false000186669200018666922024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

Amplitude, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-40817 |

|

45-3937349 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

201 Third Street, Suite 200

San Francisco, California 94103

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (415) 231-2353

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Class A Common Stock, $0.00001 par value per share |

|

AMPL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Amplitude, Inc. issued a press release announcing its financial results for the three and nine months ended September 30, 2024 (the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished under this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMPLITUDE, INC. |

|

|

|

|

Date: November 7, 2024 |

|

|

|

By: |

|

/s/ Andrew Casey Name: Andrew Casey |

|

|

|

|

|

|

Title: Chief Financial Officer |

Exhibit 99.1

Amplitude Announces Third Quarter 2024 Financial Results

•Annual Recurring Revenue was $298 million, up 9% year over year

•Third quarter revenue of $75.2 million, up 6% year over year

•Third quarter Cash Flow from Operations of $6.2 million and Free Cash Flow of $4.5 million, representing a 5 percentage point decrease in Free Cash Flow margin year over year

SAN FRANCISCO – November 7, 2024 – Amplitude, Inc. (Nasdaq: AMPL), the leading digital analytics platform, today announced financial results for its third quarter ended September 30, 2024.

"We are on the path to reaccelerating growth," said Spenser Skates, CEO and co-founder of Amplitude. "Product innovation is the biggest driver of long-term value for Amplitude. Our platform continues to evolve to serve more users, more workflows, and more outcomes. Customers see that and are turning to us for our integrated and easy-to-use experience."

Third Quarter 2024 Financial Highlights:

(in millions, except per share and percentage amounts)

|

|

|

|

|

Third Quarter 2024 |

Third Quarter 2023 |

Y/Y Change |

Annual Recurring Revenue |

$298 |

$273 |

9% |

Revenue |

$75.2 |

$70.6 |

6% |

GAAP Loss from Operations |

$(20.0) |

$(20.9) |

$0.9 |

Non-GAAP Income (Loss) from Operations |

$1.6 |

$2.8 |

$(1.2) |

GAAP Net Loss Per Share, Basic and Diluted |

$(0.14) |

$(0.15) |

$0.01 |

Non-GAAP Net Income (Loss) Per Share, Diluted |

$0.03 |

$0.05 |

$(0.02) |

Net Cash Provided by (Used in) Operating Activities |

$6.2 |

$8.0 |

$(1.8) |

Free Cash Flow |

$4.5 |

$7.5 |

$(3.0) |

Non-GAAP income (loss) from operations and non-GAAP net income (loss) per share exclude expenses related to stock-based compensation expense and related employer payroll taxes and amortization of acquired intangible assets. Stock-based compensation expense and the related employer payroll taxes were $21.5 million in the third quarter of 2024 compared to $23.5 million in the third quarter of 2023. Free Cash Flow is GAAP net cash provided by (used in) operating activities, less cash used for purchases of property and equipment and capitalized internal-use software costs. The section titled "Non-GAAP Financial Measures" below contains a description of the non-GAAP financial measures and reconciliations between historical GAAP and non-GAAP information are contained in the tables below.

Third Quarter and Recent Business Highlights:

•Annual Recurring Revenue was $298 million, an increase of 9% year over year and an increase of $8 million compared to the second quarter of 2024.

•GAAP Net Loss per share was $0.14, based on 124.3 million shares, in the third quarter of 2024, compared to a loss of $0.15 per share, based on 117.9 million shares, in the third quarter of 2023.

•Non-GAAP Net Income (Loss) per share was $0.03, based on 131.3 million diluted shares, in the third quarter of 2024, compared to $0.05 per share, based on 128.1 million diluted shares, in the third quarter of 2023.

•Cash Flow from Operations was $6.2 million, a $1.8 million decrease year over year.

•Free Cash Flow was $4.5 million, a $3.0 million decrease year over year.

•Number of paying customers grew 41% year over year to 3,486.

•Number of customers representing $100,000 or more of ARR in Q3 grew to 567, an increase of 13% year over year.

•Hired Wade Chambers as the Company's first Chief Engineering Officer.

•Launched Amplitude Made Easy, a radically simplified platform experience that makes it easier for more people and more organizations to get started, get insights, and get value faster.

