UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

| |

Criteo S.A. |

|

| |

(Name of Issuer) |

|

| |

|

|

| |

American Depositary Shares, each representing one Ordinary

Share, nominal value €0.025 per share |

|

| |

(Title of Class of Securities) |

|

| |

|

|

| |

226718104 |

|

| |

(CUSIP Number) |

|

| |

|

|

| |

Connie

Neumann

Office and compliance manager

Petrus Advisers Ltd

Eighth Floor, 6 New Street Square, New Fetter

Lane

London EC4A 3AQ, United Kingdom

+44 20 7933 8831 |

|

| |

(Name, Address and Telephone Number of Person Authorized to |

|

| |

Receive Notices and Communications) |

|

| |

|

|

| |

February 22, 2024 |

|

| |

(Date of Event which Requires Filing of this Statement) |

|

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Sections 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☒

Note: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See Section 240.13d-7 for other parties to whom

copies are to be sent.

| * | The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP No. 226718104 |

13D |

Page 2 of 11 pages |

| 1 |

NAMES OF REPORTING PERSONS I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Petrus Advisers Ltd. |

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(see instructions) |

(a) |

☐ |

| |

|

(b) |

☐ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS* (see instructions) |

|

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED |

|

|

| |

PURSUANT TO ITEMS 2(d) OR 2(e) |

|

☐ |

| |

|

|

|

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

United Kingdom |

|

|

| |

|

|

|

| |

7 |

SOLE VOTING POWER |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH: |

|

0 |

| |

|

| 8 |

SHARED VOTING POWER |

| |

2,446,674 |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

2,922,248 |

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

2,922,248 |

|

| |

|

|

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

| |

(see instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

5.29%1 |

|

|

| |

|

|

|

| 14 |

TYPE OF REPORTING PERSON* (see instructions) |

|

|

| |

FI |

|

|

| |

|

|

|

| 1 | Based

on 55,227,016 Shares (as defined herein) outstanding as of February 16, 2024, as disclosed

in the Issuer’s Annual Report on Form 10-K filed on February 23, 2024. |

| CUSIP No. 226718104 |

13D |

Page 3 of 11 pages |

| 1 |

NAMES OF REPORTING PERSONS I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Klaus Umek |

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(see instructions) |

(a) |

☐ |

| |

|

(b) |

☐ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS* (see instructions) |

|

|

| |

OO, PF |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED |

|

|

| |

PURSUANT TO ITEMS 2(d) OR 2(e) |

|

☐ |

| |

|

|

|

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

Austrian |

|

|

| |

|

|

|

| |

7 |

SOLE VOTING POWER |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH: |

|

39,649 |

| |

|

| 8 |

SHARED VOTING POWER |

| |

2,446,674 |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

39,649 |

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

2,922,248 |

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

2,961,897 |

|

| |

|

|

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

| |

(see instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

5.36%2 |

|

|

| |

|

|

|

| 14 |

TYPE OF REPORTING PERSON* (see instructions) |

|

|

| |

IN, HC |

|

|

| |

|

|

|

| 2 | Based

on 55,227,016 Shares outstanding as of February 16, 2024, as disclosed in the Issuer’s

Annual Report on Form 10-K filed on February 23, 2024. |

| CUSIP No. 226718104 |

13D |

Page 4 of 11 pages |

| 1 |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION

NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Till Hufnagel |

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(see instructions) |

(a) |

☐ |

| |

|

(b) |

☐ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS* (see instructions) |

|

|

| |

OO, PF |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED |

|

|

| |

PURSUANT TO ITEMS 2(d) OR 2(e) |

|

☐ |

| |

|

|

|

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

German |

|

|

| |

|

|

|

| |

7 |

SOLE VOTING POWER |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH: |

|

168,061 |

| |

|

| 8 |

SHARED VOTING POWER |

| |

2,446,674 |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

168,061 |

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

2,922,248 |

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

3,090,309 |

|

| |

|

|

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

| |

(see instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

5.60%3 |

|

|

| |

|

|

|

| 14 |

TYPE OF REPORTING PERSON* (see instructions) |

|

|

| |

IN, HC |

|

|

| |

|

|

|

| 3 | Based

on 55,227,016 Shares outstanding as of February 16, 2024, as disclosed in the Issuer’s

Annual Report on Form 10-K filed on February 23, 2024. |

| CUSIP No. 226718104 |

13D |

Page 5 of 11 pages |

Item 1. Security and Issuer.

