Worldline: Q3 2024 revenue

Q3 2024 revenue

€ 1,163 million Group revenue, down 1.1%

organically

Underlying growth on Worldline core

activities remains positive

Mid-single digit organic growth in our core Merchant

Services activities

Growth in Financial Services excluding large one-off

re-insourcing

Continued acceleration in Mobility & Transactional

Services

Streamlined Group profile

Leaner organization fueled by Power24

Cost base ready for Free Cash Flow generation

acceleration

Ongoing execution to rebound and refocus

Worldline

Merchant Services new leadership

Management actions in place to address specific

challenges

Investment focused on value-added product roll-outs and

growth accelerators

Portfolio pruning on some peripheral assets

All 2024 objectives

confirmed

Organic revenue growth at c.1%

Adjusted EBITDA at c.€1.1bn

Free Cash-Flow at c.€0.2bn

Paris, La Défense, October 30 2024 –

Worldline [Euronext: WLN], a global leader in payment services,

today announces its revenue for the third quarter of

2024.

Marc-Henri Desportes, CEO of Worldline,

said: “Our Q3 results followed the trend we observed

during the summer and represent a point from which we will rebound

and refocus. The core of our business remains strong, while the

execution of Power24 ensures that we will start 2025 with an

optimized cost structure.

We concentrate our investments on this solid

core and take management actions on the isolated lower

growth areas. We therefore aim to return progressively to

mid-single-digit revenue growth in 2025. The arrival of Paul

Marriott-Clarke, our new head of Merchant Services, the launch of

embedded payments, and the ongoing set-up of our new CAWL joint

venture are important steps in that direction.

Finally, after ten years of actively

consolidating the payments landscape and with the aim to

refocus our group, the time has come to prune non-synergistic

peripheral activities.”

Q3 2024 revenue by Global Business

Line

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

Q3

2024 |

Q3

2023* |

Organic growth (Published) |

Organic growth (NNR) |

|

Ytd Q3

2024 |

Ytd Q3

2023* |

Organic growth (Published) |

Organic growth (NNR) |

|

Merchant Services |

867 |

865 |

+0.2% |

(2.7)% |

|

2,525 |

2,471 |

+2.2% |

+0.7% |

|

Financial Services |

211 |

230 |

(8.3)% |

(8.2)% |

|

668 |

694 |

(3.7)% |

(3.6)% |

|

Mobility & e-Transactional Services |

85 |

81 |

+4.9% |

+4.9% |

|

259 |

253 |

+2.2% |

+2.2% |

|

Worldline |

1,163 |

1,176 |

(1.1)% |

(3.4)% |

|

3,452 |

3,418 |

+1.0% |

(0.2)% |

* at constant scope and exchange

rates

Worldline’s Q3 2024 revenue reached €

1,163 million, representing -1.1% organic

growth. The Merchant Services division’s performance was

slightly positive despite a challenging macro-economic backdrop. On

the one hand, business was resilient in some key geographies, and

on the other hand it was negatively impacted by the termination of

merchant contracts (fully finalized end Q1’24) and by some

underperforming businesses for which management has taken decisive

actions. In Financial Services, an M&A driven re-insourcing

process at one of our largest customers drove a one-off negative

performance despite positive underlying growth in Issuing and

important wins in Instant Payment. Mobility & e-Transactional

Services benefitted from positive momentum, notably in France,

driven by differentiated offerings in Worldline Contact

solutions.

Merchant Services

Merchant Services’ revenue in

Q3 2024 reached € 867 million, representing

+0.2% organic growth (+c.5%

excluding merchant terminations and specific challenges) in a soft

consumption context in Europe. Worldline continued to win market

share in Southern Europe, while Central Europe recorded steady

growth. The segment’s more challenging businesses, namely

Asia-Pacific and some specific Online verticals, as well as the

merchant terminations that had started in Q3’23 and finalized end

Q1’24, weighed on overall organic growth. The performance by

division was the following:

- Commercial

Acquiring: dynamic underlying growth driven notably by Central

Europe (Germany and Switzerland) and Southern Europe, although

impacted overall, as expected, by the termination of merchant

contracts and slower activity in APAC.

