TIDMOOA

Octopus AIM VCT plc

Half-Yearly Results

Octopus AIM VCT plc announces its unaudited half-yearly results

for the six months ended 31 August 2023.

Octopus AIM VCT plc (the 'Company') is a venture capital trust

(VCT) which aims to provide shareholders with attractive tax-free

dividends and long-term capital growth by investing in a diverse

portfolio of predominantly AIM-traded companies. The Company is

managed by Octopus Investments Limited ('Octopus' or the

'Investment Manager').

Financial Summary

Six months to 31 Six months to 31 Year to 28

August 2023 August 2022 February 2023

------------------ ------------------ ------------------ ------------------

Net assets

(GBP'000) 120,131 138,489 141,222

Loss after tax

(GBP'000) (15,972) (24,508) (33,414)

Net asset value

(NAV) per share

(p) 67.2 86.5 78.5

Total return

(%)(1) (11.2) (14.6) (19.8)

Dividends per

share paid in the

period (p) 2.5 3.0 5.5

Dividend declared

(p)(2) 2.5 2.5 2.5

------------------ ------------------ ------------------ ------------------

(1) Total return is an alternative performance measure

calculated as movement in NAV per share in the period plus

dividends paid in the period, divided by the NAV per share at the

beginning of the period.

(2) The interim dividend of 2.5p will be paid on 12 January 2024

to those shareholders on the register on 22 December 2023.

Chair's statement

The six months to 31 August 2023 have seen a continuation of the

challenging conditions for smaller company investments that were

outlined in the last annual report, and which have persisted for

several reporting periods. Inflation has been slow to fall with the

result that expectations for peak interest rates have risen and

interest rates are now expected to remain high into 2024. The

market turbulence resulting from this has been particularly harsh

on smaller companies in some of the key sectors in which we invest.

Against this background it is disappointing to report the VCT's Net

Asset Value (NAV) per share fell by 11.2% during the six month

period after adding back the 2.5p dividend paid in August. This

reduction is marginally less than the reduction in the FTSE AIM

All-Share index, which fell by 12.8% over the same period.

The flow of VCT qualifying investment opportunities was still

weak at the start of the year and any recovery in the new issues

market was delayed in response to less certain market conditions

after the collapse of Silicon Valley Bank in March. Consequently,

the level of investment in the period has been low at GBP0.5

million. More encouragingly, there has been a pick-up in activity

towards the end of the period, led by existing AIM companies many

of which have been able to access funding on lower valuations. We

have made several new investments since the period end.

Transactions with the Investment Manager

Details of amounts paid to the Investment Manager are disclosed

in Note 8 to the financial statements.

Share buybacks

In the six months to 31 August 2023, the Company bought back

2,221,434 Ordinary shares for a total consideration of

GBP1,564,000. It is evident from the conversations which your

Investment Manager has that this facility remains an important

consideration for investors. The Company remains committed to

maintaining its policy of buying back shares at a discount of

approximately 4.5% to NAV (equating to up to a 5% discount to the

selling shareholder after costs).

Share issues

In this period 1,301,464 new shares were issued, 1,260,682 of

these being issued through the Dividend Reinvestment Scheme

(DRIS).

New share offer

Since the period end the Company has launched a new combined

offer for subscription alongside Octopus AIM VCT 2 plc to raise up

to GBP20 million with an over allotment of up to a further GBP10

million.

Dividends

On 10 August 2023, the Company paid a dividend of 2.5p per

share, being the final dividend for the year ended 28 February

2023. For the period to 31 August 2023, the Company has declared an

interim dividend of 2.5p which will be paid on 12 January 2024 to

shareholders on the register on 22 December 2023. It remains the

Company's target to pay an annual dividend of 5.0p or 5% of the

year-end share price, whichever is greater at the time.

Principal risks and uncertainties

The principal risks and uncertainties faced by the VCT are set

out in Note 7 to the financial statements.

Outlook

The twin challenges of high interest rates and strong inflation,

combined with unsettled geopolitical circumstances including the

recent tragic events in the Middle East have led to significant

numbers of shares now being priced well below their recent peaks

and on valuations not seen since the last financial crisis. Your

VCT has the resilience of being invested in a widely diversified

portfolio of companies, and the recently announced fundraising

means that our Investment Manager is in a strong position to invest

in new opportunities as they arise.

Neal Ransome

Chair

7 November 2023

Investment Manager's review

Overview

The six months to 31 August 2023 has been a frustrating period

for smaller company investors. Good growth companies trading

robustly have seen their share prices and ratings fall as investors

have shied away from taking risks. This has partly been the result

of persistently high inflation, which has led to interest rates

being raised four times in the half-year to 5.25%, further than had

been anticipated a year ago, with any meaningful fall now not

expected until next year. This nervousness has resulted in many

valuations falling to levels not seen since the Financial Crisis

nearly 15 years ago and has left the wider equity market trading at

a discount of over 25% to its longer-term average. The Company has

been particularly adversely affected by these market conditions

over the past two years as it invests in early-stage companies,

which rely on supportive market conditions for capital until they

reach profitability. However, on a more positive note the economy

has remained more robust than expected and many companies in the

portfolio are still managing significant progress and growth.

