BayCom Corp (“BayCom” or the “Company”) (NASDAQ: BCML), the

holding company for United Business Bank (the “Bank” or “UBB”),

announced earnings of $7.0 million, or $0.55 per diluted common

share, for the first quarter of 2023, compared to earnings of $8.1

million, or $0.62 per diluted common share, for the fourth quarter

of 2022 and $6.5 million, or $0.51 per diluted common share, for

the first quarter of 2022.

Net income for the first quarter of 2023 compared to the fourth

quarter of 2022 decreased $1.0 million, or 12.5%, primarily as a

result of a $1.2 million decrease in net interest income, a

$798,000 increase in provision for credit losses, and a $181,000

increase in noninterest expenses, partially offset by a $946,000

increase in noninterest income and a $236,000 decrease in provision

for income taxes.

Net income for the first quarter of 2023 compared to the first

quarter of 2022 increased $556,000, or 8.6%, to $7.0 million

primarily as a result of a $2.9 million increase in net interest

income and a $1.8 million decrease in noninterest expense,

partially offset by a $1.4 million increase in provision for credit

losses, a $1.9 million decrease in noninterest income, and a

$828,000 increase in provision for income taxes.

George Guarini, Founder, President and Chief Executive Officer,

commented, “Our first quarter 2023 financial results are

encouraging, despite the turmoil in the banking sector. Our total

deposits increased during the quarter and recent deposit activities

appear to be within the normal course of business. Like other

banks, we are experiencing rising deposits rates. However, our

financial metrics including return on earnings assets and ratio of

non-performing loans to total loans improved during the

quarter.”

Guarini concluded, “The Bank's capital remains well above the

regulatory threshold for Well-Capitalized banks, our liquidity

position remains strong and our credit quality is holding up. We

have continued to repurchase shares, and we increased our cash

dividend to shareholders during the first quarter. We think current

volatility in the banking sector may yield more merger and

acquisition opportunities in the future.”

First Quarter Performance Highlights:

- Annualized net interest margin was 4.26% for the current

quarter, compared to 4.40% in the preceding quarter and 3.63% in

the same quarter a year ago.

- Annualized return on average assets was 1.11% for the current

quarter, compared to 1.28% in the preceding quarter and 0.98% in

the same quarter a year ago.

- Assets totaled $2.5 billion at both March 31, 2023 and December

31, 2022, compared to $2.8 billion at March 31, 2022.

- Loans, net of deferred fees, totaled $2.0 billion at March 31,

2023, December 31, 2022, and March 31, 2022.

- Nonperforming loans totaled $13.1 million or 0.64% of total

loans at March 31, 2023, compared to $15.2 million or 0.75% of

total loans at December 31, 2022, and $12.6 million or 0.63% of

total loans at March 31, 2022.

- The Company adopted the Current Expected Credit Losses ("CECL")

standard as of January 1, 2023, which resulted in a one-time

adjustment to the allowance for credit losses for loans by $1.5

million (which included the reclassification of the net credit

discount on acquired purchased credit impaired loans totaling

$845,000) and an allowance for unfunded credit commitments of

$45,000, and an after-tax decrease to opening retained earnings of

$491,000.

- The allowance for credit losses for loans totaled $20.4

million, or 1.00% of total loans outstanding, at March 31, 2023,

compared to allowance for loan losses of $18.9 million, or 0.94% of

total loans outstanding, at December 31, 2022, and $17.7 million,

or 0.88% of total loans outstanding, at March 31, 2022. In addition

to the CECL adjustment at the beginning of the current quarter, a

$315,000 provision for credit losses for loans was recorded during

the current quarter compared to a $617,000 and $7,000 provision for

loan losses in the prior quarter and the same quarter a year ago,

respectively.

- A $1.1 million provision for credit losses on investment

securities available-for-sale was recorded in the current quarter

as management fully reserved for one security which was determined

to be impaired due to reasons of credit quality at March 31, 2023,

compared to no provision for credit losses for investment

securities available-for-sale for both the fourth quarter of 2022

and the first quarter of 2022.

- Deposits totaled $2.1 billion at both March 31, 2023 and

December 31, 2022, compared to $2.3 billion at March 31, 2022. At

March 31, 2023, noninterest bearing deposits totaled $705.9

million, or 33.2% of total deposits, compared to $773.3 million, or

37.1% of total deposits at December 31, 2022, and $783.1 million,

or 33.6% of total deposits at March 31, 2022.

- The Company repurchased 422,877 shares of common stock at an

average cost of $19.08 per share during the first quarter of 2023,

compared to 236,985 shares repurchased at an average cost of $18.60

per share during the fourth quarter of 2022, and 57,177 shares

repurchased at an average cost of $22.18 per share during the first

quarter of 2022.

