BayCom Corp (“BayCom” or the “Company”) (NASDAQ: BCML), the

holding company for United Business Bank (the “Bank” or “UBB”),

announced earnings of $5.9 million, or $0.51 per diluted common

share, for the first quarter of 2024, compared to earnings of $6.4

million, or $0.55 per diluted common share, for the fourth quarter

of 2023 and $7.2 million, or $0.57 per diluted common share, for

the first quarter of 2023.

Net income for the first quarter of 2024 compared to the fourth

quarter of 2023 decreased $521,000, or 8.1%, primarily as a result

of a $1.1 million decrease in net interest income, a $615,000

decrease in noninterest income and a $997,000 increase in

noninterest expense, partially offset by a $2.1 million decrease in

provision for credit losses and a $138,000 decrease in provision

for income taxes. Net income for the first quarter of 2024 compared

to the first quarter of 2023 decreased $1.3 million, or 18.3%,

primarily as a result of a $2.9 million decrease in net interest

income partially offset by a $501,000 increase in noninterest

income, a $458,000 decrease in noninterest expenses, and a $554,000

decrease in provision for income taxes.

George Guarini, President and Chief Executive Officer,

commented, “Our financial results for the first quarter of 2024

reflect the continuation of many of the challenges we faced in

2023, including increased deposit costs and reduced loan demand.

Overall, our financial condition has remained strong, with no

observed systemic credit weakness, and our earnings have remained

stable.”

Looking ahead, Guarini expressed cautious optimism, stating,

"While we approach the remainder of 2024 with some reservation, we

remain hopeful for opportunities ahead. Though we anticipate

continued challenges in loan demand and M&A prospects, we are

confident in our ability to navigate these uncertainties. We remain

vigilant in managing operating costs during these times of economic

uncertainty and remain committed to strategically repurchase shares

and provide cash dividends, reinforcing our dedication to

delivering long-term value for both our clients and

shareholders."

First Quarter Performance Highlights:

- Annualized net interest margin was 3.72% for the current

quarter, compared to 3.86% for the preceding quarter and 4.26% for

the same quarter a year ago.

- Annualized return on average assets was 0.92% for the current

quarter, compared to 1.00% for the preceding quarter and 1.14% for

the same quarter a year ago.

- Assets totaled $2.6 billion at both March 31, 2024 and December

31, 2023, compared to $2.5 billion at March 31, 2023.

- Loans, net of deferred fees, totaled $1.9 billion at both March

31, 2024 and December 31, 2023, compared to $2.0 billion at March

31, 2023.

- Nonperforming loans totaled $16.5 million or 0.64% of total

loans, at March 31, 2024, compared to $13.0 million or 0.67% of

total loans at December 31, 2023, and $13.1 million, or 0.64% of

total loans, at March 31, 2023.

- The allowance for credit losses for loans totaled $18.9

million, or 1.00% of total loans outstanding, at March 31, 2024,

compared to $22.0 million, or 1.14% of total loans outstanding, at

December 31, 2023, and $20.4 million, or 1.00% of total loans

outstanding, at March 31, 2023.

- A $252,000 provision for credit losses was recorded during the

current quarter, compared to provisions for credit losses of $2.3

million and $275,000 in the prior quarter and the same quarter a

year ago, respectively.

- Deposits totaled $2.1 billion at March 31, 2024, December 31,

2023 and March 31, 2023. At March 31, 2024, noninterest-bearing

deposits totaled $630.0 million, or 29.4% of total deposits,

compared to $646.3 million, or 30.3% of total deposits, at December

31, 2023, and $705.9 million, or 33.2% of total deposits, at March

31, 2023.

- The Company repurchased 198,120 shares of common stock at an

average cost of $20.20 per share during the first quarter of 2024,

compared to 122,559 shares of common stock repurchased at an

average cost of $19.91 per share during the fourth quarter of 2023,

and 422,877 shares of common stock repurchased at an average cost

of $19.08 per share during the first quarter of 2023.

- On March 6, 2024, the Company announced the declaration of a

cash dividend on the Company’s common stock of $0.10 per share,

which was paid on April 12, 2024 to stockholders of record as of

March 16, 2024.

- The Bank remained a “well-capitalized” institution for

regulatory capital purposes at March 31, 2024.