Valuations are at an attractive level for buyers and we see scope

to deploy cash profitably once the market becomes comfortable that

interest rates have peaked.

Performance

Adding back the 2.5p paid out in dividends in the period, the

NAV fell by 11.2% in the six months to 31 August 2023. This

compares with a 12.8% fall in the FTSE AIM All-Share Index, a 3.3%

fall in the Small Cap Index (ex-Investment Trusts) and a 3.2% fall

in the FTSE All Share Index, all on a total return basis. The

Company's relatively high exposures to the healthcare and

technology sectors (which had been a reason for good returns in the

past) were once again detrimental to performance in a world where

risk averse investors have little appetite for early-stage growth

stocks. Companies yet to reach profitability were particularly

affected with those needing to raise money now rather than wait for

more favourable market conditions suffering some steep falls in

their valuations. The VCT rules require investment to be made at an

early stage and the benefits of doing so have been clear in past

periods. The FTSE All Share Index performed noticeably better than

the AIM Index, reflecting a higher weighting in larger companies,

although it also continues to be valued at a discount to indices in

other major geographies. The FTSE Small Cap Index (excluding

Investment Trusts) did better than the AIM Index but has a much

narrower membership and its constituents were less affected by the

conditions described above.

There were two main themes behind the largest detractors from

performance in the period, the most dominant of which was the

on-going de-rating of growth stocks as investors sought safe havens

such as the oil and resource sectors. Of the top ten detractors,

seven companies (Learning Technologies Group, SDI Group, Next 15

Group, GB Group, Nexteq, Ergomed and Netcall) are established and

profitable companies held for long-term growth potential. The worst

impact on the NAV was from Learning Technologies Group, which saw

its shares almost halve despite producing robust trading statements

and demonstrating the ability of the business to generate cash from

its recurring revenue base. Next 15 Group and Ergomed's shares

suffered a similar de-rating although the latter has since been

subject to a takeover bid from a private equity house at a 28%

premium to the then prevailing share price, demonstrating the value

to be found in the portfolio. Others such as SDI and GB Group did

have their 2023 forecasts cut although the longer-term investment

cases remain robust. The other main theme was early-stage companies

(such as Libertine and Feedback) either making slower progress than

expected or perceived as not having a long enough cash runway to

achieve profitability.

There were several positive contributors to performance

including some early-stage companies which did demonstrate progress

or where share prices recovered from previous lows when they

achieved funding. Among these were Equipmake which has made several

encouraging announcements since its latest funding round, Spectral

MD which announced a reverse takeover by a US special acquisitions

company (SPAC) which will enable it to tap US investors, and

Intelligent Ultrasound which is making good progress with the

commercialisation of its AI-based ultrasound software. In the

retail sector Vertu Motors is trading well and its shares have been

buoyed by takeover bids for quoted competitors.

Portfolio activity

In the period under review, the Company made one qualifying

investment totalling GBP0.5 million into a new AIM flotation, a

marked decrease on the GBP2.4 million we invested in the

corresponding period last year, reflecting caution on the part of

companies and brokers about raising new capital against a

background of volatile markets.

The new investment was in Tan Delta Systems plc, a UK-based

manufacturer of equipment which can accurately monitor the

condition of oil to reduce maintenance costs and unnecessary oil

usage. The systems are sold to operators of heavy equipment,

supplying customers globally.

A number of disposals in the period resulted in a loss of GBP0.5

million over book cost. Adept Telecom was the subject of a cash

takeover bid by a private equity bidder at a profit. We also

disposed of ITSarm (formerly In The Style), realising a loss. Its

business had been very badly affected by a squeeze between the

consumer's dwindling appetite for online purchases and cost and

logistics challenges exacerbated by inflation, and the management

sold the business for cash. We made partial disposals at an overall

profit of Genedrive, Intelligent Ultrasound, Judges Scientific,

Nexteq (formerly Quixant), EKF Diagnostics Holdings, Glantus

Holdings and Equipmake Holdings.

In the period we invested GBP1.2 million into the FP Octopus

Micro Cap Growth Fund and GBP0.1 million into the FP Octopus Future

Generations Fund and sold GBP0.7 million of the FP Octopus Multi

Cap Income Fund. The strategy is to reduce other individually held

non-qualifying holdings and replace them with liquid collective

funds. Although the funds have had a negative impact on returns in

this period, we believe valuations are currently at an attractive

level and expect them to provide a return on our cash awaiting

investment once stock markets return to a more settled state.

Unquoted investments

The Company is able to make investments in unquoted companies

intending to float. Currently 7.1% (31 August 2022: 7.3% and 28

February 2023: 6.1%) of the Company's net assets are invested in

unquoted companies. In the period there was a reduction in the

valuation of the holding in Popsa on the basis of peer group

comparisons and a slight increase in the valuation of Hasgrove,

which continues to grow strongly.

