ConocoPhillips (NYSE: COP) (“COP”) announced today the early

results of the previously announced cash tender offers (the

“Offers” or collectively, the “Tender Offer”) of its wholly-owned

subsidiary, ConocoPhillips Company (“CPCo”). In addition, COP

further announced that it has amended the Offers by increasing the

Maximum Offer Reference Amount (as defined below) from

$4,000,000,000 (as previously announced) to an amount sufficient to

accept for purchase all Notes with Acceptance Priority Levels 1-7

(as set forth in the second table below) in full, in accordance

with the terms of the Offer to Purchase (as defined below).

Pursuant to the Offers, CPCo is offering to purchase: (1) any

and all of Marathon Oil Corporation’s (“Marathon”) debt securities

listed in the first table below (collectively, the “Any and All

Notes”), and (2) (A) for Holders who validly tendered their Maximum

Offer Notes (as defined below) as of the Early Tender Deadline (as

defined below), a combined aggregate purchase price of up to

approximately $4.05 billion (an amount sufficient to accept for

purchase all Maximum Offer Notes with Acceptance Priority Levels

1-7 (as set forth in the second table below)) (as increased

pursuant to this release, and as it may be increased or decreased

by CPCo in accordance with applicable law and the Offer to

Purchase, the “Maximum Offer Reference Amount”) less the aggregate

purchase price of the Any and All Notes validly tendered and

accepted for purchase through the Early Tender Deadline (excluding

accrued and unpaid interest and excluding fees and expenses related

to the Offers) (the “Early Tender Maximum Offer Amount”) of the

debt securities listed in the second table below (collectively, the

“Maximum Offer Notes” and together with the Any and All Notes, the

“Notes”), subject to the priorities set forth in the second table

below (the “Acceptance Priority Levels”) and proration, and (B) for

Holders who validly tender their Maximum Offer Notes following the

Early Tender Deadline but on or prior to the Expiration Date (as

defined below), a combined aggregate purchase price of up to the

Maximum Offer Reference Amount less (x) the aggregate purchase

price of the Any and All Notes validly tendered and accepted for

purchase through the Early Tender Deadline (excluding accrued and

unpaid interest and excluding fees and expenses related to the

Offers), (y) the aggregate purchase price of Maximum Offer Notes

validly tendered and accepted for purchase through the Early Tender

Deadline (excluding accrued and unpaid interest and excluding fees

and expenses related to the Offers) and (z) the aggregate purchase

price of the Any and All Notes validly tendered and accepted for

purchase after the Early Tender Deadline through the Expiration

Date (excluding accrued and unpaid interest and excluding fees and

expenses related to the Offers) (the “Late Tender Maximum Offer

Amount”) of Maximum Offer Notes, subject to the Acceptance Priority

Levels and proration, provided that if the deduction of (x), (y)

and (z) results in a negative number, the Late Tender Maximum Offer

Amount will be $0. If the Late Tender Maximum Offer Amount is $0,

no additional Maximum Offer Notes will be accepted for purchase

after the Early Tender Deadline. The Offers are open to all

registered holders of the applicable Notes (collectively, the

“Holders”).

According to information provided by Global Bondholder Services

Corporation, the information agent and tender agent for the Offers,

as of 5:00 p.m., New York City time, on Dec. 9, 2024 (the “Early

Tender Deadline”), approximately $2.67 billion aggregate principal

amount of Any and All Notes were validly tendered and not validly

withdrawn, and approximately $2.28 billion aggregate principal

amount of Maximum Offer Notes were validly tendered and not validly

withdrawn. The tables below identify the principal amount of each

series of Notes validly tendered and not validly withdrawn:

Any and All of the Outstanding Securities Listed Below

(collectively, the “Any and All Notes”):

