SOITEC REPORTS SECOND QUARTER REVENUE AND HALF-YEAR RESULTS OF

FISCAL YEAR 2025

SOITEC REPORTS SECOND QUARTER REVENUE

AND

HALF-YEAR RESULTS OF FISCAL YEAR 2025

- H1’25 revenue amounted to

€338m, down 15% at constant exchange rates and perimeter

year-on-year, in line with guidance, and down 16% on a reported

basis

- Q2’25 revenue reached €217m,

down 9% at constant exchange rates and perimeter compared to Q2’24

and up 89% sequentially at constant exchange rates and

perimeter

- H1’25

EBITDA1

margin2 at

33.4%, up 40bps compared to H1’24

- H1’25 Free Cash Flow

increased by €120m year on year to +€35m while maintaining strong

R&D and industrial investments

- H1’25 current EBIT reached

€28m

- FY’25 revenue and

EBITDA1 guidance

confirmed: revenue expected to be stable year-on-year at constant

exchange rates and perimeter, and

EBITDA1

margin2

expected at around 35%

- FY’25 planned capex slightly

reduced from €250m to €230m

Bernin (Grenoble), France, November

20th,

2024 – Soitec (Euronext Paris), a world leader in

designing and manufacturing innovative semiconductor materials,

today announced its revenue for the second quarter of fiscal year

2025 and its half-year results of fiscal year 2025 (ended on

September 30th, 2024). The interim consolidated

financial statements3 were approved by the Board of

Directors during its meeting today.

Pierre Barnabé, Soitec’s CEO, commented: “As

announced, after reaching the bottom in the first quarter, the

rebound of second quarter revenue enabled the first half of the

fiscal year to be in line with our expectations. Although sales

continued to be impacted by the RF-SOI inventory correction, and

the weak Automotive market, we have benefited from the increasing

POI penetration and from the fast-growing data center market. The

product portfolio diversification provided strong resilience of

business strength and enabled the company to continue its growth in

diversified end markets.

Despite lower revenue, our cash

generation proved solid, allowing us to keep investing both in

industrial capacity and in R&D to be ready to capture future

growth, while maintaining a healthy balance sheet. We are confident

in our ability to extend our rebound in the second part of our

fiscal year, notably in the fourth quarter, as the situation of

RF-SOI inventory level started to improve, allowing us to achieve

our stable full-year revenue guidance together with around 35%

EBITDA margin.

For calendar year 2025, we

anticipate different dynamics across our three end markets, with

Mobile Communications market expected to continue to slightly

improve, Automotive & Industrial market weakness persisting

through the first half of the year, and Cloud AI investments to

remain at elevated levels.

Thereafter, our mid-term ambition to

reach 2 billion dollars revenue will continue to be supported by

the increasing adoption of engineered substrates, to deliver more

powerful and energy-efficient solutions to a higher number of

customers across our three end markets”,

added Pierre Barnabé.

Second quarter FY’25 consolidated

revenue

|

Q2’25 |

Q2’24 |

Q2’25/Q2’24 |

|

|

|

|

|

| (Euros

millions) |

|

|

change reported |

chg. at const. exch. rates &

perimeter |

|

|

|

|

|

| Mobile

Communications |

124 |

169 |

-27% |

-25% |

| Automotive

& Industrial |

33 |

38 |

-13% |

-11% |

| Edge &

Cloud AI |

61 |

37 |

+62% |

+66% |

|

|

|

|

|

|

Revenue |

217 |

245 |

-11% |

-9% |

Soitec revenue reached 217 million Euros in

Q2’25, down 11% on a reported basis compared with 245 million Euros

achieved in Q2’24. This reflects a 9% year-on-year decline at

constant exchange rates and perimeter4 and a negative

currency impact of -2%. Decline in Mobile Communications, and to a

lesser extent in Automotive & Industrial, was partially

compensated for by a very strong performance in Edge & Cloud AI

(previously named Smart Devices).

The expected rebound performed in Q2’25, with an

89% sequential organic growth, confirmed that Soitec reached the

bottom of its cycle in Q1’25.

Mobile

Communications

In Q2’25, Mobile Communications revenue reached

124 million Euros, down 25% year-on-year at constant exchange

rates compared to Q2’24. It however increased by 76 million Euros

against the 48 million Euros achieved in Q1’25, reflecting the

progress in inventory correction at Soitec customers.

In the context of a recovering smartphone

market, and progressive improvement in Soitec customers’ inventory

absorption, volumes of RF-SOI wafers sales have

picked up significantly from the weak Q1’25. They remained however

much lower than in Q2'24, in line with the Group’s expectations.

Soitec remains confident in further inventory absorption to take

place in H2’25 and expects growth in RF-SOI sales to resume,

supporting the Group’s full-year guidance.