- On February 23, 2023, the Company announced the declaration of

a cash dividend on the Company’s common stock of $0.10 per share,

paid on April 14, 2023 to stockholders of record as of March 10,

2023.

- The Bank remained a “well-capitalized” institution for

regulatory capital purposes at March 31, 2023.

Earnings

Net interest income decreased $1.2 million, or 4.6%, to $25.3

million for the first quarter of 2023 from $26.5 million in the

prior quarter and increased $2.9 million, or 13.0%, from $22.4

million in the same quarter a year ago. The decrease in net

interest income from the fourth quarter of 2022 reflects higher

funding costs related to increased market rates of interest on our

deposits and junior subordinated debt. The increase in net interest

income from the same quarter in 2022 reflects increases in interest

income on loans, cash and cash equivalents and, to a lesser extent,

investment securities, including dividends on FRB and FHLB stock,

partially offset by higher funding costs related to increased

market rates of interest on our deposits and junior subordinated

debt. Average interest-earning assets increased $18.3 million, or

0.8%, and decreased $89.8 million, or 3.6% for the three months

ended March 31, 2023 compared to the fourth quarter of 2022 and the

first quarter of 2022, respectively. Average yield (annualized) on

interest-earning assets for the first quarter of 2023 was 5.07%,

compared to 4.91% for the fourth quarter of 2022 and 4.03% for the

first quarter of 2022. The increase in average yields on

interest-earning assets during the current quarter reflects

increases in market interest rates due to recent increases in the

target range for federal funds, including a 50 basis point increase

during the first quarter of 2023, to a range of 4.75% to 5.00%. The

average rate paid on interest-bearing liabilities for first quarter

of 2023 was 1.35%, compared to 0.89% for the fourth quarter of

2022, and 0.64% for the first quarter of 2022.

Interest income on loans, including fees, increased $454,000, or

1.8%, to $26.3 million for the three months ended March 31, 2023

compared to the three months ended December 31, 2022, primarily due

to a $31.4 million increase in the average loan balance and a 12

basis point increase in the average loan yield. Interest income on

loans, including fees, increased $3.3 million, or 14.5%, for the

three months ended March 31, 2023 compared to the three months

ended March 31, 2022 primarily due to a $132.8 million increase in

the average loan balance and a 35 basis point increase in the

average loan yield. The average loan balance totaled $2.0 billion

for both the first quarter of 2023 and fourth quarter of 2022,

compared to $1.9 billion for the same quarter a year ago. The

average yield on loans was 5.24% for the first quarter of 2023,

compared to 5.12% for the fourth quarter of 2022 and 4.89% for the

first quarter of 2022.

The increase in the average yield on loans from the first

quarter of 2022 was due to the impact of increased rates on

variable rate loans as well as new loans being originated at higher

market interest rates. This increase was partially offset by a

$121,000 decrease in accretion of the net discount on acquired

loans and a $130,000 decrease in PPP loan fees recognized when

compared to the fourth quarter of 2022, and a $1.3 million decrease

in accretion of the net discount on acquired loans and a $1.3

million decrease in PPP loan fees recognized when compared to the

first quarter of 2022.

Interest income on loans included $97,000, $218,000, and $1.3

million in accretion of the net discount on acquired loans for the

three months ended March 31, 2023, December 31, 2022, and March 31,

2022, respectively. The balance of the net discounts on these

acquired loans totaled $371,000, $522,000, and $603,000 at March

31, 2023, December 31, 2022, and March 31, 2022, respectively.

Interest income included $3,000 in fees earned related to PPP loans

in the quarter ended March 31, 2023, compared to $133,000 in the

prior quarter 2022 and $1.3 million in the same quarter of 2022.

Interest income also included fees related to prepayment penalties

of $269,000 in the quarter ended March 31, 2023, compared to

$335,000 in the prior quarter 2022, and $235,000 in the same

quarter in 2022.

Interest income on investment securities available-for-sale

increased $38,000, or 2.4%, to $1.6 million for the three months

ended March 31, 2023 compared to December 31, 2022, and increased

$243,000, or 17.4%, from $1.4 million for the three months ended

March 31, 2022. Average yield on investment securities

available-for-sale increased 13 basis points to 3.52% for the three

months ended March 31, 2023, compared to 3.39% for the three months

ended December 31, 2022, and increased 37 basis points from 3.15%

for the three months ended March 31, 2022. The average balance on

investment securities available-for-sale totaled $189.0 million for

the three months ended March 31, 2023, compared to $187.5 million

and $179.9 million for the three months ended December 31, 2022 and

March 31, 2022, respectively.