•Announced a global strategic partnership with HubSpot aimed to help Go To Market teams embrace product-led growth and close more deals.

•Acquired Command AI, a startup that provides intuitive, AI-powered user assistance to make software easier to use.

•Launched Web Experimentation, a new product that makes it easy for product managers, marketers, and growth leaders to A/B test and personalize web experiences.

Financial Outlook:

The fourth quarter and full year 2024 outlook information provided below is based on Amplitude’s current estimates and is not a guarantee of future performance. These statements are forward-looking and actual results may differ materially. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause Amplitude’s actual results to differ materially from these forward-looking statements.

For the fourth quarter and full year 2024, the Company expects:

|

|

|

|

Fourth Quarter 2024 |

Full Year 2024 |

Revenue |

$76.0 - $77.0 million |

$297.1 - $298.1 million |

Non-GAAP Operating Income (Loss) |

$(2.1) - $(0.1) million |

$(6.3) - $(4.3) million |

Non-GAAP Net Income (Loss) Per Share |

$0.00 - $0.01 |

$0.04 - $0.06 |

Weighted Average Shares Outstanding |

134.9 million, diluted |

131.7 million, diluted |

An outlook for GAAP income (loss) from operations, GAAP net income (loss), GAAP net income (loss) per share and a reconciliation of expected non-GAAP income (loss) from operations to GAAP income (loss) from operations, expected non-GAAP net income (loss) to GAAP net income (loss), and expected non-GAAP net income (loss) per share to GAAP net income (loss) per share have not been provided as the quantification of certain items included in the calculation of GAAP income (loss) from operations, GAAP net income (loss) and GAAP net income (loss) per share cannot be reasonably calculated or predicted at this time without unreasonable efforts. For example, the non-GAAP adjustment for stock-based compensation expense requires additional inputs such as the number and value of awards granted that are not currently ascertainable, and the non-GAAP adjustment for amortization of acquired intangible assets depends on the timing and value of intangible assets acquired that cannot be accurately forecasted.

Conference Call Information:

Amplitude will host a live video webcast to discuss its financial results for its third quarter ended September 30, 2024, as well as the financial outlook for its fourth quarter and full year 2024 today at 2:00 PM Pacific Time / 5:00 PM Eastern Time. Interested parties may access the webcast, earnings press release, and investor presentation on the events section of Amplitude’s investor relations website at investors.amplitude.com. A replay will be available in the same location a few hours after the conclusion of the live webcast.

Forward-Looking Statements:

This press release contains express and implied "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s financial outlook for the fourth

quarter and full year 2024, the Company’s growth strategy and business aspirations and its market position and market opportunity. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words or phrases or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not statements of historical fact, and are based on current expectations, estimates, and projections about the Company’s industry as well as certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. These statements are subject to numerous uncertainties and risks that could cause actual results, performance, or achievement to differ materially and adversely from those anticipated or implied in the statements, including risks related to: the Company’s limited operating history and rapid growth over the last several years, which makes it difficult to forecast the Company’s future results of operations; the Company’s history of losses; any decline in the Company’s customer retention or expansion of its commercial relationships with existing customers or an inability to attract new customers; expected fluctuations in the Company’s financial results, making it difficult to project future results; the Company’s focus on sales to larger organizations and potentially increased dependency on those relationships, which may increase the variability of the Company’s sales cycles and results of operations; downturns or upturns in new sales, which may not be immediately reflected in the Company’s results of operations and may be difficult to discern; unfavorable conditions in the Company’s industry or the global economy, or reductions in information technology spending, which could limit the Company’s ability to grow its business; the market for SaaS applications, which may develop more slowly than the Company expects or decline; the Company’s intellectual property rights, which may not protect its business or provide the Company with a competitive advantage; evolving privacy and other data-related laws; and the impact of new sanctions related to Russia on the Company’s ability to collect receivables. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are or will be included under the caption "Risk Factors" and elsewhere in the reports and other documents that the Company files with the Securities and Exchange Commission from time to time, including the Company’s Quarterly Report on Form 10-Q being filed at or around the date hereof. The forward-looking statements made in this press release relate only to events as of the date on which the statements are made. The Company undertakes no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law.

