Full-year 2024 results

Media relations:

Victoire Grux

Tel.: +33 6 04 52 16 55

victoire.grux@capgemini.com

Investor relations:

Vincent Biraud

Tel.: +33 1 47 54 50 87

vincent.biraud@capgemini.com

Full-year 2024 results

-

Revenues of €22,096 million in 2024, down

-1.9%

-

Revenue growth at constant exchange rates*

of -2.0% for the full year, and -1.1% in Q4

-

Bookings at €23.8 billion with a 1.08

book-to-bill

-

Stable operating margin*, at 13.3% of

revenues

-

Net profit, Group share, up +0.5% and basic earnings per

share up +1.2%

-

Organic free cash

flow0F* of €1,961

million

-

Proposed dividend of €3.40 per share

Paris, February 18, 2025

– The Board of Directors of Capgemini SE, chaired by

Paul Hermelin, convened on February 17 in Paris to review and adopt

the accounts1F1 of the Capgemini Group for the

year-ended December 31, 2024.

Aiman Ezzat, Chief Executive Officer of the

Capgemini Group, said: “Our performance in the fourth quarter

is in line with expectations. As anticipated, Manufacturing and

France experienced strong headwinds, whereas we saw an improvement

in Financial Services and Consumer Goods & Retail, as well as a

robust Public Sector.

The Group demonstrated strong resilience in

2024, maintaining its operating margin and free cash flow

generation, thanks to the growth of its high value-added offerings

as well as its ecosystem of leading technology partners.

Client demand continues to be driven by

efficiency, operational agility and cost-optimization programs

which are driving traction for our Cloud and Data & AI

services. The Group is recognized as a global leader in AI by

market analysts, reflecting our continued investments. Generative

AI supported strong bookings and accounted for around 5% of

bookings in Q4. The acquisition of Syniti strengthens the Group’s

data-driven digital transformation capabilities.

Our clients keep showing a strong appetite

for technology and recognize the value we bring as their trusted

business and technology transformation partner. However, we remain

cautious in this uncertain environment, notably around

Manufacturing and Europe, and expect H1 2025 constant currency

revenue growth to remain in the same range as in Q4 2024. We will

continue to demonstrate in 2025 the strength of our positioning and

the resilience of our operating model, with growth as a

priority.”

KEY FIGURES

|

(in millions of euros) |

2023 |

2024 |

Change |

|

Revenues |

22,522 |

22,096 |

-1.9% |

|

Operating margin* |

2,991 |

2,934 |

-1.9% |

|

as a % of revenues |

13.3% |

13.3% |

0pt |

|

Operating profit |

2,346 |

2,356 |

+0.4% |

|

as a % of revenues |

10.4% |

10.7% |

+0.3pts |

|

Net profit (Group share) |

1,663 |

1,671 |

+0.5% |

|

Basic earnings per share (€) |

9.70 |

9.82 |

+1.2% |

|

Normalized earnings per share (€)* |

12.44 |

12.23 |

-1.7% |

|

Organic free cash flow* |

1,963 |

1,961 |

-€ 2m |

|

Net cash / (Net debt)* |

(2,047) |

(2,107) |

|

In an environment that proved weaker than

initially anticipated, Capgemini demonstrated in 2024 the

resilience of its operating model and its leadership on AI and

Generative AI. Clients focused on driving efficiency, prioritizing

operational agility and cost optimization while discretionary spend

remained soft. This environment has fueled a strong demand for

transformation programs which translated into continued traction

for Capgemini’s Cloud, Data & AI services as well as its

innovative offerings, most notably in intelligent supply chain,

digital core and generative AI projects. This is contributing to

the continuous improvement of the portfolio mix toward innovation

and enhanced client value creation.

Capgemini reported revenues of

€22,096 million in 2024, down -1.9% year-on-year. Constant currency

growth* was -2.0%, at the top end of the outlook as revised in

October 2024. Organic growth* (i.e., excluding the impact of

currency fluctuations and changes in Group scope) was -2.4%. After

bottoming out in Q1, revenue trends gradually improved through the

year with a revenue decline limited to -1.1% at constant currency

and -1.5% organically in Q4.