- Payment

Acceptance: this segment performed softly, mainly due to a

marked slowdown in the Travel and Gaming online verticals.

- Digital

Services: deceleration linked notably to temporary POS

sourcing delays.

Worldline continued to record new wins during

the quarter, such as Appart’City Emirates, Air Transat, Avantida

and CCP.

Financial Services

Q3 2024 revenue in Financial

Services came in at € 211 million, representing

-8.3% organic growth. This figure, when excluding

the re-insourcing impact, was +c.1 %. The continued positive

momentum in acquiring and issuing processing was more than offset

by the large one-off re-insourcing process in Account Payments

activity. The performance by division was the following:

- Card-based

payment processing activities (Issuing Processing and

Acquiring Processing): continued to deliver mid to high

single digit growth thanks to the solid contribution of volumes and

new projects notably in Germany, Italy and the Netherlands. The

pipeline remains strong.

- Digital

Banking: Lower activity, mainly due to decreasing volumes in

France and the Netherlands, overshadowing higher customer demand

for Sanctions Securities and Monitoring solutions.

- Account

Payments: activity was impacted by lower volumes linked to the

one-off re-insourcing of a large client, while the rest of the

business grew slightly thanks notably to new wins in instant

payments.

On the commercial front, Worldline has signed

new contracts with Anadolubank Nederland N.V., Bank of China (Hong

Kong) and British Petroleum (fleet card authorization system).

Mobility & e-Transactional Services

Mobility & e-Transactional Services

revenue reached € 85 million,

up 4.9% organically, mainly driven by increased

activity in France in Trusted Services and

Omnichannel interactions. The performance by division was the

following:

- Trusted

Services: good growth in France thanks to increased activity

in our e-education digital workplace and in Germany driven by our

cryptographic solution for e-health and security hardware

sales.

- Transport

& Mobility: slightly decelerating with lower activity in

the rail industry partly offset by increased volumes in ticketing

in France.

- Omnichannel

interactions: strong growth supported by higher volumes and

project deliveries.

In terms of business developments, two large

companies have extended their partnership with Worldline’s Contact

solution: BNP Paribas Group and Diot-Siaci.

Streamlined Group profile

The Power24 reorganisation was fully delivered

in Q3, as planned.

Implementation cash costs will remain unchanged at € 250

million, and we confirm the € 220 million run rate of cash

costs savings in 2025 at a minimum.

In parallel, we are executing structural actions

to improve our cash generation, with particular attention to capex

prioritization towards growth initiatives and a continuous decrease

of Integration and rationalization costs. These actions constitute

a solid base from which Worldline will accelerate its free cash

flow generation in the coming years.

Ongoing execution to rebound and refocus

Worldline

New leadership for Merchant Services

On October 7, 2024, Worldline announced the

appointment of Paul Marriott-Clarke as the new head of Merchant

Services. M. Marriott-Clarke brings extensive expertise in the

world of banking and payments. He most recently led the Customer

& Digital business at Barclays UK, where he drove the bank’s

digital transformation, shifting the organization towards an agile

and customer-centric model. He had previously served as PayPal

Europe’s CEO and PayPal’s Chief Commercial Officer in the Europe,

Middle East, and Africa region.

M. Marriott-Clarke will lead a Merchant Services

segment that has been restructured into a more customer-focused

organization around go-to markets, namely large enterprises and

small and medium-sized businesses. The new management team will

focus on deploying a differentiated product offering adapted to

clients’ specific needs to accelerate revenue growth.

Management actions in place to address specific

challenges

Worldline’s Merchant Services activity has been

impacted by specific challenges, particularly in the Travel and

Gaming online verticals and in APAC, for which management

implemented action plans.