On the other hand, sales of POI

(Piezoelectric-on-Insulator) wafers dedicated to RF

filters continued to grow sequentially, translating into a sharp

year-on-year increase against Q2’24. POI activity benefits from a

strong demand in China and from Soitec’s engagement with all

leading US fabless companies. Soitec currently has ten active

customers, and over ten more are in qualification phase.

Sales of FD-SOI wafers,

designed to equip front end modules integrated in both 5G Sub-6 GHz

and 5G mmWave smartphones, have picked up from the low level

recorded in Q1’25, also showing growth against Q2’24.

Automotive &

Industrial

Automotive & Industrial revenue reached 33

million Euros in Q2’25, down 11% year-on-year at constant exchange

rates compared to Q2’24, reflecting the softness in the automotive

market.

Power-SOI wafer sales increased

as compared to the low level recorded in Q1’25 but were lower than

Q2’24, driven by lower volumes in a context of the ongoing softness

in the automotive market. Power-SOI remains a key component for

gate drivers, in vehicle networking and increasingly Battery

Management ICs, supported by an increasing number of foundries and

IDMs worldwide.

In Q2’25, FD-SOI wafer sales,

which continue to be mostly driven by adoption for automotive

microcontrollers, radar and wireless connectivity, recorded another

good performance, stable against Q1’25 and up compared to

Q2’24.

Further

SmartSiCTM samples and

prototypes were delivered during Q2’25, paving the way for device

qualifications and wafer production ramp-up to gradually intensify,

driven by customer demand.

Edge & Cloud

AI

Edge & Cloud AI revenue reached 61 million

Euros in Q2’25, up 66% at constant exchange rates compared to

Q2’24, and up 38% on sequential basis compared to Q1’25.

Sales of FD-SOI wafers, which

remain driven by the demand for Edge AI devices across consumer and

industrial sectors, were above the level reached in Q2’24,

capitalizing on the strong momentum in the build-up of the FD-SOI

ecosystem across the industry.

Sales of Photonics-SOI wafers

were particularly strong in Q2’25, much higher than in Q2’24 and

Q1’25. This reflects the need for more powerful and more

energy-efficient data centers to support the exponential growth of

AI-related computing power capabilities. Photonics-SOI is now a

standard technology platform for high-speed and high bandwidth

optical interconnections in data centers, adopted in pluggable

optical transceivers, and used for the development of Co-Packaged

Optics.

Sales of Imager-SOI wafers for

3D imaging applications were higher than in Q2’24, benefitting from

a low base effect.

H1’25 consolidated revenue

|

H1’25 |

H1’24 |

H1’25/H1’24 |

|

|

|

|

|

| (Euros

millions) |

|

|

change reported |

chg. at const. exch. rates &

perimeter |

|

|

|

|

|

| Mobile

Communications |

172 |

258 |

-33% |

-32% |

| Automotive

& Industrial |

59 |

75 |

-21% |

-20% |

| Edge &

Cloud AI |

107 |

68 |

+56% |

+57% |

|

|

|

|

|

|

Revenue |

338 |

401 |

-16% |

-15% |

Consolidated revenue reached

338 million Euros in H1'25, down 16% on a reported basis compared

to 401 million Euros in H1'24. This reflects a 15% decline at

constant exchange rates and perimeter5, in line with

Soitec’s guidance, and a slightly negative currency impact of

-1%.

The decrease in revenue essentially reflects

lower volumes in both RF-SOI and Power-SOI due to persisting

inventory digestion across the smartphone value chain and a softer

automotive market, partly offset by strong performance in POI,

FD-SOI, Imager-SOI and Photonics-SOI. This strong performance from

Soitec’s increasingly diversified product portfolio results in a

more balanced revenue profile among the three end markets:

- Mobile

Communications revenue reached 172 million Euros in H1'25,

down 33% on a reported basis and down 32% at constant exchange

rates compared to H1'24. Mobile communications represented 51% of

total revenue against 64% in H1'24. This lower proportion notably

derives from weaker RF-SOI volumes in connection with further

inventory adjustment at customers, despite increasing penetration

of 5G smartphones. RF-SOI performance was partly offset by a strong

acceleration in POI wafer sales and, to a lesser extent, by

slightly higher FD-SOI wafer sales.

- Automotive &

Industrial revenue amounted to 59 million Euros in H1'25,

down 21% on a reported basis and down 20% at constant exchange

rates compared to H1'24. Automotive & Industrial represented

17% of total revenue against 19% in H1'24. This lower performance

was essentially driven by a weak automotive market despite

increasing adoption and higher content of Soitec’s products per

vehicle.