With bookings of

€23,821 million in 2024 and €6,806 million in Q4, the Group

maintained a strong commercial momentum despite client decision

cycles that remain long, achieving a solid book-to-bill of 1.08 for

the year, and 1.22 in Q4. When compared to 2023 bookings, this

represents, at constant exchange rates, a decrease of -0.5% for the

year and an increase of +1.9% in Q4. Generative AI bookings

amounted to close to 4% of Group bookings for the year and around

5% for Q4.

The ongoing shift in Capgemini’s offerings

portfolio towards higher value services, coupled with enhanced

operational efficiency, generated a 50 basis points increase in

gross margin to 27.4% of revenues, reflecting the resilience of its

operating model. This enabled the Group to absorb the incremental

investment in selling efforts aimed at driving future growth and

offset the slight increase in G&A expenses.

Consequently, the operating

margin* was stable at 13.3% of revenues, or

€2,934 million, in line with the operating margin target set

for 2024.

Other operating income and

expenses was a net expense of €578 million, down €67

million year-on-year. This decrease is mainly attributable to lower

restructuring charges, which decreased by €55 million.

Capgemini’s operating profit

was €2,356 million, or 10.7% of revenues, compared with €2,346

million, or 10.4% of revenues in 2023.

Capgemini reported a net financial

income of €13 million in 2024, compared to a net expense

of €42 million in 2023, reflecting higher interest income.

The income tax expense was €681

million, up from €626 million last year. This represents an

increase in the effective tax rate from 27.2% in 2023 to 28.8% this

year.

Taking into account the share of profits of

associates and non-controlling interests, the Group share

in net profit rose by +0.5% year-on-year to €1,671

million. Basic earnings per share increased by

+1.2% to €9.82. Normalized earnings per share* was

€12.23, compared with €12.44 in 2023.

Organic free cash flow*

generation remained strong at €1,961 million, in line with the 2024

target and the previous year despite lower revenues.

CAPITAL ALLOCATION & BALANCE

SHEET

In 2024, Capgemini actively redeployed close to

€2.0 billion of capital, essentially funded by the organic free

cash flow of the year. Capgemini invested €827 million in

acquisitions. The Group also paid dividends of €580 million

(€3.40 per share) to Capgemini SE shareholders and allocated

€972 million to share buybacks: €498 million on its multiyear

program and €474 million to neutralize the dilution of the

11th employee share ownership plan (ESOP). This ESOP

plan, which proved highly successful and thus contributed to

maintaining employee shareholding at around 8% of the share

capital, led to a gross capital increase of €415 million.

In October 2024, the Group also redeemed in full

and at maturity its €600 million bond issued in April 2018.

At December 31, 2024, the Group had cash, cash

equivalents and cash management assets of €3.1 billion. After

accounting for borrowings of €5.1 billion as well as for derivative

instruments, Group net debt* is €2.1 billion, slightly up compared

with €2.0 billion at December 31, 2023.

The Board of Directors decided to recommend the

payment of a dividend of €3.40 per share at the Shareholders’

Meeting of May 7, 2025. The corresponding payout ratio is 35% of

net profit (Group share), in line with the Group’s historical

distribution policy.

OPERATIONS BY REGION

At constant exchange rates, revenues in

North America (28% of Group revenues) decreased by

-4.1% with improving trends in H2. The Financial Services, Consumer

Goods & Retail and Telco, Media & Technology (TMT) sectors

were the main drivers of improvement. In contrast, the

Manufacturing and Public sectors slowed down in H2. The operating

margin increased to 16.5%, from 15.6% in 2023.

The United Kingdom and Ireland

region (12% of Group revenues) remained resilient, posting a -1.0%

decline in revenue primarily driven by the contraction of the

Consumer Goods & Retail sector. The region's return to growth

in H2 was driven by the recovery in Financial Services and the

continued strength in the Energy & Utilities sector. The

operating margin reached 19.7% compared with 18.6% in 2023.