This statement on

Schedule 13D relates to the American Depositary Shares issued within the framework of the Amended and Restated Deposit Agreement

dated December 28, 2021 between Criteo S.A., the Bank of New York Mellon and owners and holders of American Depositary Shares (the

“ADS”), each representing one ordinary share, nominal value €0.025 per share, (the

“Shares”) of Criteo S.A., a French société anonyme whose headquarters are located 32 rue

Blanche, 75009 Paris, France (the “Issuer”).

| |

|

|

|

| Item 2. Identity and Background. |

|

|

| |

|

|

|

| (a-c) |

This statement is being filed by the following persons (hereafter referred to as a “Reporting

Person” individually and “Reporting Persons” collectively): |

| NAME | |

ADDRESS | |

OCCUPATION |

| Petrus Advisers Ltd. (“Petrus”) | |

Eighth Floor, 6 New Street Square, New Fetter Lane

London EC4A 3AQ, United Kingdom | |

The principal business of Petrus Advisers Ltd. is to hold securities for investment purposes and to act as an investment manager or portfolio adviser for certain investment vehicles and certain managed accounts. |

| | |

| |

|

| Till Hufnagel | |

100 Pall Mall,

London SW1Y 5NQ, United Kingdom | |

Hufnagel’s principal business is to serve as partner of Petrus Advisers Ltd. |

| | |

| |

|

| Klaus Umek | |

100 Pall Mall,

London SW1Y 5NQ, United Kingdom | |

Umek’s principal business is to serve as the managing partner of Petrus Advisers Ltd. |

| (d-e) |

During the last five years, none of the persons or entities listed above has been (i)

convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); or (ii) a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment,

decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities

laws or finding any violation with respect to such laws. |

| |

|

|

|

| (f) |

Petrus is a private limited company organized under the laws of the United Kingdom. Klaus

Umek is a citizen of Austria and Till Hufnagel is a citizen of Germany. |

| |

|

|

|

| Item 3. Source and Amount of Funds or Other Consideration. |

|

A total of approximately €3.3 million,

excluding commissions, was paid to acquire the ADS, including options to acquire ADS, purchased since the filing of the Reporting

Persons’ Schedule 13G, filed with the Securities and Exchange Commission on December 1, 2023. The ADS reported herein were

purchased using the working capital of the investment vehicles and managed accounts that own the ADS directly, for which Petrus

serves as investment manager or portfolio adviser, as well as the personal funds of the private individuals who have signed powers

of attorney in favor of Petrus, Mr. Hufnagel and Mr. Umek.

The Reporting Persons may effect purchases

of ADS through margin accounts maintained with prime brokers, which extend margin credit as and when required to open or carry positions

in their margin accounts, subject to applicable margin regulations, stock exchange rules and such firms’ credit policies. Positions

in the ADS may be held in margin accounts and may be pledged as collateral security for the repayment of debit balances in such accounts.

Since other securities may be held in such margin accounts, it may not be possible to determine the amounts, if any, of margin used

to purchase the ADS. |

| |

|

|

|

| Item 4. Purpose of Transaction. |

|

|

| |

|

|

| The Reporting Persons believe that the ADS represent an attractive investment opportunity

as the Issuer’s value could substantially increase subject to revising its strategy, and possibly by being the target of a

tender offer. On February 22, 2024, the Reporting Persons sent a public letter (the “Letter”) asking the Issuer to (i)

prepare an investor day as soon as possible to explain its Retail Media strategy and a new mid-term plan, (ii) accelerate the existing

share buyback by means of a substantial self-tender of up to $150 million, (iii) no later than Q4 2024, initiate a comprehensive

strategic review, including to evaluate all ownership options, and (iv) refresh the board of directors of the Issuer (the “Board”)

by adding independent candidates whom the Reporting Persons will propose, with the aim of strengthening capital markets acumen and

industry experience. The Reporting Persons further seek to engage in a dialogue with the Issuer’s managers and Board members

to maximize ADS and shareholder value. The Reporting Persons may also seek to communicate with shareholders and other third parties

about such discussions and strategy. |

| CUSIP No. 226718104 |

13D |

Page 6 of 11 pages |

Depending on the evolution

of the market for the ADS, as well as the outcome of (i) the Reporting Persons’ discussions with the Issuer’s managers and