Interest income on federal funds sold and interest-bearing

balances in banks increased $107,000, or 6.2%, to $1.8 million for

the three months ended March 31, 2023, compared to $1.7 million for

the three months ended December 31, 2022, and increased $1.6

million, or 766.7%, from $211,000 for the three months ended March

31, 2022 as a result of an increase in the average yield. The

average yield on federal funds sold and interest-bearing balances

in banks increased 71 basis point to 4.56% for the three months

ended March 31, 2023, compared to 3.85% for the three months ended

December 31, 2022, and increased 434 basis point from 0.22% for the

three months ended March 31, 2022. The average balance of federal

funds sold and interest-bearing balance in banks totaled $162.8

million for the three months ended March 31, 2023, compared to

$177.4 million and $396.6 million for the three months ended

December 31, 2022 and March 31, 2022, respectively. In addition,

during the first quarter of 2023, we received $332,000 in cash

dividends on our FRB and FHLB stock, down 12.4% from $379,000 in

the fourth quarter of 2022 and up 23.0% from $270,000 in the first

quarter in 2022.

Interest expense increased $1.8 million, or 58.1%, to $4.8

million for the three months ended March 31, 2023, compared to $3.0

million for the three months ended December 31, 2022, and increased

$2.3 million, or 95.7%, compared to $2.5 million for the three

months ended March 31, 2022, primarily as a result of an increase

in the average cost of deposits. Average balance of deposits

totaled $2.1 billion for both the first quarter of 2023 and the

fourth quarter of 2022, compared to $2.2 billion for the first

quarter of 2022. The average cost of funds for the first quarter of

2023 was 1.35% compared to 0.89% for fourth quarter of 2022 and

0.64% for the same quarter in 2022. The increase in the average

cost of funds during the current quarter compared to the prior

quarter was due to higher interest rates paid on money market and

time deposits due to increased competition and pricing pressures

resulting from higher market interest rates generally. The average

cost of total deposits for the three months ended March 31, 2023

was 0.71%, compared to 0.37% for the three months ended December

31, 2022, and 0.27% for the three months ended March 31, 2022. The

average balance of noninterest bearing deposits decreased $67.2

million, or 8.3%, to $742.0 million for the three months ended

March 31, 2023, compared to $809.2 million for the three months

ended December 31, 2022 and decreased $26.3 million, or 3.4%, to

$768.3 million for the three months ended March 31, 2022. In

addition, interest expense on junior subordinated debt increased

$117,000, or 135.8%, to $203,000 for the three months ended March

31, 2023, compared to $86,000 for the same quarter in 2022 as a

result of higher market rates.

Annualized net interest margin was 4.26% for the first quarter

of 2023, compared to 4.40% for the fourth quarter of 2022 and 3.63%

for first quarter of 2022. The average yield on interest earning

assets for the first quarter of 2023 increased 16 basis point and

104 basis point over the average yields for the fourth of 2022 and

the first quarter of 2022, respectively, while the average rate

paid on interest-bearing liabilities for first quarter of 2023

increased 46 basis points and 71 basis points over the average

rates paid for the fourth quarter of 2022 and the first quarter of

2022, respectively. Net interest margin was negatively impacted by

higher funding costs outpacing increasing yields on loans,

investment securities and fed funds sold and interest

bearing-balances in banks.

The average yield on PPP loans including the recognition of

deferred PPP loan fees was 1.17%, resulting in no impact to the net

interest margin during the first quarter of 2023, compared to an

average yield of 2.30% with a positive impact to the net interest

margin of three basis points during the prior quarter 2022, and an

average yield of 5.89% with a positive impact to the net interest

margin of eight basis points during the same quarter in 2022.

Accretion of the net discount on acquired loans increased the

average yield on loans by seven basis points during the first

quarter of 2023, compared to 11 basis points during the prior

quarter 2022, and 29 basis points during the same quarter in 2022.

At March 31, 2023, there was a total of $5.9 million PPP loans

outstanding with a minimal amount of unrecognized deferred fees and

costs.

Based on our review of the allowance for credit losses for loans

at March 31, 2023, the Company recorded a $315,000 provision for

credit losses for loans for the first quarter of 2023, compared to

a $617,000 provision for loan losses and a $7,000 provision for

loan losses in the prior quarter 2022 and the same quarter in 2022,

respectively. The provision for credit losses for loans in the

first quarter of 2023 was primarily due to new loan production and,

to a lesser extent, a deterioration in forecasted economic

conditions and indicators utilized to estimate credit losses and

$315,000 in net charge-offs during the first quarter of 2023. In

addition, a provision for credit losses for investment securities

available-for-sale of $1.1 million was recorded in the current

quarter as management fully reserved for one preferred equity

security which was impaired due to reasons of credit quality at

March 31, 2023, compared to none in the prior quarter 2022 and none

in the same quarter in 2022.