Outlook

The very real issue of inflation and the need to tighten

monetary policy by raising interest rates further than had been

anticipated six months ago has prolonged the pain for the share

prices of companies exposed to growth sectors. This has impacted

the NAV and left some of the more mature companies in the portfolio

held for their long-term growth potential valued well below their

long-term averages despite profit forecasts showing resilience. It

has also had a dampening effect on the new issue pipeline although

there are recent signs that this is becoming more active again.

Short-term attention remains fixed on the monthly inflation figures

with the most recent monthly figures showing a larger than expected

fall, giving hope that interest rates may be at or close to their

peak. If confirmed it will have a huge impact on investor

confidence which should also be bolstered by recent economic growth

revisions, which no longer show the UK trailing other major

economies over the past three years.

The portfolio's strength is that it is well diversified both in

terms of sector exposure and of individual company concentration.

At the period end it contained 87 holdings (31 August 2022: 91

holdings and 28 February 2023: 88 holdings) across a range of

businesses with exposure to some exciting new technologies in the

environmental and healthcare sectors. The Company currently has

funds available for new investments as well as supporting those

which are still on their journey to profitability. These are

uncertain macroeconomic and geopolitical times, but the balance of

the portfolio towards profitable companies remains, and the

Investment Manager is confident that there will continue to be

sufficient opportunities to invest our funds in good companies

seeking more growth capital at attractive valuations, which we

expect will result in improved future returns.

The Octopus Quoted Companies team

Octopus Investments

7 November 2023

Directors' responsibilities statement

We confirm that to the best of our knowledge:

-- the half-yearly financial statements have been prepared in accordance

with Financial Reporting Standard 104 'Interim Financial Reporting'

issued by the Financial Reporting Council;

-- the half-yearly financial statements give a true and fair view of the

assets, liabilities, financial position, and profit or loss of the

Company;

-- the half-yearly report includes a fair review of the information required

by the Financial Conduct Authority's Disclosure Guidance and Transparency

Rules, being:

-- we have disclosed an indication of the important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements;

-- we have disclosed a description of the principal risks and

uncertainties for the remaining six months of the year; and

-- we have disclosed a description of related party transactions that

have taken place in the first six months of the current financial

year, that may have materially affected the financial position or

performance of the Company during that period and any changes in

the related party transactions described in the last annual report

that could do so.

On behalf of the Board

Neal Ransome

Chair

7 November 2023

Income statement

Unaudited Unaudited Audited

Six months to 31 August 2023 Six months to 31 August 2022 Year to 28 February 2023

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- --------------------------------- ----------------------------------------------------------------

Gain on

disposal of

fixed asset

investments -- 139 139 -- 15 15 -- 207 207

Loss on

disposal of

current asset

investments -- (52) (52) -- -- -- -- -- --

Loss on

valuation of

fixed asset

investments -- (13,719) (13,719) -- (21,159) (21,159) -- (29,192) (29,192)

Loss on

valuation of

current asset

investments -- (1,794) (1,794) -- (2,137) (2,137) -- (2,233) (2,233)

Investment

income 920 -- 920 448 23 471 1,068 24 1,092

Investment

management

fees (304) (912) (1,216) (359) (1,078) (1,437) (650) (1,949) (2,599)

Other expenses (250) -- (250) (261) -- (261) (689) -- (689)

-------------- ------ --------- -------------- ------- --------- --------- ------- --------- -------------

(Loss)/profit

before tax 366 (16,338) (15,972) (172) (24,336) (24,508) (271) (33,143) (33,414)

Tax _ _ _ _ _ _ _ _ _

-------------- ------ --------- -------------- ------- --------- --------- ------- --------- -------------

(Loss)/profit

after tax 366 (16,338) (15,972) (172) (24,336) (24,508) (271) (33,143) (33,414)

-------------- ------ --------- -------------- ------- --------- --------- ------- --------- -------------

Earnings per

share --

basic and

diluted 0.2p (9.1p) (8.9p) (0.1p) (15.2p) (15.3p) (0.2p) (20.0p) (20.2p)

-------------- ------ --------- -------------- ------- --------- --------- ------- --------- -------------

-- The 'Total' column of this statement represents the statutory Income

Statement of the Company; the supplementary revenue return and capital

return columns have been prepared in accordance with the AIC Statement of

Recommended Practice.

-- All revenue and capital items in the above statement derive from

continuing operations.

-- The Company has no recognised gains or losses other than those disclosed

in the Income Statement.

-- The Company has only one class of business and derives its income from

investments made in shares and securities and from bank and money market

funds, as well as OEIC funds.

The accompanying notes form an integral part of the financial

statements.