Earnings

Net interest income decreased $1.1 million, or 4.8%, to $22.4

million for the first quarter of 2024 from $23.5 million in the

prior quarter, and decreased $2.9 million, or 11.3%, from $25.3

million in the same quarter a year ago. The decrease in net

interest income from the previous quarter reflects a decrease in

interest income on loans and an increase in interest expense on

deposits, partially offset by increases in interest income on

federal funds sold and interest-bearing balances in banks. The

decrease in net interest income from the same quarter in 2023

reflects an increase in interest expense on deposits and a decrease

in interest income on loans, partially offset by increases in

interest income on federal funds sold and interest-bearing balances

in banks, interest income on investment securities and dividends on

FHLB stock. Average interest-earning assets decreased $1.4 million,

or 0.1%, and increased $18.1 million, or 0.71%, for the first

quarter of 2024 compared to the fourth quarter of 2023 and the

first quarter of 2023, respectively. The average yield earned

(annualized) on interest earning assets for the first quarter of

2024 was 5.28%, compared to 5.29% for the fourth quarter of 2023

and 5.07% for the first quarter of 2023. The average rate paid

(annualized) on interest-bearing liabilities for the first quarter

of 2024 was 2.40%, compared to 2.21% for the fourth quarter of

2023, and 1.35% for the first quarter of 2023. The increases in

average yield earned on interest-earning assets and the average

rate paid on interest-bearing liabilities for the first quarter of

2024 compared to the same quarter a year ago reflect rising market

interest rates.

Interest income on loans, including fees, decreased $909,000, or

3.5%, from the prior quarter to $25.3 million for the three months

ended March 31, 2024, compared to $26.2 million for the three

months ended December 31, 2023, primarily due to a one basis point

decrease in the average loan yield and a $35.3 million decrease in

the average balance of loans. Interest income on loans, including

fees, decreased $998,000, or 3.8%, for the three months ended March

31, 2024 from $26.3 million for three months ended March 31, 2023,

primarily due to a $121.5 million decrease in the average balance

of loans, partially offset by an eight basis point increase in the

average loan yield. The average balance of loans was $1.9 billion

for both the first quarter of 2024 and fourth quarter of 2023,

compared to $2.0 billion for the first quarter of 2023. The average

yield on loans was 5.32% for the first quarter of 2024, compared to

5.33% for the fourth quarter of 2023 and 5.24% for the first

quarter of 2023. The decrease in the average yield on loans from

the fourth quarter of 2023 to the first quarter of 2024 was due in

part to reversal of interest on new non-accrual loans during the

first quarter of 2024. The increase in the average yield on loans

from the first quarter of 2023 was due to the impact of increased

rates on variable rate loans as well as new loans being originated

at higher market interest rates.

Interest income on loans included $98,000, $29,000, and $97,000

in accretion of the net discount on acquired loans for the three

months ended March 31, 2024, December 31, 2023, and March 31, 2023,

respectively. The balance of the net discounts on these acquired

loans totaled $392,000, $354,000, and $371,000 at March 31, 2024,

December 31, 2023, and March 31, 2023, respectively. Interest

income included fees related to prepayment penalties of $176,000

for the three months ended March 31, 2024, compared to $27,000 and

$269,000 for the three months ended December 31, 2023 and March 31,

2023, respectively.

Interest income on investment securities remained at $2.0

million for the three months ended March 31, 2024, compared to the

three months ended December 31, 2023, and increased $316,000, or

19.3%, from $1.6 million for the three months ended March 31, 2023.

The average yield on investment securities decreased five basis

points to 4.24% for the three months ended March 31, 2024, compared

to 4.29% for the three months ended December 31, 2023, and

increased 72 basis points from 3.52% for the three months ended

March 31, 2023. The average balance of investment securities

totaled $185.7 million for the three months ended March 31, 2024,

compared to $181.0 million and $189.0 million for the three months

ended December 31, 2023 and March 31, 2023, respectively. In

addition, during the first quarter of 2024, we received $416,000 in

cash dividends on our FRB and FHLB stock, up 6.7% from $390,000

received in the fourth quarter of 2023 and up 25.3% from $332,000

received in the first quarter of 2023.

Interest income on federal funds sold and interest-bearing

balances in banks increased $435,000, or 11.8%, to $4.1 million for

the three months ended March 31, 2024, compared to $2.0 million for

the three months ended December 31, 2023, and increased $2.3

million, or 125.0%, from $1.8 million for the three months ended

March 31, 2023, as a result of an increase in the average yield and

average balance. The average yield on federal funds sold and

interest-bearing balances in banks increased two basis points to

5.48% for the three months ended March 31, 2024, compared to 5.46%

for the three months ended December 31, 2023, and increased 92

basis points from 4.56% for the three months ended March 31, 2023.

The average balance of federal funds sold and interest-bearing

balance in banks totaled $302.1 million for the three months ended

March 31, 2024, compared to $267.3 million and $162.8 million for

the three months ended December 31, 2023 and March 31, 2023,

respectively. The increase in average balance during the current

quarter compared to the prior quarter and the same quarter one year

ago was due to higher retained cash balances as a result of lower

new loan production.