Non-GAAP Financial Measures:

This press release includes financial information that has not been prepared in accordance with GAAP. The Company uses non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating the Company’s ongoing operational performance. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial results with other companies in the industry, many of which present similar non-GAAP financial measures to investors. There are a number of limitations related to the use of non-GAAP financial measures versus comparable financial measures determined under GAAP. For example, other companies in the Company’s industry may calculate these non-GAAP financial measures differently or may use other measures to evaluate their performance. In addition, Free Cash Flow does not reflect the Company’s future contractual commitments and the total increase or decrease of its cash balance for a given period.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. A reconciliation of the Company’s non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the financial statement tables included below in this press release. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures below.

Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP Operating Expenses, Non-GAAP Income (Loss) from Operations, Non-GAAP Operating Margin, Non-GAAP Net Income (Loss), and Non-GAAP Net Income (Loss) per Share:

The Company defines these non-GAAP financial measures as their respective GAAP measures, excluding expenses related to stock-based compensation expense and related employer payroll taxes, amortization of acquired intangible assets, and non-recurring costs such as restructuring and other related charges. The Company excludes stock-based compensation expense and related employer payroll taxes, which is a non-cash expense, from certain of its

non-GAAP financial measures because it believes that excluding this item provides meaningful supplemental information regarding operational performance. The Company excludes amortization of intangible assets, which is a non-cash expense, related to business combinations from certain of its non-GAAP financial measures because such expenses are related to business combinations and have no direct correlation to the operation of the Company’s business. Although the Company excludes these expenses from certain non-GAAP financial measures, the revenue from acquired companies subsequent to the date of acquisition is reflected in these measures and the acquired intangible assets contribute to the Company’s revenue generation. The Company excludes non-recurring costs from certain of its non-GAAP financial measures because such expenses do not repeat period over period and are not reflective of the ongoing operation of the Company’s business.

The Company uses non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income (loss) from operations, non-GAAP operating margin, non-GAAP net income (loss), and non-GAAP net income (loss) per share in conjunction with its traditional GAAP measures to evaluate the Company’s financial performance. The Company believes that these measures provide its management, board of directors, and investors consistency and comparability with its past financial performance and facilitates period-to-period comparisons of operations.

Free Cash Flow and Free Cash Flow Margin:

The Company defines Free Cash Flow as net cash provided by (used in) operating activities, less cash used for purchases of property and equipment and capitalized internal-use software costs. Free Cash Flow margin is calculated as Free Cash Flow divided by total revenue. The Company believes that Free Cash Flow and Free Cash Flow margin are useful indicators of liquidity that provides its management, board of directors, and investors with information about its future ability to generate or use cash to enhance the strength of its balance sheet and further invest in its business and pursue potential strategic initiatives.

Definitions of Business Metrics:

Annual Recurring Revenue

The Company defines Annual Recurring Revenue (“ARR”) as the annual recurring revenue of subscription agreements, including certain premium professional services that are subject to contractual subscription terms, at a point in time based on the terms of customers’ contracts. ARR should be viewed independently of revenue, and does not represent the Company’s GAAP revenue on an annualized basis, as it is an operating metric that can be impacted by contract start and end dates and renewal rates. ARR is also not intended to be a forecast of revenue.

Dollar-Based Net Retention Rate

The Company calculates dollar-based net retention rate as of a period end by starting with the ARR from the cohort of all customers as of 12 months prior to such period-end (the “Prior Period ARR”). The Company then calculates the ARR from these same customers as of the current period-end (the “Current Period ARR”). Current Period ARR includes any expansion and is net of contraction or attrition over the last 12 months, but excludes ARR from new customers as well as any overage charges in the current period. The Company then divides the total Current Period ARR by the total Prior Period ARR to arrive at the dollar-based net retention rate ("NRR"). The Company then calculates the weighted average of the trailing 12-month dollar-based net retention rates, to arrive at the trailing 12-month dollar-based net retention rate (“NRR (TTM)”).

