Bitcoin Bears In Trouble: $800 Million Set For Liquidation If BTC Reclaims This Price

16 Novembro 2024 - 7:00AM

NEWSBTC

Bitcoin (BTC) has been on a tear recently, hitting multiple

all-time highs (ATH) levels since Donald Trump emerged victorious

in the 2024 US presidential elections. Although the top

cryptocurrency has witnessed a slight pullback in the past 24

hours, rebounding to an earlier price level could spell trouble for

the bears. Bitcoin Bears Could Be Under Trouble According to

analysis shared by crypto analyst Ali Martinez on X, more than $800

million is at risk of liquidation if the flagship digital asset

reclaims the $93,000 price level. Notably, BTC’s current ATH stands

at $93,477. Related Reading: Binance Dominates As Bitcoin

Futures Volume Hits New Peaks Amid Historic Price Rally At the time

of writing, BTC is trading at $89,480, down 1.9% in the past 24

hours. On the 4-hour chart, BTC’s next prominent support level

appears to be around the $86,000. The digital asset has

already tested this support level three times, and a further dip to

this price could send BTC tumbling toward $81,600, its next major

support. If BTC fails to hold above $81,600, a decline to $79,700

may follow. While a lower BTC price would favor the bears, a

reclaim of the $93,000 level could severely hurt them. Such a move

would risk over $800 million in liquidations, potentially forcing

bearish traders to capitulate. Data from Coinglass shows that

contracts worth more than $508 million were liquidated in the past

24 hours. Of this, $355 million were long, while $153 million were

short. A recent analysis by prominent crypto analyst @CryptoKaleo

suggests that Martinez’s warning for bears may be justified.

According to @CryptoKaleo, BTC could retrace to $86,000 before

embarking on another rally to set new ATHs – possibly beyond

$100,000. The analyst stated: Just a little dip and a bit more

ranging then send to $100K+. Honestly think this is the best case

scenario for alts if we somehow get it. Would look for

outperformance while BTC is accumulating around $90K. What’s Behind

BTC’s Run? Multiple factors have contributed to BTC’s historic

price action, including the halving earlier this year, the approval

of Bitcoin exchange-traded funds (ETFs), and rising institutional

adoption of the digital asset. Related Reading: Bitcoin ETFs

Surpass 1 Million BTC Holdings In Less Than A Year Since Launch –

Details Inside However, Trump’s win in the 2024 US presidential

elections – a result seen as pro-crypto – served as a major

catalyst for BTC’s surge. Since Trump’s victory on November 5, BTC

has climbed from around $69,000 to a high of $93,000, recording

gains of more than 30% in just 10 days. Despite this impressive

price rally, experts suggest that BTC may have further room to

grow. For instance, a recent research report predicts that BTC’s

bullish momentum could continue until mid-2025 when it is expected

to peak. Additionally, relatively low profit-taking during this

bull run could further propel BTC to new heights. However, bulls

should remain cautious of a significant CME gap around the $78,000

level, which could be a magnet for price correction. At the time of

writing, the total cryptocurrency market capitalization stands at

$2.904 trillion, reflecting a 3.7% decline over the past 24 hours.

Meanwhile, Bitcoin dominance is at 60.97%, underscoring BTC’s

continued strength in the market. Featured image from Unsplash,

Charts from X, Coinglass, and Tradingview.com

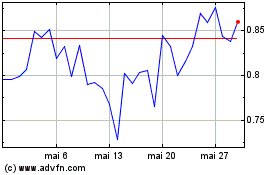

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024