Interest expense increased $672,000, or 7.8%, to $9.3 million

for the three months ended March 31, 2024, compared to $8.7 million

for the three months ended December 31, 2023, and increased $4.5

million, or 94.6%, compared to $4.8 million for the three months

ended March 31, 2023, reflecting higher funding costs primarily

related to increased rates of interest on our deposits due to

higher market rates. The average balance of deposits totaled $2.1

billion for the first quarter of 2024, fourth quarter of 2023 and

first quarter of 2023. The average cost of funds for the first

quarter of 2024 was 2.40%, compared to 2.21% for the fourth quarter

of 2023 and 1.35% for the first quarter of 2023. The increase in

the average cost of funds during the current quarter compared to

the prior quarter of 2023 and the first quarter of 2023 was due to

higher interest rates paid on money market and time deposits due to

increased competition and pricing pressures and a change in deposit

mix due to a shift of deposits from noninterest-bearing accounts to

higher costing money market and time deposits. The average cost of

deposits for the three months ended March 31, 2024 was 1.55%,

compared to 1.40% for the three months ended December 31, 2023, and

0.71% for the three months ended March 31, 2023. The average

balance of noninterest-bearing deposits decreased $16.3 million, or

2.49%, to $639.7 million for the three months ended March 31, 2024,

compared to $656.0 million for the three months ended December 31,

2023 and decreased $102.3 million, or 13.8%, compared to $742.0

million for the three months ended March 31, 2023.

Annualized net interest margin was 3.72% for the first quarter

of 2024, compared to 3.86% for the fourth quarter of 2023 and 4.26%

for first quarter of 2023. The average yield on interest earning

assets for the first quarter of 2024 decreased one basis point and

increased 21 basis points over the average yields for the fourth

quarter of 2023 and the first quarter of 2023, respectively, while

the average rate paid on interest-bearing liabilities for first

quarter of 2024 increased 19 basis points and 105 basis points over

the average rates paid for the fourth quarter of 2023 and the first

quarter of 2023, respectively. Net interest margin in the first

quarter of 2024 as compared to the fourth quarter of 2023 was

negatively impacted by increasing funding costs which outpaced, on

a percentage basis, increasing yields on investment securities and

on fed funds sold and interest-bearing balances in banks, and

decreasing yields on loans and accretion of the net discount.

Accretion of the net discount had a minimal impact on the

average yield on loans during the first quarter of 2024 and the

fourth quarter of 2023, compared to seven basis point increase in

the average yield on loans during the first quarter of 2023.

The Company recorded a $252,000 provision for credit losses for

the first quarter of 2024, compared to provision for credit losses

of $2.3 million and $275,000 for the fourth quarter of 2023 and the

first quarter of 2023, respectively. The provision for credit

losses in the first quarter of 2024 was mainly driven by a

replenishment of the allowance, partially offset by decreases in

outstanding loan balances, leading to lower quantitative reserves.

Net charges-offs totaled $3.4 million during the first quarter of

2024, of which $3.2 million was specifically reserved for at

December 31, 2023. No changes were made to the qualitative risk

factor conclusions during the first quarter of 2024. The

quantitative reserve was impacted by improvement in forecasted

economic conditions, specifically, national unemployment and

national gross domestic product, both of which are key indicators

utilized to estimate credit losses.

Noninterest income for the first quarter of 2024 decreased

$615,000, or 23.0%, to $2.1 million compared to $2.7 million in the

prior quarter of 2023, and increased $501,000, or 32.1%, compared

to $1.6 million for the first quarter of 2023. The decrease in

noninterest income for the current quarter compared to the prior

quarter of 2023 was primarily due to a $373,000 decrease in gain on

equity securities as a result of deterioration in fair value

adjustments on these securities, a $188,000 decrease in income on

investment in a Small Business Investment Company (“SBIC”) fund,

and a $53,000 decrease in loan servicing fees and other fees. The

increase in noninterest income for the current quarter compared to

the same quarter in 2023 was primarily due to a $1.5 million

increase in gain on equity securities, partially offset by a

$519,000 decrease in income on an investment in SBIC fund and a

$412,000 decrease in gain on sale of loans.

