Shell third quarter 2024 update note

The following is an update to the third quarter 2024 outlook and

gives an overview of our current expectations for the third

quarter. Outlooks presented may vary from the actual third quarter

2024 results and are subject to finalisation of those results,

which are scheduled to be published on October 31, 2024. Unless

otherwise indicated, all outlook statements exclude identified

items.

See appendix for previous quarter historical data.

Integrated Gas

|

$ billions |

Q3’24 Outlook |

Comment |

|

Adjusted EBITDA: |

|

Production (kboe/d) |

920 - 960 |

|

|

LNG liquefaction volumes (MT) |

7.3 - 7.7 |

|

|

Underlying opex |

1.1 - 1.3 |

|

|

Adjusted Earnings: |

|

Pre-tax depreciation |

1.2 - 1.6 |

|

|

Taxation charge |

0.8 - 1.1 |

|

|

Other Considerations: |

|

Trading & Optimisation results are expected to be in line with

Q2’24. |

Upstream

|

$ billions |

Q3’24 Outlook |

Comment |

|

Adjusted EBITDA: |

|

Production (kboe/d) |

1,740 - 1,840 |

|

|

Underlying opex |

1.9 - 2.5 |

|

|

Adjusted Earnings: |

|

Pre-tax depreciation |

2.3 - 2.9 |

|

|

Taxation charge |

2.0 - 2.8 |

|

|

Other Considerations: |

|

The share of profit / (loss) of joint ventures and associates in

Q3’24 is expected to be ~$0.1 billion. Q3’24 exploration well

write-offs are expected to be ~$0.1 billion. |

Marketing

|

$ billions |

Q3’24 Outlook |

Comment |

|

Adjusted EBITDA: |

|

Sales volumes (kb/d) |

2,750 - 3,150 |

|

|

Underlying opex |

2.5 - 2.9 |

|

|

Adjusted Earnings: |

|

Pre-tax depreciation |

0.4 - 0.8 |

|

|

Taxation charge |

0.2 - 0.5 |

|

|

Other Considerations: |

|

Marketing results are expected to be in line with Q2’24. |

Chemicals and Products

|

$ billions |

Q3’24 Outlook |

Comment |

|

Adjusted EBITDA: |

|

Indicative refining margin |

$5.5/bbl |

|

|

Indicative chemicals margin |

$164/tonne |

The Chemicals sub-segment adjusted earnings are expected to reflect

a marginal loss in Q3’24. |

|

Refinery utilisation |

79% - 83% |

|

|

Chemicals utilisation |

73% - 77% |

|

|

Underlying opex |

2.1 - 2.5 |

|

|

Adjusted Earnings: |

|

Pre-tax depreciation |

0.8 - 1.0 |

|

|

Taxation charge / (credit) |

(0.3) - 0.1 |

|

|

Other Considerations: |

|

Trading & Optimisation is expected to be lower than Q2’24. |

Renewables and Energy Solutions

|

$ billions |

Q3’24 Outlook |

Comment |

|

Adjusted Earnings |

(0.4) - 0.2 |

|

Corporate

|

$ billions |

Q3’24 Outlook |

Comment |

|

Adjusted Earnings |

(0.7) - (0.5) |

|

Shell Group

|

$ billions |

Q3’24 Outlook |

Comment |

|

CFFO: |

|

Tax paid |

2.5 - 3.3 |

|

|

Derivative movements |

(2) - 2 |

Derivative movements and working capital estimations inherently

have a broad range of uncertainty. |

|

Working capital |

0 - 4 |

|

Other Shell Group Considerations: |

|

- |

Guidance

The ‘Quarterly Databook’ contains guidance on Indicative

Refining Margin, Indicative Chemicals Margin and full-year price

and margin sensitivities (Link).

Consensus

The consensus collection for quarterly Adjusted

Earnings, Adjusted EBITDA is per the reporting segments and CFFO at

a Shell group level, managed by Vara Research, is expected to be

published on October 23, 2024.