Board members (regarding in particular the Reporting Persons’ proposal to submit the candidacy of independent Board members to

the next general meeting), (ii) the publication of the Letter, and (iii) the change, if any, in the Issuer’s strategy, the Reporting

Persons may seek to obtain the appointment of new Board members, or the dismissal of existing Board members, at the Issuer’s next

general meeting.

A copy of the Letter is

filed as an exhibit to this statement on Schedule 13D and is incorporated herein by reference.

The Reporting Persons intend

to review their investment in the Issuer on a continuing basis and depending upon various factors, including without limitation, the

Issuer’s financial position and strategic direction, the outcome of any discussions referenced above, overall market conditions,

other investment opportunities available to the Reporting Persons, and the availability of securities of the Issuer at prices that would

make the purchase or sale of such securities desirable, may endeavor (i) to increase or decrease their position in the Issuer through,

among other things, the purchase or sale of securities of the Issuer, including through transactions involving the ADS, the Shares and/or

other equity, debt, notes, other securities, or derivative or other instruments that are based upon or relate to the value of securities

of the Issuer in the open market or in private transactions, including through a trading plan created under Rule 10b5-1(c) or otherwise,

on such terms and at such times as the Reporting Persons may deem advisable and/or (ii) to enter into transactions that increase or hedge

their economic exposure to the ADS and the Shares without affecting their beneficial ownership of the ADS and the Shares. In addition,

the Reporting Persons may, at any time and from time to time, (i) review or reconsider their position and/or change their purpose and/or

formulate plans or proposals with respect thereto and (ii) consider or propose one or more of the actions described in subparagraphs

(a) - (j) of Item 4 of Schedule 13D.

| Item 5. Interest in Securities of the Issuer. |

|

|

| |

|

|

|

| (a) |

See rows (11) and (13) of pages 2, 3 and 4 of this Schedule 13D for

the aggregate number of ADS and percentage of ADS beneficially owned by the Reporting Persons. These amounts include an aggregate

1,550,000 ADS that the Reporting Persons have the right to acquire within 60 days upon exercise of long standardized call options.

The aggregate percentage of ADS reported beneficially owned by the Reporting Persons is based upon 55,227,016 Shares outstanding

as of February 16, 2024, as disclosed in the Issuer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023,

filed by the Issuer with the Securities and Exchange Commission on February 23, 2024. |

| |

|

|

|

| (b) |

See rows (7) through (10) of pages 2, 3 and 4 of this Schedule 13D

for the ADS as to which the Reporting Persons have the sole or shared power to vote or direct the vote and sole or shared power to

dispose or direct the disposition. Each of Petrus, Mr. Hufnagel and Mr. Umek may be deemed to share voting power and share dispositive

power over the ADS and options to acquire ADS held directly by the investment vehicles and managed accounts for which Petrus serves

as investment manager or portfolio adviser and the private individuals who have signed powers of attorney in favor of Petrus. |

| |

|

|

|

| (c) |

The transactions in the ADS effected by the Reporting Persons during the past sixty (60)

days, which were all in the open market, are set forth on Schedule 1 attached hereto. |

| |

|

|

|

| (d) |

The ADS reported on this statement on Schedule 13D as being beneficially owned by the Reporting

Persons include ADS and options to acquire ADS owned directly by certain investment vehicles and managed accounts for which Petrus

serves as investment manager or portfolio adviser, private individuals who have signed powers of attorney in favor of Petrus, and

Mr. Hufnagel and Mr. Umek, each of which is known to have the right to receive or the power to direct the receipt of dividends from,

or the proceeds from the sale of, the ADS and options to acquire ADS held directly by them. |

| |

|

|

|

| (e) |

Not applicable. |

|

|

Item 6. Contracts, Arrangements, Understandings or Relationships With

Respect to Securities of the Issuer. |

The information set forth

in each of Item 3 and Item 5 of this Schedule 13D is incorporated herein by reference.

