United Airlines (NASDAQ:UAL) – United Airlines

forecasts an adjusted profit of between $3.75 and $4.25 per share

for the June quarter. In the first quarter, it posted an adjusted

loss of 15 cents per share, better than Wall Street’s estimate of a

57-cent loss per share. The company reaffirmed its earnings

estimate for 2024 of $9 to $11 per share. Shares were up 5.3% in

pre-market trading.

Take-Two Interactive (NASDAQ:TTWO) – Take-Two

plans to lay off about 5% of its workforce, approximately 600

employees, and cancel several development projects to cut costs,

anticipating charges of up to $200 million. The move aims to

generate annual savings of over $165 million, reflecting

post-pandemic uncertainties in the video game industry.

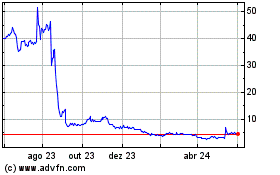

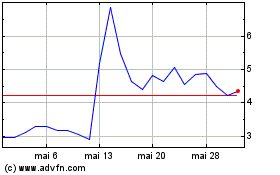

AMC Entertainment Holdings (NYSE:AMC) – AMC

shares rose 5.51% in Wednesday’s pre-market trading after

increasing 10.1% on Tuesday, the biggest daily gain since February

6, despite a four-day losing streak previously. CEO Adam Aron

dismissed the possibility of bankruptcy, highlighting efforts to

reduce debt. Analysts see a cautiously optimistic future.

Boeing (NYSE:BA) – Boeing has terminated the

lobbying firm that assisted it during the 737 Max incidents.

Cornerstone Government Affairs, previously crucial for Boeing, was

dismissed after hiring a client who had previously employed a

former Boeing executive.

Apple (NASDAQ:AAPL) – Apple is considering

building a factory in Indonesia, as discussed by CEO Tim Cook with

President Joko Widodo. The company has already invested in

developer academies in the country to meet local content

requirements.

Microsoft (NASDAQ:MSFT) – Software developer

Nikolai Avteniev tested Microsoft’s coding assistant Copilot in

2021, realizing its potential. Equipped with OpenAI’s GPT-4

technology, Copilot now answers questions and converts code between

languages, becoming an essential tool for software engineers,

saving time and improving efficiency.

ASML (NASDAQ:ASML) – In the first quarter, ASML

recorded net sales of $5.62 billion, below expectations, but

surpassed with a profit of 1.22 billion euros. Compared to the

previous year, net sales fell 21.6%, while net profit dropped

37.4%, and net bookings of machines registered a decline of 4%.

ASML expects a gradual recovery, supported by investments and

increasing demand, and reiterated net sales for 2024 to be similar

to 2023. Sales to China increased from the fourth quarter of 2023

to 49% of the total in the first quarter.

Advanced Micro Devices (NASDAQ:AMD) – AMD

launched a new series of semiconductors for enterprise laptops and

desktops with artificial intelligence on Tuesday, aiming to expand

its presence in the lucrative “AI PCs” market. The chips will be

available on HP (NYSE:HPQ) and

Lenovo (USOTC:LNVGY) platforms starting in the

second quarter of 2024.

Intel (NASDAQ:INTC) – Intel will release two AI

chips with reduced capabilities for China, in compliance with U.S.

restrictions. Scheduled for June and September, the chips based on

the Gaudi 3 line will have limited performance.

Nvidia (NASDAQ:NVDA) also plans specific chips for

China following stricter U.S. rules last year.

Amazon (NASDAQ:AMZN) – Amazon.com’s Prime

service reached a record 180 million members in the U.S. in March,

an 8% increase from the previous year, according to Consumer

Intelligence Research Partners. The growth indicates continued

consumer preference for Prime’s benefits, despite competition.

Meta Platforms (NASDAQ:META) – Meta Platforms’

Oversight Board is reviewing the company’s response to two sexually

explicit images of female celebrities created by AI, circulating on

Facebook and Instagram. Without naming the figures, the board will

use these cases to assess Meta’s enforcement policies regarding

pornographic deepfakes.

Trump Media & Technology Group (NASDAQ:DJT)

– On Tuesday, the creator of Truth Social announced that Trump

Media plans to launch its live TV streaming platform in stages

after six months of testing. The first phase will cover

distributing content from Truth Social to Android, iOS, and Web,

without disclosing a timeline for the last phase, which will

include streaming apps for TV. The company’s shares are down -1.27%

in Wednesday’s pre-market after falling 14% on Tuesday and 18% on

Monday.

Spotify (NYSE:SPOT) – A quarter of Spotify’s

paid subscribers in the U.S., UK, and Australia started an

audiobook as part of their subscriptions, indicating a growing

interest in the format. Most of these listeners, 57%, are in the 18

to 34 age group, suggesting a strong attraction among young

people.

Autodesk (NASDAQ:ADSK) – Autodesk’s shares fell

2.6% in Wednesday’s pre-market after announcing an ongoing internal

investigation into its accounting practices. The company also

revealed that it would not be able to submit its annual report for

the year ended January 31 within the extended 15-day deadline.

Autodesk states that the investigation will not affect previous

financial statements.