Noninterest income for the first quarter of 2023 increased

$946,000, or 62.7%, to $2.5 million compared to $1.5 million in the

prior quarter 2022 and decreased $1.9 million, or 44.2%, compared

to $4.4 million for the same quarter in 2022. The increase in

noninterest income for the current quarter compared to the prior

quarter 2022 was due to a $379,000 increase in gain on sale of SBA

loans (guaranteed portion), primarily due to an increase in the

volume of these loans sold during the current quarter, and a

$714,000 increase in income from our investment in a Small Business

Investment Company (“SBIC”) fund, partially offset by a $97,000

decrease in servicing charges and other fees. The decrease in

noninterest income for the current quarter compared to the same

quarter in 2022 was primarily due to the recognition of $1.6

million in bargain purchase gain in the first quarter of 2022 with

no similar activity in the current quarter 2023, a $725,000

decrease in gain on sale of loans due to a decrease in the volume

and premiums observed on SBA loans (guaranteed portion) sold, and a

$164,000 decrease in SBIC income, partially offset by a $255,000

increase in servicing charges and other fees.

Noninterest expense for the first quarter of 2023 increased

$181,000, or 1.1%, to $16.5 million compared to $16.3 million for

the prior quarter 2022 and decreased $1.8 million, or 10.0%,

compared to $18.3 million for the same quarter in 2022. The

increase in noninterest expense for the first quarter of 2023

compared to the prior quarter 2022 was primarily due to a $307,000

increase in salaries and employee benefits and a $31,000 increase

in occupancy and equipment, partially offset by a $155,000 decrease

in other noninterest expense. The decrease in noninterest expenses

for the first quarter of 2023 compared to the first quarter of 2022

was primarily due to the absence of $3.1 million of nonrecurring

acquisition-related expenses related to our acquisition of Pacific

Enterprise Bancorp (“PEB”) and its bank subsidiary, Pacific

Enterprise Bank, in February, 2022, which were comprised of

$555,000 in salary and employee benefits, $1.1 million in data

processing expenses, $725,000 in professional and legal fees,

$375,000 in occupancy expense, and $347,000 in other expenses.

Excluding the acquisition-related expenses, noninterest expenses

for the first quarter of 2023 increased $1.2 million, compared to

the first quarter of 2022. The increase was comprised of higher

salaries and employee benefits of $1.3 million and higher data

processing expenses of $265,000, partially offset by decreases in

miscellaneous expense of $280,000. Salaries and employee benefits

for the first quarter of 2023 increased compared to the same

quarter in 2022 primarily due an increase in the number of

full-time equivalent employees, reflecting our acquisition of PEB,

coupled with retention incentives and salary adjustments due to

upward market pressure on wages in 2022.

The provision for income taxes decreased $236,000, or 7.9%, to

$2.8 million for the first quarter of 2023 compared to $3.0 million

for the prior quarter 2022 and increased $828,000, or 42.8%, to

$1.9 million compared to the same quarter in 2022. The effective

tax rate for the first quarter of 2023 was 28.2%, compared to 27.1%

for the prior quarter 2022, and 23.0% for the same quarter in 2022.

The effective tax rate was higher for the first quarter 2023

compared to the prior quarter 2022 due to year-end true-up

adjustments related to non-taxable interest income on tax exempt

municipal securities in the fourth quarter of 2022 and was higher

compared to the same quarter in 2022 due to the non-taxable bargain

purchase gain in the first quarter of 2022.

Loans and Credit Quality

Loans, net of deferred fees, increased $23.4 million to $2.0

billion at March 31, 2022, compared to December 31, 2023, and

increased $40.6 million compared to March 31, 2022. The increase in

loans at March 31, 2023 compared to December 31, 2022 primarily was

due to $78.8 million of new loan originations, partially offset by

$56.3 million of loan repayments, including $5.1 million in PPP

loan repayments. At March 31, 2023, there was a total of $5.9

million PPP loans outstanding compared to $11.1 million at December

31, 2022, and $114.6 million at March 31, 2022.