- Edge & Cloud

AI revenue reached 107 million Euros in H1'25, up

56% on a reported basis and up 57% at constant exchange rates

compared to H1'24. Edge & Cloud AI represented 32% of total

revenue against 17% in H1'24. This increase in revenue was driven

by higher sales of Photonics-SOI wafers, which benefit from the

rapidly growing needs of data centers to address the expansion of

AI-related computing power capabilities, and by an uptick in

Imager-SOI sales due to non-linear demand over the year.

EBITDA1

margin2 at a

robust level

Consolidated income statement (part

1)

| (Euros

millions) |

H1’25 |

H1’24 |

% change |

|

|

|

|

|

Revenue |

338 |

401 |

-16% |

|

|

|

|

|

|

|

|

| Gross

profit |

101 |

144 |

-30% |

| As a % of

revenue |

30.0% |

36.0% |

|

|

|

|

|

| Net research

and development expenses |

(43) |

(34) |

+26% |

| Selling,

general and administrative expenses |

(31) |

(25) |

+22% |

|

|

|

|

|

|

|

|

|

Current operating income |

28 |

85 |

-67% |

| As a % of

revenue |

8.2% |

21.3% |

|

|

|

|

|

|

|

|

|

|

EBITDA1,6 |

113 |

132 |

-15% |

| As a % of

revenue |

33.4% |

33.0% |

|

Mainly reflecting lower revenue, but also

increased R&D investment, the current operating

income went down from 85 million Euros in H1'24 to 28

million Euros in H1'25.

- Gross profit

reached 101 million Euros, down from 144 million Euros in H1'24.

Gross margin declined by 6 points to 30.0% of revenue. The weaker

level of activity recorded in H1'25 resulted in a lower utilization

of Soitec industrial capacity. In addition, depreciation costs were

up, reflecting the Group’s current investment profile. These

factors were partly offset by strong cost management, some agility

in resource allocation between plants and higher subsidies.

- Net R&D

expenses increased from 34 million Euros in H1'24 to 43

million Euros in H1'25 (12.6% of revenue). Gross R&D expenses

before capitalization went up 19% to 77°million Euros, illustrating

Soitec’s ambition to continue to invest in new products

development, in the next generation of SOI products, in compound

semiconductors (notably POI, SiC and GaN), as well as in the

development of new engineered substrates. The lower proportion of

capitalized R&D spending was more than offset by the

recognition of higher R&D subsidies and higher prototype

sales.

- Selling, general and

administrative (SG&A) expenses amounted to 31 million

Euros in H1'25 (9.2% of revenue) up from 25 million Euros in

H1'24, essentially due to non-recurring positive effects in H1’24

and higher depreciation expenses.

The

EBITDA1,6 amounted to

113 million Euros in H1'25, down 15% from 132 million Euros in

H1'24. EBITDA1 margin2 remained at a robust

level, reaching 33.4%, 40 basis points above the level of 33.0%

recorded in H1'24. The combination of a lesser absorption of fixed

costs due to lower volumes and higher level of R&D investments,

as evidenced by the lower current operating margin, was offset by

higher non-cash items, notably depreciation costs.

Consolidated income statement (part

2)

| (Euros

millions) |

H1’25 |

H1’24 |

% change |

|

|

|

|

|

|

|

|

|

|

|

Current operating income |

28 |

85 |

-67% |

|

|

|

|

|

|

|

|

| Other

operating income / (expenses) |

(4) |

1 |

|

|

|

|

|

|

|

|

|

|

Operating income |

23 |

86 |

-73% |

|

|

|

|

| Net financial

result |

(8) |

2 |

|

| Income

tax |

(2) |

(8) |

|

|

|

|

|

|

|

|

|

| Net

profit from continuing operations |

14 |

80 |

-83% |

|

|

|

|

| Net profit

from discontinued operations |

0 |

(0) |

|

|

|

|

|

|

|

|

|

| Net

profit, Group share |

14 |

80 |

-83% |

|

|

|

|

|

|

|

|

| Basic

earnings per share (in €) |

0.39 |

2.24 |

-83% |

|

|

|

|

|

Diluted earnings per share (in €) |

0.39 |

2.19 |

-82% |

|

|

|

|

|

|

|

|

| Weighted

average number of ordinary shares |

35,677,855 |

35,620,925 |

|

|

|

|

|

| Weighted

average number of diluted ordinary shares |

35,752,384 |

37,623,199 |

|

Other operating expenses

amounted to 4 million Euros in H1’25. They correspond to an

impairment of Dolphin Design goodwill.

The net

financial result came as an

expense of 8 million Euros in H1'25 compared to an income of

2 million Euros in H1'24. Interest on cash investments and

other financial income are almost stable at 10 million Euros, as

are net financial expenses of 12 million Euros. The change in net

financial result essentially reflects the difference between the

net foreign exchange loss of 6 million Euros recorded in H1'25 and

the foreign exchange gain of 3 million Euros recorded in H1’24.

