3D Systems (NYSE:DDD) (“the Company”) today announced that it plans

to file its Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 (the “Form 10-K”) with the Securities and

Exchange Commission (the “SEC”) after market.

In connection with the Company’s efforts as it

concluded its audit, certain reclassifications and adjustments were

made to its fourth quarter and full year 2023 financial results,

originally furnished to the SEC on the Company’s Current Report on

Form 8-K filed on February 28, 2024. Revisions relate primarily to

a reduction in the impairment of goodwill, a decrease in interest

income and changes in certain expenses. Supplemental financial

statements and GAAP to non-GAAP reconciliations are included in the

Appendix. Changes to originally reported information are shown

below:

| Unaudited |

|

Three Months Ended December 31, 2023 |

|

Year Ended December 31, 2023 |

| (in thousands, expect per

share data) |

|

Preliminary - Previously Filed |

|

Final - To BeFiled |

|

Preliminary -Previously Filed |

|

Final - To BeFiled |

|

Revenue |

|

$ |

114,848 |

|

|

$ |

114,848 |

|

|

$ |

488,069 |

|

|

$ |

488,069 |

|

| Gross profit |

|

$ |

46,348 |

|

|

$ |

43,957 |

|

|

$ |

198,812 |

|

|

$ |

196,421 |

|

| Operating loss |

|

$ |

(335,594 |

) |

|

$ |

(327,295 |

) |

|

$ |

(414,303 |

) |

|

$ |

(406,004 |

) |

| Net loss attributable to 3D

Systems Corporation |

|

$ |

(300,412 |

) |

|

$ |

(292,668 |

) |

|

$ |

(370,432 |

) |

|

$ |

(362,688 |

) |

| Diluted loss per share |

|

$ |

(2.30 |

) |

|

$ |

(2.25 |

) |

|

$ |

(2.85 |

) |

|

$ |

(2.79 |

) |

| |

|

|

|

|

|

|

|

|

| Non-GAAP measures

for year-over-year comparisons (1) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Non-GAAP gross profit

margin |

|

|

41.9 |

% |

|

|

39.8 |

% |

|

|

41.1 |

% |

|

|

40.6 |

% |

| Adjusted EBITDA |

|

$ |

(12,260 |

) |

|

$ |

(13,993 |

) |

|

$ |

(24,525 |

) |

|

$ |

(26,258 |

) |

| Non-GAAP diluted loss per

share |

|

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.28 |

) |

(1) See “Presentation of Information in this Press Release”

below for a description, and the Appendix for the reconciliation of

non-GAAP measurements to the most closely comparable GAAP

measure.

The Company also announced that it expects

general and administrative (G&A) operating expenses for 2024 to

be higher than original estimates, driven by external auditor fees

and outside services related to the completion of the 2023 Form

10-K. These fees incurred by the Company, while transitory in

nature, are expected to total over $9 million, approximately $7.5

million higher than anticipated in the original operating expense

guidance provided for the full year. From a timing standpoint, the

Company expects approximately 65% of these cost overruns occurred

in Q1, approximately 25% in Q2, with the balance anticipated in Q3.

It is important to note that, with the transition of audit

responsibilities to a new firm, the Company expects a substantial

improvement in operating expenses beginning in Q4.

The Company plans to release its financial

results for the first quarter 2024 on or about August 19, 2024 in

conjunction with the filing of its Quarterly Report on Form 10-Q

for the quarter ended March 31, 2024 with the SEC. In addition, the

Company expects to release financial results for the second quarter

2024 during the week of August 26, 2024. Following its second

quarter earnings release, the Company will host a conference call

and simultaneous webcast to discuss its results for first half 2024

and outlook for the remainder of year.

About 3D Systems

More than 35 years ago, 3D Systems brought the innovation of 3D

printing to the manufacturing industry. Today, as the leading

additive manufacturing solutions partner, we bring innovation,

performance, and reliability to every interaction – empowering our

customers to create products and business models never before

possible. Thanks to our unique offering of hardware, software,

materials, and services, each application-specific solution is

powered by the expertise of our application engineers who

collaborate with customers to transform how they deliver their

products and services. 3D Systems’ solutions address a variety of

advanced applications in healthcare and industrial markets such as

medical and dental, aerospace & defense, automotive, and

durable goods. More information on the Company is available at

www.3DSystems.com.

