Pediatrix Medical Group, Inc. (NYSE: MD), the nation’s leading

provider of highly specialized health care for women, children and

babies, today reported a loss from continuing operations of $1.50

per share for the three months ended December 31, 2023. On a

non-GAAP basis, Pediatrix reported Adjusted EPS from continuing

operations of $0.32.

For the 2023 fourth quarter, Pediatrix reported the following

results from continuing operations:

- Net revenue of $496 million;

- Loss from continuing operations of $124 million; and

- Adjusted EBITDA of $51 million.

“Our fourth quarter operating results were consistent with our

expectations,” said James D. Swift, M.D., Chief Executive Officer

of Pediatrix Medical Group. “We believe our operating plans for

2024, which build on progress in both our hybrid revenue-cycle

management structure and increased in-network status, position us

for very reliable cash flow, a foundation for future growth.”

Operating Results from Continuing Operations – Three Months

Ended December 31, 2023

Pediatrix’s net revenue for the three months ended December 31,

2023 was $496.4 million, compared to $513.8 million for the

prior-year period. This decline reflected the impact of non-same

unit activity as well as a 1.5 percent decline in same-unit

revenue.

Same-unit revenue attributable to patient volume declined by 1.0

percent for the 2023 fourth quarter as compared to the prior-year

period. Shown below are year-over-year percentage changes in

certain same-unit volume statistics for the three months and year

ended December 31, 2023. (Note: figures in the below table reflect

contributions only to net patient service revenue and exclude other

contributions to total same-unit revenue, including contract and

administrative fees.)

Three Months Ended December

31, 2023

Year Ended December 31,

2023

Hospital-based patient services

(3.0)%

(0.9)%

Office-based patient services

3.9%

1.9%

Neonatology services (within

hospital-based services):

Neonatal intensive care unit (NICU)

days

(2.0)%

(0.7)%

Same-unit revenue from net reimbursement-related factors

declined by 0.5 percent for the 2023 fourth quarter as compared to

the prior-year period. This decline primarily reflects the impact

in the 2022 fourth quarter of financial support provided by the

Company’s revenue cycle management vendor, as well as a decrease in

funds received under the Coronavirus Aid, Relief, and Economic

Security (“CARES”) Act. During the fourth quarter of 2023, the

Company received no funds under the CARES Act compared to $1.9

million in the prior year, which decreased the Company’s same-unit

revenue from net reimbursement-related factors by 0.4 percent

during the three months ended December 31, 2023. These declines

were partially offset by modest improvements in hospital contract

administrative fees and payor mix. The percentage of services

reimbursed by commercial and other non-government payors increased

by approximately 40 basis points compared to the prior year

period.

For the 2023 fourth quarter, practice salaries and benefits

expense was $363.6 million, compared to $366.6 million for the

prior-year period. This comparison reflects declines in incentive

compensation and malpractice expenses, partially offset by

increases in same-unit clinical compensation and group health

insurance costs.

For the 2023 fourth quarter, general and administrative expenses

were $53.1 million, as compared to $51.1 million for the prior-year

period.

For the fourth quarter of 2023, transformational and

restructuring related expenses totaled $2.2 million, compared to

$19.6 million for the fourth quarter of 2022. The expense recorded

for the fourth quarter of 2023 related predominantly to the

previously disclosed termination of the Company’s services

agreement with its revenue cycle management vendor.

Adjusted EBITDA from continuing operations, which is defined as

earnings from continuing operations before interest, taxes,

depreciation and amortization, transformational and restructuring

related expenses, and impairment losses was $50.8 million for the

2023 fourth quarter, compared to $66.5 million for the prior-year

period. Funds received from the provider relief fund established by

the CARES Act favorably impacted Adjusted EBITDA by approximately

$1.5 million for the fourth quarter of 2022.

Depreciation and amortization expense of $9.1 million for the

fourth quarter of 2023 was unchanged compared to the fourth quarter

of 2022.

