£) |

Exit proceeds and deferred consideration (£) |

Total return (£) |

| Callen-Lenz

Associates Limited1 |

Full disposal |

4,875,000 |

4,875,000 |

26,266,395 |

26,266,395 |

| Specac

International Limited2 |

Full disposal |

1,300,000 |

2,054,761 |

11,876,787 |

13,326,804 |

| Crosstown Dough

Ltd |

Full disposal |

1,500,000 |

1,500,000 |

— |

— |

| So-Sure

Limited3 |

Full disposal |

1,600,000 |

1,600,000 |

11,429 |

11,429 |

| Spektrix

Limited |

Loan repayment |

112,873 |

112,873 |

112,873 |

112,873 |

|

Positive Response Corporation Ltd |

Loan repayment |

100,000 |

100,000 |

100,000 |

100,000 |

|

|

|

9,487,873 |

10,242,634 |

38,367,484 |

39,817,501 |

- Includes £2,894,000 of deferred consideration which has been

recognised within debtors.

- Includes £704,000 of deferred consideration which has been

recognised within debtors. Accounting cost includes an uplift of

£1,254,761 on transfer into the Company on merger with

Foresight 3 VCT plc.

- Includes £11,000 of deferred consideration which has been

recognised within debtors.

Pipeline

As at 30 June 2024, the Company had cash reserves of £64.5 million,

which will be used to fund new and follow‑on investments, buybacks,

dividends and corporate expenditure. We are seeing a strong

pipeline of new opportunities, with several opportunities in due

diligence or in exclusivity, with further deal completions expected

to be announced in the months to follow.

The outlook for the UK economy is more favourable during the

year to date, with inflation returning to historic norms over the

last 12 months. Consumer spending remains squeezed however,

resulting from stubbornly higher interest rates and the effects

of recent high inflation still being felt. Conflicts in

Ukraine and Gaza continue to impact supply chains and erode

confidence.

Global markets have proven to be exceptionally volatile so far

in 2024, which recently gave rise to some concern within the market

about a US recession which would have far-reaching consequences

globally. Against this unsettled backdrop, the UK economy is

performing reasonably well and UK companies continue to seek both

the capital and experience to help deliver growth in uncertain

times.

With a broad network of deal introducers across the UK and

internationally, and through its growing network of regional

offices, we continue to see a large volume of attractive investment

opportunities. This is not expected to change in the medium term.

We continue to pursue a balanced strategy, targeting companies

from a range of sectors and at different stages of maturity to

combat market volatility.

Key portfolio developments

Material changes in valuation, defined as increasing or decreasing

by £1.0 million or more since 31 December 2023, are detailed below.

Updates on these companies are included on page 12 and in the Top

Ten Investments section on pages 17 to 20 in the Unaudited

Half-Yearly Financial Report.

Key valuation changes in the period

| |

Valuation |

Valuation change |

|

|

methodology |

(£) |

| TLS Holdco

Limited1 |

Discounted earnings multiple |

2,135,763 |

| Hexarad Group

Limited1 |

Price of last funding round |

1,685,755 |

| Aerospace Tooling

Corporation Limited |

Discounted earnings multiple |

(1,417,100) |

- Updates included in Top Ten Investments section on pages 17 to

18 in the Unaudited Half-Yearly Financial Report.

Outlook

2024 has so far been a year of market volatility. Global markets

performed strongly in the first six months of the year, with US

indexes such as the S&P 500 and NASDAQ delivering consistent

gains, albeit largely driven by a handful of high‑performing

technology companies. Increasing unemployment rates created a sense

of anxiety in the US, whilst volatility across the market is

expected to continue in the medium term as a result of the ongoing

wars in Ukraine and Gaza, which threaten to morph into global

conflicts. In addition, nations representing approximately half of

the global population are holding or have held elections in 2024,

with the polarising US election taking place later in the year.

This political uncertainty deepens the sense of instability in the

markets.