Balance sheet

Unaudited Unaudited Audited

As at 31 August 2023 As at 31 August 2023 As at 28 February 2023

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------- -------- ------------- --------- --------------

Fixed asset

investments 87,322 108,474 102,667

Current assets:

Investments 14,873 14,505 16,188

Money market

funds 16,485 1,331 21,433

Debtors 282 345 354

Cash at bank 1,921 14,710 1,437

Applications

cash(1) 4 3 3

--------------- -------- ------------- -------- ------------- --------- --------------

33,565 30,894 39,415

--------------- -------- ------------- -------- ------------- --------- --------------

Creditors:

amounts

falling due

within one

year (756) (879) (860)

--------------- -------- ------------- -------- ------------- --------- --------------

Net current

assets 32,809 30,015 38,555

--------------- -------- ------------- -------- ------------- --------- --------------

Total assets

less current

liabilities 120,131 138,489 141,222

--------------- -------- ------------- -------- ------------- --------- --------------

Called up

equity share

capital 1,789 1,601 1,798

Share premium 19,807 1,080 18,924

Capital

redemption

reserve 301 252 279

Special

distributable

reserve 112,000 124,444 118,015

Capital reserve

realised (24,586) (21,993) (23,143)

Capital reserve

unrealised 12,650 35,202 27,545

Revenue reserve (1,830) (2,097) (2,196)

Total equity

shareholders'

funds 120,131 138,489 141,222

--------------- -------- ------------- -------- ------------- --------- --------------

NAV per share - 67.2p 86.5p 78.5p

basic and

diluted

--------------- -------- ------------- -------- ------------- --------- --------------

(1) Cash held but not yet allotted

The statements were approved by the Directors and authorised for

issue on 7 November 2023 and are signed on their behalf by:

Neal Ransome

Chair

Company No: 03477519

Statement of changes in equity

Capital Special Capital Capital

Share Share redemption distributable reserve reserve

capital premium reserve reserves(1) realised(1) unrealised Revenue reserve(1) Total

--------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- ------- ------- ---------- ------------- ----------- ---------- ------------------- --------

As at 28

February

2023 1,798 18,924 279 118,015 (23,143) 27,545 (2,196) 141,222

-------------- ------- ------- ---------- ------------- ----------- ---------- ------------------- --------

Total

comprehensive

loss for the

period -- -- -- -- (825) (15,513) 366 (15,972)

Contributions by and distributions to owners:

Repurchase and

cancellation

of own

shares (22) -- 22 (1,564) -- -- -- (1,564)

Issue of

shares 13 883 -- -- -- -- -- 896

Share issue

costs -- -- -- -- -- -- -- --

Dividends -- -- -- (4,451) -- -- -- (4,451)

-------------- ------- ------- ---------- ------------- ----------- ---------- ------------------- --------

Total

contributions

by and

distributions

to owners (9) 883 22 (6,015) -- -- -- (5,119)

Other

movements:

Cancellation

of share

premium -- -- -- -- -- -- -- --

Prior years'

holding

losses now

realised -- -- -- -- (618) 618 -- --

-------------- ------- ------- ---------- ------------- ----------- ---------- ------------------- --------

Total other

movements -- -- -- -- (618) 618 -- --

-------------- ------- ------- ---------- ------------- ----------- ---------- ------------------- --------

As at 31

August 2023 1,789 19,807 301 112,000 (24,586) 12,650 (1,830) 120,131

-------------- ------- ------- ---------- ------------- ----------- ---------- ------------------- --------

(1) The sum of these reserves is an amount of GBP85,584,000 (31

August 2022: GBP100,354,000 and 28 February 2023: GBP92,676,000)

which is considered distributable to shareholders.

Special Capital Capital

Share Capital redemption distributable reserve reserve Revenue

capital Share premium reserve reserves(1) realised(1) unrealised reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 March

2022 1,605 25,450 236 105,258 (20,762) 58,307 (1,925) 168,169

Total

comprehensive

income for

the period -- -- -- -- (1,040) (23,296) (172) (24,508)

Contributions by and distributions to owners:

Repurchase and

cancellation

of own

shares (16) -- 16 (1,489) -- -- -- (1,489)

Issue of

shares 12 1,090 -- -- -- -- -- 1,102

Share issue

costs -- (9) -- -- -- -- -- (9)

Dividends paid -- -- -- (4,776) -- -- -- (4,776)

-------------- ---------- ---------------- --------------------- ------------------ ----------- ------------ ---------- --------

Total

contributions

by and

distributions

to owners (4) 1,081 16 (6,265) -- -- -- (5,172)

Other

movements:

Cancellation

of share

premium -- (25,451) -- 25,451 -- -- -- --

Prior years'

holding gains

now realised -- -- -- -- (191) 191 -- --

-------------- ---------- ---------------- --------------------- ------------------ ----------- ------------ ---------- --------

Total other

movements -- (25,451) -- 25,451 (191) (191) -- --

-------------- ---------- ---------------- --------------------- ------------------ ----------- ------------ ---------- --------

As at 31

August 2022 1,601 1,080 252 124,444 (21,993) 35,202 (2,097) 138,489

-------------- ---------- ---------------- --------------------- ------------------ ----------- ------------ ---------- --------

(1) The sum of these reserves is an amount of GBP85,584,000 (31

August 2022: GBP100,354,000 and 28 February 2023: GBP92,676,000)

which is considered distributable to shareholders.

