MARKET WRAPS

Stocks:

European stocks traded higher on Monday as the rebound continued

after recent losses when markets scaled back expectations for

interest-rate cuts.

"It's a warmer start to the week for the FTSE 100 and European

indices, with stocks largely gaining ground. Even the sprinkle of

cold skepticism about the prospects for interest rate cuts isn't

acting as much of a dampener," Hargreaves Lansdown said.

Corporate earnings will be in focus this week, alongside

interest-rate decisions by the Bank of Japan and the European

Central Bank.

"This week's main event is the ECB meeting on Thursday, where we

expect rates to stay on hold for now, but signal that the next rate

change most likely is a cut, which may happen in the summer,"

Danske Bank said.

Stocks to Watch

Nokia 's recent margin guidance cut and market caution is

further evidence of a weaker development in network sales, Citi

said.

Citi also forecasts a 19% decline in Ericsson's network revenue

for 4Q23 and sees further declines in 2024, with the weak market

offsetting market share gains, leading to negative revisions to

consensus.

Porsche looks poised for a transition year with little earnings

growth, Citi said, but the brand's long-term story remains

attractive.

Stellantis shares are still cheap, but buying them isn't an

automatic win as many believe, Citi said.

Citi also said that EBIT margins risk dilution from high

inventory in the U.S, where its market share slipped to 9.8% last

year from 11%.

Economic Insight

Wage growth could snatch away an inflation victory that seems

close now for the ECB, Commerzbank said.

Pay growth remains faster than is compatible with reaching the

2% rate targeted by the ECB, and pressures are likely to remain

high in the wake of new pay deals and record low joblessness, it

said.

This could mean inflation settling above the targeted range, at

around 3%.

U.S. Markets:

Stock futures were higher, looking to build on Friday's gains

that saw the S&P 500 hit a new record, as tech shares

rallied.

Treasury yields edged lower but held above 4.1%.

Stocks to Watch

Microsoft said email accounts of some of the software company's

senior leadership team have been accessed by hackers backed by the

Russian government, allowing them to read some email messages and

attached documents. Shares were up 0.4% in premarket trading.

Spirit Airlines and JetBlue Airways said they would appeal a

federal judge's decision that blocked the $3.8 billion merger of

the airlines. Spirit shares were rising 9.3% premarket.

Forex:

The dollar edged lower and it could struggle to rise unless

concerns resurface that U.S. interest rates are likely to remain

higher for longer and rate-cut expectations are trimmed back again,

UniCredit Research said.

"A return of market expectations towards a high-for-longer

scenario in terms of U.S. policy rates is needed to provide the

greenback [dollar] with much more strength," it said.

Still, the dollar is firmer than it was at the end of 2023,

helped by 10-year Treasury yields rising above 4%, UniCredit

added.

Standard Chartered said sharp interest-rate cuts by the Fed

would be negative for the dollar , but the dollar could also fall

on moderate easing.

It thinks the full-scale dollar strength of late 2021 and 2022

is unlikely to return as it was driven by the Fed's no-compromise

stance regarding tackling inflation.

Bonds:

Robust demand for eurozone government bonds year to date is a

good sign but it is necessary to remain careful, Societe Generale

Research said.

"There will be more deals in the next few weeks, and we will

monitor whether the demand persists or starts fading amid supply

fatigue."

Government bond yield spreads remain close to their tightest

levels in a year but seem not too far from their fair value, SocGen

said. "Nevertheless, we remain cautious, especially as there tends

to be seasonal widening of spreads in February."

SEB Research said the evolution of interest-rate cut

expectations will continue to be a key driver for long-term

eurozone bonds.

Its base case is a soft landing, and in this scenario "there is

only a modest downside in long rates from their current levels."

Given this view, SEB expects 10-year Bund yields to trade around

2.0% at the end of 2024.

Citi Research is turning more positive on Italian government

bonds , expecting 10-year BTP-Bund yield spread to continue to

tighten toward 140-150 basis points, unless fundamentals are

brought into play by any downside data surprises.

Energy:

Oil prices traded lower as concerns over the macroeconomic

outlook and global oil demand offset the impact of geopolitical

tensions in Russia and the Middle East.