Paying Customers

For purposes of customer count, a customer is defined as an entity that has a unique Dunn & Bradstreet Global Ultimate (“GULT”) Data Universal Numbering System (“DUNS”) number and an active subscription contract as of the measurement date. The DUNS number is a global standard for business identification and tracking. The Company makes exceptions for holding companies, government entities, and other organizations for which the GULT, in the Company’s judgment, does not accurately represent the Amplitude customer or the DUNS does not exist.

About Amplitude

Amplitude is the leading digital analytics platform that helps companies unlock the power of their products. Almost 3,500 customers, including Atlassian, NBCUniversal, Under Armour, Shopify, and Jersey Mike’s, rely on Amplitude to gain self-service visibility into the entire customer journey. Amplitude guides companies every step of the way as they capture data they can trust, uncover clear insights about customer behavior, and take faster action. When teams understand how people are using their products, they can deliver better product experiences that drive growth. Amplitude is the best-in-class analytics solution for product, data, and marketing teams, ranked #1 in multiple categories in G2’s Fall 2024 Report. Learn how to optimize your digital products and business at amplitude.com.

Contacts

Investor Relations

Yaoxian Chew

ir@amplitude.com

Communications

Darah Easton

press@amplitude.com

AMPLITUDE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

317,448 |

|

|

$ |

248,491 |

|

Restricted cash, current |

|

|

878 |

|

|

|

— |

|

Marketable securities, current |

|

|

2,496 |

|

|

|

73,909 |

|

Accounts receivable, net |

|

|

29,335 |

|

|

|

29,496 |

|

Prepaid expenses and other current assets |

|

|

23,661 |

|

|

|

16,624 |

|

Deferred commissions, current |

|

|

14,312 |

|

|

|

11,444 |

|

Total current assets |

|

|

388,130 |

|

|

|

379,964 |

|

Property and equipment, net |

|

|

15,490 |

|

|

|

10,068 |

|

Intangible assets, net |

|

|

145 |

|

|

|

609 |

|

Goodwill |

|

|

4,073 |

|

|

|

4,073 |

|

Restricted cash, noncurrent |

|

|

— |

|

|

|

869 |

|

Deferred commissions, noncurrent |

|

|

26,292 |

|

|

|

26,942 |

|

Operating lease right-of-use assets |

|

|

4,074 |

|

|

|

6,856 |

|

Other noncurrent assets |

|

|

7,438 |

|

|

|

4,303 |

|

Total assets |

|

$ |

445,642 |

|

|

$ |

433,684 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

2,677 |

|

|

$ |

3,063 |

|

Accrued expenses |

|

|

34,791 |

|

|

|

26,657 |

|

Deferred revenue |

|

|

114,906 |

|

|

|

102,573 |

|

Total current liabilities |

|

|

152,374 |

|

|

|

132,293 |

|

Operating lease liabilities, noncurrent |

|

|

518 |

|

|

|

3,604 |

|

Noncurrent liabilities |

|

|

2,723 |

|

|

|

3,034 |

|

Total liabilities |

|

|

155,615 |

|

|

|

138,931 |

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock |

|

|

1 |

|

|

|

1 |

|

Additional paid-in capital |

|

|

715,285 |

|

|

|

658,463 |

|

Accumulated other comprehensive income (loss) |

|

|

— |

|

|

|

(181 |

) |

Accumulated deficit |

|

|

(425,259 |

) |

|

|

(363,530 |

) |

Total stockholders’ equity |

|

|

290,027 |

|

|

|

294,753 |

|

Total liabilities and stockholders’ equity |

|

$ |

445,642 |

|

|

$ |

433,684 |

|

AMPLITUDE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

$ |

75,217 |

|

|

$ |

70,637 |

|

|

$ |

221,141 |

|

|

$ |

204,881 |

|

Cost of revenue (1) |

|

|

18,744 |

|

|

|

17,291 |

|

|

|

57,118 |

|

|

|

53,658 |

|

Gross profit |

|

|

56,473 |

|

|

|

53,346 |

|

|

|

164,023 |

|

|

|

151,223 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development (1) |

|

$ |

19,037 |

|

|

$ |

21,797 |

|

|

$ |

63,135 |

|

|

$ |

67,940 |

|

Sales and marketing (1) |

|

|

40,863 |

|

|

|

38,475 |

|

|

|

125,824 |

|

|

|

115,934 |

|

General and administrative (1) |

|

|

16,586 |

|

|

|

13,997 |

|

|

|

46,942 |

|

|

|

40,138 |

|

Restructuring and other related charges (1) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,194 |

