LVMH achieves a solid performance despite an unfavorable global

economic environment

. Revenue: €84.7 billion

. Profit from recurring operations:

€19.6 billion

. Free cash flow: €10.5 billion

. Acceleration in the fourth quarter, driven by Asia,

the United States and Europe

. Major economic and social impact in France and around

the world

Paris, January 28, 202

LVMH Moët Hennessy Louis Vuitton, the world’s

leading luxury goods group, recorded revenue of €84.7 billion

in 2024. Growth continued (+1% on an organic basis) despite a

challenging economic and geopolitical environment, as well as a

high basis of comparison following several years of exceptional

post-Covid growth. Europe and the United States posted growth on a

constant consolidation scope and currency basis; Japan saw

double-digit revenue growth; the rest of Asia reflected the strong

growth in spending by Chinese customers in Europe and Japan.

In the fourth quarter, organic revenue growth came to 1%,

accelerating with respect to the third quarter.

Profit from recurring operations for 2024 came

to €19.6 billion, equating to an operating margin of 23.1%,

significantly exceeding pre-Covid levels. Exchange rate

fluctuations had a substantial negative impact during the year,

particularly on Fashion & Leather Goods and Wines &

Spirits. The Group share of net profit amounted to

€12.6 billion. Free cash flow came to €10.5 billion, up

29%.

Bernard Arnault, Chairman and CEO of LVMH,

commented: “In 2024, amid an uncertain environment, LVMH showed

strong resilience. This capacity to weather the storm in highly

turbulent times – already illustrated on many occasions throughout

our Group’s history – is yet another testament to the strength and

relevance of our strategy. The creativity and very high quality of

our products, our steadfast commitment to excellence, the agility

of our teams and the good geographic balance of our locations

underpin the success of LVMH and its Maisons, backed by the

dedication of all our people. This dedication was also behind one

of the Group’s finest collective achievements of 2024: LVMH and its

Maisons’ partnership with the Paris 2024 Olympic and Paralympic

Games, which helped make the world’s foremost sports competition a

resounding success and showcased French expertise and craftsmanship

on the global stage. As part of our ongoing commitment to design,

culture and heritage, we were also glad to witness the reopening of

Notre-Dame Cathedral in Paris at the end of the year, even more

beautiful following its restoration, which took place with support

from donors including LVMH. We also recently celebrated the 10th

anniversary of the highly successful Fondation Louis Vuitton, which

has drawn 11 million visitors since it opened and maintained

its mission of making cultural events accessible to the widest

possible audience. While remaining highly vigilant with regard to

cost management and our single-minded focus on the desirability of

our designs, we enter 2025 with confidence. Guided by our mission –

‘Passionate about creativity’ – and our core values, the Group will

rely on the agility and talent of its teams to set the stage for

future success and further extend its leadership in the luxury

market.”

Highlights of 2024 included the

following:

Good resilience in a disrupted global

environment

- Continued organic revenue

growth.

- Growth in revenue in Europe and the

United States; exceptional growth in Japan nevertheless related to

a weak currency.

- Substantial negative impact on

profit arising from exchange rate fluctuations, particularly on

Fashion & Leather Goods and Wines & Spirits.

- 29% increase in operating free cash flow, which came to more

than €10 billion.

- Performance of Wines & Spirits

reflecting the ongoing normalization of demand that began in

2023.

- Solidity of Fashion & Leather Goods driven by the powerful

appeal of its products, with its operating margin remaining at an

exceptional level.

- Strong momentum in fragrances,

driven in particular by the success of Dior’s Sauvage,

which remained the world’s best-selling fragrance.

- Numerous innovations at all the Watches and Jewelry Maisons,

and continued investments in communications and in the evolution of

our stores.

- Remarkable performance by Sephora, which consolidated its

position as world leader in beauty retail.

New progress made under our

LIFE 360 environmental program

- Acceleration in the Group’s

circular design policy: 31% of materials used to make the Maisons’

products and their packaging now sourced through recycling

processes.

- Two years ahead of schedule, target

met for reducing absolute energy-related GHG emissions (Scopes 1

and 2): 55% reduction in 2024 with respect to 2019 (Target for

2026: 50% reduction).

- Water withdrawal for production

sites and workshops: 10% reduction with respect to 2023 (Target for

2030: 30% reduction).

- As part of the Group’s biodiversity

protection plan, flora and fauna habitat regenerated or restored

increased to 3.8 million hectares by year-end 2024 (Target for

2030: 5 million hectares).

