Diamondback Stockholders,

This letter is meant to be a supplement to our

earnings release and is being furnished to the Securities and

Exchange Commission (SEC) and released to our stockholders

simultaneously with our earnings release. Please see the

information regarding forward-looking statements and non-GAAP

financial information included at the end of this letter.

Diamondback built significant momentum in the

first half of the year. As a result of our first and second quarter

performance, we are increasing our full year production guidance

and lowering our annual capex guidance. Our operations team has

done an incredible job of focusing on what we do best: lowering

costs and generating additional efficiencies in the field, truly

differentiating Diamondback as we convert rock into cash flow.

Endeavor Energy Resources, L.P.

(“Endeavor”) Merger Update: As previously disclosed, we

received stockholder approval in April to move forward with the

transformational combination with Endeavor creating the “must-own”

North American independent oil company. As a reminder, the combined

business will have an unmatched depth of high-quality inventory in

the core of the Midland Basin, which, when combined with

Diamondback’s cost structure, is set to generate significant

long-term Free Cash Flow accretion to our stockholders.

On April 29, 2024, we received a second request

for information and documents from the Federal Trade Commission

(“FTC”). We continue to work cooperatively with the FTC to comply

with its requests and expect the Endeavor transaction to close in

the third or fourth quarter of this year. We will provide more

information when possible. I appreciate the tremendous effort from

both organizations as we move towards closing.

Second Quarter Operational

Performance: During the second quarter, we drilled 80

wells and brought online 86 wells across our position. When

combined with our activity in the first quarter, we have now

drilled 64% of our total lateral feet and brought online 60% of the

wells we originally budgeted for 2024 in the first six months of

the year, yet still have only spent 51% of the midpoint of our

original capital budget.

We are clearly doing more with less and becoming

more operationally efficient each quarter. To help put this into

perspective, at the beginning of the year we were anticipating a

rig would drill 24 wells a year, and now we are modeling one rig

drilling at least 26 wells per year. On average, we are drilling

wells approximately 10% faster than at the beginning of the year,

primarily due to bit and bottom hole assembly improvements. In

fact, we set a new record this quarter on one of our wells in the

Midland Basin, drilling over 20,000' with a single bit run.

Similarly, efficiency gains on completions have

allowed us to increase the per crew annual completion rate to

nearly 100 wells per year, up from our original budget of 80 wells

per year. As a result of these drilling and completion

efficiencies, in July we reduced drilling activity from 12 rigs to

10 and lowered our frac fleet count from four simulfrac crews to

three, while raising full year production guidance.

Production:Second quarter oil

production was 276.1 MBO/d, above the high end of our guidance

range of 271 - 275 MBO/d. We continue to target maintaining fourth

quarter 2023 oil production levels and have kept our quarterly

guidance range of 271 - 275 MBO/d flat for the third quarter. For

2024, we raised our oil production guidance range to 273 - 276

MBO/d to account for accelerated first half 2024 activity and

positive well performance year to date.

Capital Expenditures:In the

second quarter, we spent $637 million in capital expenditures,

above the high end of our guidance range of $580 - $620 million.

This was directly correlated to the accelerated activity noted

above. As a result of these improved cycle times, reduced activity

in the second half of 2024 and lower leading edge Midland Basin

well costs, we have moved the midpoint of our 2024 capital

expenditure guide down by $25 million, with an updated capex range

of $2.35 - $2.45 billion. This decision demonstrates our commitment

to capital discipline and Free Cash Flow generation. Additionally,

we have increased the number of wells we anticipate drilling and

completing in 2024 as a result of the accelerated pace of

development we saw in the first half of the year.

Our capital expenditure guidance range for the

third quarter is $570 - $610 million as lower activity flows

through our cash capex and cash flow statement.

Operating Costs:Total cash

operating costs remained relatively flat quarter over quarter at

$11.67 per BOE. Lease operating expenses ("LOE") in the second

quarter were $5.88 per BOE, below the low end of the guidance range

of $6.00 - $6.50 per BOE. As a result, we lowered our LOE guidance

range to $5.90 - $6.40 per BOE. Cash G&A per BOE decreased as

anticipated, and we are on track to be within our guidance range of

$0.55 - $0.65 per BOE for the year.

