Greenlight Capital Re, Ltd. (NASDAQ: GLRE) (“Greenlight Re” or the

“Company”) today reported its financial results for the fourth

quarter and year-ended December 31, 2023.

Fourth Quarter 2023 Highlights (all comparisons

are to fourth quarter 2022 unless noted otherwise):

- Gross premiums written decreased

11.8% to $112.3 million;

- Net premiums earned increased 23.4%

to $137.4 million;

- Underwriting income of $11.8

million compared to $6.5 million;

- Net income of $17.6 million, or

$0.50 per diluted ordinary share, compared to $34.8 million, or

$0.91 per diluted ordinary share;

- Combined ratio of 91.4%, compared

to 94.2%;

- Total investment income of $13.6

million, compared to $32.5 million; and

- Fully diluted book value per share

increased $0.59, or 3.7%, to $16.74, from $16.15 at

September 30, 2023.

Full Year 2023 Highlights (all

comparisons are to full year 2022):

- Gross premiums written increased

13.1% to $636.8 million;

- Net premiums earned increased 24.2%

to $583.1 million;

- Underwriting income of $32.0

million compared to an underwriting loss of $10.7 million;

- Net income of $86.8 million, or

$2.50 per diluted ordinary share, compared to $25.3 million, or

$0.73 per diluted ordinary share;

- Combined ratio of 94.5%, compared

to 102.3%;

- Total investment income of $66.1

million, compared to $69.0 million; and

- Fully diluted book value per share

increased $2.41, or 16.8%, to $16.74, from $14.33 at December 31,

2022.

Greg Richardson, Chief Executive Officer of Greenlight Re,

stated, “The Company ended the year with robust growth in fully

diluted book value per share, driven by strong performance on both

sides of the balance sheet.”

David Einhorn, Chairman of the Board of Directors, said, “2023

was a milestone year for the company with solid returns on both our

underwriting and investing activities. We successfully executed

several executive management transitions and believe we are well

positioned going into 2024.”

Fourth Quarter 2023 Results

Gross premiums written in the fourth quarter of

2023 were $112.3 million, compared to $127.4 million in the fourth

quarter of 2022. The $15.1 million decrease, or 11.8%, was

timing-related primarily due to premium adjustments recorded in the

fourth quarter based on revised premium estimates and updated

reporting received from cedents. Earned premiums increased by $26.1

million, or 23.4%, to $137.4 million as the growth in premiums

written throughout 2023 continued to earn out.

The Company recognized net underwriting income

of $11.8 million in the fourth quarter of 2023. By comparison, the

equivalent period in 2022 recognized net underwriting income of

$6.5 million. The combined ratio for the fourth quarter of 2023 was

91.4%, compared to 94.2% for the equivalent period in 2022. The

current-year loss ratio improved by 3.8%, driven by improved

pricing on the in-force underwriting book.

The Company’s total investment income during the

fourth quarter of 2023 was $13.6 million. The Company’s investment

in the Solasglas fund, managed by DME Advisors, returned 0.3%,

representing net income of $0.9 million. The Company reported $12.7

million of other investment income, primarily from interest earned

on its restricted cash and cash equivalents.

The Company reported foreign exchange gains $3.9

million during the fourth quarter of 2023, due primarily to the

pound sterling strengthening.

The net income of $17.6 million contributed to

the 3.7% increase in fully diluted book value per share for the

quarter, which increased to $16.74 per share at December 31,

2023.

Full Year 2023 Results

Gross premiums written were $636.8 million for

the year ended December 31, 2023, an increase of $73.6 million, or

13.1%, compared to the comparable 2022 period. The increase was

across all three categories as Property, Casualty, and Specialty

premiums written increased 32.8%, 8.0%, and 12.9%,

respectively.

Net premiums earned were $583.1 million for the

year ended December 31, 2023, an increase of $113.7 million, or

24.2%, compared to the equivalent 2022 period.

