Ethena (ENA) Surges 60%, But Fantom Co-Founder Warns Of Luna-Like Demise

03 Abril 2024 - 10:00AM

NEWSBTC

Ethena Labs’ new governance token, ENA, is witnessing a staggering

60% increase in its value, shortly after its introduction to the

market. The spike in ENA’s price to approximately $0.96 has

catapulted its market capitalization to nearly $1.34 billion,

ranking ENA as the 80th largest cryptocurrency by market cap. This

ascent followed Ethena’s strategic distribution of 750 million ENA

tokens, representing 5% of its total supply, through an airdrop to

holders of its USDe token. The USDe, a synthetic dollar, is central

to Ethena’s offering, leveraging a blend of ether liquid staking

tokens and short Ether (ETH) perpetual futures positions to

maintain a target value near $1. The Ethena Labs airdrop went live

2 hours ago, with $450M of ENA to distribute. The largest $ENA

recipient so far has been 0xb56, who received 3.30M ENA worth

$1.96M. Track ENA on Arkham:https://t.co/coFsTcBUCa

https://t.co/RSZwXLhCB6 pic.twitter.com/l6c7bqKghG — Arkham

(@ArkhamIntel) April 2, 2024 At the heart of Ethena’s value

proposition is the ENA token, engineered to facilitate a digital

dollar platform on the Ethereum blockchain. This platform seeks to

provide a viable alternative to conventional banking mechanisms

through its innovative ‘Internet Bond’. By harnessing the potential

of derivative markets and staked Ethereum, the Internet Bond offers

a dollar-denominated savings instrument accessible globally,

independent of traditional banking infrastructure. Related Reading:

MakerDAO Initiates Massive $600 Million DAI Investment In USDe And

sUSDe The total supply of ENA tokens is capped at 15 billion, with

an initial issuance of 1.425 billion tokens. The distribution plan

prioritizes ecosystem development (30%), core contributor rewards

(30%), investor engagement (25%), and foundation support (15%),

embodying a holistic approach to tokenomics. Notably, Binance’s

endorsement of ENA as the 50th project on its Binance Launchpool,

enabling users to farm ENA tokens by staking BNB and FDUSD,

underscores the token’s appeal. At press time, ENA traded at $0.93,

up 60% in the past 24 hours. Fantom Co-Founder Warns Of Luna-Like

Collapse Andre Cronje, co-founder of the Fantom Foundation, issued

a warning on X, recalling the concerns that preceded the collapse

of Terra Luna. Cronje dissected the structure of perpetual

contracts (perps), a derivative product that enables traders to

speculate on the price movement of an asset without holding the

actual asset. This mechanism operates on a system of funding rates

meant to tether the perpetual price closely to the underlying

asset’s spot price. However, Cronje highlighted a critical

vulnerability in this system: the reliance on yield-generating

assets, such as staked Ethereum (stETH), as collateral. Related

Reading: Fantom (FTM) Jumps 180% In 4 Weeks: Just The Beginning?

This approach theoretically allows for a “neutral” position, where

the gains from yield should offset losses from the short position

if the asset’s price drops. Yet, this equilibrium is precarious, as

negative shifts in funding rates can erode the collateral, leading

to liquidation. “The mechanism – the theory here is that you can

generate a ‘stable’ $1000, by buying $1000 of stETH, using this as

collateral to open a $1000 stETH short, thereby achieving being

‘neutral’, while getting the benefit of the stETH yield (~3%) +

whatever is paid in funding rates,” Cronje explained. Cronje’s

concerns are not unfounded. The crypto industry witnessed the

dramatic implosion of Terra’s algorithmic stablecoin UST in 2021, a

debacle that resulted in significant financial losses across the

board. By drawing a parallel between the structural weaknesses he

perceives in Ethena’s framework and the mechanisms that led to

Terra’s downfall, Cronje raises a red flag about the sustainability

of complex financial products that lack transparent risk mitigation

strategies. Every so often we see something new in this space. I

often find myself on the mid curve for an extensive amount of time.

I am comfortable here. That being said, there have been events in

this industry I wish I was more curious about, there have also been

events I definitely did… — Andre Cronje (@AndreCronjeTech) April 3,

2024 Responding to Cronje’s critique, the founder of Ethena Labs

Guy Young aka Leptokurtic, acknowledged the validity of the

concerns raised. “These aren’t mid curve concerns at all Andre

Cronje, you rightly point out risks that absolutely do exist here.

Will work on a longer form response for you by end of this week

with some thoughts,” Young stated on X. Featured image from

LinkedIn, chart from TradingView.com

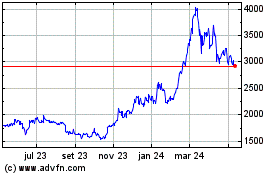

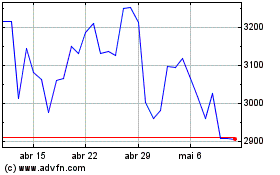

stETH (COIN:STETHUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

stETH (COIN:STETHUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024