In connection with filing

this Schedule 13D jointly, pursuant to Rule 13d-1(k)(1) under the Act, the Reporting Persons entered into a Joint Filing Agreement, a

copy of which is filed as an exhibit to this statement on Schedule 13D and is incorporated herein by reference.

Except as otherwise set

forth in this Schedule 13D, there are no contracts, arrangements, understandings or relationships between the Reporting Persons named

in Item 2 and any other person with respect to any securities of the Issuer.

| CUSIP No. 226718104 |

13D |

Page 7 of 11 pages |

| CUSIP No. 226718104 |

13D |

Page 8 of 11 pages |

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

|

Petrus Advisers Ltd. |

| |

|

|

| |

By: |

/s/ Suraj Shah |

| |

|

Suraj Shah |

| |

|

(Name) |

| |

|

|

| |

|

Director |

| |

|

(Title) |

| |

|

|

| |

|

February 27, 2024 |

| |

|

(Date) |

| |

By: |

/s/ Klaus Umek |

| |

|

Klaus Umek |

| |

|

|

| |

|

February 27, 2024 |

| |

|

(Date) |

| |

By: |

/s/ Till Hufnagel |

| |

|

Till Hufnagel |

| |

|

|

| |

|

February 27, 2024 |

| |

|

(Date) |

| CUSIP No. 226718104 |

13D |

Page 9 of 11 pages |

SCHEDULE 1

Transactions in the ADS of the Issuer by the

Reporting Persons During the Past Sixty (60) Days

The following table sets

forth all transactions in the ADS effected during the past sixty (60) days by the Reporting Persons. Except as noted below, all such

transactions were effected in the open market through brokers and the price per share excludes commissions.

