Clontarf Energy PLC GBP350,000 Fundraising and Corporate Update (3196B)

01 Junho 2023 - 3:00AM

UK Regulatory

TIDMCLON

RNS Number : 3196B

Clontarf Energy PLC

01 June 2023

1(st) June 2023

Clontarf Energy plc

("Clontarf" or "the Company")

GBP350,000 Fundraising and Corporate Update

The Directors of Clontarf Energy plc (AIM: CLON) are pleased to

announce that the Company has raised GBP350,000 (before expenses)

via the placing of, and subscription for, 437,500,000 new ordinary

shares of 0.01p each in the capital of the Company ("Ordinary

Shares") (the "Placing Shares"), via CMC Markets UK Plc, at a price

of 0.08p per Placing Share (the "Placing"). The Placing Shares

represent approximately 8.42% of the Company's issued share capital

as enlarged by the Placing.

-- The Placing shares will rank pari passu with the Company's

existing Ordinary Shares. Application will be made for the Placing

Shares to be admitted to trading on AIM ("Admission") and it is

expected that such Admission will become effective on or around

8(th) June 2023. The issue of the Placing Shares is being satisfied

from the Directors' existing authority to allot shares free of

pre-emption rights.

-- The net proceeds of the Placing will be used to advance

Clontarf's lithium projects in Bolivia, and neighbouring countries,

as well as on petroleum projects in Ghana, Australia, and

elsewhere.

-- Further updates on Bolivian lithium, as well as the Ghanaian

and Australian projects will be issued, when appropriate.

Admission and TVR

Following the Admission of the Placing Shares, there will be a

total of 5,193,326,117 Ordinary Shares in issue with each share

carrying the right of one vote. The above figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

change to their interest in, the Company under the FCA's Disclosure

Guidance and Transparency Rules.

Chairman, David Horgan, commented:

"Strong demand growth and rising, though volatile, prices are

transforming the lithium business. The Board believes that

projected demand for clean lithium cannot be met without South

American brines, and especially Direct Lithium Extraction

technology.

"Our joint venture partners, NEXT-ChemX, identified techniques

that had previously purified fluids of radioactive elements through

a technique mimicking the human kidney. This avoids the need for

high water, or power usage, facilitating a continuous process,

rather than a batch process.

"This cutting-edge extraction technology concentrates desired

ions (such as Lithium+) by drawing them out of a solution (such as

a brine) across a special purpose membrane. The technology is known

as ion-Targeting Direct Extraction. This can work even in low

concentrations.

"Working closely with the relevant authorities, under applicable

laws, we are now gathering large samples, from several priority

salt-lakes, for laboratory testing at our Joint Venture partner's

facilities. Necessary export paperwork is being finalised, so that

these brine samples can be air-freighted. Clontarf thus expects to

start testing at its Joint-Venture partner's facilities

shortly.

"The first phase of sample analysis will confirm past laboratory

testing of synthetic brines. This process includes fine-tuning the

process to facilitate large-scale pilot plant testing, which should

follow successful laboratory test-work.

"A priority has been ongoing discussions with Bolivia's State

Lithium Company, which is tasked with leading Bolivia's large-scale

entry to international markets under the 2017 Lithium Law.

"Our Joint Venture has also agreed with the relevant

titleholders to test priority brines from privately held salt-lakes

in Argentina and Chile. These are also included in our joint

venture with NEXT-ChemX on Direct Lithium Extraction.

"Meanwhile, the International Monetary Fund has approved a $3

Billion Extended Credit Facility Arrangement for Ghana. We

understand that major creditors are finally on board. The reform

package includes anti-corruption measures, and is intended to

expedite the frozen ratification of oil & gas contracts, so as

to deliver sustained growth."

For further information please visit http://clontarfenergy.com

or contact:

Clontarf Energy

David Horgan, Chairman

Jim Finn, Director +353 (0) 1 833 2833

Nominated & Financial Adviser

Strand Hanson Limited

Rory Murphy

Ritchie Balmer +44 (0) 20 7409 3494

Broker

Novum Securities Limited

Colin Rowbury +44 (0) 207 399 9400

Public Relations

BlytheRay

Megan Ray +44 (0) 207 138 3206

Teneo

Luke Hogg

Alan Tyrrell +353 (0) 1 661 4055

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFBMATMTJMMJJ

(END) Dow Jones Newswires

June 01, 2023 02:00 ET (06:00 GMT)

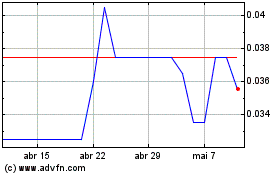

Clontarf Energy (LSE:CLON)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

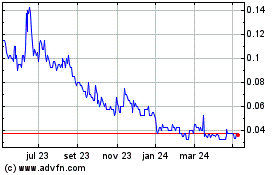

Clontarf Energy (LSE:CLON)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025