Title of Security

CUSIP / ISIN

Issuer

Aggregate Principal Amount

Outstanding Prior to the Offers

Principal Amount Tendered as

of the Early Tender Deadline

4.400% Senior Notes due 2027

565849AP1 / US565849AP16

Marathon

$1,000,000,000

$569,781,000

5.300% Senior Notes due 2029

565849AQ9 / US565849AQ98

Marathon

$600,000,000

$513,269,000

6.800% Senior Notes due 2032

565849AB2 / US565849AB20

Marathon

$550,000,000

$370,068,000

5.700% Senior Notes due 2034

565849AR7 / US565849AR71

Marathon

$600,000,000

$496,336,000

6.600% Senior Notes due 2037

565849AE6 / US565849AE68

Marathon

$750,000,000

$410,045,000

5.200% Senior Notes due 2045

565849AM8 / US565849AM84

Marathon

$500,000,000

$313,538,000

Up to the Maximum Offer Reference Amount of the Outstanding

Securities Listed Below (collectively, the “Maximum Offer Notes”)

less the Aggregate Purchase Price of the Any and All Notes Validly

Tendered and Accepted for Purchase in the Priority Listed

Below:

Title of Security

CUSIP / ISIN

Issuer

Aggregate Principal Amount

Outstanding Prior to the Offers

Acceptance Priority

Level(1)

Principal Amount Tendered as

of the Early Tender Deadline

Principal Amount Expected to

be Accepted for Purchase

7.800% Debentures due 2027

891490AR5 /

US891490AR57

CPCo

$203,268,000

1

$83,232,000

$83,232,000

7.000% Debentures due 2029

718507BK1 / US718507BK18

CPCo

$112,493,000

2

$17,010,000

$17,010,000

7.375% Senior Notes due 2029

122014AL7 / US122014AL76

Burlington Resources LLC

$92,184,000

3

$25,956,000

$25,956,000

6.950% Senior Notes due 2029

208251AE8 / US208251AE82

CPCo

$1,195,359,000

4

$490,357,000

$490,357,000

8.125% Senior Notes due 2030

891490AT1 / US891490AT14

CPCo

$389,580,000

5

$182,702,000

$182,702,000

7.400% Senior Notes due 2031

12201PAN6 / US12201PAN69

Burlington Resources LLC

$382,280,000

6

$150,717,000

$150,717,000

7.250% Senior Notes due 2031

20825UAC8 / US20825UAC80

Burlington Resources Oil &

Gas Company L.P.

$400,328,000

7

$131,980,000

$131,980,000

7.200% Senior Notes due 2031

12201PAB2 / US12201PAB22

Burlington Resources LLC

$446,574,000

8

$235,369,000

$0

5.900% Senior Notes due 2032

20825CAF1 / US20825CAF14

ConocoPhillips

$504,700,000

9

$181,098,000

$0

5.950% Senior Notes due 2036

20825VAB8 / US20825VAB80

Burlington Resources LLC

$326,321,000

10

$149,655,000

$0

5.900% Senior Notes due 2038

20825CAP9 / US20825CAP95

ConocoPhillips

$350,080,000

11

$110,843,000

$0

5.950% Senior Notes due 2046

20826FAR7 / US20826FAR73

CPCo

$328,682,000

12

$40,588,000

$0

6.500% Senior Notes due 2039

20825CAQ7 / US20825CAQ78

ConocoPhillips

$1,587,744,000

13

$481,148,000

$0

_________________________

(1)

Subject to the Early Tender Maximum Offer

Amount and the Late Tender Maximum Offer Amount, as applicable, and

proration, the principal amount of each series of Maximum Offer

Notes that are purchased in the Maximum Notes Offer will be

determined in accordance with the applicable “Acceptance Priority

Level” (in numerical priority order with 1 being the highest

Acceptance Priority Level and 13 being the lowest) specified in the

applicable column.

In conjunction with the Offers, Marathon is soliciting consents

(each, a “Consent Solicitation” and, collectively, the “Consent

Solicitations”) to adopt certain proposed amendments to each of the

indentures governing the Any and All Notes to eliminate certain of

the covenants, restrictive provisions, and events of default (the

“Proposed Amendments”).

CPCo is also offering eligible Holders of each series of Any and

All Notes, in each case upon the terms and conditions set forth in

the Offering Memorandum and Consent Solicitation (the “Offering

Memorandum”), a copy of which may be obtained from the information

agent, the opportunity to exchange the outstanding Any and All

Notes for up to $4,000,000,000 aggregate principal amount of new

notes issued by CPCo and fully and unconditionally guaranteed by

COP (the “Concurrent Exchange Offer”). Holders of any series of Any

and All Notes who validly tender and do not validly withdraw their

Any and All Notes pursuant to the Concurrent Exchange Offer will

also be deemed to have consented to the Proposed Amendments under

the Consent Solicitations. A Holder is only able to tender Any and

All Notes within a series into either the Any and All Notes Offer

or the Concurrent Exchange Offer, as the same Any and All Notes

cannot be tendered into more than one tender offer at the same

time.