France (20% of Group revenues)

revenues decreased by -3.5%, in an environment that led to a

visible degradation in H2. This evolution was mostly driven by the

contraction of the Manufacturing sector. However, as in most

regions, Financial Services visibly improved through the year. The

operating margin contracted from 12.6% to 10.2%.

In the Rest of Europe region

(31% of Group revenues), revenues stood at +0.1% with solid Public

and Energy & Utilities sectors and Financial Services returning

to growth. The Manufacturing sector also negatively weighed on

activity in the region. The operating margin was 12.0%, slightly up

from 11.7% a year earlier.

Finally, revenues in the Asia-Pacific

and Latin America region (9% of Group revenues) were

slightly down

-0.3% driven by a slower Financial Services sector in Asia-Pacific.

However, the Public Sector in Asia-Pacific and the Consumer Goods

& Retail sector in Latin America, both enjoyed double-digit

growth rates. The operating margin slightly improved to 12.4%

compared with 12.2% the year before.

OPERATIONS BY BUSINESS

At constant exchange rates, Strategy

& Transformation consulting services (9% of Group

revenues) reported +3.2% growth in total revenues* in 2024. This

continued momentum illustrates the strength of the Group's

positioning as a strategic partner to its clients.

Applications & Technology

services (62% of Group revenues and Capgemini’s core business)

reported

a -2.1% decrease in total revenues.

Finally, Operations &

Engineering services total revenues (29% of Group

revenues) decreased -2.1%.

OPERATIONS IN Q4 2024

Q4 was the third consecutive quarter of gradual

improvement in growth rate. As expected, the Financial Services and

Consumer Goods & Retail sectors saw an acceleration and TMT

returned to growth. This was offset by the slowdown in

Manufacturing.

Geographically, growth rates improved

substantially in North America, but also the United Kingdom and

Ireland, Asia-Pacific and Latin America, but slowed down visibly in

France.

Group revenues totaled €5,581 million in Q4

2024, a decline of -1.1% year-on-year at constant exchanges rate

and -1.5% organically. This decline in revenue can be solely

attributable to -6.1% slowdown in Manufacturing.

At constant exchange rates, the decline in

revenues in the North America region was limited to -1.6%, with the

growth in Financial Services, Consumer Good & Retail and TMT,

more than offset by the weakness in the Manufacturing and Energy

& Utilities sectors. Revenues in the United Kingdom and Ireland

region grew +1.5%, supported by the good performance of the Energy

& Utilities and Manufacturing sectors and to a lesser extent

the growth in Financial Services. In France, the weakness in the

Manufacturing, Consumer Goods & Retail and Energy &

Utilities sectors led the revenue to decline -5.8%. Revenues in the

Rest of Europe region were stable (+0.1%), driven by robust

activity in the Public, Energy & Utilities and Financial

Services sectors that offset the decline in the Manufacturing

sector. Finally, revenues in the Asia-Pacific and Latin America

region grew by +4.6% supported by the visible recovery in the

Financial Services and Consumer Goods & Retail sectors, more

than offsetting the weak Manufacturing and Energy & Utilities

sectors.

HEADCOUNT

At December 31, 2024, the Group’s total

headcount stood at 341,100, slightly up by +0.2% year-on-year and

+0.7% compared to the end of September 2024.

The onshore workforce decreased by -1.1% at

144,200 employees, while the offshore workforce was up by +1.2% to

196,900 employees, i.e., 58% of the total headcount.

ESG PERFORMANCE

In 2024, Capgemini demonstrated continued

leadership in corporate responsibility by making significant

advancements aligned with its ESG (Environment, Social and

Governance) policy and commitments.

From an environmental standpoint, Capgemini set

ambitious near-term (2030) and long-term (2040) carbon reduction

targets in 2022, including a 90% reduction in all emissions (Scope

1, 2 and 3) by 2040 to reach its “net zero emissions” targets as

validated by the SBTi (Science-Based Targets initiative). At the

end of 2024, the Group had reduced its absolute emissions (Scope 1,

2 and 3) by 35% compared to 2019. Reflecting the commitment to 100%

renewable electricity (RE100) by 2025, Capgemini’s scope 1 and 2

emissions have decreased by 93% since 2019. The share of renewable

energy in the Group’s electricity consumption reached 98% last year

up from 96% in 2023.