Nonperforming loans, consisting of non-accrual loans and

accruing loans 90 days or more past due, totaled $13.1 million or

0.64% of total loans at March 31, 2023, compared to $15.2 million

or 0.75% of total loans at December 31, 2022, and $12.6 million or

0.63% of total loans at March 31, 2022. The decrease in

nonperforming loans from the prior quarter was primarily due to the

renewal of one loan during the current quarter totaling $934,000

which was 90 days or more past due and in the process of collection

at December 31, 2022, and the charge-off of five non-accrual loans

totaling $330,000 during the current quarter. The portion of

nonaccrual loans guaranteed by government agencies totaled

$818,000, $839,000, and $800,000 at March 31, 2023, December 31,

2022, and March 31, 2022, respectively. There were no loans, one

loan totaling $934,000 and one loan totaling $117,000, 90 days or

more past due and still accruing and in the process of collection

at March 31, 2023, December 31, 2022 and March 31, 2022,

respectively. Accruing loans past due between 30 and 89 days at

March 31, 2023, were $12.4 million, compared to $1.5 million at

December 31, 2022, and $3.4 million at March 31, 2022. The increase

in accruing loans past due between 30-89 days from the prior

quarter was primarily due to timing of borrower payments. Of the

total $12.4 million in accruing loans 30-89 days past due at March

31, 2023, $11.6 million of that was 30 days past due with $9.1

million of the $11.6 million being brought current subsequent to

March 31, 2023.

At March 31, 2023, the Company’s allowance for credit losses for

loans was $20.4 million, or 1.00% of total loans, compared to $18.9

million, or 0.90% of total loans, at December 31, 2022 and $17.7

million, or 0.88% of total loans, at March 31, 2022. We recorded

net charge-offs of $315,000 for the first quarter of 2023, compared

to net recoveries of $233,000 in the prior quarter 2022 and net

charge-offs of $7,000 in the same quarter in 2022.

In accordance with acquisition accounting, loans acquired from

acquisitions were recorded at their estimated fair value, which

resulted in a net discount to the loans contractual amounts. Credit

discounts are included in the determination of fair value and as a

result, no allowance for credit losses is recorded for acquired

loans at the acquisition date. However, the allowance for credit

loss includes an estimate for credit deterioration of acquired

loans that occurs after the date of acquisition, which is included

in the loan loss provision in the period that the deterioration

occurred. The discount recorded on the acquired loans is not

reflected in the allowance for credit losses on loans or the

related allowance coverage ratios. As of March 31, 2023, acquired

loans net of their discount totaled $247.9 million with a remaining

net discount on these loans of $371,000, compared to $257.9 million

of acquired loans with a remaining net discount of $522,000 at

December 31, 2022, and $349.8 million of acquired loans with a

remaining net discount of $603,000 at March 31, 2022. The net

discount includes a credit discount based on estimated losses in

the acquired loans partially offset by a premium, if any, based

market interest rates on the date of acquisition.

Deposits and Borrowings

Deposits totaled $2.1 billion at both March 31, 2023, and

December 31, 2022, compared to $2.3 billion at March 31, 2022. At

March 31, 2023, noninterest bearing deposits totaled $705.9

million, or 33.2% of total deposits, compared to $773.3 million, or

37.1% of total deposits at December 31, 2022, and $783.1 million,

or 33.6% of total deposits at March 31, 2022.

At both March 31, 2023, and December 31, 2022, the Company had

outstanding junior subordinated debt, net of fair value

adjustments, related to junior subordinated deferrable interest

debentures assumed in connection with its previous acquisitions

totaling $8.5 million, compared to $8.4 million at March 31, 2022.

At March 31, 2023, the Company also had outstanding subordinated

debt, net of costs to issue, totaling $63.8 million, compared to

$63.7 million and $63.5 million at December 31, 2022 and March 31,

2022, respectively.

At March 31, 2023, December 31, 2022 and March 31, 2022, the

Company had no other borrowings outstanding.

Shareholders’ Equity

Shareholders’ equity totaled $313.5 million at March 31, 2023,

compared to $317.1 million at December 31, 2022, and $324.7 million

at March 31, 2022. The decrease from the prior period of 2022

reflects repurchases of $8.1 million of common stock and $1.3

million of accrued cash dividends payable for the quarter. In

addition, shareholder’s equity was impacted by the adoption of CECL

in the first quarter of 2023, which as of January 1, 2023, resulted

in an after-tax decrease to opening retained earnings of $491,000.

In addition, shareholder’s equity was adversely impacted by

increased unrealized losses on available for sale securities

reflecting the increase in market interest rates during the current

quarter, resulting in a $1.2 million increase in accumulated other

comprehensive loss, net of tax. At March 31, 2023, 58,915 shares

remained available for future purchases under the current stock

repurchase plan.

About BayCom Corp

The Company, through its wholly owned operating subsidiary,

United Business Bank, offers a full-range of loans, including SBA,

CalCAP, FSA and USDA guaranteed loans, and deposit products and

services to businesses and their affiliates in California,

Washington, New Mexico and Colorado. The Bank is an Equal Housing

Lender and a member of FDIC. The Company is traded on the NASDAQ

under the symbol “BCML”. For more information, go to

www.unitedbusinessbank.com.

