MARKET WRAPS

Watch For:

ECB interest rate decision; U.K. Consumer confidence survey;

France Monthly business survey, unemployment; Germany Ifo Business

climate index; trading updates from Nokia, SEB, LVHM,

STMicroelectronics, Givaudan, Salvatore Ferragamo, Sasol, Fuller

Smith & Turner, Britvic, St. James's Place, RS Group,

Intermediate Capital Group

Opening Call:

Shares may open slightly lower in Europe ahead of the European

Central Bank rate decision. In Asia, stock benchmarks were broadly

higher as investors digest China PBOC's RRR cut; Treasury yields

broadly declined; the dollar strengthened; oil gained, while gold

edged lower.

Equities:

European stock futures were tracking lower early Thursday ahead

of the ECB meeting outcome and corporate earnings reports.

U.S. stock indexes finished mixed on Wednesday, with the S&P

500 eking out a fourth consecutive all-time high as strong U.S.

economic data was weighing on investors' expectations for multiple

interest-rate cuts this year by the Federal Reserve.

Focus is now on the first estimate of fourth-quarter U.S. GDP

data due later in the day.

"We are in a bit of a FOMO, or fear-of-missing-out,

environment," said Mark Neuman, founder of Atlanta-based

Constrained Capital.

"People are excited about the technology sector, and the returns

on the share prices of the Magnificent Seven are suggesting that's

the right trade. Now other people are fearing they are going to

miss the next leg up."

Forex:

The dollar gained in Asia.

A challenging global growth outlook is expected to remain

supportive for the U.S. dollar in the near term but a bigger rally

isn't likely, MUFG's analysts said.

"The dollar's ability to stage a bigger rally should be

curtailed," the analysts said.

They point to slowing U.S. inflation, the European Central

Bank's plan not to cut rates until the summer, and to the Bank of

Japan's increased confidence that their inflation target will be

met.

China PBOC's RRR cut and a possible stabilization package that

was recently reported by media should offer some short-lived

support for macroeconomic sentiment toward China, Westpac Strategy

Group said, adding that this could be a short-term USD

headwind.

Bonds:

Treasury yields were broadly lower ahead of today's U.S. GDP

data and inflation data due Friday.

Wall Street Journal surveys with economists show expectations of

a slowdown in durable goods orders and GDP growth, while weekly

jobless claims are expected to accelerate a bit.

The data are likely to swing yields, as markets try to guess

when the Fed will start cutting rates.

Energy:

Oil futures edged higher amid lingering geopolitical

tensions.

In the short term, attacks in parts of the Middle East may lead

to enough disruption and uncertainty that an oil-price pop could

occur, Citi Research analysts said.

These tensions could support oil prices, the analysts said, and

predict Brent crude oil averaging $80/bbl in the first quarter.

Metals:

Gold was slightly weaker in Asia but lingering prospects for

rate cuts by global central banks may support.

The precious metal continues to hold above $2,000/oz, Oanda

said, adding that this may be a sign that traders remain confident

that central banks could be compelled to lower rates soon and

multiple times throughout the year.

--

Copper prices edged lower after rising overnight on China PBOC's

plan to cut reserve ratio requirement by 0.5 percentage points to

boost liquidity in its banking sector. The move will inject CNY1

trillion of long-term liquidity into the market.

The better-than-expected economic activity in the U.S. also

helped boost sentiment, ANZ analysts said.

However, there are still broad concerns over supply disruptions

in the base-metals sector, the analysts added.

--

Iron-ore futures were higher in Asia amid positive sentiment

boosted by China's planned RRR cut, ANZ Research analysts said.

Iron-ore prices rallied more than 2% overnight as investors are

hoping to see more construction activities in China, they said.

However, prices may be weighed by current weak demand and higher

inventories, they added.

TODAY'S TOP HEADLINES

ECB Plays Down Rate Cuts. Like the Fed, It's Expected to

Pause.

The European Central Bank will probably keep interest rates

unchanged on Thursday. Like the Federal Reserve, the big question

is when it will consider cuts.

The 20 nations sharing the euro are enjoying historically low

unemployment rates. But the growth outlook is weak, and rapidly

slowing inflation will soon put the pressure on the ECB to lower

borrowing costs.

The U.S. Economy Could Surprise Again. Watch the GDP

Numbers.

The U.S. economy grew at a slower but solid clip in the final

three months of 2023, capping a robust year if economists are

correct in their predictions.

Forecasters across the board expect the seasonally adjusted

annual rate of gross domestic product in the fourth quarter to come

in lower than the third quarter's 4.9% final reading. That growth

marked a steep acceleration from the second quarter's 2.1% increase

and took many by surprise.

The Fed Risks Getting Caught Up in Politics, Whatever It

Does

The problem with being independent of politics is that

appearances matter. You don't have to just be independent, you must

also appear to be independent-even if that changes what you might

otherwise do.

