Mayville Engineering Company (NYSE: MEC) (the “Company” or

“MEC”), a leading value-added provider of design, prototyping and

manufacturing solutions serving diverse end-markets, will host an

Investor Day at its Hazel Park, Michigan facility today, September

14, 2023, beginning at 9:00 a.m. ET.

At the Investor Day event, MEC will provide a progress update on

its MEC Business Excellence (MBX) value creation framework,

including a focus on targeted commercial growth, best-in-class

operational execution and its capital allocation priorities. Within

its presentation, MEC will also introduce new, three-year

performance targets, as outlined below.

“Today, we are introducing three-year performance targets that

highlight the significant value creation potential of our

business,” stated Jag Reddy, President and CEO of MEC. “Multi-year

secular trends toward reshoring and outsourcing, together with

growing demand for integrated supply chain solutions across both

existing and underserved adjacent markets, create a compelling

opportunity for MEC in the years ahead. We will seek to further

optimize recent investments in world-class engineering, design and

manufacturing capabilities, while deploying efficient, standardized

processes that enhance both our value proposition with customers

and the long-term profitability of our business. We are excited by

the outlook for our business and look forward to continuing to

build a leading platform of scale across our diverse

end-markets.”

STRATEGIC PRIORITIES UPDATE

In 2022, MEC launched MBX, a holistic, strategic framework

designed to drive profitable growth through targeted commercial

expansion within higher-value adjacent markets; the implementation

of more efficient business processes; improved asset optimization

and productivity; and further standardization across the

enterprise. MBX positions MEC to provide a solutions-based platform

equipped to scale with the unique requirements of existing

customers, while capitalizing on underserved demand within emerging

growth sectors, including energy transition. In combination, MEC

believes the MBX framework will contribute to ratable growth in

sustained revenue, margin realization and profitability.

Organic Growth Acceleration. MEC intends to further

leverage commercial expansion opportunities provided by

reshoring/outsourcing megatrends within its vertical markets, while

leveraging existing production capacity at Hazel Park and related

manufacturing facilities. The Company anticipates these actions

will result in net sales growth of $170 to $240 million between

year-end 2023 and year-end 2026.

Ratable Margin Expansion. During the next three years,

MEC intends to drive significant margin expansion through a

combination of sustained volume growth; value-based pricing;

improved asset optimization; and process improvements. These

initiatives, in combination with continued normalization in supply

chain and further optimization of the Hazel Park facility, are

expected to result in between 14% to 16% Adjusted EBITDA Margin, or

300 to 400 basis points of margin expansion, between year-end 2023

and year-end 2026.

Significant Free Cash Flow Generation. Between year-end

2023 and year-end 2026, the Company anticipates that it will

generate approximately $200 million in free cash flow. The Company

is committed to maximizing shareholder value through a reduction in

debt outstanding; investments in high-return, accretive acquisition

opportunities; and through a programmatic share repurchase

program.

REITERATING FULL-YEAR 2023 FINANCIAL GUIDANCE

Today, MEC is reiterating its full-year 2023 financial guidance,

as outlined below:

Low-End

High End

Full-Year 2023 Net Sales ($MM)

$580

$610

Full-Year 2023 Adjusted EBITDA ($MM)

$66

$71

Full-Year 2023 Capital Expenditures

($MM)

$15

$20

INTRODUCING FULL-YEAR 2026 FINANCIAL TARGETS

Today, MEC is introducing full-year 2026 financial targets, as

outlined below:

Low-End

High End

Full-Year 2026 Net Sales ($MM)

$750

$850

Full-Year 2026 Adjusted EBITDA ($MM)

$105

$135

Full-Year 2026 Adjusted EBITDA Margin

(%)

14%

16%

Full-Year 2026 Free Cash Flow ($MM)

$65

$75

INVESTOR DAY WEBCAST

The investor day event will be held today at 9:00 a.m. Eastern

Time and will include presentations by Jag Reddy, MEC’s President

and Chief Executive Officer; Todd Butz, MEC’s Chief Financial

Officer; Rand Stille, MEC’s Chief Operating Officer, and Ryan

Raber, MEC’s Executive Vice President of Strategy, Sales and

Marketing.

A webcast of the event and a link to the accompanying

presentation materials are available in the Investor Relations

section of the MEC corporate website at https://ir.mecinc.com, and

a replay of the webcast will be available at the same site

following the event.

ABOUT MAYVILLE ENGINEERING COMPANY

Founded in 1945, Mayville Engineering Company (MEC) is a leading

U.S.-based, vertically-integrated, value-added manufacturing

partner providing a full suite of manufacturing solutions from

concept to production, including design, prototyping and tooling,

fabrication, aluminum extrusion, coating, assembly and aftermarket

components. Our customers operate in diverse end markets, including

heavy- and medium-duty commercial vehicles, construction &

access equipment, powersports, agriculture, military and other end

markets. Along with process engineering and development services,

MEC maintains an extensive manufacturing infrastructure with 22

facilities across seven states. These facilities make it possible

to offer conventional and CNC (computer numerical control)

stamping, shearing, fiber laser cutting, forming, drilling,

tapping, grinding, tube bending, machining, welding, assembly, and

logistic services. MEC also possesses a broad range of finishing

capabilities including shot blasting, e-coating, powder coating,

wet spray and military grade chemical agent resistant coating

(CARC) painting.

