Fundamental Global Inc. Announces $6.5M Sale of Digital Ignition

22 Abril 2024 - 9:30AM

Fundamental Global Inc. (Nasdaq: FGF, FGFPP) (the “Company” or

“Fundamental Global”) today announced the sale of its Digital

Ignition building and wholly owned subsidiary for $6.5 million.

Fundamental Global will receive approximately

$1.3 million in cash, net of closing costs and repayment of debt.

In addition, the Company expects annual operating costs to be

reduced by approximately $1 million as a result of the sale.

This sale aligns with Fundamental Global’s key

strategic objectives:

- Simplifies

operations

- Increases focus

on a few highly scalable and high ROIC businesses

- Reduces annual

operating costs by approximately $1 million

- Reduces debt by

approximately $4.9 million

- Increases cash

that can be re-deployed into higher returning businesses

Kyle Cerminara, Chairman and CEO of Fundamental

Global, commented, “We are committed to reducing expenses and

increasing scale, focus and profitability. When I returned as CEO

it became obvious that Digital Ignition was not core to the new

strategic focus and that we should sell and focus our time, effort

and capital. This sale is one of many steps we are taking to

consolidate and simplify our operations, reduce costs, and focus

our efforts on a few highly scalable and high ROIC businesses.”

About Fundamental Global Inc.

Fundamental Global Inc. (Nasdaq: FGF, FGFPP) and

its subsidiaries engage in diverse business activities including

reinsurance, asset management, merchant banking, manufacturing and

managed services.

The FG® logo and Fundamental

Global® are registered trademarks of Fundamental Global.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These statements are therefore entitled to the protection of the

safe harbor provisions of these laws. These statements may be

identified by the use of forward-looking terminology such as

“anticipate,” “believe,” “budget,” “can,” “contemplate,”

“continue,” “could,” “envision,” “estimate,” “expect,” “evaluate,”

“forecast,” “goal,” “guidance,” “indicate,” “intend,” “likely,”

“may,” “might,” “outlook,” “plan,” “possibly,” “potential,”

“predict,” “probable,” “probably,” “pro-forma,” “project,” “seek,”

“should,” “target,” “view,” “will,” “would,” “will be,” “will

continue,” “will likely result” or the negative thereof or other

variations thereon or comparable terminology. In particular,

discussions and statements regarding the Company’s future business

plans and initiatives are forward-looking in nature. We have based

these forward-looking statements on our current expectations,

assumptions, estimates, and projections. While we believe these to

be reasonable, such forward-looking statements are only predictions

and involve a number of risks and uncertainties, many of which are

beyond our control. These and other important factors may cause our

actual results, performance, or achievements to differ materially

from any future results, performance or achievements expressed or

implied by these forward-looking statements, and may impact our

ability to implement and execute on our future business plans and

initiatives. Management cautions that the forward-looking

statements in this release are not guarantees of future

performance, and we cannot assume that such statements will be

realized or the forward-looking events and circumstances will

occur. Factors that might cause such a difference include, without

limitation: risks associated with our inability to identify and

realize business opportunities, and the undertaking of any new such

opportunities; our lack of operating history or established

reputation in the reinsurance industry; our inability to obtain or

maintain the necessary approvals to operate reinsurance

subsidiaries; risks associated with operating in the reinsurance

industry, including inadequately priced insured risks, credit risk

associated with brokers we may do business with, and inadequate

retrocessional coverage; our inability to execute on our investment

and investment management strategy, including our strategy to

invest in the risk capital of special purpose acquisition companies

(SPACs); our ability to maintain and expand our revenue streams to

compensate for the lower demand for our digital cinema products and

installation services; potential interruptions of supplier

relationships or higher prices charged by suppliers in connection

with our Strong Global business; our ability to successfully

compete and introduce enhancements and new features that achieve

market acceptance and that keep pace with technological

developments; our ability to maintain Strong Global’s brand and

reputation and retain or replace its significant customers;

challenges associated with Strong Global’s long sales cycles; the

impact of a challenging global economic environment or a downturn

in the markets; the effects of economic, public health, and

political conditions that impact business and consumer confidence

and spending, including rising interest rates, periods of

heightened inflation and market instability; potential loss of

value of investments; risk of becoming an investment company;

fluctuations in our short-term results as we implement our new

business strategy; risks of being unable to attract and retain

qualified management and personnel to implement and execute on our

business and growth strategy; failure of our information technology

systems, data breaches and cyber-attacks; our ability to establish

and maintain an effective system of internal controls; our limited

operating history as a public company; the requirements of being a

public company and losing our status as a smaller reporting company

or becoming an accelerated filer; any potential conflicts of

interest between us and our controlling stockholders and different

interests of controlling stockholders; potential conflicts of

interest between us and our directors and executive officers; risks

associated with our related party transactions and investments; and

risks associated with our investments in SPACs, including the

failure of any such SPAC to complete its initial business

combination. Our expectations and future plans and initiatives may

not be realized. If one of these risks or uncertainties

materializes, or if our underlying assumptions prove incorrect,

actual results may vary materially from those expected, estimated

or projected. You are cautioned not to place undue reliance on

forward-looking statements. The forward-looking statements are made

only as of the date hereof and do not necessarily reflect our

outlook at any other point in time. We do not undertake and

specifically decline any obligation to update any such statements

or to publicly announce the results of any revisions to any such

statements to reflect new information, future events or

developments.

Investor Contact:

investors@fundamentalglobal.com

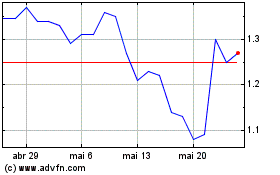

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

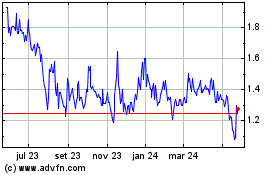

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024