The Company reported an underwriting income for

the year ended December 31, 2023, of $32.0 million, which equates

to a combined ratio of 94.5%. The equivalent 2022 period incurred

an underwriting loss of $10.7 million, representing a combined

ratio of 102.3%. The underwriting income for the year ended

December 31, 2023, was driven primarily by lower catastrophe losses

and favorable pricing in 2023, partially offset by strengthened

reserves relating to prior years. By comparison, the underwriting

loss for the year ended December 31, 2022, included losses related

to the Russian-Ukrainian conflict and various natural catastrophe

events.

Total investment income for the year ended

December 31, 2023, was $66.1 million, compared to $69.0 million

during the equivalent 2022 period. The Company’s investment in the

Solasglas fund generated income of $28.7 million for the year ended

December 31, 2023, compared to $54.8 million during the equivalent

2022 period.

The Company reported foreign exchange gains of

$11.6 million during the year ended December 31, 2023, due

primarily to the pound sterling strengthening.

The net income of $86.8 million contributed to

the 16.8% increase in fully diluted book value per share for the

year, which increased to $16.74 per share at December 31,

2023.

The following table summarizes the components of

our combined ratio.

| |

|

Fourth Quarter |

|

Full Year |

|

Underwriting ratios |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Loss ratio - current year |

|

54.7 |

% |

|

58.5 |

% |

|

59.8 |

% |

|

67.4 |

% |

| Loss ratio - prior year |

|

0.5 |

% |

|

(1.3) |

% |

|

1.9 |

% |

|

— |

% |

| Loss ratio |

|

55.2 |

% |

|

57.2 |

% |

|

61.7 |

% |

|

67.4 |

% |

| Acquisition cost ratio |

|

30.7 |

% |

|

33.3 |

% |

|

29.0 |

% |

|

30.5 |

% |

| Composite ratio |

|

85.9 |

% |

|

90.5 |

% |

|

90.7 |

% |

|

97.9 |

% |

| Underwriting expense

ratio |

|

5.5 |

% |

|

3.7 |

% |

|

3.8 |

% |

|

4.4 |

% |

| Combined ratio |

|

91.4 |

% |

|

94.2 |

% |

|

94.5 |

% |

|

102.3 |

% |

Greenlight Capital Re, Ltd. Fourth

Quarter and Year-End 2023 Earnings Call

Greenlight Re will host a live conference call

to discuss its financial results on Wednesday, March 6, 2024,

at 9:00 a.m. Eastern Time. Dial-in details:

U.S. toll free

1-877-407-9753 International 1-201-493-6739

The conference call can also be accessed via

webcast at:

https://event.webcasts.com/starthere.jsp?ei=1654363&tp_key=08652ad3de

A telephone replay will be available following

the call through March 11, 2024. The replay of the call

may be accessed by dialing 1-877-660-6853 (U.S. toll free) or

1-201-612-7415 (international), access code 13744164. An audio file

of the call will also be available on the Company’s website,

www.greenlightre.com.

Non-GAAP Financial Measures In

presenting the Company’s results, management has included financial

measures that are not calculated under standards or rules that

comprise accounting principles generally accepted in the United

States (GAAP). Such measures, including basic book value per share,

fully diluted book value per share, and net underwriting income

(loss), are referred to as non-GAAP measures. These non-GAAP

measures may be defined or calculated differently by other

companies. Management believes these measures allow for a more

thorough understanding of the underlying business. These non-GAAP

measures may not be comparable to similarly titled measures

reported by other companies and should be used to monitor our

results and should be considered in addition to, and not viewed as

a substitute for those measures determined in accordance with GAAP.

Reconciliations of such measures to the most comparable GAAP

figures are included in the attached financial information in

accordance with Regulation G.