Appendix

Indicative Margins

|

Chemicals & Products |

Q2’24 |

Q3’24 Updated Outlook |

|

Indicative refining margin |

$7.7/bbl |

$5.5/bbl |

|

Indicative chemicals margin |

$155/tonne |

$164/tonne |

Volume Data

|

|

Q2’24 Adjusted |

Q3’24 QPR Outlook |

Q3’24 Updated Outlook |

|

Integrated Gas |

|

|

|

|

Production (kboe/d) |

980 |

920 - 980 |

920 - 960 |

|

LNG liquefaction volumes (MT) |

6.9 |

6.8 - 7.4 |

7.3 - 7.7 |

|

Upstream |

|

|

|

|

Production (kboe/d) |

1,783 |

1,580 - 1,780 |

1,740 - 1,840 |

|

Marketing |

|

|

|

|

Sales volumes (kb/d) |

2,868 |

2,700 - 3,200 |

2,750 - 3,150 |

|

Chemicals & Products |

|

|

|

|

Refinery utilisation |

92% |

83% - 91% |

79% - 83% |

|

Chemicals utilisation |

80% |

73% - 81% |

73% - 77% |

Underlying Opex

|

$ billions |

Q2’24 |

Q2’24 Adjusted |

Q3’24 Updated Outlook |

|

Production and manufacturing expenses |

5.6 |

|

|

|

Selling, distribution and administrative expenses |

3.1 |

|

|

|

Research and development |

0.3 |

|

|

|

Operating Expenses (Opex) |

9.0 |

9.0 |

|

|

Less: Identified Items |

|

0.3 |

|

|

Underlying Opex |

|

8.7 |

|

|

of which: |

|

|

|

|

Integrated Gas |

1.1 |

1.0 |

1.1 - 1.3 |

|

Upstream |

2.3 |

2.2 |

1.9 - 2.5 |

|

Marketing |

2.7 |

2.6 |

2.5 - 2.9 |

|

Chemicals and Products |

1.9 |

2.0 |

2.1 - 2.5 |

|

Renewables and Energy

Solutions |

0.7 |

0.7 |

|

Depreciation, depletion and amortisation

|

$ billions |

Q2’24 |

Q2’24 Adjusted |

Q3’24 Updated Outlook |

|

Depreciation, Depletion & Amortisation |

7.6 |

7.6 |

|

|

Less: Identified Items |

|

1.9 |

|

|

Pre-tax depreciation (as Adjusted) |

|

5.6 |

|

|

of which: |

|

|

|

|

Integrated Gas |

1.4 |

1.4 |

1.2 - 1.6 |

|

Upstream |

2.8 |

2.8 |

2.3 - 2.9 |

|

Marketing |

1.6 |

0.5 |

0.4 - 0.8 |

|

Chemicals and Products |

1.5 |

0.9 |

0.8 - 1.0 |

|

Renewables and Energy

Solutions |

0.2 |

0.1 |

|

Tax Charge

|

$ billions |

Q2’24 |

Q2’24 Adjusted |

Q3’24 Updated Outlook |

|

Taxation Charge |

3.8 |

3.8 |

|

|

Less: Identified Items and Cost of supplies adjustment |

|

(0.2) |

|

|

Taxation Charge (as Adjusted) |

|

3.9 |

|

|

of which: |

|

|

|

|

Integrated Gas |

0.9 |

0.9 |

0.8 - 1.1 |

|

Upstream |

2.3 |

2.3 |

2.0 - 2.8 |

|

Marketing |

0.1 |

0.4 |

0.2 - 0.5 |

|

Chemicals and Products |

0.5 |

0.3 |

(0.3) - 0.1 |

|

Renewables and Energy

Solutions |

0.1 |

— |

|

Adjusted Earnings

The “Adjusted Earnings” measure aims to facilitate a comparative

understanding of Shell’s financial performance from period to

period by removing the effects of oil price changes on inventory

carrying amounts and removing the effects of identified items.

These items are in some cases driven by external factors and may,

either individually or collectively, hinder the comparative

understanding of Shell’s financial results from period to period.

This measure excludes earnings attributable to non-controlling

interest. For further details see the 2nd Quarter 2024 and half

year unaudited results (Link).

|

$ billions |

Q2’24 |

Q2’24 Adjusted |

Q3’24 Updated Outlook |

|

Income/(loss) attributable to Shell plc

shareholders |

3.5 |

3.5 |

|

|

Add: Current cost of supplies adjustment attributable to Shell plc

shareholders |

|

0.1 |

|

|

Less: Identified items attributable to Shell plc shareholders |

|

(2.7) |

|

|

Adjusted Earnings |

|

6.3 |

|

|

of which: |

|

|

|

|

Renewables and Energy

Solutions |

(0.1) |

(0.2) |

(0.4) - 0.2 |

|

Corporate |

(1.7) |

(0.6) |

(0.7) - (0.5) |

Enquiries

Media International: +44 (0) 207 934 5550

Media Americas: +1 832 337 4355

Cautionary Note

The companies in which Shell plc directly and indirectly owns

investments are separate legal entities. In this announcement

“Shell”, “Shell Group” and “Group” are sometimes used for

convenience where references are made to Shell plc and its

subsidiaries in general. Likewise, the words “we”, “us” and “our”