Forward-Looking Statements

This release, as well as other public or shareholder

communications released by the Company, may contain forward-looking

statements, including, but not limited to, (i) statements regarding

the financial condition, results of operations and business of the

Company, (ii) statements about the Company’s plans, objectives,

expectations and intentions and other statements that are not

historical facts and (iii) other statements identified by the words

or phrases “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimate,” “project,” “intends” or

similar expressions that are intended to identify “forward-looking

statements”, within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are not

historical facts but instead are based on current beliefs and

expectations of the Company’s management and are inherently subject

to significant business, economic and competitive uncertainties and

contingencies, many of which are beyond the Company’s control. In

addition, these forward-looking statements are subject to

assumptions with respect to future business strategies and

decisions that are subject to change.

There are a number of important factors that could cause future

results to differ materially from historical performance and these

forward-looking statements. Factors which could cause actual

results to differ materially from the results anticipated or

implied by our forward-looking statements include, but are not

limited to, potential adverse impacts to economic conditions in our

local market areas, other markets where the Company has lending

relationships, or other aspects of the Company’s business

operations or financial markets, including, without limitation, as

a result of employment levels, labor shortages and the effects of

inflation, a potential recession or slowed economic growth caused

by increasing political instability from acts of war including

Russia’s invasion of Ukraine, as well as increasing prices and

supply chain disruptions, and any governmental or societal

responses to new COVID-19 variants; the uncertain impacts of

quantitative tightening and current and future monetary policies of

the Federal Reserve; expected revenues, cost savings, synergies and

other benefits from our recent acquisition of PEB might not be

realized within the expected time frames or at all and costs or

difficulties relating to integration matters, including but not

limited to customer and employee retention, might be greater than

expected; future acquisitions by the Company of other depository

institutions or lines of business; fluctuations in interest rates;

the risks of lending and investing activities, including changes in

the level and direction of loan delinquencies and write-offs and

changes in estimates of the adequacy of the allowance for credit

losses; the Company's ability to access cost-effective funding;

fluctuations in real estate values and both residential and

commercial real estate market conditions; demand for loans and

deposits in the Company's market area; increased competitive

pressures; changes in management’s business strategies; and other

factors described in the Company’s latest Annual Report on Form

10-K and Quarterly Reports on Form 10-Q and other filings with the

Securities and Exchange Commission (“SEC”) that are available on

our website at www.unitedbusinessbank.com and on the SEC's website

at www.sec.gov.

The factors listed above could materially affect the Company’s

financial performance and could cause the Company’s actual results

for future periods to differ materially from any opinions or

statements expressed with respect to future periods in any current

statements.

The Company does not undertake - and specifically declines any

obligation - to publicly release the result of any revisions, which

may be made to any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events whether as a

result of new information, future events or otherwise, except as

may be required by law or NASDAQ rules. When considering

forward-looking statements, you should keep in mind these risks and

uncertainties. You should not place undue reliance on any

forward-looking statement, which speaks only as of the date

made.

BAYCOM CORP

STATEMENTS OF COMPREHENSIVE

INCOME (UNAUDITED)

(Dollars in thousands, except per

share data)

Three months ended

March 31,

December 31,

March 31,

2023

2022

2022

Interest income

Loans, including fees

$

26,255

$

25,801

$

22,927

Investment securities

1,640

1,602

1,397

Fed funds sold and interest-bearing

balances in banks

1,829

1,722

211

FHLB dividends

188

217

149

FRB dividends

144

162

121

Total interest and dividend income

30,056

29,504

24,805

Interest expense

Deposits

3,700

1,963

1,470

Subordinated debt

896

896

896

Junior subordinated debt

203

176

86

Total interest expense

4,799

3,035

2,452

Net interest income

25,257

26,469

22,353

Provision for credit losses

1,415

617

7

Net interest income after provision for

credit losses

23,842

25,852

22,346

Noninterest income

Gain on sale of loans

412

33

1,137

Service charges and other fees

885

942

630

Loan servicing fees and other fees

410

507

574

Income (loss) on investment in SBIC

fund

489

(225

)

197

Bargain purchase gain

—

—

1,665

Other income and fees

261

252

196

Total noninterest income

2,457

1,509

4,399

Noninterest expense

Salaries and employee benefits

11,036

10,729

10,310

Occupancy and equipment

2,027

1,996

2,426

Data processing

1,465

1,467

2,273

Other expense

1,961

2,116

3,312

Total noninterest expense

16,489

16,308

18,321

Income before provision for income

taxes

9,810

11,053

8,424

Provision for income taxes

2,764

3,000

1,936

Net income

$

7,046

$

8,053

$

6,488

Net income per common share:

Basic

$

0.55

$

0.62

$

0.51

Diluted

0.55

0.62

0.51

Weighted average shares used to compute

net income per common share:

Basic

12,699,476

12,960,723

12,646,981

Diluted

12,699,476

12,960,723

12,646,981

Comprehensive income (loss)

Net income

$

7,046

$

8,053

$

6,488

Other comprehensive loss:

Change in unrealized loss on

available-for-sale securities

(1,617

)

(677

)

(9,761

)

Deferred tax benefit

465

196

2,809

Other comprehensive loss, net of tax

(1,152

)

(481

)

(6,952

)

Comprehensive income (loss)

$

5,894

$

7,572

$

(464

)

BAYCOM CORP

STATEMENTS OF CONDITION

(UNAUDITED)

At March 31, 2023, December

31, 2022, March 31, 2022

(Dollars in thousands)

March 31,

December 31,

March 31,

2023

2022

2022

Assets

Cash and due from banks

$

28,850

$

26,980

$

35,532

Federal funds sold and interest-bearing

balances in banks

168,688

149,835

391,667

Cash and cash equivalents

197,538

176,815

427,199

Time deposits in banks

2,241

2,241

3,336

Investment securities available-for-sale

(AFS)

166,361

167,761

184,673

Allowance for credit loss for investments

AFS

(1,100

)

—

—

Federal Home Loan Bank ("FHLB") stock, at

par

10,679

10,679

10,679

Federal Reserve Bank ("FRB") stock, at

par

9,609

9,602

8,547

Loans held for sale

—

2,380

970

Loans, net of deferred fees

2,044,536

2,021,124

2,003,928

Allowance for credit losses for loans

(20,400

)

(18,900

)

(17,700

)

Premises and equipment, net

13,008

13,278

14,257

Other real estate owned ("OREO")

21

21

21

Core deposit intangible

4,832

5,201

6,750

Cash surrender value of bank owned life

insurance policies, net

22,359

22,193

21,736

Right-of-use assets

15,706

16,569

13,645

Goodwill

38,838

38,838

38,838

Interest receivable and other assets

43,832

45,532

39,133

Total Assets

$

2,548,060

$

2,513,334

$

2,756,012

Liabilities and Shareholders’ Equity

Noninterest bearing deposits

$

705,941

$

773,274

$

783,110

Interest bearing deposits

Transaction accounts and savings

799,484

837,289

1,089,774

Premium money market

232,404

181,567

146,662

Time deposits

389,940

293,349

310,849

Total deposits

2,127,769

2,085,479

2,330,395

Junior subordinated deferrable interest

debentures, net

8,504

8,484

8,423

Subordinated debt, net

63,754

63,711

63,584

Salary continuation plans

4,921

4,840

4,517

Lease liabilities

16,329

17,138

14,177

Interest payable and other liabilities

13,311

16,533

10,262

Total Liabilities

2,234,588

2,196,185

2,431,358

Shareholders’ Equity

Common stock, no par value

196,772

204,588

220,581

Retained earnings

132,670

127,379

108,859

Accumulated other comprehensive loss, net

of tax

(15,970

)

(14,818

)

(4,786

)

Total shareholders’ equity

313,472

317,149

324,654

Total Liabilities and Shareholders’

Equity

$

2,548,060

$

2,513,334

$

2,756,012

BAYCOM CORP

FINANCIAL HIGHLIGHTS

(UNAUDITED)

(Dollars in thousands, except per

share data)

At and for the three months

ended

March 31,

December 31,

March 31,

Selected Financial Ratios and Other

Data:

2023

2022

2022

Performance Ratios:

Return on average assets (1)

1.11

%

1.28

%

0.98

%

Return on average equity (1)

8.84

10.15

8.50

Yield on earning assets (1)

5.07

4.91

4.03

Rate paid on average interest-bearing

liabilities

1.35

0.89

0.64

Interest rate spread - average during the

period

3.72

4.02

3.39

Net interest margin (1)

4.26

4.40

3.63

Loan to deposit ratio

96.09

96.91

85.99

Efficiency ratio (2)

59.50

58.29

68.48

Charge-offs/(recoveries), net

$

315

$

(233)

$

7

Per Share Data:

Shares outstanding at end of period

12,443,977

12,838,462

13,677,729

Average diluted shares outstanding

12,699,476

12,960,723

12,646,981

Diluted earnings per share

$

0.55

$

0.62

$

0.51

Book value per share

25.19

24.70

23.74

Tangible book value per share (3)

21.68

21.27

20.40

Asset Quality Data:

Nonperforming assets to total assets

(4)