Major economic and social impact in

France and around the world

- More than 215,000 employees

worldwide as of year-end 2024 (including nearly 40,000 employees in

France).

- France’s largest private-sector

recruiter.

- Preserving and passing on skills and expertise in more than 280

professions in design, craftsmanship and customer experience, with

over 3,300 apprentices trained by LVMH’s IME (Institut des Métiers

d’Excellence) program since its launch in 2014.

- Support for over 910 nonprofits and charitable foundations in

2024, with around 65,000 Group employees taking part in a community

involvement partnership, serving more than

1,900,000 people.

- Operating investments of €5.5 billion in 2024, mainly dedicated

to the expansion of the store network and the development of

production facilities, including €1.7 billion in France.

- 119 production facilities and craft

workshops in France.

- €6 billion in corporate tax paid

worldwide in 2024, around half of which in France.

Financial highlights

In millions of euros |

2023 |

2024 |

Change

2024/2023 |

|

Revenue |

86 153 |

84 683 |

-2%

Reported |

+1%

Organic |

|

Profit from recurring operations |

22 802 |

19 571 |

-14% |

|

Net profit, Group share |

15 174 |

12 550 |

-17% |

|

Operating free cash flow |

8 104 |

10 478 |

+29% |

|

Net financial debt |

10 746 |

9 228 |

-14% |

|

Equity |

62 701 |

69 287 |

+11% |

Revenue by business group changed as

follows:

|

In millions of euros |

2023 |

2024 |

Change

2024/2023

Reported Organic* |

|

Wines & Spirits |

6 602 |

5 862 |

-11% |

-8% |

|

Fashion & Leather Goods |

42 169 |

41 060 |

-3% |

-1% |

|

Perfumes & Cosmetics |

8 271 |

8 418 |

+2% |

+4% |

|

Watches & Jewelry |

10 902 |

10 577 |

-3% |

-2% |

|

Selective Retailing |

17 885 |

18 262 |

+2% |

+6% |

|

Other activities and eliminations |

324 |

504 |

- |

- |

|

Total LVMH |

86 153 |

84 683 |

-2% |

+1% |

* On a constant consolidation scope and currency basis. For

the Group, the impact of changes in scope with respect to 2023 was

-1% and the impact of exchange rate fluctuations was -2%.

Profit from recurring operations by business

group changed as follows:

In millions of euros |

2023 |

2024 |

Change 2024/2023 |

|

Wines & Spirits |

2 109 |

1 356 |

-36% |

|

Fashion & Leather Goods |

16 836 |

15 230 |

-10% |

|

Perfumes & Cosmetics |

713 |

671 |

-6% |

|

Watches & Jewelry |

2 162 |

1 546 |

-28% |

|

Selective Retailing |

1 391 |

1 385 |

0% |

|

Other activities and eliminations |

(409) |

(617) |

- |

|

Total LVMH |

22 802 |

19 571 |

-14% |

Wines & Spirits: Ongoing normalization of demand

that began in 2023

Revenue for Wines & Spirits

was down 8% (organic). Profit from recurring operations was down

36%, notably due to exchange rate fluctuations. After three

exceptional years, the post-Covid normalization of demand for

champagne and cognac, which began in 2023, continued amid a certain

slowdown in consumption and a more challenging market environment

in China. LVMH’s champagne houses maintained their market share of

more than 22% of all Champagne-appellation shipments. Revenue for

Hennessy cognac was held back by weaker local demand. In Provence

rosé wines, Château d’Esclans stepped up its international

expansion. The joint venture with Beyoncé Knowles-Carter gave rise

to a new American whisky, SirDavis. A partnership with French

Bloom, the market leader in premium alcohol-free sparkling wine,

was also announced.