In human capital development, Capgemini

continued to invest in its talent in 2024. The average number of

learning hours per employee trained reached 77 hours last year,

significantly up notably with the expansion of the generative AI

training program.

The Group also made notable progress in gender

balance, nearing its global objective of 40% by 2025. By the end of

2024, women comprised 39.7% of the total workforce, up by almost 1

point year-on-year and almost 7 points since 2019. The proportion

of women among executive leadership positions globally reached

29.0%, up by almost 3 points year-on-year and more than 12 points

since 2019.

The scale of impact through digital inclusion

initiatives also extended greatly in 2024. Overall, the Group's

various programs and partnerships with leading non-profit

organizations benefited almost 3.2 million individuals in 2024.

In recognition of this continued progress, the

Group was confirmed as a constituent of the Dow Jones

Sustainability Index (DJSI) Europe and maintained its position on

the “A list” in the 2024 CDP (Carbon Disclosure Project)

assessment.

OUTLOOK

The Group’s financial targets for 2025 are:

- Revenue growth of -2.0% to +2.0% at

constant currency;

- Operating margin of 13.3% to

13.5%;

- Organic free cash flow of around

€1.9 billion.

CONFERENCE CALL

Aiman Ezzat, Chief Executive Officer,

accompanied by Nive Bhagat, Chief Financial Officer, will comment

on this publication during a conference call in English to be held

today at 8.00 a.m. Paris time (CET). You can

follow this conference call live via webcast at the following link.

A replay will also be available for a period of one year.

All documents relating to this publication will

be posted on the Capgemini investor website at

https://investors.capgemini.com/en/.

PROVISIONAL CALENDAR

April 29,

2025 Q1 2025

revenues

May 7,

2025 Shareholders’

meeting

July 30, 2025 H1

2025 results

October 28, 2025 Q3

2025 revenues

The dividend payment schedule to be submitted to

the Shareholders’ Meeting for approval would be:

May 20,

2025 Ex-dividend

date on Euronext Paris

May 22, 2025 Payment

of the dividend

DISCLAIMER

This press release may contain forward-looking

statements. Such statements may include projections, estimates,

assumptions, statements regarding plans, objectives, intentions

and/or expectations with respect to future financial results,

events, operations and services and product development, as well as

statements, regarding future performance or events. Forward-looking

statements are generally identified by the words “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “plans”,

“projects”, “may”, “would”, “should” or the negatives of these

terms and similar expressions. Although Capgemini’s management

currently believes that the expectations reflected in such

forward-looking statements are reasonable, investors are cautioned

that forward-looking statements are subject to various risks and

uncertainties (including, without limitation, risks identified in

Capgemini’s Universal Registration Document available on

Capgemini’s website), because they relate to future events and

depend on future circumstances that may or may not occur and may be

different from those anticipated, many of which are difficult to

predict and generally beyond the control of Capgemini. Actual

results and developments may differ materially from those expressed

in, implied by or projected by forward-looking statements.

Forward-looking statements are not intended to and do not give any

assurances or comfort as to future events or results. Other than as

required by applicable law, Capgemini does not undertake any

obligation to update or revise any forward-looking statement.

This press release does not contain or

constitute an offer of securities for sale or an invitation or

inducement to invest in securities in France, the United States or

any other jurisdiction.

ABOUT CAPGEMINI

Capgemini is a global business and technology

transformation partner, helping organizations to accelerate their

dual transition to a digital and sustainable world, while creating

tangible impact for enterprises and society. It is a responsible

and diverse group of 340,000 team members in more than 50

countries. With its strong over 55-year heritage, Capgemini is

trusted by its clients to unlock the value of technology to address

the entire breadth of their business needs. It delivers end-to-end

services and solutions leveraging strengths from strategy and

design to engineering, all fueled by its market leading

capabilities in AI, generative AI, cloud and data, combined with

its deep industry expertise and partner ecosystem. The Group

reported 2024 global revenues of €22.1 billion.

