Energy Transfer and Sunoco Announce Strategic Permian Basin Crude Oil Joint Venture

16 Julho 2024 - 10:10AM

Business Wire

Energy Transfer LP (NYSE: ET) (“Energy Transfer”) and Sunoco LP

(NYSE: SUN) (“Sunoco”) today announced the formation of a joint

venture combining their respective crude oil and produced water

gathering assets in the Permian Basin.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240716166218/en/

(Graphic: Business Wire)

Energy Transfer will serve as the operator of the joint venture

and contribute its Permian crude oil and produced water gathering

assets and operations. Sunoco will contribute all of its Permian

crude oil gathering assets and operations to the joint venture.

Energy Transfer’s long-haul crude pipeline network that provides

transportation of crude oil out of the Permian Basin to Nederland,

Houston, and Cushing is excluded from the joint venture.

As depicted in the included map, the joint venture will operate

more than 5,000 miles of crude oil and water gathering pipelines

with crude oil storage capacity in excess of 11 million

barrels.

Energy Transfer will hold a 67.5% interest in the joint venture

with Sunoco holding a 32.5% interest.

The formation of the joint venture has an effective date of July

1, 2024, and is expected to be immediately accretive to

distributable cash flow per LP unit for both Energy Transfer and

Sunoco.

Intrepid Partners, LLC served as financial advisor to Energy

Transfer’s conflicts committee, while Guggenheim Securities, LLC

served as financial advisor to Sunoco’s special committee. Potter

Anderson & Corroon LLP acted as Delaware counsel for Energy

Transfer’s conflicts committee, and Richards, Layton & Finger,

P.A. acted as Delaware counsel for Sunoco’s special committee.

Vinson & Elkins LLP and Akin Gump Strauss Hauer & Feld LLP

also acted as legal counsel to the partnerships on the

transaction.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the

largest and most diversified portfolios of energy assets in the

United States, with more than 130,000 miles of pipeline and

associated energy infrastructure. Energy Transfer’s strategic

network spans 44 states with assets in all of the major U.S.

production basins. Energy Transfer is a publicly traded limited

partnership with core operations that include complementary natural

gas midstream, intrastate and interstate transportation and storage

assets; crude oil, natural gas liquids (“NGL”) and refined product

transportation and terminalling assets; and NGL fractionation.

Energy Transfer also owns Lake Charles LNG Company, as well as the

general partner interests, the incentive distribution rights and

approximately 21% of the outstanding common units of Sunoco LP

(NYSE: SUN), and the general partner interests and approximately

39% of the outstanding common units of USA Compression Partners, LP

(NYSE: USAC). For more information, visit the Energy Transfer LP

website at www.energytransfer.com.

About Sunoco LP

Sunoco LP (NYSE: SUN) is a leading energy infrastructure and

fuel distribution master limited partnership operating in over 40

U.S. states, Puerto Rico, Europe, and Mexico. The Partnership’s

midstream operations include an extensive network of approximately

14,000 miles of pipeline and over 100 terminals. This critical

infrastructure complements the Partnership’s fuel distribution

operations, which serve approximately 7,400 Sunoco and partner

branded locations and additional independent dealers and commercial

customers. SUN's general partner is owned by Energy Transfer LP

(NYSE: ET).

Forward-Looking Statements

This news release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control. An extensive list of factors that can affect

future results are discussed in Energy Transfer’s and Sunoco’s

Annual Reports on Forms 10-K and other documents filed from time to

time with the Securities and Exchange Commission. Energy Transfer

and Sunoco undertake no obligation to update or revise any

forward-looking statement to reflect new information or events.

The information contained in this press release is available on

Energy Transfer’s website at www.energytransfer.com and Sunoco’s

website at www.sunocolp.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240716166218/en/

Energy Transfer Investors: Bill Baerg, Vice President –

Investor Relations Brent Ratliff, Vice President – Investor

Relations Lyndsay Hannah, Director – Investor Relations (214)

840-0795, InvestorRelations@energytransfer.com

Media: Vicki Granado – Vice President, Media &

Communications (214) 981-0761, vicki.granado@energytransfer.com

Sunoco LP Investors: Scott Grischow, Treasurer, Senior

Vice President – Finance (214) 840-5660,

scott.grischow@sunoco.com

Media: Chris Cho, Senior Manager – Communications (210)

918-3953, chris.cho@sunoco.com

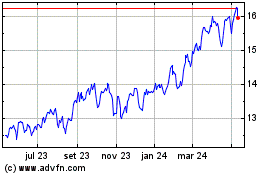

Energy Transfer (NYSE:ET)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

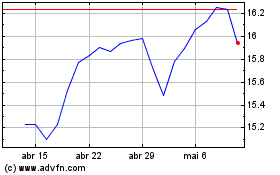

Energy Transfer (NYSE:ET)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024