Forward-Looking Statements

Certain statements made in this release that are

not statements of historical or current facts are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, performance or achievements of the Company to be

materially different from historical results or from any future

results or projections expressed or implied by such forward-looking

statements. In many cases, forward looking statements can be

identified by terms such as “believes,” “belief,” “expects,” “may,”

“will,” “estimates,” “intends,” “anticipates” or “plans” or the

negative of these terms or other comparable terminology.

Forward-looking statements are based upon management’s beliefs,

assumptions and current expectations and may include comments as to

the Company’s beliefs and expectations as to future events and

trends affecting its business and are necessarily subject to

uncertainties, many of which are outside the control of the

Company. The factors described under the headings “Forward-Looking

Statements” and “Risk Factors” in the Company’s periodic filings

with the SEC, as well as other factors, could cause actual results

to differ materially from those reflected or predicted in

forward-looking statements. Although management believes that the

expectations reflected in the forward-looking statements are

reasonable, forward-looking statements are not, and should not be

relied upon as a guarantee of future performance or results, nor

will they necessarily prove to be accurate indications of the times

at which such performance or results will be achieved. The

forward-looking statements included are made only as the date of

the statement. 3D Systems undertakes no obligation to update or

revise any forward-looking statements made by management or on its

behalf, whether as a result of future developments, subsequent

events or circumstances or otherwise, except as required by

law.

Presentation of Information in this

Press Release

3D Systems reports its financial results in

accordance with GAAP. Management also reviews and reports certain

non-GAAP measures, including: non-GAAP gross profit, non-GAAP gross

profit margin, non-GAAP diluted income (loss) per share, and

Adjusted EBITDA. These non-GAAP measures exclude certain items that

management does not view as part of 3D Systems’ core results as

they may be highly variable, may be unusual or infrequent, are

difficult to predict and can distort underlying business trends and

results. Management believes that the non-GAAP measures provide

useful additional insight into underlying business trends and

results and provide meaningful information regarding the comparison

of period-over-period results. Additionally, management uses the

non-GAAP measures for planning, forecasting and evaluating business

and financial performance, including allocating resources and

evaluating results relative to employee compensation targets. 3D

Systems’ non-GAAP measures are not calculated in accordance with or

as required by GAAP and may not be calculated in the same manner as

similarly titled measures used by other companies. These non-GAAP

measures should thus be considered as supplemental in nature and

not considered in isolation or as a substitute for the related

financial information prepared in accordance with GAAP.

To calculate the non-GAAP measures, 3D Systems

excludes the impact of the following items:

- amortization of intangible assets,

a non-cash expense, as 3D Systems’ intangible assets were primarily

acquired in connection with business combinations;

- costs incurred in connection with

acquisitions and divestitures, such as legal, consulting and

advisory fees;

- stock-based compensation expenses,

a non-cash expense;

- charges related to restructuring

and cost optimization plans, impairment charges, including

goodwill, and divestiture gains or losses;

- certain compensation expense

related to the 2021 Volumetric acquisition; and

- costs, including legal fees,

related to significant or unusual litigation matters.

Amortization of intangibles and acquisition and

divestiture-related costs are excluded from non-GAAP measures as

the timing and magnitude of business combination transactions are

not predictable, can vary significantly from period to period and

the purchase price allocated to amortizable intangible assets and

the related amortization period are unique to each acquisition.

Amortization of intangible assets will recur in future periods

until such intangible assets have been fully amortized. While

intangible assets contribute to the company’s revenue generation,

the amortization of intangible assets does not directly relate to

the sale of the company’s products or services. Additionally,

intangible assets amortization expense typically fluctuates based

on the size and timing of the company’s acquisition activity.

Accordingly, the company believes excluding the amortization of

intangible assets enhances the company’s and investors’ ability to

compare the company’s past financial performance with its current

performance and to analyze underlying business performance and

trends. Although stock-based compensation is a key incentive

offered to certain of our employees, the expense is non-cash in

nature, and we continue to evaluate our business performance

excluding stock-based compensation; therefore, it is excluded from

non-GAAP measures. Stock-based compensation expenses will recur in

future periods. Charges related to restructuring and cost

optimization plans, impairment charges, including goodwill,

divestiture gains or losses, and the costs, including legal fees,

related to significant or unusual litigation matters are excluded

from non-GAAP measures as the frequency and magnitude of these

activities may vary widely from period to period. Additionally,

impairment charges, including goodwill, are non-cash. Furthermore,

the company believes the costs, including legal fees, related to

significant or unusual litigation matters are not indicative of our

core business' operations. Finally, 3D Systems excludes contingent

consideration recorded as compensation expense related to the 2021

Volumetric acquisition from non-GAAP measures as management

evaluates financial performance excluding this expense, which is

viewed by management as similar to acquisition consideration.