Get the Future You Want |

www.capgemini.com

* *

*

APPENDIX3F2

BUSINESS CLASSIFICATION

- Strategy &

Transformation includes all strategy, innovation and

transformation consulting services.

- Applications &

Technology brings together “Application Services” and

related activities and notably local technology services.

- Operations &

Engineering encompasses all other Group businesses. These

comprise Business Services (including Business Process Outsourcing

and transaction services), all Infrastructure and Cloud services,

and R&D and Engineering services.

DEFINITIONS

Organic growth or like-for-like

growth in revenues is the growth rate calculated at

constant Group scope and exchange rates. The Group scope

and exchange rates used are those for the reported period. Exchange

rates for the reported period are also used to calculate

growth at constant exchange rates.

|

Reconciliation of growth rates |

Q1

2024 |

Q2

2024 |

Q3

2024 |

Q4

2024 |

FY

2024 |

|

Organic growth |

-3.6% |

-2.3% |

-2.1% |

-1.5% |

-2.4% |

|

Changes in Group scope |

+0.3 pts |

+0.4 pts |

+0.5 pts |

+0.4 pts |

+0.4 pts |

|

Growth at constant exchange rates |

-3.3% |

-1.9% |

-1.6% |

-1.1% |

-2.0% |

|

Exchange rate fluctuations |

-0.2 pts |

+0.4 pts |

-0.3 pts |

+0.5 pts |

+0.1 pts |

|

Reported growth |

-3.5% |

-1.5% |

-1.9% |

-0.6% |

-1.9% |

When determining activity trends by business and

in accordance with internal operating performance measures, growth

at constant exchange rates is calculated based on total

revenues, i.e., before elimination of inter-business

billing. The Group considers this to be more representative of

activity levels by business. As its businesses change, an

increasing number of contracts require a range of business

expertise for delivery, leading to a rise in inter-business

flows.

Operating margin is one of the

Group’s key performance indicators. It is defined as the difference

between revenues and operating costs. It is calculated before

“Other operating income and expenses” which include amortization of

intangible assets recognized in business combinations, expenses

relative to share-based compensation (including social security

contributions and employer contributions) and employee share

ownership plan, and non-recurring revenues and expenses, notably

impairment of goodwill, negative goodwill, capital gains or losses

on disposals of consolidated companies or businesses, restructuring

costs incurred under a detailed formal plan approved by the Group’s

management, the cost of acquiring and integrating companies

acquired by the Group, including earn-outs comprising conditions of

presence, and the effects of curtailments, settlements and

transfers of defined benefit pension plans.

Normalized net profit is equal to profit for the

year (Group share) adjusted for the impact of items recognized in

“Other operating income and expense”, net of tax calculated using

the effective tax rate. Normalized earnings per

share is computed like basic earnings per share, i.e.,

excluding dilution.

Organic free cash flow is equal

to cash flow from operations less acquisitions of property, plant,

equipment and intangible assets (net of disposals) and repayments

of lease liabilities, adjusted for cash out relating to the net

interest cost.

Net debt (or net

cash) comprises (i) cash and cash equivalents, as

presented in the Consolidated Statement of Cash Flows (consisting

of short-term investments and cash at bank) less bank overdrafts,

and also including (ii) cash management assets (assets presented

separately in the Consolidated Statement of Financial Position due

to their characteristics), less (iii) short- and long-term

borrowings. Account is also taken of (iv) the impact of hedging

instruments when these relate to borrowings, intercompany loans,

and own shares.