Forward-Looking Statements This

news release contains forward-looking statements concerning

Greenlight Capital Re, Ltd. and/or its subsidiaries (the “Company”)

within the meaning of the U.S. federal securities laws. We intend

these forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements in the U.S. federal

securities laws. These statements involve risks and uncertainties

that could cause actual results to differ materially from those

contained in forward-looking statements made on the Company’s

behalf. These risks and uncertainties include a downgrade or

withdrawal of our A.M. Best ratings; any suspension or revocation

of any of our licenses; losses from catastrophes; the loss of

significant brokers; the performance of Solasglas Investments, LP;

the carry values of our investments made under our Greenlight Re

Innovations pillar may differ significantly from those that would

be used if we carried these investments at fair value; and other

factors described in our most recent Annual Report on Form 10-K

filed with the Securities and Exchange Commission (“SEC”) on March

5, 2024, as those factors may be updated from time to time in our

periodic and other filings with the SEC, which are accessible on

the SEC’s website at www.sec.gov. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements, which speak only as to the date of this release,

whether as a result of new information, future events, or

otherwise, except as provided by law.

About Greenlight Capital Re,

Ltd.Greenlight Re (www.greenlightre.com) provides

multiline property and casualty insurance and reinsurance through

its licensed and regulated reinsurance entities in the Cayman

Islands and Ireland, and its Lloyd’s platform, Greenlight

Innovation Syndicate 3456. The Company complements its underwriting

activities with a non-traditional investment approach designed to

achieve higher rates of return over the long term than reinsurance

companies that exclusively employ more traditional investment

strategies. The Company’s innovations unit, Greenlight Re

Innovations, supports technology innovators in the (re)insurance

space by providing investment capital, risk capacity, and access to

a broad insurance network.

Investor Relations ContactKarin DalyVice

President, The Equity Group Inc. (212)

836-9623IR@greenlightre.ky

GREENLIGHT CAPITAL RE,

LTD.CONSOLIDATED BALANCE

SHEETS

(expressed in thousands of U.S. dollars,

except per share and share amounts)

| |

December 31, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Investments |

|

|

|

|

Investment in related party investment fund, at fair value |

$ |

258,890 |

|

$ |

178,197 |

| Other investments |

|

73,293 |

|

|

70,279 |

| Total investments |

|

332,183 |

|

|

248,476 |

| Cash and cash equivalents |

|

51,082 |

|

|

38,238 |

| Restricted cash and cash

equivalents |

|

604,648 |

|

|

668,310 |

| Reinsurance balances

receivable (net of allowance for expected credit losses) |

|

619,401 |

|

|

505,555 |

| Loss and loss adjustment

expenses recoverable (net of allowance for expected credit

losses) |

|

25,687 |

|

|

13,239 |

| Deferred acquisition

costs |

|

79,956 |

|

|

82,391 |

| Unearned premiums ceded |

|

17,261 |

|

|

18,153 |

| Other assets |

|

5,089 |

|

|

6,019 |

| Total

assets |

$ |

1,735,307 |

|

$ |

1,580,381 |

| Liabilities and

equity |

|

|

|

|

Liabilities |

|

|

|

| Loss and loss adjustment

expense reserves |

$ |

661,554 |

|

$ |

555,468 |

| Unearned premium reserves |

|

306,310 |

|

|

307,820 |

| Reinsurance balances

payable |

|

68,983 |

|

|

105,135 |

| Funds withheld |

|

17,289 |

|

|

21,907 |

| Other liabilities |

|

11,795 |

|

|

6,397 |

| Debt |

|

73,281 |

|

|

80,534 |

| Total

liabilities |

|

1,139,212 |

|

|

1,077,261 |

| Shareholders'

equity |

|

|

|

| Ordinary share capital (par

value $0.10; authorized, 125,000,000; issued and outstanding,

35,336,732 (2022: Class A: par value $0.10; authorized,

100,000,000; issued and outstanding, 28,569,346: Class B: 2022: par

value $0.10; authorized, 25,000,000; issued and outstanding,

6,254,715) |

$ |

3,534 |

|

$ |

3,482 |

| Additional paid-in

capital |

|

484,532 |

|

|

478,439 |

| Retained earnings |

|

108,029 |

|

|

21,199 |

| Total shareholders'

equity |

|

596,095 |

|

|

503,120 |

| Total liabilities and

equity |

$ |

1,735,307 |

|

$ |

1,580,381 |

GREENLIGHT CAPITAL RE,

LTD.CONSOLIDATED RESULTS OF

OPERATIONS(UNAUDITED)