| Reporting

Person | |

Type | |

Quantity4 | |

Name

of Security | |

Price5 | |

Trade

Date6 |

| Petrus Advisers LTD | |

Sell | |

-1,518 | |

CRTO US Equity | |

25.20593 | |

20231227 |

Klaus

Umek | |

Sell | |

-600 | |

CRTO

US Equity | |

25.0071 | |

20231227 |

| Petrus Advisers LTD | |

Sell | |

-2,889 | |

CRTO US Equity | |

25.10727 | |

20231228 |

| Petrus Advisers LTD | |

Sell | |

-1,712 | |

CRTO US Equity | |

25.12770 | |

20231228 |

| Petrus Advisers LTD | |

Sell | |

-50,000 | |

CRTO US Equity | |

25.19000 | |

20231229 |

| Petrus Advisers LTD | |

Buy | |

1,000 | |

CRTO US Equity | |

25.09900 | |

20231229 |

| Petrus Advisers LTD | |

Buy | |

25,000 | |

CRTO US Equity | |

25.29758 | |

20231229 |

| Petrus Advisers LTD | |

Buy | |

30,000 | |

CRTO US Equity | |

25.28340 | |

20231229 |

| Petrus Advisers LTD | |

Buy | |

34,000 | |

CRTO US Equity | |

25.28418 | |

20231229 |

| Klaus Umek | |

Sell | |

-4,832 | |

CRTO

US Equity | |

25.0257 | |

20231229 |

| Petrus Advisers LTD | |

Buy | |

45,000 | |

CRTO US Equity | |

24.99485 | |

20240102 |

| Petrus Advisers LTD | |

Buy | |

50,000 | |

CRTO US Equity | |

24.84981 | |

20240102 |

| Petrus Advisers LTD | |

Sell | |

-5,000 | |

CRTO US Equity | |

24.74000 | |

20240104 |

| Petrus Advisers LTD | |

Buy | |

250 | |

CRTO US Equity | |

24.50980 | |

20240104 |

| Petrus Advisers LTD | |

Buy | |

10,380 | |

CRTO US Equity | |

24.45797 | |

20240104 |

| Petrus Advisers LTD | |

Sell | |

-22,300 | |

CRTO US Equity | |

24.57729 | |

20240105 |

| Petrus Advisers LTD | |

Buy | |

11,269 | |

CRTO US Equity | |

24.26476 | |

20240105 |

| Petrus Advisers LTD | |

Buy | |

3,244 | |

CRTO US Equity | |

24.23029 | |

20240109 |

| Petrus Advisers LTD | |

Sell | |

-37,719 | |

CRTO US Equity | |

24.81149 | |

20240111 |

| Petrus Advisers LTD | |

Buy | |

1,500 | |

CRTO US Equity | |

24.42397 | |

20240111 |

| Petrus Advisers LTD | |

Sell | |

-15,721 | |

CRTO US Equity | |

25.00029 | |

20240112 |

| Petrus Advisers LTD | |

Buy | |

15,000 | |

CRTO US Equity | |

24.86574 | |

20240112 |

| Petrus Advisers LTD | |

Buy | |

2,500 | |

CRTO US Equity | |

24.46904 | |

20240116 |

| Petrus Advisers LTD | |

Buy | |

2,500 | |

CRTO US Equity | |

24.49454 | |

20240116 |

| Petrus Advisers LTD | |

Sell | |

-100 | |

CRTO US Equity | |

24.30000 | |

20240117 |

| Klaus Umek | |

Sell | |

-55,560 | |

CRTO

US Equity | |

24.4358 | |

20240117 |

| Petrus Advisers LTD | |

Sell | |

-4,168 | |

CRTO US Equity | |

24.43117 | |

20240118 |

| Petrus Advisers LTD | |

Sell | |

-10,077 | |

CRTO US Equity | |

24.62221 | |

20240119 |

| Petrus Advisers LTD | |

Assignment | |

5,000

500,000

| |

CRTO

US 01/19/24 P25 Equity

CRTO US Equity

| |

0.00000

25.00000

| |

20240119 |

| Petrus Advisers LTD | |

Sell | |

-2,392 | |

CRTO US Equity | |

24.88343 | |

20240122 |

| Petrus Advisers LTD | |

Sell | |

-9,100 | |

CRTO US Equity | |

25.16000 | |

20240123 |

| Petrus Advisers LTD | |

Sell | |

-1,547 | |

CRTO US Equity | |

25.21319 | |

20240123 |

| Petrus Advisers LTD | |

Sell | |

-10,000 | |

CRTO US Equity | |

25.39511 | |

20240124 |

| Petrus Advisers LTD | |

Sell | |

-9,735 | |

CRTO US Equity | |

25.45067 | |

20240124 |

| Petrus Advisers LTD | |

Buy | |

2,000 | |

CRTO US 02/16/24 C30 Equity | |

0.25000 | |

20240124 |

| 4 | Quantity of options reflects number of contracts, with each contract representing 100 ADS. |