The income tax expense amounted

to 2 million Euros in H1'25 compared to 8 million Euros in H1'24.

This reflects an effective tax rate of 12% compared to 9% in H1'24,

the enforcement of the global minimum tax rule of 15% (Pillar 2)

having an impact of around 1 point.

In line with the decline in operating income,

the net profit amounted to 14 million in

H1'25.

Solid Free Cash Flow generation after constantly high

investments

Consolidated cash-flows

| (Euros

millions) |

H1’25 |

H1’24 |

|

|

|

| Continuing

operations |

|

|

|

|

|

|

EBITDA1,6 |

113 |

132 |

|

|

|

|

Inventories |

(65) |

(65) |

| Trade

receivables |

130 |

106 |

| Trade

payables |

(48) |

(105) |

| Other

receivables and liabilities |

9 |

(5) |

|

|

|

| Change in

working capital |

27 |

(69) |

| Tax paid |

(10) |

(19) |

|

|

|

|

|

|

| Net cash

generated by operating activities |

129 |

45 |

|

|

|

| Net cash used

in investing activities |

(94) |

(129) |

|

|

|

|

|

|

| Free

Cash Flow |

35 |

(85) |

|

|

|

|

|

|

| New loans and

debt repayment (including finance leases), drawing on credit

lines |

(36) |

(32) |

| Financial

expenses |

(7) |

(6) |

| Liquidity

contract and other items |

(1) |

(7) |

|

|

|

|

|

|

| Net cash (used

in) / generated from financing activities |

(44) |

(45) |

|

|

|

| Impact of

exchange rate fluctuations |

(4) |

2 |

|

|

|

|

|

|

|

|

|

| Net

change in cash |

(13) |

(127) |

The Group generated a positive Free Cash

Flow of 35 million Euros in H1'25, which represents an

improvement of 120 million Euros compared to the 85 million

Euros negative Free Cash Flow recorded in H1'24. Despite a lower

EBITDA1,6, this strong increase essentially comes as a

result of a much-improved change in working capital in H1’25, while

capital expenditure was maintained at a high level to support the

Group’s current expansion.

The cash inflow from working

capital amounted to 27 million Euros in H1'25, compared to

a 69 million Euros cash outflow in H1'24. This is essentially

reflecting:

- a strong 130

million Euros decrease in trade receivables, explained by the

seasonality of sales with a particularly high level of activity

recorded in the fourth quarter of FY’24; decrease was even higher

than in H1'24 (106 million Euros),

- the favorable

impact of subsidies cashed in during the period.

These were partially offset by:

- a seasonal

65 million Euros increase in inventories built to fuel the

expected rebound in the second part of the fiscal year (similar

level of increase as in the first half of FY’24),

- a 48 million

Euros decrease in trade payables (compared to a 105 million Euros

decrease in H1'24 which included non-recurring downpayments in

connection with the signing of new long-term supply

agreements).

The net cash used in investing

activities amounted to 94 million Euros in H1'25, compared

to 129 million Euros in H1'24. It takes into account the 10 million

Euros positive impact of financial income from cash investment (8

million Euros in H1'24). Including production equipment under

leases (17 million Euros in H1'25), total cash out related to

capital expenditure amounted to 120 million Euros, slightly below

the 138 million Euros spent in H1'24. Capital expenditure was

essentially related to industrial investments, including:

- the ongoing

phase 1 of Singapore 300-mm facility extension,

- additional POI

and SmartSiCTM manufacturing tools.

Capital expenditure also included investments

supporting the Group’s environmental policy, as well as IT

investments.

Net cash used in financing

activities amounted to 44 million Euros in H1'25

essentially reflecting a net decrease in borrowings and related

interest paid.

In total, including a 4 million Euros negative

impact of exchange rate fluctuations (2 million Euros positive

impact in H1'24), the net cash outflow was

moderate, reaching 13 million Euros in H1'25 (127 million Euros in

H1’24) resulting in a steady strong cash position

of 696 million Euros on September 30th, 2024.

Strong balance sheet

maintained

Soitec maintained a strong balance sheet as of

September 30th, 2024.

Shareholders’ equity stood at

1.5 billion Euros on September 30th, 2024. It was stable

compared to March 31st, 2024.

Following the sale of Dolphin Design IP

activities finalized in October 2024, and the signing of Dolphin

ASIC activities in November 2024, the assets and liabilities of

Dolphin Design activities have been classified in the Group’s

balance sheet as assets held for sales for 65 million Euros and

liabilities associated with assets held for sale for 33 million

Euros as of September 30th, 2024.