Noninterest expense for the first quarter of 2024 increased

$997,000, or 6.6%, to $16.1 million compared to $15.1 million for

the prior quarter of 2023, and decreased $458,000, or 2.8%,

compared to $16.5 million for the first quarter of 2023. The

increase in noninterest expense for current quarter compared to the

prior quarter of 2023 was primarily due to a $1.1 million increase

in salaries and employee benefits as a result of a downward

adjustment to bonus accruals during the prior quarter of 2023, a

$130,000 increase in occupancy and equipment expense, partially

offset by a $219,000 decrease in other expense due to decreased

professional fees. The decrease in noninterest expense for the

first quarter of 2024 compared to the first quarter of 2023 was

primarily due to a $1.0 million decrease in salaries and employee

benefits as a result of a $675,000 decrease in bonus accrual,

decrease in full-time equivalent employees, and reduction in

deferred loan origination expenses, partially offset by wage

increases during 2024. This decrease was partially offset by a

$288,000 increase in data processing expense due to decline in

pricing credits offered and expense relating to enhancements to the

Bank’s network, a $127,000 increase in other expense due to

increased FDIC insurance costs and professional fees, and a

$127,000 increase in occupancy and equipment expense.

The provision for income taxes decreased $138,000, or 5.7%, to

$2.3 million for the first quarter of 2024 compared to $2.4 million

for the fourth quarter of 2023 and decreased $554,000, or 19.6%,

from $2.8 million for the first quarter of 2023. The effective tax

rate for the first quarter of 2024 was 27.9%, compared to 27.3% for

the prior quarter of 2023 and 28.2% for the first quarter of 2023.

The effective tax rate remained consistent with the prior quarter

of 2023 and was lower compared to the first quarter of 2023 due to

higher low income housing tax credits.

Loans and Credit Quality

Loans, net of deferred fees, decreased $41.1 million and $157.8

million from December 31, 2023 and March 31, 2023, respectively,

and totaled $1.9 billion at both March 31, 2024 and December 31,

2023, compared to $2.0 billion at March 31, 2023. The decrease in

loans from March 31, 2023 primarily was due to $72.4 million of

loan repayments, including $834,000 in Small Business

Administration (“SBA”) Paycheck Protection (“PPP”) loan repayments,

partially offset by $32.0 million of new loan originations during

the current quarter. At March 31, 2024, there were $2.9 million in

PPP loans outstanding compared to $3.8 million at December 31,

2023, and $5.9 million at March 31, 2023.

Nonperforming loans, consisting solely of non-accrual loans,

totaled $16.5 million, or 0.64% of total loans, at March 31, 2024,

compared to $13.0 million, or 0.67% of total loans, at December 31,

2023, and $13.1 million, or 0.64% of total loans, at March 31,

2023. The increase in nonperforming loans from the prior

quarter-end was primarily due to six new loans placed on

non-accrual during the current quarter totaling $7.3 million,

partially offset by partial charge-offs of two non-accrual loans

totaling $2.9 million, charge-offs of five non-accrual loans

totaling $435,000 and, to a lesser extent, pay-offs of five

non-accrual loans totaling $305,000.

The portion of nonaccrual loans guaranteed by government

agencies totaled $2.2 million at March 31, 2024, compared to

$740,000 and $818,000 at December 31, 2023 and March 31, 2023,

respectively. There were no loans 90 days or more past due and

still accruing and in the process of collection at March 31, 2024,

December 31, 2023, and March 31, 2023. Accruing loans past due

between 30 and 89 days at March 31, 2024, were $2.6 million,

compared to $4.8 million at December 31, 2023, and $12.4 million at

March 31, 2023. The decrease in accruing loans past due between

30-89 days at March 31, 2024 compared to December 31, 2023, was

primarily due to timing of borrower payments. The decrease in

accruing loans past due between 30-89 days at March 31, 2024

compared to March 31, 2023, was primarily due to one $4.7 million

multifamily commercial real estate loan which was past due in the

same quarter a year ago and was placed on non-accrual during the

current quarter, and due to timing of borrower payments.

At March 31, 2024, the Company’s allowance for credit losses for

loans was $18.9 million, or 1.00% of total loans, compared to $22.0

million, or 1.14% of total loans, at December 31, 2023 and $20.4

million, or 1.00% of total loans, at March 31, 2023. We recorded

net charge-offs of $3.4 million for the first quarter of 2024,

compared to net charge-offs of $150,000 in the prior quarter of

2023 and net charge-offs of $315,000 in the first quarter of 2023.

The increase in net charge-offs during the first quarter of 2024

compared to the prior quarter of 2023 and the first quarter of 2023

was primarily due to activity in the current quarter. This activity

involved partial charge-offs of two non-accrual loans totaling $2.9

million, as well as complete write-offs of five non-accrual loans

totaling $435,000. These actions were taken due to collateral

shortfalls deemed uncollectable.

As of March 31, 2024, acquired loans net of their discount

totaled $200.4 million with a remaining net discount on these loans

of $392,000, compared to $215.2 million of acquired loans with a

remaining net discount of $354,000 at December 31, 2023, and $247.9

million of acquired loans with a remaining net discount of $371,000

at March 31, 2023. The net discount includes a credit discount

based on estimated losses on the acquired loans, partially offset

by a premium, if any, based on market interest rates on the date of

acquisition.