COP also announced that, as of the Early Tender Deadline,

Marathon has received the requisite number of consents to adopt the

Proposed Amendments with respect to each of the six outstanding

series of Any and All Notes that are subject to the Consent

Solicitations (pursuant to the Any and All Notes Offer and the

Concurrent Exchange Offer). Marathon has entered into a

supplemental indenture with the trustee for the Any and All Notes

to effect the Proposed Amendments.

In addition, COP also announced that the Financing Condition for

the Offers as described in the Offer to Purchase has been

satisfied.

The Offers and Consent Solicitations are being made pursuant to

and are subject to the terms and conditions set forth in the Offer

to Purchase dated Nov. 25, 2024 (as amended by this release, the

"Offer to Purchase"). The Any and All Notes Offer is a separate

offer from the Maximum Offer, and each of the Any and All Notes

Offer and the Maximum Offer may be individually amended, extended

or terminated by CPCo.

As of 5:00 p.m., New York City time, on Dec. 9, 2024 (the

“Withdrawal Deadline”), Notes validly tendered in the Offers may no

longer be withdrawn except in certain limited circumstances where

additional withdrawal rights are required by law.

Because the aggregate purchase price of Maximum Offer Notes

validly tendered and not validly withdrawn on or prior to the Early

Tender Deadline is expected to exceed the Early Tender Maximum

Offer Amount, CPCo expects to accept all validly tendered 7.800%

Debentures due 2027, 7.000% Debentures due 2029, 7.375% Senior

Notes due 2029, 6.950% Senior Notes due 2029, 8.125% Senior Notes

due 2030, 7.400% Senior Notes due 2031 and 7.250% Senior Notes due

2031, and none of the validly tendered 7.200% Senior Notes due

2031, 5.900% Senior Notes due 2032, 5.950% Senior Notes due 2036,

5.900% Senior Notes due 2038, 5.950% Senior Notes due 2046, and

6.500% Senior Notes due 2039. Although the Maximum Offer is

scheduled to expire at 5:00 p.m., New York City time, on Dec. 24,

2024 (such date and time, as may be extended or earlier terminated

by CPCo), because the Maximum Offer is expected to have been fully

subscribed as of the Early Tender Deadline, CPCo does not expect to

accept for purchase any Maximum Offer Notes tendered after the

Early Tender Deadline. Maximum Offer Notes tendered and not

accepted for purchase will be promptly returned to the tender

Holders as described in the Offer to Purchase.

The consideration to be paid in the Offers for each series of

Notes validly tendered and expected to be accepted for purchase as

described in the Offer to Purchase will be determined at 10:00

a.m., New York City time, on Dec. 10, 2024 (such date and time as

may be extended by CPCo). Holders of Notes validly tendered and not

validly withdrawn on or prior to the Early Tender Deadline and

accepted for purchase will receive the applicable total

consideration (the “Total Tender Offer Consideration”), which

includes an early tender premium of $50.00 per $1,000 principal

amount of Notes accepted for purchase. The applicable Total Tender

Offer Consideration will be determined by reference to a fixed

spread specified for each series of Notes over the yield based on

the bid-side price of the applicable U.S. Treasury Security, as

described in the Offer to Purchase. In addition to the applicable

Total Tender Offer Consideration, Holders of Notes validly tendered

and not validly withdrawn on or prior to the Early Tender Deadline

and accepted for purchase will also receive accrued and unpaid

interest rounded to the nearest cent on such $1,000 principal

amount of Notes from the last applicable interest payment date up

to, but not including, the Early Settlement Date.

The settlement date for Notes validly tendered and not validly

withdrawn on or prior to the Early Tender Deadline and accepted for

purchase is expected to be Dec. 12, 2024, the third business day

after the Early Tender Deadline (the “Early Settlement Date”).