Share capital Share premium Capital redemption reserve Special distributable reserves(1) Capital reserve realised(1) Capital reserve unrealised Revenue reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------------- -------------- --------------------------- ---------------------------------- ---------------------------- --------------------------- ------------------- --------

As at 1 March 2022 1,605 25,450 236 105,258 (20,762) 58,307 (1,925) 168,169

---------------------------- -------------- -------------- --------------------------- ---------------------------------- ---------------------------- --------------------------- ------------------- --------

Comprehensive income for the

year:

Management fee allocated as

capital expenditure -- -- -- -- (1,949) -- -- (1,949)

Current year gains on

disposal -- -- -- -- 207 -- -- 207

Current period gains on fair

value of investments -- -- -- -- -- (31,425) -- (31,425)

Capital investment income -- -- -- -- 24 -- -- 24

Loss after tax -- -- -- -- -- -- (271) (271)

---------------------------- -------------- -------------- --------------------------- ---------------------------------- ---------------------------- --------------------------- ------------------- --------

Total comprehensive loss for

the year -- -- -- -- (1,718) (31,425) (271) (33,414)

Contributions by and

distributions to owners:

Repurchase and cancellation

of own shares (43) -- 43 (3,567) -- -- -- (3,567)

Issue of shares 236 19,742 -- -- -- -- -- 19,978

Share issue costs -- (668) -- -- -- -- -- (668)

Dividends paid -- -- -- (9,276) -- -- -- (9,276)

---------------------------- -------------- -------------- --------------------------- ---------------------------------- ---------------------------- --------------------------- ------------------- --------

Total contributions by and

distributions to owners 193 19,074 43 (12,843) -- -- -- 6,467

Other movements:

Cancellation of share

premium -- (25,600) -- 25,600 -- -- -- --

Prior years' holding gains

now realised -- -- -- -- (663) 663 -- --

---------------------------- -------------- -------------- --------------------------- ---------------------------------- ---------------------------- --------------------------- ------------------- --------

Total other movements -- (25,600) -- 25,600 (663) 663 -- --

---------------------------- -------------- -------------- --------------------------- ---------------------------------- ---------------------------- --------------------------- ------------------- --------

Balance as at 28 February

2023 1,798 18,924 279 118,015 (23,143) 27,545 (2,196) 141,222

---------------------------- -------------- -------------- --------------------------- ---------------------------------- ---------------------------- --------------------------- ------------------- --------

(1) The sum of these reserves is an amount of GBP85,584,000 (31

August 2022: GBP100,354,000 and 28 February 2023: GBP92,676,000)

which is considered distributable to shareholders.

Cash flow statement

Audited year to

28 February

Unaudited six months to 31 August 2023 Unaudited six months to 31 August 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------ -------------------------------------------- -------------------------------------------- ---------------------

Cash flows from operating activities

Loss before tax (15,972) (24,508) (33,414)

Adjustments for:

(Increase)/decrease in debtors 72 (16) (25)

Decrease in creditors (105) (289) (794)

Gain on disposal of fixed assets (139) (15) (207)

Loss on disposal of current assets 52 -- --

Loss on valuation of fixed asset

investments 13,719 21,159 29,192

Loss on valuation of current asset

investments 1,794 2,137 2,233

Non-cash distributions -- (23) (24)

------------------------------------ -------------------------------------------- -------------------------------------------- ---------------------

Net cash used in operating

activities (579) (1,555) (3,039)

Cash flows from investing activities

Purchase of fixed asset investments (453) (2,425) (4,880)

Purchase of current asset

investments (1,259) (99) (1,878)

Proceeds from sale of fixed asset

investments 2,218 2,056 2,478

Proceeds from sale of current asset

investments 728 -- --

------------------------------------ -------------------------------------------- -------------------------------------------- ---------------------

Net cash used in investing

activities 1,234 (468) (4,280)

Cash flows from financing activities

Movement in applications account 1 (243) 243

Purchase of own shares (1,564) (1,489) (3,567)

Share issues 28 209 18,217

Share issues costs -- (9) (668)

Dividends paid (3,583) (3,883) (7,515)

------------------------------------ -------------------------------------------- -------------------------------------------- ---------------------

Net cash used in financing

activities (5,118) (5,415) 6,710

Decrease in cash and cash

equivalents (4,463) (7,438) (609)

Opening cash and cash equivalents 22,873 23,482 23,482

------------------------------------ -------------------------------------------- -------------------------------------------- ---------------------

Closing cash and cash equivalents 18,410 16,044 22,873

------------------------------------ -------------------------------------------- -------------------------------------------- ---------------------