Deposits and Borrowings

Deposits totaled $2.1 billion at March 31, 2024, December 31,

2023 and March 31, 2023. The deposit mix shifted, in part, due to

interest rate sensitive clients moving a portion of their

non-operating deposit balances from lower costing deposits,

including noninterest-bearing deposits, into higher costing money

market and time deposits. At March 31, 2024, noninterest-bearing

deposits totaled $630.0 million, or 29.4% of total deposits,

compared to $646.3 million, or 30.3% of total deposits, at December

31, 2023, and $705.9 million, or 33.2% of total deposits, at March

31, 2023.

We consider our deposit base to be seasoned, stable and

well-diversified, and we do not have any significant industry

concentrations among our non-insured deposits. We also offer an

insured cash sweep product (ICS) that allows customers to insure

deposits above FDIC insurance limits. At March 31, 2024 and

December 31, 2023, our average deposit account size (excluding

public funds), calculated by dividing period-end deposits by the

population of accounts with balances, was approximately $58,100 and

$58,700, respectively.

The Bank has an approved secured borrowing facility with the

FHLB of San Francisco for up to 25% of total assets for a term not

to exceed five years under a blanket lien of certain types of

loans, with no FHLB advances outstanding at March 31, 2024,

December 31, 2023 or March 31, 2023. The Bank has Federal Funds

lines with four corresponding banks with an aggregate available

commitment on these lines of $65.0 million at March 31, 2024. There

were no amounts outstanding under these lines at March 31, 2024,

December 31, 2023 or March 31, 2023. During the first quarter of

2024, the Bank was approved for discount window advances with the

FRB of San Francisco secured by certain types of loans. At March

31, 2024 the Bank had no FRB of San Francisco advances

outstanding.

At March 31, 2024 and December 31, 2023, the Company had

outstanding junior subordinated debt, net of fair value

adjustments, related to junior subordinated deferrable interest

debentures assumed in connection with its previous acquisitions

totaling $8.6 million, compared to $8.5 million at March 31, 2023.

At March 31, 2023, the Company had outstanding subordinated debt,

net of costs to issue, totaling $63.6 million, compared to $63.9

million and $63.8 million at December 31, 2023 and March 31, 2023,

respectively.

At March 31, 2024, December 31, 2023 and March 31, 2023, the

Company had no other borrowings outstanding.

Shareholders’ Equity

Shareholders’ equity totaled $314.2 million at March 31, 2024,

compared to $312.9 million at December 31, 2023, and $313.5 million

at March 31, 2023. The increase at March 31, 2024 compared to

December 31, 2023, reflects $5.9 million of net income during the

current quarter and a $484,000 decrease in accumulated other

comprehensive loss net of taxes, partially offset by repurchases of

$4.0 million of common stock and $1.2 million of accrued cash

dividends payable. At March 31, 2024, 161,632 shares remained

available for future repurchases under the Company’s current stock

repurchase plan.

The increase to shareholders’ equity for activity during the

three months March 31, 2024, as compared to activity during three

months ended March 31, 2023, primarily was due to a $1.8 million

increase in accumulated other comprehensive income net of taxes,

partially offset by a $1.3 million decrease in net income.

About BayCom Corp

The Company, through its wholly owned operating subsidiary,

United Business Bank, offers a full-range of loans, including SBA,

CalCAP, FSA and USDA guaranteed loans, and deposit products and

services to businesses and their affiliates in California,

Washington, New Mexico and Colorado. The Bank is an Equal Housing

Lender and a member of FDIC. The Company’s common stock is listed

on the NASDAQ Global Select Market under the symbol “BCML”. For

more information, go to www.unitedbusinessbank.com.

Forward-Looking Statements

This release, as well as other public or shareholder

communications by the Company, may contain forward-looking

statements, including, but not limited to, (i) statements regarding

the financial condition, results of operations and business of the

Company, (ii) statements about the Company’s plans, objectives,

expectations and intentions and other statements that are not

historical facts and (iii) other statements identified by the words

or phrases “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimate,” “project,” “intends” or

similar expressions that are intended to identify “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are not historical

facts but instead are based on current beliefs and expectations of

the Company’s management and are inherently subject to significant

business, economic and competitive uncertainties and contingencies,

many of which are beyond the Company’s control. In addition, these

forward-looking statements are subject to assumptions with respect

to future business strategies and decisions that are subject to

change.