| 5 | Price per share in US dollars. |

| 6 | Trade dates are following the format YYYYMMDD. |

| CUSIP No. 226718104 |

13D |

Page 10 of 11 pages |

| Petrus Advisers LTD | |

Buy | |

1,000 | |

CRTO US Equity | |

25.5640 | |

20240125 |

| Petrus Advisers LTD | |

Sell | |

-13,757 | |

CRTO US Equity | |

25.73459 | |

20240126 |

| Petrus Advisers LTD | |

Sell | |

-10,061 | |

CRTO US Equity | |

25.70472 | |

20240126 |

Klaus Umek | |

Buy | |

13,730 | |

CRTO US Equity | |

25.85765 | |

20240126 |

| Petrus Advisers LTD | |

Sell | |

-10,996 | |

CRTO US Equity | |

25.91127 | |

20240129 |

| Petrus Advisers LTD | |

Sell | |

-2,946 | |

CRTO US Equity | |

26.01494 | |

20240129 |

| Petrus Advisers LTD | |

Sell | |

-3,692 | |

CRTO US Equity | |

26.13014 | |

20240130 |

| Petrus Advisers LTD | |

Sell | |

-2,128 | |

CRTO US Equity | |

26.13919 | |

20240130 |

| Klaus Umek | |

Buy | |

3,500 | |

CRTO US Equity | |

26.024 | |

20240130 |

| Till Hufnagel | |

Buy | |

10,000 | |

CRTO US Equity | |

26.1247 | |

20240130 |

| Petrus Advisers LTD | |

Buy | |

2,000 | |

CRTO US Equity | |

26.04555 | |

20240131 |

| Petrus Advisers LTD | |

Buy | |

20,000 | |

CRTO US Equity | |

26.14175 | |

20240131 |

| Petrus Advisers LTD | |

Buy | |

20,000 | |

CRTO US Equity | |

26.14425 | |

20240131 |

| Petrus Advisers LTD | |

Sell | |

-240,856 | |

CRTO US Equity | |

24.72210 | |

20240201 |

| Petrus Advisers LTD | |

Sell | |

-94,144 | |

CRTO US Equity | |

24.72210 | |

20240201 |

| Petrus Advisers LTD | |

Buy | |

250 | |

CRTO US Equity | |

26.25800 | |

20240201 |

| Petrus Advisers LTD | |

Buy | |

5,000 | |

CRTO US 07/19/24 C25 Equity | |

3.00000 | |

20240201 |

| Petrus Advisers LTD | |

Sell | |

-6,400 | |

CRTO US Equity | |

26.38500 | |

20240202 |

| Petrus Advisers LTD | |

Sell | |

-100 | |

CRTO US Equity | |

26.40000 | |

20240202 |

| Petrus Advisers LTD | |

Buy | |

25,000 | |

CRTO US Equity | |

26.04621 | |

20240205 |

| Petrus Advisers LTD | |

Sell | |

-4,830 | |

CRTO US Equity | |

26.20041 | |

20240206 |

| Petrus Advisers LTD | |

Sell | |

-1,094 | |

CRTO US Equity | |

26.20411 | |

20240206 |

| Petrus Advisers LTD | |

Sell | |

-50,000 | |

CRTO US Equity | |

30.77579 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

30.65444 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

30.78328 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

30.85994 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

30.70018 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-16,450 | |

CRTO US Equity | |

30.77751 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-15,200 | |

CRTO US Equity | |

30.93281 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-15,000 | |

CRTO US Equity | |

30.91514 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-15,000 | |

CRTO US Equity | |

30.82196 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-8,550 | |

CRTO US Equity | |

30.68247 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-1,100 | |

CRTO US Equity | |

30.9100 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-600 | |

CRTO US Equity | |

31.00333 | |

20240207 |

| Petrus Advisers LTD | |

Buy | |

5,000 | |

CRTO US Equity | |

31.51830 | |

20240207 |

Klaus Umek | |

Sell | |

-23,790 | |

CRTO US Equity | |

30.41270 | |

20240207 |

| Petrus Advisers LTD | |

Sell | |

-28,094 | |

CRTO US Equity | |

32.02819 | |

20240208 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

31.64675 | |

20240208 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

31.78200 | |

20240208 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

32.00063 | |

20240208 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

32.02503 | |

20240208 |

| Petrus Advisers LTD | |

Sell | |

-25,000 | |

CRTO US Equity | |

32.17000 | |

20240208 |

| Petrus Advisers LTD | |

Sell | |

-20,000 | |

CRTO US Equity | |

31.50428 | |

20240208 |

| Petrus Advisers LTD | |

Sell | |

-1,906 | |

CRTO US Equity | |

31.92099 | |

20240208 |

| Petrus Advisers LTD | |

Sell | |

-500 | |

CRTO US Equity | |

32.30200 | |

20240208 |

| Petrus Advisers LTD | |