Fashion & Leather Goods: Good

resilience

The Fashion & Leather Goods

business group, which was broadly stable in terms of organic growth

in 2024, showed solid resilience. Profit from recurring operations

was down 10%, mainly affected by exchange rate fluctuations. Louis

Vuitton and Christian Dior both enjoyed high visibility over the

summer with the Paris 2024 Olympic and Paralympic Games. Louis

Vuitton was once again driven by its remarkable capacity for

innovation in the world of travel: bespoke trunks, handcrafted in

its historic Asnières workshops, held the world’s most prestigious

sports trophies, such as those of the Louis Vuitton 37th America’s

Cup in Barcelona, as well as the torches and medals of the Paris

2024 Olympic and Paralympic Games. The Maison’s new flagship store

in New York was a major success, offering an immersive experience

in the world of Louis Vuitton. Christian Dior maintained its

creative momentum, fusing heritage and modernity. The L’Or de

Dior exhibition at the Guardian Art Center in Beijing honored

the Maison’s strong ties with China through the prism of art. New

My Dior designs inspired by Dior’s iconic cannage

stitching celebrated and reinterpreted traditional jewelry-making

craftsmanship. Dior celebrated the end-of-year holiday season with

spectacular façades and enchanting window displays around the

world, in particular at its 30 Montaigne store in Paris and at the

new Dior Gold House in Bangkok. Loro Piana, which celebrated one

hundred years of history and exceptional craftsmanship in 2024,

delivered a remarkable performance and decorated all the window

displays at Harrods at the end of the year. Loewe was buoyed by

growing brand awareness and the bold creativity of its collections.

Rimowa confirmed its excellent momentum. The Group welcomed two new

creative directors: Michael Rider at Celine and Sarah Burton at

Givenchy.

Perfumes & Cosmetics: Solid momentum

in fragrances; selective distribution strategy

maintained

The Perfumes & Cosmetics

business group achieved organic revenue growth of 4% in 2024 thanks

to the ongoing success of its flagship lines, powerful innovative

momentum and a selective distribution policy. Profit from recurring

operations was down 6%. Christian Dior delivered a very robust

performance. Sauvage continued to achieve solid growth,

consolidating its position as the world’s leading fragrance, while

Rihanna became the new face of iconic women’s perfume

J’adore. The new Miss Dior Parfum edition was a

major success. Makeup – in particular the Forever

foundation line – also contributed to the Maison’s good results.

Guerlain saw positive momentum in fragrances, driven in particular

by its L’Art & La Matière premium fragrance collection

and the addition of its new Florabloom scent to the

Aqua Allegoria line. Parfums Givenchy achieved further

growth, driven by fragrances and its Prisme Libre powder.

Maison Francis Kurkdjian opened a new showcase store on Rue

François 1er in Paris, while Fenty Beauty began its

development in China and launched a new range of haircare

products.

Watches & Jewelry: Further innovation in jewelry and

watches

Revenue for Watches &

Jewelry decreased by 2% on an organic basis in 2024.

Profit from recurring operations was down 28%, partly due to

ongoing investments in store renovations and communications, as

well as exchange rate fluctuations. Tiffany & Co. showcased its

iconic lines through its global “With Love, Since 1837” campaign.

The new Tiffany Titan by Pharrell Williams collection was

exceptionally well received, while a ring version of the

Bone cuff was unveiled to mark the 50th anniversary of

designs by Elsa Peretti. The new store concept continued to be

rolled out with great success; The Landmark – the Maison’s flagship

store on New York’s Fifth Avenue, and the first to be renovated –

achieved record-breaking revenue in 2024 and became the world’s

premier luxury store. Tiffany has seen revenue from high jewelry

quadruple since the Maison’s acquisition, and operating profit

double. Bulgari celebrated its 140th anniversary with the new

“Eternally Reborn” campaign and the launch of the Aeterna

high jewelry collection, which achieved record-breaking revenue.

The Maison also unveiled the new Tubogas jewelry

collection, a contemporary take on its iconic 1950s line. Chaumet

enjoyed high visibility thanks to its design of the medals for the

Paris 2024 Olympic and Paralympic Games. A 10-year global

partnership between LVMH and Formula 1 was announced, and in

2025, TAG Heuer will return as the Official Timekeeper of

Formula 1 for all its circuits worldwide.

Selective Retailing: Remarkable

performance by Sephora; DFS still held back by prevailing

international conditions

The Selective Retailing

business group posted organic revenue growth of 6% in 2024. Profit

from recurring operations remained stable. Sephora delivered a

remarkable performance, with double-digit growth in both revenue

and profit. Reaffirming its position as the world’s leading

fragrance and cosmetics retailer, the Maison continued to gain

market share. Its retail network continued to grow, most notably in

the United Kingdom and the United States, in particular through a

collaboration with Kohl’s. DFS, which saw business activity remain

below its 2019 pre-Covid level, was hard hit in particular by

exchange rate fluctuations. Le Bon Marché continued to develop,

achieving record levels of revenue, driven by the department

store’s differentiation strategy, with its continuously renewed

selection of products and services and unique slate of events.

Confidence for 2025

Despite a geopolitical and macroeconomic

environment that remains uncertain, the Group

remains confident and will pursue its brand

development-focused strategy, underpinned by continued innovation

and investment as well as an extremely exacting quest for

desirability and quality in its products and their highly selective

distribution.