0.51

%

0.61

%

0.46

%

Nonperforming loans to total loans (5)

0.64

%

0.75

%

0.63

%

Allowance for credit losses to

nonperforming loans (5)

155.84

%

124.16

%

141.02

%

Allowance for credit losses to total

loans

1.00

%

0.94

%

0.88

%

Classified assets (graded substandard and

doubtful)

$

20,863

$

20,355

$

16,341

Total accruing loans 30‑89 days past

due

12,353

1,497

3,406

Total loans 90 days past due and still

accruing

—

934

117

Capital Ratios (6):

Tier 1 leverage ratio — Bank

13.26

%

13.64

%

11.77

%

Common equity tier 1 — Bank

16.40

%

16.42

%

16.03

%

Tier 1 capital ratio — Bank

16.40

%

16.42

%

16.03

%

Total capital ratio — Bank

17.43

%

17.36

%

16.92

%

Equity to total assets — end of period

12.30

%

12.62

%

11.80

%

Tangible equity to tangible assets — end

of period (3)

10.77

%

11.06

%

10.32

%

Loans:

Real estate

$

1,825,633

$

1,806,187

$

1,665,799

Non-real estate

205,458

201,252

326,838

Nonaccrual loans

13,090

14,289

12,434

Mark to fair value at acquisition

371

(522)

(603)

Total Loans

2,044,552

2,021,206

2,004,469

Net deferred fees on loans (7)

(16)

(82)

(541)

Loans, net of deferred fees

$

2,044,536

$

2,021,124

$

2,003,928

Other Data:

Number of full-service offices

34

34

34

Number of full-time equivalent

employees

366

374

352

(1)

Annualized.

(2)

Total noninterest expense as a percentage

of net interest income and total noninterest income.

(3)

Represents a non-GAAP financial measure.

See “Non-GAAP Financial Measures” below.

(4)

Nonperforming assets consist of nonaccrual

loans, accruing loans that are 90 days or more past due, and other

real estate owned.

(5)

Nonperforming loans consist of nonaccrual

loans and accruing loans that are 90 days or more past due.

(6)

Capital ratios are for United Business

Bank only.

(7)

Deferred fees include $3,000, $94,000 and

$735,000 as of March 31, 2023, December 31, 2022, and March 31,

2022, respectively, in fees related to PPP loans.

Non-GAAP Financial Measures:

In addition to results presented in accordance with generally

accepted accounting principles utilized in the United States

(“GAAP”), this earnings release contains the tangible book value

per share, a non-GAAP financial measure. Tangible book value per

share is calculated by dividing tangible common shareholders’

equity by the number of common shares outstanding at the end of the

period. Tangible common shareholders’ equity is calculated by

excluding intangible assets from shareholders’ equity. For this

financial measure, the Company’s intangible assets are goodwill and

core deposit intangibles. The Company believes that this measure is

consistent with the capital treatment by our bank regulatory

agencies, which excludes intangible assets from the calculation of

risk-based capital ratios, and presents this measure to facilitate

comparison of the quality and composition of the Company’s capital

over time in comparison to its competitors. Non-GAAP financial

measures have inherent limitations, are not required to be

uniformly applied, and are not audited. Further, these non-GAAP

financial measure should not be considered in isolation or as a

substitute for the comparable financial measures determined in

accordance with GAAP and may not be comparable to a similarly

titled measure reported by other companies.

Reconciliation of the GAAP and non-GAAP financial measures is

presented below:

Non-GAAP Measures

(Dollars in thousands, except per

share data)

March 31,

December 31,

March 31,

2023

2022

2022

Tangible Book Value:

Total common shareholders’ equity

$

313,472

$

317,149

$

325,339

less: Goodwill and other intangibles

43,670

44,039

45,588

Tangible common shareholders’ equity

$

269,802

$

273,110

$

279,751

Total assets

$

2,548,060

$

2,513,334

$

2,756,012

less: Goodwill and other intangibles

43,670

44,039

45,588

Total tangible assets

$

2,504,390

$

2,469,295

$

2,710,424

Equity to total assets

12.30

%

12.62

%

11.78

%

Tangible equity to tangible assets

10.77

%

11.06

%

10.32

%

Book value per share

$

25.19

$

24.70

$

23.74

Tangible book value per share

$

21.68

$

21.27

$

20.45

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230420005172/en/

BayCom Corp Keary Colwell, 925-476-1800

kcolwell@ubb-us.com

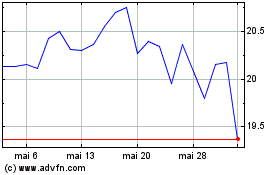

BayCom (NASDAQ:BCML)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

BayCom (NASDAQ:BCML)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024