The matters discussed above are tax effected, as

applicable, in calculating non-GAAP diluted income (loss) per

share.

Adjusted EBITDA, defined as net income, plus

income tax (provision) benefit, interest and other income

(expense), net, stock-based compensation expense, amortization of

intangible assets, depreciation expense, and other non-GAAP

adjustments, all as described above, is used by management to

evaluate performance and helps measure financial performance

period-over-period.

A reconciliation of GAAP to non-GAAP financial

measures is provided in the accompanying schedules.

3D Systems does not provide forward-looking

guidance for certain measures on a GAAP basis. The company is

unable to provide a quantitative reconciliation of forward-looking

non-GAAP gross profit margin, Adjusted EBITDA, and non-GAAP

operating expense to the most directly comparable forward-looking

GAAP measures without unreasonable effort because certain items,

including litigation costs, acquisition expenses, stock-based

compensation expense, intangible assets amortization expense,

restructuring expenses, and goodwill impairment charges are

difficult to predict and estimate. These items are inherently

uncertain and depend on various factors, many of which are beyond

the company’s control, and as such, any associated estimate and its

impact on GAAP performance could vary materially.

|

3D Systems CorporationUnaudited

Consolidated Balance SheetsDecember 31,

2023 and December 31,

2022 |

| |

| (in thousands, except

par value) |

December 31, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

331,525 |

|

|

$ |

388,134 |

|

|

Short-term investments |

|

— |

|

|

|

180,603 |

|

|

Accounts receivable, net of reserves — $3,389 and $3,114 |

|

101,497 |

|

|

|

93,886 |

|

|

Inventories |

|

152,188 |

|

|

|

137,832 |

|

|

Prepaid expenses and other current assets |

|

42,612 |

|

|

|

33,790 |

|

|

Total current assets |

|

627,822 |

|

|

|

834,245 |

|

| Property and equipment,

net |

|

64,461 |

|

|

|

58,072 |

|

| Intangible assets, net |

|

62,724 |

|

|

|

90,230 |

|

| Goodwill |

|

116,082 |

|

|

|

385,312 |

|

| Operating lease right-of-use

assets |

|

58,406 |

|

|

|

39,502 |

|

| Finance lease right-of-use

assets |

|

12,174 |

|

|

|

3,244 |

|

| Long-term deferred income tax

assets |

|

4,230 |

|

|

|

7,038 |

|

| Other assets |

|

44,761 |

|

|

|

28,970 |

|

|

Total assets |

$ |

990,660 |

|

|

$ |

1,446,613 |

|

| LIABILITIES,

REDEEMABLE NON-CONTROLLING INTEREST AND EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Current operating lease liabilities |

