Strong Global Entertainment, Inc. (NYSE: SGE)

(“

Strong Global”) and

Fundamental Global

Inc. (Nasdaq: FGF, FGFPP) (“Fundamental Global”) are

pleased to announce the closing of the previously announced sale of

Strong/MDI Screen Systems, Inc. (“

MDI”) from

Strong Global to Saltire Holdings Ltd (“Saltire”).

Mark Roberson, Chief Executive Officer of Strong

Global, commented, “We are pleased to announce the closing of the

sale of MDI. This is one element of our previously announced

strategy to streamline operations, increase liquidity and drive

shareholder value. We expect the transaction to result in a net

pre-tax financial statement gain in excess of $25 million. At

closing, Strong Global holds approximately 37% of the outstanding

common shares of Saltire, and we look forward to participating in

the Saltires’ long term growth strategy.”

At closing, and after a working capital

adjustment, Strong Global received total consideration of $29.5

million, consisting of $0.8 million of cash, $9.0 million of

preferred shares of Saltire, and $19.7 million of common shares of

Saltire.

Prior to the Closing, Strong Global did not own

or control any securities of Saltire. Strong Global received

1,972,723 common shares and 900,000 series A preferred shares of

Saltire as consideration under the transaction.

Strong Global may acquire additional securities

including on the open market or through private acquisitions or

sell the securities including on the open market or through private

dispositions in the future depending on market conditions, general

economic and industry conditions, Saltire’s business and financial

condition, and/or other relevant factors, and Strong Global may

develop such plans or intentions in the future.

A copy of the Early Warning Report to be filed

by Strong Global in connection with the transaction described above

will be available on its SEDAR+ profile at www.sedarplus.ca.

About Strong Global Entertainment,

Inc.

Strong Global Entertainment, Inc., a majority

owned subsidiary of Fundamental Global Inc., is a leader in the

entertainment industry, providing mission critical products and

services to cinema exhibitors and entertainment venues for over 90

years.

About Fundamental Global

Inc.

Fundamental Global Inc. (Nasdaq: FGF, FGFPP) and

its subsidiaries engage in diverse business activities including

reinsurance, asset management, merchant banking, manufacturing and

managed services.

The FG® logo and Fundamental

Global® are registered trademarks of Fundamental Global

LLC.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These statements are therefore entitled to the protection of the

safe harbor provisions of these laws. These statements may be

identified by the use of forward-looking terminology such as

“anticipate,” “believe,” “budget,” “can,” “contemplate,”

“continue,” “could,” “envision,” “estimate,” “expect,” “evaluate,”

“forecast,” “goal,” “guidance,” “indicate,” “intend,” “likely,”

“may,” “might,” “outlook,” “plan,” “possibly,” “potential,”

“predict,” “probable,” “probably,” “pro-forma,” “project,” “seek,”

“should,” “target,” “view,” “will,” “would,” “will be,” “will

continue,” “will likely result” or the negative thereof or other

variations thereon or comparable terminology. In particular,

discussions and statements regarding the Company’s future business

plans and initiatives are forward-looking in nature. We have based

these forward-looking statements on our current expectations,

assumptions, estimates, and projections. While we believe these to

be reasonable, such forward-looking statements are only predictions

and involve a number of risks and uncertainties, many of which are

beyond our control. These and other important factors may cause our

actual results, performance, or achievements to differ materially

from any future results, performance or achievements expressed or

implied by these forward-looking statements, and may impact our

ability to implement and execute on our future business plans and

initiatives. Management cautions that the forward-looking

statements in this release are not guarantees of future

performance, and we cannot assume that such statements will be

realized or the forward-looking events and circumstances will

occur. Factors that might cause such a difference include, without

limitation: risks associated with our inability to identify and

realize business opportunities, and the undertaking of any new such

opportunities; our lack of operating history or established

reputation in the reinsurance industry; our inability to obtain or

maintain the necessary approvals to operate reinsurance

subsidiaries; risks associated with operating in the reinsurance

industry, including inadequately priced insured risks, credit risk

associated with brokers we may do business with, and inadequate

retrocessional coverage; our inability to execute on our investment

and investment management strategy, including our strategy to

invest in the risk capital of special purpose acquisition companies

(SPACs); our ability to maintain and expand our revenue streams to

compensate for the lower demand for our digital cinema products and

installation services; potential interruptions of supplier

relationships or higher prices charged by suppliers in connection

with our Strong Global business; our ability to successfully

compete and introduce enhancements and new features that achieve

market acceptance and that keep pace with technological

developments; our ability to maintain Strong Global’s brand and

reputation and retain or replace its significant customers;

challenges associated with Strong Global’s long sales cycles; the

impact of a challenging global economic environment or a downturn

in the markets; the effects of economic, public health, and

political conditions that impact business and consumer confidence

and spending, including rising interest rates, periods of

heightened inflation and market instability; potential loss of

value of investments; risk of becoming an investment company;

fluctuations in our short-term results as we implement our new

business strategy; risks of being unable to attract and retain

qualified management and personnel to implement and execute on our

business and growth strategy; failure of our information technology

systems, data breaches and cyber-attacks; our ability to establish

and maintain an effective system of internal controls; our limited

operating history as a public company; the requirements of being a

public company and losing our status as a smaller reporting company

or becoming an accelerated filer; any potential conflicts of

interest between us and our controlling stockholders and different

interests of controlling stockholders; potential conflicts of

interest between us and our directors and executive officers; risks

associated with our related party transactions and investments; and

risks associated with our investments in SPACs, including the

failure of any such SPAC to complete its initial business

combination. Our expectations and future plans and initiatives may

not be realized. If one of these risks or uncertainties

materializes, or if our underlying assumptions prove incorrect,

actual results may vary materially from those expected, estimated

or projected. You are cautioned not to place undue reliance on

forward-looking statements. The forward-looking statements are made

only as of the date hereof and do not necessarily reflect our

outlook at any other point in time. We do not undertake and

specifically decline any obligation to update any such statements

or to publicly announce the results of any revisions to any such

statements to reflect new information, future events or

developments.

Investor Relations

Contacts:IR@strong-entertainment.com

investors@fundamentalglobal.com

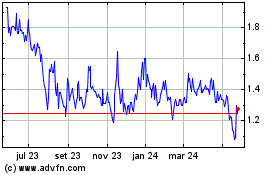

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

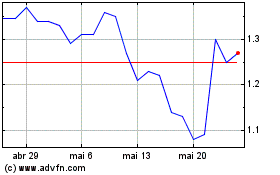

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024