Financial Performance and Return of

Capital:During the quarter, Diamondback generated $1.5

billion of net cash provided by operating activities and $816

million in Free Cash Flow. Unique to this quarter, we adjusted Free

Cash Flow upwards to account for a $25 million loss on 30 year

treasury locks executed prior to, and fully settled upon, pricing

of the senior notes issued in April 2024, making Adjusted Free Cash

Flow $841 million for the quarter. Consistent with our capital

return commitment, we will return 50% of the Adjusted Free Cash

Flow to our stockholders through our base and variable dividend

totaling $421 million, or $2.34 per share. We did not repurchase

any shares during the quarter.

Balance Sheet:In April, we

successfully completed a $5.5 billion Senior Notes offering to fund

a portion of the cash consideration for the Endeavor merger. As a

result, total debt increased quarter over quarter and was $12.2

billion at quarter end. However, net debt decreased by

approximately $600 million to $5.3 billion as a result of Free Cash

Flow generation and proceeds from non-core asset sales.

As we have stated previously, our near-term goal

will be to lower pro forma net debt below $10 billion after the

completion of the Endeavor combination, which will be done through

Free Cash Flow generation and proceeds from non-core asset sales.

Our long-term priority is to maintain a leverage ratio of

approximately 0.5x at mid-cycle oil pricing, or approximately $6 to

$8 billion in net debt. We feel we can achieve this goal within the

next couple of years solely by dedicating 50% of Free Cash Flow to

debt paydown.

Non-Core Asset Sales:During the

quarter, we received proceeds of approximately $150 million as a

result of continued portfolio optimization. This included a

$95 million sale of non-operated properties in the Delaware

Basin as well as other smaller non-core transactions.

In July, Energy Transfer LP (NYSE: ET) (“ET”)

completed its previously announced acquisition of WTG Midstream

Holdings LLC (“WTG”). Total pre-tax consideration to Diamondback is

valued at approximately $375 million made up of cash and

approximately 10.1 million ET common units. The WTG sale

represents ~3.5x multiple on invested capital for Diamondback.

Other Business:We continue to

focus on our consistent, low-cost execution strategy and the

forthcoming integration of Endeavor. We are confident that the

operational gains realized so far in 2024 will benefit our expanded

Midland Basin asset base and that the pro forma company will

continue to generate differentiated returns for our

stockholders.

Thank you for your ongoing support and interest in

Diamondback Energy.

Travis D. SticeChairman of the Board and Chief

Executive Officer

Investor Contact:Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

Forward-Looking Statements:

This letter contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Exchange Act of 1934,

as amended, which involve risks, uncertainties, and assumptions.

All statements, other than statements of historical fact, including

statements regarding the proposed business combination transaction

between Diamondback and Endeavor; future performance; business

strategy; future operations (including drilling plans and capital

plans); estimates and projections of revenues, losses, costs,

expenses, returns, cash flow, and financial position; reserve

estimates and its ability to replace or increase reserves;

anticipated benefits of strategic transactions (including

acquisitions and divestitures), including the proposed transaction;

the expected amount and timing of synergies from the proposed

transaction; the anticipated timing of the proposed transaction;

and plans and objectives of management (including plans for future

cash flow from operations and for executing environmental

strategies) are forward-looking statements. When used in this

letter, the words “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “future,” “guidance,”

“intend,” “may,” “model,” “outlook,” “plan,” “positioned,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” and similar expressions (including the negative of

such terms) are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Although Diamondback believes that the

expectations and assumptions reflected in its forward-looking

statements are reasonable as and when made, they involve risks and

uncertainties that are difficult to predict and, in many cases,

beyond Diamondback’s control. Accordingly, forward-looking

statements are not guarantees of future performance and actual

outcomes could differ materially from what Diamondback has

expressed in its forward-looking statements.