NON-GAAP FINANCIAL MEASURES

The financial target information provided in this press release

includes the forward-looking financial measures calculated in a

manner other than in accordance with U.S. generally accepted

accounting principles (GAAP).

The non-GAAP measures used in this press release are adjusted

net income (loss) before interest, taxes, depreciation and

amortization (Adjusted EBITDA), Adjusted EBITDA as a percentage of

net sales (Adjusted EBITDA margin) and free cash flow, which

management uses as key performance indicators, and we believe they

are measures frequently used by securities analysts, investors and

other parties to evaluate companies in our industry. These metrics

are supplemental measures of our operating performance that are

neither required by, nor presented in accordance with, GAAP. These

measures should not be considered as an alternative to net income

or cash provided by operating activities, or any other performance

measure derived in accordance with GAAP as an indicator of our

operating performance.

The Company calculates forward-looking Adjusted EBITDA and

Adjusted EBITDA margin based on internal forecasts that omit

certain amounts that would be included in forward-looking GAAP net

income (loss). The Company calculates free cash flow based on

forward-looking cash provided from operating activities less

forward-looking capital expenditures. The Company is not able to

provide a reconciliation of forward-looking Adjusted EBITDA,

Adjusted EBITDA margin or free cash flow guidance to

forward-looking GAAP net income (loss) or forward-looking cash flow

provided by operating activities because forecasting the exact

timing or impact of items, including, without limitation, the

impact of macroeconomic, industry and operational changes through

2026, that have not yet occurred and are out of its control is

inherently uncertain and unavailable without unreasonable efforts.

Further, the Company believes that such reconciliations would imply

a degree of precision and certainty that could be confusing to

investors and could have substantial impact on GAAP measures of

financial performance.

FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements that

reflect plans, estimates and beliefs. Such statements involve risk

and uncertainties. Actual results may differ materially from those

contemplated by these forward-looking statements as a result of

various factors. Important factors that could cause actual results

or events to differ materially from those expressed in

forward-looking statements include, but are not limited to:

macroeconomic conditions, including inflation, rising interest

rates and recessionary concerns, as well as ongoing supply chain

challenges, labor availability and cost pressures, and the COVID-19

pandemic, have had, and may continue to have, a negative impact on

our business, financial condition, cash flows and results of

operations (including future uncertain impacts); risks relating to

developments in the industries in which our customers operate;

risks related to scheduling production accurately and maximizing

efficiency; our ability to realize net sales represented by our

awarded business; failure to compete successfully in our markets;

our ability to maintain our manufacturing, engineering and

technological expertise; the loss of any of our large customers or

the loss of their respective market shares; risks related to

entering new markets; our ability to recruit and retain our key

executive officers, managers and trade-skilled personnel;

volatility in the prices or availability of raw materials critical

to our business; manufacturing risks, including delays and

technical problems, issues with third-party suppliers,

environmental risks and applicable statutory and regulatory

requirements; our ability to successfully identify or integrate

acquisitions; our ability to develop new and innovative processes

and gain customer acceptance of such processes; risks related to

our information technology systems and infrastructure; geopolitical

and economic developments, including foreign trade relations and

associated tariffs; results of legal disputes, including product

liability, intellectual property infringement and other claims;

risks associated with our capital-intensive industry; risks related

to our treatment as an S Corporation prior to the consummation of

our initial public offering; risks related to our employee stock

ownership plan’s treatment as a tax-qualified retirement plan; and

other factors described in “Risk Factors” in Part I, Item 1A of our

Annual Report on Form 10-K for the year ended December 31, 2022, as

such may be amended or supplemented in our subsequently filed

Quarterly Reports on Form 10-Q. This discussion should be read in

conjunction with our audited consolidated financial statements

included in the Company’s previously filed Annual Report on Form

10-K for the year ended December 31, 2022. We undertake no

obligation to update or revise any forward-looking statements after

the date on which any such statement is made, whether as a result

of new information, future events or otherwise, except as required

by federal securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230914048627/en/

INVESTOR CONTACT

Stefan Neely or Noel Ryan (615) 844-6248 MEC@val-adv.com

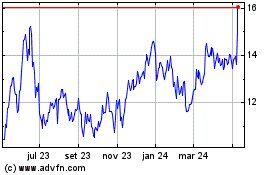

Mayville Engineering (NYSE:MEC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

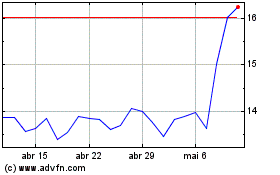

Mayville Engineering (NYSE:MEC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025