Investors Title Company today announced results for the fourth

quarter and year ended December 31, 2022. For the quarter, net

income decreased 60.2% to $7.5 million, or $3.97 per diluted share,

versus $18.9 million, or $9.94 per diluted share, in the prior year

period. For the year, net income decreased 64.3% to $23.9 million,

or $12.59 per diluted share, versus $67.0 million, or $35.28 per

diluted share, in the prior year.

Revenues for the quarter decreased 28.1% to $65.5 million,

compared to $91.0 million in the prior year period, primarily as a

result of a 32.1% decrease in net premiums written, a $5.9 million

decrease in the change in the estimated fair value of equity

security investments, and a loss in other investments. These

factors were partially offset by net realized gains in our equity

portfolio, increases in escrow fees and other title-related fees,

and higher levels of revenue derived from non-title services. The

reduction in net premiums written is attributable to an overall

decline in the level of real estate transaction volumes resulting

from higher average mortgage interest rates. Although overall

premium revenue declined, escrow and other title-related fees

increased 27.1% due to an increase in business in markets that

generate escrow income, and fee income associated with commercial

activity. Revenues from non-title services increased 97.8% due to

increases in income from like-kind exchange revenues. Realized

gains from sales of equity securities were $2.4 million higher than

the prior year quarter.

Operating expenses decreased 16.3% compared to the prior year

quarter, mainly due to a 39.5% decline in commissions to agents

commensurate with the decrease in agent premium volume. Personnel

expenses were 29.5% higher than the prior year due to staffing of

new offices and hiring to support growth initiatives. Office

expenses increased 11.8% in support of expanding our geographic

footprint.

Income before income taxes decreased 61.2% to $9.3 million

compared with $23.9 million for the prior year quarter. Excluding

the impact of changes in the estimated fair value of equity

security investments, adjusted income before income taxes

(non-GAAP) decreased 53.7% to $7.5 million versus $16.2 million for

the prior year period (see Appendix A for a reconciliation of this

non-GAAP measure to the most directly comparable GAAP measure).

For the year, revenues decreased 14.0% to $283.4 million

compared with $329.5 million for the prior year. Operating expenses

increased 3.6% to $253.3 million compared with $244.6 million for

the prior year period, mainly due to increases in personnel and

office, technology and other operating expenses, partially offset

by a decrease in commissions. Income before income taxes decreased

64.6% to $30.1 million compared with $84.9 million for the prior

year. Excluding the impact of changes in the estimated fair value

of equity security investments, adjusted income before income taxes

(non-GAAP) decreased 27.0% to $51.1 million versus $70.0 million

for the prior year (see Appendix A for a reconciliation of this

non-GAAP measure to the most directly comparable GAAP measure).

Aside from a non-recurring gain on the sale of property in the

prior year period and an increase in technology and other operating

expenses, overall results for the year-to-date period have been

shaped predominantly by the same factors that affected the fourth

quarter.

Chairman J. Allen Fine commented, “The impact of Federal Reserve

efforts to fight inflation by slowing economic activity came into

sharper focus in the fourth quarter. The rapid rise in mortgage

interest rates over the course of the year and the appreciation in

home prices in recent years combined to dampen financial results

for the fourth quarter relative to the record performance of the

prior year. Home prices have increased nearly 40% following the

pandemic, and mortgage rates doubled since the beginning of 2022.

Although home prices in most of our key markets seem to be largely

holding steady, transaction volumes were more impacted by these

recent trends.

“Despite these challenging economic conditions, we reported

another year of solid operating results in 2022. The level of

claims activity remained low, and we are seeing a partial offset to

Fed policy in the opportunity to earn a higher level of return on

our investment portfolio from the highest level of interest rates

available in over a decade. Operationally we are also benefitting

from growth initiatives of the last several years.

“While we expect these market headwinds to persist for a while,

there are some positive signs on the horizon. Inflation data has

moderated in recent months and this recent trend may enable the Fed

to moderate or cease its inflation fighting program in the upcoming

months. In anticipation of this, mortgage rates have already fallen

slightly from their peak in December. We believe this should help

affordability and provide support to the market going forward.

