Australian Dollar Declines As Trade Deficit Widens

02 Outubro 2012 - 11:43PM

RTTF2

During the early Asian session on Wednesday, the Australian

dollar fell against its major opponents after a report showed that

country's trade deficit widened more-than-expected.

Australia recorded a seasonally adjusted merchandise trade

deficit of A$2.027 billion in August, the Australian Bureau of

Statistics said today.

That was well shy of forecasts for a shortfall of A$685 million

following the downwardly revised A$1.530 billion deficit in July -

which was originally pegged as a A$556 million deficit.

Exports were down 3.0 percent on month to A$24.589 billion after

falling 3.0 percent in the previous month.

Imports eased 1.0 percent to A$26.615 billion after easing 1.0

percent a month earlier.

The aussie was under selling pressure following weak home sales

data and service sector activity from Australia.

The new home sales in Australia were down 5.3 percent on month

in August, the Housing Industry Association said, hitting a 15-year

low.

That follows the 5.6 percent monthly contraction in July.

According to the Australian Industry Group, an index measuring

the performance of the service sectors in Australia came in with a

score of 41.9 in September - down from 42.4 in August and deeper

into contraction.

The aussie also depreciated yesterday after the Reserve Bank of

Australia cut the interest rate to 3.25 percent.

Against the U.S. dollar and the yen, the aussie declined to near

4-week lows of 1.0224 and 79.96 with 1.015 and 79.00 likely to find

next downside target levels, respectively. The aussie ended deals

at 1.0269 against the greenback and 80.27 against the yen on

Tuesday.

The aussie fell to 1.0073 against the loonie for the first time

since September 5. If the aussie slides further, it may break 1.005

level. At yesterday's close, the pair was worth 1.0108.

Against the European single currency, the aussie underperformed,

hitting 1.2629, its weakest level since June 15. The next support

level for the aussie is seen at 1.27.

The aussie fell to 1.2407 against the kiwi, down from an early

high of 1.2439. The aussie-kiwi pair closed Tuesday's deals at

1.2411.

In the European session, Eurozone retail sales for August and

PMI's from major European economies are due.

From the U.S., ADP employment data and ISM non-manufacturing

composite index for September are likely to garner attention in the

New York morning session.

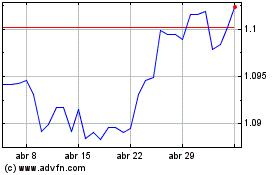

AUD vs NZD (FX:AUDNZD)

Gráfico Histórico de Câmbio

De Jun 2024 até Jul 2024

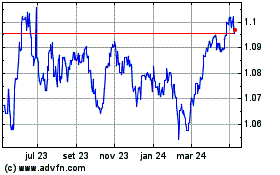

AUD vs NZD (FX:AUDNZD)

Gráfico Histórico de Câmbio

De Jul 2023 até Jul 2024