are also used to refer to Shell plc and its subsidiaries in general

or to those who work for them. These terms are also used where no

useful purpose is served by identifying the particular entity or

entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell

companies” as used in this announcement refer to entities over

which Shell plc either directly or indirectly has control. The term

“joint venture”, “joint operations”, “joint arrangements”, and

“associates” may also be used to refer to a commercial arrangement

in which Shell has a direct or indirect ownership interest with one

or more parties. The term “Shell interest” is used for

convenience to indicate the direct and/or indirect ownership

interest held by Shell in an entity or unincorporated joint

arrangement, after exclusion of all third-party interest.

The numbers presented in this announcement may

not sum precisely to the totals provided and percentages may not

precisely reflect the absolute figures due to rounding.

Forward-Looking Statements

This announcement contains forward-looking statements (within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995) concerning the financial condition, results of operations and

businesses of Shell. All statements other than statements of

historical fact are, or may be deemed to be, forward-looking

statements. Forward-looking statements are statements of future

expectations that are based on management’s current expectations

and assumptions and involve known and unknown risks and

uncertainties that could cause actual results, performance or

events to differ materially from those expressed or implied in

these statements. Forward-looking statements include, among other

things, statements concerning the potential exposure of Shell to

market risks and statements expressing management’s expectations,

beliefs, estimates, forecasts, projections and assumptions. These

forward-looking statements are identified by their use of terms and

phrases such as “aim”; “ambition”; ‘‘anticipate’’; ‘‘believe’’;

“commit”; “commitment”; ‘‘could’’; ‘‘estimate’’; ‘‘expect’’;

‘‘goals’’; ‘‘intend’’; ‘‘may’’; “milestones”; ‘‘objectives’’;

‘‘outlook’’; ‘‘plan’’; ‘‘probably’’; ‘‘project’’; ‘‘risks’’;

“schedule”; ‘‘seek’’; ‘‘should’’; ‘‘target’’; ‘‘will’’; “would” and

similar terms and phrases. There are a number of factors that could

affect the future operations of Shell and could cause those results

to differ materially from those expressed in the forward-looking

statements included in this announcement, including (without

limitation): (a) price fluctuations in crude oil and natural gas;

(b) changes in demand for Shell’s products; (c) currency

fluctuations; (d) drilling and production results; (e) reserves

estimates; (f) loss of market share and industry competition; (g)

environmental and physical risks; (h) risks associated with the

identification of suitable potential acquisition properties and

targets, and successful negotiation and completion of such

transactions; (i) the risk of doing business in developing

countries and countries subject to international sanctions; (j)

legislative, judicial, fiscal and regulatory developments including

regulatory measures addressing climate change; (k) economic and

financial market conditions in various countries and regions; (l)

political risks, including the risks of expropriation and

renegotiation of the terms of contracts with governmental entities,

delays or advancements in the approval of projects and delays in

the reimbursement for shared costs; (m) risks associated with the

impact of pandemics, such as the COVID-19 (coronavirus) outbreak,

regional conflicts, such as the Russia-Ukraine war, and a

significant cybersecurity breach; and (n) changes in trading

conditions. No assurance is provided that future dividend payments

will match or exceed previous dividend payments. All

forward-looking statements contained in this announcement are

expressly qualified in their entirety by the cautionary statements

contained or referred to in this section. Readers should not place

undue reliance on forward-looking statements. Additional risk

factors that may affect future results are contained in Shell plc’s

Form 20-F for the year ended December 31, 2023 (available at

www.shell.com/investors/news-and-filings/sec-filings.html and

www.sec.gov). These risk factors also expressly qualify all

forward-looking statements contained in this announcement and

should be considered by the reader. Each forward-looking statement

speaks only as of the date of this announcement, October 7, 2024.

Neither Shell plc nor any of its subsidiaries undertake any

obligation to publicly update or revise any forward-looking

statement as a result of new information, future events or other

information. In light of these risks, results could differ

materially from those stated, implied or inferred from the

forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon

Intensity” (NCI), which includes Shell’s carbon emissions from the

production of our energy products, our suppliers’ carbon emissions

in supplying energy for that production and our customers’ carbon

emissions associated with their use of the energy products we sell.