$ |

9,924 |

|

|

$ |

8,343 |

|

|

Accounts payable |

|

49,757 |

|

|

|

53,826 |

|

|

Accrued and other liabilities |

|

49,460 |

|

|

|

56,264 |

|

|

Customer deposits |

|

7,599 |

|

|

|

6,911 |

|

|

Deferred revenue |

|

30,448 |

|

|

|

26,464 |

|

|

Total current liabilities |

|

147,188 |

|

|

|

151,808 |

|

| Long-term debt, net of

deferred financing costs |

|

319,356 |

|

|

|

449,510 |

|

| Long-term operating lease

liabilities |

|

56,795 |

|

|

|

38,499 |

|

| Long-term deferred income tax

liabilities |

|

5,162 |

|

|

|

7,631 |

|

| Other liabilities |

|

33,400 |

|

|

|

47,461 |

|

|

Total liabilities |

|

561,901 |

|

|

|

694,909 |

|

| Commitments and contingencies

(Note 23) |

|

|

|

| Redeemable non-controlling

interest |

|

2,006 |

|

|

|

1,760 |

|

| Stockholders’ equity: |

|

|

|

|

Common stock, $0.001 par value, authorized 220,000 shares; shares

issued 133,619 and 131,207 as of December 31, 2023 and 2022,

respectively |

|

134 |

|

|

|

131 |

|

|

Additional paid-in capital |

|

1,577,519 |

|

|

|

1,547,597 |

|

|

Accumulated deficit |

|

(1,106,650 |

) |

|

|

(743,962 |

) |

|

Accumulated other comprehensive loss |

|

(44,250 |

) |

|

|

(53,822 |

) |

|

Total stockholders’ equity |

|

426,753 |

|

|

|

749,944 |

|

|

Total liabilities, redeemable non-controlling interest and

stockholders’ equity |

$ |

990,660 |

|

|

$ |

1,446,613 |

|

|

3D Systems CorporationUnaudited

Consolidated Statements of OperationsYear Ended

December 31, 2023,

2022 and

2021 |

| |

| |

Year Ended December 31, |

|

(in thousands, except per share amounts) |

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenue: |

|

|

|

|

|

|

Products |

$ |

328,731 |

|

|

$ |

395,396 |

|

|

$ |

428,742 |

|

|

Services |

|

159,338 |

|

|

|

142,635 |

|

|

|

186,897 |

|

|

Total revenue |

|

488,069 |

|

|

|

538,031 |

|

|

|

615,639 |

|

| Cost of sales: |

|

|

|

|

|

|

Products |

|

203,258 |

|

|

|

237,386 |

|

|

|

245,169 |

|

|

Services |

|

88,390 |

|

|

|

86,412 |

|

|

|

106,692 |

|

|

Total cost of sales |

|

291,648 |

|

|

|

323,798 |

|

|

|

351,861 |

|

| Gross profit |

|

196,421 |

|

|

|

214,233 |

|

|

|

263,778 |

|

| Operating expenses: |

|

|

|

|

|

|

Selling, general and administrative |

|

210,172 |

|

|

|

244,181 |

|

|

|

227,697 |

|

|

Research and development |

|

89,466 |

|

|

|

87,071 |

|

|

|

69,150 |

|

|

Impairments of goodwill and intangible assets |

|

302,787 |

|

|

|

— |

|

|

|

— |

|

| Total operating expenses |

|

602,425 |

|

|

|

331,252 |

|

|

|

296,847 |

|

| Loss from operations |

|

(406,004 |

) |

|

|

(117,019 |

) |

|

|

(33,069 |

) |

| Interest and other income

(expense), net |

|

43,692 |

|

|

|

(3,790 |

) |

|

|

352,609 |

|

| (Loss) income before income

taxes |

|

(362,312 |

) |

|

|

(120,809 |

) |

|

|

319,540 |

|

| Benefit (provision) for income

taxes |

|

641 |

|

|

|

(2,140 |

) |

|

|

2,512 |

|

| Loss on equity method

investment, net of income taxes |

|

(1,282 |

) |

|

|

— |

|

|

|

— |

|

| Net (loss) income before

redeemable non-controlling interest |

|

(362,953 |

) |

|

|

(122,949 |

) |

|

|

322,052 |

|

| Less: net loss attributable to