RESULTS BY REGION

| |

Revenues |

|

Year-on-year growth |

|

Operating margin rate |

|

|

2024

(in millions of euros) |

|

reported

|

at constant exchange rates |

|

2023 |

2024 |

|

North America |

6,188 |

|

-4.2% |

-4.1% |

|

15.6% |

16.5% |

|

United Kingdom and Ireland |

2,753 |

|

+1.6% |

-1.0% |

|

18.6% |

19.7% |

|

France |

4,380 |

|

-3.5% |

-3.5% |

|

12.6% |

10.2% |

|

Rest of Europe |

6,851 |

|

+0.2% |

+0.1% |

|

11.7% |

12.0% |

|

Asia-Pacific and Latin America |

1,924 |

|

-2.6% |

-0.3% |

|

12.2% |

12.4% |

|

TOTAL |

22,096 |

|

-1.9% |

-2.0% |

|

13.3% |

13.3% |

RESULTS BY BUSINESS

| |

Total revenues* |

|

Year-on-year growth |

|

|

2024

(% of Group revenues) |

|

At constant exchange rates in Total revenues*

of the business |

|

Strategy & Transformation |

9% |

|

+3.2% |

|

Applications & Technology |

62% |

|

-2.1% |

|

Operations & Engineering |

29% |

|

-2.1% |

SUMMARY INCOME STATEMENT AND OPERATING

MARGIN

|

(in millions of euros) |

2023 |

2024 |

Change |

|

Revenues |

22,522 |

22,096 |

-1.9% |

|

Operating expenses |

(19,531) |

(19,162) |

|

|

Operating margin |

2,991 |

2,934 |

-1.9% |

|

as a % of revenues |

13.3% |

13.3% |

0bp |

|

Other operating income and expenses |

(645) |

(578) |

|

|

Operating profit |

2,346 |

2,356 |

+0.4% |

|

as a % of revenues |

10.4% |

10.7% |

+30bp |

|

Net financial expenses |

(42) |

13 |

|

|

Income tax income/(expense) |

(626) |

(681) |

|

|

Share of profit of associates and joint-ventures |

(10) |

(11) |

|

|

(-) Non-controlling interests |

(5) |

(6) |

|

|

Profit for the period, Group share |

1,663 |

1,671 |

+0.5% |

NORMALIZED AND DILUTED EARNINGS PER

SHARE

|

(in millions of euros) |

2023 |

2024 |

Change |

|

Average number of shares outstanding |

171,350,138 |

170,201,409 |

-0.7% |

|

BASIC EARNINGS PER SHARE (in

euros) |

9.70 |

9.82 |

+1.2% |

|

Diluted average number of shares outstanding |

177,396,346 |

176,375,256 |

|

|

DILUTED EARNINGS PER SHARE (in

euros) |

9.37 |

9.47 |

+1.1% |

|

|

|

|

|

|

(in millions of euros) |

2023 |

2024 |

Change |

|

Profit for the period, Group share |

1,663 |

1,671 |

+0.5% |

|

Effective tax rate |

27.2% |

28.8% |

|

|

(-) Other operating income and expenses, net of tax |

469 |

412 |

|

|

Normalized profit for the period |

2,132 |

2,083 |

-2.3% |

|

Average number of shares outstanding |

171,350,138 |

170,201,409 |

-0.7% |

|

NORMALIZED EARNINGS PER SHARE (in

euros) |

12.44 |

12.23 |

-1.7% |

CHANGE IN CASH AND CASH EQUIVALENTS AND

ORGANIC FREE CASH FLOW

|

(in millions of euros) |

2023 |

2024 |

|

Net cash from operating activities |

2,525 |

2,526 |

|

Acquisitions of property, plant and equipment and intangible

assets, net of disposals |

(254) |

(310) |

|

Net interest cost |

(11) |

37 |

|

Repayments of lease liabilities |

(297) |

(292) |

|

ORGANIC FREE CASH FLOW |

1,963 |

1,961 |

|

Other cash flows from (used in) investing and financing

activities |

(2,126) |

(2,788) |

|

Increase (decrease) in cash and cash

equivalents |

(163) |

(827) |

|

Effect of exchange rate fluctuations |

(115) |

97 |

|

Opening cash and cash equivalents |

3,795 |

3,517 |

|

Closing cash and cash equivalents |

