AAVE Whale Goes On $6.78 Million Buying Spree As Price Recovers 16%

05 Setembro 2024 - 4:00AM

NEWSBTC

AAVE, the native token of the crypto lending protocol with the same

name, was among the top performers during August. The

cryptocurrency showed strength throughout the retraces, displaying

green numbers in most timeframes after recovering. Its performance

gathered the attention of crypto analysts, who consider the token

could become a top narrative at the end of the year. As a result,

crypto whales have turned their eyes to the token, accumulating

millions of dollars worth of AAVE in the past month. Related

Reading: FET Price Targets $3.4 After Breakout, Here Are The Key

Levels To Watch Whales Continue Buying Spree AAVE became one of the

best-performing cryptocurrencies since August, rising nearly 63.5%

in the last 30 days. This performance sparked renewed interest in

the token, driving whales to accumulate it throughout the past two

weeks. Since August 20, the crypto lending protocol’s token caught

the attention of several whales. As reported by on-chain data

analysis firm Lookonchain, large investors have purchased around

170,382 tokens, worth $22.27 million, in the last two weeks. One

whale took advantage of the price drops and accumulated over

120,000 AAVE since August 21. This whale used 4,000 stETH to buy

77,270 AAVE tokens two weeks ago. The purchase was valued at $10.4

million, with an average token price of $135. On Wednesday morning,

the same investor bought another 50,604 tokens, worth around $6.78

million. After the buying spree, the whale holds 125,605 AAVE,

worth $16.9 million, purchased at an average price of $134.6. AAVE

Recovers $130 Support Zone AAVE’s price dropped over 12% to $116 as

Bitcoin dropped below the $57,000 mark on Tuesday night. However,

the token quickly regained over 16% of its price to trade above the

$135 range. The price recovery appears to be fueled by whale

activity and recent reports of a Trump link, as noted by some

analysts. On Wednesday, reports suggested that Donald Trump’s

crypto project, “World Liberty Financial,” will be a DeFi lending

platform based on Aave and Ethereum. Following the news, Altcoin

Sherpa highlighted the token’s “nice move,” adding that it

“undoubtedly” is one of the strongest cryptocurrencies in the

market. Nonetheless, the analysts suggested that AAVE might

continue to chop around the current price range in the short term.

According to Nebraskangooner, the token has one of the

“best-looking monthly charts” but will continue to depend on the

broader market’s performance. To the analyst, AAVE’s price will

likely go down if the market drops. Related Reading: Dogwifhat

(WIF) Leads Memecoins Recovery With 12% Jump, Is $2.2 The Next

Stop? However, he also considers it is worth keeping an eye on as

it could be one of the best-performing assets “if the market finds

a good support level.” Crypto trader CrediBull also suggested that

the token could target the $150 mark if Bitcoin and Ethereum bounce

from the current levels. As of this writing, AAVE is trading at

$130, a 1.2% drop in the last 24 hours. Featured Image from

Unsplash.com, Chart from TradingView.com

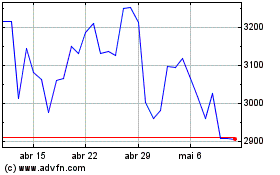

stETH (COIN:STETHUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

stETH (COIN:STETHUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024