Investment and other income was $2.2 million for the fourth

quarter of 2023, compared to $1.3 million for the fourth quarter of

2022.

Interest expense was $10.1 million for the fourth quarter of

2023 compared to $10.0 million for the fourth quarter of 2022. This

comparison reflects higher interest rates on the Company’s

adjustable-rate borrowings, largely offset by lower total

borrowings.

During the fourth quarter of 2023, Pediatrix recorded an

aggregate non-cash impairment loss of $168.3 million related to

goodwill and other assets.

Pediatrix generated a loss from continuing operations of $124.3

million, or $1.50 per diluted share, for the 2023 fourth quarter,

based on a weighted average 82.7 million shares outstanding. This

compares with income from continuing operations of $24.0 million,

or $0.29 per diluted share, for the 2022 fourth quarter, based on a

weighted average 82.2 million shares outstanding.

For the fourth quarter of 2023, Pediatrix reported Adjusted EPS

from continuing operations of $0.32, compared to $0.47 for the

fourth quarter of 2022. For these periods, Adjusted EPS from

continuing operations is defined as diluted income from continuing

operations per common and common equivalent share excluding

non-cash amortization expense, stock-based compensation expense,

transformational and restructuring related expenses, discrete tax

events and impairment losses. Funds received from the provider

relief fund established by the CARES Act favorably impacted

Adjusted EPS by $0.01 for the fourth quarter of 2022.

Operating Results from Continuing Operations – Year Ended

December 31, 2023

For the year ended December 31, 2023, Pediatrix generated

revenue from continuing operations of $1.99 billion, compared to

$1.97 billion for the prior year. For 2023, the Company did not

record any miscellaneous revenue from the provider relief fund

established by the CARES Act compared to $13.3 million for the

prior year. Adjusted EBITDA from continuing operations for the year

ended December 31, 2023 was $200.4 million, compared to $241.0

million for the prior year. Funds received from the provider relief

fund established by the CARES Act favorably impacted Adjusted

EBITDA by approximately $8.2 million for the year ended December

31, 2022. Pediatrix generated a loss from continuing operations of

$60.4 million, or $0.73 per share, for the year ended December 31,

2023, based on a weighted average 82.2 million shares outstanding,

which compares to income from continuing operations of $62.6

million, or $0.74 per share, based on a weighted average 84.1

million shares outstanding for the prior year. For the year ended

December 31, 2023, Pediatrix reported Adjusted EPS from continuing

operations of $1.26, compared to $1.66 for 2022. Funds received

from the provider relief fund established by the CARES Act

favorably impacted Adjusted EPS by approximately $0.07 for the year

ended December 31, 2022.

Financial Position and Cash Flow – Continuing Operations

Pediatrix had cash and cash equivalents of $73.3 million at

December 31, 2023, compared to $9.8 million on December 31, 2022,

and net accounts receivable were $272.3 million.

For the fourth quarter of 2023, Pediatrix generated cash from

continuing operations of $72.1 million, compared to $102.3 million

for the fourth quarter of 2022. During the fourth quarter of 2023,

the Company used $9.0 million to fund capital expenditures and $5.0

million to fund a practice acquisition.

At December 31, 2023, Pediatrix had total debt outstanding of

$628 million, consisting of its $400 million in 5.375% Senior Notes

due 2030 and $228 million in borrowings under its Term A Loan. At

December 31, 2023, the Company had no borrowings against its $450

million revolving line of credit.

Non-GAAP Measures

A reconciliation of Adjusted EBITDA from continuing operations

and Adjusted EPS from continuing operations to the most directly

comparable GAAP measures for the three months and years ended

December 31, 2023 and 2022 is provided in the financial tables of

this press release.

Preliminary 2024 Outlook

On a preliminary basis, Pediatrix anticipates that its 2024

Adjusted EBITDA, as defined above, will be in a range of $200

million to $220 million.

