Norway, an often overlooked European investment destination, is

known for crude oil production. Despite being the world’s fifth

largest oil producer and second major natural gas exporter after

Russia, the country is yet to get strong footing on overall

growth.

Nonetheless, Norway has recently drawn enough investor attention

thanks to the long-stretched, gnawing geo-political tension between

Russia and the West on the Ukraine issue.

Europe is highly energy-dependent on Russia, from where it imports

about 40% of its energy requirements. This dependency has made it

difficult for Europe to go against Russia completely.

European leaders are diligently planning to increase their energy

supplies from other nations, and Norway is a possible solution as a

long-term source of oil and gas supplies with which the continent

shares an affable relation (read: 3 Energy ETFs to Buy on the

Ukraine Crisis).

Even if the Russia-factor is ruled out, Norway is poised to benefit

from higher natural gas demand from Europe if the continent seeks

to attain its ‘decarbonization’ target of 85–90% by 2050, as per

Statoil natural gas senior vice president. The target would

involve lower usage of coal and higher usage of natural gas (Read:

3 Incredible ETF Buys Under $20).

Norway Economics

Beyond geopolitical issues, as per Bloomberg, Norway’s central bank

has maintained its benchmark interest rate at 1.5%, with no plan to

raise the key rate until the “summer” of 2015. The nation has

manageable public debt to GDP ratio (29.5% in 2013) which is an

impressive number in the European bloc. The country does have

some issues like huge consumer debt and a sagging housing market,

but any spike in the oil sector will likely give the nation a

much-needed boost.

Also, investors should note that since two-thirds of this

export-oriented country’s goods go to Europe, its economy will

profit from Euro zone recovery. The economy expanded 2% in

2013 after growing 3.4% in 2012, per the Bloomberg data.

The central bank slashed its growth forecast for this year to 1.75%

from 2% predicted in December. However, even after the downward

revision, this energy-rich nation boasts a better growth rate than

many of its European cousins (read: Hot Euro Zone ETFs for

Summer).

Given the still-strong potential, a look at the top-ranked Norway

ETF could be a good idea, especially based on our Zacks ETF Ranking

system.

About the Zacks ETF Rank

This technique provides a recommendation for the ETF in the context

of our outlook of the underlying industry, sector, style box or

asset class. Our proprietary methodology also takes into account

the risk preferences of investors as well.

The aim of our model is to select the best ETFs within each risk

category. We assign each ETF one of the five ranks within each risk

bucket. Thus, the Zacks ETF Rank reflects the expected return of an

ETF relative to other ETFs with a similar level of risk (see more

in the Zacks ETF Rank Guide).

For investors seeking to apply this methodology to their portfolio

in the Norway market, we have taken a closer look below at the

top-ranked NORW, which currently has a Zacks ETF Rank of 2 (Buy)

with a moderate risk outlook:

Global X FTSE Norway 30 ETF

(NORW)

This fund seeks to match the price and yield of the FTSE Norway 30

Index. Holding 31 stocks in its basket, the fund is still somewhat

concentrated from both a sector and an individual security

perspective (see: all European Equities ETFs here).

Energy comprises roughly half of the total assets while financial

companies make up one-fifth of the total. Beyond this, materials,

telecoms and consumer staples round out the rest of the top five,

making up a combined 25%.

From an individual holdings perspective, the product puts about 73%

of assets in top 10 holdings. Statoil ASA accounts for as much as

20.94% share in the fund followed by DNB NOR ASA (11.34%) and

Telenor (8.65%).

While the ETF focuses on large caps that account for 84% share, mid

cap takes the remaining portion in the basket. The fund has a value

tilt with 55% focus trailed by blend stocks with 35% exposure.

The product has so far managed assets of over $98.1 million.

However, the fund is light on volume, suggesting that bid/ask

spreads are relatively wide and that total costs will come in

higher than the 50 bps expense ratio. Further, it is less volatile

as indicated by its annualized standard deviation of 18.46%. NORW

delivered a modest return of more than 5.0% this year.

Bottom Line

Thanks to its oil funds, some fundamental tailwinds in the energy

sector and still-decent growth rate in debt-laden Europe, this

top-ranked ETF could still be a great pick for many investors in

the days ahead. There is a high chance that Russian worries would

brighten the appeal for Norway’s energy exports.

However, investors should also take note of currency fluctuations

as the ETF is an un-hedged one. With the Norwegian central bank’s

strategy to maintain the easy monetary policy for long, the

nation’s currency will likely remain devalued against the U.S.

dollar and eat up a portion of investors’ profits, though the

potential for NORW and the country’s economy is still very strong

overall.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

GLBL-X NORWAY (NORW): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

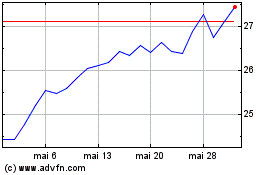

Global X MSCI Norway ETF (AMEX:NORW)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Global X MSCI Norway ETF (AMEX:NORW)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024