Financial debt on September

30th, 2024, was also stable at 747 million Euros

compared to 6 months before. The 49 million Euros net increase

in leasing debt was mainly offset by a total of 39°million Euros of

debt repayments as well as the 16 million Euros impact of the

classification of Dolphin Design liabilities as liabilities

associated with assets held for sale. Taking into account the 13

million Euros cash outflow recorded in H1'25, the net debt

position7 was kept at a

moderate level up from 39 million Euros on March 31st,

2024, to 51 million Euros on September 30th,

2024.

FY’25 revenue and EBITDA outlook

confirmed, capex revised slightly down

Soitec confirms anticipating

revenue to rebound in the second half of FY’25,

driven by the ongoing recovery of the RF-SOI activity following the

progressive end of the inventory correction among customers.

Besides, Soitec will continue to benefit from the strong structural

demand for Photonics-SOI and FD-SOI and the continued adoption of

POI. Consequently, Soitec confirms anticipating a stable

year-on-year revenue in FY’25.

Soitec also confirms expecting FY’25

EBITDA1

margin2 to be

around 35%

Expected annual capital

expenditure has been revised slightly down, at

around 230 million Euros, against 250 million

Euros initially planned, to reflect slower end market dynamics.

Q2’25 key events

Soitec kicks off European project to

develop future high-frequency semiconductors

On September 10th, 2024, a European

research and industry consortium led by Soitec began work to

develop a future generation of high-frequency semiconductors based

on Indium Phosphide (InP). These technologies are set to address

applications ranging from photonics for mega data centers and AI to

radio frequency front-ends and integrated antennas critical for 6G

mobile communication, Sub-THz radar sensing and beyond. Indium

phosphide (InP) devices can operate at frequencies approaching or

exceeding 1 terahertz (THz), offering superior speeds and increased

energy-efficiency compared to silicon technologies.

Soitec signs of a joint development agreement in

SmartSiC™ with Resonac to accelerate high-performance silicon

carbide adoption in next-generation electric

vehicles

On September 24th, 2024, Soitec signed an

agreement with Resonac Corporation (formerly Showa Denko K.K.) to

develop 200mm (8-inch) SmartSiC™ silicon carbide (SiC) wafers using

Resonac substrates and epitaxy processes, in a major step for the

deployment of Soitec’s high-yielding silicon carbide technology in

Japan and other international markets. SmartSiC™ silicon carbide is

a disruptive compound semiconductor material providing superior

performance and efficiency over silicon in high-growth power

applications for electric mobility and industrial processes. It

allows for more efficient power conversion, lighter and more

compact designs and overall system cost savings – all key factors

for success in electric vehicles and industrial systems.

Post-closing events

Divestment of Dolphin Design’s main

businesses

Under an agreement completed on October 31,

2024, between Jolt Capital and Dolphin Design, a Soitec subsidiary,

Dolphin Design’s mixed-signal IP activities have been acquired by

Jolt Capital, a private equity firm specializing in European

deeptech investments, via a newly created company, Dolphin

Semiconductor. The signing of the sale of Dolphin ASIC activities

was finalized with NanoXplore in November 2024, a major player in

SoC and FPGA semiconductor design.

The sale process is expected to be completed in

the second half of fiscal year 2024-2025.

Dolphin Design, acquired by Soitec in 2018, has

long been at the forefront of delivering cutting-edge semiconductor

design solutions in mixed-signal IP and ASICs.

The sale of Dolphin Design’s two main business

activities will support Soitec’s focus on strategic development and

growth opportunities in its core advanced semiconductor materials

business.

Appointment of Frédéric Lissalde as

Chairman of the Board

During the meeting of the Board of Directors

held on November 20, 2024 upon recommendation of the Compensation

and Nominations Committee, Frédéric Lissalde, who has been Director

since the Annual General Meeting held on July 23, 2024, was

appointed as Chairman of the Board of Directors as of March 1, 2025

for the remainder of his term of office as Director.

# # #

H1’25 results will be commented during

an analyst and investor conference call to be held on November

21st, 2024, at 8:00am

CET. The meeting will be conducted in English.

The live webcast and slide presentation will be

available on:

https://channel.royalcast.com/soitec/#!/soitec/20241121_1

# # #

Agenda

Q3’25 revenue is due to be published on February

5th, 2025, after market close.

# # #

Disclaimer

This document is provided by Soitec (the

“Company”) for information purposes only.

The Company’s business operations and

financial position are described in the Company’s Universal

Registration Document (which notably includes the Annual Financial

Report) which was filed on June 5th,

2024, with the French stock market authority (Autorité des Marchés

Financiers, or AMF) under number D.24-0462. The French version of

the 2023-2024 Universal Registration Document, together with

English courtesy translations for information purposes, are

available for consultation on the Company’s website

(www.soitec.com), in the section Company - Investors - Financial

Reports.