Despite this challenging backdrop, the UK economy continues to

perform relatively well. The FTSE 100 has shown steady gains

throughout the year, rather than the significant gains and losses

driven by highly valued technology companies seen in the US. GDP

growth forecasts for the year are modest but exceed the

expectations set earlier in 2024. Inflation has returned to

historic levels, despite evidence which suggests that increased

costs continue to be passed on to consumers, eroding spending

power. As a result, the base interest rate has been held at 5% or

over until September, with further reductions likely to be

measured. The first Labour government in over a decade appears

relatively moderate and business-friendly, but is yet to announce

its first budget, which could have wide‑ranging consequences for

small businesses in the UK.

In light of the volatile global economy and geopolitical

environment, and a UK economy that is showing moderate signs of

growth, the Company has performed well in the year to date. NAV

Total Return in the year to date is 5.9%. Strong exits from Specac

and Callen-Lenz have significantly contributed to the 3.3p dividend

paid in July and a very attractive dividend yield of 14.3% (based

on the mid-market share price as at 30 June 2024 of 58.0p).

The disappointing exits of So-Sure and Crosstown, however,

exemplify the current challenges faced by businesses linked to

consumer spending. The Company maintains a balanced portfolio

across different sectors and stages of the business lifecycle,

which should stand it in good stead to face the volatility ahead.

Our hands-on approach to challenges and exit planning continues to

add value to the portfolio companies.

Looking to the remainder of 2024 and beyond, it would be

reasonable to expect further volatility given the geopolitical and

economic environment. The US election could have far-reaching

consequences, while few concrete details have yet emerged on the

new UK government's first budget. Interest rates are likely to

remain relatively high in the medium term, although this may create

opportunities for equity investors to support SMEs put off by the

cost of debt.

On the optimistic side, the UK’s relatively low market

volatility and moderate government should mean it remains an

attractive place to do business. We expect to see continuing

interest in UK companies as acquisition targets for overseas

corporations. The UK continues to invest heavily in innovation

through world-class universities and support networks, generating a

good flow of attractive investment opportunities for us.

We are pleased with the performance in the year to date, with a

successful fundraising, high-potential new investments and

attractive exits. With inflation returning to historic norms and

consumer confidence hopefully improving, there is cause for some

optimism looking to the future. Crucially, the portfolio remains

diversified across sectors and with a mix of higher-growth and

cash-generative businesses, the Company is resilient to headwinds

and challenges. The Company has further strengthened its position

in the rankings against its peers in the VCT market, which

remains an important source of capital for UK

entrepreneurs.

James Livingston

Foresight Group LLP

26 September 2024

Unaudited Half-Yearly Results And Responsibilities

Statements

Principal risks and uncertainties

The principal risks faced by the Company are as follows:

- Market risk

- Strategic and performance risk

- Internal control risk

- Legislative and regulatory risk

- VCT qualifying status risk

- Investment valuation and liquidity risk

The Board reported on the principal risks and uncertainties

faced by the Company in the Annual Report and Accounts for the year

ended 31 December 2023. A detailed explanation can be found on

pages 47 to 49 of the Annual Report and Accounts, which is

available on Foresight Enterprise VCT’s website

www.foresightenterprisevct.com or by writing to Foresight Group LLP

at The Shard, 32 London Bridge Street, London SE1 9SG.

In the view of the Board, there have been no changes to the

fundamental nature of these risks since the previous Annual Report

and Accounts. The emerging risks identified in the previous report

included those of climate change, inflationary pressures, interest

rates, supply chain issues, energy prices and geopolitical

tensions. These emerging risks continue to apply and be monitored.

The Board and the Manager continue to follow all emerging risks

closely with a view to identifying where changes affect the areas

of the market in which portfolio companies operate. This enables

the Manager to work closely with portfolio companies, preparing

them so far as possible to ensure they are well positioned to

endure potential volatility.

Directors’ responsibility statement

The Disclosure and Transparency Rules (“DTR”) of the UK Listing

Authority require the Directors to confirm their responsibilities

in relation to the preparation and publication of the Half-Yearly

Financial Report.