CPCo’s obligation to accept for purchase, and to pay for, the

Notes validly tendered and not validly withdrawn in the Offers is

subject to the satisfaction or waiver of the conditions as

described in the Offer to Purchase. CPCo reserves the absolute

right, subject to applicable law, to: (i) waive any and all

conditions applicable to any of the Offers; (ii) extend or

terminate any of the Offers; (iii) increase or decrease the Maximum

Offer Reference Amount for purposes of determining the Early Tender

Maximum Offer Amount or the Late Tender Maximum Offer Amount, in

either case, without extending the Early Tender Deadline or the

Withdrawal Deadline; or (iv) otherwise amend any of the Offers in

any respect.

TD Securities (USA) LLC, HSBC Securities (USA) Inc., J.P. Morgan

Securities LLC and Wells Fargo Securities, LLC are the Lead Dealer

Managers and Solicitation Agents for the Tender Offer. Global

Bondholder Services Corporation is the Tender Agent and Information

Agent. Persons with questions regarding the Tender Offer should

contact TD Securities (USA) LLC (toll-free) at (866) 584-2096, HSBC

Securities (USA) Inc. (toll-free) at (888) HSBC-4LM, J.P. Morgan

Securities LLC (toll-free) at (866) 834-4666 or (collect) at (212)

834-4818, and Wells Fargo Securities (toll-free) at (866) 309-6316

or (collect) at (704) 410-4235. Requests for copies of the Offer to

Purchase, the related Letter of Transmittal and related materials

should be directed to Global Bondholder Services Corporation at

(+1) (212) 430-3774, (toll-free) (855) 654-2015 or

contact@gbsc-usa.com. Questions regarding the tendering of Notes

may be directed to Global Bondholder Services Corporation

(toll-free) at (855) 654-2015.

This news release is neither an offer to purchase nor a

solicitation of an offer to sell the Notes. The Offers and Consent

Solicitations are made only by the Offer to Purchase and the

information in this news release is qualified by reference to the

Offer to Purchase and related Letter of Transmittal, dated Nov. 25,

2024. None of ConocoPhillips or its affiliates, their respective

boards of directors, the Dealer Managers, the Solicitation Agents,

the Tender Agent and Information Agent or the trustees with respect

to any Notes is making any recommendation as to whether holders

should tender any Notes in response to the Offers, and neither

ConocoPhillips nor any such other person has authorized any person

to make any such recommendation. Holders must make their own

decision as to whether to tender any of their Notes, and, if so,

the principal amount of Notes to tender.

---# # # ---

About ConocoPhillips

ConocoPhillips is one of the world’s leading exploration and

production companies based on both production and reserves, with a

globally diversified asset portfolio. Headquartered in Houston,

Texas, ConocoPhillips had operations and activities in 13

countries, $97 billion of total assets, and approximately 10,300

employees at Sept. 30, 2024. Production averaged 1,921 MBOED for

the nine months ended Sept. 30, 2024, and proved reserves were 6.8

BBOE as of Dec. 31, 2023.

For more information, go to www.conocophillips.com.

CAUTIONARY STATEMENT FOR THE PURPOSES

OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements as defined

under the federal securities laws. Forward-looking statements

relate to future events, plans and anticipated results of

operations, business strategies, and other aspects of our

operations or operating results. Words and phrases such as

“ambition,” “anticipate,” “believe,” “budget,” “continue,” “could,”

“effort,” “estimate,” “expect,” “forecast,” “goal,” “guidance,”

“intend,” “may,” “objective,” “outlook,” “plan,” “potential,”

“predict,” “projection,” “seek,” “should,” “target,” “will,”

“would,” and other similar words can be used to identify

forward-looking statements. However, the absence of these words

does not mean that the statements are not forward-looking. Where,

in any forward-looking statement, the company expresses an

expectation or belief as to future results, such expectation or

belief is expressed in good faith and believed to be reasonable at

the time such forward-looking statement is made. However, these

statements are not guarantees of future performance and involve

certain risks, uncertainties and other factors beyond our control.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecast in the forward-looking statements.