Driven by the agility of its teams, their entrepreneurial spirit

and its well-diversified presence across the geographic areas in

which its customers are located, LVMH once again sets an objective

of reinforcing its global leadership position in luxury goods in

2025.

Dividend for 2024

At the Shareholders’ Meeting on April 17, 2025,

LVMH will propose a dividend of €13 per share. An interim dividend

of €5.50 per share was paid on December 4, 2024. The balance of

€7.50 per share will be paid on April 28, 2025.

The Board of Directors met on January 28 to

approve the financial statements for fiscal year 2024. Audit

procedures have been carried out and the audit report is being

issued.

Regulated information related to this press release, the

presentation of annual results and the “Financial Documents” report

are available at www.lvmh.com.

Details from the webcast on the publication of 2024 full-year

results are available at www.lvmh.com.

APPENDIX

The condensed consolidated financial statements for

2024 are included in the PDF version of the press release.

Revenue by business group and by

quarter

Revenue for 2024 (in millions of

euros)

|

Full-year 2024 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities

and eliminations |

Total |

|

First quarter |

1 417 |

10 490 |

2 182 |

2 466 |

4 175 |

(36) |

20 694 |

|

Second quarter |

1 391 |

10 281 |

1 953 |

2 685 |

4 457 |

216 |

20 983 |

|

First half |

2 807 |

20 771 |

4 136 |

5 150 |

8 632 |

181 |

41 677 |

|

Third quarter |

1 386 |

9 151 |

2 012 |

2 386 |

3 927 |

214 |

19 076 |

|

First nine months |

4 193 |

29 922 |

6 148 |

7 536 |

12 559 |

395 |

60 753 |

|

Fourth quarter |

1 669 |

11 139 |

2 270 |

3 041 |

5 703 |

108 |

23 930 |

|

Total 2024 |

5 862 |

41 060 |

8 418 |

10 577 |

18 262 |

504 |

84 683 |

Revenue for 2024 (organic change versus

same period in 2023)

|

Full-year 2024 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities

and eliminations |

Total |

|

First quarter |

-12% |

+2% |

+7% |

-2% |

+11% |

- |

+3% |

|

Second quarter |

-5% |

+1% |

+4% |

-4% |

+5% |

- |

+1% |

|

First half |

-9% |

+1% |

+6% |

-3% |

+8% |

- |

+2% |

|

Third quarter |

-7% |

-5% |

+3% |

-4% |

+2% |

- |

-3% |

|

First nine months |

-8% |

-1% |

+5% |

-3% |

+6% |

- |

+0% |

|

Fourth quarter |

-8% |

-1% |

+2% |

+3% |

+7% |

- |

+1% |

|

Total 2024 |

-8% |

-1% |

+4% |

-2% |

+6% |

- |

+1% |

Revenue for 2023 (in millions of

euros)

|

Full-year 2023 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities

and eliminations |

Total |

|

First quarter |

1 694 |

10 728 |

2 115 |

2 589 |

3 961 |

(52) |

21 035 |

|

Second quarter |

1 486 |

10 434 |

1 913 |

2 839 |

4 394 |

140 |

21 206 |

|

First half |

3 181 |

21 162 |

4 028 |

5 427 |

8 355 |

87 |

42 240 |

|

Third quarter |

1 509 |

9 750 |

1 993 |

2 524 |

4 076 |

113 |

19 964 |

|

First nine months |

4 689 |

30 912 |

6 021 |

7 951 |

12 431 |

201 |

62 205 |

|

Fourth quarter |

1 912 |

11 257 |

2 250 |

2 951 |

5 454 |

124 |

23 948 |

|

Total 2023 |

6 602 |

42 169 |

8 271 |

10 902 |

17 885 |

324 |

86 153 |

Alternative performance

measures

For the purposes of its financial communications, in addition to

the accounting aggregates defined by IAS/IFRS, LVMH uses

alternative performance measures established in accordance with AMF

position DOC-2015-12.