The Directors confirm to the best of their knowledge that:

a) The

summarised set of financial statements has been prepared in

accordance with FRS 104

b) The

Half-Yearly Financial Report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year)

c) The

summarised set of financial statements gives a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company as required by DTR 4.2.4R

d) The

Half-Yearly Financial Report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties’

transactions and changes therein)

Going concern

The Company’s business activities, together with the factors likely

to affect its future development, performance and position, are set

out in the Strategic Report of the Annual Report. The financial

position of the Company, its cash flows, liquidity position and

borrowing facilities are described in the Chair’s Statement,

Strategic Report and Notes to the Accounts of the 31 December 2023

Annual Report.

In addition, the Annual Report includes the Company’s

objectives, policies and processes for managing its capital; its

financial risk management objectives; details of its financial

instruments; and its exposures to credit risk and liquidity

risk.

The Company has considerable financial resources together with

investments and income generated therefrom across a variety of

industries and sectors. As a consequence, the Directors believe

that the Company is well placed to manage its business risks

successfully.

The Directors have reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Thus they continue to adopt the going concern

basis of accounting in preparing the annual financial

statements.

The Half-Yearly Financial Report has not been audited nor

reviewed by the auditors.

On behalf of the Board

Michael Gray

Chair

26 September 2024

Unaudited Income Statement

For the six months ended 30 June 2024

| |

Six months ended |

Six months ended |

Year ended |

| |

30 June 2024 |

30 June 2023 |

31 December 2023 |

| |

(Unaudited) |

(Unaudited) |

(Audited) |

| |

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Realised gains on investments |

— |

25,300 |

25,300 |

— |

3,411 |

3,411 |

— |

5,366 |

5,366 |

| Investment holding

(losses)/gains |

— |

(13,044) |

(13,044) |

— |

1,950 |

1,950 |

— |

6,405 |

6,405 |

| Income |

1,750 |

— |

1,750 |

1,048 |

— |

1,048 |

2,683 |

— |

2,683 |

| Investment

management fees |

(434) |

(2,614) |

(3,048) |

(373) |

(1,573) |

(1,946) |

(759) |

(3,845) |

(4,604) |

|

Other expenses |

(420) |

— |

(420) |

(417) |

— |

(417) |

(790) |

— |

(790) |

|

Return on ordinary activities before taxation |

896 |

9,642 |

10,538 |

258 |

3,788 |

4,046 |

1,134 |

7,926 |

9,060 |

|

Taxation |

(183) |

183 |

— |

— |

— |

— |

(225) |

225 |

— |

|

Return on ordinary activities after taxation |

713 |

9,825 |

10,538 |

258 |

3,788 |

4,046 |

909 |

8,151 |

9,060 |

|

Return per share |

0.3p |

3.6p |

3.9p |

0.1p |

1.7p |

1.8p |

0.4p |

3.5p |

3.9p |

The total columns of this statement are the profit and loss

account of the Company and the revenue and capital columns

represent supplementary information.

All revenue and capital items in the above Income Statement are

derived from continuing operations. No operations were acquired or

discontinued in the period.

The Company has no recognised gains or losses other than those

shown above, therefore no separate statement of total recognised

gains and losses has been presented.

The Company has only one class of business and one reportable

segment, the results of which are set out in the Income Statement

and Balance Sheet.

There are no potentially dilutive capital instruments in issue

and, therefore, no diluted earnings per share figures are relevant.

The basic and diluted earnings per share are, therefore,

identical.

Unaudited Reconciliation Of Movements In Shareholders’