Buy | |

10,905 | |

CRTO US Equity | |

26.175 | |

20240208 |

| Petrus Advisers LTD | |

Buy | |

14,000 | |

CRTO US Equity | |

26.175 | |

20240208 |

| CUSIP No. 226718104 |

13D |

Page 11 of 11 pages |

| Petrus Advisers LTD |

|

Buy |

|

24,185 |

|

CRTO US Equity |

|

26.175 |

|

20240208 |

| Petrus Advisers LTD |

|

Sell |

|

-32,500 |

|

CRTO US Equity |

|

31.90000 |

|

20240209 |

| Petrus Advisers LTD |

|

Sell |

|

-2,500 |

|

CRTO US 07/19/24 C35 Equity |

|

2.10000 |

|

20240209 |

| Petrus Advisers LTD |

|

Buy |

|

2,500 |

|

CRTO US 07/19/24 C32.5 Equity |

|

3.17000 |

|

20240209 |

| Petrus Advisers LTD |

|

Sell |

|

-10,200 |

|

CRTO US Equity |

|

32.29186 |

|

20240212 |

| Petrus Advisers LTD |

|

Sell |

|

-4,052 |

|

CRTO US Equity |

|

32.21594 |

|

20240212 |

| Petrus Advisers LTD |

|

Buy |

|

6,500 |

|

CRTO US Equity |

|

32.17424 |

|

20240212 |

| Petrus Advisers LTD |

|

Sell |

|

-6,750 |

|

CRTO US Equity |

|

32.01 |

|

20240213 |

| Petrus Advisers LTD |

|

Buy |

|

2,500 |

|

CRTO US Equity |

|

31.97153 |

|

20240213 |

| Klaus Umek |

|

Buy |

|

6,750 |

|

CRTO US Equity |

|

32.01 |

|

20240213 |

| Petrus Advisers LTD |

|

Exercise |

|

-2,000

200,000 |

|

CRTO US 02/16/24 C30 Equity

CRTO US Equity |

|

0.00000

30.00000 |

|

20240216 |

| Petrus Advisers LTD |

|

Sell |

|

-63,000 |

|

CRTO US Equity |

|

31.00000 |

|

20240221 |

| Petrus Advisers LTD |

|

Sell |

|

-3,000 |

|

CRTO US 10/18/24 C35 Equity |

|

2.55000 |

|

20240221 |

| Petrus Advisers LTD |

|

Buy |

|

1,681 |

|

CRTO US Equity |

|

31.28570 |

|

20240221 |

| Petrus Advisers LTD |

|

Buy |

|

2,403 |

|

CRTO US Equity |

|

31.28570 |

|

20240221 |

| Petrus Advisers LTD |

|

Buy |

|

2,621 |

|

CRTO US Equity |

|

31.76980 |

|

20240221 |

| Petrus Advisers LTD |

|

Buy |

|

2,974 |

|

CRTO US Equity |

|

31.28570 |

|

20240221 |

| Petrus Advisers LTD |

|

Buy |

|

3,000 |

|

CRTO US 10/18/24 C30 Equity |

|

4.90000 |

|

20240221 |

| Petrus Advisers LTD |

|

Buy |

|

4,901 |

|

CRTO US Equity |

|

31.76980 |

|

20240221 |

| Petrus Advisers LTD |

|

Buy |

|

6,018 |

|

CRTO US Equity |

|

31.76980 |

|

20240221 |

Exhibit 1

JOINT

FILING AGREEMENT

The

undersigned acknowledge and agree that the foregoing statement on Schedule 13D is, and that all subsequent amendments to this statement

on Schedule 13D (including amendments on Schedule 13G) signed by each of the undersigned shall be, filed on behalf of each of them pursuant

to and in accordance with the provisions of Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended. The undersigned acknowledge

that each shall be responsible for the timely filing of this Schedule 13D and any amendments thereto, and for the completeness and accuracy

of the information concerning them or it contained herein and therein, but shall not be responsible for the completeness and accuracy

of the information concerning the others, except to the extent that they or it knows or has reason to believe that such information is

inaccurate.

| |

|

Petrus Advisers

Ltd. |

| |

|

|

| |

By: |

/s/

Suraj Shah |

| |

|

Suraj Shah |

| |

|

(Name) |

| |

|

|

| |

|

Director |

| |

|

(Title)

|

| |

|

February

27, 2024 |

| |

|

(Date) |

| |

By: |

/s/

Klaus Umek |

| |

|

Klaus Umek |

| |

|

|

| |

|

February

27, 2024 |

| |

|

(Date) |

| |

By: |

/s/

Till Hufnagel |

| |

|

Till Hufnagel |

| |

|

|

| |

|

February

27, 2024 |

| |

|

(Date) |

Exhibit

2

Rachel

Picard (Chair of the Board of Directors), Megan Clarken (CEO)

Criteo

S.A. (“Criteo”)

32,

Rue Blanche

75009

Paris

London,

22 February 2024

Dear

Rachel and Megan,

We

have recently added to our shareholding. Petrus Advisers now control 5.5% of the company. After deliberating with you, we are writing

to propose change:

Criteo

has what it takes to become an Ad-tech market leader – in Targeting, Retargeting and the emerging Retail Media space. We are buying

into the vision you laid out to manage this transition. We are focused on human capital and supportive of your investment in people.