The table below lists these performance measures and the reference

to their definition and their reconciliation with the aggregates

defined by IAS/IFRS in the published documents.

|

Performance measures |

Reference to published documents |

|

Operating free cash flow |

FD (condensed consolidated financial statements, consolidated cash

flow statement) |

|

Net financial debt |

FD (Notes 1.22 and 19 to the condensed consolidated financial

statements) |

|

Gearing |

FD (Part 7, “Comments on the consolidated balance sheet”) |

|

Organic growth |

FD (Part 1, “Comments on the consolidated income statement”) |

FD: Financial Documents as of

December 31, 2024

LVMH

LVMH Moët Hennessy Louis Vuitton is

represented in Wines and Spirits by a portfolio of brands that

includes Moët & Chandon, Dom Pérignon, Veuve Clicquot, Krug,

Ruinart, Mercier, Château d’Yquem, Domaine du Clos des Lambrays,

Château Cheval Blanc, Colgin Cellars, Hennessy, Glenmorangie,

Ardbeg, Belvedere, Woodinville, Volcán de mi Tierra, Chandon,

Cloudy Bay, Terrazas de los Andes, Cheval des Andes, Newton, Bodega

Numanthia, Ao Yun, Château d’Esclans, Château Galoupet, Joseph

Phelps and Château Minuty. Its Fashion and Leather Goods division

includes Louis Vuitton, Christian Dior, Celine, Loewe, Kenzo,

Givenchy, Fendi, Emilio Pucci, Marc Jacobs, Berluti, Loro Piana,

RIMOWA, Patou, Barton Perreira and Vuarnet. LVMH is present in the

Perfumes and Cosmetics sector with Parfums Christian Dior,

Guerlain, Parfums Givenchy, Kenzo Parfums, Perfumes Loewe, Benefit

Cosmetics, Make Up For Ever, Acqua di Parma, Fresh, Fenty Beauty by

Rihanna, Maison Francis Kurkdjian and Officine Universelle Buly.

LVMH's Watches and Jewelry division comprises Bulgari, TAG Heuer,

Tiffany & Co, Chaumet, Zenith, Fred and Hublot. LVMH is also

active in Selective Retailing as well as in other activities

through DFS, Sephora, Le Bon Marché, La Samaritaine, Groupe Les

Echos-Le Parisien, Paris Match, Cova, Le Jardin d’Acclimatation,

Royal Van Lent, Belmond and Cheval Blanc hotels.

“This document may contain certain

forward-looking statements which are based on estimations and

forecasts. By their nature, these forward-looking statements are

subject to important risks and uncertainties and factors beyond our

control or ability to predict, in particular those described in

LVMH’s Universal Registration Document which is available on the

website (www.lvmh.com). These forward-looking

statements should not be considered as a guarantee of future

performance, the actual results could differ materially from those

expressed or implied by them. The forward-looking statements only

reflect LVMH’s views as of the date of this document, and LVMH does

not undertake to revise or update these forward-looking statements.

The forward-looking statements should be used with caution and

circumspection and in no event can LVMH and its Management be held

responsible for any investment or other decision based upon such

statements. The information in this document does not constitute an

offer to sell or an invitation to buy shares in LVMH or an

invitation or inducement to engage in any other investment

activities.”

LVMH CONTACTS

Analysts and investors

Rodolphe Ozun

LVMH

+ 33 1 44 13 27 21 |

Media

Jean-Charles Tréhan

LVMH

+ 33 1 44 13 26 20 |

MEDIA CONTACTS |

|

France

Charlotte Mariné / +33 6 75 30 43 91

Axelle Gadala / +33 6 89 01 07 60

Publicis Consultants

+ 33 1 44 82 46 05 |

France

Michel Calzaroni / + 33 6 07 34 20 14

Olivier Labesse / Hugues Schmitt / Thomas Roborel de

Climens / + 33 6 79 11 49 71 |

Italy

Michele Calcaterra / Matteo Steinbach

SEC and Partners

+ 39 02 6249991 |

UK

Hugh Morrison / Charlotte McMullen

Montfort Communications

+ 44 7921 881 800 |

US

Nik Deogun / Blake Sonnenshein

Brunswick Group

+ 1 212 333 3810

|

China

Daniel Jeffreys

Deluxewords

+ 44 772 212 6562

+ 86 21 80 36 04 48 |

- Press Release - LVMH Annual results 2024

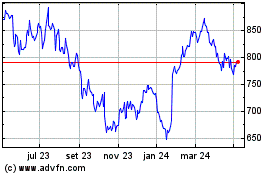

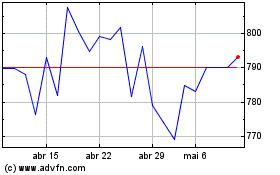

Lvmh Moet Hennessy Louis... (BIT:1MC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Lvmh Moet Hennessy Louis... (BIT:1MC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025