Your attention is drawn to the risk factors

described in Chapter 2.1 (Risk factors and controls mechanism) of

the Company’s Universal Registration Document.

This document contains summary information

and should be read in conjunction with the Universal Registration

Document.

This document contains certain

forward-looking statements. These forward-looking statements relate

to the Company’s future prospects, developments and strategy and

are based on analyses of earnings forecasts and estimates of

amounts not yet determinable. By their nature, forward-looking

statements are subject to a variety of risks and uncertainties as

they relate to future events and are dependent on circumstances

that may or may not materialize in the future. Forward-looking

statements are not a guarantee of the Company’s future performance.

The occurrence of any of the risks described in Chapter 2.1 (Risk

factors and controls mechanism) of the Universal Registration

Document may have an impact on these forward-looking

statements.

The Company’s actual financial position,

results and cash flows, as well as the trends in the sector in

which the Company operates may differ materially from those

contained in this document. Furthermore, even if the Company’s

financial position, results, cash-flows and the developments in the

sector in which the Company operates were to conform to the

forward-looking statements contained in this document, such

elements cannot be construed as a reliable indication of the

Company’s future results or developments.

The Company does not undertake any

obligation to update or make any correction to any forward-looking

statement in order to reflect an event or circumstance that may

occur after the date of this document.

This document does not constitute or form

part of an offer or a solicitation to purchase, subscribe for, or

sell the Company’s securities in any country whatsoever. This

document, or any part thereof, shall not form the basis of, or be

relied upon in connection with, any contract, commitment or

investment decision.

Notably, this document does not constitute

an offer or solicitation to purchase, subscribe for or to sell

securities in the United States. Securities may not be offered or

sold in the United States absent registration or an exemption from

the registration under the U.S. Securities Act of 1933, as amended

(the “Securities Act”). The Company’s shares have not been and will

not be registered under the Securities Act. Neither the Company nor

any other person intends to conduct a public offering of the

Company’s securities in the United States.

# # #

About Soitec

Soitec (Euronext - Tech Leaders), a world leader

in innovative semiconductor materials, has been developing

cutting-edge products delivering both technological performance and

energy efficiency for over 30 years. From its global headquarters

in France, Soitec is expanding internationally with its unique

solutions, and generated sales of 1 billion Euros in fiscal year

2023-2024. Soitec occupies a key position in the semiconductor

value chain, serving three main strategic markets: Mobile

Communications, Automotive and Industrial, and Edge & Cloud AI

(previously Smart Devices). The company relies on the talent and

diversity of its 2,300 employees, representing 50 different

nationalities, working at its sites in Europe, the United States

and Asia. Soitec has registered over 4,000 patents.

Soitec, SmartSiC™ and Smart Cut™ are registered

trademarks of Soitec.

For more information: https://www.soitec.com/en/

and follow us on X : @Soitec_Official

# # #

Investor Relations:

investors@soitec.com

|

Media contact:

Fabrice Baron

+33 6 14 08 29 81

fabrice.baron@omnicomprgroup.com |

# # #

Financial information and consolidated financial statements in

appendix include:

- Consolidated revenue per

quarter

- H1’25 consolidated income

statement

- Balance sheet at September

30th, 2024

- Consolidated cash

flows

Appendix 1 – Consolidated revenue per

quarter

| Quarterly

revenue |

Q1’24 |

Q2’24 |

Q3’24 |

Q4’24 |

Q1’25 |

Q2’25 |

|

H1’24 |

H1’25 |

(Euros millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile Communications |

89 |

169 |

130 |

222 |

48 |

124 |

|

258 |

172 |

|

Automotive°& Industrial |

37 |

38 |

44 |

44 |

26 |

33 |

|

75 |

59 |

| Edge & Cloud

AI |

31 |

37 |

65 |

70 |

46 |

61 |

|

68 |

107 |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

157 |

245 |

240 |

337 |

121 |

217 |

|

401 |

338 |

| Change in

quarterly revenue |

Q1’25/Q1’24 |

Q2’25/Q2’24 |

|

H1’25/H1’24 |

|

Reported

change |

Organic change1 |

Reported

change |

Organic change1 |

|

Reported

change |

Organic

change1 |

| (vs.

previous year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile Communications |

-45% |

-46% |

-27% |

-25% |

|

-33% |

-32% |

|

Automotive & Industrial |

-29% |

-31% |

-13% |

-11% |

|

-21% |

-20% |

| Edge & Cloud

AI |

+49% |

+47% |

+62% |

+66% |

|

+56% |

+57% |

|

|

|

|

|

|

|

|

|

Revenue |

-23% |

-24% |

-11% |

-9% |

|

-16% |

-15% |

- At constant exchange rates and comparable scope of

consolidation (there was no scope effect in H1’25 vs.