- In Australia,

the business is not meeting our expectations. A new management team

has been brought in and has started to turn the business around.

Repricing actions are being implemented in agreement with

Worldline’s local banking partner to factor in our cost increases

and secure a return to growth in Q4.

- In the online

business, revenue was held back notably by lower demand in the

Travel and Gaming verticals. Consequently, dedicated actions have

been put in place such as a profound work to accelerate customer

onboarding, i.e. volume ramp-up of already signed customers like

Google or Turkish Airlines.

- As previously

indicated, the impact of merchant terminations (maximum € 130

million on annual revenue) will no longer affect the reported

growth by end-Q1’25 and with already a lesser impact in Q4’24.

Investment focused on value-added product

roll-outs and growth accelerators

To secure Worldline's growth rebound, we are

accelerating the work already engaged in releasing new products

addressing new verticals or distribution channels while reinforcing

banking distribution networks through partnerships.

On the new products release side, while the

Group continues to successfully expand its Tap-on-Mobile solution,

new releases have been launched to address new verticals and

distribution channels, such as among others:

- Leveraging the

partnership with OPP, Worldline has launched an innovative Embedded

Payments solution in Europe for ISV’s and marketplaces. OPP,

coupled with Worldline's 50 years of payment expertise, will

provide a new solution covering the full revenue ecosystem from

global online acceptance to full acquiring capabilities. The

solution is easy to use and integrate, flexible, fully compliant

with the EU regulations particularly the GDPR, secure and flexible

and comes with a full range of value-added capabilities.

- The result of a

combined solution of Merchant Services and Financial Services,

Worldline has launched “Bank Transfer by Worldline”, a new

account-to-account payment method which will be available in 14

European countries by the end of 2024.

Regarding our banking distribution networks, the

implementation of the Group’s roadmap has been pursued to open new

markets (CAWL in France) or to reinforce our positions in new

markets, such as Italy where we continue to grow by over 20%.

- The development

of Worldline’s strategic partnership in France with the operational

set-up of CAWL, our joint-venture with Crédit Agricole, is fully

on-track and as per plan, and we confirmed its go live date in

2025.

- Worldline

continued its geographic expansion in 2024, particularly in Italy.

The CCB partnership signed in Q1’24 is a strategic development that

will ramp-up at the beginning of 2025 with the full migration of

circa 60,000 merchants’ portfolio on the Worldline platform. We

will pursue our development in Italy, which is a very promising

market and one of our highest growth contributors.

Portfolio pruning on some peripheral assets

After a decade of actively consolidating the

European payments landscape, Worldline's management and Board are

currently assessing the relevance of some peripheral assets in the

portfolio that may not enjoy many synergies with the Group’s other

businesses.

This analysis is driven by the Group’s strategic

refocusing, with an objective of orderly execution to generate

shareholder value.

2024 objectives confirmed

- Organic revenue

growth of around 1%.

- Adjusted EBITDA

of around € 1.1 billion.

- Free cash flow

of around € 0.2 billion.

Appendices

RECONCILIATION OF Q3 2023 STATUTORY

REVENUE WITH Q3 2023 REVENUE AT CONSTANT SCOPE AND EXCHANGE

RATES

For the analysis of the Group’s performance, Q3 2023 revenue at

constant scope and exchange rates as presented below per Global

Business Lines:

|

|

|

Revenue |

|

|

|

|

|

|

|

|

In € million |

|

Q3 2023 |

Scope effects** |

Exchange rates effects |

Q3 2023* |

|

Merchant Services |

|

868 |

-0.5 |

-3.2 |

865 |

|

Financial Services |

|

232 |

-2.7 |

+0.3 |

230 |

|

Mobility & e-Transactional Services |

|

81 |

+0.0 |

+0.3 |

81 |

|

Worldline |

|

1,182 |

-3.2 |

-2.6 |

1,176 |

|

* At constant scope and September 2024 YTD average exchange

rates |

|

|

|

|

|

|

** At December 2023 YTD average exchange rates |

|

|

|

|

|

Exchanges rates effect in Q3 were mainly due to

appreciation of Swiss France and depreciation of Turkish Lira while

scope effects are mainly related to scope adjustment in the

Financial Services division.