There are a number of factors that could cause future results to

differ materially from historical performance and these

forward-looking statements. Factors which could cause actual

results to differ materially from the results anticipated or

implied by our forward-looking statements include, but are not

limited to: potential adverse impacts to economic conditions in our

local market areas, other markets where the Company has lending

relationships, or other aspects of the Company’s business

operations or financial markets, including, without limitation, as

a result of employment levels, labor shortages and the effects of

inflation, a potential recession or slowed economic growth; changes

in the interest rate environment, including the past increases in

the Federal Reserve benchmark rate and duration at which such

increased interest rate levels are maintained, which could

adversely affect our revenues and expenses, the values of our

assets and obligations, and the availability and cost of capital

and liquidity; the impact of continuing high inflation and the

current and future monetary policies of the Federal Reserve in

response thereto; the effects of any federal government shutdown;

the impact of bank failures or adverse developments at other banks

and related negative press about the banking industry in general on

investor and depositor sentiment; review of the Company’s

accounting, accounting policies and internal control over financial

reporting; risks and uncertainties related to the recent

restatement of certain of our historical consolidated financial

statements; the subsequent discovery of additional adjustments to

the Company’s previously issued financial statements; future

acquisitions by the Company of other depository institutions or

lines of business; fluctuations in interest rates; the risks of

lending and investing activities, including changes in the level

and direction of loan delinquencies and write-offs and changes in

estimates of the adequacy of the allowance for credit losses; the

Company's ability to access cost-effective funding; fluctuations in

real estate values and both residential and commercial real estate

market conditions; demand for loans and deposits in the Company's

market area; increased competitive pressures; changes in

management’s business strategies; disruptions, security breaches,

or other adverse events, failures or interruptions in, or attacks

on, our information technology systems or on the third-party

vendors who perform critical processing functions for us; the

effects of climate change, severe weather events, natural

disasters, pandemics, epidemics and other public health crises,

acts of war or terrorism, and other external events on our

business; and other factors described in the Company’s latest

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and

other reports filed with or furnished to the Securities and

Exchange Commission (“SEC”), which are available on our website at

www.unitedbusinessbank.com and on the SEC's website at

www.sec.gov.

The factors listed above could materially affect the Company’s

financial performance and could cause the Company’s actual results

for future periods to differ materially from any opinions or

statements expressed with respect to future periods in any current

statements.

The Company does not undertake - and specifically declines any

obligation - to publicly release the result of any revisions that

may be made to any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events, whether as a

result of new information, future events or otherwise, except as

may be required by law or NASDAQ rules. When considering

forward-looking statements, you should keep in mind these risks and

uncertainties. You should not place undue reliance on any

forward-looking statement, which speaks only as of the date

made.

BAYCOM CORP

STATEMENTS OF COMPREHENSIVE

INCOME (UNAUDITED)

(Dollars in thousands, except per

share data)

Three months ended

March 31,

December 31,

March 31,

2024

2023

2023

(As Restated)

Interest income

Loans, including fees

$

25,257

$

26,166

$

26,255

Investment securities

1,956

1,956

1,640

Fed funds sold and interest-bearing

balances in banks

4,115

3,680

1,829

FHLB dividends

272

245

188

FRB dividends

144

145

144

Total interest and dividend income

31,744

32,192

30,056

Interest expense

Deposits

8,227

7,551

3,700

Subordinated debt

893

896

896

Junior subordinated debt

217

218

203

Total interest expense

9,337

8,665

4,799

Net interest income

22,407

23,527

25,257

Provision for credit losses

252

2,325

275

Net interest income after provision for

credit losses

22,155

21,202

24,982

Noninterest income

Gain on sale of loans

—

—

412

Gain (loss) on equity securities

573

946

(896

)

Service charges and other fees

839

830

885

Loan servicing fees and other fees

392

445

410

(Loss) income on investment in SBIC

fund

(30

)

158

489

Other income and fees

288

298

261

Total noninterest income

2,062

2,677

1,561

Noninterest expense

Salaries and employee benefits

10,036

8,936

11,036

Occupancy and equipment

2,154

2,024

2,027

Data processing

1,753

1,767

1,465

Other expense

2,128

2,347

2,001

Total noninterest expense

16,071

15,074

16,529

Income before provision for income

taxes

8,146

8,805

10,014

Provision for income taxes

2,269

2,407

2,823

Net income

$

5,877

$

6,398

$

7,191

Net income per common share:

Basic

$

0.51

$

0.55

$

0.57

Diluted

0.51

0.55

0.57

Weighted average shares used to compute

net income per common share:

Basic

11,525,752

11,571,796

12,699,476

Diluted

11,525,752

11,571,796

12,699,476

Comprehensive income

Net income

$

5,877

$

6,398

$

7,191

Other comprehensive gain (loss):

