This Expert Claims Crypto Winter Is Not Over But There’s A Catch

03 Novembro 2022 - 11:54PM

NEWSBTC

The ongoing crypto bear market seems like an unending journey, with

more firms coming down with financial crises due to asset

devaluations and other effects. Although some assets have seen

brief rallies, many remain in decline. Regarding the crypto bear

effects, Kathleen Breitman, CEO of Tezos, a blockchain platform,

shared her opinion. Breitman thinks the end of the crypto winter is

not near yet, but she is confident about the survival of a few

useful crypto applications. Related Reading: Bitcoin Shocker:

Lightning Network Capacity Reaches 5,000 BTC Reasons For Price

Devaluations The Tezos CEO argued that the recent rallies do not

signify the end of the bear market. In her opinion, easy money from

venture capitalists seeking profit and low-interest rates

artificially hiked the valuations of many crypto companies.

Kathleen further said that even if the Feds stop hiking interest

rates, only a few useful crypto applications that can grow organic

users will survive. The CEO also commented on the fall in the price

of many digital assets in 2022. She said easy money going into the

system inflated the values of digital assets. She cited examples of

crypto devaluation in the industry using the OpenSea NFT

marketplace as a case study. According to data from Dune Analytics,

OpenSea’s trading volume dropped from ~$3 billion in September 2021

to less than $350 million in September 2022. Kathleen explained

that the cheap money phenomenon started and spread into many

markets. She said OpenSea has a $13 billion valuation currently.

Other top industry players gave their opinions regarding the end of

the bear market. Charles Hoskinson, founder of Cardano, Brett

Harrison, ex-president of FTX US, and Brain Amstrong, CEO of

Coinbase, predicted when the bear market would end. Only Useful

Crypto Applications Can Survive Bear Market, Breitman According to

the Tezos CEO, since the easy money is unavailable, get the

communities (organic users). When asked if a pause in Fed’s rates

hikes could revive the crypto market, Breitman said there would

still be a shift in crypto and tech valuations. She said that the

valuations would base on user growth and not the use of cheap

tactics (easy money) that quickly goes. Furthermore, Breitman said

no metric had evaluated cryptocurrency or technology in the last

ten years when interest rates were low. However, she maintained

that practical crypto applications would thrive no matter the

challenges. As per Breitman, the demand for digital arts and their

trading on blockchain was the driving factor for Tezos’ increased

popularity in 2021. According to Breitman, the use case of

blockchain in creating and trading digital arts is among the only

sources of organic growth in the crypto industry. Related Reading:

Lightning Speed: 5 Ways To Make Money/ Earn Sats Using The

Lightning Network Amid the crypto winter, the end of the easy money

era has been a hot topic among analysts. Some believe the recent

Bitcoin price stability is good for the industry. The founder of

Nexo, a crypto lending firm, told reporters that BTC performance

strongly indicates that the digital asset market has matured.

featured Image from Pixabay | Charts by TradingView

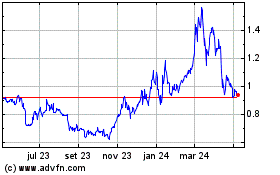

Tezos (COIN:XTZUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

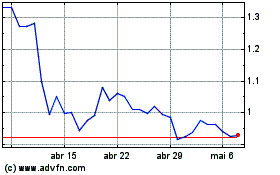

Tezos (COIN:XTZUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024