Company to Add Annualized Revenues of

Approximately $280 Million in Seven States and Enter Texas as the

State’s Largest Personal Care Provider

Addus HomeCare Corporation (Nasdaq: ADUS), a provider of home

care services, today announced a definitive agreement to acquire

the personal care operations of Gentiva for an anticipated purchase

price, after customary purchase price adjustments, of approximately

$350 million. Based in Atlanta, Georgia, Gentiva is a dedicated

hospice, palliative, and personal care services company and the

transaction relates only to its personal care operations, which

serve over 16,000 patients per day in a seven-state service area of

Arizona, Arkansas, California, Missouri, North Carolina, Tennessee

and Texas. Addus expects to close the transaction following

completion of regulatory approvals and subject to customary closing

conditions. Addus will fund the acquisition through the Company’s

existing revolving credit facility.

Commenting on the announcement, Dirk Allison, Chairman and Chief

Executive Officer of Addus, stated, “We believe this acquisition is

a great strategic fit for Addus, and we are excited about the

opportunity to expand our personal care market coverage in seven

states, including Texas and Missouri, which are new markets for

Addus. Notably, Gentiva is the largest provider of personal care

services in the state of Texas, where we currently have no personal

care operations. This acquisition fits squarely into our growth

strategy to leverage our strong personal care experience to build

scale in existing markets as well as enter select new markets where

we can immediately establish a significant presence. Founded in

1999, Gentiva has an established reputation for quality,

compassionate care, and we will continue this important work

through our proven operating model. We look forward to working with

the experienced operational leadership team and clinical staff in

Gentiva’s personal care operations, who share our mission to

provide safe, cost-effective care in the preferred home

setting.

“The Gentiva personal care operations have annualized revenues

of approximately $280.0 million, and we expect this transaction to

be accretive to our financial results. Importantly, after funding

this acquisition, Addus will still maintain a leverage ratio of

less than three times, with the ability to quickly reduce our

leverage through the additional expected cash flow,” said

Allison.

David Causby, Chief Executive Officer of Gentiva, added, “A

recognized leader in personal care services, Addus is the right

home for our personal care division and our teammates who provide

care to these important clients. This will ensure continued growth

for that segment under proven leadership and will allow us to

sharpen our focus on our industry-leading core hospice and

palliative businesses, where we have the greatest opportunity to

deliver the compassionate care that defines who we are, to those

who need us the most.”

Allison added, “Acquisitions remain an important part of our

growth strategy, and we will continue to pursue strategic

acquisitions that meet our criteria and are accretive to our

operations. Fortunately, our strong capital structure supports our

strategy, and we look forward to additional opportunities ahead for

Addus.”

BofA Securities, Inc. is serving as an exclusive financial

advisor and Bass Berry & Sims PLC is serving as legal counsel

to Addus in this transaction. Goldman Sachs & Co. LLC is

serving as financial advisor and Debevoise & Plimpton LLP and

Ropes & Gray LLP are serving as legal counsel to Gentiva.

Forward-Looking Statements

Certain matters discussed in this press release constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements may be identified by words such as “preliminary,”

“continue,” “expect,” and similar expressions. These

forward-looking statements are based on our current expectations

and beliefs concerning future developments and their potential

effect on us. Forward-looking statements involve a number of risks

and uncertainties that may cause actual results to differ

materially from those expressed or implied by such forward-looking

statements, including discretionary determinations by government

officials, the consummation and integration of acquisitions,

transition to managed care providers, our ability to successfully

execute our growth strategy, unexpected increases in SG&A and

other expenses, expected benefits and unexpected costs of

acquisitions and dispositions, management plans related to

dispositions, the possibility that expected benefits may not

materialize as expected, the failure of the business to perform as

expected, changes in reimbursement, changes in government

regulations, changes in Addus HomeCare’s relationships with

referral sources, increased competition for Addus HomeCare’s

services, changes in the interpretation of government regulations,

the uncertainty regarding the outcome of discussions with managed

care organizations, changes in tax rates, the impact of adverse

weather, higher than anticipated costs, lower than anticipated cost

savings, estimation inaccuracies in future revenues, margins,

earnings and growth, whether any anticipated receipt of payments

will materialize, any security breaches, cyber-attacks, loss of

data or cybersecurity threats or incidents, and other risks set

forth in the Risk Factors section in Addus HomeCare’s Annual Report

on Form 10-K filed with the Securities and Exchange Commission on

February 27, 2024, which is available at www.sec.gov. The financial

information described herein and the periods to which they relate

are preliminary estimates that are subject to change and

finalization. There is no assurance that the final amounts and

adjustments will not differ materially from the amounts described

above, or that additional adjustments will not be identified, the

impact of which may be material. Addus HomeCare undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

In addition, these forward-looking statements necessarily depend

upon assumptions, estimates and dates that may be incorrect or

imprecise and involve known and unknown risks, uncertainties, and

other factors. Accordingly, any forward-looking statements included

in this press release do not purport to be predictions of future

events or circumstances and may not be realized.

About Addus HomeCare

Addus HomeCare is a provider of home care services that

primarily include personal care services that assist with

activities of daily living, as well as hospice and home health

services. Addus HomeCare’s consumers are primarily persons who,

without these services, are at risk of hospitalization or

institutionalization, such as the elderly, chronically ill and

disabled. Addus HomeCare’s payor clients include federal, state,

and local governmental agencies, managed care organizations,

commercial insurers, and private individuals. Addus HomeCare

currently provides home care services to over 49,000 consumers

through 214 locations across 22 states. For more information,

please visit www.addus.com.

About Gentiva

Gentiva is a family of industry-leading home healthcare

providers, including hospice, palliative, home health, and personal

care, with more than 590 locations and thousands of compassionate

clinicians and caregivers across 38 states. From assistance with

daily living and restorative care to helping patients and their

families manage the effects of serious illness or a terminal

diagnosis, our place is by the side of those who need us. Gentiva’s

corporate headquarters is in Atlanta, Georgia, with providers

delivering care across the U.S.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240610676671/en/

Brian W. Poff Executive Vice President, Chief Financial Officer

Addus HomeCare Corporation (469) 535-8200

investorrelations@addus.com

Dru Anderson FINN Partners (615) 324-7346

dru.anderson@finnpartners.com

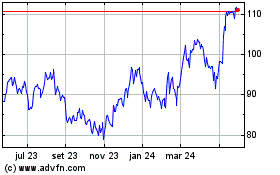

Addus HomeCare (NASDAQ:ADUS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

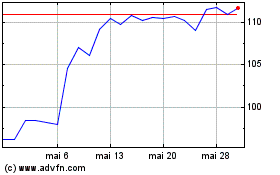

Addus HomeCare (NASDAQ:ADUS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024