H1’24)

Consolidated financial statements for H1’25

As previously reported, Soitec’s refocus on

Electronics operations decided in January 2015 was nearly completed

on March 31st, 2016. Consequently, the

H1’25 residual income and expenses relating to Solar and Other

activities are reported under ‘Net result from discontinued

operations’, below the ‘Operating income’ line, meaning that down

to the line ‘Net result after tax from continuing operations’, the

consolidated income statement fully and exclusively reflects the

Electronics activity as well as the Group’s corporate functions

expenses. This was already the case in H1’24 financial

statements.

Appendix 2 - Consolidated income

statement

|

H1’25 |

H1’24 |

| (Euros

millions) |

(ended

Sept. 30, 2024) |

(ended

Sept. 30, 2023) |

|

|

|

|

|

|

| Revenue |

338 |

401 |

|

|

|

| Cost of

sales |

(236) |

(257) |

|

|

|

|

|

|

| Gross

profit |

101 |

144 |

|

|

|

| Research and

development expenses |

(43) |

(34) |

| Selling,

general and administrative expenses |

(31) |

(25) |

|

|

|

|

|

|

| Current

operating income |

28 |

85 |

|

|

|

| Other

operating income / (expenses) |

(4) |

1 |

|

|

|

|

|

|

| Operating

income |

23 |

86 |

|

|

|

| Financial

income |

10 |

12 |

| Financial

expenses |

(18) |

(11) |

|

|

|

|

|

|

| Net

financial income/(expense) |

(8) |

2 |

|

|

|

|

|

|

| Profit before

tax |

15 |

88 |

|

|

|

| Income

tax |

(2) |

(8) |

|

|

|

|

|

|

| Net profit

from continuing operations |

14 |

80 |

|

|

|

| Net profit

from discontinued operations |

0 |

(0) |

|

|

|

|

|

|

| Consolidated

net profit |

14 |

80 |

|

|

|

|

|

|

|

|

|

| Net profit,

Group share |

14 |

80 |

| Basic earnings

per share (in €) |

0.39 |

2.24 |

|

|

|

| Diluted

earnings per share (in €) |

0.39 |

2.19 |

|

|

|

| Weighted

average number of ordinary shares |

35,677,855 |

35,620,925 |

|

|

|

| Weighted

average number of diluted ordinary shares |

35,752,384 |

37,623,199 |

Appendix 3 - Balance sheet

|

Assets |

Sept. 30, 2024 |

March 31,

2024 |

| (Euros

millions) |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

| Intangible

assets |

126 |

156 |

| Property,

plant and equipment |

953 |

913 |

| Non-current

financial assets |

19 |

19 |

| Other

non-current assets |

53 |

70 |

| Deferred tax

assets |

62 |

62 |

|

|

|

|

|

|

| Total

non-current assets |

1,211 |

1,220 |

|

|

|

| Current

assets |

|

|

|

|

|

|

Inventories |

261 |

209 |

| Trade

receivables |

292 |

448 |

| Other current

assets |

76 |

101 |

| Current

financial assets |

6 |

7 |

| Cash and cash

equivalents |

696 |

708 |

| Assets held

for sale |

65 |

- |

|

|

|

|

|

|

| Total current

assets |

1,396 |

1,472 |

|

|

|

| Total

assets |

2,607 |

2,692 |

|

Equity and liabilities |

Sept. 30, 2024 |

March 31,

2024 |

| (Euros

millions) |

|

|

|

|

|

|

Equity |

|

|

|

|

|

| Share

capital |

71 |

71 |

| Share

premium |

228 |

228 |

| Reserves and

retained earnings |

1,198 |

1,180 |

| Other

reserves |

(7) |

15 |

|

|

|

|

|

|

|

Equity, Group Share |

1,491 |

1,495 |

|

|

|

|

|

|

| Total

equity |

1,491 |

1,495 |

|

|

|

|

Non-current liabilities |

|

|

|

|

|

| Long-term

financial debt |

678 |

669 |

| Provisions and

other non-current liabilities |

78 |

79 |

|

|

|

|

|

|

| Total

non-current liabilities |

756 |

748 |

|

|

|

| Current

liabilities |

|

|

|

|

|

| Short-term

financial debt |

69 |

78 |

| Trade

payables |

114 |

169 |

| Provisions and

other current liabilities |

144 |

202 |

| Liabilities

associated with assets held for sale |

33 |

- |

|

|

|

|

|

|

| Total current

liabilities |

360 |

449 |

|

|

|

|

|

|

| Total equity

and liabilities |

2,607 |

2,692 |

Appendix 4 - Consolidated cash

flows

|

H1’25 |

H1’24 |

| (Euros

millions) |

(ended

Sept. 30, 2024) |

(ended

Sept. 30, 2023) |

|

|

|

|

|

|

| Consolidated

net profit |

14 |

80 |

|

of which continuing operations |

14 |