Factors that could cause the outcomes to differ

materially include (but are not limited to) the following: the

completion of the proposed Endeavor transaction on anticipated

terms and timing or at all, including obtaining regulatory approval

and satisfying other conditions to the completion of the

transaction; uncertainties as to whether the proposed transaction,

if consummated, will achieve its anticipated benefits and projected

synergies within the expected time period or at all; Diamondback’s

ability to integrate Endeavor’s operations in a successful manner

and in the expected time period; the occurrence of any event,

change, or other circumstance that could give rise to the

termination of the proposed transaction; risks that the anticipated

tax treatment of the proposed transaction is not obtained;

unforeseen or unknown liabilities; unexpected future capital

expenditures; litigation relating to the proposed transaction; the

possibility that the proposed transaction may be more expensive to

complete than anticipated, including as a result of unexpected

factors or events; the effect of the pendency, or completion of the

proposed transaction on the parties’ business relationships and

business generally; risks that the proposed transaction disrupts

current plans and operations of Diamondback or Endeavor and their

respective management teams and potential difficulties in retaining

employees as a result of the proposed transaction; the risks

related to Diamondback’s financing of the proposed transaction;

potential negative effects of the pendency or completion of the

proposed transaction on the market price of Diamondback’s common

stock and/or operating results; rating agency actions and

Diamondback’s ability to access short- and long-term debt markets

on a timely and affordable basis; changes in supply and demand

levels for oil, natural gas, and natural gas liquids, and the

resulting impact on the price for those commodities; the impact of

public health crises, including epidemic or pandemic diseases and

any related company or government policies or actions; actions

taken by the members of OPEC and Russia affecting the production

and pricing of oil, as well as other domestic and global political,

economic, or diplomatic developments, including any impact of the

ongoing war in Ukraine and the Israel-Hamas war on the global

energy markets and geopolitical stability; instability in the

financial markets; concerns over a potential economic slowdown or

recession; inflationary pressures; rising interest rates and their

impact on the cost of capital; regional supply and demand factors,

including delays, curtailment delays or interruptions of

production, or governmental orders, rules or regulations that

impose production limits; federal and state legislative and

regulatory initiatives relating to hydraulic fracturing, including

the effect of existing and future laws and governmental

regulations; physical and transition risks relating to climate

change; those risks described in Item 1A of Diamondback’s Annual

Report on Form 10-K, filed with the SEC on February 22, 2024, and

those risks disclosed in its subsequent filings on Forms 10-Q and

8-K, which can be obtained free of charge on the SEC’s website at

http://www.sec.gov and Diamondback’s website at

www.diamondbackenergy.com/investors/; and those risks more fully

described in the definitive proxy statement on Schedule 14A filed

with the SEC in connection with the proposed transaction.

In light of these factors, the events

anticipated by Diamondback’s forward-looking statements may not

occur at the time anticipated or at all. Moreover, Diamondback

operates in a very competitive and rapidly changing environment and

new risks emerge from time to time. Diamondback cannot predict all

risks, nor can it assess the impact of all factors on its business

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those anticipated by

any forward-looking statements it may make. Accordingly, you should

not place undue reliance on any forward-looking statements. All

forward-looking statements speak only as of the date of this letter

or, if earlier, as of the date they were made. Diamondback does not

intend to, and disclaims any obligation to, update or revise any

forward-looking statements unless required by applicable law.

Non-GAAP Financial Measures

This letter includes financial information not

prepared in conformity with generally accepted accounting

principles (GAAP), including free cash flow. The non-GAAP

information should be considered by the reader in addition to, but

not instead of, financial information prepared in accordance with

GAAP. A reconciliation of the differences between these non-GAAP

financial measures and the most directly comparable GAAP financial

measures can be found in Diamondback's quarterly results posted on

Diamondback's website at www.diamondbackenergy.com/investors/.

Furthermore, this letter includes or references certain

forward-looking, non-GAAP financial measures. Because Diamondback

provides these measures on a forward-looking basis, it cannot

reliably or reasonably predict certain of the necessary components

of the most directly comparable forward-looking GAAP financial

measures, such as future impairments and future changes in working

capital. Accordingly, Diamondback is unable to present a

quantitative reconciliation of such forward-looking, non-GAAP

financial measures to the respective most directly comparable

forward-looking GAAP financial measures. Diamondback believes that

these forward-looking, non-GAAP measures may be a useful tool for

the investment community in comparing Diamondback's forecasted

financial performance to the forecasted financial performance of

other companies in the industry.

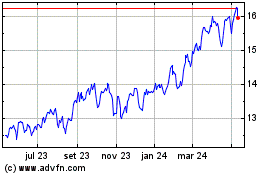

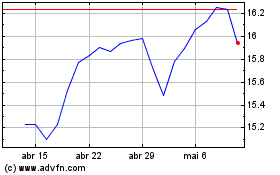

Energy Transfer (NYSE:ET)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Energy Transfer (NYSE:ET)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024