“Real estate markets are cyclical in nature due in part to

sensitivity to changes in interest rates and their impact on

borrowing costs. Downturns in market activity require companies to

make appropriate adjustments. We are focused on maintaining a

disciplined management approach balancing both the need for shorter

term cost control with an appropriate level of investment in longer

term growth opportunities.”

Investors Title Company’s subsidiaries issue and underwrite

title insurance policies. The Company also provides investment

management services and services in connection with tax-deferred

exchanges of like-kind property.

-----------------------------------------------------------------------------------------------------------------------------

Cautionary Statements Regarding

Forward-Looking Statements

Certain statements contained herein constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements may be identified by the use

of words such as “plan,” expect,” “aim,” “believe,” “project,”

“anticipate,” “intend,” “estimate,” “should,” “could,” “would,” and

other expressions that indicate future events and trends. Such

statements include, among others, any statements regarding the

Company’s expected performance for this year, future home price

fluctuations, changes in home purchase or refinance demand,

activity and the mix thereof, interest rate changes, expansion of

the Company’s market presence, enhancing competitive strengths,

development in housing affordability, wages, unemployment or

overall economic conditions or statements regarding our actuarial

assumptions and the application of recent historical claims

experience to future periods. These statements involve a number of

risks and uncertainties that could cause actual results to differ

materially from anticipated and historical results. Such risks and

uncertainties include, without limitation: the cyclical demand for

title insurance due to changes in the residential and commercial

real estate markets; the occurrence of fraud, defalcation or

misconduct; variances between actual claims experience and

underwriting and reserving assumptions, including the limited

predictive power of historical claims experience; declines in the

performance of the Company’s investments; government regulations;

changes in the economy; the potential impact of inflation and

responses by government regulators, including the Federal Reserve;

the impact of the COVID-19 pandemic (including any of its variants)

on the economy and the Company’s business; loss of agency

relationships, or significant reductions in agent-originated

business; difficulties managing growth, whether organic or through

acquisitions and other considerations set forth under the caption

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2021 as filed with the Securities and

Exchange Commission, and in subsequent filings.

Investors Title Company and

Subsidiaries

Consolidated Statements of

Operations

For the Three and Twelve

Months Ended December 31, 2022 and 2021

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2022

2021

2022

2021

Revenues:

Net premiums written

$

49,223

$

72,536

$

248,632

$

273,885

Escrow and other title-related fees

4,485

3,530

21,721

13,678

Non-title services

5,410

2,735

14,524

9,667

Interest and dividends

1,649

966

4,704

3,773

Other investment (loss) income

(720

)

2,310

3,896

6,920

Net realized investment gains

3,469

1,098

9,735

1,869

Changes in the estimated fair value of

equity security investments

1,761

7,668

(20,961

)

14,934

Other

217

200

1,141

4,772

Total Revenues

65,494

91,043

283,392

329,498

Operating Expenses:

Commissions to agents

24,405

40,357

121,566

142,815

Provision for claims

803

666

4,255

5,686

Personnel expenses

21,593

16,669

85,331

64,193

Office and technology expenses

4,393

3,931

17,323

13,059

Other expenses

5,026

5,528

24,809

18,813

Total Operating Expenses

56,220

67,151

253,284

244,566

Income before Income Taxes

9,274

23,892

30,108

84,932

Provision for Income Taxes

1,748

4,980

6,205

17,912

Net Income

$

7,526

$

18,912

$

23,903

$

67,020

Basic Earnings per Common Share

$

3.97

$

9.98

$

12.60

$

35.38

Weighted Average Shares Outstanding –

Basic

1,897

1,895

1,897

1,894

Diluted Earnings per Common

Share

$

3.97

$

9.94

$

12.59

$

35.28

Weighted Average Shares Outstanding –

Diluted

1,897

1,903

1,898

1,900

Investors Title Company and

Subsidiaries

Consolidated Balance

Sheets

As of December 31, 2022 and

2021

(in thousands)

(unaudited)

December 31,

2022

December 31, 2021

Assets

Cash and cash equivalents

$

35,311

$

37,168

Investments:

Fixed maturity securities,

available-for-sale, at fair value

53,989

79,791

Equity securities, at fair value

51,691

76,853

Short-term investments

103,649

45,930

Other investments

18,368

20,298

Total investments

227,697

222,872

Premiums and fees receivable

19,047

22,953

Accrued interest and dividends

872

817

Prepaid expenses and other receivables

11,095

11,721

Property, net

17,785

13,033

Goodwill and other intangible assets,

net

17,611

15,951

Lease assets

6,707

5,202

Other assets

2,458

1,771

Current income taxes recoverable

1,174

—

Total Assets

$

339,757

$

331,488

Liabilities and Stockholders’

Equity

Liabilities:

Reserve for claims

$

37,192

$

36,754

Accounts payable and accrued

liabilities

47,050

43,868

Lease liabilities

6,839

5,329

Current income taxes payable

—

3,329

Deferred income taxes, net

7,665

13,121

Total liabilities

98,746

102,401

Stockholders’ Equity:

Common stock – no par value (10,000

authorized shares; 1,897 and 1,895 shares issued and outstanding as

of December 31, 2022 and 2021, respectively, excluding in each

period 292 shares of common stock held by the Company's

subsidiary)

—

—

Retained earnings

240,811

225,861

Accumulated other comprehensive income

200

3,226

Total stockholders’ equity

241,011

229,087

Total Liabilities and Stockholders’

Equity

$

339,757

$

331,488

Investors Title Company and

Subsidiaries

Direct and Agency Net Premiums

Written

For the Three and Twelve

Months Ended December 31, 2022 and 2021

(in thousands)

(unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2022

%

2021

%

2022

%

2021

%

Direct

$

16,230

33.0

$

19,363

26.7

$

85,676

34.5

$

82,085

30.0

Agency

32,993

67.0

53,173

73.3

162,956

65.5

191,800

70.0

Total

$

49,223

100.0

$

72,536

100.0

$

248,632

100.0

$

273,885

100.0

Investors Title Company and

Subsidiaries

Appendix A

Non-GAAP Measures

Reconciliation

For the Three and Twelve

Months Ended December 31, 2022 and 2021

(in thousands)

(unaudited)

Management uses various financial and

operational measurements, including financial information not

prepared in accordance with generally accepted accounting

principles ("GAAP"), to analyze Company performance. This includes

adjusting revenues to remove the impact of changes in the estimated

fair value of equity security investments, which are recognized in

net income under GAAP. Management believes that these measures are

useful to evaluate the Company's internal operational performance

from period to period because they eliminate the effects of

external market fluctuations. The Company also believes users of

the financial results would benefit from having access to such

information, and that certain of the Company’s peers make available

similar information. This information should not be used as a

substitute for, or considered superior to, measures of financial

performance prepared in accordance with GAAP, and may be different

from similarly titled non-GAAP financial measures used by other

companies.

The following tables reconcile non-GAAP

financial measurements used by Company management to the comparable

measurements using GAAP:

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2022

2021

2022

2021

Revenues

Total revenues (GAAP)

$

65,494

$

91,043

$

283,392

$

329,498

(Subtract) Add: Changes in the estimated

fair value of equity security investments

(1,761

)

(7,668

)

20,961

(14,934

)

Adjusted revenues (non-GAAP)

$

63,733

$

83,375

$

304,353

$

314,564

Income before Income Taxes

Income before income taxes (GAAP)

$

9,274

$

23,892

$

30,108

$

84,932

(Subtract) Add: Changes in the estimated

fair value of equity security investments

(1,761

)

(7,668

)

20,961

(14,934

)

Adjusted income before income taxes

(non-GAAP)

$

7,513

$

16,224

$

51,069

$

69,998

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230214005112/en/

Elizabeth B. Lewter Telephone: (919) 968-2200

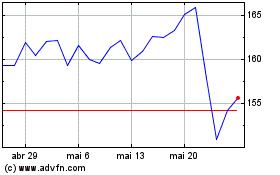

Investors Title (NASDAQ:ITIC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Investors Title (NASDAQ:ITIC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024