(expressed in thousands of U.S. dollars,

except percentages and per share amounts)

| |

Three months ended December 31 |

|

Year ended December 31 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Underwriting

revenue |

|

|

|

|

|

|

|

| Gross premiums written |

$ |

112,338 |

|

|

$ |

127,359 |

|

|

$ |

636,810 |

|

|

$ |

563,171 |

|

| Gross premiums ceded |

|

(7,022 |

) |

|

|

(11,456 |

) |

|

|

(42,762 |

) |

|

|

(33,429 |

) |

| Net premiums written |

|

105,316 |

|

|

|

115,903 |

|

|

|

594,048 |

|

|

|

529,742 |

|

| Change in net unearned premium

reserves |

|

32,129 |

|

|

|

(4,518 |

) |

|

|

(10,901 |

) |

|

|

(60,265 |

) |

| Net premiums earned |

$ |

137,445 |

|

|

$ |

111,385 |

|

|

$ |

583,147 |

|

|

$ |

469,477 |

|

| Underwriting related

expenses |

|

|

|

|

|

|

|

| Net loss and loss adjustment

expenses incurred: |

|

|

|

|

|

|

|

|

Current year |

$ |

75,228 |

|

|

$ |

65,135 |

|

|

$ |

348,798 |

|

|

$ |

316,367 |

|

|

Prior year |

|

704 |

|

|

|

(1,440 |

) |

|

|

11,206 |

|

|

|

118 |

|

| Net loss and loss adjustment

expenses incurred |

|

75,932 |

|

|

|

63,696 |

|

|

|

360,004 |

|

|

|

316,485 |

|

| Acquisition costs |

|

42,175 |

|

|

|

37,047 |

|

|

|

168,877 |

|

|

|

143,148 |

|

| Underwriting expenses |

|

5,541 |

|

|

|

3,779 |

|

|

|

19,587 |

|

|

|

13,813 |

|

| Deposit interest expense |

|

2,042 |

|

|

|

344 |

|

|

|

2,687 |

|

|

|

6,717 |

|

| Net underwriting

income (loss)(1) |

$ |

11,755 |

|

|

$ |

6,519 |

|

|

$ |

31,992 |

|

|

$ |

(10,686 |

) |

| |

|

|

|

|

|

|

|

| Income from investment in

SILP |

$ |

905 |

|

|

$ |

30,370 |

|

|

$ |

28,696 |

|

|

$ |

54,844 |

|

| Net investment income |

|

12,662 |

|

|

|

2,161 |

|

|

|

37,367 |

|

|

|

14,139 |

|

| Total investment

income |

$ |

13,567 |

|

|

$ |

32,531 |

|

|

$ |

66,063 |

|

|

$ |

68,983 |

|

| |

|

|

|

|

|

|

|

| Corporate expenses |

$ |

9,833 |

|

|

$ |

5,100 |

|

|

$ |

23,653 |

|

|

$ |

17,793 |

|

| Other (income) expense,

net |

|

(4,473 |

) |

|

|

(1,597 |

) |

|

|

(17,872 |

) |

|

|

11,777 |

|

| Interest expense |

|

2,367 |

|

|

|

790 |

|

|

|

5,344 |

|

|

|

4,201 |

|

| Income tax expense

(benefit) |

|

(11 |

) |

|

|

7 |

|

|

|

100 |

|

|

|

(816 |

) |

| Net

income |

$ |

17,606 |

|

|

$ |

34,750 |

|

|

$ |

86,830 |

|

|

$ |

25,342 |

|

| |

|

|

|

|

|

|

|

| Earnings per

share |

|

|

|

|

|

|

|

| Basic |

$ |

0.52 |

|

|

$ |

1.02 |

|

|

$ |

2.55 |

|

|

$ |

0.75 |

|

| Diluted |

$ |

0.50 |

|

|

$ |

0.91 |

|

|

$ |

2.50 |

|

|

$ |

0.73 |

|

1 Net underwriting income (loss) is a non-GAAP financial

measure. See “Key Financial Measures and Non-GAAP Measures” below

for discussion and reconciliation of non-GAAP financial

measures.

The following tables present the Company’s net premiums earned

and underwriting ratios by line of business:

| |

Three months ended December 31 |

|

Three months ended December 31 |

| |

|

2023 |

|

|

|

2022 |

|

| |

Property |

|

Casualty |

|

Other |

|

Total |

|

Property |

|

Casualty |

|

Other |

|

Total |

| |

($ in thousands except percentage) |

|

Net premiums earned |

$ |

22,685 |

|

|

$ |

72,121 |

|

|

$ |

42,639 |

|

|

$ |

137,445 |

|

|

$ |

14,820 |

|

|

$ |

64,498 |

|

|

$ |

32,067 |

|

|

$ |

111,385 |

|

| Underwriting

ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss ratio |

|

44.8 |

% |

|

|

71.6 |

% |

|

|

33.2 |

% |

|

|

55.2 |

% |

|

|

82.6 |

% |

|

|

70.9 |

% |

|

|

17.9 |

% |

|

|

57.2 |

% |

| Acquisition cost ratio |

|

19.3 |

|

|

|

28.5 |

|

|

|

40.4 |

|

|

|

30.7 |

|

|

|

21.3 |

|

|

|

30.1 |

|

|

|

45.1 |

|

|

|

33.3 |

|

| Composite ratio |

|

64.1 |

% |

|

|

100.1 |

% |

|

|

73.6 |

% |

|

|

85.9 |

% |

|

|

103.9 |

% |

|

|

101.0 |

% |

|

|

63.0 |

% |

|

|

90.5 |

% |

| Underwriting expense

ratio |

|

|

|

|

|

|

|

5.5 |

|

|

|

|

|

|

|

|

|

3.7 |

|

| Combined ratio |

|

|

|

|

|

|

|

91.4 |

% |

|

|

|

|

|

|

|

|

94.2 |

% |

| |

Year ended December 31 |

|

Year ended December 31 |

| |

|

2023 |

|

|

|

2022 |

|

| |

Property |

|

Casualty |

|

Other |

|

Total |

|

Property |

|

Casualty |

|

Other |

|

Total |

| |

($ in thousands except percentage) |

|

Net premiums earned |

$ |

86,539 |

|

|

$ |

331,196 |

|

|

$ |

165,412 |

|

|

$ |

583,147 |

|

|

$ |

52,397 |

|

|

$ |

289,820 |

|

|

$ |

127,260 |

|

|

$ |

469,477 |

|

| Underwriting

ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss ratio |

|

72.0 |

% |

|

|

68.0 |

% |

|

|

43.8 |

% |

|

|

61.7 |

% |

|

|

78.0 |

% |

|

|

71.0 |

% |

|

|

55.0 |

% |

|

|

67.4 |

% |

| Acquisition cost ratio |

|

18.7 |

|

|

|

30.5 |

|

|

|

31.3 |

|

|

|

29.0 |

|

|

|

22.2 |

|

|

|

29.0 |

|

|

|

37.4 |

|

|

|

30.5 |

|

| Composite ratio |

|

90.7 |

% |

|

|

98.5 |

% |

|

|

75.1 |

% |

|

|

90.7 |

% |

|

|

100.2 |

% |

|

|

100.0 |

% |

|

|

92.4 |

% |

|

|

97.9 |

% |

| Underwriting expense

ratio |

|

|

|

|

|

|

|

3.8 |

|

|

|

|

|

|

|

|

|

4.4 |

|

| Combined ratio |

|

|

|

|

|

|

|

94.5 |

% |

|

|

|

|

|

|

|

|

102.3 |

% |

GREENLIGHT CAPITAL RE,

LTD.KEY FINANCIAL MEASURES AND NON-GAAP

MEASURES

Management uses certain key financial measures,

some of which are not prescribed under U.S. GAAP rules and

standards (“non-GAAP financial measures”), to evaluate our

financial performance, financial position, and the change in

shareholder value. Generally, a non-GAAP financial measure, as

defined in SEC Regulation G, is a numerical measure of a company’s

historical or future financial performance, financial position, or

cash flows that either excludes or includes amounts that are not

normally excluded or included in the most directly comparable

measure calculated and presented under U.S. GAAP. We believe that

these measures, which may be calculated or defined differently by

other companies, provide consistent and comparable metrics of our

business performance to help shareholders understand performance

trends and facilitate a more thorough understanding of the

Company’s business. Non-GAAP financial measures should not be