80 |

|

|

|

| Depreciation

and amortization expense |

68 |

60 |

| Impairment

/(reversals of impairment) of non-current assets |

4 |

- |

| Provisions /

(reversals of provisions), net |

2 |

(4) |

| Provisions

expense / (reversal) for retirement benefit obligation, net |

0 |

0 |

| Gains on

disposals of assets |

1 |

- |

| Income

tax |

2 |

8 |

| Financial

expense / (income) |

8 |

(2) |

| Share-based

payments |

7 |

7 |

| Other non-cash

items |

7 |

(17) |

| Items related

to discontinued operations |

(0) |

0 |

|

|

|

|

|

|

|

EBITDA1 |

113 |

132 |

|

of which continuing operations |

113 |

132 |

|

|

|

|

|

|

| Increase /

(decrease) in cash relating to: |

|

|

|

|

|

|

Inventories |

(65) |

(65) |

| Trade

receivables |

130 |

106 |

| Trade

payables |

(48) |

(105) |

| Other

receivables and payables |

9 |

(5) |

| Income tax

paid |

(10) |

(19) |

| Changes in

working capital and income tax paid related to discontinued

operations |

(0) |

(0) |

|

|

|

|

|

|

| Change in

working capital and income tax paid |

16 |

(88) |

|

of which continuing operations |

16 |

(88) |

|

|

|

|

|

|

| Net cash

generated by operating activities |

129 |

44 |

|

of which continuing operations |

129 |

45 |

|

H1’25 |

H1’24 |

| (Euros

millions) |

(ended

Sept. 30, 2024) |

(ended

Sept. 30, 2023) |

|

|

|

|

|

|

| Net cash

generated by operating activities |

129 |

44 |

|

of which continuing operations |

129 |

45 |

|

|

|

| Purchases of

intangible assets |

(15) |

(23) |

| Purchases of

property, plant and equipment |

(88) |

(114) |

| Interest

received |

10 |

8 |

| Acquisitions

and disposals of financial assets |

(1) |

(0) |

| Divestment

flows related to discontinued operations |

0 |

0 |

|

|

|

|

|

|

| Net cash used

in investing activities (1) |

(93) |

(129) |

|

of which continuing operations (1) |

(94) |

(129) |

|

|

|

| Loans and

drawdowns on credit lines |

3 |

3 |

| Repayment of

borrowings and lease liabilities |

(39) |

(35) |

| Interest

paid |

(7) |

(6) |

| Liquidity

agreement |

- |

(8) |

| Change in

interest in subsidiaries without change of control |

(1) |

(0) |

| Other

financing flows |

(0) |

1 |

| Financing

flows related to discontinued operations |

(0) |

(0) |

|

|

|

|

|

|

| Net cash used

in financing activities |

(44) |

(45) |

|

of which continuing operations |

(44) |

(45) |

|

|

|

| Effects of

exchange rate fluctuations |

(4) |

2 |

|

|

|

|

|

|

| Net change in

cash |

(13) |

(127) |

|

of which continuing operations |

(13) |

(127) |

|

|

|

|

Cash at beginning of the period |

708 |

788 |

|

Cash at end of the period |

696 |

661 |

(1) Net cash used in investing activities is net of leases and

net of interest received. Total cash out related to capital

expenditure amounted to 120 million Euros in first-half 2024-2025

compared to 138 million Euros in first half 2023-2024.

1 The EBITDA represents operating income before

depreciation, amortization, impairment of non-current assets,

non-cash items relating to share-based payments, provisions for

impairment of current assets and for contingencies and expenses,

and disposals gains and losses. EBITDA is not a financial indicator

defined by IFRS and may not be comparable to EBITDA as reported by

other groups. It represents additional information and should not

be considered as a substitute for operating income or net cash

generated by operating activities.

2 EBITDA margin = EBITDA from continuing operations /

Revenue.

3 Review procedures were completed and the review

report is in the process of being issued.

4 There was no scope effect in Q2’25 vs. Q2’24

5 There was no scope effect in H1’25 vs. H1’24

6 EBITDA from continuing operations.

7 Financial debt less cash and cash equivalents

- Soitec PR H1'25 results VA

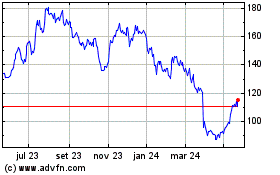

SOITEC (EU:SOI)

Gráfico Histórico do Ativo

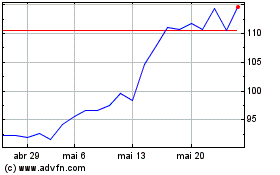

De Out 2024 até Nov 2024

SOITEC (EU:SOI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024