|

Total operating expenses |

|

|

76,486 |

|

|

|

74,269 |

|

|

|

235,901 |

|

|

|

232,206 |

|

Loss from operations |

|

|

(20,013 |

) |

|

|

(20,923 |

) |

|

|

(71,878 |

) |

|

|

(80,983 |

) |

Other income (expense), net |

|

|

3,901 |

|

|

|

3,444 |

|

|

|

11,522 |

|

|

|

9,889 |

|

Loss before provision for (benefit from) income taxes |

|

|

(16,112 |

) |

|

|

(17,479 |

) |

|

|

(60,356 |

) |

|

|

(71,094 |

) |

Provision for (benefit from) income taxes |

|

|

742 |

|

|

|

268 |

|

|

|

1,373 |

|

|

|

726 |

|

Net loss |

|

$ |

(16,854 |

) |

|

$ |

(17,747 |

) |

|

$ |

(61,729 |

) |

|

$ |

(71,820 |

) |

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.14 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.62 |

) |

Weighted-average shares used in calculating net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

124,324 |

|

|

|

117,902 |

|

|

|

122,601 |

|

|

|

116,160 |

|

(1) Amounts include stock-based compensation expense as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

$ |

1,559 |

|

|

$ |

1,947 |

|

|

$ |

4,581 |

|

|

$ |

5,426 |

|

Research and development |

|

|

6,994 |

|

|

|

9,285 |

|

|

|

24,105 |

|

|

|

27,173 |

|

Sales and marketing |

|

|

8,333 |

|

|

|

7,843 |

|

|

|

23,851 |

|

|

|

21,677 |

|

General and administrative |

|

|

4,226 |

|

|

|

4,010 |

|

|

|

12,377 |

|

|

|

9,876 |

|

Restructuring and other related charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

853 |

|

Total stock-based compensation expense |

|

$ |

21,112 |

|

|

$ |

23,085 |

|

|

$ |

64,914 |

|

|

$ |

65,005 |

|

AMPLITUDE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(16,854 |

) |

|

$ |

(17,747 |

) |

|

$ |

(61,729 |

) |

|

$ |

(71,820 |

) |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,375 |

|

|

|

1,448 |

|

|

|

4,137 |

|

|

|

4,200 |

|

Stock-based compensation expense |

|

|

21,112 |

|

|

|

23,085 |

|

|

|

64,914 |

|

|

|

65,005 |

|

Other |

|

|

656 |

|

|

|

(384 |

) |

|

|

(33 |

) |

|

|

(934 |

) |

Non-cash operating lease costs |

|

|

982 |

|

|

|

992 |

|

|

|

2,947 |

|

|

|

2,948 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

4,862 |

|

|

|

1,230 |

|

|

|

(703 |

) |

|

|

(10,776 |

) |

Prepaid expenses and other current assets |

|

|

(2,170 |

) |

|

|

(3,439 |

) |

|

|

(7,235 |

) |

|

|

635 |

|

Deferred commissions |

|

|

(2,346 |

) |

|

|

121 |

|

|

|

(2,217 |

) |

|

|

(694 |

) |

Other noncurrent assets |

|

|

1,320 |

|

|

|

(577 |

) |

|

|

(3,631 |

) |

|

|

1,787 |

|

Accounts payable |

|

|

402 |

|

|

|

5,425 |

|

|

|

(307 |

) |

|

|

5,754 |

|

Accrued expenses |

|

|

7,810 |

|

|

|

2,946 |

|

|

|

10,593 |

|

|

|

11,080 |

|

Deferred revenue |

|

|

(9,532 |

) |

|

|

(4,471 |

) |

|

|

12,333 |

|

|

|

19,027 |

|

Operating lease liabilities |

|

|

(1,447 |

) |

|

|

(665 |

) |

|

|

(3,719 |

) |

|

|

(2,903 |

) |

Net cash provided by (used in) operating activities |

|

|

6,170 |

|

|

|

7,964 |

|

|

|

15,350 |

|

|

|

23,309 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash received from maturities of marketable securities |

