London's blue chip index ended the day flat on Thursday,

underperforming its European peers after an initial modest pullback

on the previous session's gains. The FTSE 100 closed slightly up,

by 0.027%, finishing at 7,529.73 points. Its worst performer was

St. James's Place after the wealth manager reported slower inflows,

while asset manager Intermediate Capital Group was its top riser on

a better-than-expected quarterly print. The U.S.'s fourth-quarter

GDP print helped boost equipment-rental provider Ashtead Group,

which is exposed to the market, while the energy sector--including

BP and Shell's stocks--was lifted by firmer oil prices after U.S.

inventories came in below expectations, CMC Markets analyst Michael

Hewson writes in a market comment.

COMPANIES NEWS:

RS Group Like-for-like Revenue Declines on Weaker-Than-Expected

Markets

RS Group said its third-quarter revenue declined on a

like-for-like basis on weak industrial sentiment and slower

unwinding of customer surplus inventories, particularly in

electronics.

---

Haleon Agrees to Sell ChapStick Brand for Up to $510 Mln

Haleon said that it has agreed to sell ChapStick lip-care brand

to Suave Brands Co. for up to $510 million as it seeks to divest

from non-core assets and reduce debt.

---

Intermediate Capital Group's Total Assets Under Management

Rose

Intermediate Capital Group said its total assets under

management rose, and that it reached its fundraising target two

months ahead of time.

---

St. James's Place Funds Under Management Rose, Beating

Consensus

St. James's Place said funds under management at the end of 2023

rose, beating consensus, and client capacity and confidence to

commit to long-term investment had been affected by the economic

environment.

---

Foxtons Group's Revenue, Adjusted Profit Beat Market Views

Foxtons Group said revenue and adjusted operating profit were

slightly ahead of market expectations, as its operational

turnaround continues to drive growth.

---

Britvic Sees Growth for Year Within Market Ranges after Strong

Start

Britvic said group revenue rose 8.1% over the first quarter of

fiscal 2024 and that it is confident to achieve growth for the year

within the range of market expectations.

---

Dr. Martens Posts In-Line Revenue Fall On Weak Christmas

Performance

Dr. Martens said that third-quarter revenue fell in line with

expectations driven by a weak performance in the U.S., and that its

guidance for fiscal 2024 remains unchanged.

---

Fuller Smith & Turner Sales Grow, Reports Strong Christmas

Period

Fuller Smith & Turner said has delivered like-for-like sales

growth in the fiscal year to date, with particularly strong sales

over the five week Christmas and New Year period.

---

Wizz Air Swings to Pretax Loss on Higher Costs; Backs

Guidance

Wizz Air said it swung to a pretax loss for the third quarter

after booking higher costs, and backed its fiscal-year guidance

after seeing a positive performance at the start of the fourth

quarter.

---

Capricorn Energy Misses Production Target; Flags Lower Drilling

Activity

Capricorn Energy said it produced less oil and gas in 2023 than

the prior year, missing its target.

---

Fevertree Backs Guidance After U.S. Growth

Fevertree Drinks said Ebitda doubled in the second half of 2023

and backed its guidance for the year after strong growth in the

U.S.

---

Halfords Backs Profit Guidance Despite Weaker-Than-Expected

Sales

Halfords backed its profit guidance for fiscal 2024 despite

weaker-than-expected sales in the third quarter, supported by

better-than-expected cost savings.

---

Mitie Group's Revenue Rose; Backs Profit Guidance

Mitie Group said its revenue rose and reiterated its full-year

operating profit guidance.

---

NCC Group Swings to Pretax Loss After In-Line Performance

NCC Group said it swung to a pretax loss in the first half of

fiscal 2024, partly driven by dragging revenue from its technical

assurance services, but said it revenue and profitability was in

line with expectations.

---

IG Group Profit Drops on Soft Market Conditions, Backs Margin

Views

IG Group Holdings reported a fall in profit during the first

half driven by a soft market backdrop, but backed its margin target

for fiscal 2024.

---

Keywords Studios Revenue Rises, Expects Strong Growth in Year

Ahead

Keywords Studios said revenue last year rose, and that it

expects to report strong revenue and profit growth for 2024.

---

Workspace Group Rent Rose and Demand Remains Resilient; CEO to

Retire

Workspace Group said its like-for-like rent roll rose and

customer demand remained resilient, and that Chief Executive

Officer Graham Clemett intends to retire in 2024.

---

Mortgage Advice Bureau Expects Profit to Beat Views; Flags

Improving Market Trends

Mortgage Advice Bureau said it expects to book slightly higher

adjusted pretax profit than the current market consensus expects

for 2023, and flagged improving market conditions ahead.

---

PPHE Hotel Group Expects to Beat Revenue, Earnings Guidance

PPHE Hotel Group said it expects to exceed previously upgraded

guidance and that it was optimistic heading into the new year.

---

Treatt's Revenue Fell as Expected; Flags Improving Demand

Treatt said its revenue fell as anticipated in the first quarter

of fiscal 2024, but that trading conditions are improving.

---

Secure Trust Bank Names Jim Brown Chairman; Net Lending

Rises

Secure Trust Bank said it appointed Jim Brown as chairman, and

that net lending rose in the fourth quarter, when all of its

specialist lending businesses delivered record levels of new

lending.

---

Greencore Sees Operating Profit in Line With Views Despite

Revenue Drop

Greencore said revenue for the first fiscal quarter fell,

reflecting the disposal of its Trilby Trading business, and that it

expects operating profit to be in line with market

expectations.

MARKET TALK:

Fevertree Drinks Has Long-Term Sparkle Despite Hurdles

1516 GMT - Fevertree Drinks's longer-term outlook is bright

despite a downbeat trading statement, Panmure Gordon says. The

end-of-year update was disappointing, with 2023 revenue below

guidance and adjusted EBITDA at the bottom of the guided range,

Panmure says. Still, the company looks well-placed to gain further

market share, margins are expected to start recovering this year

and its lackluster share price makes it an attractive acquisition

target, the brokerage says. "Despite this update, we still believe

there are plenty of long-term opportunities available to

Fevertree," Panmure analysts say in a note. The brokerage keeps its

buy recommendation, but cuts its target price to 1560 pence from

1725p. Shares rise 5% to 1061p. (philip.waller@wsj.com)

Contact: London NewsPlus, Dow Jones Newswires;

(END) Dow Jones Newswires

January 25, 2024 12:20 ET (17:20 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

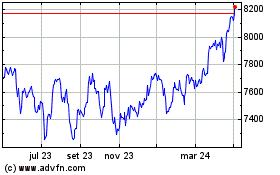

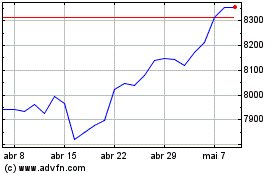

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Out 2024 até Nov 2024

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Nov 2023 até Nov 2024