Cash and cash equivalents comprise

Cash at bank 1,921 14,710 1,437

Applications cash 4 3 3

Money market funds 16,485 1,331 21,433

------------------------------------ -------------------------------------------- -------------------------------------------- ---------------------

Total cash and cash equivalents 18,410 16,044 22,873

------------------------------------ -------------------------------------------- -------------------------------------------- ---------------------

Notes to the financial statements

1. Basis of preparation

The unaudited financial statements which covers the six months

to 31 August 2023 has been prepared in accordance with the

Financial Reporting Council's (FRC) Financial Reporting Standard

104 'Interim Financial Reporting' (March 2018) and the Statement of

Recommended Practice (SORP) for Investment Companies re-issued by

the Association of Investment Companies in July 2022.

The principal accounting policies have remained unchanged from

those set out in the Company's 2023 Annual Report and Accounts.

2. Publication of non-statutory accounts

The unaudited financial statements for the six months ended 31

August 2023 does not constitute statutory accounts within the

meaning of Section 415 of the Companies Act 2006 and has not been

delivered to the Registrar of Companies. The comparative figures

for the year ended 28 February 2023 have been extracted from the

audited financial statements for that year, which have been

delivered to the Registrar of Companies. The independent auditor's

report on those financial statements, in accordance with chapter 3,

part 16 of the Companies Act 2006, was unqualified. This financial

statements have not been reviewed by the Company's auditor.

3. Earnings per share

The earnings per share is calculated on the basis of 178,768,443

Ordinary shares (31 August 2022: 159,856,324 and 28 February 2023:

165,688,082), being the weighted average number of shares in issue

during the period.

There are no potentially dilutive capital instruments in issue

and, therefore, no diluted return per share figures are relevant.

The basic and diluted earnings per share are therefore

identical.

4. Net asset value per share

The net asset value per share is based on net assets as at 31

August 2023 divided by 178,882,114 shares in issue at that date (31

August 2022: 160,064,444 and 28 February 2023: 179,802,084).

31 August 2023 31 August 2022 28 February 2023

-------------------------- -------------- -------------- ----------------

Net assets (GBP'000) 120,131 138,489 141,222

Shares in Issue 178,882,114 160,064,444 179,802,084

-------------------------- -------------- -------------- ----------------

Net asset value per share 67.2p 86.5p 78.5p

-------------------------- -------------- -------------- ----------------

5. Dividends

The interim dividend declared of 2.5p per Ordinary share will be

paid on 12 January 2024 to those shareholders on the register on 22

December 2023.

6. Buybacks and share issues

During the six months ended 31 August 2023 the Company

repurchased the following shares.

Date No. of shares Price (p) Cost (GBP)

----------------- ------------- --------- ----------

16 March 2023 459,683 72.5 333,000

20 April 2023 558,866 72.5 405,000

18 May 2023 290,881 71.9 209,000

15 June 2023 221,943 70.4 156,000

13 July 2023 247,764 68.2 169,000

17 August 2023 442,297 66.2 292,000

----------------- ------------- --------- ----------

Total 2,221,434 1,564,000

----------------- ------------- --------- ----------

The weighted average price of all buybacks during the period was

70.4p per share.

During the six months ended 31 August 2023 the Company issued

the following shares.

Date No. of shares Price (p) Gross proceeds (GBP)

------------------------ ------------- --------- --------------------

10 August 2023 (DRIS) 1,260,682 68.8 868,000

10 August 2023(1) 40,782 68.8 28,000

------------------------ ------------- --------- --------------------

Total 1,301,464 896,000

------------------------ ------------- --------- --------------------

(1) Shares issued as a result of reduced adviser charges, and

reduced annual management fee for Octopus people.

The weighted average allotment price of all shares issued during

the period was 68.8p per share.

7. Principal risks and uncertainties

The Company's principal risks are investment performance, VCT

qualifying status risk, operational risk, information security,

economic and price risk, regulatory and reputational/legislative

risk, liquidity/cash flow risk and valuation risk. These risks, and

the way in which they are managed, are described in more detail in

the Company's Annual Report and Accounts for the year ended 28

February 2023. The Company's principal risks and uncertainties have

not changed materially since the date of that report.

8. Related Party Transactions

The Company has employed Octopus Investments Limited throughout

the period as Investment Manager. Octopus has also been appointed

as Custodian of the Company's investments under a Custodian

Agreement. The Company has been charged GBP1,216,000 by Octopus as

a management fee in the period to 31 August 2023 (31 August 2022:

GBP1,437,000 and 28 February 2023 GBP2,599,000). The management fee

is payable quarterly and is based on 2% of net assets at six-month

intervals.