Prices failed to gain momentum despite Ukraine's drone attack on

a Russian fuel terminal in the Baltic Sea on Sunday and growing

tensions in the Middle East amid increasing missile attacks

throughout the region.

Metals:

Base metals and gold prices were lower on a mixed macroeconomic

environment and as investors await key monetary policy

decisions.

"Thursday's [ECB] decision will be the most impactful for our

markets via the direction of the Euro," Peak Trading Research

said.

EMEA HEADLINES

Gambling Deal to Create One of European Industry's Biggest

Firms

La Francaise des Jeux has agreed to acquire Kindred Group for

close to $2.7 billion, in a deal that would create one of Europe's

biggest online gambling companies.

The deal follows calls for the possible sale of Kindred, which

is listed in Stockholm, by Corvex Management, a New York activist

investor headed by Keith Meister.

EU Tackles New $22 Billion Plan to Boost Ukraine Military

Aid

BERLIN-European Union officials will this week start tackling a

new plan to unlock tens of billions of dollars in military

assistance for Ukraine, seeking to revamp a critical aid program

bogged down by internal divisions.

The EU move comes after a number of European countries have

increased their bilateral military assistance to Ukraine even as

the Biden administration is hamstrung by Congress on providing

large-scale assistance.

Ocean Shipping Rates Surge as Red Sea Attacks Continue

Global shipping prices are continuing to rise as Houthi rebels

keep up attacks on cargo vessels in and around the Red Sea.

The disruptions are at a key point for ships passing through the

Suez Canal and are creating ripples across supply chains in Europe

and the U.S., delaying shipments and raising transportation

costs.

GLOBAL NEWS

China Benchmark Lending Rates Held Steady

China's benchmark lending rates were kept steady after the

central bank held its key policy rates unchanged earlier this

month, according to data released by the People's Bank of

China.

The one-year loan prime rate stayed at 3.45% while the five-year

rate was left at 4.2%, said the PBOC.

Stocks Are at Record Highs, but Things Will Only Get Harder From

Here

Wall Street entered 2024 betting the year would go perfectly,

but an up-and-down start for stocks and bonds suggests the going

won't be easy.

Stocks have climbed to records, driven by cooling inflation that

has spurred investors to anticipate as many as six interest-rate

cuts. Falling rates often boost share prices by reducing the

relative appeal of bonds and making it cheaper for companies and

consumers to borrow, lifting corporate profits.

Ahead of New Hampshire Primary, Underdog Nikki Haley Gets

One-on-One Race With Donald Trump

DERRY, N.H.-Nikki Haley finally secured the one-on-one matchup

against Donald Trump that she had long sought after Ron DeSantis

dropped out of the Republican presidential nomination race two days

before the New Hampshire primary. It might be too late.

The Florida governor, who endorsed the former president, wasn't

expected to be a major factor in Tuesday's GOP primary. A poll

released Sunday showed him at just 6% in the state.

Trump's Legal Woes Splinter GOP Unity

NASHUA, N.H.-A strong victory in New Hampshire's presidential

primary will leave little doubt about Donald Trump's hold on the

Republican nomination. But as he looks ahead to the general

election, the former president will confront the concerns of fellow

Republicans like Mario Faucher.

Faucher said he wouldn't vote for Trump if he is convicted in

one of the four criminal cases he is facing. "If that happens,

who's going to support Republicans?" asked Faucher, who drove from

Massachusetts to Nashua on Friday to see Florida Gov. Ron DeSantis,

his preferred candidate.

Write to ina.kreutz@wsj.com

Write to us at newsletters@dowjones.com

We offer an enhanced version of this briefing that is optimized

for viewing on mobile devices and sent directly to your email

inbox. If you would like to sign up, please go to

https://newsplus.wsj.com/subscriptions.

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 22, 2024 05:49 ET (10:49 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

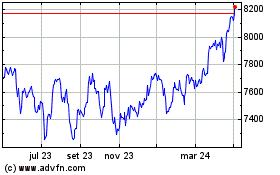

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Out 2024 até Nov 2024

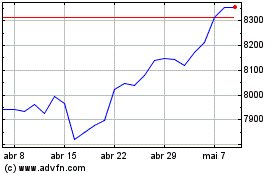

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Nov 2023 até Nov 2024