Funds

For the six months ended 30 June 2024

| |

Called-up |

Share |

Capital |

|

|

|

|

| |

share |

premium |

redemption |

Distributable |

Capital |

Revaluation |

|

| |

capital |

account |

reserve |

reserve1 |

reserve1 |

reserve |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1 January 2024 |

2,567 |

102,801 |

679 |

44,046 |

(31,047) |

49,430 |

168,476 |

| Share issues in the

period |

171 |

10,894 |

— |

— |

— |

— |

11,065 |

| Expenses in relation

to share issues |

— |

(348) |

— |

— |

— |

— |

(348) |

| Repurchase of

shares |

(88) |

— |

88 |

(5,460) |

— |

— |

(5,460) |

| Realised gains on

disposal of investments |

— |

— |

— |

— |

25,300 |

— |

25,300 |

| Investment holding

losses |

— |

— |

— |

— |

— |

(13,044) |

(13,044) |

| Dividends paid |

— |

— |

— |

(13,200) |

— |

— |

(13,200) |

| Management fees

charged to capital |

— |

— |

— |

— |

(2,614) |

— |

(2,614) |

| Revenue return for the

period before taxation |

— |

— |

— |

896 |

— |

— |

896 |

|

Taxation for the period |

— |

— |

— |

(183) |

183 |

— |

— |

|

As at 30 June 2024 |

2,650 |

113,347 |

767 |

26,099 |

(8,178) |

36,386 |

171,071 |

- Reserve is available for distribution, total distributable

reserves at 30 June 2024 are £17,921,000 (31 December 2023:

£12,999,000)