Factors that could cause actual results or events to differ

materially from what is presented include changes in commodity

prices, including a prolonged decline in these prices relative to

historical or future expected levels; global and regional changes

in the demand, supply, prices, differentials or other market

conditions affecting oil and gas, including changes resulting from

any ongoing military conflict, including the conflicts in Ukraine

and the Middle East, and the global response to such conflict,

security threats on facilities and infrastructure, or from a public

health crisis or from the imposition or lifting of crude oil

production quotas or other actions that might be imposed by OPEC

and other producing countries and the resulting company or

third-party actions in response to such changes; insufficient

liquidity or other factors, such as those listed herein, that could

impact our ability to repurchase shares and declare and pay

dividends such that we suspend our share repurchase program and

reduce, suspend, or totally eliminate dividend payments in the

future, whether variable or fixed; changes in expected levels of

oil and gas reserves or production; potential failures or delays in

achieving expected reserve or production levels from existing and

future oil and gas developments, including due to operating

hazards, drilling risks or unsuccessful exploratory activities;

unexpected cost increases, inflationary pressures or technical

difficulties in constructing, maintaining or modifying company

facilities; legislative and regulatory initiatives addressing

global climate change or other environmental concerns; public

health crises, including pandemics (such as COVID-19) and epidemics

and any impacts or related company or government policies or

actions; investment in and development of competing or alternative

energy sources; potential failures or delays in delivering on our

current or future low-carbon strategy, including our inability to

develop new technologies; disruptions or interruptions impacting

the transportation for our oil and gas production; international

monetary conditions and exchange rate fluctuations; changes in

international trade relationships or governmental policies,

including the imposition of price caps, or the imposition of trade

restrictions or tariffs on any materials or products (such as

aluminum and steel) used in the operation of our business,

including any sanctions imposed as a result of any ongoing military

conflict, including the conflicts in Ukraine and the Middle East;

our ability to collect payments when due, including our ability to

collect payments from the government of Venezuela or PDVSA; our

ability to complete any announced or any future dispositions or

acquisitions on time, if at all; the possibility that regulatory

approvals for any announced or any future dispositions or

acquisitions will not be received on a timely basis, if at all, or

that such approvals may require modification to the terms of the

transactions or our remaining business; business disruptions

relating to the acquisition of Marathon Oil Corporation (Marathon

Oil) or following any other announced or other future dispositions

or acquisitions, including the diversion of management time and

attention; the ability to deploy net proceeds from our announced or

any future dispositions in the manner and timeframe we anticipate,

if at all; our ability to successfully integrate Marathon Oil’s

business and technologies, which may result in the combined company

not operating as effectively and efficiently as expected; our

ability to achieve the expected benefits and synergies from the

Marathon Oil acquisition in a timely manner, or at all; potential

liability for remedial actions under existing or future

environmental regulations; potential liability resulting from

pending or future litigation, including litigation related directly

or indirectly to pending or completed transactions; the impact of

competition and consolidation in the oil and gas industry; limited

access to capital or insurance or significantly higher cost of

capital or insurance related to illiquidity or uncertainty in the

domestic or international financial markets or investor sentiment;

general domestic and international economic and political

conditions or developments, including as a result of any ongoing

military conflict, including the conflicts in Ukraine and the

Middle East; changes in fiscal regime or tax, environmental and

other laws applicable to our business; and disruptions resulting

from accidents, extraordinary weather events, civil unrest,

political events, war, terrorism, cybersecurity threats or

information technology failures, constraints or disruptions; and

other economic, business, competitive and/or regulatory factors

affecting our business generally as set forth in our filings with

the Securities and Exchange Commission. Unless legally required,

ConocoPhillips expressly disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210752076/en/

Dennis Nuss (media) 281-293-1149

dennis.nuss@conocophillips.com

Investor Relations 281-293-5000

investor.relations@conocophillips.com

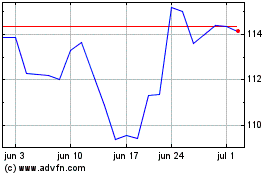

ConocoPhillips (NYSE:COP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

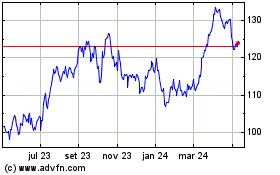

ConocoPhillips (NYSE:COP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024