Tarkett Participation, Tarkett's controlling shareholder, announces its intention to file a public buy-out offer, followed by a squeeze-out, on the Tarkett shares it does not hold

20 Fevereiro 2025 - 2:25PM

UK Regulatory

Tarkett Participation, Tarkett's controlling shareholder, announces

its intention to file a public buy-out offer, followed by a

squeeze-out, on the Tarkett shares it does not hold

Tarkett Participation, Tarkett's

controlling shareholder, announces its intention to file a public

buy-out offer, followed by a squeeze-out, on the Tarkett shares it

does not hold

-

Offer at a price of 16 euros per share, representing a

premium of 32.3% and 37.5% over respectively the volume-weighted

average share price over the last 20 and 60 trading

days

-

Appointment of an ad hoc Committee comprising a majority of

independent members of the Supervisory Board, and designation of

Finexsi - Expert & Conseil Financier as independent

expert

-

Based on a recommendation of its ad hoc Committee,

Tarkett's Supervisory Board has favorably and unanimously welcomed

the proposed public buy-out offer followed by a

squeeze-out

PARIS, FRANCE, February 20, 2025

- Tarkett Participation announces its intention to file in

the next few days a public buy-out offer, followed by a squeeze-out

(OPR-RO), on the Tarkett shares it does not hold (the

“Offer”).

The Offer will be initiated by Tarkett

Participation, a company controlled by the Deconinck family and in

which Wendel has invested as a minority shareholder. Tarkett

Participation directly holds 90.32% of the share capital and 94.66%

of the voting rights of

Tarkett1,2.

The Offer will be made at a price of 16 euros

per share, representing a premium of 32.3% and 37.5% over

respectively the volume-weighted average share price over the last

20 and 60 trading days and a premium of 18.1% over the last closing

price prior to the announcement of the Offer.

It is specified that Tarkett Participation has

sufficient equity capital and credit lines, in particular under its

existing credit facilities, to finance the Offer3.

Based on a preliminary recommendation of

its ad hoc Committee, the Offer has been favorably and unanimously

welcomed by Tarkett's Supervisory Board, which met on February 20,

2025.

This ad hoc Committee, set up by the

Supervisory Board in the context of the preparation of the Offer,

comprises a majority of independent members4.

Upon the recommendation of the ad hoc

Committee, Finexsi - Expert & Conseil Financier, represented by

Mr. Olivier Péronnet and Mr. Olivier Courau, has been appointed as

independent expert, with the mandate to submit a report including a

fairness opinion on the financial terms of the public buy-out offer

followed by a squeeze-out, in accordance with the provisions of

article 261-1, I, 1°, 2° and 4° and II of the Règlement général

de l’Autorité des Marchés Financiers (AMF).

The reasoned opinion of the Supervisory Board on

the merits of the Offer and its consequences for Tarkett, its

shareholders and its employees will be included in the draft

response document (projet de note en réponse) prepared by

Tarkett.

Main conditions and timetable of the

public buy-out offer followed by a squeeze-out

In accordance with applicable regulations,

completion of the Offer will be subject to the AMF's

clearance decision on the proposed Offer. The Offer will not be

subject to any other conditions.

The Offer will be filed with the AMF in

the coming days and, subject to the AMF's clearance

decision, is expected to take place in April 2025.

After the completion of the Offer, Tarkett

Participation will carry out a squeeze-out procedure for all the

shares it does not hold, insofar as the minority shareholders hold

less than 10% of the capital and voting rights of Tarkett. The

squeeze-out will be carried out in consideration of a compensation

equal to the Offer price.

Disclaimer

The Offer is made to Tarkett shareholders

located in France and outside of France, provided that local law to

which they are subject allows them to participate in the Offer

without requiring Tarkett Participation to complete any additional

formalities.

Investor Relations Contact

investors@tarkett.com

Media Contacts

Brunswick – tarkett@brunswickgroup.com – Tel: +33 (0) 1 53 96 83

83

Tarkett – communication@tarkett.com

Hugues Boëton – Tel: +33 (0)6 79 89 27 15 – Benoit Grange – Tel +33

(0)6 14 45 09 26

About Tarkett

With a 140-year history, Tarkett is a world leader in innovative

and sustainable solutions for floor coverings and sports surfaces,

with sales of 3.3 billion euros in 2024. The Group employs nearly

12,000 people and has 24 R&D centers, 8 recycling centers and

35 production sites. Tarkett designs and manufactures solutions for

hospitals, schools, homes, hotels, offices, retail outlets and

sports fields, serving customers in over 100 countries. To build

"The Way to Better Floors", the Group is committed to the circular

economy and sustainable development, in line with its Tarkett

Human-Conscious Design® approach. Tarkett is listed on the Euronext

regulated market (compartment B, ISIN code FR0004188670, mnemonic

code: TKTT). www.tarkett-group.com

1 On the basis of 65,550,281 shares and

123,799,014 theoretical voting rights as at January, 31, 2025.

2 Tarkett Participation also holds, together with Mr. Fabrice

Barthélemy, President of the Tarkett Management Board and President

of Tarkett Participation, and members of the Deconinck family,

59,257, 355 shares and 117,237,748 voting rights, and Tarkett's

18,559 treasury shares, together representing 90.40% of the capital

and 94.71% of the voting rights.

3 Tarkett Participation may also carry out additional financing

rounds on the market without these being necessary for the

financing of the Offer.

4 The ad hoc Committee is composed of three members:

Didier Michaud-Daniel, president of the ad hoc Committee

(independent member), Sabine Roux de Bézieux (independent member)

and Marine Charles.

- Tarkett Participation- Tarkett- CP EN 20.2.25

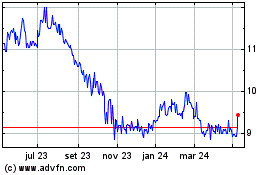

Tarkett (EU:TKTT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

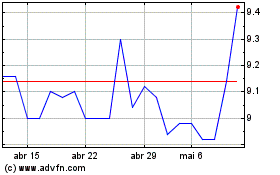

Tarkett (EU:TKTT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025