Unaudited Balance Sheet

At 30 June 2024

Registered number: 03506579

| |

As at 30 June |

As at 30 June |

As at 31 December |

| |

2024 |

2023 |

2023 |

| |

(Unaudited) |

(Unaudited) |

(Audited) |

|

|

£’000 |

£’000 |

£’000 |

|

Fixed assets |

|

|

|

|

Investments held at fair value through profit or loss |

102,729 |

107,332 |

119,587 |

|

Current assets |

|

|

|

| Debtors |

5,418 |

3,341 |

2,726 |

|

Cash and cash equivalents |

64,515 |

39,012 |

47,843 |

|

Total current assets |

69,933 |

42,353 |

50,569 |

|

Creditors |

|

|

|

|

Amounts falling due within one year |

(1,591) |

(1,531) |

(1,680) |

|

Net current assets |

68,342 |

40,822 |

48,889 |

|

Net assets |

171,071 |

148,154 |

168,476 |

|

Capital and reserves |

|

|

|

| Called-up share

capital |

2,650 |

2,337 |

2,567 |

| Share premium

account |

113,347 |

83,327 |

102,801 |

| Capital redemption

reserve |

767 |

606 |

679 |

| Distributable

reserve |

26,099 |

47,864 |

44,046 |

| Capital reserve |

(8,178) |

(30,955) |

(31,047) |

|

Revaluation reserve |

36,386 |

44,975 |

49,430 |

|

Equity Shareholders’ funds |

171,071 |

148,154 |

168,476 |

|

Net Asset Value per share |

64.5p |

63.4p |

65.6p |

Unaudited Cash Flow Statement

For the six months ended 30 June 2024

| |

Six months ended 30 June 2024 |

Six months ended 30 June 2023 |

Year ended 31 December 2023 |

| |

(Unaudited) |

(Unaudited) |

(Audited) |

|

|

£’000 |

£’000 |

£’000 |

|

Cash flow from operating activities |

|

|

|

| Loan interest received

from investments |

401 |

636 |

1,238 |

| Dividends received

from investments |

165 |

— |

175 |

| Other income received

from investments |

— |

— |

71 |

| Deposit and similar

interest received |

979 |

412 |

1,190 |

| Investment management

fees paid |

(1,747) |

(1,485) |

(3,029) |

| Performance incentive

fee paid |

(1,115) |

— |

(734) |

| Secretarial fees

paid |

(101) |

(91) |

(197) |

|

Other cash payments |

(240) |

(288) |

(549) |

|

Net cash outflow from

operating activities |

(1,658) |

(816) |

(1,835) |

|

Cash flow from investing activities |

|

|

|

| Purchase of

investments |

(8,969) |

(7,608) |

(17,652) |

| Net proceeds on sale

of investments |

34,486 |

16,430 |

20,572 |

| Net proceeds on

deferred consideration |

1,057 |

— |

669 |

|

Net cash inflow from investing activities |

26,574 |

8,822 |

3,589 |

|

Cash flow from financing activities |

|

|

|

| Proceeds of

fundraising |

9,182 |

14,685 |

34,910 |

| Expenses of

fundraising |

(535) |

(360) |

(474) |

| Repurchase of own

shares |

(5,432) |

(1,448) |

(6,504) |

|

Equity dividends paid |

(11,459) |

(6,685) |

(6,657) |

|

Net cash (outflow)/inflow from

financing activities |

(8,244) |

6,192 |

21,275 |

|

Net inflow of cash in the period |

16,672 |

14,198 |

23,029 |

|

Reconciliation of net cash flow to movement in net

funds |

|

|

|

| Increase in cash and

cash equivalents for the period |

16,672 |

14,198 |

23,029 |

|

Net cash and cash equivalents at start of period |

47,843 |

24,814 |

24,814 |

|

Net cash and cash equivalents at end

of period |

64,515 |

39,012 |

47,843 |

Analysis of changes in net debt

| |

At 1 January |

|

At 30 June |

| |

2024 |

Cash flow |

2024 |

|

|

£’000 |

£’000 |

£’000 |

|

Cash and cash equivalents |

47,843 |

16,672 |

64,515 |

Notes To The Unaudited Half-Yearly Results

For the six months ended 30 June 2024

1

The Unaudited Half-Yearly Financial Report has been prepared on the

basis of the accounting policies set out in the statutory

accounts of the Company for the year ended 31 December 2023.

Unquoted investments have been valued in accordance with IPEV

Valuation Guidelines (as updated in December 2022 including

further COVID-19 guidance in March 2020).

2

These are not statutory accounts in accordance with S436 of the

Companies Act 2006 and the financial information for the six months

ended 30 June 2024 and 30 June 2023 has been neither audited nor

formally reviewed. Statutory accounts in respect of the year ended

31 December 2023 have been audited and reported on by the

Company’s auditors and delivered to the Registrar of Companies and

included the report of the auditors which was unqualified and did

not contain a statement under S498(2) or S498(3) of the Companies

Act 2006. No statutory accounts in respect of any period after

31 December 2023 have been reported on by the Company’s

auditors.

3

Copies of the Unaudited Half-Yearly Financial Report will be sent

to Shareholders via their chosen method and will be available for

inspection at the Registered Office of the Company at The

Shard, 32 London Bridge Street, London SE1 9SG.

4 Net Asset Value per share

The Net Asset Value per share is based on net assets at the end of

the period and on the number of shares in issue at the date.

| |

|

Number of |

|

|

Net assets |

shares in issue |

|

30 June 2024 |

£171,071,000 |

265,024,186 |

| 30 June 2023 |

£148,154,000 |

233,691,676 |

|

31 December 2023 |

£168,476,000 |

256,728,468 |

5 Return per share

The weighted average number of shares used to calculate the

respective returns are shown in the table below.

|

|

Shares |

|

Six months ended 30 June 2024 |

271,618,784 |

| Six months ended 30

June 2023 |

225,472,482 |

|

Year ended 31 December 2023 |

230,692,970 |

Earnings for the period should not be taken as a guide to the

results for the full year.

6 Income

|

|

Six months ended 30 June 2024

£’000 |

Six months ended 30 June 2023

£’000 |

Year ended 31 December 2023

£’000 |

|

Deposit and similar interest received |

979 |

412 |

1,190 |

| Loan stock

interest |

606 |

636 |

1,247 |

| Dividends

receivable |

165 |

— |

175 |

| Other income |

— |

— |

71 |

|

Total income |

1,750 |

1,048 |

2,683 |

7 Investments at fair value through profit or

loss

|

|

£’000 |

|

Book cost as at 1 January 2024 |

72,698 |

|

Investment holding gains |

46,889 |

|

Valuation at 1 January 2024 |

119,587 |

| Movements in the

period: |

|

|

Purchases |

8,969 |

|

Disposal proceeds1 |

(34,486) |

|

Realised gains2 |

24,243 |

|

Investment holding losses3 |

(15,584) |

|

Valuation at 30 June 2024 |

102,729 |

|

Book cost at 30 June 2024 |

71,424 |

|

Investment holding gains |

31,305 |

|

Valuation at 30 June 2024 |

102,729 |

- The Company received £34,486,000 from the disposal of

investments during the period. The book cost of these investments

when they were purchased was £10,243,000. These investments have

been revalued over time and until they were sold, any unrealised

gains or losses were included in the fair value of the

investments.