2023 ESTIMATED PRO FORMA

FY 2023 estimated pro forma at constant scope is presented below

(per Global Business Lines):

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 |

|

Q2 |

|

H1 |

|

Q3 |

|

Ytd Q3 |

|

Q4 |

|

H2 |

|

FY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Merchant Services |

|

757 |

|

849 |

|

1,606 |

|

865 |

|

2,471 |

|

850 |

|

1,715 |

|

3,321 |

|

Financial Services |

|

229 |

|

235 |

|

464 |

|

230 |

|

694 |

|

245 |

|

475 |

|

939 |

|

Mobility & e-Transactional Services |

|

84 |

|

88 |

|

172 |

|

81 |

|

253 |

|

90 |

|

171 |

|

343 |

|

Worldline |

|

1,070 |

|

1,172 |

|

2,242 |

|

1,176 |

|

3,418 |

|

1,185 |

|

2,361 |

|

4,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

Adjusted EBITDA |

|

Adjusted EBITDA |

|

Merchant Services |

|

|

|

|

|

400 |

|

|

|

|

|

|

|

448 |

|

848 |

|

Financial Services |

|

|

|

|

|

125 |

|

|

|

|

|

|

|

148 |

|

273 |

|

Mobility & e-Transactional Services |

|

|

|

|

24 |

|

|

|

|

|

|

|

24 |

|

48 |

|

Corporate costs |

|

|

|

|

|

-30 |

|

|

|

|

|

|

|

-29 |

|

-59 |

|

Worldline |

|

|

|

|

|

518 |

|

|

|

|

|

|

|

591 |

|

1,109 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In % of revenue |

|

|

|

|

|

Adjusted EBITDA % |

|

|

|

|

|

|

|

Adjusted EBITDA % |

|

Adjusted EBITDA % |

|

Merchant Services |

|

|

|

|

|

24.9% |

|

|

|

|

|

|

|

26.1% |

|

25.5% |

|

Financial Services |

|

|

|

|

|

26.9% |

|

|

|

|

|

|

|

31.2% |

|

29.1% |

|

Mobility & e-Transactional Services |

|

|

|

|

13.7% |

|

|

|

|

|

|

|

14.2% |

|

13.9% |

|

Corporate costs |

|

|

|

|

|

-1.3% |

|

|

|

|

|

|

|

-1.2% |

|

-1.3% |

|

Worldline |

|

|

|

|

|

23.1% |

|

|

|

|

|

|

|

25.0% |

|

24.1% |

Main components of the scope effects in 2023

estimated pro forma:

Banco Desio added contribution of 3 months

(integrated for 9 months in 2023 reported).

Scope adjustment within Financial Services division in Q3 2024.

PUBLISHED REVENUE TO NET NET

REVENUE

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

Q3 2024 Published |

Schemes & Partners fees |

Q3 2024 Net Net |

|

Q3 2023 Published* |

Schemes & Partners fees |

Q3 2023 Net Net |

|

OG% Q3 Published |

OG% Q3 Net Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchant Services |

867 |

(238) |

629 |

|

865 |

(218) |

647 |

|

+0.2% |

(2.7)% |

|

Financial Services |

211 |

(2) |

209 |

|

230 |

(3) |

227 |

|

(8.3)% |

(8.2)% |

|

Mobility & e-Transactional Services |

85 |

|

85 |

|

81 |

|

81 |

|

+4.9% |

+4.9% |

|

Revenue |

1,163 |

(240) |

923 |

|

1,176 |

(221) |

955 |

|

(1.1)% |

(3.4)% |

|

* at constant scope and exchange rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