Earnings Conference Call

Pediatrix will host an investor conference call to discuss the

quarterly results at 9 a.m., ET today. The conference call Webcast

may be accessed from the Company’s Website, www.pediatrix.com. A

telephone replay of the conference call will be available from

12:45 p.m. ET today through midnight ET March 5, 2024 by dialing

1-866-207-1041, access code 2056898. The replay will also be

available at www.pediatrix.com.

ABOUT PEDIATRIX MEDICAL GROUP

Pediatrix® Medical Group, Inc. (NYSE:MD) is the nation’s leading

provider of physician services. Pediatrix-affiliated clinicians are

committed to providing coordinated, compassionate and clinically

excellent services to women, babies and children across the

continuum of care, both in hospital settings and office-based

practices. Specialties include obstetrics, maternal-fetal medicine

and neonatology complemented by more than 20 pediatric

subspecialties, as well as pediatric primary and urgent care

clinics. The group’s high-quality, evidence-based care is bolstered

by significant investments in research, education,

quality-improvement and safety initiatives. The physician-led

company was founded in 1979 as a single neonatology practice and

today provides its highly specialized and often critical care

services through more than 5,000 affiliated physicians and other

clinicians in 37 states. To learn more about Pediatrix, visit

www.pediatrix.com or follow us on Facebook, Instagram, LinkedIn,

Twitter and the Pediatrix blog. Investment information can be found

at www.pediatrix.com/investors.

Certain statements and information in this press release may be

deemed to contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements may include, but are not limited to,

statements relating to the Company’s objectives, plans and

strategies, and all statements, other than statements of historical

facts, that address activities, events or developments that we

intend, expect, project, believe or anticipate will or may occur in

the future. These statements are often characterized by terminology

such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,”

“plan,” “will,” “expect,” “estimate,” “project,” “positioned,”

“strategy” and similar expressions, and are based on assumptions

and assessments made by the Company’s management in light of their

experience and their perception of historical trends, current

conditions, expected future developments and other factors they

believe to be appropriate. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no duty to update or revise any such statements, whether

as a result of new information, future events or otherwise.

Forward-looking statements are not guarantees of future performance

and are subject to risks and uncertainties. Important factors that

could cause actual results, developments, and business decisions to

differ materially from forward-looking statements are described in

the Company’s most recent Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q, including the sections entitled

“Risk Factors”, as well the Company’s current reports on Form 8-K,

filed with the Securities and Exchange Commission, and include the

impact of the Company’s termination of its current third-party

revenue cycle management provider and transition to a hybrid

revenue cycle management model with one or more new third-party

service providers, including any transition costs associated

therewith; the impact of surprise billing legislation; the effects

of economic conditions on the Company’s business; the effects of

the Affordable Care Act and potential healthcare reform; the

Company’s relationships with government-sponsored or funded

healthcare programs, including Medicare and Medicaid, and with

managed care organizations and commercial health insurance payors;

the Company’s ability to comply with the terms of its debt

financing arrangements; the impact of the COVID-19 pandemic on the

Company and its financial condition and results of operations; the

impact of the divestiture of the Company’s anesthesiology and

radiology medical groups; the impact of management transitions; the

timing and contribution of future acquisitions or organic growth

initiatives; the effects of share repurchases; and the effects of

the Company’s transformation initiatives, including its

reorientation on, and growth strategy for, its pediatrics and

obstetrics business.

Pediatrix Medical Group,

Inc.

