ASM announces third quarter 2024 results

29 Outubro 2024 - 2:00PM

UK Regulatory

ASM announces third quarter 2024 results

Almere, The Netherlands

October 29, 2024, 6 p.m. CET

AI-related demand drives robust growth in bookings and

revenue

ASM International N.V. (Euronext Amsterdam: ASM) today reports

its Q3 2024 results (unaudited).

Financial highlights

|

€ million |

Q3 2023 |

Q2 2024 |

Q3 2024 |

|

New orders |

627.4 |

755.4 |

815.3 |

|

yoy change % at constant currencies |

0% |

56% |

30% |

| |

|

|

|

|

Revenue |

622.3 |

706.1 |

778.6 |

|

yoy change % at constant currencies |

9% |

6% |

26% |

| |

|

|

|

|

Gross profit margin % |

48.1 % |

49.8 % |

49.4 % |

|

Adjusted gross profit margin 1 |

48.9 % |

49.8 % |

49.4 % |

| |

|

|

|

|

Operating result |

147.3 |

177.6 |

215.2 |

|

Operating result margin % |

23.7 % |

25.1 % |

27.6 % |

| |

|

|

|

|

Adjusted operating result 1 |

157.2 |

182.3 |

219.9 |

|

Adjusted operating result margin 1 |

25.3 % |

25.8 % |

28.2 % |

| |

|

|

|

|

Net earnings |

129.6 |

159.0 |

127.9 |

|

Adjusted net earnings 1 |

139.1 |

164.7 |

133.6 |

1 Adjusted figures are non-IFRS performance measures

(previously referred to as "normalized"). Refer to Annex 3 for a

reconciliation of non-IFRS performance measures.

- New orders of €815 million in Q3 2024 increased by 30% at

constant currencies (also 30% as reported) mainly driven by strong

demand for gate-all-around (GAA) and high-bandwidth memory

(HBM).

- Revenue of €779 million increased by 26% at constant currencies

(increased by 25% as reported) from Q3 of last year and at the

upper end of the guidance (€740-780 million).

- YoY improvement in adjusted gross profit margin is due to mix

including slightly stronger-than-expected sales to China.

- Adjusted operating result margin increased to 28.2%, compared

to 25.3% in Q3 last year and increased from 25.8% last quarter

mainly due to higher revenue and a one-off positive result of €7

million related to the sale of a building.

- Revenue for Q4 2024 is expected to be in the range of €770-810

million.

Comment

"ASM delivered strong results against a backdrop of continued

mixed market conditions,” said Hichem M’Saad, CEO of ASM. “Revenue

increased 26% at constant currencies to €779 million in the third

quarter of 2024, which is a new quarterly high and at the upper end

of our guidance of €740-780 million. With a gross margin of 49.4%,

and ongoing focus on cost control, adjusted operating result

increased by 40% to €220 million compared to Q3 2023.

Orders were up 30% to €815 million in Q3 2024 compared to last

year's Q3, driven by a further increase in orders for

gate-all-around (GAA) technology and continued solid demand for

high-bandwidth memory (HBM) DRAM applications. Total orders were

ahead of our expectations at the start of the quarter due to some

bookings that were pulled in from Q4.

AI continues to be the dominant semiconductor end market driver,

while recovery in other markets such as PCs and smartphones is

still sluggish, and the automotive/industrial segments remain in a

cyclical downturn. AI is increasingly driving the demand for the

most advanced devices, both in logic/foundry and HBM DRAM, and this

plays to the strengths of ASM.

While recently announced capex reductions have somewhat impacted

the outlook for advanced logic/foundry spending, we still project a

substantial increase in our GAA-related sales in 2025. Leading

customers have reiterated their plans to ramp the GAA node in

high-volume manufacturing next year. With this transition we

continue to expect meaningful increases in our served available

market.

Sales and orders in China held up slightly better than expected in

Q3. We still expect sales in China to be lower in the second half

compared to the first half, and Q4 to be lower than Q3. While

visibility for FY 2025 is still limited, we currently assume sales

from Chinese customers to be moderately lower in the first half of

2025 compared to the second half of 2024.

For SiC Epi, we still expect a double-digit percentage increase in

sales in FY 2024, despite the current market slowdown in this

segment, and reflecting the contribution from previously won new

customers. We believe that SiC Epi remains an attractive long-term

growth market. ASM is well positioned, in particular on the back of

our recently launched PE2O8 SiC Epi tool, which combines our proven

best-in-class film performance with a new dual-chamber

high-productivity platform for 200mm applications."

Outlook

On a currency-comparable level, we project revenue of €770-810

million for Q4 2024. At constant currencies and taking into account

the guidance for Q4, we project revenue in the second half of 2024

to increase by slightly more than 15% compared to the first half,

and for FY 2024, we expect revenue to show a year-on-year increase

of approximately 10%.

For WFE spending, a slight increase is expected in 2024, followed

by continued growth in 2025. Based on this, we now expect revenue

to be in the range of €3.2-3.6 billion for 2025, in particular

driven by GAA related sales, and taking into account continued

mixed end market conditions. This compares to our previous revenue

target of €3.0-3.6 billion for 2025.

In terms of order intake we expect the level in Q4 to be again

solid, albeit lower than in the third quarter. GAA related orders

are expected to further increase, offset by a drop in China orders

and the effect of aforementioned order pull-ins in Q3.

Share buyback program

On February 27, 2024, ASM announced the authorization of a new

share buyback program of up to €150 million. The program started on

May 15, 2024, and was completed on July 25, 2024. In total, we

repurchased 228,389 shares at an average price of €656.77, under

the 2024 program.

About ASM

ASM International N.V., headquartered in Almere,

the Netherlands, and its subsidiaries design and manufacture

equipment and process solutions to produce semiconductor devices

for wafer processing, and have facilities in the United States,

Europe, and Asia. ASM International's common stock trades on the

Euronext Amsterdam Stock Exchange (symbol: ASM). For more

information, visit ASM's website at www.asm.com.

Cautionary note regarding forward-looking

statements: All matters discussed in this press release, except for

any historical data, are forward-looking statements.

Forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from those in the

forward-looking statements. These include, but are not limited to,

economic conditions and trends in the semiconductor industry

generally and the timing of the industry cycles specifically,

currency fluctuations, corporate transactions, financing and

liquidity matters, the success of restructurings, the timing of

significant orders, market acceptance of new products, competitive

factors, litigation involving intellectual property, shareholders

or other issues, commercial and economic disruption due to natural

disasters, terrorist activity, armed conflict or political

instability, changes in import/export regulations, epidemics,

pandemics and other risks indicated in the company's reports and

financial statements. The company assumes no obligation nor intends

to update or revise any forward-looking statements to reflect

future developments or circumstances.

This press release contains inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

Quarterly earnings conference call details

ASM will host the quarterly earnings conference

call and webcast on Wednesday, October 30, 2024, at 3:00 p.m.

CET.

Conference-call participants should pre-register

using this link to receive the dial-in numbers, passcode and a

personal PIN, which are required to access the conference call.

A simultaneous audio webcast and replay will be accessible at

this link.

- 20241029 ASM reports Q3 2024 results

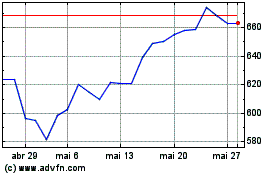

ASM International NV (EU:ASM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

ASM International NV (EU:ASM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025