Many investors think the Federal Reserve might be pushed to do

exactly that, lowering interest rates in March to get the

rate-cutting cycle started before the election campaigns really get

going.

Economy revs up in early 2024, S&P finds. 'Soft landing' in

sight?

The numbers: The U.S. economy got off to a good start as growth

sped up in January a pair of S&P business surveys showed,

indicating a recession still appears far off.

The S&P flash U.S. services PMI climbed to a seven-month

high of 52.9 in January from 51.4 in the prior month, S&P said

Wednesday.

Israel Builds Buffer Zone Along Gaza Border, Risking New Rift

With U.S.

TEL AVIV-Beginning last November, an Israeli soldier and members

of his reserve unit worked day after day in a northern section of

the Gaza Strip to create a wasteland.

Their orders were to clear a 1-kilometer-wide area along the

border, the soldier said, as part of an Israeli plan to construct a

security zone just inside Gaza-to which Palestinians would be

barred entry.

Swiss Financial Regulator Appoints European Central Bank

Executive as Head

Swiss financial regulator Finma appointed European Central Bank

executive Stefan Walter as its new head.

The hiring of 59-year-old Walter, who will take over the chief

executive role on April 1, follows criticism of the regulator over

its handling of the collapse in March of Credit Suisse. Days before

Credit Suisse's downfall, the regulator said that the bank was

meeting its capital and liquidity requirements and that problems at

the time in the U.S. financial sector didn't pose a direct

contagion risk.

The Middle East Crisis Is Starting to Weigh on the Economy

Europe's economy is beginning to feel the pain from supply-chain

disruptions caused by the crisis in the Middle East.

Data released on Wednesday showed businesses had to wait longer

for parts to arrive in January after attacks by Yemen-based Houthi

rebels on cargo ships in the Red Sea disrupted freight routes from

Asia.

FAA Puts Limits on Boeing 737 Output, Clears Path for Grounded

Jets to Fly

U.S. air-safety regulators on Wednesday put limits on Boeing's

production of 737 MAX jets, but cleared the way for grounded jets

to resume flying after airlines complete inspections.

Most of Boeing's MAX 9 jets were grounded on Jan. 6, a day after

a near-catastrophe on an Alaska Airlines flight. A door plug ripped

away from the plane shortly after it took off, leaving a gaping

hole the size of an emergency exit in its side.

Tesla Projects Slower Growth in 2024 as EV Demand Softens

Tesla warned of "notably" slower growth in 2024, and its profit

margin took a hit in the fourth quarter, signaling more uncertainty

ahead for the world's most valuable automaker and the broader

electric-vehicle industry.

Chief Executive Elon Musk also reiterated his desire for greater

control over the electric-car company, saying he wants enough to

have strong influence and deter activist shareholders.

IBM Stock Rallies on Surge in AI Demand. The CEO Feels 'Really

Good' About This Year.

IBM delivered mixed fourth-quarter results, as both its software

and consulting arms grew less than anticipated.

But IBM provided upbeat guidance for the year ahead and

disclosed a surge in demand for its AI software and services

businesses. Plus, IBM's closely watched full-year free cash flow

forecast came in higher than expected.

Write to singaporeeditors@dowjones.com

Expected Major Events for Thursday

00:01/UK: Dec UK monthly automotive manufacturing figures

06:00/FIN: Dec Labour force survey, incl unemployment

07:00/SWE: Dec PPI

07:00/NOR: Nov Labour force survey SA, incl unemployment

07:45/FRA: Jan Monthly business survey (goods-producing

industries)

08:00/SPN: Dec PPI

09:00/NOR: Norges Bank monetary policy decision

09:00/GER: Jan Ifo Business Climate Index

10:00/LUX: Nov Trade

11:00/TUR: Turkish interest rate decision

11:00/FRA: 4Q Claimant count and job advertisements collected by

Pole emploi

11:00/UK: Jan CBI Distributive Trades Survey

13:15/EU: ECB interest rate announcement

14:00/BEL: Jan Business Confidence Survey

15:59/UKR: Dec PPI

17:59/UK: REC JobsOutlook survey

All times in GMT. Powered by Onclusive and Dow Jones.

Write to us at newsletters@dowjones.com

We offer an enhanced version of this briefing that is optimized

for viewing on mobile devices and sent directly to your email

inbox. If you would like to sign up, please go to

https://newsplus.wsj.com/subscriptions.

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 25, 2024 00:15 ET (05:15 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

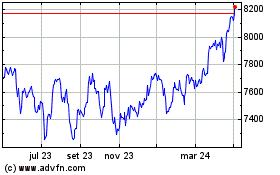

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Out 2024 até Nov 2024

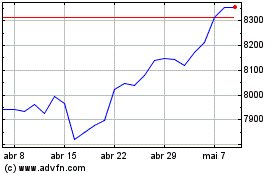

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Nov 2023 até Nov 2024