The Company has invested a further GBP1.3 million into Octopus

managed funds (31 August 2022: GBP0.1 million and 28 February 2023

GBP1.9 million), being the Multi Cap Income Fund, Micro Cap Growth

Fund and Future Generations Fund. The Company has partially

disposed its holding in Multi Cap Income Fund for total

consideration of GBP0.7 million (31 August 2022: nil and 28

February 2023: nil) and has made a loss of GBP0.02 million over

book cost (31 August 2022: nil and 28 February 2023: nil). To make

sure the Company is not double charged management fees on these

products, the Company receives a reduction in the management fee as

a percentage of the value of these investments. This amounted to

GBP43,000 in the period to 31 August 2023 (31 August 2022:

GBP43,000 and 28 February 2023: GBP83,000). For further details

please refer to the Company's Annual Report and Accounts for the

year ended 28 February 2023.

In the period, Octopus Investments Nominees Limited (OINL)

purchased shares in the Company from shareholders to correct

administrative issues, on the understanding that shares will be

sold back to the Company in subsequent share buybacks at the

prevailing market price. As at 31 August 2023, OINL held nil shares

(31 August 2022: 4,540 shares and 28 February 2023: 7,598 shares)

in the Company as beneficial owner, with a nil book cost (31 August

2022: GBP4,000 and 28 February 2023: GBP7,000). Throughout the

period to 31 August 2023 OINL purchased 2,657 shares (31 August

2022: 6,253 shares and 28 February 2023: 9,875 shares) at a cost of

GBP2,372 (31 August 2022: GBP5,930 and 28 February 2023: GBP9,000)

and sold 10,255 shares (31 August 2022: 2,602 shares and 28

February 2023: 3,166 shares) for proceeds of GBP7,383 (31 August

2022: GBP2,328 and 28 February 2023: GBP3,000). This is classed as

a related party transaction as Octopus, the Investment Manager and

OINL are part of the same group of companies. Any such future

transactions, where OINL takes over the legal and beneficial

ownership of Company shares, will be announced to the market and

disclosed in annual and financial statements.

9. Fixed asset investments

Accounting Policy

The Company's principal financial assets are its investments and

the policies in relation to those assets are set out below.

Purchases and sales of investments are recognised in the

financial statements at the date of the transaction (trade

date).

These investments will be managed and their performance

evaluated on a fair value basis in accordance with a documented

investment strategy and information about them has to be provided

internally on that basis to the Board. Accordingly, as permitted by

FRS 102, the investments are measured as being fair value through

profit or loss on the basis that they qualify as a group of assets

managed, and whose performance is evaluated, on a fair value basis

in accordance with a documented investment strategy. The Company's

investments are measured at subsequent reporting dates at fair

value.

In the case of investments quoted on a recognised stock

exchange, fair value is established by reference to the closing bid

price on the relevant date or the last traded price, depending upon

convention of the exchange on which the investment is quoted. This

is consistent with the International Private Equity and Venture

Capital Valuation (IPEV) guidelines.

Gains and losses arising from changes in fair value of

investments are recognised as part of the capital return within the

Income Statement and allocated to the capital reserve --

unrealised. The Managers review changes in fair value of

investments for any permanent reductions in value and will give

consideration to whether these losses should be transferred to the

Capital reserve -- realised.

In the preparation of the valuations of assets the Directors are

required to make judgements and estimates that are reasonable and

incorporate their knowledge of the performance of the investee

companies.

Fair value hierarchy

Paragraph 34.22 of FRS 102 suggests following a hierarchy of

fair value measurements for financial instruments measured at fair

value in the Balance Sheet, which gives the highest priority to

unadjusted quoted prices in active markets for identical assets or

liabilities (Level 1) and the lowest priority to unobservable

inputs (Level 3). This methodology is adopted by the Company and

requires disclosure of financial instruments to be dependent on the

lowest significant applicable input, as laid out below:

Level 1: The unadjusted, fully accessible and current quoted

price in an active market for identical assets or liabilities that

an entity can access at the measurement date.

Level 2: Inputs for similar assets or liabilities other than the

quoted prices included in Level 1 that are directly or indirectly

observable, which exist for the duration of the period of

investment.

Level 3: This is where inputs are unobservable, where no active

market is available and recent transactions for identical

instruments do not provide a good estimate of fair value for the

asset or liability.

There have been no reclassifications between levels in the year.

The change in fair value for the current and previous year is

recognised through the profit and loss account.

Level 3: Unquoted

Level 1: Quoted equity investments investments Total

Disclosure GBP'000 GBP'000 GBP'000

------------------------ ---------------------------------- ----------------- --------

Cost as at 1 March 2023 72,846 4,488 77,334

Opening unrealised gain

at 1 March 2023 21,207 4,126 25,333

------------------------ ---------------------------------- ----------------- --------

Valuation at 1 March

2023 94,053 8,614 102,667

------------------------ ---------------------------------- ----------------- --------

Purchases at cost 453 -- 453

Disposal proceeds (2,218) -- (2,218)

Gain on realisation of

investments 139 -- 139

Change in fair value in

year (13,663) (56) (13,719)

------------------------ ---------------------------------- ----------------- --------

Closing valuation at 31

August 2023 78,764 8,558 87,322

------------------------ ---------------------------------- ----------------- --------

Cost at 31 August 2023 70,570 4,488 75,058

Closing unrealised gain

at 31 August 2023 8,194 4,070 12,264

------------------------ ---------------------------------- ----------------- --------

Valuation at 31 August

2023 78,764 8,558 87,332

------------------------ ---------------------------------- ----------------- --------

Level 1 valuations are valued in accordance with the bid-price

on the relevant date. Further details of the fixed asset

investments held by the Company are shown within the Investment

Manager's review.