redeemable non-controlling interest |

|

(265 |

) |

|

|

(238 |

) |

|

|

— |

|

| Net (loss) income attributable

to 3D Systems Corporation |

$ |

(362,688 |

) |

|

$ |

(122,711 |

) |

|

$ |

322,052 |

|

| |

|

|

|

|

|

| Net (loss) income per common

share |

|

|

|

|

|

|

Basic |

$ |

(2.79 |

) |

|

$ |

(0.96 |

) |

|

$ |

2.62 |

|

|

Diluted |

$ |

(2.79 |

) |

|

$ |

(0.96 |

) |

|

$ |

2.55 |

|

| |

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

Basic |

|

129,944 |

|

|

|

127,818 |

|

|

|

122,867 |

|

|

Diluted |

|

129,944 |

|

|

|

127,818 |

|

|

|

126,334 |

|

|

3D Systems CorporationUnaudited

Consolidated Statements of OperationsThree Months

Ended December 31, 2023,

2022 and

2021 |

| |

| |

Three Months Ended December 31, |

|

(in thousands, except per share amounts) |

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenue: |

|

|

|

|

|

|

Products |

$ |

74,763 |

|

|

$ |

94,734 |

|

|

$ |

117,572 |

|

|

Services |

|

40,085 |

|

|

|

37,998 |

|

|

|

33,298 |

|

|

Total revenue |

|

114,848 |

|

|

|

132,732 |

|

|

|

150,870 |

|

| Cost of sales: |

|

|

|

|

|

|

Products |

|

49,816 |

|

|

|

55,541 |

|

|

|

64,918 |

|

|

Services |

|

21,075 |

|

|

|

22,561 |

|

|

|

19,734 |

|

|

Total cost of sales |

|

70,891 |

|

|

|

78,102 |

|

|

|

84,652 |

|

| Gross profit |

|

43,957 |

|

|

|

54,630 |

|

|

|

66,218 |

|

| Operating expenses: |

|

|

|

|

|

|

Selling, general and administrative |

|

59,549 |

|

|

|

58,783 |

|

|

|

50,897 |

|

|

Research and development |

|

22,513 |

|

|

|

23,891 |

|

|

|

19,163 |

|

|

Impairments of goodwill and intangible assets |

|

289,190 |

|

|

|

— |

|

|

|

— |

|

| Total operating expenses |

|

371,252 |

|

|

|

82,674 |

|

|

|

70,060 |

|

| Loss from operations |

|

(327,295 |

) |

|

|

(28,044 |

) |

|

|

(3,842 |

) |

| Interest and other income

(expense), net |

|

34,001 |

|

|

|

1,666 |

|

|

|

(1,787 |

) |

| Loss before income taxes |

|

(293,294 |

) |

|

|

(26,378 |

) |

|

|

(5,629 |

) |

| Benefit (provision) for income

taxes |

|

1,045 |

|

|

|

771 |

|

|

|

(571 |

) |

| Loss on equity method

investment, net of income taxes |

|

(535 |

) |

|

|

— |

|

|

|

— |

|

| Net loss before redeemable

non-controlling interest |

|

(292,784 |

) |

|

|

(25,607 |

) |

|

|

(6,200 |

) |

| Less: net loss attributable to

redeemable non-controlling interest |

|

(116 |

) |

|

|

(54 |

) |

|

|

— |

|

| Net loss attributable to 3D

Systems Corporation |

$ |

(292,668 |

) |

|

$ |

(25,553 |

) |

|

$ |

(6,200 |

) |

| |

|

|

|

|

|

| Net loss per share available

to 3D Systems Corporation common stockholders |

|

|

|

|

|

|

Basic |

$ |

(2.25 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.05 |

) |

|

Diluted |

$ |

(2.25 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.05 |

) |

|

3D Systems CorporationUnaudited

Consolidated Statements of Cash Flows |

| |

| |

Year Ended December 31, |

|

(in thousands) |

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

Net (loss) income before redeemable non-controlling interest |

$ |

(362,953 |

) |

|

$ |

(122,949 |

) |

|

$ |

322,052 |

|

|

Adjustments to reconcile net (loss) income to net cash (used in)