However, Google’s phasing out of third-party cookies creates uncertainty which has been weighing on the equity story.

During

the Q3 2023 earnings call, you slashed your 2025 net revenue1 target of $1.4 billion and today broker consensus sits at

c. $1.1 billion2, implying an Adj. EBITDA shortfall of some $100 million3. This abrupt measure continues to

frustrate market participants: Criteo’s share price dropped by 12% on earnings day to $24.644, vs. a June 2021 peak

of $45.455 and average broker price target of $40.23 before the warning6. In the 3 months since then your average

broker price target has come down to c. $367. No one sees relevant upside.

This

episode demonstrates the challenges of designing, executing and communicating a business model transformation for a complicated, listed,

small Ad-tech company. The communication chosen by the team was least-in-class. The corporate structure of Criteo (HQ in Paris, listed

on NASDAQ) remains unchanged and has resulted in the current situation: (i) no real French followership, (ii) only few but large investors

who can stomach your complexity and (iii) the unsatisfactory illiquidity of the stock.

While

the top 10 holders currently own more than two thirds of the company and you have a big buyback, Criteo’s stock performance is

not reflective of the business’ underlying performance and growth outlook. The company continues to be vulnerable to opportunistic

approaches by strategic and/or financial buyers who understand the value potential and are not too worried by the cookie deprecation.

We

therefore demand that Criteo:

| (i) | prepare

an investor day ASAP to explain the Retail Media strategy and a new mid-term plan; |

| (ii) | accelerate

the existing share buyback by means of a substantial self-tender of up to $150 million; |

| (iii) | no

later than Q4 2024, initiate a comprehensive strategic review, including to evaluate all ownership options; |

| (iv) | refresh

the Board of Directors by adding independent candidates whom we will propose, with the aim of strengthening capital markets acumen and

industry experience. |

Criteo

must not remain ‘Lost in transition’ for all times. Standing by and watching the stock fluctuate like a branch in

the waves of the ocean does not deliver any acceptable reward for being invested in Criteo.

| Sincerely, |

|

|

|

|

|

| Klaus Umek |

|

Till Hufnagel |

| Managing Partner |

|

Partner |

| 1 | Refers to Contribution Ex TAC. |

| 2 | Contribution

Ex TAC 2025E broker consensus as of 21 February 2024, as per Factset data. |

| 3 | Compared

to the implied Adj. EBITDA target disclosed at the 2022 investor day. Delta based on the mid-point of the Adj. EBITDA margin 2025E target

range of 28-32%, applied to the $1.4 billion Contribution Ex TAC 2025E target, vs. the current consensus EBITDA 2025E expectation, as

per Factset data. |

| 4 | Close

price as of 2 November 2023, as per Factset data. |

| 5 | Close

price as of 29 June 2021, as per Factset data. |

| 6 | Average

broker price target as of 1 November 2023, as per Factset data. |

| 7 | Average

broker price target as of 21 February 2024, as per Factset data. |

Petrus Advisers - 100 Pall Mall - London

SW1Y 5NQ - www.petrusadvisers.com - office@petrusadvisers.com

Petrus Advisers Ltd, Company Number 08288908 is a company incorporated

as private limited by shares, having its registered office situated in England and Wales with the registered office address of 8th Floor,

6 New Street Square, New Fetter Lane, London EC4A 3AQ. Petrus Advisers Ltd is Authorised and Regulated by the Financial Conduct Authority.

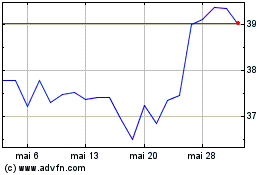

Criteo (NASDAQ:CRTO)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Criteo (NASDAQ:CRTO)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024