Level 3 investments are reported at fair value in accordance

with FRS 102 Sections 11 and 12, which is determined in accordance

with the latest IPEV guidelines. In estimating fair value, there is

an element of judgement, notably in deriving reasonable

assumptions, and it is possible that, if different assumptions were

to be used, different valuations could have been attributed to some

of the Company's investments.

Level 3 investments include GBP600,000 (31 August 2022:

GBP600,000 and 28 February 2023: GBP600,000) of convertible loan

notes held at cost, which is deemed to be current fair value. In

addition to this the Company holds eight unquoted investments which

are classified as level 3 in terms of fair value hierarchy. These

are valued based on a range of valuation methodologies, determined

on an investment specific basis. The price of recent investment is

used where a transaction has occurred sufficiently close to the

reporting date to make this the most reliable indicator of fair

value. Where recent investment is not deemed to indicate the most

reliable indicator of fair value i.e. the most recent investment is

too distant from the reporting date for this to be deemed a

reasonable indicator, other market-based approaches including

earnings multiples, annualised recurring revenues, discounted cash

flows or net assets are used to determine a fair value for the

investments.

All capital gains or losses on investments are classified at

FVTPL (fair value through profit or loss). Given the nature of the

Company's venture capital investments, the changes in fair value of

such investments recognised in these financial statements are not

considered to be readily convertible to cash in full at the balance

sheet date and accordingly these gains are treated as holding gains

or losses.

At 31 August 2023 there were no commitments in respect of

investments approved by the Investment Manager but not yet

completed. The transaction costs incurred when purchasing or

selling assets are written off to the Income Statement in the

period that they occur.

10. Post balance sheet events

The following events occurred between the balance sheet date and

the signing of these financial statements.

-- A follow-on investment totalling GBP210,000 completed in FP Octopus UK

Future Generations Fund.

-- A follow-on investment totalling GBP180,000 (convertible loan note)

completed in Rosslyn Data Technologies Plc.

-- A follow-on investment totalling GBP540,000 completed in Rosslyn Data

Technologies Plc.

-- A new investment totalling GBP1,620,000 completed in Eden Research Plc.

-- A follow-on investment totalling GBP1,259,000 completed in Haydale

Graphene Industries Plc.

-- A partial disposal with proceeds totalling GBP39,000 completed in

Equipmake Holdings Limited.

-- A partial disposal with proceeds totalling GBP967,000 completed in

Ergomed Plc.

-- A partial disposal with proceeds totalling GBP38,000 completed in Clean

Power Hydrogen plc.

-- A full disposal with proceeds totalling GBP364,000 completed in Glantus

Holdings plc.

-- A full redemption of the Osirium Technologies plc Loan Notes with

proceeds totalling GBP766,000.

-- A partial disposal with proceeds totalling GBP1,260,000 completed in FP

Octopus UK Multi Cap Income Fund.

-- 284,846 shares were bought back on 21 September 2023 at a price of 64.6p

per share.

-- 978,221 shares were bought back on 19 October 2023 at a price of 60.4p

per share.

-- On 14 September 2023, a prospectus offer was launched alongside Octopus

AIM VCT 2 plc to raise a combined total of up to GBP20 million with a

GBP10 million over allotment facility. The Offer will close on 13

September 2024 or earlier if fully subscribed.

-- A final order to cancel share premium amounting to GBP19.8 million was

granted on 20 October 2023.

11. Half Yearly Report

The unaudited half-yearly report for the six months ended 31

August 2023 will shortly be available to view on the Company's

website http://www.octopusinvestments.com

A copy of the half-yearly report will be submitted to the

National Storage Mechanism and will shortly be available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further enquiries, please contact:

Rachel Peat

Octopus Company Secretarial Services Limited

Tel: +44 (0)80 0316 2067

LEI: 213800C5JHJUQLAFP619

(END) Dow Jones Newswires

November 07, 2023 13:20 ET (18:20 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

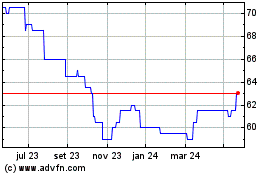

Octopus Aim Vct (LSE:OOA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

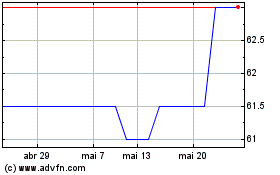

Octopus Aim Vct (LSE:OOA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025