|

|

33,750 |

|

|

|

— |

|

|

|

91,250 |

|

|

|

— |

|

Purchase of marketable securities |

|

|

— |

|

|

|

— |

|

|

|

(18,352 |

) |

|

|

— |

|

Purchase of property and equipment |

|

|

(16 |

) |

|

|

— |

|

|

|

(979 |

) |

|

|

(995 |

) |

Capitalization of internal-use software costs |

|

|

(1,656 |

) |

|

|

(476 |

) |

|

|

(4,170 |

) |

|

|

(1,349 |

) |

Net cash provided by (used in) investing activities |

|

|

32,078 |

|

|

|

(476 |

) |

|

|

67,749 |

|

|

|

(2,344 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from the exercise of stock options |

|

|

2,346 |

|

|

|

1,183 |

|

|

|

5,603 |

|

|

|

3,569 |

|

Cash received for tax withholding obligations on equity award settlements |

|

|

1,940 |

|

|

|

807 |

|

|

|

4,223 |

|

|

|

13,030 |

|

Cash paid for tax withholding obligations on equity award settlements |

|

|

(7,422 |

) |

|

|

(5,313 |

) |

|

|

(23,959 |

) |

|

|

(16,875 |

) |

Repurchase of unvested stock options |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(648 |

) |

Net cash provided by (used in) financing activities |

|

|

(3,136 |

) |

|

|

(3,323 |

) |

|

|

(14,133 |

) |

|

|

(924 |

) |

Net increase (decrease) in cash, cash equivalents, and restricted cash |

|

|

35,112 |

|

|

|

4,165 |

|

|

|

68,966 |

|

|

|

20,041 |

|

Cash, cash equivalents, and restricted cash at beginning of the period |

|

|

283,214 |

|

|

|

235,225 |

|

|

|

249,360 |

|

|

|

219,349 |

|

Cash, cash equivalents, and restricted cash at end of the period |

|

$ |

318,326 |

|

|

$ |

239,390 |

|

|

$ |

318,326 |

|

|

$ |

239,390 |

|

AMPLITUDE, INC.

Reconciliation of GAAP to Non-GAAP Data

(In thousands, except percentages and per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Reconciliation of gross profit and gross margin |