provided by operating activities: |

|

|

|

|

|

|

Depreciation, amortization and accretion of debt discount |

|

36,053 |

|

|

|

38,686 |

|

|

|

34,623 |

|

|

Stock-based compensation |

|

23,504 |

|

|

|

42,415 |

|

|

|

55,153 |

|

|

Loss on short-term investments |

|

6 |

|

|

|

3,146 |

|

|

|

— |

|

|

Non-cash operating lease expense |

|

9,267 |

|

|

|

6,366 |

|

|

|

5,681 |

|

|

Provision for inventory obsolescence and revaluation |

|

6,350 |

|

|

|

2,586 |

|

|

|

(2,909 |

) |

|

Loss on hedge accounting de-designation and termination |

|

— |

|

|

|

— |

|

|

|

721 |

|

|

Provision for bad debts |

|

595 |

|

|

|

562 |

|

|

|

232 |

|

|

Loss (gain) on the disposition of businesses, property, equipment

and other assets |

|

6 |

|

|

|

104 |

|

|

|

(350,846 |

) |

|

Gain on debt extinguishment |

|

(32,181 |

) |

|

|

— |

|

|

|

— |

|

|

Benefit for deferred income taxes and reserve adjustments |

|

(2,412 |

) |

|

|

(2,518 |

) |

|

|

(11,679 |

) |

|

Loss on equity method investment |

|

1,282 |

|

|

|

— |

|

|

|

— |

|

|

Impairments of assets |

|

304,698 |

|

|

|

4,095 |

|

|

|

1,676 |

|

|

Changes in operating accounts: |

|

|

|

|

|

|

Accounts receivable |

|

(6,186 |

) |

|

|

8,144 |

|

|

|

(11,912 |

) |

|

Inventories |

|

(20,555 |

) |

|

|

(51,082 |

) |

|

|

7,866 |

|

|

Prepaid expenses and other current assets |

|

(7,961 |

) |

|

|

8,229 |

|

|

|

(8,106 |

) |

|

Accounts payable |

|

(5,526 |

) |

|

|

(3,787 |

) |

|

|

27,159 |

|

|

Deferred revenue and customer deposits |

|

1,245 |

|

|

|

(6,947 |

) |

|

|

(3,325 |

) |

|

Accrued and other liabilities |

|

(12,933 |

) |

|

|

10,702 |

|

|

|

(12,389 |

) |

|

All other operating activities |

|

(12,994 |

) |

|

|

(7,773 |

) |

|

|

(5,850 |

) |

| Net cash (used in) provided by

operating activities |

|

(80,695 |

) |

|

|

(70,021 |

) |

|

|

48,147 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

(27,183 |

) |

|

|

(20,907 |

) |

|

|

(18,791 |

) |

|

Purchases of short-term investments |

|

— |

|

|

|

(384,388 |

) |

|

|

— |

|

|

Sales and maturities of short-term investments |

|

180,925 |

|

|

|

200,314 |

|

|

|

— |

|

|

Proceeds from sale of assets and businesses, net of cash sold |

|

194 |

|

|

|

325 |

|

|

|

421,485 |

|

|

Acquisitions and other investments, net of cash acquired |

|

(29,152 |

) |

|

|

(103,699 |

) |

|

|

(139,685 |

) |

|

Other investing activities |

|

— |

|

|

|

— |

|

|

|

(2,454 |

) |

| Net cash provided by (used in)

investing activities |

|

124,784 |

|

|

|

(308,355 |

) |

|

|

260,555 |

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from borrowings |

|

— |

|

|

|

— |

|

|

|

460,000 |

|

|

Debt issuance costs |

|

— |

|

|

|

— |

|

|

|

(13,466 |

) |

|

Repayment of borrowings/long-term debt |

|

(100,614 |

) |

|

|

— |

|

|

|

(21,392 |

) |

|

Purchase of non-controlling interests |

|

— |

|

|

|

(2,300 |

) |

|

|

(6,300 |

) |

|

Taxes paid related to net-share settlement of equity awards |

|

(5,211 |

) |

|

|

(10,864 |

) |

|

|

(12,619 |

) |

|

Other financing activities |

|

(644 |

) |

|

|

(651 |

) |

|

|

(423 |

) |

| Net cash (used in) provided by

financing activities |

|

(106,469 |

) |

|

|

(13,815 |

) |

|

|

405,800 |

|

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

3,516 |

|

|

|

(5,804 |

) |

|

|

(9,243 |

) |

| Net (decrease) increase in

cash, cash equivalents and restricted cash |

|

(58,864 |

) |

|

|

(397,995 |

) |

|

|

705,259 |

|

| Cash, cash equivalents and

restricted cash at the beginning of the year a |

|

391,975 |

|

|

|

789,970 |

|

|

|

84,711 |

|

| Cash, cash equivalents and

restricted cash at the end of the year a |

$ |

333,111 |

|

|

$ |

391,975 |

|

|

$ |

789,970 |

|

(a) The amounts for cash and cash equivalents shown above

include restricted cash of $119, $114 and $313 as of December 31,

2023, 2022 and 2021, respectively, which are included in prepaid

expenses and other current assets. In addition, included in cash

and cash equivalents above as of December 31, 2023 and 2022 is

$1,467 and $3,727 of restricted cash, which, is included in other

non-current assets.