Shell’s NCI also includes the emissions associated with the

production and use of energy products produced by others which

Shell purchases for resale. Shell only controls its own emissions.

The use of the terms Shell’s “Net Carbon Intensity” or NCI are for

convenience only and not intended to suggest these emissions are

those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a

ten-year period and are updated every year. They reflect the

current economic environment and what we can reasonably expect to

see over the next ten years. Accordingly, they reflect our Scope 1,

Scope 2 and NCI targets over the next ten years. However,

Shell’s operating plans cannot reflect our 2050 net-zero emissions

target, as this target is currently outside our planning period. In

the future, as society moves towards net-zero emissions, we expect

Shell’s operating plans to reflect this movement. However, if

society is not net zero in 2050, as of today, there would be

significant risk that Shell may not meet this target.

Forward-Looking Non-GAAP measures

This announcement may contain certain

forward-looking non-GAAP measures such as IFRS, including

Adjusted Earnings, “Adjusted EBITDA”, Cash flow from operating

activities excluding working capital movements, Cash capital

expenditure, Net debt and Underlying opex.

Adjusted Earnings and Adjusted EBITDA are

measures used to evaluate Shell’s performance in the period and

over time.

The “Adjusted Earnings” and Adjusted EBITDA are measures which aim

to facilitate a comparative understanding of Shell’s financial

performance from period to period by removing the effects of oil

price changes on inventory carrying amounts and removing the

effects of identified items.

Adjusted Earnings is defined as income/(loss) attributable to

shareholders adjusted for the current cost of supplies and

excluding identified items. “Adjusted EBITDA (CCS basis)” is

defined as “Income/(loss) for the period” adjusted for current cost

of supplies; identified items; tax charge/(credit); depreciation,

amortisation and depletion; exploration well write-offs and net

interest expense. All items include the non-controlling interest

component.

Cash flow from operating activities excluding working capital

movements is a measure used by Shell to analyse its operating cash

generation over time excluding the timing effects of changes in

inventories and operating receivables and payables from period to

period. Working capital movements are defined as the sum of the

following items in the Consolidated Statement of Cash Flows: (i)

(increase)/decrease in inventories, (ii) (increase)/decrease in

current receivables, and (iii) increase/(decrease) in current

payables. Cash capital expenditure is the sum of the following

lines from the Consolidated Statement of Cash flows: Capital

expenditure, Investments in joint ventures and associates and

Investments in equity securities. Net debt is defined as the sum of

current and non-current debt, less cash and cash equivalents,

adjusted for the fair value of derivative financial instruments

used to hedge foreign exchange and interest rate risks relating to

debt, and associated collateral balances. Underlying operating

expenses is a measure of Shell’s cost management performance and

aimed at facilitating a comparative understanding of performance

from period to period by removing the effects of identified items,

which, either individually or collectively, can cause volatility,

in some cases driven by external factors. Underlying operating

expenses comprises the following items from the Consolidated

statement of Income: production and manufacturing expenses;

selling, distribution and administrative expenses; and research and

development expenses and removes the effects of identified items

such as redundancy and restructuring charges or reversals,

provisions or reversals and others.

We are unable to provide a reconciliation of

these forward-looking Non-GAAP measures to the most comparable GAAP

financial measures because certain information needed to reconcile

those Non-GAAP measures to the most comparable GAAP financial

measures is dependent on future events some of which are outside

the control of Shell, such as oil and gas prices, interest rates

and exchange rates. Moreover, estimating such GAAP measures with

the required precision necessary to provide a meaningful

reconciliation is extremely difficult and could not be accomplished

without unreasonable effort. Non-GAAP measures in respect of future

periods which cannot be reconciled to the most comparable GAAP

financial measure are calculated in a manner which is consistent

with the accounting policies applied in Shell plc’s consolidated

financial statements.

The contents of websites referred to in this announcement do not

form part of this announcement.

We may have used certain terms, such as

resources, in this announcement that the United States Securities

and Exchange Commission (SEC) strictly prohibits us from including

in our filings with the SEC. Investors are urged to consider

closely the disclosure in our Form 20-F, File No 1-32575, available

on the SEC website www.sec.gov.

LEI number of Shell plc:

21380068P1DRHMJ8KU70

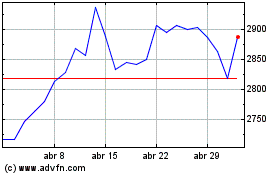

Shell (LSE:SHEL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Shell (LSE:SHEL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024