Consolidated Statements of

Income and Comprehensive Income

(in thousands, except per

share data)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

Net revenue

$

496,443

$

513,844

$

1,994,640

$

1,972,021

Operating expenses:

Practice salaries and benefits

363,604

366,557

1,448,275

1,383,319

Practice supplies and other operating

expenses

31,672

31,480

124,800

121,669

General and administrative expenses

53,064

51,057

227,542

231,397

Depreciation and amortization

9,062

9,136

36,171

35,636

Transformational and restructuring related

expenses

2,219

19,576

2,219

27,312

Goodwill impairment

148,312

—

148,312

—

Total operating expenses

607,933

477,806

1,987,319

1,799,333

(Loss) income from operations

(111,490

)

36,038

7,321

172,688

Investment and other income

2,242

1,335

4,338

3,671

Interest expense

(10,081

)

(9,952

)

(42,075

)

(39,695

)

Impairment loss

(20,000

)

—

(20,000

)

—

Loss on early extinguishment of debt

—

—

—

(57,016

)

Equity in earnings of unconsolidated

affiliates

479

403

2,057

1,722

Total non-operating expenses

(27,360

)

(8,214

)

(55,680

)

(91,318

)

(Loss) income from continuing operations

before income taxes

(138,850

)

27,824

(48,359

)

81,370

Income tax benefit (provision)

14,563

(3,824

)

(12,049

)

(18,806

)

(Loss) income from continuing

operations

(124,287

)

24,000

(60,408

)

62,564

Income from discontinued operations, net

of tax

—

5,659

—

3,767

Net (loss) income

(124,287

)

29,659

(60,408

)

66,331

Net loss attributable to noncontrolling

interest

—

—

—

4

Net (loss) income attributable to

Pediatrix Medical Group, Inc.

$

(124,287

)

$

29,659

$

(60,408

)

$

66,335

Other comprehensive income (loss), net of

tax

Unrealized holding gain (loss) on

investments, net of tax of $427, $122, $527 and $1,694

1,303

366

1,521

(5,051

)

Total comprehensive (loss) income

attributable to Pediatrix Medical Group, Inc.

$

(122,984

)

$

30,025

$

(58,887

)

$

61,284

Per common and common equivalent share

data (diluted):

(Loss) income from continuing

operations

$

(1.50

)

$

0.29

$

(0.73

)

$

0.74

Income from discontinued operations

$

—

$

0.07

$

—

$

0.05

Net (loss) income attributable to

Pediatrix Medical Group, Inc.

$

(1.50

)

$

0.36

$

(0.73

)

$

0.79

Weighted average common shares

82,660

82,158

82,201

84,121

Pediatrix Medical Group,

Inc.

Reconciliation of (Loss)

Income from Continuing Operations

to Adjusted EBITDA from

Continuing Operations Attributable to

Pediatrix Medical Group,

Inc.

(in thousands)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

(Loss) income from continuing operations

attributable to Pediatrix Medical Group, Inc.

$

(124,287

)

$

24,000

$

(60,408

)

$

62,568

Interest expense

10,081

9,952

42,075

39,695

Loss on early extinguishment of debt

—

—

—

57,016

Income tax (benefit) provision

(14,563

)

3,824

12,049

18,806

Depreciation and amortization expense

9,062

9,136

36,171

35,636

Transformational and restructuring related

expenses

2,219

19,576

2,219

27,312

Impairment losses

168,312

—

168,312

—

Adjusted EBITDA from continuing operations

attributable to Pediatrix Medical Group, Inc.

$

50,824

$

66,488

$

200,418

$

241,033

Pediatrix Medical Group,

Inc.

Reconciliation of Diluted

(Loss) Income from Continuing Operations per Share

to Adjusted Income from

Continuing Operations per Diluted Share (“Adjusted EPS”)

(in thousands, except per

share data)

(Unaudited)

Three Months Ended December

31,

2023

2022

Weighted average diluted shares

outstanding

82,660

82,158

(Loss) income from continuing operations

and diluted income from continuing operations per share

attributable to Pediatrix Medical Group, Inc.

$

(124,287

)

$

(1.50

)

$

24,000

$

0.29

Adjustments (1):

Amortization (net of tax of $502 and

$606)

1,510

0.02

1,820

0.02

Stock-based compensation (net of tax of

$756 and $374)

2,268

0.03

1,120

0.01

Transformational and restructuring

expenses (net of tax of $555 and $4,894)

1,664

0.02

14,682

0.18

Impairment losses (net of tax of

$42,078)

126,234

1.53

—

—

Net impact from discrete tax events

18,841

0.22

(3,073

)

(0.03

)

Adjusted income and diluted EPS from

continuing operations attributable to Pediatrix Medical Group,

Inc.