|

Appendix3D Systems

CorporationUnaudited Reconciliations of GAAP to

Non-GAAP MeasuresThree Months Ended December

31, 2023 and

2022. |

| |

|

|

| Constant

Currency Revenue (4) |

|

|

| |

Three Months Ended December 31, |

|

|

Constant Currency (1) |

|

| (in

thousands) |

2023 |

|

2022 |

|

$ Change |

|

% Change |

|

FX Effect (2) |

|

% Change (3) |

|

Healthcare Solutions |

$ |

51,188 |

|

$ |

60,694 |

|

$ |

(9,506 |

) |

|

(15.7 |

)% |

|

$ |

454 |

|

(16.4 |

)% |

|

Industrial Solutions |

|

63,660 |

|

|

72,038 |

|

|

(8,378 |

) |

|

(11.6 |

)% |

|

|

1,196 |

|

(13.3 |

)% |

|

Total revenue |

$ |

114,848 |

|

$ |

132,732 |

|

$ |

(17,884 |

) |

|

(13.5 |

)% |

|

$ |

1,650 |

|

(14.7 |

)% |

(1) To assist in the analysis of the Company’s revenue trends,

the Company estimated the impact of foreign exchange on

year-over-year revenue growth by recasting revenue for the three

months ended December 31, 2023 by applying the foreign exchange

rates used to translate 2022 non-US functional currency revenue to

2023 non-US functional currency revenue.(2) Represents the

estimated impact on "as reported" revenue due to changes in foreign

currency exchange rates(3) Represents the % increase or decrease in

revenue excluding the estimated "FX effect"(4)Amounts in table may

not foot due to rounding

| |

Year Ended December 31, |

|

|

Constant Currency (1) |

|

| (in

thousands) |

2023 |

|

2022 |

|

$ Change |

|

% Change |

|

FX Effect (2) |

|

% Change (3) |

|

Healthcare Solutions |

$ |

213,216 |

|

$ |

260,988 |

|

$ |

(47,772 |

) |

|

(18.3 |

)% |

|

$ |

817 |

|

(18.6 |

)% |

|

Industrial Solutions |

|

274,853 |

|

|

277,043 |

|

|

(2,190 |

) |

|

(0.8 |

)% |

|

|

971 |

|

(1.1 |

)% |

|

Total revenue |

$ |

488,069 |

|

$ |

538,031 |

|

$ |

(49,962 |

) |

|

(9.3 |

)% |

|

$ |

1,788 |

|

(9.6 |

)% |

(1) To assist in the analysis of the Company’s revenue trends,

the Company estimated the impact of foreign exchange on

year-over-year revenue growth by recasting revenue for the year

ended December 31, 2023 by applying the foreign exchange rates used

to translate 2022 non-US functional currency revenue to 2023 non-US

functional currency revenue.(2) Represents the estimated impact on

"as reported" revenue due to changes in foreign currency exchange

rates(3) Represents the % increase or decrease in revenue excluding

the estimated "FX effect"(4)Amounts in table may not foot due to

rounding

| Gross

Profit and Gross Profit Margin (1) |

| |

Three Months Ended December 31, |

| (in

thousands) |

|

2023 |

|

|

|

2022 |

|

| |

Gross Profit |

|

Gross Profit Margin (2) |

|

Gross Profit |

|

Gross Profit Margin (2) |

|

GAAP |

$ |

43,957 |

|

38.3 |

% |

|

$ |

54,630 |

|

|

41.2 |

% |

|

Amortization expense included in Cost of sales |

|

382 |

|

|

|

|

(398 |

) |

|

|

|

Restructuring expense included in Cost of sales |

|

1,427 |

|

|

|

|

— |

|

|

|

| Non-GAAP |

$ |

45,766 |

|

39.8 |

% |

|

$ |

54,232 |

|

|

40.9 |

% |

(1) Amounts in table may not foot due to rounding(2)

Calculated as non-GAAP gross profit as a percentage of total

revenue.

| |

Year Ended December 31, |

| (in

thousands) |

|

2023 |

|

|

|

2022 |

|

| |

Gross Profit |

|

Gross Profit Margin (2) |

|

Gross Profit |

|

Gross Profit Margin(2) |

|

GAAP |

$ |

196,421 |

|

40.2 |

% |

|

$ |

214,233 |

|

39.8 |

% |

|

Amortization expense included in Cost of sales |

|

506 |

|

|

|

|

14 |

|

|

|

Restructuring expense included in Cost of sales |

|

1,427 |

|

|

|

|

— |

|

|

| Non-GAAP |

$ |

198,354 |

|

40.6 |

% |

|

$ |

214,247 |

|

39.8 |

% |

(1) Amounts in table may not foot due to rounding(2)

Calculated as non-GAAP gross profit as a percentage of total

revenue.