|

|

|

|

|

|

|

|

|

|

|

GAAP gross profit |

$ |

56,473 |

|

|

$ |

53,346 |

|

|

$ |

164,023 |

|

|

$ |

151,223 |

|

Plus: stock-based compensation expense and related employer payroll taxes |

|

1,559 |

|

|

|

1,947 |

|

|

|

4,581 |

|

|

|

5,426 |

|

Plus: amortization of acquired intangible assets |

|

— |

|

|

|

273 |

|

|

|

332 |

|

|

|

965 |

|

Non-GAAP gross profit |

$ |

58,032 |

|

|

$ |

55,566 |

|

|

$ |

168,936 |

|

|

$ |

157,614 |

|

GAAP gross margin |

|

75.1 |

% |

|

|

75.5 |

% |

|

|

74.2 |

% |

|

|

73.8 |

% |

Non-GAAP adjustments |

|

2.1 |

% |

|

|

3.1 |

% |

|

|

2.2 |

% |

|

|

3.1 |

% |

Non-GAAP gross margin |

|

77.2 |

% |

|

|

78.7 |

% |

|

|

76.4 |

% |

|

|

76.9 |

% |

Reconciliation of operating expenses |

|

|

|

|

|

|

|

|

|

|

|

GAAP research and development |

$ |

19,037 |

|

|

$ |

21,797 |

|

|

$ |

63,135 |

|

|

$ |

67,940 |

|

Less: stock-based compensation expense and related employer payroll taxes |

|

(7,151 |

) |

|

|

(9,395 |

) |

|

|

(25,165 |

) |

|

|

(27,928 |

) |

Non-GAAP research and development |

$ |

11,886 |

|

|

$ |

12,402 |

|

|

$ |

37,970 |

|

|

$ |

40,012 |

|

GAAP research and development as percentage of revenue |

|

25.3 |

% |

|

|

30.9 |

% |

|

|

28.5 |

% |

|

|

33.2 |

% |

Non-GAAP research and development as percentage of revenue |

|

15.8 |

% |

|

|

17.6 |

% |

|

|

17.2 |

% |

|

|

19.5 |

% |

GAAP sales and marketing |

$ |

40,863 |

|

|

$ |

38,475 |

|

|

$ |

125,824 |

|

|

$ |

115,934 |

|

Less: stock-based compensation expense and related employer payroll taxes |

|

(8,531 |

) |

|

|

(8,011 |

) |

|

|

(24,621 |

) |

|

|

(22,352 |

) |

Less: amortization of acquired intangible assets |

|

(44 |

) |

|

|

(44 |

) |

|

|

(131 |

) |

|

|

(131 |

) |

Non-GAAP sales and marketing |

$ |

32,288 |

|

|

$ |

30,420 |

|

|

$ |

101,072 |

|

|

$ |

93,451 |

|

GAAP sales and marketing as percentage of revenue |

|

54.3 |

% |

|

|

54.5 |

% |

|

|

56.9 |

% |

|

|

56.6 |

% |

Non-GAAP sales and marketing as percentage of revenue |

|

42.9 |

% |

|

|

43.1 |

% |

|

|

45.7 |

% |

|

|

45.6 |

% |

GAAP general and administrative |

$ |

16,586 |

|

|

$ |

13,997 |

|

|

$ |

46,942 |

|

|

$ |

40,138 |

|

Less: stock-based compensation expense and related employer payroll taxes |

|

(4,295 |

) |

|

|

(4,097 |

) |

|

|

(12,805 |

) |

|

|

(10,177 |

) |

Non-GAAP general and administrative |

$ |

12,291 |

|

|

$ |

9,900 |

|

|

$ |

34,137 |

|

|

$ |

29,961 |

|

GAAP general and administrative as percentage of revenue |

|

22.1 |

% |

|

|

19.8 |

% |

|

|

21.2 |

% |

|

|

19.6 |

% |

Non-GAAP general and administrative as percentage of revenue |

|

16.3 |

% |

|

|

14.0 |

% |

|

|

15.4 |

% |

|

|

14.6 |

% |

Reconciliation of operating loss and operating margin |

|

|

|

|

|

|

|

|

|

|

|

GAAP loss from operations |

$ |

(20,013 |

) |

|

$ |

(20,923 |

) |

|

$ |

(71,878 |

) |

|

$ |

(80,983 |

) |

Plus: stock-based compensation expense and related employer payroll taxes |

|

21,536 |

|

|

|

23,450 |

|

|

|

67,172 |

|

|

|

65,883 |

|

Plus: amortization of acquired intangible assets |

|

44 |

|

|

|

317 |

|

|

|

463 |

|

|

|

1,096 |

|

Plus: restructuring and other related charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,194 |

|

Non-GAAP income (loss) from operations |

$ |

1,567 |

|

|

$ |

2,844 |

|

|

$ |

(4,243 |

) |

|

$ |

(5,810 |

) |

GAAP operating margin |

|

(26.6 |

%) |

|

|

(29.6 |

%) |

|

|

(32.5 |

%) |

|

|

(39.5 |

%) |

Non-GAAP adjustments |

|

28.7 |

% |

|

|

33.6 |

% |

|

|

30.6 |

% |

|

|

36.7 |

% |

Non-GAAP operating margin |

|

2.1 |

% |

|

|

4.0 |

% |

|

|

(1.9 |

%) |

|

|

(2.8 |

%) |

Reconciliation of net income (loss) |

|

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss) |

$ |

(16,854 |

) |

|

$ |

(17,747 |

) |

|

$ |

(61,729 |

) |

|

$ |

(71,820 |

) |

Plus: stock-based compensation expense and related employer payroll taxes |

|

21,536 |

|

|

|

23,450 |

|

|

|

67,172 |

|

|

|

65,883 |

|

Plus: amortization of acquired intangible assets |

|

44 |

|

|

|

317 |

|

|

|

463 |

|

|

|

1,096 |

|

Plus: restructuring and other related charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,194 |

|

Less: income tax effect of non-GAAP adjustments |

|

(261 |

) |

|

|

(130 |

) |

|

|

(419 |

) |

|

|

(130 |

) |

Non-GAAP net income (loss) |

$ |

4,465 |

|

|

$ |

5,890 |

|

|

$ |

5,487 |

|

|

$ |

3,223 |

|

Reconciliation of net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss) per share, basic |