Ytd Q3 2024 Published |

Schemes & Partners fees |

Ytd Q3 2024 Net Net |

|

Ytd Q3 2023 Published* |

Schemes & Partners fees |

Ytd Q3 2023 Net Net |

|

OG% Ytd Q3 Published |

OG% Ytd Q3 Net Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchant Services |

2,525 |

(660) |

1,865 |

|

2,471 |

(618) |

1,853 |

|

+2.2% |

+0.7% |

|

Financial Services |

668 |

(7) |

661 |

|

694 |

(8) |

685 |

|

(3.7)% |

(3.6)% |

|

Mobility & e-Transactional Services |

259 |

|

259 |

|

253 |

|

253 |

|

+2.2% |

+2.2% |

|

Revenue |

3,452 |

(666) |

2,785 |

|

3,418 |

(626) |

2,792 |

|

+1.0% |

(0.2)% |

|

* at constant scope and exchange rates |

|

|

|

|

|

|

|

|

|

Schemes & Partners fees = scheme fees +

kickbacks PM03 + full buy-rate

FORTHCOMING EVENTS

- 26 February

2025: FY 2024

results

INVESTOR RELATIONS

Laurent Marie

E laurent.marie@worldline.com

Peter Farren

E peter.farren@worldline.com

Guillaume Delaunay

E guillaume.delaunay@worldline.com

COMMUNICATION

Sandrine van der Ghinst

E sandrine.vanderghinst@worldline.com

Hélène Carlander

E helene.carlander@worldline.com

ABOUT WORLDLINE

Worldline [Euronext: WLN] helps businesses of

all shapes and sizes to accelerate their growth journey – quickly,

simply, and securely. With advanced payment technology, local

expertise, and solutions customised for hundreds of markets and

industries, Worldline powers the growth of over one million

businesses worldwide. Worldline generated a 4.6 billion euros

revenue in 2023. worldline.com

Worldline’s corporate purpose (“raison d’être”)

is to design and operate leading digital payment and transactional

solutions that enable sustainable economic growth and reinforce

trust and security in our societies. Worldline makes them

environmentally friendly, widely accessible, and supports social

transformation.

FOLLOW US

DISCLAIMER

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group's expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviours. Any forward-looking

statements made in this document are statements about Worldline’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Worldline’s plans, objectives, strategies, goals, future events,

future revenues or synergies, or performance, and other information

that is not historical information. Actual events or results may

differ from those described in this document due to a number of

risks and uncertainties that are described within the 2022

Universal Registration Document filed with the French Autorité des

marchés financiers (AMF) on April 30, 2024, under the filling

number: D.24-0377 and its Amendment filed on August 2, 2024, under

number D.24-0377-A01.

Revenue organic growth and Adjusted EBITDA

improvement are presented at constant scope and exchange rate.

Adjusted EBITDA is presented as defined in the 2023 Universal

Registration Document. All amounts are presented in € million

without decimal. This may in certain circumstances lead to

non-material differences between the sum of the figures and the

subtotals that appear in the tables. 2024 objectives are expressed

at constant scope and exchange rates and according to Group’s

accounting standards.

Worldline does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document is disseminated for information

purposes only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any securities in the United

States or any other jurisdiction. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S. Securities

Act”) or the securities laws of any U.S. are exempt from

registration. The securities that may be offered in any transaction

have not been and will not be registered under the U.S. Securities

Act or the securities laws of any U.S. state and Worldline does not

intend to make a public offering of any such securities in the

United States.

- 20241030 - Worldline - Q3 2024 revenue - Press Release

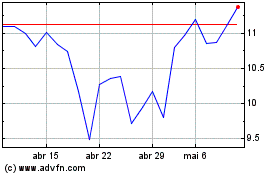

Worldline (EU:WLN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Worldline (EU:WLN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024