3,517 |

2,787 |

NET DEBT

|

(in millions of euros) |

December 31, 2023 |

December 31, 2024 |

|

Cash and cash equivalents |

3,536 |

2,789 |

|

Bank overdrafts |

(19) |

(2) |

|

Cash and cash equivalents |

3,517 |

2,787 |

|

Cash management assets |

161 |

268 |

|

Long-term borrowings |

(5,071) |

(4,281) |

|

Short-term borrowings and bank overdrafts |

(675) |

(863) |

|

(-) Bank overdrafts |

19 |

2 |

|

Borrowings, excluding bank overdrafts |

(5,727) |

(5,142) |

|

Derivative instruments |

2 |

(20) |

|

NET CASH / (NET DEBT) |

(2,047) |

(2,107) |

ESG PERFORMANCE

|

|

Objectives |

Key Performance Indicators |

2019

(baseline) |

2023 |

2024 |

Change vs. 2019 |

2025 Objective |

2030 Objective (vs 2019) |

Environment

|

Be carbon neutral for our own operations no later than 2025 and

across our supply chain by 2030, and committed to becoming a net

zero business by 2040

|

Scope 1 & 2 - Absolute emissions (ktCO₂e) |

154.1 |

13.6 |

11.2 |

-93% |

|

-80% |

|

Scope 3 - Employee commuting emissions per headcount

(tCO₂e/head) |

1.08 |

0.50 |

0.55 |

-49% |

|

-55% |

|

Scope 3 - Business travel emissions per headcount (tCO₂e/head) |

1.26 |

0.50 |

0.48 |

-62% |

|

-55% |

|

Scope 3 - Purchased goods and services (ktCO₂e) |

305.7 |

352.1 |

301.5 |

-1% |

|

-50% |

|

Transition to 100% renewable electricity by 2025, and electric

vehicles by 2030 |

% of electricity from renewables |

28% |

96% |

98% |

+70pts |

100% |

|

Social

|

Increase average learning hours per employee by 5% every year to

ensure regular lifelong learning |

Average Completed Learning Hours per headcount trained during the

reporting period |

41.9 |

53.8 |

77.4 |

+85% |

|

|

|

40% of women in our teams by 2025 |

% of women in the workforce |

33.0% |

38.8% |

39.7% |

+6.7pts |

40% |

|

|

5m beneficiaries supported by our digital inclusion programs by

2030 |

Cumulated number of beneficiaries since 2018 |

29,012 |

4.4m |

7.5m |

|

|

5m |

Governance

|

30% of women in Group executive leadership positions in 2025 |

% of women in Group executive leadership positions |

16.8% |

26.2% |

29.0% |

+12.2pts |

30% |

|

|

Maintain over 80% of the workforce with an Ethics score of

7-10 |

% of the headcount with an Ethics score of 7-10 |

|

86% |

85% |

|

>80% |

>80% |

Be recognized as a front leader in data protection and

cybersecurity

|

Cyber Rating agencies - CyberVadis score |

|

958 |

977 |

|

940-950

out of 1,000 |

|

DPO certification |

|

72% |

76% |

|

95% |

|

Note: in the table above, 2024 data may include

some estimates and some historical data points have been restated

to ensure comparability.

1 Audit procedures on the

consolidated financial statements have been completed. The auditors

are in the process of issuing their report.

2 Note that in the appendix, certain totals may not

equal the sum of amounts due to rounding adjustments.

- Capgemini_-_2025-02-18_-_2024_Annual_Results

- Capgemini_FY_2024_infographics_ENG

- Capgemini_Q4_2024_infographics_ENG

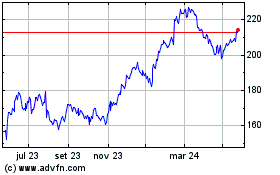

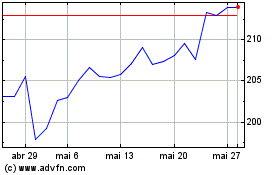

Capgemini (EU:CAP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Capgemini (EU:CAP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025