viewed as substitutes for those determined under U.S. GAAP.

The key non-GAAP financial measures used in this

Annual Report are:

- Fully diluted book value per share;

and

- Net underwriting income

(loss).

These non-GAAP financial measures are described

below.

Fully Diluted Book Value Per Share

Our primary financial goal is to increase fully

diluted book value per share over the long term. We use fully

diluted book value as a financial measure in our incentive

compensation plan.

We believe that long-term growth in fully

diluted book value per share is the most relevant measure of our

financial performance because it provides management and investors

a yardstick to monitor the shareholder value generated. Fully

diluted book value per share may also help our investors,

shareholders, and other interested parties form a basis of

comparison with other companies within the property and casualty

reinsurance industry. Fully diluted book value per share should not

be viewed as a substitute for the most comparable U.S. GAAP

measure, which in our view is the basic book value per share.

We calculate basic book value per share as (a)

ending shareholders' equity, divided by (b) the total ordinary

shares issued and outstanding, as reported in the consolidated

financial statements. In prior years, we calculated the basic book

value per share by modifying the denominator to exclude unearned

performance-based restricted shares granted after December 31,

2021. We have revised this calculation in 2023 to eliminate the

basic book value per share non-GAAP financial measure and have

restated the 2022 comparative basic book value per share in the

table below and elsewhere in this Annual Report to conform with the

current presentation.

Fully diluted book value per share represents

basic book value per share combined with any dilutive impact of

in-the-money stock options and all outstanding restricted stock

units “RSUs”. We believe these adjustments better reflect the

ultimate dilution to our shareholders.

The following table presents a reconciliation of

the fully diluted book value per share to basic book value per

share (the most directly comparable U.S. GAAP financial

measure):

| |

December 31, 2023 |

|

September 30, 2023 |

|

June 30, 2023 |

|

March 31, 2023 |

December 31, 2022 |

| Numerator for

basic and fully diluted book value per share: |

|

|

|

|

|

|

|

|

|

Total equity as reported under U.S. GAAP |

$ |

596,095 |

|

$ |

575,865 |

|

$ |

561,121 |

|

$ |

510,041 |

$ |

503,120 |

| Denominator for basic

and fully diluted book value per share: |

|

|

|

|

|

|

|

|

| Ordinary shares issued

and outstanding as reported and denominator for basic

book value per share |

|

35,336,732 |

|

|

35,337,407 |

|

|

35,272,013 |

|

|

35,262,678 |

|

34,824,061 |

| Add: In-the-money stock

options and all outstanding RSUs |

|

264,870 |

|

|

312,409 |

|

|

312,409 |

|

|

312,409 |

|

277,960 |

| Denominator for fully diluted

book value per share |

|

35,601,602 |

|

|

35,649,816 |

|

|

35,584,422 |

|

|

35,575,087 |

|

35,102,021 |

| |

|

|

|

|

|

|

|

|

| Basic book value per

share |

$ |

16.87 |

|

$ |

16.30 |

|

$ |

15.91 |

|

$ |

14.46 |

$ |

14.45 |

| Fully diluted book

value per share |

$ |

16.74 |

|

$ |

16.15 |

|

$ |

15.77 |

|

$ |

14.34 |

$ |

14.33 |

Net Underwriting Income (Loss)