Change in unrealized gain (loss) on

available-for-sale securities

696

3,746

(1,821

)

Deferred tax (expense) benefit

(212

)

(1,078

)

524

Other comprehensive gain (loss), net of

tax

484

2,668

(1,297

)

Comprehensive income

$

6,361

$

9,066

$

5,894

BAYCOM CORP

STATEMENTS OF CONDITION

(UNAUDITED)

(Dollars in thousands)

March 31,

December 31,

March 31,

2024

2023

2023

(As Restated)

Assets

Cash and due from banks

$

20,379

$

17,901

$

28,850

Federal funds sold and interest-bearing

balances in banks

327,953

289,638

168,688

Cash and cash equivalents

348,332

307,539

197,538

Time deposits in banks

996

1,245

2,241

Investment securities available-for-sale

("AFS")

167,919

163,152

152,427

Equity securities

13,158

12,585

12,834

Federal Home Loan Bank ("FHLB") stock, at

par

11,313

11,313

10,679

Federal Reserve Bank ("FRB") stock, at

par

9,630

9,626

9,609

Loans held for sale

1,684

—

—

Loans, net of deferred fees

1,886,730

1,927,829

2,044,536

Allowance for credit losses for loans

(18,890

)

(22,000

)

(20,400

)

Premises and equipment, net

14,355

13,734

13,008

Other real estate owned ("OREO")

—

—

21

Core deposit intangible

3,610

3,915

4,832

Cash surrender value of bank owned life

insurance policies, net

23,044

22,867

22,359

Right-of-use assets

13,460

13,939

15,706

Goodwill

38,838

38,838

38,838

Interest receivable and other assets

46,530

47,378

43,832

Total Assets

$

2,560,709

$

2,551,960

$

2,548,060

Liabilities and Shareholders’ Equity

Noninterest-bearing deposits

$

629,962

$

646,278

$

705,941

Interest-bearing deposits

Transaction accounts and savings

725,399

745,712

799,484

Premium money market

273,329

263,516

232,404

Time deposits

514,217

477,244

389,940

Total deposits

2,142,907

2,132,750

2,127,769

Junior subordinated deferrable interest

debentures, net

8,585

8,565

8,504

Subordinated debt, net

63,609

63,881

63,754

Salary continuation plans

4,667

4,552

4,921

Lease liabilities

14,321

14,752

16,329

Interest payable and other liabilities

12,385

14,591

13,311

Total Liabilities

2,246,474

2,239,091

2,234,588

Shareholders’ Equity

Common stock, no par value

177,362

181,200

196,772

Accumulated other comprehensive loss, net

of tax

(14,108

)

(14,592

)

(12,858

)

Retained earnings

150,981

146,261

129,558

Total Shareholders’ Equity

314,235

312,869

313,472

Total Liabilities and Shareholders’

Equity

$

2,560,709

$

2,551,960

$

2,548,060

BAYCOM CORP

FINANCIAL HIGHLIGHTS

(UNAUDITED)

(Dollars in thousands, except per

share data)

At and for the three months

ended

March 31,

December 31,

March 31,

Selected Financial Ratios and Other

Data:

2024

2023

2023

(As Restated)

Performance Ratios:

Return on average assets (1)

0.92

%

1.00

%

1.14

%

Return on average equity (1)

7.44

8.26

9.06

Yield earned on average interest-earning

assets (1)

5.28

5.29

5.07

Rate paid on average interest-bearing

liabilities (1)

2.40

2.21

1.35

Interest rate spread - average during the

period (1)

2.88

3.08

3.72

Net interest margin (1)

3.72

3.86

4.26

Loan to deposit ratio

88.05

90.39

96.09

Efficiency ratio (2)

65.68

57.53

61.63

Charge-offs, net

$

3,372

$

150

$

315

Per Share Data:

Shares outstanding at end of period

11,377,117

11,551,271

12,443,977

Average diluted shares outstanding

11,525,752

11,571,796

12,699,476

Diluted earnings per share

$

0.51

$

0.55

$

0.57

Book value per share

27.62

27.09

25.19

Tangible book value per share (3)

23.89

23.38

21.68

Asset Quality Data:

Nonperforming assets to total assets

(4)

0.64

%

0.51

%

0.51

%

Nonperforming loans to total loans (5)

0.87

%

0.67

%

0.64

%

Allowance for credit losses on loans to

nonperforming loans (5)

114.55

%

169.53

%

155.84

%

Allowance for credit losses on loans to

total loans

1.00

%

1.14

%

1.00

%

Classified assets (graded substandard and

doubtful)

$

39,352

$

30,801

$

20,863

Total accruing loans 30‑89 days past

due

2,625

4,773

12,353

Total loans 90 days past due and still

accruing

—

—

—

Capital Ratios:

Tier 1 leverage ratio — Bank (6)

13.41

%

13.08

%

13.26

%

Common equity tier 1 capital ratio — Bank

(6)

16.91

%

16.94

%

16.40

%

Tier 1 capital ratio — Bank (6)

16.91

%

16.94

%

16.40

%

Total capital ratio — Bank (6)

17.87

%

18.08

%

17.43

%

Equity to total assets — end of period

12.27

%

12.26

%

12.30

%

Tangible equity to tangible assets — end

of period (3)

10.79

%

10.76

%

10.77

%

Loans:

Real estate

$

1,707,064

$

1,752,626

$

1,825,633

Non-real estate

162,791

161,816

205,458

Nonaccrual loans

16,491

12,977

13,090

Mark to fair value at acquisition

392

354

371

Total Loans

1,886,738

1,927,773

2,044,552

Net deferred fees on loans (7)

(8

)

56

(16

)

Loans, net of deferred fees

$

1,886,730

$

1,927,829

$

2,044,536

Other Data:

Number of full-service offices

35

35

34

Number of full-time equivalent

employees

345

358

366

(1)

Annualized.

(2)

Total noninterest expense as a percentage

of net interest income and total noninterest income.

(3)

Represents a non-GAAP financial measure.

See “Non-GAAP Financial Measures” below.

(4)

Nonperforming assets consist of nonaccrual

loans, accruing loans that are 90 days or more past due, and other

real estate owned.

(5)

Nonperforming loans consist of nonaccrual

loans and accruing loans that are 90 days or more past due.

(6)

Regulatory capital ratios are for United

Business Bank only.

(7)

Deferred fees include $2,100, $2,400 and

$3,000 as of March 31, 2024, December 31, 2023, and March 31, 2023,

respectively, in fees related to PPP loans.

Non-GAAP Financial Measures:

In addition to results presented in accordance with generally

accepted accounting principles utilized in the United States

(“GAAP”), this earnings release contains tangible book value per

share and tangible equity to tangible assets, both of which are

non-GAAP financial measures. Tangible book value per share is

calculated by dividing tangible common shareholders’ equity by the

number of common shares outstanding at the end of the period.

Tangible equity and tangible common shareholders’ equity exclude

intangible assets from shareholders’ equity, and tangible assets

exclude intangible assets from total assets. For these financial

measures, the Company’s intangible assets are goodwill and core

deposit intangibles. The Company believes that these measures are

consistent with the capital treatment by our bank regulatory

agencies, which excludes intangible assets from the calculation of

risk-based capital ratios, and presents these measures to

facilitate comparison of the quality and composition of the

Company’s capital over time in comparison to its peers. Non-GAAP

financial measures have inherent limitations, are not required to

be uniformly applied, and are not audited. Further, these non-GAAP

financial measures should not be considered in isolation or as a

substitute for the comparable financial measures determined in

accordance with GAAP and may not be comparable to similarly titled

measures reported by other companies.

Reconciliation of the GAAP and non-GAAP financial measures is

presented below:

Non-GAAP Measures

(Dollars in thousands, except per

share data)

March 31,

December 31,

March 31,

2024

2023

2023

(As Restated)

Tangible Book Value:

Total equity and common shareholders’

equity (GAAP)

$

314,235

$

312,869

$

313,472

less: Goodwill and other intangibles

42,448

42,753

43,670

Tangible equity and common shareholders’

equity (Non-GAAP)

$

271,787

$

270,116

$

269,802

Total assets (GAAP)

$

2,560,709

$

2,551,960

$

2,548,060

less: Goodwill and other intangibles

42,448

42,753

43,670

Total tangible assets (Non-GAAP)

$

2,518,261

$

2,509,207

$

2,504,390

Equity to total assets (GAAP)

12.27

%

12.26

%

12.30

%

Tangible equity to tangible assets

(Non-GAAP)

10.79

%

10.76

%

10.77

%

Book value per share (GAAP)

$

27.62

$

27.09

$

25.19

Tangible book value per share

(Non-GAAP)

$

23.89

$

23.38

$

21.68

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418143853/en/

BayCom Corp Keary Colwell, 925-476-1800

kcolwell@ubb-us.com

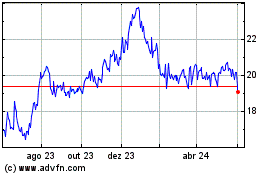

BayCom (NASDAQ:BCML)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

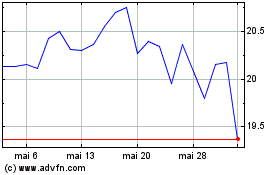

BayCom (NASDAQ:BCML)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024