|

Appendix3D Systems

CorporationUnaudited Reconciliations of GAAP to

Non-GAAP MeasuresThree and Twelve

Months Ended December 31,

2023 and

2022 |

| |

| Net Loss

to Adjusted EBITDA (1) |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(in thousands) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net loss attributable

to 3D Systems Corporation |

$ |

(292,668 |

) |

|

$ |

(25,553 |

) |

|

$ |

(362,688 |

) |

|

$ |

(122,711 |

) |

|

Interest income, net |

|

(3,092 |

) |

|

|

(2,522 |

) |

|

|

(16,210 |

) |

|

|

(6,541 |

) |

|

(Benefit) provision for income taxes |

|

(1,045 |

) |

|

|

(771 |

) |

|

|

(641 |

) |

|

|

2,140 |

|

|

Depreciation expense |

|

5,656 |

|

|

|

5,104 |

|

|

|

21,346 |

|

|

|

21,096 |

|

|

Amortization expense |

|

2,391 |

|

|

|

5,207 |

|

|

|

12,067 |

|

|

|

15,480 |

|

|

Stock-based compensation expense |

|

8,361 |

|

|

|

10,980 |

|

|

|

23,504 |

|

|

|

42,489 |

|

|

Acquisition and divestiture-related expense |

|

(1,202 |

) |

|

|

2,978 |

|

|

|

(1,070 |

) |

|

|

12,360 |

|

|

Legal expense |

|

3,174 |

|

|

|

(1,418 |

) |

|

|

8,053 |

|

|

|

19,062 |

|

|

Restructuring expense |

|

4,774 |

|

|

|

381 |

|

|

|

11,487 |

|

|

|

733 |

|

|

Net loss attributable to redeemable non-controlling interest |

|

(116 |

) |

|

|

(54 |

) |

|

|

(265 |

) |

|

|

(238 |

) |

|

Loss (income) on equity method investment, net of income taxes |

|

535 |

|

|

|

— |

|

|

|

1,282 |

|

|

|

— |

|

|

Goodwill and other assets impairment charges |

|

290,148 |

|

|

|

3 |

|

|

|

304,359 |

|

|

|

18 |

|

|

Gain on repurchase of debt |

|

(32,181 |

) |

|

|

— |

|

|

|

(32,181 |

) |

|

|

— |

|

|

Other non-operating expense |

|

1,272 |

|

|

|

857 |

|

|

|

4,699 |

|

|

|

10,331 |

|

|

Adjusted EBITDA |

$ |

(13,993 |

) |

|

$ |

(4,808 |

) |

|

$ |

(26,258 |

) |

|

$ |

(5,781 |

) |

(1) Amounts in table may not foot due to rounding

|

Appendix3D Systems

CorporationUnaudited Reconciliations of GAAP to

Non-GAAP MeasuresThree and Twelve

Months Ended December 31,

2023 and

2022 |

| |

| Non-GAAP

Diluted Loss per Share (1)(2) |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(in dollars) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Diluted loss per share |

$ |

(2.25 |

) |

|

$ |

(0.20 |

) |

|

$ |

(2.79 |

) |

|

$ |

(0.96 |

) |

|

Amortization expense |

|

0.02 |

|

|

|

0.04 |

|

|

|

0.09 |

|

|

|

0.12 |

|

|

Stock-based compensation expense |

|

0.06 |

|

|

|

0.09 |

|

|

|

0.18 |

|

|

|

0.33 |

|

|

Acquisition and divestiture-related expense |

|

(0.01 |

) |

|

|

0.02 |

|

|

|

(0.01 |

) |

|

|

0.10 |

|

|

Legal expense |

|

0.03 |

|

|

|

(0.01 |

) |

|

|

0.06 |

|

|

|

0.17 |

|

|

Restructuring expense |

|

0.04 |

|

|

|

— |

|

|

|

0.09 |

|

|

|

0.01 |

|

|

Goodwill and other assets impairment charges |

|

2.23 |

|

|

|

— |

|

|

|

2.35 |

|

|

|

— |

|

|

Gain on repurchase of debt |

|

(0.25 |

) |

|

|

— |

|

|

|

(0.25 |

) |

|

|

— |

|

| Non-GAAP diluted loss per

share |

$ |

(0.13 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.23 |

) |

(1) Amounts in table may not foot due to

rounding(2) Amounts in table are stated per share

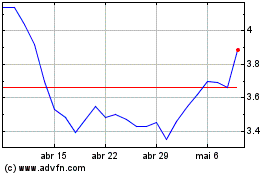

3D Systems (NYSE:DDD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

3D Systems (NYSE:DDD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025