One way that we evaluate the Company’s

underwriting performance is by measuring net underwriting income

(loss). We do not use premiums written as a measure of performance.

Net underwriting income (loss) is a performance measure used by

management to evaluate the fundamentals underlying the Company’s

underwriting operations. We believe that the use of net

underwriting income (loss) enables investors and other users of the

Company’s financial information to analyze our performance in a

manner similar to how management analyzes performance. Management

also believes this measure follows industry practice and allows the

users of financial information to compare the Company’s performance

with that of our industry peer group.

Net underwriting income (loss) is considered a

non-GAAP financial measure because it excludes items used to

calculate net income before taxes under U.S. GAAP. We calculate net

underwriting income (loss) as net premiums earned less net loss and

loss adjustment expenses, acquisition costs, underwriting expenses

(including related G&A expenses), and deposit interest expense.

The measure excludes, on a recurring basis: (1) investment income

(loss); (2) other income (expense) not related to underwriting,

including foreign exchange gains or losses, and Lloyd’s interest

income and expense; (3) corporate G&A expenses; and (4)

interest expense. We exclude total investment income or loss,

foreign exchange gains or losses, and Lloyd’s interest income or

expense as we believe these items are influenced by market

conditions and other factors unrelated to underwriting decisions.

Additionally, we exclude corporate G&A and interest expenses

because these costs are generally fixed and not incremental to or

directly related to our underwriting operations. We believe all of

these amounts are largely independent of our underwriting process,

and including them could hinder the analysis of trends in our

underwriting operations. Net underwriting income (loss) should not

be viewed as a substitute for U.S. GAAP net income before income

taxes.

The reconciliations of net underwriting income (loss) to income

(loss) before income taxes (the most directly comparable U.S. GAAP

financial measure) on a consolidated basis are shown below:

| |

Three months ended December 31 |

|

Year ended December 31 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

($ in thousands) |

| Income (loss) before income

tax |

$ |

17,595 |

|

|

$ |

34,757 |

|

|

$ |

86,930 |

|

|

$ |

24,526 |

|

| Add (subtract): |

|

|

|

|

|

|

|

|

Total investment (income) loss |

|

(13,567 |

) |

|

|

(32,531 |

) |

|

|

(66,063 |

) |

|

|

(68,983 |

) |

|

Other non-underwriting (income) expense |

|

(4,473 |

) |

|

|

(1,597 |

) |

|

|

(17,872 |

) |

|

|

11,777 |

|

|

Corporate expenses |

|

9,833 |

|

|

|

5,100 |

|

|

|

23,653 |

|

|

|

17,793 |

|

|

Interest expense |

|

2,367 |

|

|

|

790 |

|

|

|

5,344 |

|

|

|

4,201 |

|

| Net underwriting income

(loss) |

$ |

11,755 |

|

|

$ |

6,519 |

|

|

$ |

31,992 |

|

|

$ |

(10,686 |

) |

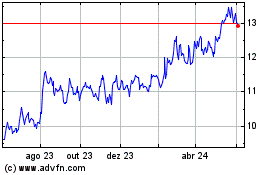

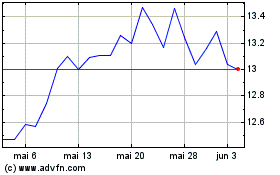

Greenlight Capital Re (NASDAQ:GLRE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Greenlight Capital Re (NASDAQ:GLRE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024