$

26,230

$

0.32

$

38,549

$

0.47

(1) A blended tax rate of 25% was used to

calculate the tax effects of the adjustments for the three months

ended December 31, 2023 and 2022.

Twelve Months Ended December

31,

2023

2022

Weighted average diluted shares

outstanding

82,201

84,121

(Loss) income from continuing operations

and diluted income from continuing operations per share

attributable to Pediatrix Medical Group, Inc.

$

(60,408

)

$

(0.73

)

$

62,568

$

0.74

Adjustments (1):

Amortization (net of tax of $2,010 and

$2,242)

6,032

0.07

6,727

0.08

Stock-based compensation (net of tax of

$3,081 and $3,596)

9,242

0.11

10,788

0.13

Transformational and restructuring related

expenses (net of tax of $555 and $6,828)

1,664

0.02

20,484

0.24

Impairment losses (net of tax of

$42,078)

126,234

1.54

—

—

Loss on early extinguishment of debt (net

of tax of $14,254)

—

—

42,762

0.51

Net impact from discrete tax events

20,825

0.25

(3,370

)

(0.04

)

Adjusted income and diluted EPS from

continuing operations attributable to Pediatrix Medical Group,

Inc.

$

103,589

$

1.26

$

139,959

$

1.66

(1) A blended tax rate of 25% was used to

calculate the tax effects of the adjustments for the twelve months

ended December 31, 2023 and 2022.

Pediatrix Medical Group,

Inc.

Balance Sheet

Highlights

(in thousands)

(Unaudited)

As of December 31,

2023

As of December 31,

2022

Assets:

Cash and cash equivalents

$

73,258

$

9,824

Investments

104,485

93,239

Accounts receivable, net

272,313

296,787

Other current assets

33,398

28,139

Intangible assets, net

21,240

18,491

Operating and finance lease right-of-use

assets

70,294

66,924

Goodwill, other assets, property and

equipment

1,644,822

1,834,483

Total assets

$

2,219,810

$

2,347,887

Liabilities and shareholders'

equity:

Accounts payable and accrued expenses

$

350,798

$

374,225

Total debt, net

633,334

651,279

Operating lease liabilities

68,314

65,802

Other liabilities

318,303

364,949

Total liabilities

1,370,749

1,456,255

Total shareholders' equity

849,061

891,632

Total liabilities and shareholders'

equity

$

2,219,810

$

2,347,887

Pediatrix Medical Group,

Inc.

Reconciliation of Income from

Continuing Operations

to Forward-Looking Adjusted

EBITDA from Continuing Operations Attributable to

Pediatrix Medical Group,

Inc.

(in thousands)

(Unaudited)

Year Ended December 31,

2024

Income from continuing operations

attributable to Pediatrix Medical Group, Inc.

$

68,750

$

83,700

Interest expense

40,600

39,900

Income tax provision

26,650

32,400

Depreciation and amortization expense

39,000

39,000

Transformational and restructuring related

expenses

25,000

25,000

Adjusted EBITDA from continuing operations

attributable to Pediatrix Medical Group, Inc.

$

200,000

$

220,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240220939114/en/

Charles Lynch Senior Vice President, Finance and Strategy

954-384-0175, x 5692 charles.lynch@pediatrix.com

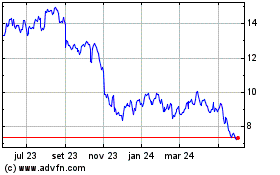

Pediatrix Medical (NYSE:MD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

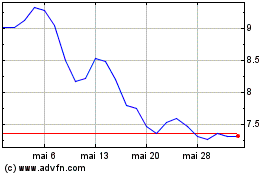

Pediatrix Medical (NYSE:MD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025