$ |

(0.14 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.62 |

) |

Non-GAAP adjustments to net income (loss) |

|

0.17 |

|

|

|

0.20 |

|

|

|

0.55 |

|

|

|

0.65 |

|

Non-GAAP net income (loss) per share, basic |

$ |

0.04 |

|

|

$ |

0.05 |

|

|

$ |

0.04 |

|

|

$ |

0.03 |

|

Non-GAAP net income (loss) per share, diluted |

$ |

0.03 |

|

|

$ |

0.05 |

|

|

$ |

0.04 |

|

|

$ |

0.03 |

|

Weighted-average shares used in GAAP and non-GAAP per share calculation, basic |

|

124,324 |

|

|

|

117,902 |

|

|

|

122,601 |

|

|

|

116,160 |

|

Weighted-average shares used in GAAP and non-GAAP per share calculation, diluted(1) |

|

131,319 |

|

|

|

128,140 |

|

|

|

130,713 |

|

|

|

126,759 |

|

Note: Certain figures may not sum due to rounding

(1) For the three and nine months ended September 30, 2024 and for the three and nine months ended September 30, 2023, the weighted average shares used in the GAAP per share calculation excludes 7.0 million shares, 8.1 million shares, 10.2 million shares, and 10.6 million shares, respectively, as the effect is anti-dilutive in the period.

AMPLITUDE, INC.

Reconciliation of GAAP Cash Flows from Operations to Free Cash Flow

(In thousands, except percentages)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net cash provided by (used in) operating activities |

|

$ |

6,170 |

|

|

$ |

7,964 |

|

|

$ |

15,350 |

|

|

$ |

23,309 |

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(16 |

) |

|

|

— |

|

|

|

(979 |

) |

|

|

(995 |

) |

Capitalization of internal-use software costs |

|

|

(1,656 |

) |

|

|

(476 |

) |

|

|

(4,170 |

) |

|

|

(1,349 |

) |

Free cash flow |

|

$ |

4,498 |

|

|

$ |

7,488 |

|

|

$ |

10,201 |

|

|

$ |

20,965 |

|

Net cash provided by (used in) operating activities margin |

|

|

8.2 |

% |

|

|

11.3 |

% |

|

|

6.9 |

% |

|

|

11.4 |

% |

Non-GAAP adjustments |

|

|

(2.2 |

%) |

|

|

(0.7 |

%) |

|

|

(2.3 |

%) |

|

|

(1.1 |

%) |

Free cash flow margin |

|

|

6.0 |

% |

|

|

10.6 |

% |

|

|

4.6 |

% |

|

|

10.2 |

% |

Note: Certain figures may not sum due to rounding

AMPLITUDE, INC.

Historicals - Key Business Metrics

(In millions, except percentages)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2023 |

|

|

March 31, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2024 |

|

Annual Recurring Revenue (ARR) |

|

$ |

268 |

|

|

$ |

273 |

|

|

$ |

281 |

|

|

$ |

285 |

|

|

$ |

290 |

|

|

$ |

298 |

|

Dollar-based Net Retention Rate (NRR) |

|

|

101 |

% |

|

|

99 |

% |

|

|

98 |

% |

|

|

97 |

% |

|

|

96 |

% |

|

|

98 |

% |

Dollar-based Net Retention Rate (NRR TTM) |

|

|

108 |

% |

|

|

105 |

% |

|

|

101 |

% |

|

|

99 |

% |

|

|

98 |

% |

|

|

97 |

% |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

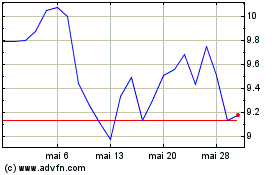

Amplitude (NASDAQ:AMPL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Amplitude (NASDAQ:AMPL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024