Tesla (NASDAQ:TSLA) – Tesla’s shares are up

1.27% in Wednesday’s pre-market, after closing down 2.7% on Tuesday

at $157.11, reflecting a 37% drop this year. This brought its

market valuation below $500 billion on Tuesday. Recent job cuts

have highlighted slowing growth, declining demand, and underscore

challenges for the company.

Toyota Motor (NYSE:TM) – Toyota Motor has

recalled over 135,000 hybrid Prius cars in Japan and stopped new

orders due to issues with the rear door handles. The affected

vehicles were manufactured between November 2022 and April 2024,

with no reports of accidents due to the flaw.

Stellantis (NYSE:STLA) – Stellantis faces a

challenging year with rising price pressures, its CEO warned on

Tuesday, ahead of shareholders voting to approve his generous 2023

salary package. CEO Carlos Tavares’ compensation increased by 56%,

reaching $38.8 million, sparking criticism.

JB Hunt Transport Services (NASDAQ:JBHT) – JB

Hunt recorded a 6% drop in pre-market shares after reporting

reduced quarterly profits and revenues. Earnings were $127.5

million, or $1.22 per share, compared to $197.8 million, or $1.89

per share, in the same period last year. Revenue fell 9%, to $2.94

billion.

Rio Tinto (NYSE:RIO) – Rio Tinto plans to keep

all the copper from its Resolution mine in the U.S. if the

controversial project is approved, producing over 40 billion pounds

of copper over its lifetime. The company sees strong demand in the

U.S. for the project’s copper.

America Movil (NYSE:AMX) – America Movil

recorded a 55.2% drop in net profit, reaching $816.7 million (13.5

billion pesos). Quarterly revenue was $12.3 billion (203.3 billion

pesos), falling 2.7% from the previous year. EBITDA dropped 2.6%,

to 80.6 billion pesos. America Movil added 1.5 million mobile

subscribers, including 1.3 million postpaid customers, driven by an

increase in Brazilian customers. In the fixed-line segment, the

company added 562,000 broadband accesses.

Morgan Stanley (NYSE:MS) – Morgan Stanley is

reducing investment banking jobs in the Asia-Pacific due to weaker

business activities. Morgan Stanley will cut 50 jobs, affecting 13%

of the team.

HSBC (NYSE:HSBC) – HSBC plans to cut an

additional 20 investment banking jobs in Asia, adding to about 30

layoffs this week. The bank began the layoffs on Tuesday, notifying

about a dozen bankers due to the downturn in business.

Citigroup (NYSE:C) – American banks continued

to reduce their workforce in the first quarter, with Citigroup

leading with a drop of 2,000 employees. Bank of

America (NYSE:BAC), Wells Fargo

(NYSE:WFC), and PNC Financial (NYSE:PNC) also saw

combined reductions of about 2,000 jobs.

Goldman Sachs (NYSE:GS) – Goldman Sachs’ growth

capital division invested $47.5 million in the Polish startup

Kontakt.io, specializing in Bluetooth-connected devices for

hospital management. Focused on efficiency and resource savings,

the company plans to expand its AI system for hospital

operations.

PNC Financial (NYSE:PNC) – In the first

quarter, PNC’s net profit fell 21%, reaching $1.34 billion, or

$3.10 per share diluted, from $1.69 billion, or $3.98 per share, in

the same period last year.

Bank of Montreal (NYSE:BMO) – The Chairman of

Bank of Montreal highlighted the robust growth of the U.S. economy,

especially in California, a key market for the bank. With a third

of revenue coming from the U.S. after acquiring Bank of the West,

BMO is well-positioned to meet global shifts.

Northern Trust (NASDAQ:NTRS) – Northern Trust

recorded a 38% drop in first-quarter profit, to $196.1 million, or

$0.96 per share, compared to $315.2 million, or $1.51 per share, in

the same period last year. Total revenue fell 5.6%, to $1.65

billion.

BlackRock (NYSE:BLK) – Larry Fink, CEO of

BlackRock, seeks to expand his presence in Saudi Arabia, despite

controversies over human rights and oil dependence. The company has

established an office in Riyadh and hired about 20 local employees,

aiming to influence emerging markets and strengthen geopolitical

ties.

Interactive Brokers (NASDAQ:IBKR) – Interactive

Brokers beat estimates with a profit of $1.64 per share and revenue

of $1.203 billion in the first quarter. Shares fell 1.27% in

pre-market. The dividend increased to 25 cents per share. The

company attracted 184,000 new accounts and net interest revenue

grew 17%.

Mondelez International (NASDAQ:MDLZ) – The

European Union is planning to fine Mondelez for blocking

international sales, reported the Financial Times. The fine,

potentially worth millions of euros, is expected to be issued next

month, ordering Mondelez to stop blocking sales between EU member

states.

Urban Outfitters (NASDAQ:URBN) – Urban

Outfitters saw its shares fall 3.1% to $36.84 after analysts from

Jefferies downgraded the retailer’s stock recommendation from

“Hold” to “Underperform”, also lowering the target price from $42

to $32.

AMC Entertainment (NYSE:AMC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

AMC Entertainment (NYSE:AMC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025