- Realised gains in the Income Statement include deferred

consideration receipts from Datapath Group Limited (£583,000),

Codeplay Software Limited (£463,000) and Mologic Ltd

(£11,000).

- Investment holding losses in the Income Statement include the

deferred consideration debtor increase of £2,540,000. The debtor

movement reflects the recognition of amounts receivable from

Callen-Lenz Associates Limited (£2,894,000), Specac International

Limited (£704,000) and So-Sure Limited (£11,000) offset by receipts

from Datapath Group Limited (£583,000), Codeplay Software Limited

(£463,000) and Mologic Ltd (£11,000) and a provision made against

the balance potentially due from Ixaris Systems Ltd (£12,000).

8 Related party transactions

No Director has an interest in any contract to which the Company is

a party other than their appointment and payment as Directors.

9 Performance incentive fee

In order to incentivise the Manager to generate enhanced returns

for Shareholders, the Manager is entitled to a performance

incentive fee, designated a share-based payment due to its nature.

This fee is equal to 15% of dividends paid to Shareholders, subject

to the total return (Net Asset Value plus cumulative dividends paid

per share on or after 11 January 2011) exceeding 100p (“High

Watermark”), both immediately before and after the performance

incentive fee is paid. After each distribution is made to

Shareholders where a performance incentive is paid, the High

Watermark required to be achieved by the Company to trigger a

further performance incentive fee will be amended to take account

of the dividend paid.

A £1,115,000 performance incentive fee was paid during the

period (31 December 2023: £734,000) following the January 2024

dividend. The High Watermark as at 19 January 2024 was at 110.3p.

The total return as at 19 January 2024 was 113.1p. As a result of

performance incentive fee payments made in the current and previous

years, the High Watermark as at 30 June 2024 was 112.7p (31

December 2023: 110.3p). The total return as at 30 June 2024 was

117.2p (31 December 2023: 113.1p). At 30 June 2024, the Company has

accrued an amount of £1,312,000 in relation to future performance

incentive fees as it is considered likely such payment will become

due over the medium term (31 December 2023: £1,115,000).

10 Transactions with the Manager

Foresight Group LLP advises the Company on investments under an

agreement dated 30 July 2004. During the period,

Foresight Group LLP earned fees of £1,736,000

(30 June 2023: £1,492,000; 31 December 2023:

£3,035,000). A performance incentive fee of £1,115,000 (30 June

2023: £nil; 31 December 2023: £734,000) was paid in the period with

an additional provision of £1,312,000 (30 June 2023: £734,000;

31 December 2023: £1,115,000) recognised as at the period

end.

During the period, administration services of a total cost of

£101,000 (30 June 2023: £91,000; 31 December 2023: £197,000) were

delivered to the Company by Foresight Group LLP, Company

Secretary.

At 30 June 2024, the amount due from Foresight Group LLP was

£46,000 (30 June 2023: £nil; 31 December 2023: (£8,000)).

A copy of the Unaudited Half-Yearly Financial Report will be

submitted to the National Storage Mechanism in accordance with UK

Listing Rules (“UKLR”)11.4.1 / UKLR 6.4.1 and UKLR 6.4.3.

END

For further information, please contact:

Company Secretary

Foresight Group LLP

Contact: Stephen Thayer Tel: 0203 667 8100

Investor Relations

Foresight Group LLP

Contact: Andrew James Tel: 0203 667 8181

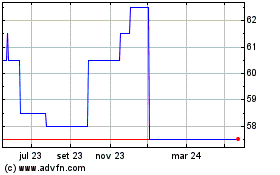

Foresight Enterprise Vct (LSE:FTF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Foresight Enterprise Vct (LSE:FTF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024